|

|

市場調査レポート

商品コード

1786315

エアロゲルの世界市場:製品・技術・形態・用途・国別の分析・予測 (2025-2034年)Aerogel Market - A Global and Regional Analysis: Focus on Product, Technology, Form, Application, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| エアロゲルの世界市場:製品・技術・形態・用途・国別の分析・予測 (2025-2034年) |

|

出版日: 2025年08月08日

発行: BIS Research

ページ情報: 英文 150 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

エアロゲル市場:産業概要

エアロゲル市場は、建設、航空宇宙、自動車、エネルギーなど複数の産業分野において重要な役割を果たしており、省エネルギー効果と製品性能を高める超軽量・高効率の断熱材需要によって牽引されています。厳格な環境規制、産業化の進展、環境配慮型素材を好む消費者志向といった背景から、世界的に省エネルギー、持続可能性、カーボンフットプリント削減への関心が高まる中で、優れた断熱特性とスケーラブルな生産方法を備えた革新的なエアロゲル技術の必要性が一層高まっています。

この業界は、エアロゲルの合成技術の改善、製造コストの削減、応用可能性の拡大を目的とした継続的な技術革新によって特徴づけられています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2034年 |

| 2025年評価 | 24億7,000万米ドル |

| 2034年予測 | 115億9,000万米ドル |

| CAGR | 18.59% |

主要メーカーは、熱抵抗性、機械的強度、撥水性を高めたシリカ系、ポリマー系、複合材系エアロゲルの開発を進めています。これらの進展は、超臨界乾燥、常圧乾燥、表面機能化技術の向上によって支えられており、建築断熱、熱管理、自動車の軽量化など多様な分野での採用拡大を可能にしています。

最新のエアロゲル技術では、熱伝導率、柔軟性、耐久性といった特性を最適化するためにナノ多孔構造の微調整が行われています。革新例としては、再生可能原料から製造されるバイオ由来エアロゲル、機械的耐性を高めるために繊維やポリマーと組み合わせたハイブリッド複合材、新たな製造プロセスに適合しスケーラビリティとコスト効率を高めた配合などがあります。これらの進歩により、産業界は高性能と環境配慮を兼ね備えた素材の需要増加に応えることが可能になります。

持続可能性、省エネルギー、規制順守への関心が高まる中、エアロゲルは高性能断熱材や軽量部品製造における素材戦略の中核的存在となりつつあります。この市場動向は今後も続くと予想され、企業はより環境に優しく高性能なエアロゲルソリューションの研究開発に投資し、世界的な環境基準に適合しつつ、省エネルギーで耐久性が高く多機能な産業用素材への転換を支えていくでしょう。

エアロゲル市場の分類:

セグメンテーション1:製品別

- シリカ

- ポリマー

- カーボン

- その他

セグメンテーション2:技術別

- 超臨界乾燥

- その他

セグメンテーション3:形態別

- ブランケット

- 粒子

- パネル

- モノリス (単塊)

セグメンテーション4:用途別

- エネルギー・工業

- 輸送

- 建築・建設

- その他

セグメンテーション5:地域別

- 北米:米国、カナダ、メキシコ

- 欧州:ドイツ、フランス、イタリア、英国、その他

- アジア太平洋地域:中国、日本、韓国、インド、その他

- その他地域:南米、中東・アフリカ

当レポートでは、世界のエアロゲルの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の分析、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場:産業の展望

- 動向:現状と将来への影響評価

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 規制および政策の影響分析

- 特許分析

- 世界の価格分析

第2章 エアロゲル市場:製品別

- シリカ

- ポリマー

- カーボン

- その他

第3章 エアロゲル市場:技術別

- 超臨界乾燥

- その他

第4章 エアロゲル市場:形態別

- ブランケット

- 粒子

- パネル

- モノリス (単塊)

