|

|

市場調査レポート

商品コード

1753873

ロボット脳神経外科市場 - 世界および地域別分析:用途別、製品タイプ別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年)Robotic Neurosurgery Market - A Global and Regional Analysis: Focus on Application, Product Type, End User, and Regional Analysis - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| ロボット脳神経外科市場 - 世界および地域別分析:用途別、製品タイプ別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年06月23日

発行: BIS Research

ページ情報: 英文 153 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のロボット脳神経外科の市場規模は、2023年に3億3,480万米ドルとなりました。

同市場は2035年には22億3,860万米ドルに達すると予測され、2025年から2035年の予測期間中に16.35%のCAGRで成長すると予測されています。この成長を促進する主な要因には、神経疾患の有病率の上昇が含まれ、高度な外科的介入に対する需要が増加しています。精度の向上、リアルタイム画像の統合、AI対応機能などの技術革新は、手術結果を向上させ、ロボット神経外科の範囲を広げています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 4億9,240万米ドル |

| 2035年の予測 | 22億3,860万米ドル |

| CAGR | 16.35% |

さらに、低侵襲手術へのシフトは、患者の回復時間と合併症発生率を低減することで普及を促進しています。特に新興市場では、世界のヘルスケアインフラの拡充が市場成長をさらに後押ししています。さらに、研究開発への投資拡大と業界各社の戦略的提携が、製品革新と市場浸透を加速させ、ヘルスケア業界の主要成長分野としてのロボット脳神経外科の役割を確固たるものにしています。

世界のロボット脳神経外科市場は、分析と成長機会のための明確な枠組みを提供するために、製品タイプと臨床用途に基づいて主要なセグメントに分類されています。製品タイプには、精密で低侵襲な手術を可能にする中核プラットフォームであるロボットシステムと、システムの最適な機能性を確保するための設置、トレーニング、メンテナンス、ソフトウェア更新などの必要不可欠なサービスが含まれます。さらに、特殊な手術器具や消耗品で構成される器具や付属品は、手術の成功や継続的な需要に重要な役割を果たします。用途別では、市場は主に脊椎に関連する疾患を扱う脊髄神経外科と、脳や頭蓋骨に関連する手技に重点を置く頭蓋神経外科に分けられます。地域別では、北米、欧州、アジア太平洋地域、その他世界の各地域で市場が拡大しています。このように細分化することで、業界利害関係者は動向を把握し、リソースを効果的に配分し、異なる外科領域特有のニーズを満たすように技術革新を調整することができ、地域の成長を活用することができます。

影響分析:

ロボット脳外科手術市場は、以下のような点で影響を及ぼしています:

- 手術精度の向上:ロボットシステムは、複雑な神経外科手術の精度を大幅に向上させ、それによりリスクを減らし、患者の転帰を向上させています。

- 最小侵襲技術:ロボット工学の採用により、侵襲の少ない手術が可能になり、回復時間の短縮、合併症の減少、ヘルスケアコストの削減につながっています。

- 先進医療へのアクセスの拡大:ロボット工学の導入により、最先端の脳神経外科治療が、医療サービスが行き届いていない地域を含め、世界中のより多くのヘルスケア施設で受けられるようになりました。

- 技術革新と市場成長:絶え間ない技術の進歩と投資の増加により、新しいロボットプラットフォームや機器の開発が加速し、市場の堅調な拡大を後押ししています。

市場セグメンテーション:

セグメンテーション1:製品タイプ別

- ロボットシステム

- サービス

- 機器とアクセサリー

器具・付属品セグメントがロボット脳神経外科市場を独占し続ける(製品タイプ別)

製品タイプ別では、ロボット脳外科手術市場は器具と付属品がリードしており、2023年には51.48%のシェアを占めました。

セグメンテーション2:用途別

- 脊髄神経外科

- 頭蓋神経外科

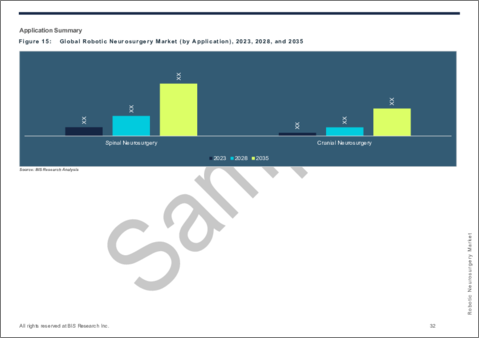

脊髄神経外科セグメントがロボット脳神経外科市場を独占し続ける(用途別)

