|

市場調査レポート

商品コード

1672839

BNPL(Buy Now Pay Later)プラットフォーム市場:チャネル別、企業タイプ別、カテゴリー別、地域別Buy Now Pay Later Platforms Market, By Channel (Point of Sale (POS) and Online), By Enterprise Type (SMEs and Large Enterprises), By Category, By Geography (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) |

||||||

カスタマイズ可能

|

|||||||

| BNPL(Buy Now Pay Later)プラットフォーム市場:チャネル別、企業タイプ別、カテゴリー別、地域別 |

|

出版日: 2025年02月18日

発行: Coherent Market Insights

ページ情報: 英文 155 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

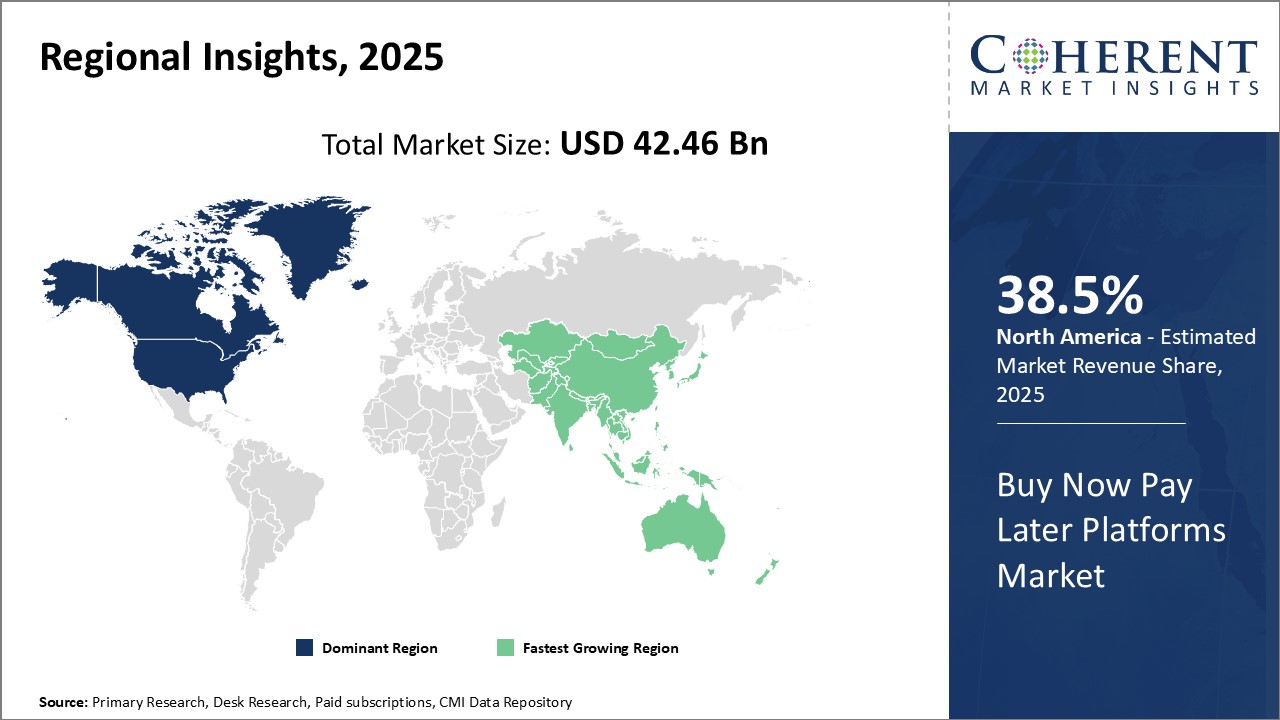

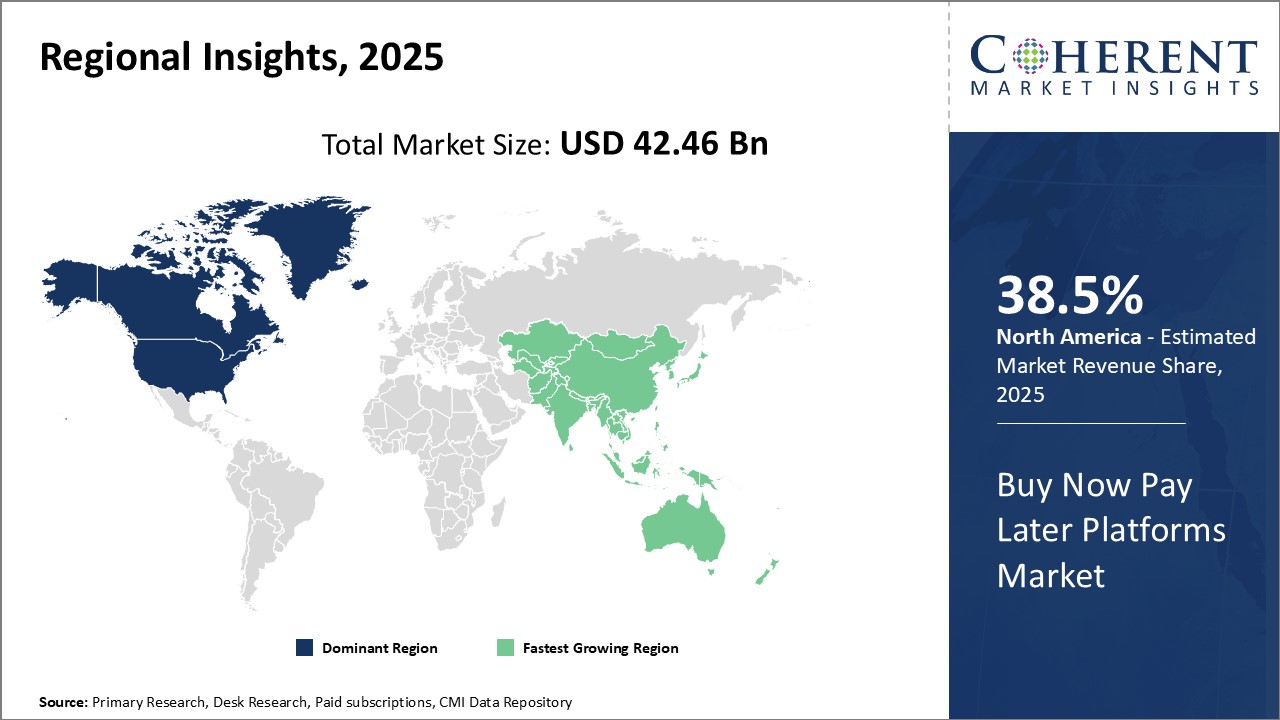

