|

|

市場調査レポート

商品コード

1764704

定位的ニューロナビゲーションシステム市場- 世界および地域別分析:製品別、用途別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年)Stereotactic Neuro-Navigation System Market - A Global and Regional Analysis: Focus on Product, Application, End User, and Region - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 定位的ニューロナビゲーションシステム市場- 世界および地域別分析:製品別、用途別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年07月09日

発行: BIS Research

ページ情報: 英文 126 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の定位的ニューロナビゲーションシステムの市場規模は、2024年に8億4,070万米ドルとなりました。

同市場は、2035年までに31億30万米ドルに急増し、2025年から2035年までの期間に12.92%のCAGR(複合年間成長率)を記録し、大幅な成長を示すと予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 9億2,010万米ドル |

| 2035年の予測 | 31億30万米ドル |

| CAGR | 12.92% |

同市場は、神経疾患の有病率の上昇、従来の手術よりもナビゲーション支援手術がもたらすメリット、低侵襲手術へのシフトなどを背景に、2桁成長を続けています。

人工知能(AI)、機械学習(ML)、拡張現実(AR)の統合を含む技術の進歩は、手術精度を高め、これらのシステムの能力を拡大しています。さらに、低侵襲手術(MIS)の採用が増加していることが、より高度で正確なナビゲーションツールの需要を促進しています。また、高齢化人口の増加により、外科的治療を必要とする加齢に関連した神経疾患が増加していることも市場を後押ししています。しかし、これらのシステムの高価格、統合の複雑さ、手術中の潜在的な合併症などの課題が、市場の成長を妨げる可能性があります。このような課題にもかかわらず、継続的な技術革新、有利な規制当局の支援、神経外科やその他の専門分野でのアプリケーションの拡大が、市場の継続的拡大に拍車をかけると予想されます。

市場イントロダクション

定位的ニューロナビゲーションシステム市場は、手術精度と患者の転帰を向上させる技術革新と戦略的提携が原動力となり、急速に進展しています。MedtronicとBrainlabとの提携のようなパートナーシップは、リアルタイムの画像処理と高度な手術計画を組み合わせた統合ナビゲーション・ソリューションを開拓し、脳神経外科手術の精度を向上させています。一方、Orthofix Medicalのような企業は、低侵襲脊椎手術を容易にするニューロナビゲーションシステムの開発を通じてポートフォリオを拡大しています。Strykerの頭蓋ナビゲーションシステムを含む最近の製品発表は、複雑な腫瘍切除をサポートする強化された可視化と拡張現実機能を提供しています。さらに、BrainlabによるNovalis Circleの買収などの買収により、専門知識と技術が統合され、市場は力強い成長を遂げようとしています。これらの開発は、高精度脳神経外科手術ツールに対する需要の高まりを裏付けるものであり、この分野における技術革新と臨床応用の拡大を後押ししています。

産業への影響

世界の定位的ニューロナビゲーションシステム市場は、Medtronic、Brainlab、Stryker、Orthofix Medical Inc.MRIやCTなどの高度な画像診断モダリティとリアルタイムナビゲーションを統合することで、これらの企業は腫瘍切除、脳深部刺激、てんかん治療などの精密な脳手術のための包括的なソリューションを提供しています。MedtronicのStealthStationやBrainlabのCurve Navigation Systemなどの製品は、この技術的統合を例証するもので、手術精度を高め、手術リスクを低減します。産業界への影響は、臨床神経外科、研究、トレーニングに及び、低侵襲手術を促進し、患者の転帰を改善しています。継続的な技術革新と臨床応用の拡大を通じて、定位ニューロナビゲーション市場は世界的に脳神経外科医療を大きく前進させています。

市場セグメンテーション

セグメンテーション1:製品別

- ニューロナビゲーションシステム

- 定位的フレームユニット

製品別では、世界の定位的ニューロナビゲーションシステム市場はニューロナビゲーションシステムが牽引し、2024年には80.9%のシェアを占めました。このセグメントが市場を独占している主な理由は、その高度な技術力、精度の向上、近代的な外科手術における汎用性の向上です。ニューロナビゲーションシステムは、リアルタイムの3Dイメージングと、MRI、CTスキャン、超音波などのモダリティとの高度な統合を利用して、手術中に正確で動的なガイダンスを提供します。このため、脳や脊髄の複雑な部位の標的設定やナビゲーションに優れた精度が得られ、合併症を最小限に抑え、患者の転帰を改善するために不可欠です。

セグメンテーション2:用途別

- 頭蓋

- 脊髄

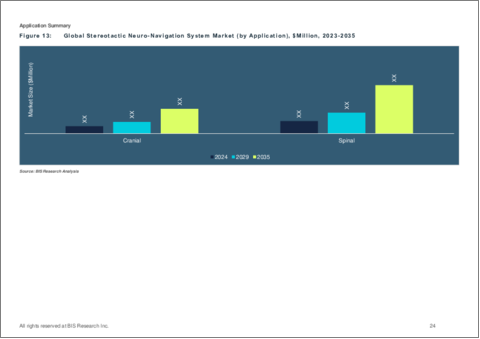

用途タイプ別に見ると、世界の定位的ニューロナビゲーションシステム市場は脊椎セグメントが牽引し、2024年には62.6%のシェアを占めました。変性疾患、脊椎変形、外傷など、頻繁な外科的介入を必要とする脊椎疾患の発生率が高いため、脊椎用途がニューロナビゲーションシステム市場を独占しています。低侵襲脊椎手術(MISS)の採用が増加しており、これらの手術ではニューロナビゲーションシステムが提供する高精度が要求されるため、需要がさらに高まっています。さらに、脊椎手術の複雑さと、加齢に伴う脊椎の問題に直面する高齢化人口の増加が、脊椎ナビゲーションシステムの利用拡大に寄与しています。これらの要因が相まって、脊髄アプリケーションは頭蓋アプリケーションよりも市場をリードしています。

