|

|

市場調査レポート

商品コード

1208612

眼科診断装置の世界市場-2023-2030Global Ophthalmic Diagnostic Equipment Market - 2023-2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 眼科診断装置の世界市場-2023-2030 |

|

出版日: 2023年02月01日

発行: DataM Intelligence

ページ情報: 英文 200 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場概要

眼科診断装置の世界市場規模は2023年に45億米ドル、2030年には64億米ドルに達すると推定され、予測期間(2023~2030年)のCAGRは5.4%で成長するとされています。

眼科診断装置とは、緑内障、糖尿病関連網膜症、加齢黄斑変性症などの眼科疾患の診断に利用される装置を指します。眼科医はこの機器を使用することで、診断の精度を大幅に向上させるとともに、診断の効率化を図ることができます。

市場力学

眼科診断装置の世界市場を牽引する主な要因は、緑内障、加齢黄斑変性、白内障などの視覚障害の発生率の増加による眼科診断装置に対する需要の高まり、意識改革の取り組み、新規製品の開発につながる技術の進歩、手術中に目を保護する必要性の高まりなどです。

手術中に目を保護する必要性の高まりや、新しい機器の開発につながる技術の進歩が、市場の成長を促進すると期待されています。

眼科診断装置市場は、技術の進歩、老年人口の増加、研究開発投資の急増、緑内障、白内障、糖尿病性黄斑浮腫、AMDなどの眼科疾患の増加、最新技術を用いた新製品への改良、および新興市場の医療インフラの改善によって牽引されています。

眼科診断機器は、手術や治療のために広く使用されています。これらの機器やデバイスの採用が進み、政府の取り組みや資金が増加することにつながっています。これらの資金は、眼科用超音波装置、眼圧計、細隙灯などの眼科診断機器製品の生産に役立てられます。これらの機器や装置の市場は、眼科疾患の増加により世界的に拡大しています。また、主要メーカーによる先進的な製品の提供も、市場の成長に重要な役割を果たすと予想されます。

診断と治療のためのこれらの眼科診断機器に関連するさまざまな新製品の発売、調査研究、啓発活動の高まりは、市場の成長に寄与しています。例えば、2022年4月1日、Ziemer Ophthalmic Systemsは、独自のLDV Z8 Multipurpose Femtosecond Laserの後継となる新規フェムト秒レーザー、FEMTO Z8 NEOのFDAによる認可取得について発表しています。FEMTO Z8 NEOは、先進のハードウェアに加え、改良された新しいソフトウェア・アプリケーションを提供します。新たに開発されたプラットフォームは、操作性、性能、患者の快適性を大幅に向上させています。信頼性と精度は、新しいレーザー光源やモニタリングシステムによって最適化されました。

製品に含まれる臓器の感度に起因する高いリスクは、市場の成長を妨げると予想されます。

眼科診断に利用される機器の承認のための厳格な規則や規制は、眼科診断機器市場の成長を妨げる主要な要因です。様々な要件や臨床試験を満たさなければならないため、これらの機器の総コストが増加します。

また、製品に含まれる臓器の感度が高いためリスクが高く、これらの機器を適切に取り扱う経験豊富な専門家がいないことも、市場の成長を制限する主な要因となっています。

COVID-19影響度分析

パンデミックは、世界の財政的な期待、業務、危機対応戦略に悪影響を及ぼしています。COVID-19の発生はヘルスケア産業に深刻な影響を及ぼしています。眼科診断装置市場は、COVIDにより莫大な損失を被っています。主要メーカーは様々な研究・臨床試験を開始しました。様々な取り組み、製品の発売、コラボレーション、合併が世界中で行われ、市場の成長を後押ししています。例えば、2021年5月19日、Glaukos Corporationは、Santenowned STN2000100 surgical device(「DE-128」)の開発、マーケティング、オーストラリア、南北アメリカ(北、中、南米)、ニュージーランドでの販売に関するSanten Pharmaceutical Co, Ltd.との拡大協力関係の締結について発表しています。