世界のBNPL(Buy Now Pay Later)プラットフォーム市場は、2025年には424億6,000万米ドルと推定され、2032年には1,758億7,000万米ドルに達すると予測され、2025~2032年までの年間平均成長率(CAGR)は22.5%で成長する見込みです。

| レポート範囲 | レポート詳細 | ||

|---|---|---|---|

| 基準年 | 2024年 | 2025年の市場規模 | 424億6,000万米ドル |

| 実績データ | 2020~2024年 | 予測期間 | 2025~2032年 |

| 予測期間:2025~2032年のCAGR | 22.50% | 2032年の金額予測 | 1,758億7,000万米ドル |

レポート概要

BNPL(Buy Now Pay Later)プラットフォーム市場は、ここ数年で大きな成長を遂げています。これらのプラットフォームは、消費者が商品を購入し、一定期間にわたって無利子で代金を支払うという柔軟性を記載しています。Buy Now Pay Laterサービスは、従来のクレジットと現金やカードのような決済オプションの間の重要なギャップを埋めるものです。従来のローンに比べ、よりシンプルな条件と短い返済期限で、即座にクレジット承認が得られます。複数のBNPL参入企業が登場し、主にモバイルアプリやウェブプラットフォームを通じて革新的な決済ソリューションを提供しています。eコマースの普及と顧客直接販売ブランドの成長は、BNPLサービスの採用を加速させています。