セグメンテーション3:エンドユーザー別

- 病院

- 麻酔科

エンドユーザー別では、世界の定位的ニューロナビゲーションシステム市場は病院セグメントが牽引し、2024年のシェアは91.9%でした。病院は、包括的な外科治療を提供する上で中心的な役割を担っており、複雑で大量の手術を処理する能力があるため、エンドユーザーに基づくニューロナビゲーションシステム市場を独占しています。ヘルスケア、特に大学医療センターや大規模な医療施設には、高度なインフラ、熟練した医療専門家、脳神経外科、整形外科、脊椎外科などの専門部門が備わっており、これがニューロナビゲーションシステムの需要を促進しています。これらのシステムは、正確で低侵襲な手術を行うために不可欠であり、それによって患者の転帰を改善し、回復時間を短縮することができます。さらに、病院は一般的に、日常的な手術から複雑な手術まで、より多くの手術を実施しており、これが市場の優位性をさらに高めています。病院が最先端技術に投資し、ナビゲーションシステムの多科目用途を採用する能力は、この市場の成長における主要プレーヤーとなっています。

セグメンテーション4:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他

- アジア太平洋

- 日本

- 中国

- その他

- その他の地域

北米地域の定位的ニューロナビゲーションシステム市場は、予測期間中に12.36%という著しい成長率を記録すると予想されています。この顕著な成長は、高度なヘルスケアインフラ、革新的技術の高い採用率、強力な研究開発能力など、いくつかの主な要因によるものです。この地域には、世界有数の病院、医療センター、学術機関があり、最先端の設備と高度な技術を持つ専門家が揃っています。こうしたインフラが、ニューロナビゲーションシステムなどの最先端技術の導入を容易にしています。さらに、北米では脊椎や頭蓋の疾患の有病率が高く、精密な外科的介入に対する需要が高まっています。同地域のヘルスケアシステムは、高度な治療への幅広いアクセスを提供しており、ニューロナビゲーションが不可欠な低侵襲手術の使用を後押ししています。さらに、米国とカナダには強固な規制環境と技術革新への強力な支援があり、メドトロニックやストライカーなどの企業がニューロナビゲーション技術の開発を主導しているため、この市場における北米のリーダーシップはさらに強固なものとなっています。

定位的ニューロナビゲーションシステム市場の最近の動向

- 2024年9月、Stryker Corporationは、腫瘍および脳内出血(ICH)処置のための低侵襲手術への体系的アプローチを提供する株式非公開企業であるNICO Corporationを買収しました。この買収は、特に腫瘍と脳卒中治療における神経技術へのストライカーのコミットメントを強化するものです。

- 2024年5月、AiM RoboticsはSynaptive Medicalと提携し、ニューロナビゲーションソフトウェアModus Navを神経外科ロボットに統合し、視覚化、ナビゲーション、制御を改善しました。

- 2023年7月には、Stryker Corporationが頭蓋誘導ソフトウェア付きQ Guidance Systemを発売しました。

需要- 促進要因、課題、機会

市場促進要因:

- 神経疾患の有病率の上昇:神経疾患の有病率の上昇は、定位ニューロナビゲーション市場の重要な促進要因です。脳腫瘍、てんかん、パーキンソン病などの疾患の世界の発生率が高まるにつれて、正確な外科的介入に対する需要が高まっています。例えば、Health Dataによると、2021年には約34億人が神経系に影響を及ぼす疾患を患っています。高い精度と最小限の侵襲性を提供する定位的ニューロナビゲーションシステムは、これらの課題に対処するためにますます利用されるようになっています。さらに、神経疾患は世界的に疾病負担の主要原因の第1位となっています。さらに、世界人口の高齢化が進み、加齢に伴う神経疾患が増加しています。このような人口動態の変化が、神経外科的介入、ひいては高度なニューロナビゲーション技術に対する需要の高まりにつながっています。世界人口の高齢化に伴い、認知症やパーキンソン病など、加齢に関連する神経疾患の発生率が上昇します。このため、これらの疾患に対して外科的介入を必要とする患者数が増加します。外科治療の需要が増加するにつれて、これらの複雑な手技をガイドする正確で信頼性の高いニューロナビゲーションシステムの需要も増加しています。

市場の課題:

- ナビゲーションシステムの使用に伴う合併症:ニューロナビゲーションシステムは、精度、安全性、効率を高めることで神経外科手術に革命をもたらしましたが、その使用には合併症がつきものです。他の先端技術と同様、神経外科におけるナビゲーションシステムの統合にも課題があります。ナビゲーション支援別神経外科手術では、器具のエントリーポイントや軌道は明確に定義されていますが、手作業によるタッピングや挿入のため、スクリュー挿入時に不正確さが生じることがあり、軸中心からのぐらつきや最大半径方向の移動につながります。これを軽減するために、スクリューの挿入は、計画した軌道がすべて作成されるまで遅らせることが望ましいです。現在、動力式ペディクル・スクリュー・ドライブ・システムが利用可能であり、より迅速で正確なスクリュー挿入を提供することで、外科医の経験を向上させています。

市場機会:

- 人工知能(AI)と機械学習の統合:人工知能(AI)と機械学習(ML)技術は、脳神経外科における統合に大きな機会をもたらし、変革的な能力を提供します。これらの技術は、特にペディクルスクリューの正確な配置におけるナビゲーションシステムを強化するための術中画像のセグメンテーションなど、いくつかの重要な用途において極めて重要です。さらに、MLアルゴリズムは、椎間板や全脊椎のX線写真を描写する画像の解釈において重要な役割を果たし、臨床医の診断手順の自動化と合理化を促進します。さらに、バーチャルリアリティ(VR)や拡張現実(AR)システムを外科手術トレーニングプログラムに統合することは、すでに有望な成果を示しています。これらの先端技術は、研修生に没入型の学習体験を提供し、現実的な仮想環境で外科手術のシミュレーションを可能にします。研究では、このような没入型トレーニングは、手術時間の改善と研修生の全体的なパフォーマンスに相関することが示されており、外科教育と熟練度を向上させるVRとARの価値が強調されています。

製品/イノベーション戦略:世界の定位的ニューロナビゲーションシステム市場は、製品の応用分野、エンドユーザー、地域など、さまざまなカテゴリーに基づいて広範にセグメント化されています。これにより、読者は、どのセグメントが最大のシェアを占めているのか、また、どのセグメントが今後数年間で成長する可能性が高いのかを明確に把握することができます。

成長/マーケティング戦略:パートナーシップ、提携、共同開発が主な発展の最大数を占めました。すなわち、世界の定位的ニューロナビゲーションシステム市場における2020年1月から2025年4月までの発展は、全体の35.0%近くを占めました。

競合戦略:世界の定位的ニューロナビゲーションシステム市場には、製品ポートフォリオを持つ数多くの既存プレーヤーが存在します。本調査で分析・プロファイリングした世界の定位的ニューロナビゲーションシステム市場の主要企業プロファイルには、定位的ニューロナビゲーションシステム向け製品を提供する既存企業が含まれます。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 市場動向

- 償還シナリオ

- 特許分析

- 規制状況/コンプライアンス

- サプライチェーン分析

- 価格分析

- 市場力学

第2章 世界の定位的ニューロナビゲーションシステム市場(製品別)、100万米ドル、2023年~2035年

- ニューロナビゲーションシステム

- ステルスステーションナビゲーション

- カーブナビゲーション

- Qガイダンスシステム

- イージーナビ

- 7D外科システム

- Xvision-Spineシステム

- カドゥケウスS(AR)

- 定位フレームユニット

第3章 世界の定位的ニューロナビゲーションシステム市場(用途別)、100万米ドル、2023年~2035年

- 脊椎

- 頭蓋骨

第4章 世界の定位的ニューロナビゲーションシステム市場(エンドユーザー別)、100万米ドル、2023年~2035年

- 病院、診療所

- 外来手術センター(ASC)

第5章 世界の定位的ニューロナビゲーションシステム市場(地域別)、100万米ドル、2023年~2035年

- 北米

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 米国

- カナダ

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 英国

- ドイツ

- フランス

- その他

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 日本

- 中国

- その他

- その他の地域

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

第6章 市場-競合ベンチマーキングと企業プロファイル

- 主要戦略と開発

- 製品ベンチマーク

- 市場シェア

- 企業プロファイル

- Medtronic Plc

- Brainlab AG

- ClearPoint Neuro, Inc.

- Elekta

- Stryker Corporation

- Orthofix Medical Inc

- SaphireX Surgicals

- FHC

- Integra LifeSciences Corporation

- SURGLASSES Inc.

- HRS Navigation

- Augmedics

第7章 調査手法

List of Figures

- Figure 1: Global Stereotactic Neuro-Navigation System Market (by Scenario), $Million, 2025, 2029, and 2035

- Figure 2: Global Stereotactic Neuro-Navigation System Market, $Million, 2024 and 2035

- Figure 3: Stereotactic Neuro-Navigation System Market (by Application), $Million, 2024, 2029, and 2035

- Figure 4: Stereotactic Neuro-Navigation System Market (by End User), in Million, 2024, 2029, and 2035

- Figure 5: Organization of the Health System in the U.S.

- Figure 6: Number of Patents Filed, January 2021-April 2025

- Figure 7: FDA Classification

- Figure 8: EU Classification

- Figure 9: NHS Classification

- Figure 10: Japan Federation of Medical Devices Associations (JFMDA) Classification

- Figure 11: NMPA Classification

- Figure 12: Supply Chain and Risks within the Supply Chain

- Figure 13: Prevalence of Parkinson's Disease (by Region), 2016-2021

- Figure 14: Increasing Incidence of CNS Brain Tumor Cases (by Region), 2022, 2025, 2035, and 2045

- Figure 15: Increasing Aging Population Globally, Million, 2020-2023

- Figure 16: Global Stereotactic Neuro-Navigation System Market (by Product), $Million, 2024,2029, and 2035

- Figure 17: Global Stereotactic Neuro-Navigation System Market, by Product, by Neuro-Navigation Systems, $Million, 2023-2035

- Figure 18: Global Stereotactic Neuro-Navigation System Market, by Neuro-Navigation Systems, $Million, 2023-2035

- Figure 19: Stealth Station Navigation System, Installed Base, 2023-2035

- Figure 20: Stealth Station Navigation System, Unit Sold, 2023-2035

- Figure 21: Global Stereotactic Neuro-Navigation System Market, Neuro-Navigation Systems, Stealth Station Navigation System, $Million, 2023-2035

- Figure 22: Curve Navigation System, Installed Base, 2023-2035

- Figure 23: Curve Navigation System, Unit Sold, 2023-2035

- Figure 24: Global Stereotactic Neuro-Navigation System Market, by Neuro-Navigation Systems, Curve Navigation, $Million, 2023-2035