用途別では、ロボット脳神経外科市場は脊髄脳神経外科がリードしており、2023年には73.51%のシェアを占めました。

セグメンテーション3:エンドユーザー別

- 病院

- 外来手術センター

病院セグメントがロボット脳神経外科市場で優位を維持し続ける(エンドユーザー別)

エンドユーザー別では、ロボット脳神経外科市場は病院がリードしており、2023年のシェアは91.90%でした。

セグメンテーション4:地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋諸国

- その他の地域

2023年のアジア太平洋のロボット脳神経外科市場は、いくつかの重要な要因によって中国が支配的でした。これには、ヘルスケア・インフラの急速な進歩、医療技術の導入に対する政府の強力な支援、神経疾患の有病率が上昇している患者人口の多さなどが含まれます。さらに、研究開発への投資の増加と、低侵襲手術手技に対する認識と受容の高まりが、ロボット脳神経外科システムの需要を煽っています。国内大手メーカーの存在と世界の技術プロバイダーとの戦略的提携により、地域市場における中国の主導的地位はさらに強化されています。

ロボット脳神経外科市場の最近の動向

- 2025年4月、Brain Navi Biotechnology Co., Ltd.は、First Securities Inc.との新規株式公開(IPO)カウンセリングの開始を発表しました。

- 2025年3月、脳神経外科用ロボットのパイオニアであるBrain Navi Biotechnologyは、BenQ Medical Technologyと戦略的提携を結び、脳神経外科用ナビゲーションロボット「NaoTrac」を中国で発売・商品化することを明らかにしました。この提携はブレイン・ナビの2025年世界化戦略をサポートするもので、市場参入を迅速化し臨床導入を促進するため、地域密着型のパートナーシップに焦点を当てています。

- 2024年8月、MMI(Medical Microinstruments, Inc.)は、脳神経外科手術におけるSymani Surgical Systemの実現可能性を確認する前臨床試験が成功裏に終了したと発表しました。

- 2024年5月、AiM Medical Robotics Inc.は、パーキンソン病患者の脳深部刺激療法に使用する先進的なロボットを検証するため、ブリガム・アンド・ウィメンズ病院(BWH)およびハーバード大学のSurgical Navigation and Robotics(SNR)ラボとの共同研究を発表。

- 2024年5月、Monteris Medical Corporationは、ロボット支援NeuroBlateシステム用に設計されたNeuroBlate NB3 FullFire 1.6mmレーザープローブの発売を発表しました。

需要- 促進要因と限界

市場需要促進要因:

- 従来の開腹手術に対するロボット脳神経外科手術の利点:ロボット支援別脳神経外科手術は、従来の開腹手術に比べて大きな利点があり、現代医療におけるゲームチェンジャーとなっています。アナリストは、これらのシステムは精度と正確性が向上しているため、脳や脊髄の重要な部位をより正確に狙うことができ、健康な組織を損傷するリスクを軽減できることから、大きな進歩であると見ています。ロボット手術の低侵襲性は、切開創の縮小、出血量の減少、回復時間の短縮、入院期間の短縮をもたらし、最終的には患者の転帰を改善し、ヘルスケアコストを削減します。

さらに、ロボットシステムは、従来の開腹手術によく見られる脳腫脹、出血、感染症などの合併症の可能性を低減します。また、ロボット・プラットフォームは優れた手先の器用さと3D可視化を提供するため、外科医は効率性の向上、より大きな制御、快適性の向上から恩恵を受けます。このような利点を背景に、ロボット脳神経外科に対する需要の高まりは、この分野を再構築し、患者により安全で効果的な治療を提供すると同時に、ヘルスケアプロバイダーのコスト削減を促しています。技術が進化し続けるにつれて、ロボット神経外科手術は幅広い神経学的処置の標準治療になるとアナリストは予測しています。

