|

|

市場調査レポート

商品コード

1391759

ドローン物流・輸送市場- 世界の規模、シェア、動向分析、機会、予測レポート、2019-2029年Drone Logistics and Transportation Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2019-2029, Segmented By Component ; By Coverage Area ; By Application ; By End User ; By Region |

||||||

|

|||||||

| ドローン物流・輸送市場- 世界の規模、シェア、動向分析、機会、予測レポート、2019-2029年 |

|

出版日: 2023年11月10日

発行: Blueweave Consulting

ページ情報: 英文 400 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のドローン物流・輸送市場規模は11倍に急拡大、2029年には60億4,000万米ドルに達する

世界のドローン物流・輸送市場は、eコマース産業の繁栄、費用対効果の高いラストワンマイル配送ソリューション、ドローン技術の進歩、商用ドローン運航に対する規制支援、効率的で環境に優しい貨物輸送方法の必要性などにより、ドローン物流・輸送に対する需要がますます高まっているため、活況を呈しています。

大手戦略コンサルティング・市場調査会社のブルーウィーブ・コンサルティング(BlueWeave Consulting)は最近の調査で、2022年の世界のドローン物流・輸送市場規模を5億5,412万米ドルと推定しました。2023年から2029年の予測期間中、世界のドローン物流・輸送市場規模は48.93%の堅調なCAGRで成長し、2029年には60億4,536万米ドルに達するとBlueWeaveは予測しています。世界のドローン物流・輸送市場は、いくつかの重要な要因によって牽引されています。特にeコマース分野での効率的で費用対効果の高い配送ソリューションに対する需要の高まりが、ドローン物流の採用を後押ししています。また、ペイロード容量の向上や飛行距離の延長など、ドローン技術の進歩がドローンを使った輸送の能力を拡大しています。ドローンの統合に対する規制の変更や政府の支援も重要な役割を果たしています。さらに、環境問題への懸念や二酸化炭素排出量の削減への要望は、従来の配送方法に代わる環境に優しい代替手段を提供することから、ラストマイル配送へのドローンの利用を促し、市場の成長をさらに後押ししています。

当レポートの詳細分析では、世界のドローン物流・輸送市場の成長可能性、今後の動向、統計に関する情報を提供しています。また、総市場規模の予測を促進する要因にも焦点を当てています。当レポートは、世界のドローン物流・輸送市場の最新技術動向や、意思決定者が健全な戦略的意思決定を行うための業界洞察を提供することをお約束します。さらに、市場の成長促進要因・課題・競争力についても分析しています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界のドローン物流・輸送市場に関する洞察

- 業界のバリューチェーン分析

- DROC分析

- 成長促進要因

- 時間効率の良い配送サービスに対する需要の高まり

- ラストワンマイル配送におけるドローン需要の高まり

- 抑制要因

- 安全性とセキュリティの問題

- 熟練した運用専門家が不足している

- 機会

- ゼロエミッションへの取り組みの拡大

- スマートシティの数が増加

- 課題

- 地上インフラの限定的な実装

- さまざまな業種での商用利用に制限がかかる

- 成長促進要因

- 技術の進歩/最近の開発

- 規制の枠組み

- ポーターのファイブフォース分析

第4章 世界のドローン物流・輸送市場概要

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

- カバーエリア別

- 5km未満

- 5~10キロ

- 10~15キロ

- 15キロ以上

- 用途別

- 倉庫と保管管理

- 輸送管理

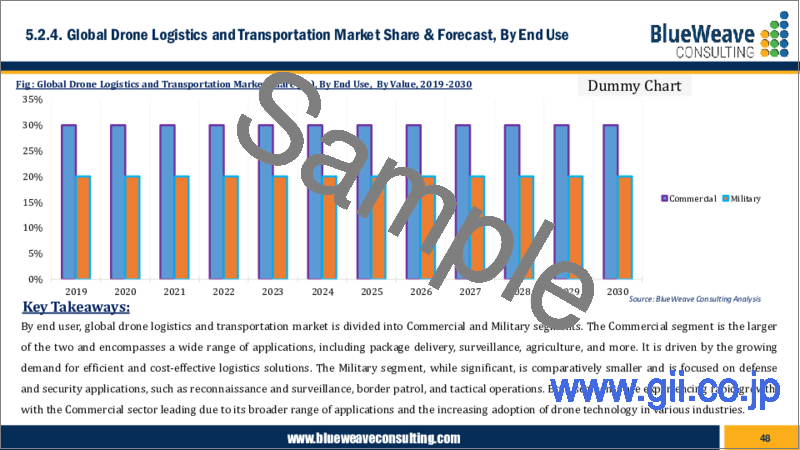

- エンドユーザー別

- コマーシャル

- 軍隊

- 地域別

- 北米

- 欧州

- アジア太平洋(APAC)