第5章 エアロゲル市場:用途別

- エネルギー・工業

- 輸送

- 建築・建設

- その他

第6章 エアロゲル市場:地域別

- エアロゲル市場:地域別

- 北米

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- 製品

- 技術

- 形態

- 用途

- 北米 (国別)

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- 製品

- 技術

- 形態

- 用途

- 欧州 (国別)

- アジア太平洋

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- 製品

- 技術

- 形態

- 用途

- アジア太平洋 (国別)

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

- 主要企業

- 製品

- 技術

- 形態

- 用途

- その他の地域 (地域別)

第7章 市場:競合ベンチマーキングと企業プロファイル

- 次のフロンティア

- 地理的評価

- 企業プロファイル

- Armcell International S.A.

- Cabot Corporation

- Aspen Aerogels, Inc.

- Nano Tech Co., Ltd.

- Zhejiang Ugoo Technology Co., Ltd.

- Guangdong Alison Technology Co., Ltd.

- Beerenberg AS

- Enersens

- IBIH Advanced Material Co., Ltd.

- Aerogel-IT GMBH

- Jios Aerogel Pte Ltd.

- Svenska Aerogel Holdings AB

- Thermablock Aerogels Ltd.

- その他の主要企業

第8章 調査手法

List of Figures

- Figure 1: Aerogel Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Aerogel Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Aerogel Market (by Product), $Billion, 2024, 2025, and 2034

- Figure 4: Aerogel Market (by Technology), $Billion, 2024, 2025, and 2034

- Figure 5: Aerogel Market (by Form), $Billion, 2024, 2025, and 2034

- Figure 6: Aerogel Market (by Application), $Billion, 2024, 2028, and 2034

- Figure 7: Competitive Landscape Snapshot

- Figure 8: Supply Chain Analysis

- Figure 9: Value Chain Analysis

- Figure 10: Patent Analysis (by Country), January 2021-June 2025

- Figure 11: Patent Analysis (by Company), January 2021-June 2025

- Figure 12: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 13: U.S. Aerogel Market, $Billion, 2024-2034

- Figure 14: Canada Aerogel Market, $Billion, 2024-2034

- Figure 15: Mexico Aerogel Market, $Billion, 2024-2034

- Figure 16: Germany Aerogel Market, $Billion, 2024-2034

- Figure 17: France Aerogel Market, $Billion, 2024-2034

- Figure 18: Italy Aerogel Market, $Billion, 2024-2034

- Figure 19: U.K. Aerogel Market, $Billion, 2024-2034

- Figure 20: Rest-of-Europe Aerogel Market, $Billion, 2024-2034

- Figure 21: China Aerogel Market, $Billion, 2024-2034

- Figure 22: Japan Aerogel Market, $Billion, 2024-2034

- Figure 23: India Aerogel Market, $Billion, 2024-2034

- Figure 24: South Korea Aerogel Market, $Billion, 2024-2034

- Figure 25: Rest-of-Asia-Pacific Aerogel Market, $Billion, 2024-2034

- Figure 26: South America Aerogel Market, $Billion, 2024-2034

- Figure 27: Middle East and Africa Aerogel Market, $Billion, 2024-2034

- Figure 28: Strategic Initiatives (by Company), 2021-2025

- Figure 29: Share of Strategic Initiatives, 2021-2025

- Figure 30: Data Triangulation

- Figure 31: Top-Down and Bottom-Up Approach

- Figure 32: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Aerogel Market Pricing Forecast, 2024-2034

