|

|

市場調査レポート

商品コード

1730126

欧州のキッチン家具市場The European Market for Kitchen Furniture |

||||||

|

|||||||

| 欧州のキッチン家具市場 |

|

出版日: 2025年05月21日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 282 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

当レポートは、欧州のキッチン家具市場の包括的な状況と、最新の動向に関するCSILの評価による広範な分析・洞察をまとめており、以下のとおり構成されています。

第1章 シナリオ:本章では、欧州のキッチン家具市場の概況を表やグラフを用いて示しています。キッチン家具の生産、消費、国際貿易に関するデータが全体および対象となる各国について、金額ベースおよび数量ベースの両面から、全体のセクターおよび価格帯別に分析されています。また、欧州の主要グループ企業とその市場シェアについても概観されています。本章の最後には、2025年~2027年のキッチン家具消費予測が提示されています。

第2章 ビジネスパフォーマンス:本章では、過去6年間の業績分析に必要なキッチン家具統計および主なマクロ経済指標を全体および対象国ごとに提示しています。さらに、2025年~2027年の予測も含まれています。

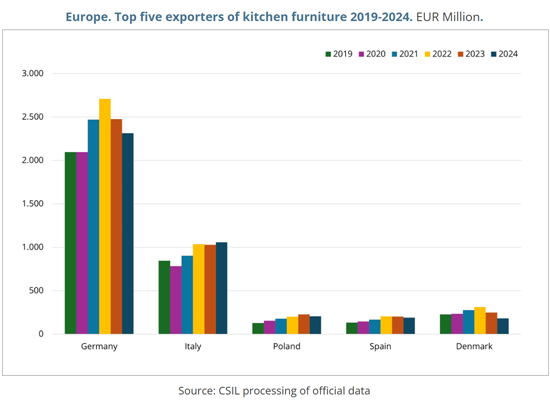

第3章 国際貿易:本章では、過去6年間の30カ国のキッチン家具の輸出入に関する詳細な表を掲載しており、国別および仕向地/原産地の地理的地域別に分類されています。

第4章 供給構造:本章では、欧州のキッチン家具メーカーによる製品タイプに関する分析を提供しており、各セグメントで活動する主要企業に関する表や情報も含まれています。生産は、キャビネット扉の素材、スタイル、カラー、ラッカー仕上げの種類、ワークトップの素材別に分類されています。

第5章 流通経路:本章では、欧州のキッチン家具市場で活発に機能している主要な流通チャネルについて、欧州全体および対象国別に概観しています。

第6章 競合システム:国内および海外企業について、また価格帯別セグメントにおける状況について分析しています。詳細な表には、主要なキッチン家具企業の売上データや市場シェアが示されており、主要企業の簡潔なプロファイルも掲載されています。本章の最後では、欧州域外へのキッチン家具輸出と地域別(北・中南米、アジア・太平洋、中東・アフリカ)の市場シェアに焦点を当てています。

本レポートで言及した企業のリスト

調査地域:

|

|

|

主要企業

本レポートに記載されている企業:Agata Meble, Alvic, Aran, Armony, Arredo3, Arrital, Artego, Aster, Ballingslov, Ballerina, Bauformat, Boffi, Bruynzeel, BRW, Bulthaup, Colombini, Dan, Decodom, Delta Cocinas, Discac, Eggo, Ekipa, Elkjop, Euromobil, Fournier, Freda, Gama Decor, Haecker, Hanak, Howdens Joinery, Ikea, Leicht, Lube, Mandemaakers、Menuiseries du Centre, Mob Cozinhas, Mondo Convenienza, Nikolidakis, Nobia, Nobilia, Nolte, Omega, Puustelli, Rempp, Rotpunkt, Sanitas Troesch, Santos, Scavolini, Snaidero, Symphony, Schmidt, Siko, Snaidero, Stosa, Strai, TCM, Tom Howley, Turi Group, Valcucine, Vedum, Veneta Cucine, WFM Kitchen, Wren Kitchens

ハイライト

CSILによると、欧州のキッチン家具生産額は約180億ユーロと推定されています。貿易動向に関しては、キッチン家具分野は構造的に貿易黒字を維持しています。業界の開放度は家具産業全体の平均より依然として低いものの、生産に占める輸出の割合や消費に占める輸入の割合は徐々に増加しています。欧州のキッチン家具輸出の大部分は欧州向けですが、北米、アジア太平洋、中東など海外市場にも一定量が輸出されています。