- Figure 25: Q Guidance System, Installed Base, 2023-2035

- Figure 26: Q Guidance System, Unit Sold, 2023-2035

- Figure 27: Global Stereotactic Neuro-Navigation System Market, by Neuro-Navigation Systems, Q Guidance System $Million, 2023-2035

- Figure 28: easyNav, Installed Base, 2023-2035

- Figure 29: easyNav, Unit Sold, 2023-2035

- Figure 30: Global Stereotactic Neuro-Navigation System Market, by Neuro-Navigation Systems, easyNav, $Million, 2023-2035

- Figure 31: 7D Surgical System, Installed Base, 2023-2035

- Figure 32: 7D Surgical System, Unit Sold, 2023-2035

- Figure 33: Global Stereotactic Neuro-Navigation System Market, by Neuro-Navigation Systems, 7D Surgical System, $Million, 2023-2035

- Figure 34: Xvision-Spine System, Installed Base, 2023-2035

- Figure 35: Xvision-Spine System, Unit Sold, 2023-2035

- Figure 36: Global Stereotactic Neuro-Navigation System Market, by Neuro-Navigation Systems, Xvision-Spine System, $Million, 2023-2035

- Figure 37: Caduceus S (AR) System, Installed Base, 2023-2035

- Figure 38: Caduceus S (AR), Unit Sold, 2023-2035

- Figure 39: Global Stereotactic Neuro-Navigation System Market, by Neuro-Navigation Systems, Caduceus S (AR), $Million, 2023-2035

- Figure 40: Global Stereotactic Neuro-Navigation System Market, Stereotactic Frame Units, $Million, 2023-2035

- Figure 41: Global Stereotactic Neuro-Navigation System Market (by Application), $Million, 2023-2035

- Figure 42: Global Stereotactic Neuro-Navigation System Market, Spinal, $Million, 2023-2035

- Figure 43: Global Stereotactic Neuro-Navigation System Market, Cranial, $Million, 2023-2035

- Figure 44: Global Stereotactic Neuro-Navigation System Market (by End User), $Million, 2023-2035

- Figure 45: Global Stereotactic Neuro-Navigation System Market, Hospitals and Clinics, $Million, 2023-2035

- Figure 46: Global Stereotactic Neuro-Navigation System Market, Ambulatory Surgical Centers, $Million, 2023-2035

- Figure 47: North America Stereotactic Neuro-Navigation Market, Spinal Navigation Surgery, Procedure Volume, Thousands, 2023-2035

- Figure 48: North America Stereotactic Neuro-Navigation Market, Cranial Stereotactic Surgery, Procedure Volume, Thousands, 2023-2035

- Figure 49: North America Stereotactic Neuro-Navigation Market, $Million, 2023-2035

- Figure 50: Incidences of Neurological Disorders in U.S., Million, 2018-2021

- Figure 51: U.S. Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 52: Incidences of Neurological Disorders in Canada, Million, 2018-2021

- Figure 53: Canada Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 54: Europe Stereotactic Neuro-Navigation Market, Spinal Navigation Surgery, Procedure Volume, Thousands, 2023-2035

- Figure 55: Europe Stereotactic Neuro-Navigation Market, Cranial Stereotactic Surgery, Procedure Volume, Thousands, 2023-2035

- Figure 56: Europe Stereotactic Neuro-Navigation Market, $Million, 2023-2035

- Figure 57: Incidences of Neurological Disorders in U.K., Million, 2018-2021

- Figure 58: U.K. Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 59: Incidences of Neurological Disorders in Germany, Million, 2018-2021

- Figure 60: Germany Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 61: Incidences of Neurological Disorders in France, Million, 2018-2021

- Figure 62: France Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 63: Incidences of Neurological Disorders in Rest-of-Europe, Million, 2018-2021

- Figure 64: Rest-of-Europe Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 65: Asia Pacific Stereotactic Neuro-Navigation Market, Spinal Navigation Surgery, Procedure Volume, Thousands, 2023-2035

- Figure 66: Asia Pacific Stereotactic Neuro-Navigation Market, Cranial Stereotactic Surgery, Procedure Volume, Thousands, 2023-2035

- Figure 67: Asia Pacific Stereotactic Neuro-Navigation Market, $Million, 2023-2035

- Figure 68: Incidences of Neurological Disorders in Japan, Million, 2018-2021

- Figure 69: Japan Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 70: Incidences of Neurological Disorders in China, Million, 2018-2021

- Figure 71: China Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 72: Incidences of Neurological Disorders in Rest-of-Asia-Pacific, Million, 2018-2021

- Figure 73: Rest-of-Asia-Pacific Stereotactic Neuro-Navigation System Market, $Million, 2023-2035

- Figure 74: Rest-of-the-World Stereotactic Neuro-Navigation Market, Spinal Navigation Surgery, Procedure Volume, Thousands, 2023-2035

- Figure 75: Rest-of-the-World Stereotactic Neuro-Navigation Market, Cranial Stereotactic Surgery, Procedure Volume, Thousands, 2023-2035

- Figure 76: Rest-of-the-World Stereotactic Neuro-Navigation Market, $Million, 2023-2035

- Figure 77: Strategic Initiatives, January 2017-May 2025

- Figure 78: Data Triangulation

- Figure 79: Top-Down and Bottom-Up Approach

- Figure 80: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Some of the Key Developments

- Table 4: CPT Coding

- Table 5: Inpatient Reimbursement

- Table 6: Medical Devices Classification Medical Devices in Japan

- Table 7: Regulatory Process in RoW

- Table 8: Price of Stereotactic Neuro-Navigation System

- Table 9: Drivers, Restraints, and Opportunities: Current and Future Impact Assessment