- Table 5: Aerogel Market (by Region), $Billion, 2024-2034

- Table 6: North America Aerogel Market (by Product), $Billion, 2024-2034

- Table 7: North America Aerogel Market (by Technology), $Billion, 2024-2034

- Table 8: North America Aerogel Market (by Form), $Billion, 2024-2034

- Table 9: North America Aerogel Market (by Application), $Billion, 2024-2034

- Table 10: U.S. Aerogel Market (by Product), $Billion, 2024-2034

- Table 11: U.S. Aerogel Market (by Technology), $Billion, 2024-2034

- Table 12: U.S. Aerogel Market (by Form), $Billion, 2024-2034

- Table 13: U.S. Aerogel Market (by Application), $Billion, 2024-2034

- Table 14: Canada Aerogel Market (by Product), $Billion, 2024-2034

- Table 15: Canada Aerogel Market (by Technology), $Billion, 2024-2034

- Table 16: Canada Aerogel Market (by Form), $Billion, 2024-2034

- Table 17: Canada Aerogel Market (by Application), $Billion, 2024-2034

- Table 18: Mexico Aerogel Market (by Product), $Billion, 2024-2034

- Table 19: Mexico Aerogel Market (by Technology), $Billion, 2024-2034

- Table 20: Mexico Aerogel Market (by Form), $Billion, 2024-2034

- Table 21: Mexico Aerogel Market (by Application), $Billion, 2024-2034

- Table 22: Europe Aerogel Market (by Product), $Billion, 2024-2034

- Table 23: Europe Aerogel Market (by Technology), $Billion, 2024-2034

- Table 24: Europe Aerogel Market (by Form), $Billion, 2024-2034

- Table 25: Europe Aerogel Market (by Application), $Billion, 2024-2034

- Table 26: Germany Aerogel Market (by Product), $Billion, 2024-2034

- Table 27: Germany Aerogel Market (by Technology), $Billion, 2024-2034

- Table 28: Germany Aerogel Market (by Form), $Billion, 2024-2034

- Table 29: Germany Aerogel Market (by Application), $Billion, 2024-2034

- Table 30: France Aerogel Market (by Product), $Billion, 2024-2034

- Table 31: France Aerogel Market (by Technology), $Billion, 2024-2034

- Table 32: France Aerogel Market (by Form), $Billion, 2024-2034

- Table 33: France Aerogel Market (by Application), $Billion, 2024-2034

- Table 34: Italy Aerogel Market (by Product), $Billion, 2024-2034

- Table 35: Italy Aerogel Market (by Technology), $Billion, 2024-2034

- Table 36: Italy Aerogel Market (by Form), $Billion, 2024-2034

- Table 37: Italy Aerogel Market (by Application), $Billion, 2024-2034

- Table 38: U.K. Aerogel Market (by Product), $Billion, 2024-2034

- Table 39: U.K. Aerogel Market (by Technology), $Billion, 2024-2034

- Table 40: U.K. Aerogel Market (by Form), $Billion, 2024-2034

- Table 41: U.K. Aerogel Market (by Application), $Billion, 2024-2034

- Table 42: Rest-of-Europe Aerogel Market (by Product), $Billion, 2024-2034

- Table 43: Rest-of-Europe Aerogel Market (by Technology), $Billion, 2024-2034

- Table 44: Rest-of-Europe Aerogel Market (by Form), $Billion, 2024-2034

- Table 45: Rest-of-Europe Aerogel Market (by Application), $Billion, 2024-2034

- Table 46: Asia-Pacific Aerogel Market (by Product), $Billion, 2024-2034

- Table 47: Asia-Pacific Aerogel Market (by Technology), $Billion, 2024-2034

- Table 48: Asia-Pacific Aerogel Market (by Form), $Billion, 2024-2034

- Table 49: Asia-Pacific Aerogel Market (by Application), $Billion, 2024-2034

- Table 50: China Aerogel Market (by Product), $Billion, 2024-2034

- Table 51: China Aerogel Market (by Technology), $Billion, 2024-2034

- Table 52: China Aerogel Market (by Form), $Billion, 2024-2034

- Table 53: China Aerogel Market (by Application), $Billion, 2024-2034

- Table 54: Japan Aerogel Market (by Product), $Billion, 2024-2034

- Table 55: Japan Aerogel Market (by Technology), $Billion, 2024-2034

- Table 56: Japan Aerogel Market (by Form), $Billion, 2024-2034

- Table 57: Japan Aerogel Market (by Application), $Billion, 2024-2034

- Table 58: India Aerogel Market (by Product), $Billion, 2024-2034