市場力学

後払いオプションに対する消費者の嗜好の高まりが、BNPL(Buy Now Pay Later)プラットフォーム市場を推進する主要要因となっています。これらのプラットフォームは、一括払いのコストをなくすことで、より手頃な価格で購入を可能にします。オンラインショッピングと金融技術の成長により、新たな決済選択肢が可能になりました。若年労働人口の増加という良好な人口動態は、顧客基盤を拡大しています。しかし、使い過ぎや負債リスクに対する懸念が足かせとなっています。詐欺やセキュリティの問題も市場成長の課題となっています。銀行、加盟店、スマートフォンメーカーとの戦略的提携により、サービスを多様化する機会があります。新たな小売業態や地域への参入は、市場拡大の余地があります。

本調査の主要特徴

- 本レポートでは、世界のBNPL(Buy Now Pay Later)プラットフォーム市場を詳細に分析し、2024年を基準年とした予測期間(2025~2032年)の市場規模と複合年間成長率(CAGR %)を掲載しています。

- また、さまざまなセグメントにおける潜在的な収益成長機会を明らかにし、この市場の魅力的な投資提案マトリクスについて解説しています。

- また、市場促進要因、抑制要因、機会、新製品の上市や承認、市場動向、地域による展望、主要企業が採用する競争戦略などに関する主要考察も提供しています。

- 本レポートでは、企業ハイライト、製品ポートフォリオ、主要なハイライト、財務実績、戦略などのパラメータに基づいて、世界のBNPL(Buy Now Pay Later)プラットフォーム市場における主要企業プロファイルを掲載しています。

- 本レポートから洞察により、マーケティング担当者や企業の経営陣は、将来の製品発売、タイプアップ、市場拡大、マーケティング戦術に関する情報に基づいた意思決定を行うことができます。

- この調査レポートは、投資家、サプライヤー、製品メーカー、流通業者、新規参入者、財務アナリストなど、この産業のさまざまな利害関係者を対象としています。

- 利害関係者は、世界のBNPL(Buy Now Pay Later)プラットフォーム市場分析に使用される様々な戦略マトリックスを通じて、意思決定を容易にすることができます。

目次:

第1章 調査の目的と前提条件

- 調査目的

- 前提条件

- 略語

第2章 市場展望

- レポートの説明

- 市場の定義と範囲

- エグゼクティブサマリー

- 一貫型機会マップ(COM)

第3章 市場力学、規制、動向分析

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 影響分析

- 規制シナリオ

- 製品の発売/承認

- PEST分析

- ポーター分析

- 合併と買収のシナリオ

第4章 世界のBNPL(Buy Now Pay Later)プラットフォーム市場-コロナウイルス(COVID-19)パンデミックの影響

- COVID-19疫学

- 供給側と需要側の分析

- 経済への影響

第5章 世界のBNPL(Buy Now Pay Later)プラットフォーム市場、チャネル別、2020~2032年(10億米ドル)

- イントロダクション

- 販売時点管理(POS)

- オンライン

第6章 世界のBNPL(Buy Now Pay Later)プラットフォーム市場、企業タイプ別、2020~2032年(10億米ドル)

- イントロダクション

- 中小企業

- 大企業

第7章 世界のBNPL(Buy Now Pay Later)プラットフォーム市場、カテゴリー別、2020~2032年(10億米ドル)

- イントロダクション

- 銀行、金融サービス、保険(BFSI)

- 民生用電子機器

- ファッション・衣料

- 医療

- 小売

- メディアとエンターテイメント

- その他(旅行・運輸、教育、物流)

第8章 世界のBNPL(Buy Now Pay Later)プラットフォーム市場、地域別、2020~2032年(10億米ドル)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第9章 競合情勢

- 企業プロファイル

- Affirm, Inc.

- Afterpay Pty Ltd

- Atome

- Flipkart Internet Private Limited

- Grab Holdings Inc.

- Hoolah Holdings Pte Ltd.

- Klarna Inc.

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited(Paytm)

- Openpay Pty Ltd.

