|

|

市場調査レポート

商品コード

1795083

車両用コンピュータ断層撮影市場:スキャナータイプ・用途・エンドユーザー・地域別の分析・予測 (2025-2034年)Vehicle Computer Tomography Market - A Global and Regional Analysis: Focus on Scanner Type, Application, End User, and Regional Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 車両用コンピュータ断層撮影市場:スキャナータイプ・用途・エンドユーザー・地域別の分析・予測 (2025-2034年) |

|

出版日: 2025年08月21日

発行: BIS Research

ページ情報: 英文 140 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

車両用コンピュータ断層撮影 (CT) の市場は、より広範な産業用CTおよび非破壊検査 (NDT) エコシステムの中で重要なセグメントを構成しています。

CT技術は、マルチスライス撮影、検出器感度、AIベースの画像処理アルゴリズムの進歩により進化を続けています。

車両用CTシステムは、エンジン、トランスミッション、バッテリーパック、鋳造部品といった自動車部品を分解することなく内部検査するために不可欠です。近年のコーンビームCTやナノCTといった革新は、画像解像度とスキャン速度を大幅に向上させ、自動車製造や研究開発における適用範囲を広げています。

さらに、AIや機械学習の統合によって、自動欠陥認識が可能となり、スループットを高め、人為的ミスを削減しています。研究開発への投資は、自動車の品質管理や電気自動車バッテリー診断に特化した、高速かつコスト効率の高いCTシステムの開発に注力しています。車両用CT市場は、製造歩留まりの改善や安全基準の遵守を目的とした非破壊検査の導入拡大により、恩恵を受けています。

世界の車両用コンピュータ断層撮影 (CT) 市場のライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2034年 |

| 2025年評価額 | 13億9,000万米ドル |

| 2034年予測 | 29億7,000万米ドル |

| CAGR | 8.76% |

現在、車両用CT市場は堅調な成長を遂げており、その背景には、自動車生産量の増加と世界的に厳格化する安全・品質規制があります。この市場はすでに高度な技術成熟度に達しており、北米、欧州、アジア太平洋地域で採用が拡大しています。特に米国の自動車産業は、イノベーションと品質保証に重点を置いているため、需要を強く牽引しています。

CTスキャナーメーカー、自動車OEM、研究機関の間での戦略的パートナーシップは、カスタマイズされたスキャンソリューションの開発を加速させています。また、自動車の安全性や環境基準に関する規制枠組みが市場動向を形作っています。

さらに、自動化、デジタル分析、AIの進歩により、運用上の障壁が低下し、CTシステムを車両製造プロセスにインライン統合することが可能になりつつあります。電気自動車の生産拡大や軽量・欠陥のない部品への需要増加によって、車両用CT市場は今後10年間にわたり強い成長を維持すると予測されています。

車両用コンピュータ断層撮影 (CT) 市場のセグメンテーション

セグメンテーション1:スキャナタイプ別

- 産業用CTスキャナー

- モバイルCTスキャナー

- 自動CTスキャナー

- AI解析付きCT

セグメンテーション2:用途別

- 品質管理

- プロトタイプ開発

- 材料分析

- 非破壊検査

- 構造完全性

セグメンテーション3:エンドユーザー別

- OEM

- 自動車アフターマーケットおよびメンテナンスサービスプロバイダー

- 研究開発機関

- ティア1・ティア2の自動車部品サプライヤー

セグメンテーション4:地域別

- 北米:米国、カナダ、メキシコ

- 欧州:ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域:中国、日本、韓国、インド、その他

- その他地域:南米、中東・アフリカ

当レポートでは、世界の車両用コンピュータ断層撮影 (CT) の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の分析、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 規制および政策影響分析

