|

|

市場調査レポート

商品コード

1172563

オレイルアルコールの世界市場:市場規模、市場シェア、動向分析、機会、予測:供給源別、用途別、地域別(2018年~2028年)Oleyl Alcohol Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2018-2028, Segmented By Source ; By Application ; By Region |

||||||

| オレイルアルコールの世界市場:市場規模、市場シェア、動向分析、機会、予測:供給源別、用途別、地域別(2018年~2028年) |

|

出版日: 2022年12月08日

発行: Blueweave Consulting

ページ情報: 英文 240 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界のオレイルアルコールの市場規模は、2021年の6億8,510万米ドルから2028年には11億430万米ドルに達し、予測期間(2022年~2028年)中に7.2%のCAGRで成長すると予測されています。さまざまな最終用途産業からのオレイルアルコールに対する需要の高まり、オレイルアルコールの利点に対する認知度の高まりは、市場の成長を促進しています。

当レポートでは、世界のオレイルアルコール市場について調査しており、市場概要、市場分析、企業プロファイルなど、包括的な情報を提供しています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界のオレイルアルコール市場の洞察

- 業界バリューチェーン分析

- DROC分析

- 促進要因

- パーソナルケアおよび化粧品におけるオレイルアルコールの需要の急増

- 研究開発活動における製品の使用の増加

- 製薬業界からの急増する需要

- 抑制要因

- 原材料価格の変動

- 機会

- 環境に配慮した製品に対する意識の高まり

- オレイルアルコールを使用した費用対効果の高いバイオベースの界面活性剤の開発の増加

- 課題

- アルコールへの過度の暴露

- 促進要因

- 技術の進歩/最近の開発

- 規制の枠組み

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争の激しさ

第4章 世界のオレイルアルコール市場概要

- 市場規模と予測(2018年~2028年)

- 金額別(10億米ドル)

- 数量別(100万トン)

- 市場シェアと予測

- 供給源別

- 牛油

- 魚油

- オリーブオイル

- 用途別

- 化粧品とパーソナルケア

- 医薬品

- 食品と飲料

- 農薬

- テキスタイル

- 界面活性剤

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東とアフリカ

- 供給源別

第5章 北米のオレイルアルコール市場

第6章 欧州のオレイルアルコール市場

第7章 アジア太平洋のオレイルアルコール市場

第8章 ラテンアメリカのオレイルアルコール市場

第9章 中東およびアフリカのオレイルアルコール市場

第10章 競合情勢

- 主要企業とその範囲のリスト

- 世界のオレイルアルコール企業の市場シェア分析(2021年)

- 競合ベンチマーキング:操作パラメータ別

- 主要な戦略的開発(合併、買収、パートナーシップ)

第11章 世界のオレイルアルコール市場産業に対するCOVID-19の影響

第12章 企業プロファイル(企業概要、財務マトリックス、競合情勢、主要な人材、主要な競合、連絡先住所、および戦略的展望)

- Akzo Nobel N.V.

- Ecogreen Oleochemicals

- Procter & Gamble

- Croda International Plc

- Stepan Company

- Sasol Limited

- Henkel AG & Co. KGaA

- Ashland

- The Lubrizol Corporation

- FPG Oleochemicals Sdn Bhd

- その他

第13章 主要な戦略的推奨事項

第14章 調査手法

Global Oleyl Alcohol Market Size Expanding to Cross USD 1.1 Billion by 2028.