- 神経疾患の有病率の上昇:神経疾患の発生率の上昇は、ロボット神経外科市場の拡大に大きな影響を与えています。高度で低侵襲な手術オプションに対する需要が伸び続ける中、ロボットシステムは近代的な神経外科診療において重要な役割を果たす態勢が整っており、それ別患者ケアと手術効率が向上しています。The Lancet Neurology誌に掲載された研究によると、神経疾患は世界的に病気や障害の主な原因となっており、2021年には約340万人が影響を受けるといいます。これは過去30年間での著しい増加であり、障害調整生存年(DALY)は1990年から2021年にかけて18%増加しています。この負担の主な原因には、脳卒中、新生児脳症、片頭痛、アルツハイマー病などの認知症、糖尿病性神経障害などがあります。特筆すべきは、神経発達および小児疾患が世界全体の神経学的負担の20%近くを占めていることで、2021年には8,000万年の健康寿命が失われることになります。

神経疾患の増加は、人口の高齢化、平均寿命の伸び、環境、代謝、ライフスタイルの危険因子への曝露といった要因に起因しています。憂慮すべきことに、神経疾患による死亡や健康喪失の80%以上が低・中所得国で発生しており、健康格差の大きさが浮き彫りになっています。この研究は、拡大する公衆衛生上の問題に対処するために、効果的な予防、治療、リハビリテーション、長期ケア戦略を実施することの重要性を強調しています。

このような神経疾患の有病率の上昇は、ロボット脳神経外科市場の主要な促進要因です。効果的で低侵襲な治療オプションに対する需要の高まりが、ロボット支援脳神経外科手術の採用に拍車をかけています。これらの技術は、従来の開腹手術と比較して、精度の向上、合併症の減少、回復時間の短縮を実現し、現代の神経外科診療において重要な要素となっています。

市場の抑制要因:

- 投資コストの高さ:脳神経外科用ロボットの導入コストが高いことは、多くのヘルスケア機関にとって経済的なハードルとなり、この革新的技術の普及を妨げています。ロボットシステムに必要な初期投資と、継続的なメンテナンス、トレーニング、運用コストは、特に小規模の病院や財源が限られている病院にとっては、予算面で大きな課題となります。病院がロボットシステムの導入を検討する際には、購入時の初期費用だけでなく、長期的な運用費用も考慮に入れ、総所有コストを慎重に評価する必要があります。

市場機会:

- 長距離遠隔手術ロボットシステムの開発:長距離遠隔手術ロボットシステムの開発は、ロボット脳神経外科市場に大きな機会をもたらします。専門的な脳神経外科治療への遠隔アクセスを可能にすることで、これらのシステムは地理的な障壁を克服し、十分なサービスを受けていない地域や地方のヘルスケアアクセスを改善することができます。高度なロボット工学、リアルタイム通信、人工知能の統合は、手術の精度を高め、回復時間を短縮し、病院に費用対効果の高いソリューションを提供します。さらに、世界中の外科医が遠隔トレーニングや協働作業を行うことができるため、継続的な技術革新と知識の共有が促進され、ロボットシステムの導入がさらに加速されます。技術が進化し続けるにつれ、長距離ロボット脳神経外科手術の可能性は拡大し、市場の成長を促し、世界の外科治療の未来を再構築していくと思われます。

製品/イノベーション戦略:世界のロボット神経外科市場は、製品タイプ、用途、エンドユーザー、地域など、さまざまなカテゴリーに基づいて広範にセグメント化されています。これにより、読者は、どのセグメントが最大のシェアを占めているのか、また、どのセグメントが今後数年間で成長する可能性が高いのかを明確に把握することができます。

成長/マーケティング戦略:2022年1月から2025年4月にかけての世界のロボット脳神経外科市場における主要な開発では、新規提供が最大数を占めています。

競合戦略:世界のロボット脳外科市場には、製品・サービスポートフォリオを持つ数多くの既存参入企業が存在します。本調査で分析・プロファイルした世界のロボット神経外科市場の主要企業には、ロボット神経外科システム、器具、付属品、サービスを提供する既存企業が含まれます。

当レポートでは、世界のロボット脳神経外科市場について調査し、市場の概要とともに、用途別、製品タイプ別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 世界のロボット脳神経外科市場:業界見通し

