|

|

市場調査レポート

商品コード

1579886

ヘッジファンドの世界市場規模調査:戦略別、タイプ別、地域別、予測、2022年~2032年Global Hedge Fund Market Size Study, by Strategy (Long/Short Equity, Event Driven, Currency Counterfeit Detector, Managed Futures/CTA, Others), by Type (Offshore, Fund of Funds, Domestic) and Regional Forecasts 2022-2032 |

||||||

カスタマイズ可能

|

|||||||

| ヘッジファンドの世界市場規模調査:戦略別、タイプ別、地域別、予測、2022年~2032年 |

|

出版日: 2024年10月28日

発行: Bizwit Research & Consulting LLP

ページ情報: 英文 285 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

ヘッジファンドの世界市場は、2023年に5兆3,100億米ドルと評価され、2024年から2032年にかけてCAGR10.7%で成長し、2032年には13兆米ドルに拡大すると予測されています。

ヘッジファンドは、金融業界の重要なセグメントを代表するもので、プロのマネジャーによって運用される投資ファンドが、さまざまな投資家から資金を集め、リスクを管理しながらリターンを生み出すことを目的とした多様な投資戦略を採用しています。これらのファンドは、株式、債券、通貨、コモディティ、デリバティブなど、幅広い資産に投資する柔軟性を持っています。ヘッジファンド市場の情勢は、進化し続ける金融業界の性質を反映し、様々な要因がダイナミックに絡み合っているのが特徴です。多様な投資戦略の利用やテクノロジーへの依存の高まりなど、いくつかの動向や特徴がヘッジファンド市場の現在のシナリオを特徴づけています。ヘッジファンドは、株式のロング/ショート、グローバルマクロ、イベントドリブン、クオンツ戦略など幅広いアプローチを採用しており、投資家がさまざまなアルファソースにアクセスできるようにし、変化する市場状況に柔軟に対応できるようにしています。さらに、高度なデータ分析、人工知能、機械学習の統合がますます普及し、ヘッジファンド業界の意思決定プロセスと運用効率を高めています。

デジタル資産への投資の急増とテクノロジーの進歩がヘッジファンド市場の成長を後押ししています。規制状況の進化が市場拡大をさらに後押ししています。しかし、ヘッジファンドに関連する高額な手数料や、規制当局の監視とコンプライアンス・コストが、市場成長の課題となっています。逆に、クオンツ戦略やシステマティック戦略の台頭は、予測期間中の市場成長に有利な機会をもたらします。これらの要素は、世界のヘッジファンド市場の軌跡に大きな影響を与えることになるでしょう。ヘッジファンド産業は、戦略、タイプ、地域によって区分されます。戦略別では、市場は株式のロング/ショート、イベントドリブン、通貨偽造検出、マネージド先物/CTA、その他に分割されます。タイプ別では、オフショア、ファンド・オブ・ファンズ、国内に区分されます。また、北米、欧州、アジア太平洋、LAMEAの地域別にも分析しています。

目次

第1章 世界のヘッジファンド市場:エグゼクティブサマリー

- ヘッジファンドの世界市場:規模・予測(2022-2032年)

- 地域別概要

- セグメント別概要

- 戦略別

- タイプ別

- 主要動向

- 景気後退の影響

- アナリストの結論・提言

第2章 世界のヘッジファンド市場の定義と調査前提条件

- 調査目的

- 市場の定義

- 調査前提条件

- 包含と除外

- 制限事項

- 供給サイドの分析

- 入手可能性

- インフラ

- 規制環境

- 市場競争

- 経済性(消費者の視点)

- 需要サイド分析

- 規制の枠組み

- 技術の進歩

- 環境への配慮

- 消費者の意識と受容

- 調査手法

- 調査対象年

- 通貨換算レート

第3章 世界のヘッジファンド市場力学

- 市場促進要因

- デジタル資産への投資の増加

- テクノロジーの進化

- 規制状況の進化

- 市場の課題

- ヘッジファンドが課す高額な手数料

- 規制当局の精査とコンプライアンス・コスト

- 市場機会

- クオンツ戦略とシステマティック戦略の台頭

- アジア太平洋地域での拡大

- オフショアヘッジファンドの成長

第4章 世界のヘッジファンド市場:産業分析

- ポーターのファイブフォースモデル

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- ポーターのファイブフォースモデルへの未来的アプローチ