- Table 10: Comparison between Various Navigation-Assisted Surgeries Over Conventional Surgeries

- Table 11: Sources of Error in Navigated Surgery

- Table 12: Cost of Acquisition of Key Neuro-Navigation Systems

- Table 13: Stealth Station Navigation System, Average Selling Price, (in $), 2024

- Table 14: Curve Navigation System, Average Price, (in $), 2024

- Table 15: Q Guidance System, Average Pricing, (in $), 2024

- Table 16: easyNav, Average Pricing, (in $), 2024

- Table 17: 7D Surgical System, Average Pricing, (in $), 2024

- Table 18: Xvision-Spine System, Average Pricing, (in $), 2024

- Table 19: Caduceus S (AR), Average Pricing, (in $), 2024

- Table 20: Global Stereotactic Neuro-Navigation System Market, Stereotactic Frame Units (by Type), $Million, 2023-2035

- Table 21: Global Stereotactic Neuro-Navigation System Market (by Region), $Million, 2023-2035

- Table 22: U.S. Incidences of Neurological Disorders, By Disease Type, 2018-2020

- Table 23: Canada Incidences of Neurological Disorders, By Disease Type, 2018-2020

- Table 24: U.K. Incidences of Neurological Disorders, By Disease Type, 2018-2021

- Table 25: Germany Incidences of Neurological Disorders, By Disease Type, 2018-2020

- Table 26: France Incidences of Neurological Disorders, By Disease Type, 2018-2020

- Table 27: Rest-of-Europe Incidences of Neurological Disorders, By Disease Type, 2018-2020

- Table 28: Japan Incidences of Neurological Disorders, By Disease Type, 2018-2020

- Table 29: China Incidences of Neurological Disorders, By Disease Type, 2018-2020

- Table 30: Rest-of-Asia-Pacific Incidences of Neurological Disorders, By Disease Type, 2018-2020

- Table 31: Some of the Strategies and Development, January 2017-May 2025

- Table 32: Global Stereotactic Neuro-Navigation System Market, Product Benchmarking (by Product)

- Table 33: Market Share Analysis, 2024

This report can be delivered within 1 working day.

Introduction of Stereotactic Neuro-Navigation System Market

The global stereotactic neuro-navigation system market, initially valued at $840.7 million in 2024, is projected to witness substantial growth, surging to $3,100.3 million by 2035, marking a remarkable compound annual growth rate (CAGR) of 12.92% over the period from 2025 to 2035.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $920.1 Million |

| 2035 Forecast | $3,100.3 Million |

| CAGR | 12.92% |

The market has been witnessing double-digit growth, driven by the rising prevalence of neurological disorders, benefits offered by navigation-assisted surgeries over conventional surgeries, and a shift toward minimally invasive surgery.

Technological advancements, including the integration of artificial intelligence (AI), machine learning (ML), and augmented reality (AR), have been enhancing surgical precision and expanding the capabilities of these systems. Additionally, the increasing adoption of minimally invasive surgery (MIS) has been driving the demand for more advanced and accurate navigation tools. The market is also bolstered by a growing aging population, leading to an increase in age-related neurological conditions that require surgical treatment. However, challenges such as the high cost of these systems, integration complexities, and potential complications during surgery may hinder market growth. Despite these challenges, ongoing innovation, favorable regulatory support, and expanding applications in neurosurgery and other specialties are expected to fuel continued market expansion.

Market Introduction

The stereotactic neuro-navigation system market has been rapidly advancing, driven by technological innovations and strategic collaborations that enhance surgical precision and patient outcomes. Partnerships, such as Medtronic's collaboration with Brainlab, have been pioneering integrated navigation solutions that combine real-time imaging with advanced surgical planning, thereby improving accuracy in neurosurgical procedures. Meanwhile, companies such as Orthofix Medical have been expanding their portfolio through the development of neuro-navigation system, facilitating minimally invasive spine surgeries. Recent product launches, including Stryker's Cranial Navigation System, offer enhanced visualization and augmented reality features that support complex tumor resections. Additionally, acquisitions such as Brainlab's acquisition of Novalis Circle are consolidating expertise and technology, positioning the market for robust growth. These developments underscore the increasing demand for precision neurosurgery tools, driving innovation and expanding clinical applications in the field.

Industrial Impact

The global stereotactic neuro-navigation system market, driven by industry leaders such as Medtronic, Brainlab, Stryker, and Orthofix Medical Inc., has been transforming the landscape of neurosurgical interventions. By integrating advanced imaging modalities such as MRI and CT with real-time navigation, these companies provide comprehensive solutions for precise brain surgeries, including tumor resections, deep brain stimulation, and epilepsy treatment. Products such as Medtronic's StealthStation and Brainlab's Curve Navigation System exemplify this technological integration, enhancing surgical accuracy and reducing operative risks. The industrial impact extends across clinical neurosurgery, research, and training, facilitating minimally invasive procedures and improving patient outcomes. Through continuous innovation and expanding clinical applications, the stereotactic neuro-navigation market has been driving significant advancements in neurosurgical care globally.

Market Segmentation:

Segmentation 1: by Product

- Neuro-Navigation System

- Stereotactic Frame Units

Neuro-Navigation Systems Segment to Dominate the Stereotactic Neuro-Navigation System Market (by Product)

Based on product, the global stereotactic neuro-navigation system market was led by the neuro-navigation system, which held an 80.9% share in 2024. The segment dominates the market primarily due to its advanced technological capabilities, enhanced precision, and increased versatility in modern surgical practices. Neuro-navigation systems utilize real-time 3D imaging and advanced integration with modalities such as MRI, CT scans, and ultrasound to provide precise, dynamic guidance during surgery. This offers superior accuracy in targeting and navigating complex areas of the brain and spinal cord, which is essential for minimizing complications and improving patient outcomes.