- 動向:現状と将来への影響評価

- ロボット脳神経外科手術の導入増加

- 市場参入企業間の多数のコラボレーション

- 製品発売と規制承認の増加

- サプライチェーンの概要

- 規制の枠組み

- 米国

- 欧州連合(EU)

- 英国

- 日本

- 中国

- その他の地域

- 償還シナリオ

- 米国における償還シナリオ

- 特許分析

- 特許出願動向(国別、年別)

- 価格分析

- ケーススタディ

- 資金調達シナリオ

- 市場力学

第2章 世界のロボット脳神経外科市場(製品タイプ別)、100万米ドル、2023年~2035年

- ロボットシステム

- 機器とアクセサリー

- サービス

第3章 世界のロボット脳神経外科市場(用途別)、100万米ドル、2023年~2035年

- 脊椎神経外科

- 頭蓋神経外科

第4章 世界のロボット脳神経外科市場(エンドユーザー別)、100万米ドル、2023年~2035年

- 病院

- 外来手術センター

第5章 世界のロボット脳神経外科市場(地域別)、100万米ドル、2023年~2035年

- 地域サマリー

- 北米

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 手技件数

- 米国

- カナダ

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 手技件数

- ドイツ

- スペイン

- 英国

- その他

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 手技件数

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- その他の地域

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 手技件数

第6章 市場- 製品プロファイル

- Medtronic plc

- Globus Medical, Inc.

- Renishaw plc

- Zimmer Biomet Holdings, Inc.

第7章 市場-競合ベンチマーキングと企業プロファイル

- 製品ベンチマーク

- 主要戦略と開発

- 企業プロファイル

- Brainlab AG

- Renishaw plc

- Globus Medical, Inc.

- Zimmer Biomet Holdings, Inc.

- Medical Microinstruments, Inc.

- Monteris Medical Corporation

- Medtronic plc

- Accuray Incorporated

- AiM Medical Robotics

- KUKA AG (Midea Group)

- Beijing Baihui Weikang Technology Co., Ltd.

- Brain Navi Biotechnology Co. Ltd

- Beijing Tinavi Medical Technologies Co., Ltd.

第8章 調査手法

List of Figures

- Figure 1: Global Robotic Neurosurgery Market (by Scenario), $Million, 2024, 2028, and 2035

- Figure 2: Global Robotic Neurosurgery Market, $Million, 2023 and 2035

- Figure 3: Robotic Neurosurgery Market (by End User), $Million, 2023, 2028, and 2035

- Figure 4: Robotic Neurosurgery Market (by Product Type), $Million, 2023, 2028, and 2035

- Figure 5: Robotic Neurosurgery Market (by Application), $Million, 2023, 2028, and 2035

- Figure 6: Robotic Neurosurgery Literature Published, January 2015 to April 2025

- Figure 7: Robotic Neurosurgery Market Segmentation

- Figure 8: Supply Chain and Risks within the Supply Chain

- Figure 9: FDA Classification

- Figure 10: EU Classification

- Figure 11: NHS Classification

- Figure 12: Japan Federation of Medical Devices Associations (JFMDA) Classification

- Figure 13: NMPA Classification

- Figure 14: Organization of the Health System in the U.S.

- Figure 15: Global Robotic Neurosurgery Market, Patent Analysis (by Country), January 2019-April 2025

- Figure 16: Global Robotic Neurosurgery Market, Patent Analysis (by Year), January 2019-April 2025

- Figure 17: Impact Analysis of Market Navigating Factors, 2024-2035

- Figure 18: Global Incidences of Neurological Disorders, Thousands, 2018-2021

- Figure 19: Global Prevalence of Neurological Disorders (by Type of Neurological Disease), Thousands, 1990-2019

- Figure 20: Prevalence of Parkinson's Disease, Region (2016-2021)

- Figure 21: Timeline of the FDA Approvals for Various Robotic Neurosurgery Systems

- Figure 22: Global Robotic Neurosurgery Market (by Product Type), $Million, 2023, 2028, and 2035

- Figure 23: Global Robotic Neurosurgery Market, Robotic Systems, $Million, 2023-2035