- 地域別

- 特許分析

- 年別

- 地域別

- 技術情勢

- 車両におけるCTスキャンの主な利点

- スタートアップの情勢

- 投資情勢と研究開発動向

- バリューチェーン分析

- 業界の魅力

第2章 世界の車両用コンピュータ断層撮影 (CT) 市場:スキャナータイプ別

- 産業用CTスキャナー

- モバイルCTスキャナー

- 自動CTスキャナー

- AI分析別CT

第3章 世界の車両用コンピュータ断層撮影 (CT) 市場:用途別

- 品質管理

- プロトタイプ開発

- 材料分析

- 非破壊検査

- 構造の健全性

第4章 世界の車両用コンピュータ断層撮影 (CT) 市場:エンドユーザー別

- OEM

- 自動車アフターマーケットおよびメンテナンスサービスプロバイダー

- 研究開発機関

- ティア1・ティア2自動車サプライヤー

第5章 世界の車両用コンピュータ断層撮影 (CT) 市場:地域別

- 世界の車両コンピューター断層撮影市場 (地域別)

- 北米

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- スキャナータイプ

- 用途

- エンドユーザー

- 北米 (国別)

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- スキャナータイプ

- 用途

- エンドユーザー

- 欧州 (国別)

- アジア太平洋

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- スキャナータイプ

- 用途

- エンドユーザー

- アジア太平洋 (国別)

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- スキャナータイプ

- 用途

- エンドユーザー

- その他の地域 (地域別)

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- スキャナータイプ

- 用途

- エンドユーザー

- その他の地域 (地域別)

第6章 市場:競合ベンチマーキングと企業プロファイル

- 次のフロンティア

- 地理的評価

- 企業プロファイル

- Fraunhofer Institute for Integrated Circuits IIS

- Nikon Corporation

- Baker Hughes Company

- Lumafield

- Comet (Xylon)

- ZEISS

- North Star Imaging Inc.

- Mircea Tudor Scan Tech

- OMRON Corporation

- その他の主要企業

第7章 調査手法

List of Figures

- Figure 1: Vehicle Computer Tomography Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Vehicle Computer Tomography Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024, 2027, and 2034

- Figure 4: Vehicle Computer Tomography Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 5: Vehicle Computer Tomography Market (by End User), $Billion, 2024, 2027, and 2034

- Figure 6: Competitive Landscape Snapshot

- Figure 7: Supply Chain Analysis

- Figure 8: Value Chain Analysis

- Figure 9: Patent Analysis (by Country), January 2021-April 2025

- Figure 10: Patent Analysis (by Company), January 2021-April 2025

- Figure 11: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 12: U.S. Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 13: Canada Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 14: Mexico Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 15: Germany Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 16: France Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 17: Italy Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 18: Spain Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 19: U.K. Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 20: Rest-of-Europe Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 21: China Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 22: Japan Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 23: India Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 24: South Korea Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 25: Rest-of-Asia-Pacific Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 26: South America Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 27: Middle East and Africa Vehicle Computer Tomography Market, $Billion, 2024-2034

- Figure 28: Strategic Initiatives (by Company), 2021-2025

- Figure 29: Share of Strategic Initiatives, 2021-2025

- Figure 30: Data Triangulation

- Figure 31: Top-Down and Bottom-Up Approach

- Figure 32: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Vehicle Computer Tomography Market (by Region), $Billion, 2024-2034

- Table 5: North America Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 6: North America Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 7: North America Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 8: U.S. Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 9: U.S. Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 10: U.S. Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 11: Canada Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 12: Canada Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 13: Canada Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 14: Mexico Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 15: Mexico Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 16: Mexico Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 17: Europe Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 18: Europe Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 19: Europe Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 20: Germany Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 21: Germany Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 22: Germany Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 23: France Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 24: France Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 25: France Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 26: Italy Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 27: Italy Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 28: Italy Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 29: Spain Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 30: Spain Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 31: Spain Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 32: U.K. Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 33: U.K. Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 34: U.K. Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 35: Rest-of-Europe Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 36: Rest-of-Europe Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 37: Rest-of-Europe Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 38: China Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 39: China Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 40: China Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 41: Japan Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 42: Japan Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 43: Japan Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 44: India Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 45: India Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 46: India Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 47: South Korea Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 48: South Korea Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 49: South Korea Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 50: Rest-of-Asia-Pacific Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 51: Rest-of-Asia-Pacific Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 52: Rest-of-Asia-Pacific Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 53: Rest-of-the-World Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 54: Rest-of-the-World Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 55: Rest-of-the-World Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 56: South America Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 57: South America Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 58: South America Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 59: Middle East and Africa Vehicle Computer Tomography Market (by Scanner Type), $Billion, 2024-2034