- Table 59: India Aerogel Market (by Technology), $Billion, 2024-2034

- Table 60: India Aerogel Market (by Form), $Billion, 2024-2034

- Table 61: India Aerogel Market (by Application), $Billion, 2024-2034

- Table 62: South Korea Aerogel Market (by Product), $Billion, 2024-2034

- Table 63: South Korea Aerogel Market (by Technology), $Billion, 2024-2034

- Table 64: South Korea Aerogel Market (by Form), $Billion, 2024-2034

- Table 65: South Korea Aerogel Market (by Application), $Billion, 2024-2034

- Table 66: Rest-of-Asia-Pacific Aerogel Market (by Product), $Billion, 2024-2034

- Table 67: Rest-of-Asia-Pacific Aerogel Market (by Technology), $Billion, 2024-2034

- Table 68: Rest-of-Asia-Pacific Aerogel Market (by Form), $Billion, 2024-2034

- Table 69: Rest-of-Asia-Pacific Aerogel Market (by Application), $Billion, 2024-2034

- Table 70: Rest-of-the-World Aerogel Market (by Product), $Billion, 2024-2034

- Table 71: Rest-of-the-World Aerogel Market (by Technology), $Billion, 2024-2034

- Table 72: Rest-of-the-World Aerogel Market (by Form), $Billion, 2024-2034

- Table 73: Rest-of-the-World Aerogel Market (by Application), $Billion, 2024-2034

- Table 74: South America Aerogel Market (by Product), $Billion, 2024-2034

- Table 75: South America Aerogel Market (by Technology), $Billion, 2024-2034

- Table 76: South America Aerogel Market (by Form), $Billion, 2024-2034

- Table 77: South America Aerogel Market (by Application), $Billion, 2024-2034

- Table 78: Middle East and Africa Aerogel Market (by Product), $Billion, 2024-2034

- Table 79: Middle East and Africa Aerogel Market (by Technology), $Billion, 2024-2034

- Table 80: Middle East and Africa Aerogel Market (by Form), $Billion, 2024-2034

- Table 81: Middle East and Africa Aerogel Market (by Application), $Billion, 2024-2034

- Table 82: Market Share

Aerogel Market: Industry Overview

The aerogel market plays a crucial role across multiple industries such as construction, aerospace, automotive, and energy, driven by the demand for ultra-lightweight, highly efficient thermal insulation materials that enhance energy savings and product performance. As global focus intensifies on energy efficiency, sustainability, and carbon footprint reduction-fuelled by stringent environmental regulations, increasing industrialization, and consumer preference for eco-friendly materials-the need for innovative aerogel technologies with superior insulating properties and scalable production methods becomes increasingly important.

The industry is characterized by ongoing technological advancements aimed at improving aerogel synthesis, reducing manufacturing costs, and expanding application potential.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $2.47 Billion |

| 2034 Forecast | $11.59 Billion |

| CAGR | 18.59% |

Leading manufacturers are innovating with silica-based, polymeric, and composite aerogels that provide enhanced thermal resistance, mechanical strength, and hydrophobicity. These developments are supported by advances in supercritical drying, ambient pressure drying, and surface functionalization techniques, enabling broader adoption across diverse sectors including building insulation, thermal management, and automotive lightweighting.

Modern aerogel technologies involve fine-tuning the nanoporous structure to optimize properties such as thermal conductivity, flexibility, and durability. Innovations include bio-based aerogels derived from renewable raw materials, hybrid composites integrating aerogel with fibres or polymers for improved mechanical resilience, and formulations compatible with emerging manufacturing processes to increase scalability and cost-effectiveness. These advancements empower industries to meet rising demands for materials that combine performance with environmental responsibility.