- ポーターのファイブフォースの影響分析

- PESTEL分析

- 政治

- 経済

- 社会

- 技術

- 環境

- 法律

- 主な投資機会

- 主要成功戦略

- 破壊的動向

- 業界専門家の視点

- アナリストの結論・提言

第5章 ヘッジファンドの世界市場:規模・予測、戦略別、2022年~2032年

- セグメントダッシュボード

- 世界のヘッジファンド市場:戦略別、収益動向分析、2022年および2032年

- 株式のロング/ショート

- イベントドリブン

- 通貨偽造検知

- マネージド先物/CTA

- その他

第6章 ヘッジファンドの世界市場:規模・予測、タイプ別、2022年~2032年

- セグメントダッシュボード

- 世界のヘッジファンド市場:タイプ別、収益動向分析、2022年および2032年

- オフショア

- ファンド・オブ・ファンズ

- 国内

第7章 ヘッジファンドの世界市場:規模・予測、地域別、2022年~2032年

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- アルゼンチン

- その他ラテンアメリカ

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他中東とアフリカ

第8章 競合情報

- 主要企業のSWOT分析

- 主要市場戦略

- 企業プロファイル

- Bridgewater Associates LP

- Renaissance Technologies LLC

- Man Group Ltd.

- AQR Capital Management LLC

- Two Sigma Investments LP

- Millennium Management LLC

- Citadel LLC

- Elliott Management Corporation

- Brevan Howard

- BlackRock Inc.

- Davidson Kempner Capital Management LP

- Pershing Square Capital Management

- Tiger Global Management LLC

- D.E. Shaw Group

- Third Point LLC

第9章 調査プロセス

- 調査プロセス

- データマイニング

- 分析

- 市場推定

- 検証

- 出版

- 調査属性

The Global Hedge Fund Market, valued at USD 5.31 trillion in 2023, is projected to expand to USD 13 trillion by 2032, growing at a compound annual growth rate (CAGR) of 10.7% from 2024 to 2032. Hedge funds represent a significant segment of the financial industry where investment funds, managed by professional managers, pool capital from various investors to employ a diverse array of investment strategies aimed at generating returns while managing risk. These funds have the flexibility to invest in a broad spectrum of assets, including stocks, bonds, currencies, commodities, and derivatives. The hedge fund market landscape is characterized by a dynamic interplay of various factors, reflecting the ever-evolving nature of the financial industry. Several trends and features define the current scenario in the hedge fund market, including the use of diverse investment strategies and the increasing reliance on technology. Hedge funds are employing a wide range of approaches, such as long/short equity, global macro, event-driven, and quantitative strategies, allowing investors to access different sources of alpha and providing flexibility in navigating changing market conditions. Furthermore, the integration of advanced data analytics, artificial intelligence, and machine learning is becoming increasingly prevalent, enhancing decision-making processes and operational efficiency in the hedge fund industry.

The surge in investments in digital assets and advancements in technology have fueled the growth of the hedge fund market. The evolving regulatory landscape has further bolstered market expansion. However, the high fees associated with hedge funds and the regulatory scrutiny & compliance costs pose challenges to market growth. Conversely, the rise of quantitative and systematic strategies presents lucrative opportunities for market growth during the forecast period. These elements are poised to significantly impact the Global Hedge Fund Market's trajectory. The hedge fund industry is segmented by strategy, type, and region. By strategy, the market is divided into long/short equity, event-driven, currency counterfeit detector, managed futures/CTA, and others. By type, it is segmented into offshore, fund of funds, and domestic. The market is also analyzed regionally across North America, Europe, Asia-Pacific, and LAMEA.

By Type In 2023, the Global Hedge Fund Market was led by the fund of funds segment, which is projected to maintain its dominance throughout the forecast period. This segment offers investors a diversified portfolio of funds, helping to reduce risk by spreading investments across different funds. However, the offshore segment is expected to experience the highest growth rate during the forecast period, driven by technological advancements and increased awareness, attracting a larger consumer base and propelling the global market forward.

- The key regions considered in the study include Asia Pacific, North America, Europe, Latin America, and the Middle East and Africa. North America dominated the Global Hedge Fund Market in 2023 and is expected to retain its leading position throughout the forecast period. This dominance is attributed to the rising demand for sophisticated risk management techniques in the region. Nevertheless, Asia-Pacific is anticipated to witness significant growth during the forecast period, driven by the increasing presence of prominent fund managers and substantial hedge fund assets under management (AUM) in the region.

Major market players included in this report are:

- Bridgewater Associates LP

- Renaissance Technologies LLC

- Man Group Ltd.

- AQR Capital Management LLC

- Two Sigma Investments LP

- Millennium Management LLC

- Citadel LLC

- Elliott Management Corporation

- Brevan Howard

- BlackRock Inc.