- Table 60: Middle East and Africa Vehicle Computer Tomography Market (by Application), $Billion, 2024-2034

- Table 61: Middle East and Africa Vehicle Computer Tomography Market (by End User), $Billion, 2024-2034

- Table 62: Market Share

Vehicle Computer Tomography Market Industry and Technology Overview

The vehicle computer tomography market represents a vital segment within the broader industrial CT and non-destructive testing ecosystem. CT technology continues to evolve with advancements in multi-slice imaging, detector sensitivity, and AI-based image processing algorithms. Vehicle computer tomography systems are essential for internal inspection of automotive components such as engines, transmissions, battery packs, and castings without disassembly. Recent innovations including cone-beam CT and nano-CT have significantly enhanced image resolution and scan speed, expanding their applicability in vehicle manufacturing and R&D. Artificial intelligence and machine learning integration enable automated defect recognition, increasing throughput and reducing human error. Investment in R&D focuses on developing high-speed, cost-efficient CT systems tailored for automotive quality control and electric vehicle battery diagnostics. The vehicle computer tomography market benefits from increasing adoption of non-destructive testing to improve manufacturing yield and safety compliance.

Global Vehicle Computer Tomography Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $1.39 Billion |

| 2034 Forecast | $2.97 Billion |

| CAGR | 8.76% |

Currently, the vehicle computer tomography market is experiencing robust growth, supported by rising automotive production volumes and stringent safety and quality regulations worldwide. The market has reached advanced technology readiness levels, with growing adoption in North America, Europe, and Asia-Pacific regions. The U.S. automotive sector notably drives demand due to its focus on innovation and quality assurance. Strategic partnerships among CT scanner manufacturers, automotive OEMs, and research institutions foster accelerated development of customized scanning solutions. Regulatory frameworks related to vehicle safety and environmental standards shape market dynamics. Continued advancements in automation, digital analytics, and AI are reducing operational barriers and enabling in-line integration of CT systems in vehicle manufacturing processes. The vehicle computer tomography market is projected to sustain strong growth through the next decade, driven by increasing electric vehicle production and demand for lightweight, defect-free components.

Vehicle Computer Tomography Market Segmentation:

Segmentation 1: by Scanner Type

- Industrial CT Scanners

- Mobile CT Scanners

- Automated CT Scanners

- CT with AI Analysis

Segmentation 2: by Application

- Quality Control

- Prototype Development

- Material Analysis

- Non-Destructive Testing

- Structural Integrity

Segmentation 3: by End User

- Original Equipment Manufacturers

- Automotive Aftermarket and Maintenance Service Providers

- Research and Development Institutions

- Tier 1 and Tier 2 Automotive Suppliers

Segmentation 4: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Demand - Drivers and Limitations

The following are the demand drivers for the vehicle computer tomography market:

- Increasing automotive industry focus on non-destructive testing and quality assurance

- Growing demand for electric vehicles (EVs)

- Regulatory mandates for vehicle safety and component traceability

- Technological advancements in AI integration and faster scanning capabilities

The vehicle computer tomography market is expected to face some limitations as well due to the following challenges:

- High initial investment and operational costs associated with CT systems

- Requirement for specialized technical expertise in data interpretation

- Integration complexities with existing automotive manufacturing lines

Vehicle Computer Tomography Market Key Players and Competition Synopsis

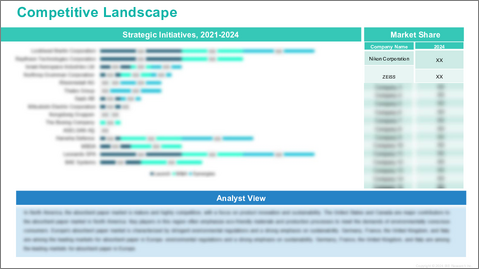

The vehicle computer tomography market features a competitive landscape shaped by established industrial imaging leaders and innovative automotive inspection technology providers. Key global companies such as Nikon Corporation, Lumafield, Comet (Xylon), ZEISS, North Star Imaging Inc., and Fraunhofer Institute for Integrated Circuits IIS play pivotal roles in advancing vehicle-grade computed tomography solutions. These players emphasize the development of high-resolution, fast CT scanners with AI-enabled defect detection and integration into automotive manufacturing workflows. Alongside these established firms, emerging technology companies are contributing novel portable and automated CT scanning systems tailored for electric vehicle battery analysis and quality assurance. Competition in the vehicle computer tomography market is driven by strategic collaborations with automotive OEMs, continuous product innovation, and expansion into emerging geographic markets. As the vehicle computer tomography market grows, participants focus on delivering scalable, cost-effective solutions that meet evolving automotive safety and performance standards.

Some prominent names established in the vehicle computer tomography market are:

- Fraunhofer Institute for Integrated Circuits IIS

- Nikon Corporation

- Baker Hughes Company

- Lumafield

- Comet (Xylon)

- ZEISS

- North Star Imaging Inc.

- Mircea Tudor Scan Tech

- OMRON Corporation

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1 Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Regulatory & Policy Impact Analysis

- 1.3.1 By Region

- 1.4 Patent Analysis

- 1.4.1 By Year

- 1.4.2 By Region

- 1.5 Technology Landscape

- 1.6 Key Benefits of using CT Scanning in Vehicles

- 1.7 Start-Up Landscape

- 1.8 Investment Landscape and R&D Trends

- 1.9 Value Chain Analysis

- 1.1 Industry Attractiveness

2 Global Vehicle Computer Tomography Market (by Scanner Type)

- 2.1 Industrial CT Scanners

- 2.2 Mobile CT Scanners

- 2.3 Automated CT Scanners

- 2.4 CT with AI Analysis

3 Global Vehicle Computer Tomography Market (by Application)

- 3.1 Quality Control

- 3.2 Prototype Development

- 3.3 Material Analysis

- 3.4 Non-Destructive Testing

- 3.5 Structural Integrity

4 Global Vehicle Computer Tomography Market (by End User)

- 4.1 Original Equipment Manufacturers

- 4.2 Automotive Aftermarket and Maintenance Service Providers

- 4.3 Research and Development Institutions

- 4.4 Tier 1 and Tier 2 Automotive Suppliers

5 Global Vehicle Computer Tomography Market (by Region)

- 5.1 Global Vehicle Computer Tomography Market (by Region)

- 5.2 North America

- 5.2.1 Regional Overview

- 5.2.2 Driving Factors for Market Growth

- 5.2.3 Factors Challenging the Market

- 5.2.4 Key Companies

- 5.2.5 Scanner Type

- 5.2.6 Application

- 5.2.7 End User

- 5.2.8 North America (by Country)

- 5.2.8.1 U.S.

- 5.2.8.1.1 Market by Scanner Type

- 5.2.8.1.2 Market by Application

- 5.2.8.1.3 Market by End User

- 5.2.8.2 Canada

- 5.2.8.2.1 Market by Scanner Type

- 5.2.8.2.2 Market by Application

- 5.2.8.2.3 Market by End User

- 5.2.8.3 Mexico

- 5.2.8.3.1 Market by Scanner Type

- 5.2.8.3.2 Market by Application

- 5.2.8.3.3 Market by End User

- 5.2.8.1 U.S.