With growing emphasis on sustainability, energy efficiency, and regulatory compliance, aerogels are becoming increasingly central to material strategies in high-performance insulation and lightweight component manufacturing. This market trend is expected to continue as companies invest in R&D to develop greener, higher-performance aerogel solutions that align with global environmental standards and support the transition to energy-conscious, durable, and multifunctional industrial materials.

Aerogel Market - Lifecycle Stage

The aerogel market is currently positioned in a growth and expansion stage within its lifecycle, reflecting increasing adoption across a broadening range of industries and continuous technological innovation. While aerogels have been known since the early 20th century, commercial-scale production and diverse applications have only recently gained significant momentum due to advancements in manufacturing efficiency and material performance.

This growth phase is marked by rising market penetration in sectors such as construction, aerospace, automotive, and energy, driven by stringent energy efficiency regulations and sustainability goals. The ongoing reduction in production costs, combined with improvements in mechanical robustness and ease of integration, is facilitating wider acceptance beyond niche applications into mainstream industrial use.

Aerogel market players are actively investing in research and development to refine aerogel formulations, enhance scalability, and tailor products for specific end-use requirements. As a result, innovations such as ambient pressure drying and bio-based aerogels are making production more economical and environmentally sustainable, accelerating market expansion.

Despite strong growth, the aerogel market has not yet reached full maturity, as barriers such as cost sensitivity in certain regions and competition from alternative insulation materials remain. However, the increasing focus on decarbonization, lightweight materials for electric vehicles, and energy-efficient building solutions is expected to sustain rapid market advancement.

Aerogel Market - Segmentation:

Segmentation 1: by Product

- Silica

- Polymers

- Carbon

- Others

Segmentation 2: by Technology

- Supercritical Drying

- Others

Segmentation 3: by Form

- Blanket

- Particle

- Panel

- Monolith

Segmentation 4: by Application

- Energy Industrial

- Transportation

- Architecture & Construction

- Other

Segmentation 5: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Demand - Drivers and Limitations

The following are the demand drivers for the Aerogel Market:

- Growth in Aerospace and Automotive Industries

- Expansion of Construction and Infrastructure Projects

- Rising Energy Efficiency Regulations

The Aerogel Market is expected to face some limitations as well due to the following challenges:

- High Production Costs and Mechanical Fragility

- Limited Awareness and Adoption

Aerogel Market Key Players and Competition Synopsis

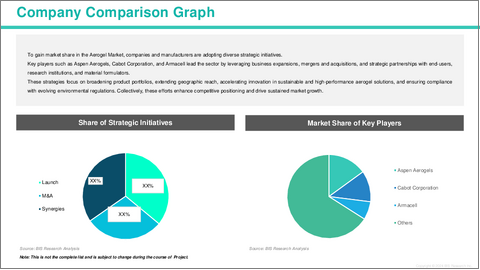

The aerogel market presents a highly competitive landscape shaped by a mix of specialized material innovators and major chemical conglomerates. Prominent global players such as Aspen Aerogels, Inc., and Cabot Corporation lead the sector, offering advanced aerogel solutions renowned for their exceptional thermal insulation, lightweight properties, and application versatility across industries including aerospace, construction, automotive, and energy.

These companies are at the forefront of innovation, developing next-generation aerogels that enhance thermal performance, reduce environmental impact, and support energy efficiency mandates. Efforts are focused on creating cost-effective, scalable production methods while improving aerogel durability and flexibility to meet stringent regulatory standards and sustainability goals. This aligns with the growing industrial demand for eco-friendly, high-performance insulation and lightweight materials.

Other significant players, such as Armacell International S.A., Nano Tech Co., Ltd., and Guangdong Alison Hi-Tech Co., Ltd., specialize in tailored aerogel products targeting regional markets, particularly in Asia-Pacific, where rapid industrialization and energy efficiency initiatives drive market growth. These companies leverage localized manufacturing and supply chain efficiencies to provide competitively priced aerogel materials, capturing expanding market segments with customized solutions.