目次

第1章 調査手法と調査範囲

- 調査手法

- 調査目的および調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場影響要因

- 促進要因

- 手術時の眼球保護ニーズの高まり

- 技術的進歩の急増

- 視覚障害者の増加

- 抑制要因

- 製品に含まれる臓器が敏感であること別リスク

- ビジネスチャンス

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- プライシング分析

第6章 COVID-19の分析

- COVID-19の市場分析

- COVID-19以前の市場シナリオ

- COVID-19の現在の市場シナリオ

- COVID-19の後、または将来のシナリオ

- COVID-19の中での価格ダイナミクス

- 需要-供給スペクトラム

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的取り組み

- まとめ

第7章 製品タイプ別

- 屈折計

- 光コヒーレンス・トモグラフィー

- 眼科用超音波診断装置

- 眼圧計

- スリットランプ

- 角膜トポグラフィーシステム

- 検眼鏡

- 眼底カメラ

- レンズメーター

- その他

第8章 アプリケーション別

- 白内障

- 緑内障

- 加齢黄斑変性症

- 糖尿病性黄斑浮腫

- その他

第9章 エンドユーザー別

- 病院

- 眼科クリニック

- 外来手術センター

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ地域

第11章 競合情勢

- 主な展開と戦略

- 企業シェア分析

- 製品ベンチマーク

- 注目の主要企業リスト

第12章 企業プロファイル

- Halma Plc

- 企業概要

- 製品ポートフォリオと説明

- 主なハイライト

- 財務概要

- Coburn Technologies, Inc.

- Ellex

- Nidek Co., Ltd.

- Kowa American Corporation

- Quantel Medical

- Topcon Corporation

- ZEISS Group

- Haag-Streit Group

- Ziemer Ophthalmic Systems AG

第13章 眼科診断装置の世界市場-DataM

Market Overview

The global ophthalmic diagnostic equipment market size was valued at US$ 4.5 billion in 2023 and is estimated to reach US$ 6.4 billion by 2030, growing at a CAGR of 5.4% during the forecast period (2023-2030).

Ophthalmic diagnostic equipment refers to the equipment utilized for the diagnosis of ophthalmic conditions such as glaucoma, diabetes-related retinopathy, age-related macular degeneration, and more. With this equipment, ophthalmologists can greatly enhance their accuracy while improving their efficiency.

Market Dynamics

The major factors driving the global ophthalmic diagnostic equipment market are the rising demand for ophthalmic diagnostic equipment owing to increasing incidences of visual impairment such as glaucoma, age-related macular degeneration and cataract, surging awareness initiatives, advancements in technologies leading to the development of novel products and rising need to protect the eyes during surgeries.

The rising need to protect the eyes during surgeries and rising technological advancements leading to the development of new equipment are expected to drive the market's growth.

The ophthalmic diagnostic equipment market is driven by rising advancements in technology, an increase in the geriatric population, a surge in research and development investments, an increasing number of ophthalmic disorders such as glaucoma, cataract, diabetic macular edema, AMD and improvements in novel products using the latest technology along with improvements in medical infrastructure in emerging markets.

The ophthalmic diagnostic equipment and devices are being used widely for surgeries or treatment purpose. The adoption of these equipment or devices is increasing, leading to rising government initiatives and funds. These funds will help produce ophthalmic diagnostic equipment products such as ophthalmic ultrasound devices, tonometers or slit lamp. The market for these equipment or devices is increasing worldwide due to the enhanced number of these ophthalmic disorders. Moreover, the availability of technologically advanced products by key players is also expected to play a vital role in the market's growth.

Various novel product launches, research studies, and rising awareness initiatives related to these ophthalmic diagnostic equipment for diagnosis and treatment contribute to the market's growth. For instance, in April 1, 2022, Ziemer Ophthalmic Systems announced about received clearance by FDA for the FEMTO Z8 NEO, its novel femtosecond laser, the successor of the unique LDV Z8 Multipurpose Femtosecond Laser. The FEMTO Z8 NEO offers advanced hardware along with novel improved software applications. The newly developed platform provides substantial improvements on usability, performance and patient comfort. Reliability and precision were optimized by a novel laser source or monitoring system.

High risks involved due to the sensitivity of the organ in the product are expected to hamper the market's growth.

Strict rules and regulations for the approval of equipment utilized for ophthalmic diagnostic is the major factor hindering the growth of the ophthalmic diagnostic equipment market. Various requirements, clinical trials must be fulfilled, leading to an increase in the overall cost of these equipment.

High risk related due to the sensitivity of the organ in the product and the lack of experienced professionals for proper handling of these equipment devices is also a key factor limiting market's growth.