- Figure 24: Global Robotic Neurosurgery Market, Instruments and Accessories, $Million, 2023-2035

- Figure 25: Global Robotic Neurosurgery Market, Services, $Million, 2023-2035

- Figure 26: Global Robotic Neurosurgery Market (by Application), 2023, 2028, and 2035

- Figure 27: Global Robotic Neurosurgery Market, Spinal Neurosurgery,$Million, 2023-2035

- Figure 28: Global Robotic Neurosurgery Market, Cranial Neurosurgery,$Million, 2023-2035

- Figure 29: Global Robotic Neurosurgery Market (by End User), $Million, 2023, 2028, and 2035

- Figure 30: Global Robotic Neurosurgery Market, Hospitals, $Million, 2023-2035

- Figure 31: Global Robotic Neurosurgery Market, Ambulatory Surgical Centers, $Million, 2023-2035

- Figure 32: North America Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 33: North America Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 34: North America Robotic Neurosurgery Market, Installed Base, 2023-2035

- Figure 35: North America Robotic Neurosurgery Market, Unit Sold, 2023-2035

- Figure 36: Incidences of Neurological Disorders in U.S., 2018-2021

- Figure 37: U.S. Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 38: U.S. Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 39: Incidences of Neurological Disorders in Canada, 2018-2021

- Figure 40: Canada Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 41: Canada Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 42: Europe Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 43: Europe Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 44: Europe Robotic Neurosurgery Market, Installed Base, 2023-2035

- Figure 45: Europe Robotic Neurosurgery Market, Unit Sold, 2023-2035

- Figure 46: Incidences of Neurological Disorders in Germany, 2018-2021

- Figure 47: Germany Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 48: Germany Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 49: Incidences of Neurological Disorders in France, 2018-2021

- Figure 50: France Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 51: France Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 52: Incidences of Neurological Disorders in Italy, 2018-2021

- Figure 53: Italy Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 54: Italy Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 55: Incidences of Neurological Disorders in Spain, 2018-2021

- Figure 56: Spain Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 57: Spain Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 58: Incidences of Neurological Disorders in U.K., 2018-2021

- Figure 59: U.K. Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 60: U.K. Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 61: Rest-of-Europe Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 62: Rest-of-Europe Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 63: Asia-Pacific Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 64: Asia-Pacific Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 65: Asia-Pacific Robotic Neurosurgery Market, Installed Base, 2023-2035

- Figure 66: Asia-Pacific Robotic Neurosurgery Market, Unit Sold, 2023-2035

- Figure 67: Incidences of Neurological Disorders in China, 2018-2021

- Figure 68: China Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 69: China Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 70: Incidences of Neurological Disorders in Japan, 2018-2021

- Figure 71: Japan Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 72: Japan Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 73: Incidences of Neurological Disorders in India, 2018-2021

- Figure 74: India Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 75: India Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 76: Incidences of Neurological Disorders in Australia, 2018-2021

- Figure 77: Australia Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 78: Australia Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 79: Incidences of Neurological Disorders in South Korea, 2018-2021

- Figure 80: South Korea Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 81: South Korea Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 82: Rest-of-Asia-Pacific Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 83: Rest-of-Asia-Pacific Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 84: Rest-of-the-World Robotic Neurosurgery Market, Procedure Volume, 2023-2035

- Figure 85: Rest-of-the-World Robotic Neurosurgery Market, $Million, 2023-2035

- Figure 86: Rest-of-the-World Robotic Neurosurgery Market, Installed Base, 2023-2035

- Figure 87: Rest-of-the-World Robotic Neurosurgery Market, Unit Sold, 2023-2035

- Figure 88: Strategic Initiatives, January 2022-April 2025

- Figure 89: Data Triangulation

- Figure 90: Top-Down and Bottom-Up Approach

- Figure 91: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Robotic Neurosurgery Market Trend Analysis

- Table 4: Some of the Partnerships and Collaborations in the Global Robotic Neurosurgery Market

- Table 5: Some of the Product Launch and Regulatory Approvals in the Global Robotic Neurosurgery Market

- Table 6: FDA Classification Details for Several Prominent Robotic Neurosurgery Systems