Competition intensifies with a focus on continuous R&D investments aimed at enhancing aerogel properties such as hydrophobicity, mechanical strength, and thermal resistance. Strategic collaborations, mergers, and acquisitions further enable these players to enhance technological capabilities, broaden product portfolios, and expand global market presence. As the aerogel industry evolves, the competitive environment is defined by the pursuit of multifunctional, sustainable aerogel materials that meet the dual challenges of performance optimization and environmental compliance, solidifying their critical role in next-generation industrial applications.

Some prominent names established in the aerogel market are:

- Armcell International S.A.

- Cabot Corporation

- Aspen Aerogels, Inc.

- Nano Tech Co., Ltd.

- Zhejiang Ugoo Technology Co., Ltd.

- Guangdong Alison Technology Co., Ltd.

- Beerenberg AS

- Enersens

- IBIH Advanced Material Co., Ltd.

- Aerogel-IT GMBH

- Jios Aerogel Pte Ltd.

- Svenska Aerogel Holdings AB

- Thermablock Aerogels Ltd.

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the aerogel market report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Regulatory & Policy Impact Analysis

- 1.4 Patent Analysis

- 1.5 Global Pricing Analysis

2. Aerogel Market (by Product)

- 2.1 Silica

- 2.2 Polymers

- 2.3 Carbon

- 2.4 Others

3. Aerogel Market (by Technology)

- 3.1 Supercritical Drying

- 3.2 Others

4. Aerogel Market (by Form)

- 4.1 Blanket

- 4.2 Particle

- 4.3 Panel

- 4.4 Monolith

5. Aerogel Market (by Application)

- 5.1 Energy Industrial

- 5.2 Transportation

- 5.3 Architecture & Construction

- 5.4 Other

6. Aerogel Market (by Region)

- 6.1 Aerogel Market (by Region)

- 6.2 North America

- 6.2.1 Regional Overview

- 6.2.2 Driving Factors for Market Growth

- 6.2.3 Factors Challenging the Market

- 6.2.4 Key Companies

- 6.2.5 Product

- 6.2.6 Technology

- 6.2.7 Form

- 6.2.8 Application

- 6.2.9 North America (by Country)

- 6.2.9.1 U.S.

- 6.2.9.1.1 Market by Product

- 6.2.9.1.2 Market by Technology

- 6.2.9.1.3 Market by Form

- 6.2.9.1.4 Market by Application

- 6.2.9.2 Canada

- 6.2.9.2.1 Market by Product

- 6.2.9.2.2 Market by Technology

- 6.2.9.2.3 Market by Form

- 6.2.9.2.4 Market by Application

- 6.2.9.3 Mexico

- 6.2.9.3.1 Market by Product

- 6.2.9.3.2 Market by Technology

- 6.2.9.3.3 Market by Form

- 6.2.9.3.4 Market by Application

- 6.2.9.1 U.S.

- 6.3 Europe

- 6.3.1 Regional Overview

- 6.3.2 Driving Factors for Market Growth

- 6.3.3 Factors Challenging the Market

- 6.3.4 Key Companies

- 6.3.5 Product

- 6.3.6 Technology

- 6.3.7 Form

- 6.3.8 Application

- 6.3.9 Europe (by Country)

- 6.3.9.1 Germany

- 6.3.9.1.1 Market by Product

- 6.3.9.1.2 Market by Technology

- 6.3.9.1.3 Market by Form

- 6.3.9.1.4 Market by Application

- 6.3.9.2 France

- 6.3.9.2.1 Market by Product

- 6.3.9.2.2 Market by Technology

- 6.3.9.2.3 Market by Form

- 6.3.9.2.4 Market by Application

- 6.3.9.3 Italy

- 6.3.9.3.1 Market by Product

- 6.3.9.3.2 Market by Technology

- 6.3.9.3.3 Market by Form

- 6.3.9.3.4 Market by Application

- 6.3.9.4 U.K.