Global oleyl alcohol market size is flourishing as oleyl alcohol is used in a variety of industrial applications as a defoaming agent, cosmetic emollient, plasticizer, rheology modifier, chemical intermediate, and automotive lubricant owing to its performance, quality, eco-friendliness, purity, and effectiveness.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated global oleyl alcohol market size at USD 685.1 million in 2021. During the forecast period between 2022 and 2028, BlueWeave expects the size of global oleyl alcohol market to grow at a CAGR of 7.2%, reaching a value of USD 1,104.3 million by 2028. The rising demand for oleyl alcohol from a variety of end-use industries, including industrial applications, cosmetic applications, and others, is propelling market growth. In addition, rising awareness of the benefits of oleyl alcohol is expected to drive demand during the forecast period. Oleyl alcohol is used as a cosmetic emollient and stabilizer in a wide range of topical and dermatological products, including eye makeup, hair shampoos and conditioners, body lotions, creams, and balms. Furthermore, rising pharmaceutical demand is expected to have an impact on oleyl alcohol demand during the forecast period, as it is used to manufacture a variety of medicines and ointments.

Global Oleyl Alcohol Market - Overview

Oleic acid esters undergo catalytic hydrogenation to yield oleyl alcohol. It can also be produced using the Boweault-Blanc reduction reaction of sodium, butyl alcohol, and butyl oleate. It consequently exists in fish oil and the oils of other aquatic mammals by nature. Additionally, it is anticipated that in the upcoming years, increasing product usage in R&D activities for pharmaceutical formulations for drug delivery will offer the global market lucrative growth opportunities. An organic substance called oleyl alcohol can be derived from both plant and animal sources. It has a distinct smell and is a clear liquid. Natural sources include rapeseed oil, soy oil, castor oil, and palm kernel oil. Propylene glycols are synthesized chemically to produce artificial sources.

One of the biggest opportunities for the surfactant market is bio-based surfactants, where increasing consumer awareness of environmentally friendly products has significantly fueled surfactant demand for oleyl alcohol. As foaming agents, emulsifiers, detergents, and wetting agents, surfactants also have a wide range of uses. Some of the essential characteristics of surfactants include conditioning and detergency, which contribute to their broad range of applications. The personal care, textile, pharmaceutical, soap, and detergent industries are just a few examples of where oleyl alcohol-based surfactants are used extensively. Key manufacturers have collaborated and entered into several agreements with other businesses to market new products and increase their market share. Oleyl alcohol also has other uses, such as a fabric plasticizer. Due to shifting lifestyles and the development of the economies of Asia Pacific and Latin America, the market for oleyl alcohol in plasticizers has been growing noticeably. Additionally, the plasticizers market has been boosted by developments in several emerging economies, including Brazil, Russia, China, and India, as well as by rising environmental awareness and legal requirements.

Opportunity: Growing Demand for Oleyl Alcohol in Personal Care and Cosmetic Products

The rising demand for personal care items like hair care and skin care due to greater awareness of the significance of having healthy hair and skin is anticipated to be another significant factor influencing the demand for oleyl alcohol. Additionally, as oleyl alcohol is used to make a variety of medicines and ointments, rising pharmaceutical demand is anticipated to influence oleyl alcohol demand during the forecast period. Oleyl alcohol's rising use in surfactants due to its accessibility and affordability has also significantly aided in the market's growth.

Challenge: Volatile Raw Material Prices

Fluctuating feedstock prices have been a major source of concern for manufacturers, and they are expected to limit market growth. The emphasis on commercializing and developing cost-effective bio-based surfactants based on oleyl alcohol is expected to open new market opportunities.

Impact of COVID-19 on Global Oleyl Alcohol Market

COVID-19 pandemic significantly affected businesses across the world. The epidemic's spread has disrupted supply chains for businesses, forcing them to update their business models and marketing plans. Additionally, the outbreak affected the product sales and profits. For instance, Pernod Ricard anticipated that the spread of COVID-19 would cause profit margins to decline by almost 20%. Additionally, businesses reported that off-premises sales were growing faster than on-premises sales.