- Davidson Kempner Capital Management LP

- Pershing Square Capital Management

- Tiger Global Management LLC

- D.E. Shaw Group

- Third Point LLC

The detailed segments and sub-segment of the market are explained below:

By Strategy:

- Long/Short Equity

- Event Driven

- Currency Counterfeit Detector

- Managed Futures/CTA

- Others

By Type:

- Offshore

- Fund of Funds

- Domestic

By Region:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Years considered for the study are as follows:

- Historical year - 2022

- Base year - 2023

- Forecast period - 2024 to 2032

Key Takeaways:

- Market Estimates & Forecast for 10 years from 2022 to 2032.

- Annualized revenues and regional level analysis for each market segment.

- Detailed analysis of geographical landscape with country-level analysis of major regions.

- Competitive landscape with information on major players in the market.

- Analysis of key business strategies and recommendations on future market approach.

- Analysis of competitive structure of the market.

- Demand-side and supply-side analysis of the market.

Table of Contents

Chapter 1. Global Hedge Fund Market Executive Summary

- 1.1. Global Hedge Fund Market Size & Forecast (2022-2032)

- 1.2. Regional Summary

- 1.3. Segmental Summary

- 1.3.1. By Strategy

- 1.3.2. By Type

- 1.4. Key Trends

- 1.5. Recession Impact

- 1.6. Analyst Recommendation & Conclusion

Chapter 2. Global Hedge Fund Market Definition and Research Assumptions

- 2.1. Research Objective

- 2.2. Market Definition

- 2.3. Research Assumptions

- 2.3.1. Inclusion & Exclusion

- 2.3.2. Limitations

- 2.3.3. Supply Side Analysis

- 2.3.3.1. Availability

- 2.3.3.2. Infrastructure

- 2.3.3.3. Regulatory Environment

- 2.3.3.4. Market Competition

- 2.3.3.5. Economic Viability (Consumer's Perspective)