- 6.3.9.4.1 Market by Product

- 6.3.9.4.2 Market by Technology

- 6.3.9.4.3 Market by Form

- 6.3.9.4.4 Market by Application

- 6.3.9.5 Rest-of-Europe

- 6.3.9.5.1 Market by Product

- 6.3.9.5.2 Market by Technology

- 6.3.9.5.3 Market by Form

- 6.3.9.5.4 Market by Application

- 6.3.9.1 Germany

- 6.4 Asia-Pacific

- 6.4.1 Regional Overview

- 6.4.2 Driving Factors for Market Growth

- 6.4.3 Factors Challenging the Market

- 6.4.4 Key Companies

- 6.4.5 Product

- 6.4.6 Technology

- 6.4.7 Form

- 6.4.8 Application

- 6.4.9 Asia-Pacific (by Country)

- 6.4.9.1 China

- 6.4.9.1.1 Market by Product

- 6.4.9.1.2 Market by Technology

- 6.4.9.1.3 Market by Form

- 6.4.9.1.4 Market by Application

- 6.4.9.2 Japan

- 6.4.9.2.1 Market by Product

- 6.4.9.2.2 Market by Technology

- 6.4.9.2.3 Market by Form

- 6.4.9.2.4 Market by Application

- 6.4.9.3 India

- 6.4.9.3.1 Market by Product

- 6.4.9.3.2 Market by Technology

- 6.4.9.3.3 Market by Form

- 6.4.9.3.4 Market by Application

- 6.4.9.4 South Korea

- 6.4.9.4.1 Market by Product

- 6.4.9.4.2 Market by Technology

- 6.4.9.4.3 Market by Form

- 6.4.9.4.4 Market by Application

- 6.4.9.5 Rest-of-Asia-Pacific

- 6.4.9.5.1 Market by Product

- 6.4.9.5.2 Market by Technology

- 6.4.9.5.3 Market by Form

- 6.4.9.5.4 Market by Application

- 6.4.9.1 China

- 6.5 Rest-of-the-World

- 6.5.1 Regional Overview

- 6.5.2 Driving Factors for Market Growth

- 6.5.3 Factors Challenging the Market

- 6.5.4 Key Companies

- 6.5.5 Product

- 6.5.6 Technology

- 6.5.7 Form

- 6.5.8 Application

- 6.5.9 Rest-of-the-World (by Region)

- 6.5.9.1 South America

- 6.5.9.1.1 Market by Product

- 6.5.9.1.2 Market by Technology

- 6.5.9.1.3 Market by Form

- 6.5.9.1.4 Market by Application

- 6.5.9.2 Middle East and Africa

- 6.5.9.2.1 Market by Product

- 6.5.9.2.2 Market by Technology

- 6.5.9.2.3 Market by Form

- 6.5.9.2.4 Market by Application

- 6.5.9.1 South America

7. Markets - Competitive Benchmarking & Company Profiles

- 7.1 Next Frontiers

- 7.2 Geographic Assessment

- 7.3 Company Profiles

- 7.3.1 Armcell International S.A.

- 7.3.1.1 Overview

- 7.3.1.2 Top Products/Product Portfolio

- 7.3.1.3 Top Competitors

- 7.3.1.4 Target Customers

- 7.3.1.5 Key Personnel

- 7.3.1.6 Analyst View

- 7.3.1.7 Market Share

- 7.3.2 Cabot Corporation

- 7.3.2.1 Overview

- 7.3.2.2 Top Products/Product Portfolio

- 7.3.2.3 Top Competitors

- 7.3.2.4 Target Customers

- 7.3.2.5 Key Personnel

- 7.3.2.6 Analyst View

- 7.3.2.7 Market Share

- 7.3.3 Aspen Aerogels, Inc.