- Table 7: Medical Devices in Japan

- Table 8: Regulatory Process in RoW

- Table 9: Costs of Neurosurgery Robotic Systems

- Table 10: Funding Scenario of Neurosurgery Robotic Systems

- Table 11: Comparison of Robotic Neurosurgical Procedures Over Conventional Open Surgical Procedures

- Table 12: Comparison Between Various Navigation Systems Cost Breakdown of Robotic Neurosurgery Systems

- Table 13: Global Robotic Neurosurgery Market, Robotic Systems (by Company), $Million, 2023-2035

- Table 14: Global Robotic Neurosurgery Market, Instruments and Accessories (by Company), $Million, 2023-2035

- Table 15: Global Robotic Neurosurgery Market, Services (by Company), $Million, 2023-2035

- Table 16: Robotic Neurosurgery Market (by Region), $Million, 2023-2035

- Table 17: North America Robotic Neurosurgery Market (by Product Type), $Million, 2023-2035

- Table 18: Incidences of Neurological Disorders in U.S., By Disease Type, 2018-2021

- Table 19: Incidences of Neurological Disorders in Canada, By Disease Type, 2018-2021

- Table 20: Europe Robotic Neurosurgery Market (by Product Type), $Million, 2023-2035

- Table 21: Incidences of Neurological Disorders in Germany, By Disease Type, 2018-2021

- Table 22: Incidences of Neurological Disorders in France, By Disease Type, 2018-2021

- Table 23: Incidences of Neurological Disorders in Italy, By Disease Type, 2018-2021

- Table 24: Incidences of Neurological Disorders in Spain, By Disease Type, 2018-2021

- Table 25: Incidences of Neurological Disorders in U.K., By Disease Type, 2018-2021

- Table 26: Asia-Pacific Robotic Neurosurgery Market (by Product Type), $Million, 2023-2035

- Table 27: Incidences of Neurological Disorders in China, By Disease Type, 2018-2021

- Table 28: Incidences of Neurological Disorders in Japan, By Disease Type, 2018-2021

- Table 29: Incidences of Neurological Disorders in India, By Disease Type, 2018-2021

- Table 30: Incidences of Neurological Disorders in Australia, By Disease Type, 2018-2021

- Table 31: Incidences of Neurological Disorders in South Korea, By Disease Type, 2018-2021

- Table 32: Rest-of-the-World Robotic Neurosurgery Market (by Product Type), $Million, 2023-2035

- Table 33: Global Robotic Neurosurgery Market, Product Benchmarking (by Product)

- Table 34: Key Strategies, January 2022-April 2025

This report can be delivered within 1 working day.

Introduction to Robotic Neurosurgery Market

The global robotic neurosurgery market is projected to reach $2,238.6 million in 2035 and estimated $334.8 million in 2023, growing at a CAGR of 16.35% during the forecast period 2025-2035. Key factors driving this growth include the rising prevalence of neurological disorders, which increases the demand for advanced surgical interventions. Technological innovations, including improved precision, the integration of real-time imaging, and AI-enabled capabilities, are enhancing surgical outcomes and broadening the scope of robotic neurosurgery.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $492.4 Million |

| 2035 Forecast | $2,238.6 Million |

| CAGR | 16.35% |

Additionally, the shift toward minimally invasive procedures has been fueling adoption by reducing patient recovery times and complication rates. The expansion of healthcare infrastructure worldwide, particularly in emerging markets, further supports market growth. Moreover, increased investment in research and development, coupled with strategic collaborations among industry players, has been accelerating product innovation and market penetration, solidifying robotic neurosurgery's role as a key growth sector in the healthcare industry.

Market Introduction

The global robotic neurosurgery market is categorized into key segments based on product type and clinical application to provide a clear framework for analysis and growth opportunities. Product types include robotic systems, the core platforms that enable precise and minimally invasive surgeries, alongside essential services such as installation, training, maintenance, and software updates that ensure optimal system functionality. Additionally, instruments and accessories, comprising specialized surgical tools and consumables, play a critical role in procedure success and ongoing demand. On the application side, the market is primarily divided into spinal neurosurgery, which addresses conditions related to the spine, and cranial neurosurgery, focused on brain and skull-related procedures. Geographically, the market has been expanding across regions including North America, Europe, Asia-Pacific, and the Rest-of-the-World. This segmentation enables industry stakeholders to identify trends, allocate resources effectively, and tailor innovations to meet the specific needs of different surgical domains, thereby capitalizing on regional growth.