- 5.3 Europe

- 5.3.1 Regional Overview

- 5.3.2 Driving Factors for Market Growth

- 5.3.3 Factors Challenging the Market

- 5.3.4 Key Companies

- 5.3.5 Scanner Type

- 5.3.6 Application

- 5.3.7 End User

- 5.3.8 Europe (by Country)

- 5.3.8.1 Germany

- 5.3.8.1.1 Market by Scanner Type

- 5.3.8.1.2 Market by Application

- 5.3.8.1.3 Market by End User

- 5.3.8.2 France

- 5.3.8.2.1 Market by Scanner Type

- 5.3.8.2.2 Market by Application

- 5.3.8.2.3 Market by End User

- 5.3.8.3 Italy

- 5.3.8.3.1 Market by Scanner Type

- 5.3.8.3.2 Market by Application

- 5.3.8.3.3 Market by End User

- 5.3.8.4 Spain

- 5.3.8.4.1 Market by Scanner Type

- 5.3.8.4.2 Market by Application

- 5.3.8.4.3 Market by End User

- 5.3.8.5 U.K.

- 5.3.8.5.1 Market by Scanner Type

- 5.3.8.5.2 Market by Application

- 5.3.8.5.3 Market by End User

- 5.3.8.6 Rest-of-Europe

- 5.3.8.6.1 Market by Scanner Type

- 5.3.8.6.2 Market by Application

- 5.3.8.6.3 Market by End User

- 5.3.8.1 Germany

- 5.4 Asia-Pacific

- 5.4.1 Regional Overview

- 5.4.2 Driving Factors for Market Growth

- 5.4.3 Factors Challenging the Market

- 5.4.4 Key Companies

- 5.4.5 Scanner Type

- 5.4.6 Application

- 5.4.7 End User

- 5.4.8 Asia-Pacific (by Country)

- 5.4.8.1 China

- 5.4.8.1.1 Market by Scanner Type

- 5.4.8.1.2 Market by Application

- 5.4.8.1.3 Market by End User

- 5.4.8.2 Japan

- 5.4.8.2.1 Market by Scanner Type

- 5.4.8.2.2 Market by Application

- 5.4.8.2.3 Market by End User

- 5.4.8.3 India

- 5.4.8.3.1 Market by Scanner Type

- 5.4.8.3.2 Market by Application

- 5.4.8.3.3 Market by End User

- 5.4.8.4 South Korea

- 5.4.8.4.1 Market by Scanner Type

- 5.4.8.4.2 Market by Application

- 5.4.8.4.3 Market by End User

- 5.4.8.5 Rest-of-Asia-Pacific

- 5.4.8.5.1 Market by Scanner Type

- 5.4.8.5.2 Market by Application

- 5.4.8.5.3 Market by End User

- 5.4.8.1 China

- 5.5 Rest-of-the-World

- 5.5.1 Regional Overview

- 5.5.2 Driving Factors for Market Growth

- 5.5.3 Factors Challenging the Market

- 5.5.4 Key Companies

- 5.5.5 Scanner Type

- 5.5.6 Application

- 5.5.7 End User

- 5.5.8 Rest-of-the-World (by Region)

- 5.5.8.1 South America

- 5.5.8.1.1 Market by Scanner Type

- 5.5.8.1.2 Market by Application

- 5.5.8.1.3 Market by End User

- 5.5.8.2 Middle East and Africa

- 5.5.8.2.1 Market by Scanner Type

- 5.5.8.2.2 Market by Application

- 5.5.8.2.3 Market by End User

- 5.5.8.1 South America

- 5.6 Rest-of-the-World

- 5.6.1 Regional Overview

- 5.6.2 Driving Factors for Market Growth

- 5.6.3 Factors Challenging the Market

- 5.6.4 Key Companies

- 5.6.5 Scanner Type

- 5.6.6 Application

- 5.6.7 End User

- 5.6.8 Rest-of-the-World (by Region)