Global Oleyl Alcohol Market - By Industry

The global oleyl alcohol market is segmented based on application into Surfactants, Food & Beverages, Agrochemicals, Textiles, and Cosmetics & Personal Care. With a significant market share in 2021, the cosmetics and personal care segment dominated the market. The growing consumer awareness of personal hygiene and the increased demand for anti-aging products are both responsible for its high market share. Eye creams, foundation, hair conditioners, and skin cleansers are just a few of the products that contain it. Demand for the product is also fueled by its moisturizing and emollient qualities in cosmetic and personal care products. Avon, Revlon, Christian Dior, Estee Lauder, L'Oreal, Burberry, Calvin Klein, Maybelline New York, Bobbi Brown, and Body Shop are just a few of the multinational personal care and cosmetics companies that strictly follow the European Commission's and the US government's environmental protection regulations, which emphasize the use of bio-based materials. As a result, there is now more demand for personal care items like moisturizers, eye shadow, lip gloss, styling gels, lipsticks, and anti-aging creams.

Competitive Landscape

Global oleyl alcohol market is fiercely competitive. Prominent players in global oleyl alcohol market include Akzo Nobel N.V., Ecogreen Oleochemicals, Procter & Gamble, Croda International Plc, Stepan Company, Sasol Limited, Henkel AG & Co. KGaA, Ashland, The Lubrizol Corporation, and FPG Oleochemicals Sdn Bhd. These companies use various strategies, including increasing investments in their R&D activities, mergers and acquisitions, joint ventures, collaborations, licensing agreements, and new product and service releases to further strengthen their position in global oleyl alcohol market.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and statistics of Global Oleyl Alcohol Market. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in Global Oleyl Alcohol Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Oleyl Alcohol Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Surging Demand for Oleyl Alcohol in Personal Care and Cosmetics Products

- 3.2.1.2. Rising Use of Product in R&D Activities

- 3.2.1.3. Surging Demand from Pharmaceutical Industry

- 3.2.2. Restraints

- 3.2.2.1. Fluctuation in Raw Material Prices

- 3.2.3. Opportunity

- 3.2.3.1. Rising Awareness Toward Eco-Friendly Products

- 3.2.3.2. Increasing Development of Cost-Effective, Bio-based Surfactants Using Oleyl Alcohol

- 3.2.4. Challenges

- 3.2.4.1. Over Exposure to Alcohol

- 3.2.1. Growth Drivers

- 3.3. Technological Advancement/Recent Development

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Oleyl Alcohol Market Overview

- 4.1. Market Size & Forecast, 2018-2028

- 4.1.1. By Value (USD Billion)

- 4.1.2. By Volume (Million Tons)

- 4.2. Market Share & Forecast

- 4.2.1. By Source

- 4.2.1.1. Beef Oil

- 4.2.1.2. Fish Oil

- 4.2.1.3. Olive Oil

- 4.2.2. By Application

- 4.2.2.1. Cosmetics & Personal Care

- 4.2.2.2. Pharmaceutical

- 4.2.2.3. Food & Beverages

- 4.2.2.4. Agrochemicals

- 4.2.2.5. Textiles

- 4.2.2.6. Surfactants

- 4.2.3. By Region

- 4.2.3.1. North America

- 4.2.3.2. Europe

- 4.2.3.3. The Asia Pacific

- 4.2.3.4. Latin America

- 4.2.3.5. The Middle East and Africa

- 4.2.1. By Source

5. North America Oleyl Alcohol Market

- 5.1.1. Market Size & Forecast, 2018-2028

- 5.1.2. By Value (USD Billion)

- 5.1.3. By Volume (Million Tons)

