|

|

市場調査レポート

商品コード

1319153

ポンペ病治療の世界市場-2023年~2030年Global Pompe Disease Therapeutics Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポンペ病治療の世界市場-2023年~2030年 |

|

出版日: 2023年07月31日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

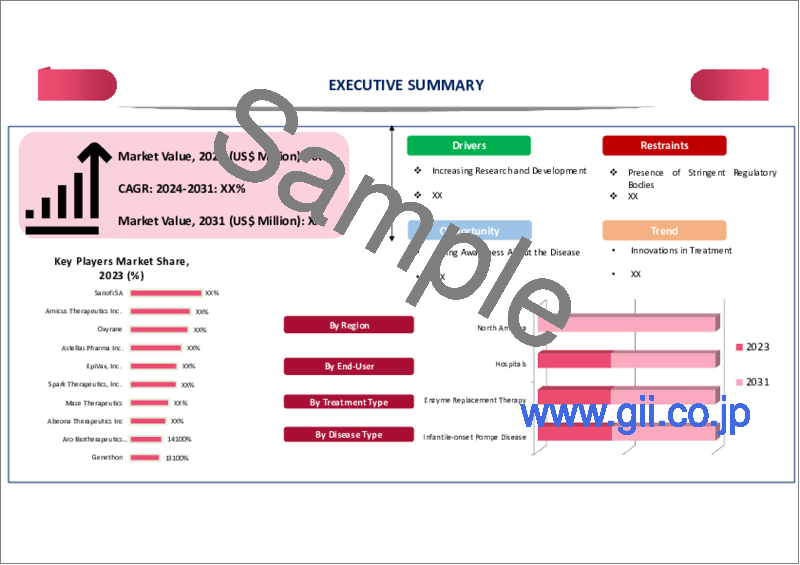

世界のポンペ病治療市場は2022年に13億米ドルに達し、2030年には19億米ドルに達するなど、有利な成長が見込まれています。世界のポンペ病治療市場は、予測期間中(2023~2030年)にCAGR 4.3%を示すと予測されています。

ポンペ病は、酸性α-グルコシダーゼ(GAA)という酵素の欠乏によって誘発される遺伝性のライソゾーム病であり、ポンペ障害の臨床症状をもたらすと考えられています。ポンペ病は、心機能に影響を及ぼす急速に悪化する小児期から、骨格筋や進行性の呼吸器病変を主症状とする緩徐に進行する晩期発症型まで様々です。

症例数の増加、製品の承認、合併、買収、拡大、共同研究などの新興国市場の開発、ポンペ病治療の進歩や製品承認のための臨床研究活動の活発化などは、予測期間における世界のポンペ病治療市場の成長を後押しすると予想される要因のひとつです。

市場力学

製品承認の増加がポンペ病治療市場の成長を促進

ポンペ病治療のための製品承認の増加は、予測期間における世界のポンペ病治療市場の成長を促進すると期待されています。例えば、2023年6月、希少疾患の新規治療法の設計と商業化に専念する患者専用の多国籍バイオテクノロジー企業であるAmicus Therapeuticsは、後期発症ポンペ病の成人に対する長期酵素補充療法であるシパグルコシダーゼアルファの酵素安定化剤であるオプフォルダ(ミグルスタット)65mgカプセルの欧州委員会(EC)認可を取得しました。

また、Amicusは、シパグルコシダーゼと経口酵素安定化剤ミグルスタットの2剤併用療法であるポンビリチ(シパグルコシダーゼアルファ)を2023年3月にECより発売する予定であり、ドイツでは血中酵素活性の低下を抑制することを目的としており、他の欧州諸国でも医療当局との償還戦略を開始しています。

認知度の向上が世界のポンペ病治療市場に成長機会をもたらすと期待される

ポンペ病に関する認知を広める取り組みの増加は、世界のポンペ病治療市場に有利な成長機会をもたらしています。例えば、2023年4月、ポンペサポートネットワークは国際ポンペデーを記念し、「Every Move Counts」をテーマに、チェシャー州ウィンスフォードのNeuroMusclarセンターで開催されたポンペ春季総会では、ポンペ協会から異例の参加者が集まりました。

厳しい規制機関の存在は、予測期間中、世界のポンペ病治療市場の妨げになると予測される

新しく開発されたポンペ病治療の承認のための厳しい規制機関の存在は、予測期間における世界市場の成長を妨げています。例えば、食品医薬品局(FDA)と欧州医薬品庁(EMA)は、医薬品と医療機器の開発と商業化を管理する他の国別の規制機関の中でも、2つの主要な規制機関です。