Segmentation 2: by Application

- Cranial

- Spinal

Spinal Segment to Dominate the Stereotactic Neuro-Navigation System Market (by Application)

Based on application type, the global stereotactic neuro-navigation system market was led by the spinal segment, which held a 62.6% share in 2024. Spinal applications dominate the neuro-navigation system market due to the higher incidence of spinal conditions, such as degenerative diseases, spinal deformities, and trauma, which require frequent surgical intervention. The increasing adoption of minimally invasive spine surgery (MISS) further drives demand, as these procedures require enhanced precision, which neuro-navigation systems provide. Additionally, the complexity of spinal surgeries, combined with the growing aging population facing age-related spinal issues, contributes to the greater utilization of spinal navigation systems. These factors collectively make spinal applications the leading segment in the market over cranial applications.

Segmentation 3: by End User

- Hospitals

- ASCs

Hospital Segment to Dominate the Stereotactic Neuro-Navigation System Market (by End User)

Based on end user, the global stereotactic neuro-navigation system market was led by the hospital segment, which held a 91.9% share in 2024. Hospitals dominate the neuro-navigation system market based on end-users due to their central role in providing comprehensive surgical care and their capacity to handle complex and high-volume surgeries. Hospitals, especially academic medical centers, and large healthcare facilities, are equipped with advanced infrastructure, skilled medical professionals, and specialized departments such as neurosurgery, orthopedics, and spinal surgery, which drive the demand for neuro-navigation systems. These systems are essential for performing precise, minimally invasive surgeries, thereby improving patient outcomes and reducing recovery times, all of which are crucial for hospitals striving to deliver the best care. Additionally, hospitals generally conduct a higher volume of surgeries, ranging from routine to complex procedures, which further contributes to their market dominance. The ability of hospitals to invest in cutting-edge technology and adopt multi-specialty applications of navigation systems makes them key players in the growth of this market.

Segmentation 4: by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Rest-of-Europe

- Asia-Pacific

- Japan

- China

- Rest-of-Asia-Pacific

- Rest-of-the-World

The stereotactic neuro-navigation system market in the North America region is expected to witness a significant growth rate of 12.36% during the forecast period. This notable growth can be attributed to several key factors, including advanced healthcare infrastructure, high adoption of innovative technologies, and strong research and development capabilities. The region is home to some of the world's leading hospitals, medical centers, and academic institutions, which are equipped with state-of-the-art facilities and highly skilled professionals. This infrastructure facilitates the adoption of cutting-edge technologies such as neuro-navigation systems. Additionally, North America has a high prevalence of spinal and cranial conditions, which increases the demand for precise surgical interventions. The region's healthcare system, which provides wide access to advanced treatments, drives the use of minimally invasive surgeries where neuro-navigation is essential. Furthermore, the U.S. and Canada have robust regulatory environments and strong support for innovation, with companies such as Medtronic and Stryker leading the development of neuro-navigation technologies, thereby further cementing North America's leadership in this market.

Recent Developments in the Stereotactic Neuro-Navigation System Market

- In September 2024, Stryker Corporation acquired NICO Corporation, a privately held firm offering a systematic approach to minimally invasive surgery for tumor and intracerebral hemorrhage (ICH) procedures. This acquisition reinforces Stryker's commitment to neurotechnology, particularly in tumor and stroke care.

- In May 2024, AiM Robotics partnered with Synaptive Medical to integrate the Modus Nav neuro-navigation software into its neurosurgery robot, improving visualization, navigation, and control.

- In July 2023, Stryker Corporation launched the Q Guidance System with Cranial Guidance Software.

Demand - Drivers, Challenges, and Opportunities

Market Drivers:

- Rising Prevalence of Neurological Disorder: The rising prevalence of neurological disorders is a significant driver of the stereotactic neuro-navigation market. As the global incidence of conditions such as brain tumors, epilepsy, and Parkinson's disease increases, the demand for precise surgical interventions has escalated. For instance, as per the Health Data, around 3.40 billion individuals had conditions affecting the nervous system in 2021. Stereotactic neuro-navigation systems, which offer high accuracy and minimal invasiveness, are increasingly utilized to address these challenges. Moreover, neurological conditions are the number one leading cause of disease burden worldwide. Moreover, the global population has been aging, leading to an increase in age-related neurological conditions. This demographic shift is contributing to a higher demand for neurosurgical interventions and, consequently, for advanced neuro-navigation technologies. As the global population ages, the incidence of age-related neurological diseases, such as dementia and Parkinson's disease, rises. This contributes to a larger patient base requiring surgical intervention for these conditions. As the demand for surgical treatments increases, so does the demand for accurate, reliable neuro-navigation systems to guide these complex procedures.

Market Challenges:

- Complications Associated with the Use of Navigation Systems: While neuro-navigation systems have revolutionized neurosurgery by enhancing precision, safety, and efficiency, their use does not come without complications. Like any advanced technology, the integration of navigation systems in neurosurgery has its challenges. In navigation-assisted neuro surgeries, while entry points and trajectories for instrumentation are clearly defined, inaccuracies may arise during screw insertion due to manual tapping or insertion, leading to wobbling and maximal radial movement from the center of the axis. To mitigate this, it is advisable to delay screw insertion until after all planned trajectories have been created. Presently, powered pedicle screw drive systems are available, offering faster and more accurate screw insertions, thereby enhancing the surgeon's experience.