Impact Analysis:

The robotic neurosurgery market has made an impact in the following ways:

- Enhanced Surgical Precision: Robotic systems have significantly improved the accuracy of complex neurosurgical procedures, thereby reducing risks and enhancing patient outcomes.

- Minimally Invasive Techniques: The adoption of robotics has enabled less invasive surgeries, leading to shorter recovery times, reduced complications, and lower healthcare costs.

- Expanded Access to Advanced Care: Robotics has facilitated the availability of cutting-edge neurosurgical interventions in more healthcare facilities worldwide, including underserved regions.

- Innovation and Market Growth: Continuous technological advancements and increased investments have accelerated the development of new robotic platforms and instruments, driving robust market expansion.

Market Segmentation:

Segmentation 1: by Product Type

- Robotic Systems

- Services

- Instruments and Accessories

Instruments and Accessories Segment to Continue Dominating the Robotic Neurosurgery Market (by Product Type)

Based on product type, the robotic neurosurgery market is led by instrument and accessories, which held a 51.48% share in 2023.

Segmentation 2: by Application

- Spinal Neurosurgery

- Cranial Neurosurgery

Spinal Neurosurgery Segment to Continue Dominating the Robotic Neurosurgery Market (by Application)

Based on application, the robotic neurosurgery market is led by spinal neurosurgery, which held a 73.51% share in 2023.

Segmentation 3: by End User

- Hospitals

- Ambulatory Surgical Centers

Hospitals Segment to Continue Holding its Dominance in the Robotic Neurosurgery Market (by End User)

Based on end users, the robotic neurosurgery market is led by hospitals, which held a 91.90% share in 2023.

Segmentation 4: by Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest-of-Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest-of-Asia-Pacific

- Rest-of-the-World

China dominated the Asia-Pacific robotic neurosurgery market in 2023, driven by several key factors. These include rapid advancements in healthcare infrastructure, strong government support for the adoption of medical technology, and a large patient population with a rising prevalence of neurological disorders. Additionally, increasing investments in research and development, coupled with growing awareness and acceptance of minimally invasive surgical techniques, have fueled demand for robotic neurosurgery systems. The presence of leading domestic manufacturers and strategic partnerships with global technology providers further strengthen China's leadership position in the regional market.

Recent Developments in the Robotic Neurosurgery Market

- In April 2025, Brain Navi Biotechnology Co., Ltd. announced the commencement of its initial public offering (IPO) counseling with First Securities Inc., a significant move toward tapping into the capital markets to fuel its long-term growth in the surgical robot technology sector.

- In March 2025, Brain Navi Biotechnology, a pioneer in neurosurgical robotics, revealed a strategic partnership with BenQ Medical Technology to launch and commercialize the NaoTrac neurosurgical navigation robot in China. This collaboration supports Brain Navi's 2025 globalization strategy, focusing on localized partnerships to expedite market entry and boost clinical adoption.

- In August 2024, MMI (Medical Microinstruments, Inc.) announced the successful completion of a preclinical study that confirmed the feasibility of the Symani Surgical System for neurosurgical procedures.

- In May 2024, AiM Medical Robotics Inc. announced a collaboration with Brigham and Women's Hospital (BWH) and the Surgical Navigation and Robotics (SNR) Lab at Harvard to validate their advanced robot for deep brain stimulation in Parkinson's patients.

- In May 2024, Monteris Medical Corporation announced the release of the NeuroBlate NB3 FullFire 1.6mm laser probe, designed for use with their robotic-assisted NeuroBlate system.

Demand - Drivers and Limitations

Market Demand Drivers:

- Advantages of Robotic Neurosurgical Procedures Over Conventional Open Surgical Procedures: Robotic-assisted neurosurgical procedures offer significant advantages over conventional open surgeries, making them a game-changer in modern medicine. Analysts view these systems as a major advancement due to their enhanced precision and accuracy, which allows for more accurate targeting of critical brain and spinal areas, reducing the risk of damaging healthy tissues. The minimally invasive nature of robotic surgeries results in smaller incisions, reduced blood loss, faster recovery times, and shorter hospital stays, ultimately improving patient outcomes and lowering healthcare costs.