- ラテンアメリカ(LATAM)

- 中東およびアフリカ(MEA)

- コンポーネント別

第5章 北米のドローン物流・輸送市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- コンポーネント別

- カバーエリア別

- 用途別

- エンドユーザー別

- 国別

- 米国

- カナダ

第6章 欧州のドローン物流・輸送市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- コンポーネント別

- カバーエリア別

- 用途別

- エンドユーザー別

- 国別

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- ベルギー

- ロシア

- オランダ

- その他欧州

第7章 アジア太平洋地域のドローン物流・輸送市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- コンポーネント別

- カバーエリア別

- 用途別

- エンドユーザー別

- 国別

- 中国

- インド

- 日本

- 韓国

- オーストラリアとニュージーランド

- インドネシア

- マレーシア

- シンガポール

- ベトナム

- その他

第8章 ラテンアメリカのドローン物流・輸送市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- コンポーネント別

- カバーエリア別

- 用途別

- エンドユーザー別

- 国別

- ブラジル

- メキシコ

- アルゼンチン

- ペルー

- その他

第9章 中東およびアフリカのドローン物流・輸送市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- コンポーネント別

- カバーエリア別

- 用途別

- エンドユーザー別

- 国別

- サウジアラビア

- アラブ首長国連邦

- カタール

- クウェート

- 南アフリカ

- ナイジェリア

- アルジェリア

- その他

第10章 競合情勢

- 主要企業とその製品のリスト

- 世界のドローン物流・輸送市場シェア分析、2022年

- 経営パラメータによる競合ベンチマーキング

- 主要な戦略的展開(合併、買収、パートナーシップなど)

第11章 世界のドローン物流・輸送市場に対するCOVID-19症の影響

第12章 企業プロファイル(会社概要、財務マトリックス、競合情勢、主要人材、主要競合、連絡先住所、戦略的展望、 SWOT分析)

- Deutsche Post DHL Group

- Airbus SE

- Hardis Group

- Wingcopter GmbH, PINC Solution

- Amazon.com, Inc.

- Matternet, Inc.

- Infinium Robotics

- FedEx Corporation

- Wing Aviation LLC

- United Parcel Service of America, Inc.

- Workhorse Group Incorporated

- DroneScan

- Zipline International Inc.

- Drone Delivery Canada

- Flytrex Inc.

- その他の主要企業

第13章 主要な戦略的推奨事項

第14章 調査手法

Global Drone Logistics and Transportation Market Size Zooming 11X to Reach Whopping USD 6.04 Billion by 2029.

Global drone logistics and transportation market is flourishing due to an increasingly high demand for drone logistics and transportation by thriving e-commerce industry, cost-effective last-mile delivery solutions, advancements in drone technology, regulatory support for commercial drone operations, and the need for efficient and environmentally friendly cargo transportation methods.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the global drone logistics and transportation market size at USD 554.12 million in 2022. During the forecast period between 2023 and 2029, BlueWeave expects the global drone logistics and transportation market size to grow at a robust CAGR of 48.93% reaching a value of USD 6,045.36 million by 2029. Global drone logistics and transportation market is driven by several key factors. Increasing demand for efficient and cost-effective delivery solutions, especially in the e-commerce sector, propels the adoption of drone logistics. Also, advancements in drone technology, including improved payload capacity and longer flight ranges, are expanding the capabilities of drone-based transportation. Regulatory changes and government support for drone integration also play a crucial role. Further, environmental concerns and the desire to reduce carbon emissions are encouraging the use of drones for last-mile delivery, as they offer greener alternatives to traditional delivery methods, further boosting the market's growth.

Drone Logistics and Transportation - Overview

Drone logistics and transportation is a cutting-edge field that leverages unmanned aerial vehicles (UAVs) for the efficient movement of goods and services. These drones offer numerous advantages, including rapid delivery, reduced operational costs, and minimized environmental impact. Applications range from last-mile deliveries of packages to remote areas, medical supply transport in emergencies, and surveillance in industries such as agriculture and construction. However, regulatory and safety challenges, as well as technological limitations, must be addressed to fully realize the potential of drone logistics and transportation in revolutionizing the way we move goods and services.