- 5.2. Market Share & Forecast

- 5.2.1. By Source

- 5.2.2. By Application

- 5.2.3. By Country

- 5.2.3.1. United States

- 5.2.3.1.1. By Source

- 5.2.3.1.2. By Application

- 5.2.3.2. Canada

- 5.2.3.2.1. By Source

- 5.2.3.2.2. By Application

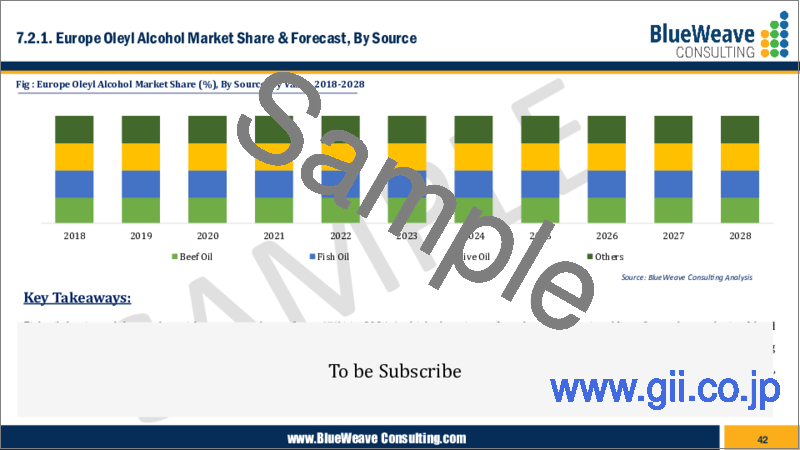

6. Europe Oleyl Alcohol Market

- 6.1.1. Market Size & Forecast, 2018-2028

- 6.1.2. By Value (USD Billion)

- 6.1.3. By Volume (Million Tons)

- 6.2. Market Share & Forecast

- 6.2.1. By Source

- 6.2.2. By Application

- 6.2.3. By

- 6.2.4. By Country

- 6.2.4.1. Germany

- 6.2.4.1.1. By Source

- 6.2.4.1.2. By Application

- 6.2.4.2. UK

- 6.2.4.2.1. By Source

- 6.2.4.2.2. By Application

- 6.2.4.3. Italy

- 6.2.4.3.1. By Source

- 6.2.4.3.2. By Application

- 6.2.4.4. France

- 6.2.4.4.1. By Source

- 6.2.4.4.2. By Application

- 6.2.4.5. Spain

- 6.2.4.5.1. By Source

- 6.2.4.5.2. By Application

- 6.2.4.6. The Netherlands

- 6.2.4.6.1. By Source

- 6.2.4.6.2. By Application

- 6.2.4.7. Belgium

- 6.2.4.7.1. By Source

- 6.2.4.7.2. By Application

- 6.2.4.8. NORDIC Countries

- 6.2.4.8.1. By Source

- 6.2.4.8.2. By Application

- 6.2.4.9. Rest of Europe

- 6.2.4.9.1. By Source

- 6.2.4.9.2. By Application

7. Asia-Pacific Oleyl Alcohol Market

- 7.1.1. Market Size & Forecast, 2018-2028

- 7.1.2. By Value (USD Billion)

- 7.1.3. By Volume (Million Tons)

- 7.2. Market Share & Forecast

- 7.2.1. By Source

- 7.2.2. By Application

- 7.2.3. By Country

- 7.2.3.1. China

- 7.2.3.1.1. By Source

- 7.2.3.1.2. By Application

- 7.2.3.2. India

- 7.2.3.2.1. By Source

- 7.2.3.2.2. By Application

- 7.2.3.3. Japan

- 7.2.3.3.1. By Source

- 7.2.3.3.2. By Application

- 7.2.3.4. South Korea

- 7.2.3.4.1. By Source

- 7.2.3.4.2. By Application

- 7.2.3.5. Australia & New Zealand

- 7.2.3.5.1. By Source

- 7.2.3.5.2. By Application

- 7.2.3.6. Indonesia

- 7.2.3.6.1. By Source

- 7.2.3.6.2. By Application

- 7.2.3.7. Malaysia

- 7.2.3.7.1. By Source

- 7.2.3.7.2. By Application

- 7.2.3.8. Singapore

- 7.2.3.8.1. By Source

- 7.2.3.8.2. By Application

- 7.2.3.9. Philippines

- 7.2.3.9.1. By Source

- 7.2.3.9.2. By Application

- 7.2.3.10. Vietnam

- 7.2.3.10.1. By Source

- 7.2.3.10.2. By Application

- 7.2.3.11. Rest of APAC

- 7.2.3.11.1. By Source

- 7.2.3.11.2. By Application

8. Latin America Oleyl Alcohol Market

- 8.1.1. Market Size & Forecast, 2018-2028

- 8.1.2. By Value (USD Billion)