目次

目次の要約

調査手法

- 調査ツールと用語、目次

エグゼクティブサマリー

第1章 シナリオ:国別の動向、市場セグメント、数値

- 国別の市場の動向と数値

- 市場セグメント別の生産内訳

- 市場セグメント別の消費内訳

- 欧州の主要グループとその市場シェア

- 現在の動向と予測

第2章 ビジネスパフォーマンス:国別基礎データとマクロ経済指標

- 北欧州(デンマーク、フィンランド、ノルウェー、スウェーデン)

- 西欧(ベルギー/ルクセンブルク、フランス、アイルランド、オランダ、英国)

- 中欧(DACH:オーストリア、ドイツ、スイス)

- 南欧(ギリシャ、イタリア、ポルトガル、スペイン)

- 中東欧(ブルガリア、クロアチア、キプロス、チェコ共和国、エストニア、ハンガリー、リトアニア、ラトビア、マルタ、ポーランド、ルーマニア、スロベニア、スロバキア)

第3章 国際貿易

- 貿易収支、輸出、輸入の推移

- 国別および仕向地/原産地別の輸出入

- 特定家電製品の国別輸出入

第4章 供給構造

- 供給内訳:キャビネット扉の材質別

- 供給内訳:キャビネット扉のスタイル別

- 供給内訳:キャビネット扉の色と塗装タイプ別

- 供給内訳:ワークトップ素材別

- 供給内訳:レイアウトタイプ別

- 蝶番と引き出し

- 埋め込み照明

- 知的財産

第5章 流通チャネル

- 概要:キッチン専門店、家具店、家具チェーン、建築業、契約、DIY、eコマース、直接販売

- 特定の国および地域(中東欧)における流通チャネル別の売上高の内訳

- ビルトイン家電

- 持続可能性

競争システム

- 欧州の主要企業と市場シェア(消費と生産)

- 欧州の競争システム:市場セグメント別

- 国別の競争システム

- 欧州から欧州外市場および海外への輸出

付録

- 付録1.財務分析:120社の製造業者の主要財務指標・雇用分析

- 付録2.主要キッチン家具会社のリスト

CSIL's Report "The European Market for Kitchen Furniture" offers a comprehensive picture of the kitchen furniture sector in Europe, an extensive analysis which is introduced by CSIL's assessment of the latest trends and insights and is structured as follows:

Chapter 1. Scenario presents an overview of the European kitchen furniture sector through tables and graphs, data on kitchen furniture production, consumption and international trade are analysed, at the European level as a whole and for each country considered, both in value and in volume, for the total sector and by price range. A panorama of the leading European groups and their market shares is also provided. The chapter closes with the kitchen consumption forecasts for the years 2025-2027.

Chapter 2. Business performance offers kitchen furniture statistics and the main macroeconomic indicators necessary to analyse the performance of the sector for the last 6 years (2019-2024), together with forecasts for 2025-2027, at a European level as a whole and for each country considered.

Chapter 3. International trade provides detailed tables on the kitchen furniture exports and imports in the 30 European Countries considered, for the last 6 years, broken down by country and by geographical area of destination/origin.

Chapter 4. Supply structure offers an analysis of the types of products manufactured by the European kitchen furniture manufacturers, in addition to tables and information on the key players operating in each segment. Production is broken down by cabinet door material, by cabinet door style, by cabinet door colour, by lacquered cabinet door type and by worktop material.

Chapter 5. Distribution channels gives an overview of the main distribution channels active on the European kitchen furniture market, at the European level as a whole and for each country considered.

Chapter 6. The competitive system: sales by price range and by country offers an insight into the leading local and foreign players present in each European country and in each price range segment considered. Detailed tables show sales data and market shares of the top kitchen furniture companies; short profiles of the main players in the kitchen furniture industry are also available. At the end of this chapter, there is a focus on European kitchen furniture exports and market shares outside Europe, by area of destination (North and Central-South America, Asia and Pacific, and Middle East and Africa).

Financial Analysis builds on a sample of 120 European kitchen furniture manufacturers, a study of their main profitability ratios (ROA, ROE and EBITDA) and measures their employee ratios.

List of mentioned companies in this report.