- 7.3.3.1 Overview

- 7.3.3.2 Top Products/Product Portfolio

- 7.3.3.3 Top Competitors

- 7.3.3.4 Target Customers

- 7.3.3.5 Key Personnel

- 7.3.3.6 Analyst View

- 7.3.3.7 Market Share

- 7.3.4 Nano Tech Co., Ltd.

- 7.3.4.1 Overview

- 7.3.4.2 Top Products/Product Portfolio

- 7.3.4.3 Top Competitors

- 7.3.4.4 Target Customers

- 7.3.4.5 Key Personnel

- 7.3.4.6 Analyst View

- 7.3.4.7 Market Share

- 7.3.5 Zhejiang Ugoo Technology Co., Ltd.

- 7.3.5.1 Overview

- 7.3.5.2 Top Products/Product Portfolio

- 7.3.5.3 Top Competitors

- 7.3.5.4 Target Customers

- 7.3.5.5 Key Personnel

- 7.3.5.6 Analyst View

- 7.3.5.7 Market Share

- 7.3.6 Guangdong Alison Technology Co., Ltd.

- 7.3.6.1 Overview

- 7.3.6.2 Top Products/Product Portfolio

- 7.3.6.3 Top Competitors

- 7.3.6.4 Target Customers

- 7.3.6.5 Key Personnel

- 7.3.6.6 Analyst View

- 7.3.6.7 Market Share

- 7.3.7 Beerenberg AS

- 7.3.7.1 Overview

- 7.3.7.2 Top Products/Product Portfolio

- 7.3.7.3 Top Competitors

- 7.3.7.4 Target Customers

- 7.3.7.5 Key Personnel

- 7.3.7.6 Analyst View

- 7.3.7.7 Market Share

- 7.3.8 Enersens

- 7.3.8.1 Overview

- 7.3.8.2 Top Products/Product Portfolio

- 7.3.8.3 Top Competitors

- 7.3.8.4 Target Customers

- 7.3.8.5 Key Personnel

- 7.3.8.6 Analyst View

- 7.3.8.7 Market Share

- 7.3.9 IBIH Advanced Material Co., Ltd.

- 7.3.9.1 Overview

- 7.3.9.2 Top Products/Product Portfolio

- 7.3.9.3 Top Competitors

- 7.3.9.4 Target Customers

- 7.3.9.5 Key Personnel

- 7.3.9.6 Analyst View

- 7.3.9.7 Market Share

- 7.3.10 Aerogel-IT GMBH

- 7.3.10.1 Overview

- 7.3.10.2 Top Products/Product Portfolio

- 7.3.10.3 Top Competitors

- 7.3.10.4 Target Customers

- 7.3.10.5 Key Personnel

- 7.3.10.6 Analyst View

- 7.3.10.7 Market Share

- 7.3.10.8 Share

- 7.3.11 Jios Aerogel Pte Ltd.

- 7.3.11.1 Overview

- 7.3.11.2 Top Products/Product Portfolio

- 7.3.11.3 Top Competitors

- 7.3.11.4 Target Customers

- 7.3.11.5 Key Personnel

- 7.3.11.6 Analyst View

- 7.3.11.7 Market Share

- 7.3.11.8 Share

- 7.3.12 Svenska Aerogel Holdings AB

- 7.3.12.1 Overview

- 7.3.12.2 Top Products/Product Portfolio

- 7.3.12.3 Top Competitors

- 7.3.12.4 Target Customers

- 7.3.12.5 Key Personnel

- 7.3.12.6 Analyst View

- 7.3.12.7 Market Share

- 7.3.13 Thermablock Aerogels Ltd.

- 7.3.13.1 Overview

- 7.3.13.2 Top Products/Product Portfolio

- 7.3.13.3 Top Competitors

- 7.3.13.4 Target Customers

- 7.3.13.5 Key Personnel

- 7.3.13.6 Analyst View

- 7.3.13.7 Market Share

- 7.3.13.8 Share

- 7.3.1 Armcell International S.A.

- 7.4 Other Key Companies