Impact of COVID-19 on Global Drone Logistics and Transportation Market

COVID-19 pandemic significantly impacted the global drone logistics and transportation market. While the industry saw increased interest due to its potential for contactless delivery and monitoring, disruptions in the supply chain, economic uncertainty, and lockdowns slowed its growth. Many companies in this sector repurposed drones for medical supply deliveries and surveillance during the crisis. Post-pandemic, the market is expected to rebound as demand for autonomous, efficient delivery systems grows, but it will also face heightened scrutiny on safety and privacy concerns, reflecting the pandemic's lasting influence on the industry.

Global Drone Logistics and Transportation Market - By Component

Based on component, the global drone logistics and transportation market is divided into Hardware, Software, and Services segments. The Hardware segment encompasses the physical components of drone logistics and transportation, such as drones themselves and associated equipment. Software plays a crucial role in drone operation, including navigation, data analytics, and automation. The Services segment involves a range of support offerings, including maintenance, consulting, and logistics management. These three segments collectively define the diverse landscape of the market, reflecting the integral role of technology, software solutions, and associated services in the development and growth of drone-based logistics and transportation systems.

Competitive Landscape

Global drone logistics and transportation market is fiercely competitive. Major companies in the market include Deutsche Post DHL Group, Airbus SE, Hardis Group, Wingcopter GmbH, PINC Solution, Amazon.com, Inc., Matternet, Inc., Infinium Robotics, FedEx Corporation, Wing Aviation LLC, United Parcel Service of America, Inc., Workhorse Group Incorporated, DroneScan, Zipline International Inc., Drone Delivery Canada, and Flytrex Inc. These companies use various strategies, including increasing investments in their R&D activities, mergers, and acquisitions, joint ventures, collaborations, licensing agreements, and new product and service releases to further strengthen their position in global drone logistics and transportation market.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and statistics of Global Drone Logistics and Transportation Market. It also highlights the factors driving forecasts of total Market size. The report promises to provide recent technology trends in Global Drone Logistics and Transportation Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Drone Logistics and Transportation Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Rise in demand for time-efficient delivery service

- 3.2.1.2. Growing rise in demand for drones in last-mile delivery

- 3.2.2. Restraints

- 3.2.2.1. Safety and security issues

- 3.2.2.2. Lack of skilled professionals for operations

- 3.2.3. Opportunities

- 3.2.3.1. Increasing zero-emission initiatives

- 3.2.3.2. Rising number of smart cities

- 3.2.4. Challenges

- 3.2.4.1. Limited implementation of ground infrastructure

- 3.2.4.2. Restrictions imposed on commercial use for various industries

- 3.2.1. Growth Drivers

- 3.3. Technological Advancements/Recent Developments

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Drone Logistics and Transportation Market Overview

- 4.1. Market Size & Forecast, 2019-2029

- 4.1.1. By Value (USD Million)

- 4.2. Market Share and Forecast

- 4.2.1. By Component

- 4.2.1.1. Hardware

- 4.2.1.2. Software

- 4.2.1.3. Services

- 4.2.2. By Coverage Ares

- 4.2.2.1. Below 5 Km

- 4.2.2.2. 5-10 Km

- 4.2.2.3. 10-15 Km

- 4.2.2.4. Above 15 Km

- 4.2.3. By Application

- 4.2.3.1. Warehouse and Storage Management

- 4.2.3.2. Transportation Management

- 4.2.4. By End User

- 4.2.4.1. Commercial

- 4.2.4.2. Military

- 4.2.5. By Region

- 4.2.5.1. North America

- 4.2.5.2. Europe

- 4.2.5.3. Asia Pacific (APAC)

- 4.2.5.4. Latin America (LATAM)

- 4.2.5.5. Middle East and Africa (MEA)

- 4.2.1. By Component

5. North America Drone Logistics and Transportation Market

- 5.1. Market Size & Forecast, 2019-2029

- 5.1.1. By Value (USD Million)

- 5.2. Market Share & Forecast

- 5.2.1. By Component

- 5.2.2. By Coverage Area

- 5.2.3. By Application

- 5.2.4. By End User

- 5.2.5. By Country

- 5.2.5.1. United States

- 5.2.5.1.1. By Component

- 5.2.5.1.2. By Coverage Area

- 5.2.5.1.3. By Application

- 5.2.5.1.4. By End User

- 5.2.5.2. Canada

- 5.2.5.2.1. By Component

- 5.2.5.2.2. By Coverage Area

- 5.2.5.2.3. By Application

- 5.2.5.2.4. By End User

6. Europe Drone Logistics and Transportation Market

- 6.1. Market Size & Forecast, 2019-2029

- 6.1.1. By Value (USD Million)