Market Opportunities:

- Integration of Artificial Intelligence (AI) and Machine Learning: AI and machine learning (ML) techniques present significant opportunities for integration within neurosurgery, offering transformative capabilities. These technologies are pivotal in several key applications, including the segmentation of intraoperative images to enhance navigation systems, especially in the precise placement of pedicle screws. Moreover, ML algorithms play a vital role in the interpretation of images depicting intervertebral discs or full spine radiographs, facilitating automation and streamlining diagnostic procedures for clinicians. Furthermore, the integration of virtual reality (VR) and augmented reality (AR) systems into surgical training programs has already shown promising outcomes. These advanced technologies provide immersive learning experiences for trainees, enabling them to simulate surgical procedures in realistic virtual environments. Studies have indicated that such immersive training correlates with improved operative times and overall performance among trainees, underscoring the value of VR and AR in enhancing surgical education and proficiency.

How can this report add value to an organization?

Product/Innovation Strategy: The global stereotactic neuro-navigation system market has been extensively segmented based on various categories, such as product application area, end user, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Partnerships, alliances, and collaborations accounted for the maximum number of key developments, i.e., nearly 35.0% of the total developments in the global stereotactic neuro-navigation system market were between January 2020 and April 2025.

Competitive Strategy: The global stereotactic neuro-navigation system market has numerous established players with product portfolios. Key players in the global stereotactic neuro-navigation system market analyzed and profiled in the study include established players offering products for stereotactic neuro-navigation systems.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2024. A historical year analysis has been done for the period FY2020-FY2023. The market size has been estimated for FY2024 and projected for the period FY2025-FY2035.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report presents a comprehensive market study of the upstream and downstream products in the stereotactic neuro-navigation system market.

- The market contribution of stereotactic neuro-navigation systems is anticipated to be launched in the future and has been calculated based on the historical analysis of the solutions.

- Revenues of the companies have been referenced from their annual reports for FY2023 and FY2024. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available stereotactic neuro-navigation systems. All the key companies with significant offerings in this field have been considered and profiled in this report.

Primary Research:

The primary sources involve industry experts in stereotactic neuro-navigation systems, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research:

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies profiled have been selected based on inputs gathered from primary experts and an analysis of company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- Medtronic Plc

- Brainlab AG

- ClearPoint Neuro, Inc.

- Elekta

- Stryker Corporation

- Orthofix Medical Inc.

- Saphirex Surgicals

- FHC

- Integra LifeSciences Corporation

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Market Trends

- 1.1.1 Leveraging Synergies to Diversify Business Portfolio

- 1.2 Reimbursement Scenario

- 1.3 Patent Analysis

- 1.4 Regulatory Landscape/Compliance

- 1.4.1 U.S.

- 1.4.2 Europe

- 1.4.2.1 U.K.

- 1.4.3 Japan

- 1.4.4 China

- 1.4.5 Rest-of-the-World (RoW)

- 1.5 Supply Chain Analysis

- 1.6 Pricing Analysis

- 1.7 Market Dynamics

- 1.7.1 Market Drivers

- 1.7.1.1 Rising Prevalence of Neurological Disorders

- 1.7.1.2 Benefits Offered by Navigation-Assisted Surgeries Over Conventional Surgeries

- 1.7.2 Market Restraints

- 1.7.2.1 Complications Associated with the Use of Navigation Systems

- 1.7.2.2 High Cost of Acquisition

- 1.7.3 Market Opportunities

- 1.7.3.1 Integration of Artificial Intelligence (AI) and Machine Learning

- 1.7.1 Market Drivers

2 Global Stereotactic Neuro-navigation System Market (By Product), $Million, 2023-2035

- 2.1 Neuro-Navigation System

- 2.1.1 Stealth Station Navigation

- 2.1.1.1 Overview

- 2.1.1.2 Installed Base

- 2.1.1.3 Average Selling Price

- 2.1.1.4 Unit Sold

- 2.1.1.5 Market Sizing and Forecast

- 2.1.2 Curve Navigation

- 2.1.2.1 Overview

- 2.1.2.2 Installed Base

- 2.1.2.3 Average Selling Price

- 2.1.2.4 Unit Sold

- 2.1.2.5 Market Sizing and Forecast

- 2.1.3 Q Guidance System

- 2.1.3.1 Overview

- 2.1.3.2 Installed Base

- 2.1.3.3 Average Selling Price

- 2.1.3.4 Unit Sold

- 2.1.3.5 Market Sizing and Forecast

- 2.1.4 easyNav

- 2.1.4.1 Overview

- 2.1.4.2 Installed Base

- 2.1.4.3 Average Selling Price

- 2.1.4.4 Unit Sold

- 2.1.4.5 Market Sizing and Forecast

- 2.1.5 7D Surgical System

- 2.1.5.1 Overview

- 2.1.5.2 Installed Base

- 2.1.5.3 Average Selling Price

- 2.1.5.4 Unit Sold

- 2.1.5.5 Market Sizing and Forecast

- 2.1.6 Xvision-Spine System

- 2.1.6.1 Overview

- 2.1.6.2 Installed Base

- 2.1.6.3 Average Selling Price

- 2.1.6.4 Unit Sold

- 2.1.6.5 Market Sizing and Forecast

- 2.1.7 Caduceus S (AR)

- 2.1.7.1 Overview

- 2.1.7.2 Average Selling Price

- 2.1.7.3 Unit Sold

- 2.1.7.4 Market Sizing and Forecast

- 2.1.1 Stealth Station Navigation

- 2.2 Stereotactic Frame Units

3 Global Stereotactic Neuro-navigation System Market (By Application), $Million, 2023-2035

- 3.1 Spinal

- 3.2 Cranial

4 Global Stereotactic Neuro-navigation System Market (By End User), $Million, 2023-2035

- 4.1 Hospitals and Clinics

- 4.2 Ambulatory Surgical Centers (ASCs)

5 Global Stereotactic Neuro-navigation System Market (By Region), $Million, 2023-2035

- 5.1 North America

- 5.1.1 Regional Overview

- 5.1.2 Driving Factors for Market Growth

- 5.1.3 Factors Challenging the Market

- 5.1.4 U.S.