COVID-19影響分析

COVID-19のパンデミックと世界各国でのロックダウンにより、あらゆる業種の企業の財務の健全性が影響を受けています。そのため、COVID-19公衆衛生緊急事態の期間中、米国食品医薬品局(FDA)は、スポンサーと研究者を支援し、試験参加者の安全を確保し、適正臨床実施基準(GCP)を遵守し、試験の完全性に対するリスクを最小限に抑えるための一般的な配慮を含むガイドラインを発表しました。

ロシア・ウクライナ紛争の影響分析

ロシアとウクライナの紛争は、世界のポンペ病治療市場に与える影響は小さいと考えられます。ウクライナの診療所は、ロシア軍からの侵攻を受け続けているもの、死者数の増加や限られた医療援助に追われています。あらゆる種類の治療薬が不足しています。繰り返しになりますが、基本的な材料の輸出入の重要性は、予測期間における世界のポンペ病治療市場の成長に最小限の影響を与えると予想されます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 産業分析

- ポーターの5フォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第4章 エグゼクティブサマリー

第5章 市場力学

- 影響要因

- 促進要因

- 製品承認の増加

- 臨床研究活動の成長

- 抑制要因

- 厳しい規制当局

- 機会

- 認知度の向上

- 影響分析

- 促進要因

第6章 COVID-19分析

第7章 治療タイプ別

- 薬剤

- 酵素補充療法

- 理学療法

- シャペロン-高度補充療法

第8章 投与経路別

- 経口

- 非経口

第9章 エンドユーザー別

- 病院

- 専門クリニック

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Genzyme(Sanofi)

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Amicus Therapeutics

- Valerion Therapeutics

- Audentes Therapeutics

- Actus Therapeutics

- BioMarin Pharmaceutical

- EpiVax

- Oxyrane

- Sangamo BioSciences

- Avrobio

- Spark Therapeutics

第13章 付録

Market Overview

The global Pompe disease therapeutics market reached US$ 1.3 billion in 2022 and is expected to witness lucrative growth by reaching up to US$ 1.9 billion by 2030. The global Pompe disease therapeutics market is expected to exhibit a CAGR of 4.3% during the forecast period (2023-2030).

Pompe disease is an inherited lysosomal condition induced by a lack of the enzyme acid alpha-glucosidase (GAA), which is supposed to result in the clinical presentations of Pompe disorder. Pompe disease varies from a rapidly worsening infantile state with an influential effect on heart function, to a more slowly progressive, late-onset form predominantly impacting skeletal muscle and progressive respiratory involvement.

The increase in the number of cases, and the increasing market developments such as product approvals, mergers, acquisitions, expansions, and collaborations among other; rising clinical research activities for the Pompe disease therapeutics advancements and product approvals are among other factors expected to boost the global Pompe disease therapeutics market growth in the forecast period.

Market Dynamics

Increasing Product Approvals Drive The Growth Of The Pompe Disease Therapeutics Market

The increasing product approvals for the treatment of Pompe disease are expected to boost the global Pompe disease therapeutics market growth in the forecast period. For instance, in June 2023, Amicus Therapeutics, a patient-dedicated multinational biotechnology corporation concentrated on designing and commercializing novel therapies for rare conditions, obtained the European Commission (EC) authorization for its Opfolda (miglustat) 65mg capsules, an enzyme stabilizer of cipaglucosidase alfa, a long-term enzyme replacement therapy for adults with late-onset Pompe disease.

Furthermore, Amicus intends to instantly launch Pombiliti (cipaglucosidase alfa) was earlier authorized by the EC in March 2023 in combination with Opfolda, a two-component therapy that consists of cipaglucosidase alfa and the oral enzyme stabilizer, miglustat, that's designed to reduce loss of enzyme activity in the blood in Germany and is beginning reimbursement strategies with healthcare authorities in other European countries.

The Increase Awareness is Expected To Present The Global Pompe Disease Therapeutics Market With Growth Opportunities.

The increasing efforts to spread awareness about Pompe disease are presenting the global Pompe disease therapeutics market with lucrative growth opportunities. For instance, in April 2023, the Pompe Support Network marked International Pompe Day and honored the day with a theme of "Every Move Counts", an exceptional turnout from the Pompe Society at the Pompe Spring Meeting was observed at the event conducted at the NeuroMusclar Centre in Winsford, Cheshire.

The Presence of Stringent Regulatory Bodies is Estimated To Hamper The Global Pompe Disease Therapeutics Market During The Forecast Period.

The presence of stringent regulatory bodies for the approval of the newly developed Pompe disease therapeutics is hampering the global market growth in the forecast period. For instance, the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are two major regulatory bodies among other country-specific regulatory bodies controlling the development and commercialization of pharmaceutical and medical devices.