- 5.6.8.1 South America

- 5.6.8.1.1 Market by Scanner Type

- 5.6.8.1.2 Market by Application

- 5.6.8.1.3 Market by End User

- 5.6.8.2 Middle East and Africa

- 5.6.8.2.1 Market by Scanner Type

- 5.6.8.2.2 Market by Application

- 5.6.8.2.3 Market by End User

- 5.6.8.1 South America

6 Markets - Competitive Benchmarking & Company Profiles

- 6.1 Next Frontiers

- 6.2 Geographic Assessment

- 6.3 Company Profiles

- 6.3.1 Fraunhofer Institute for Integrated Circuits IIS

- 6.3.1.1 Overview

- 6.3.1.2 Top Products/Product Portfolio

- 6.3.1.3 Top Competitors

- 6.3.1.4 Target Customers

- 6.3.1.5 Key Personnel

- 6.3.1.6 Analyst View

- 6.3.1.7 Market Share

- 6.3.2 Nikon Corporation

- 6.3.2.1 Overview

- 6.3.2.2 Top Products/Product Portfolio

- 6.3.2.3 Top Competitors

- 6.3.2.4 Target Customers

- 6.3.2.5 Key Personnel

- 6.3.2.6 Analyst View

- 6.3.2.7 Market Share

- 6.3.3 Baker Hughes Company

- 6.3.3.1 Overview

- 6.3.3.2 Top Products/Product Portfolio

- 6.3.3.3 Top Competitors

- 6.3.3.4 Target Customers

- 6.3.3.5 Key Personnel

- 6.3.3.6 Analyst View

- 6.3.3.7 Market Share

- 6.3.4 Lumafield

- 6.3.4.1 Overview

- 6.3.4.2 Top Products/Product Portfolio

- 6.3.4.3 Top Competitors

- 6.3.4.4 Target Customers

- 6.3.4.5 Key Personnel

- 6.3.4.6 Analyst View

- 6.3.4.7 Market Share

- 6.3.5 Comet (Xylon)

- 6.3.5.1 Overview

- 6.3.5.2 Top Products/Product Portfolio

- 6.3.5.3 Top Competitors

- 6.3.5.4 Target Customers

- 6.3.5.5 Key Personnel

- 6.3.5.6 Analyst View

- 6.3.5.7 Market Share

- 6.3.6 ZEISS

- 6.3.6.1 Overview

- 6.3.6.2 Top Products/Product Portfolio

- 6.3.6.3 Top Competitors

- 6.3.6.4 Target Customers

- 6.3.6.5 Key Personnel

- 6.3.6.6 Analyst View

- 6.3.6.7 Market Share

- 6.3.7 North Star Imaging Inc.

- 6.3.7.1 Overview

- 6.3.7.2 Top Products/Product Portfolio

- 6.3.7.3 Top Competitors

- 6.3.7.4 Target Customers

- 6.3.7.5 Key Personnel

- 6.3.7.6 Analyst View

- 6.3.7.7 Market Share

- 6.3.8 Mircea Tudor Scan Tech

- 6.3.8.1 Overview

- 6.3.8.2 Top Products/Product Portfolio

- 6.3.8.3 Top Competitors

- 6.3.8.4 Target Customers

- 6.3.8.5 Key Personnel

- 6.3.8.6 Analyst View

- 6.3.8.7 Market Share

- 6.3.9 OMRON Corporation

- 6.3.9.1 Overview

- 6.3.9.2 Top Products/Product Portfolio

- 6.3.9.3 Top Competitors

- 6.3.9.4 Target Customers

- 6.3.9.5 Key Personnel

- 6.3.9.6 Analyst View

- 6.3.9.7 Market Share

- 6.3.1 Fraunhofer Institute for Integrated Circuits IIS

- 6.4 Other Key Companies