COVID-19 Impact Analysis

The pandemic has negatively impacted global financial expectations, operations and crisis response strategy. The COVID-19 outbreak has severely impacted the healthcare industry. The ophthalmic diagnostic equipment market has experienced huge losses due to COVID. Key manufacturers have started various research and clinical trials. Various initiatives, product launches, collaborations and mergers are happening worldwide, boosting the market's growth. For instance, in May 19, 2021, Glaukos Corporation announced about entering into an expanded collaboration with the Santen Pharmaceutical Co., Ltd. for the Santenowned STN2000100 surgical device ("DE-128") development, marketing, and sales in the Australia, Americas (North, Central, and South America) and New Zealand.

Segment Analysis

The optical coherence tomography segment is expected to grow at the fastest CAGR during the forecast period (2022-2029)

The optical coherence tomography segment is the highest market holder in the global ophthalmic diagnostic equipment market. The global ophthalmic diagnostic equipment market is segmented based on product type as refractometers, optical coherence tomography, ophthalmic ultrasound devices, tonometers, slit lamp, corneal topography systems, ophthalmoscope, fundus camera, lensometers and others. The optical coherence tomography segment is the largest market shareholder due to the increasing number of visual impairments incidences globally, increasing technological advancements and novel product launches.

Optical coherence tomography (OCT) is the most commonly used ophthalmic diagnostic equipment. Optical coherence tomography is a non-invasive imaging procedure which utilizes reflected light and produce pictures of the retina, back of the eye. OCT can be utilized for diagnosis and management of diseases such as glaucoma and diabetes-related retinopathy. This method creates an image by evaluating the dim red light's amount which reflects off of the optic nerve and retina. OCT can evaluate the thickness of optic nerve and retina. The ophthalmologists use OCT angiography to have a look inside the blood vessels present in the eye.

The growing number of regulatory approvals, technological advancements, product launches, and research/clinical trial studies drive the market's growth. For instance, on May 25, 2022, Ziemer Ophthalmology launched the novel upgrades of the GALILEI G6 Toric IOL Calculator and Barrett Formula taking the refractive cataract surgery planning to next level. The GALILEI G6 provides extensive, up-to-date calculator and formulas software packages, creating its full capability as all-in-one diagnostic equipment integrating dual scheimpflug tomography with optical biometry and Placido topography.

Geographical Analysis

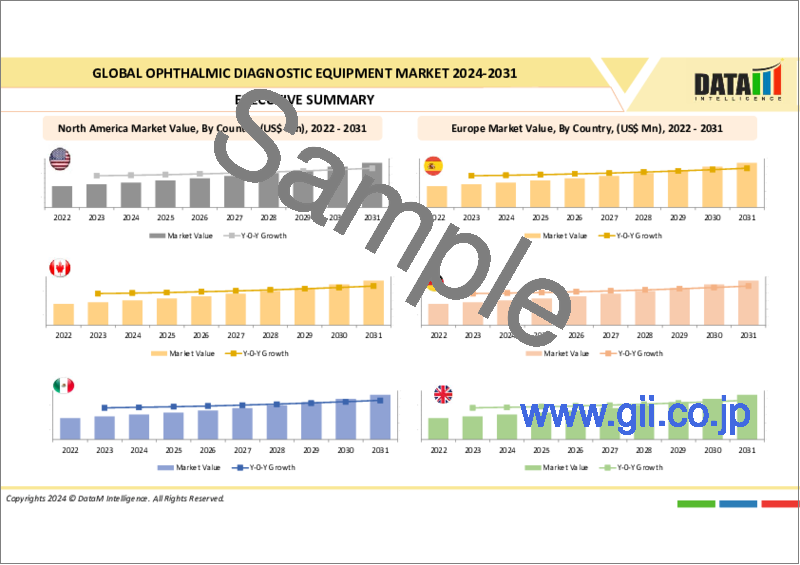

North America holds the largest market share in the global ophthalmic diagnostic equipment market.

North America dominates the global ophthalmic diagnostic equipment market primarily due to its large population, excellent medical infrastructure, and high-income levels. The market is expected to grow at a relatively moderate pace during the forecast period due to healthcare expenditure in the US. The market's significant size is attributed to the high medical expenditure.

Increasing expenditure on healthcare and raising awareness among people is also contributing to the market's growth in this region. Advancement of ophthalmic diagnostic equipment in several ophthalmic conditions like glaucoma, age-related macular degeneration or cataract, increase in pharmaceutical establishment across the region and government approvals, and the presence of key players in the region are contributing to the growth of the ophthalmic diagnostic equipment market.