- 2.3.4. Demand Side Analysis

- 2.3.4.1. Regulatory frameworks

- 2.3.4.2. Technological Advancements

- 2.3.4.3. Environmental Considerations

- 2.3.4.4. Consumer Awareness & Acceptance

- 2.4. Estimation Methodology

- 2.5. Years Considered for the Study

- 2.6. Currency Conversion Rates

Chapter 3. Global Hedge Fund Market Dynamics

- 3.1. Market Drivers

- 3.1.1. Increasing Investments in Digital Assets

- 3.1.2. Advancements in Technology

- 3.1.3. Evolving Regulatory Landscape

- 3.2. Market Challenges

- 3.2.1. High Fees Charged by Hedge Funds

- 3.2.2. Regulatory Scrutiny and Compliance Costs

- 3.3. Market Opportunities

- 3.3.1. Rise of Quantitative and Systematic Strategies

- 3.3.2. Expansion in Asia-Pacific

- 3.3.3. Growth in Offshore Hedge Funds

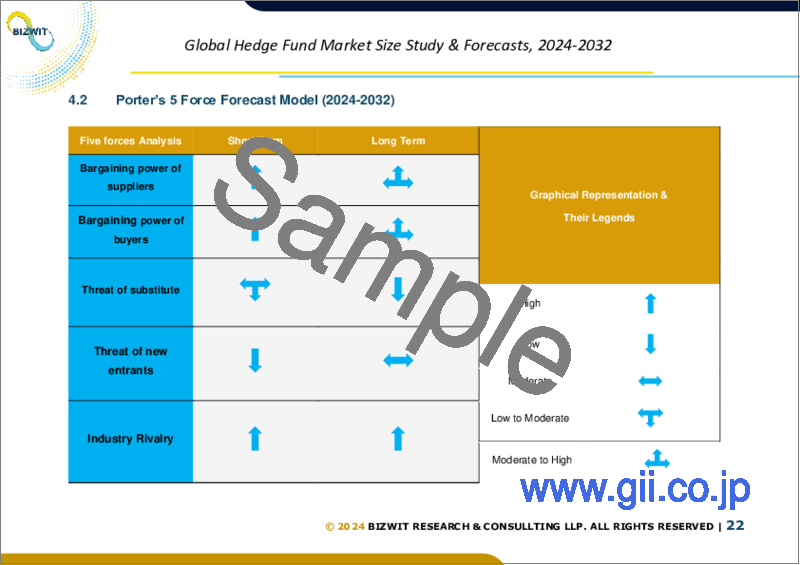

Chapter 4. Global Hedge Fund Market Industry Analysis

- 4.1. Porter's 5 Force Model

- 4.1.1. Bargaining Power of Suppliers

- 4.1.2. Bargaining Power of Buyers

- 4.1.3. Threat of New Entrants

- 4.1.4. Threat of Substitutes

- 4.1.5. Competitive Rivalry

- 4.1.6. Futuristic Approach to Porter's 5 Force Model

- 4.1.7. Porter's 5 Force Impact Analysis

- 4.2. PESTEL Analysis

- 4.2.1. Political

- 4.2.2. Economical

- 4.2.3. Social

- 4.2.4. Technological

- 4.2.5. Environmental

- 4.2.6. Legal

- 4.3. Top investment opportunity

- 4.4. Top winning strategies

- 4.5. Disruptive Trends

- 4.6. Industry Expert Perspective

- 4.7. Analyst Recommendation & Conclusion

Chapter 5. Global Hedge Fund Market Size & Forecasts by Strategy 2022-2032

- 5.1. Segment Dashboard

- 5.2. Global Hedge Fund Market: Strategy Revenue Trend Analysis, 2022 & 2032 (USD Trillion)

- 5.2.1. Long/Short Equity

- 5.2.2. Event Driven

- 5.2.3. Currency Counterfeit Detector

- 5.2.4. Managed Futures/CTA

- 5.2.5. Others

Chapter 6. Global Hedge Fund Market Size & Forecasts by Type 2022-2032

- 6.1. Segment Dashboard

- 6.2. Global Hedge Fund Market: Type Revenue Trend Analysis, 2022 & 2032 (USD Trillion)

- 6.2.1. Offshore

- 6.2.2. Fund of Funds

- 6.2.3. Domestic

Chapter 7. Global Hedge Fund Market Size & Forecasts by Region 2022-2032

- 7.1. North America Hedge Fund Market

- 7.1.1. U.S. Hedge Fund Market

- 7.1.1.1. Strategy breakdown size & forecasts, 2022-2032

- 7.1.1.2. Type breakdown size & forecasts, 2022-2032

- 7.1.2. Canada Hedge Fund Market

- 7.1.1. U.S. Hedge Fund Market

- 7.2. Europe Hedge Fund Market

- 7.2.1. UK Hedge Fund Market

- 7.2.2. Germany Hedge Fund Market

- 7.2.3. France Hedge Fund Market

- 7.2.4. Italy Hedge Fund Market

- 7.2.5. Spain Hedge Fund Market

- 7.2.6. Rest of Europe Hedge Fund Market

- 7.3. Asia-Pacific Hedge Fund Market

- 7.3.1. China Hedge Fund Market

- 7.3.2. Japan Hedge Fund Market

- 7.3.3. India Hedge Fund Market

- 7.3.4. South Korea Hedge Fund Market

- 7.3.5. Australia Hedge Fund Market

- 7.3.6. Rest of Asia Pacific Hedge Fund Market

- 7.4. Latin America Hedge Fund Market

- 7.4.1. Brazil Hedge Fund Market

- 7.4.2. Argentina Hedge Fund Market

- 7.4.3. Rest of Latin America Hedge Fund Market

- 7.5. Middle East & Africa Hedge Fund Market

- 7.5.1. GCC Countries Hedge Fund Market

- 7.5.2. South Africa Hedge Fund Market

- 7.5.3. Rest of Middle East & Africa Hedge Fund Market

Chapter 8. Competitive Intelligence

- 8.1. Key Company SWOT Analysis

- 8.2. Top Market Strategies

- 8.3. Company Profiles

- 8.3.1. Bridgewater Associates LP

- 8.3.2. Renaissance Technologies LLC

- 8.3.3. Man Group Ltd.

- 8.3.4. AQR Capital Management LLC

- 8.3.5. Two Sigma Investments LP

- 8.3.6. Millennium Management LLC

- 8.3.7. Citadel LLC

- 8.3.8. Elliott Management Corporation

- 8.3.9. Brevan Howard

- 8.3.10. BlackRock Inc.

- 8.3.11. Davidson Kempner Capital Management LP

- 8.3.12. Pershing Square Capital Management

- 8.3.13. Tiger Global Management LLC

- 8.3.14. D.E. Shaw Group

- 8.3.15. Third Point LLC

Chapter 9. Research Process

- 9.1. Research Process

- 9.1.1. Data Mining

- 9.1.2. Analysis

- 9.1.3. Market Estimation

- 9.1.4. Validation

- 9.1.5. Publishing

- 9.2. Research Attributes