- 8.1.3. By Volume (Million Tons)

- 8.2. Market Share & Forecast

- 8.2.1. By Source

- 8.2.2. By Application

- 8.2.3. By Country

- 8.2.3.1. Brazil

- 8.2.3.1.1. By Source

- 8.2.3.1.2. By Application

- 8.2.3.2. Mexico

- 8.2.3.2.1. By Source

- 8.2.3.2.2. By Application

- 8.2.3.3. Argentina

- 8.2.3.3.1. By Source

- 8.2.3.3.2. By Application

- 8.2.3.4. Peru

- 8.2.3.4.1. By Source

- 8.2.3.4.2. By Application

- 8.2.3.5. Colombia

- 8.2.3.5.1. By Source

- 8.2.3.5.2. By Application

- 8.2.3.6. Rest of Latin America

- 8.2.3.6.1. By Source

- 8.2.3.6.2. By Application

9. Middle East & Africa Oleyl Alcohol Market

- 9.1.1. Market Size & Forecast, 2018-2028

- 9.1.2. By Value (USD Billion)

- 9.1.3. By Volume (Million Tons)

- 9.2. Market Share & Forecast

- 9.2.1. By Source

- 9.2.2. By Application

- 9.2.3. By Country

- 9.2.3.1. Saudi Arabia

- 9.2.3.1.1. By Source

- 9.2.3.1.2. By Application

- 9.2.3.2. UAE

- 9.2.3.2.1. By Source

- 9.2.3.2.2. By Application

- 9.2.3.3. Qatar

- 9.2.3.3.1. By Source

- 9.2.3.3.2. By Application

- 9.2.3.4. Kuwait

- 9.2.3.4.1. By Source

- 9.2.3.4.2. By Application

- 9.2.3.5. Iran

- 9.2.3.5.1. By Source

- 9.2.3.5.2. By Application

- 9.2.3.6. South Africa

- 9.2.3.6.1. By Source

- 9.2.3.6.2. By Application

- 9.2.3.7. Nigeria

- 9.2.3.7.1. By Source

- 9.2.3.7.2. By Application

- 9.2.3.8. Kenya

- 9.2.3.8.1. By Source

- 9.2.3.8.2. By Application

- 9.2.3.9. Egypt

- 9.2.3.9.1. By Source

- 9.2.3.9.2. By Application

- 9.2.3.10. Morocco

- 9.2.3.10.1. By Source

- 9.2.3.10.2. By Application

- 9.2.3.11. Algeria

- 9.2.3.11.1. By Source

- 9.2.3.11.2. By Application

- 9.2.3.12. Rest of Middle East & Africa

- 9.2.3.12.1. By Source

- 9.2.3.12.2. By Application

10. Competitive Landscape

- 10.1. List of Key Players and Their Range

- 10.2. Global Oleyl Alcohol Company Market Share Analysis, 2021

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Development (Merger, Acquisition, Partnership)

11. Impact of Covid-19 on Global Oleyl Alcohol Market Industry

12. Company Profile (Company Overview, Financial Matrix, Competitive Landscape, Key Personnel, Key Competitors, Contact Address, and Strategic Outlook)

- 12.1. Akzo Nobel N.V.

- 12.2. Ecogreen Oleochemicals

- 12.3. Procter & Gamble

- 12.4. Croda International Plc

- 12.5. Stepan Company

- 12.6. Sasol Limited

- 12.7. Henkel AG & Co. KGaA

- 12.8. Ashland

- 12.9. The Lubrizol Corporation

- 12.10. FPG Oleochemicals Sdn Bhd

- 12.11. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumption & Limitation