Moreover, the growing number of product launches is responsible for the market's growth. Many key developments, technological advancements, collaborations, and agreements are taking place in this region. For instance, in August 31, 2021, Santen Pharmaceutical Co., Ltd., a specialized ophthalmology company announced its strategic partnership with Shanghai Airdoc Medical Technology Co., Ltd., a retina artificial intelligence enterprise to enhance eye disease diagnostic rate and improve eye health level among communities of China. Santen will provide full play to its extensive channels in ophthalmology to commercialize portable fundus camera to concerned departments in medical institutions in China, and to offer Chinese grassroots medical system with accurate, fair-price, fine, and guaranteed fundi screening devices with supporting solutions.

Competitive Landscape

The ophthalmic diagnostic equipment market is highly competitive with local and global companies' presence. Halma Plc, Coburn Technologies, Inc., Ellex, Nidek Co., Ltd., Kowa American Corporation, Quantel Medical, Topcon Corporation, ZEISS Group, Haag-Streit Group, Ziemer Ophthalmic Systems AG, and more. The key players are adopting various growth strategies such as product launches, mergers & acquisitions, partnerships, and collaborations, contributing to the market's growth. For instance, in July 1, 2021, Ziemer, a laser diagnostics and eye care provider announced its strategic alliance with Zubisoft to introduce lens calculation and laser nomogram technologies in the market. Zubisoft GmbH is the IBRA digital health suite manufacturer, a treatment planning or outcome system for refractive and cataract surgery.

Halma Plc

Overview: Halma Plc is a life-saving technology companies group that consists of 44 businesses regulated in a decentralized manner. Halma, via its products, is focused on trying to make the world cleaner, safer and healthier. This group operates in three segments: environmental and analysis, safety, and medical equipment.

Product Portfolio:

4 Sight: For ophthalmic diagnostics, it provides a single solution by combining a Pachymeter, A-Scan, B-Scan, and UBM in one, easy-to-utilize platform.

Key Development: In June 8, 2022, Keeler, part of Halma supported the Vision 2020 LINKS Programme and donated a slit lamp to Dominica. The laser unit in Dominica broke down which now is replaced by this latest Keeler slit lamp.

The global ophthalmic diagnostic equipment market report would provide access to approx.: 45+market data table, 40+figures and 200 (approximate) pages.

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising need to protect the eyes during surgeries

- 4.1.1.2. Surge in technological advancements

- 4.1.1.3. Increasing cases of visual impairment

- 4.1.2. Restraints:

- 4.1.2.1. Risks involved due to the sensitivity of the organ in the product

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1 Porter's Five Forces Analysis

- 5.2 Supply Chain Analysis

- 5.3 Pricing Analysis

6. COVID-19 Analysis

- 6.1. Analysis of Covid-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid Covid-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturer's Strategic Initiatives

- 6.6. Conclusion

7. By Product Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 7.1.2. Market Attractiveness Index, By Product Type

- 7.2. Refractometer *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 7.3. Optical Coherence Tomography

- 7.4. Ophthalmic Ultrasound Devices

- 7.5. Tonometers

- 7.6. Slit Lamp

- 7.7. Corneal Topography Systems

- 7.8. Ophthalmoscope

- 7.9. Fundus Camera

- 7.10. Lensometers

- 7.11. Others

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Cataract *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 8.3. Glaucoma

- 8.4. Age-related Macular Degeneration

- 8.5. Diabetic Macular Edema

- 8.6. Others

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-User

- 9.2. Hospitals *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029

- 9.3. Ophthalmic Clinics

- 9.4. Ambulatory Surgical Centers

- 9.5. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis US$ Million, 2020-2029 and Y-o-Y Growth Analysis (%), 2021-2029, By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. U.K.

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Key Developments and Strategies

- 11.2. Company Share Analysis

- 11.3. Products Benchmarking

- 11.4. List of Key Companies to Watch

12. Company Profiles

- 12.1. Halma Plc *

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Key Highlights

- 12.1.4. Financial Overview

- 12.2. Coburn Technologies, Inc.

- 12.3. Ellex

- 12.4. Nidek Co., Ltd.

- 12.5. Kowa American Corporation

- 12.6. Quantel Medical

- 12.7. Topcon Corporation

- 12.8. ZEISS Group

- 12.9. Haag-Streit Group

- 12.10. Ziemer Ophthalmic Systems AG

LIST NOT EXHAUSTIVE

13. Global Ophthalmic Diagnostic Equipment Market - DataM

- 13.1. Appendix

- 13.2. About Us and Medications

- 13.3. Contact Us