- 5.1.5 Canada

- 5.2 Europe

- 5.2.1 Regional Overview

- 5.2.2 Driving Factors for Market Growth

- 5.2.3 Factors Challenging the Market

- 5.2.4 U.K.

- 5.2.5 Germany

- 5.2.6 France

- 5.2.7 Rest of the Europe

- 5.3 Asia Pacific

- 5.3.1 Regional Overview

- 5.3.2 Driving Factors for Market Growth

- 5.3.3 Factors Challenging the Market

- 5.3.4 Japan

- 5.3.5 China

- 5.3.6 Rest-of-Asia-Pacific

- 5.4 Rest-of-the-World

- 5.4.1 Regional Overview

- 5.4.2 Driving Factors for Market Growth

- 5.4.3 Factors Challenging the Market

6 Markets - Competitive Benchmarking & Company Profiles

- 6.1 Key Strategies and Development

- 6.2 Product Benchmarking

- 6.3 Market Share

- 6.4 Company Profiles

- 6.4.1 Medtronic Plc

- 6.4.1.1 Overview

- 6.4.1.2 Top Products/Product Portfolio

- 6.4.1.3 Top Competitors

- 6.4.1.4 Target Customers

- 6.4.1.5 Key Personal

- 6.4.1.6 Analyst View

- 6.4.2 Brainlab AG

- 6.4.2.1 Overview

- 6.4.2.2 Top Products/Product Portfolio

- 6.4.2.3 Top Competitors

- 6.4.2.4 Target Customers

- 6.4.2.5 Key Personal

- 6.4.2.6 Analyst View

- 6.4.3 ClearPoint Neuro, Inc.

- 6.4.3.1 Overview

- 6.4.3.2 Top Products/Product Portfolio

- 6.4.3.3 Top Competitors

- 6.4.3.4 Target Customers

- 6.4.3.5 Key Personal

- 6.4.3.6 Analyst View

- 6.4.4 Elekta

- 6.4.4.1 Overview

- 6.4.4.2 Top Products/Product Portfolio

- 6.4.4.3 Top Competitors

- 6.4.4.4 Target Customers

- 6.4.4.5 Key Personal

- 6.4.4.6 Analyst View

- 6.4.5 Stryker Corporation

- 6.4.5.1 Overview

- 6.4.5.2 Top Products/Product Portfolio

- 6.4.5.3 Top Competitors

- 6.4.5.4 Target Customers

- 6.4.5.5 Key Personal

- 6.4.5.6 Analyst View

- 6.4.6 Orthofix Medical Inc

- 6.4.6.1 Overview

- 6.4.6.2 Top Products/Product Portfolio

- 6.4.6.3 Top Competitors

- 6.4.6.4 Target Customers

- 6.4.6.5 Key Personal

- 6.4.6.6 Analyst View

- 6.4.7 SaphireX Surgicals

- 6.4.7.1 Overview

- 6.4.7.2 Top Products/Product Portfolio

- 6.4.7.3 Top Competitors

- 6.4.7.4 Target Customers

- 6.4.7.5 Key Personal

- 6.4.7.6 Analyst View

- 6.4.8 FHC

- 6.4.8.1 Overview

- 6.4.8.2 Top Products/Product Portfolio

- 6.4.8.3 Top Competitors

- 6.4.8.4 Target Customers

- 6.4.8.5 Key Personal

- 6.4.8.6 Analyst View

- 6.4.9 Integra LifeSciences Corporation

- 6.4.9.1 Overview

- 6.4.9.2 Top Products/Product Portfolio

- 6.4.9.3 Top Competitors

- 6.4.9.4 Target Customers

- 6.4.9.5 Key Personal

- 6.4.9.6 Analyst View

- 6.4.10 SURGLASSES Inc.

- 6.4.10.1 Overview

- 6.4.10.2 Top Products/Product Portfolio

- 6.4.10.3 Top Competitors

- 6.4.10.4 Target Customers

- 6.4.10.5 Key Personal

- 6.4.10.6 Analyst View

- 6.4.11 HRS Navigation

- 6.4.11.1 Overview

- 6.4.11.2 Top Products/Product Portfolio

- 6.4.11.3 Top Competitors

- 6.4.11.4 Target Customers

- 6.4.11.5 Key Personal

- 6.4.11.6 Analyst View

- 6.4.12 Augmedics

- 6.4.12.1 Overview

- 6.4.12.2 Top Products/Product Portfolio

- 6.4.12.3 Top Competitors

- 6.4.12.4 Target Customers

- 6.4.12.5 Key Personal

- 6.4.12.6 Analyst View

- 6.4.1 Medtronic Plc

7 Research Methodology

- 7.1 Data Sources

- 7.1.1 Primary Data Sources

- 7.1.2 Secondary Data Sources

- 7.1.3 Data Triangulation

- 7.2 Market Estimation and Forecast