GEOGRAPHICAL COVERAGE:

|

|

|

Selected companies:

Among the companies mentioned in the Report: Agata Meble, Alvic, Aran, Armony, Arredo3, Arrital, Artego, Aster, Ballingslov, Ballerina, Bauformat, Boffi, Bruynzeel, BRW, Bulthaup, Colombini, Dan, Decodom, Delta Cocinas, Discac, Eggo, Ekipa, Elkjop, Euromobil, Fournier, Freda, Gama Decor, Haecker, Hanak, Howdens Joinery, Ikea, Leicht, Lube, Mandemaakers, Menuiseries du Centre, Mob Cozinhas, Mondo Convenienza, Nikolidakis, Nobia, Nobilia, Nolte, Omega, Puustelli, Rempp, Rotpunkt, Sanitas Troesch, Santos, Scavolini, Snaidero, Symphony, Schmidt, Siko, Snaidero, Stosa, Strai, TCM, Tom Howley, Turi Group, Valcucine, Vedum, Veneta Cucine, WFM Kitchen, Wren Kitchens.

Highlights:

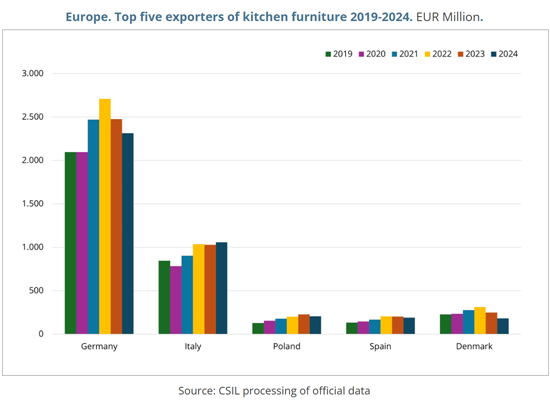

According to CSIL, the European kitchen furniture production is valued at approximately EUR 18 billion. As far as trade dynamics are concerned, the kitchen furniture segment has a structurally positive trade balance. The sector's openness still remains well below the average of the furniture industry as a whole, but the share of exports on production and the share of imports on consumption have progressively increased. Most European kitchen furniture exports are destined within Europe, with the remainder going overseas, mainly to North America, Asia-Pacific, and the Middle East.

Table of Contents

Abstract of table of contents

Methodology

- Research tools and terminology, Contents

Executive summary

1. Scenario: Trends, market segment and figures by country

- 1.1. Market evolution and figures by country

- 1.2. Production breakdown by market segment

- 1.3. Consumption breakdown by market segment

- 1.4. Leading groups in Europe and their market shares

- 1.5. Current trends and forecasts for 2025-2027

2. Business performance: basic data and macroeconomic indicators by country

- 2.1. Northern Europe (Denmark, Finland, Norway and Sweden)

- 2.2. Western Europe (Belgium/Luxembourg, France, Ireland, Netherlands, the UK)

- 2.3. Central Europe (DACH: Austria, Germany, Switzerland)

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- 2.5. Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. International trade

- 3.1. Trade balance, exports, imports evolution

- 3.2. Exports and imports by country and by geographical area of destination/origin

- 3.3. Exports and imports by country for selected household appliances

4. Supply structure

- 4.1. Breakdown of supply by cabinet door material

- 4.2. Breakdown of supply by cabinet door style

- 4.3. Breakdown of supply by cabinet door colour and lacquered type

- 4.5. Breakdown of supply by worktop material

- 4.6. Breakdown of supply by kind of lay-out

- 4.7. Hinges and drawers

- 4.8. Embedded lighting

- 4.9. Intellectual Property

5. Distribution channels

- Overview: Kitchen specialists, Furniture shops, Furniture chains, Building trade, Contract, DIY, E-commerce, Direct sales

- Breakdown of sales by distribution channels in selected countries and geographic region (Central-Eastern Europe)

- Built-in appliances

- Sustainability

The competitive system

- 6.1. Leading players in Europe and market shares (consumption and production)

- 6.2. The European competitive system by market segment (luxury, upper-end, upper-middle, middle, middle-low, lower-end)

- 6.3. The competitive system by country

- 6.4. Exports from Europe to Extra-European markets and Overseas

Annex

- Annex 1. Financial Analysis Key financial indicators and Employment analysis in a sample of 120 manufacturers

- Annex 2. List of selected kitchen furniture companies