- Payl8r(Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

第10章 隆盛と衰退

- 隆盛と衰退

- 一貫型機会マップ

第11章 セクション

- 調査手法

- 出版社について

Global Buy Now Pay Later Platforms Market is estimated to be valued at USD 42.46 Bn in 2025 and is expected to reach USD 175.87 Bn by 2032, growing at a compound annual growth rate (CAGR) of 22.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 42.46 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 22.50% | 2032 Value Projection: | USD 175.87 Bn |

Report Description:

The buy now pay later platforms market has seen significant growth over the past few years. These platforms provide consumers the flexibility to purchase goods and pay for them interest-free, over a period of time. This has boosted the spending power of consumers while driving sales for merchants. buy now pay later services fill an important gap between conventional credit and payment options like cash or cards. They offer instant credit approval, with simpler terms and shorter repayment windows compared to traditional loans. Several BNPL players have emerged, providing innovative payment solutions primarily through mobile apps and web platforms. The proliferation of e-commerce and the growth of direct to customer brands have accelerated the adoption of BNPL services.

Market Dynamics:

Rising consumer preference for deferred payment options is a key driver propelling the buy now pay later platforms market. These platforms make purchases more affordable by removing lump sum costs. Growing online shopping and financial technologies have enabled new payment choices. Favorable demographics with N increasing young working population is expanding the customer base. However, concerns around overspending and debt risks act as restraints. Fraud and security issues also challenge the market growth. Opportunities lie in strategic partnerships with banks, merchants, and smartphone makers to diversify services. Entering new retail verticals and geographic regions presents scope for market expansion.

Key Features of the Study:

- This report provides an in-depth analysis of the global buy now pay later platforms market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global buy now pay later platforms market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Affirm, Inc., Afterpay Pty Ltd, Atome, Flipkart Internet Private Limited, Grab Holdings Inc., Hoolah Holdings Pte Ltd., Klarna Inc., LatitudePay Australia Pty Ltd, Laybuy Group Holdings Limited., Mastercard International Incorporated, Monzo Bank Limited, One97 Communications Limited (Paytm), Openpay Pty Ltd., Payl8r (Social Money Ltd.), PayPal Holdings, Inc., Perpay Inc., Sezzle Inc, SPLITIT USA INC., and Zip Co Limited

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global buy now pay later platform market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global buy now pay later market

Market Segmentation

- By Channel

- Point of Sale (POS)

- Online

- By Enterprise Type

- SMEs

- Large Enterprises

- By Category

- Banking, Financial Services and Insurance (BFSI)

- Consumer Electronics

- Fashion & Garment

- Healthcare

- Retail

- Media and Entertainment

- Others (Travel and Transportation, Education, Logistics)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players Insights

- Affirm, Inc.

- Afterpay Pty Ltd

- Atome

- Flipkart Internet Private Limited

- Grab Holdings Inc.

- Hoolah Holdings Pte Ltd.

- Klarna Inc.

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited (Paytm)

- Openpay Pty Ltd.

- Payl8r (Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

Table of Contents:

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Channel

- Market Snapshot, By Enterprise Type

- Market Snapshot, By Category

- Market Snapshot, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Buy Now Pay Later Platforms Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Buy Now Pay Later Platforms Market, By Channel, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Point of Sale (POS)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Online

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Buy Now Pay Later Platforms Market, By Enterprise Type, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- SMEs

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Large Enterprises

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

7. Global Buy Now Pay Later Platforms Market, By Category, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Banking, Financial Services and Insurance (BFSI)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Consumer Electronics

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Fashion & Garment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Healthcare

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Retail

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Media and Entertainment

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Others (Travel and Transportation, Education, Logistics)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

8. Global Buy Now Pay Later Platforms Market, By Region, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- U.K.

- Germany

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country, 2025 and 2032 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Channel, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Enterprise Type, 2020 - 2032 (USD Billion)

- Market Size and Forecast, By Category, 2020 - 2032 (USD Billion)

- Market Share Analysis, By Country/Sub-region, 2025 and 2032 (%)

- South Africa

- GCC Countries

- Rest of the Middle East & Africa

9. Competitive Landscape

- Company Profiles

- Affirm, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Afterpay Pty Ltd

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Atome

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Flipkart Internet Private Limited

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Grab Holdings Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Hoolah Holdings Pte Ltd.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Klarna Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited (Paytm)

- Openpay Pty Ltd.

- Payl8r (Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

- Affirm, Inc.

10. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Section:

- Research Methodology

- About Us