- 6.2. Market Share & Forecast

- 6.2.1. By Component

- 6.2.2. By Coverage Area

- 6.2.3. By Application

- 6.2.4. By End User

- 6.2.5. By Country

- 6.2.5.1. Germany

- 6.2.5.1.1. By Component

- 6.2.5.1.2. By Coverage Area

- 6.2.5.1.3. By Application

- 6.2.5.1.4. By End User

- 6.2.5.2. United Kingdom

- 6.2.5.2.1. By Component

- 6.2.5.2.2. By Coverage Area

- 6.2.5.2.3. By Application

- 6.2.5.2.4. By End User

- 6.2.5.3. Italy

- 6.2.5.3.1. By Component

- 6.2.5.3.2. By Coverage Area

- 6.2.5.3.3. By Application

- 6.2.5.3.4. By End User

- 6.2.5.4. France

- 6.2.5.4.1. By Component

- 6.2.5.4.2. By Coverage Area

- 6.2.5.4.3. By Application

- 6.2.5.4.4. By End User

- 6.2.5.5. Spain

- 6.2.5.5.1. By Component

- 6.2.5.5.2. By Coverage Area

- 6.2.5.5.3. By Application

- 6.2.5.5.4. By End User

- 6.2.5.6. Belgium

- 6.2.5.6.1. By Component

- 6.2.5.6.2. By Coverage Area

- 6.2.5.6.3. By Application

- 6.2.5.6.4. By End User

- 6.2.5.7. Russia

- 6.2.5.7.1. By Component

- 6.2.5.7.2. By Coverage Area

- 6.2.5.7.3. By Application

- 6.2.5.7.4. By End User

- 6.2.5.8. The Netherlands

- 6.2.5.8.1. By Component

- 6.2.5.8.2. By Coverage Area

- 6.2.5.8.3. By Application

- 6.2.5.8.4. By End User

- 6.2.5.9. Rest of Europe

- 6.2.5.9.1. By Component

- 6.2.5.9.2. By Coverage Area

- 6.2.5.9.3. By Application

- 6.2.5.9.4. By End User

7. Asia Pacific Drone Logistics and Transportation Market

- 7.1. Market Size & Forecast, 2019-2029

- 7.1.1. By Value (USD Million)

- 7.2. Market Share & Forecast

- 7.2.1. By Component

- 7.2.2. By Coverage Area

- 7.2.3. By Application

- 7.2.4. By End User

- 7.2.5. By Country

- 7.2.5.1. China

- 7.2.5.1.1. By Component

- 7.2.5.1.2. By Coverage Area

- 7.2.5.1.3. By Application

- 7.2.5.1.4. By End User

- 7.2.5.2. India

- 7.2.5.2.1. By Component

- 7.2.5.2.2. By Coverage Area

- 7.2.5.2.3. By Application

- 7.2.5.2.4. By End User

- 7.2.5.3. Japan

- 7.2.5.3.1. By Component

- 7.2.5.3.2. By Coverage Area

- 7.2.5.3.3. By Application

- 7.2.5.3.4. By End User

- 7.2.5.4. South Korea

- 7.2.5.4.1. By Component

- 7.2.5.4.2. By Coverage Area

- 7.2.5.4.3. By Application

- 7.2.5.4.4. By End User

- 7.2.5.5. Australia & New Zealand

- 7.2.5.5.1. By Component

- 7.2.5.5.2. By Coverage Area

- 7.2.5.5.3. By Application

- 7.2.5.5.4. By End User

- 7.2.5.6. Indonesia

- 7.2.5.6.1. By Component

- 7.2.5.6.2. By Coverage Area

- 7.2.5.6.3. By Application

- 7.2.5.6.4. By End User

- 7.2.5.7. Malaysia

- 7.2.5.7.1. By Component

- 7.2.5.7.2. By Coverage Area

- 7.2.5.7.3. By Application

- 7.2.5.7.4. By End User

- 7.2.5.8. Singapore

- 7.2.5.8.1. By Component

- 7.2.5.8.2. By Coverage Area

- 7.2.5.8.3. By Application

- 7.2.5.8.4. By End User

- 7.2.5.9. Vietnam

- 7.2.5.9.1. By Component

- 7.2.5.9.2. By Coverage Area

- 7.2.5.9.3. By Application

- 7.2.5.9.4. By End User

- 7.2.5.10. Rest of APAC

- 7.2.5.10.1. By Component

- 7.2.5.10.2. By Coverage Area

- 7.2.5.10.3. By Application

- 7.2.5.10.4. By End User

8. Latin America Drone Logistics and Transportation Market

- 8.1. Market Size & Forecast, 2019-2029

- 8.1.1. By Value (USD Million)