COVID-19 Impact Analysis

The financial health of companies across all industries has been impacted by the COVID-19 pandemic and lockdown in numerous nations throughout the world. Therefore, for the period of the COVID-19 public health emergency, the U.S. Food and Drug Administration (FDA) issued guidelines that include general considerations to aid sponsors and researchers, ensuring the safety of trial participants, adhering to good clinical practice (GCP), and minimizing risks to trial integrity.

Russia-Ukraine War Impact Analysis

The Russia-Ukraine conflict is thought to hold a minimal influence on the global Pompe disease therapeutics market, as there is a low incidence of conditions and a lack of primary market players in this region. Though continuing to countenance invasions from Russian armies, Ukrainian clinics are forced by growing numbers of deaths and limited medical aid. There are shortages across all treatment types of medications. Again, the significance of the import and export of fundamental materials are expected to minimally impact the global Pompe Disease Therapeutics market growth in the forecast period.

Segment Analysis

The global Pompe disease therapeutics market is segmented based on treatment type, route of administration, end-user, and region.

The Enzyme Replacement Treatment Type is Estimated to Dominate the Global Pompe Disease Therapeutics Market.

The enzyme replacement treatment type is estimated to hold about 27% of the global pompe therapeutics market owing to the increasing advancements in the therapy. For instance, in November 2022, the specialists at Duke Health were in a multi-national crew concerned with treating a fetus for infantile-onset Pompe disease utilizing an enzyme replacement therapy, a first in the world. The case, which was documented online on November 9 in the New England Journal of Medicine, emphasizes the possibility of introducing treatment for Pompe disease before birth.

Geographical Analysis

Europe is Estimated to Hold 27.4% of the Market Share Owing to the Presence of Key Market Players in this Region.

Owing to the presence of key market players involved in distinct market tactics holding a majority of the market and the presence of distinct organizations working to raise funding and spread awareness about conditions, the European Pompe disease therapeutics market is estimated to hold about 29% of the global market share.

For instance, Sanofi, a French global pharmaceutical and healthcare corporation, and Maze Therapeutics, an operator of a biotechnology firm utilized to concentrate on deciphering genetical understandings into new medicines formed a contract for the sole global consent of Maze's glycogen synthase 1 (GYS1) program and oral substrate reduction therapy, MZE001, to treat Pompe disease.

Competitive Landscape

The major global players in the market include: Genzyme (Sanofi), Amicus Therapeutics, Valerion Therapeutics, Audentes Therapeutics, Actus Therapeutics, BioMarin Pharmaceutical, EpiVax, Oxyrane, Sangamo BioSciences, Avrobio, Spark Therapeutics among others.

Why Purchase the Report?

- To visualize the global Pompe disease therapeutics market segmentation based on treatment type, route of administration, end-user, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Pompe disease therapeutics market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available in Excel consisting of key products of all the major players.

The global Pompe disease therapeutics market report would provide approximately 53 tables, 54 figures, and 195 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Industry Analysis

- 3.1. Porter's 5 Forces Analysis

- 3.2. Supply Chain Analysis

- 3.3. Pricing Analysis

- 3.4. Regulatory Analysis

4. Executive Summary

- 4.1. Snippet by Treatment Type

- 4.2. Snippet by Route of Administration

- 4.3. Snippet by End User

- 4.4. Snippet by Region

5. Dynamics

- 5.1. Impacting Factors

- 5.1.1. Drivers

- 5.1.1.1. Increasing Product Approvals

- 5.1.1.2. Growing Clinical Research Activities

- 5.1.2. Restraints

- 5.1.2.1. Stringent Regulatory Authorities

- 5.1.3. Opportunity

- 5.1.3.1. Increasing Awareness

- 5.1.4. Impact Analysis

- 5.1.1. Drivers

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers' Strategic Initiatives

- 6.6. Conclusion

7. By Treatment Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 7.1.2. Market Attractiveness Index, By Treatment Type

- 7.2. Drug *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Enzyme Replacement Therapy

- 7.4. Physical Therapy

- 7.5. Chaperone-Advanced Replacement Therapy

8. By Route of Administration

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 8.1.2. Market Attractiveness Index, By Route of Administration

- 8.2. Oral *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Parenteral

9. By End User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 9.1.2. Market Attractiveness Index, By End User

- 9.2. Hospitals *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Specialty Clinics

- 9.4. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. U.K.

- 10.3.6.3. France

- 10.3.6.4. Spain

- 10.3.6.5. Italy

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Genzyme (Sanofi)*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Amicus Therapeutics

- 12.3. Valerion Therapeutics

- 12.4. Audentes Therapeutics

- 12.5. Actus Therapeutics

- 12.6. BioMarin Pharmaceutical

- 12.7. EpiVax

- 12.8. Oxyrane

- 12.9. Sangamo BioSciences

- 12.10. Avrobio

- 12.11. Spark Therapeutics

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us