- 8.2. Market Share & Forecast

- 8.2.1. By Component

- 8.2.2. By Coverage Area

- 8.2.3. By Application

- 8.2.4. By End User

- 8.2.5. By Country

- 8.2.5.1. Brazil

- 8.2.5.1.1. By Component

- 8.2.5.1.2. By Coverage Area

- 8.2.5.1.3. By Application

- 8.2.5.1.4. By End User

- 8.2.5.2. Mexico

- 8.2.5.2.1. By Component

- 8.2.5.2.2. By Coverage Area

- 8.2.5.2.3. By Application

- 8.2.5.2.4. By End User

- 8.2.5.3. Argentina

- 8.2.5.3.1. By Component

- 8.2.5.3.2. By Coverage Area

- 8.2.5.3.3. By Application

- 8.2.5.3.4. By End User

- 8.2.5.4. Peru

- 8.2.5.4.1. By Component

- 8.2.5.4.2. By Coverage Area

- 8.2.5.4.3. By Application

- 8.2.5.4.4. By End User

- 8.2.5.5. Rest of LATAM

- 8.2.5.5.1. By Component

- 8.2.5.5.2. By Coverage Area

- 8.2.5.5.3. By Application

- 8.2.5.5.4. By End User

9. Middle East & Africa Drone Logistics and Transportation Market

- 9.1. Market Size & Forecast, 2019-2029

- 9.1.1. By Value (USD Million)

- 9.2. Market Share & Forecast

- 9.2.1. By Component

- 9.2.2. By Coverage Area

- 9.2.3. By Application

- 9.2.4. By End User

- 9.2.5. By Country

- 9.2.5.1. Saudi Arabia

- 9.2.5.1.1. By Component

- 9.2.5.1.2. By Coverage Area

- 9.2.5.1.3. By Application

- 9.2.5.1.4. By End User

- 9.2.5.2. UAE

- 9.2.5.2.1. By Component

- 9.2.5.2.2. By Coverage Area

- 9.2.5.2.3. By Application

- 9.2.5.2.4. By End User

- 9.2.5.3. Qatar

- 9.2.5.3.1. By Component

- 9.2.5.3.2. By Coverage Area

- 9.2.5.3.3. By Application

- 9.2.5.3.4. By End User

- 9.2.5.4. Kuwait

- 9.2.5.4.1. By Component

- 9.2.5.4.2. By Coverage Area

- 9.2.5.4.3. By Application

- 9.2.5.4.4. By End User

- 9.2.5.5. South Africa

- 9.2.5.5.1. By Component

- 9.2.5.5.2. By Coverage Area

- 9.2.5.5.3. By Application

- 9.2.5.5.4. By End User

- 9.2.5.6. Nigeria

- 9.2.5.6.1. By Component

- 9.2.5.6.2. By Coverage Area

- 9.2.5.6.3. By Application

- 9.2.5.6.4. By End User

- 9.2.5.7. Algeria

- 9.2.5.7.1. By Component

- 9.2.5.7.2. By Coverage Area

- 9.2.5.7.3. By Application

- 9.2.5.7.4. By End User

- 9.2.5.8. Rest of MEA

- 9.2.5.8.1. By Component

- 9.2.5.8.2. By Coverage Area

- 9.2.5.8.3. By Application

- 9.2.5.8.4. By End User

10. Competitive Landscape

- 10.1. List of Key Players and Their Offerings

- 10.2. Global Drone Logistics and Transportation Market Share Analysis, 2022

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Developments (Mergers, Acquisitions, Partnerships, etc.)

11. Impact of COVID-19 on Global Drone Logistics and Transportation Market

12. Company Profile (Company Overview, Financial Matrix, Competitive Landscape, Key Personnel, Key Competitors, Contact Address, Strategic Outlook, SWOT Analysis)

- 12.1. Deutsche Post DHL Group

- 12.2. Airbus SE

- 12.3. Hardis Group

- 12.4. Wingcopter GmbH, PINC Solution

- 12.5. Amazon.com, Inc.

- 12.6. Matternet, Inc.

- 12.7. Infinium Robotics

- 12.8. FedEx Corporation

- 12.9. Wing Aviation LLC

- 12.10. United Parcel Service of America, Inc.

- 12.11. Workhorse Group Incorporated

- 12.12. DroneScan

- 12.13. Zipline International Inc.

- 12.14. Drone Delivery Canada

- 12.15. Flytrex Inc.

- 12.16. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumptions & Limitations