Additionally, robotic systems reduce the likelihood of complications such as brain swelling, bleeding, and infections, which are common in traditional open surgeries. Surgeons also benefit from improved efficiency, greater control, and enhanced comfort, as robotic platforms offer superior dexterity and 3D visualization. With these advantages, the growing demand for robotic neurosurgery has been reshaping the field, offering patients safer, more effective treatments while driving cost savings for healthcare providers. As technology continues to evolve, analysts predict that robotic neurosurgery will become the standard of care for a wide range of neurological procedures.

- Rising Prevalence of Neurological Disorders: The rising incidence of neurological conditions has been significantly influencing the expansion of the robotic neurosurgery market. As the demand for advanced, minimally invasive surgical options continues to grow, robotic systems are poised to play a crucial role in modern neurosurgical practices, thereby enhancing patient care and surgical efficiency. The study published in The Lancet Neurology reveals that neurological conditions have become the leading cause of ill health and disability globally, affecting approximately 3.4 million people in 2021. This marks a significant increase over the past three decades, with the number of disability-adjusted life years (DALYs) rising by 18% from 1990 to 2021. The primary contributors to this burden include stroke, neonatal encephalopathy, migraine, Alzheimer's disease and other dementias, and diabetic neuropathy. Notably, neurodevelopmental and pediatric conditions accounted for nearly 20% of the total neurological burden worldwide, equating to 80 million years of healthy life lost in 2021.

The rise in neurological disorders is attributed to factors such as population aging, increased life expectancy, and exposure to environmental, metabolic, and lifestyle risk factors. Alarmingly, over 80% of neurological deaths and health loss occur in low- and middle-income countries, underscoring significant health disparities. The study highlights the importance of implementing effective prevention, treatment, rehabilitation, and long-term care strategies to address this growing public health issue.

This escalating prevalence of neurological conditions is a key driver for the robotic neurosurgery market. The increasing demand for effective and minimally invasive treatment options has spurred the adoption of robotic-assisted neurosurgical procedures. These technologies offer enhanced precision, reduced complications, and shorter recovery times compared to traditional open surgeries, positioning them as a critical component in modern neurosurgical practices.

Market Restraints:

- High Cost of Investment: The high cost of acquiring neurosurgery robots presents a significant financial hurdle for many healthcare institutions, hindering the widespread adoption of this transformative technology. The initial investment required for robotic systems, along with ongoing maintenance, training, and operational costs, can create a considerable budgetary challenge, particularly for smaller hospitals or those with limited financial resources. As hospitals look to integrate robotic systems, they must carefully assess the total cost of ownership, factoring in not only the upfront purchase price but also the long-term operational expenses.

Market Opportunities:

- Development of Long-Distance Teleoperated Surgical Robotic Systems: The development of long-distance teleoperated surgical robotic systems presents a significant opportunity for the robotic neurosurgery market. By enabling remote access to specialized neurosurgical care, these systems can overcome geographical barriers, improving healthcare access in underserved and rural regions. The integration of advanced robotics, real-time communication, and artificial intelligence enhances surgical precision, reduces recovery times, and offers cost-effective solutions for hospitals. Moreover, the ability to provide remote training and collaboration among surgeons worldwide fosters continuous innovation and knowledge sharing, further accelerating the adoption of robotic systems. As technology continues to evolve, the potential for long-distance robotic neurosurgery will expand, driving market growth and reshaping the future of surgical care globally.

How can this report add value to an organization?

Product/Innovation Strategy: The global robotic neurosurgery market has been extensively segmented based on various categories, such as product type, application, end user, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: The new offering accounted for the maximum number of key developments in the global robotic neurosurgery market between January 2022 and April 2025.

Competitive Strategy: The global robotic neurosurgery market has numerous established players with product and service portfolios. Key players in the global robotic neurosurgery market, as analyzed and profiled in the study, include established companies offering robotic neurosurgery systems, instruments, accessories, and services.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research was performed to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Exact revenue information, up to a certain extent, was extracted for each company from secondary sources and databases. The revenues specific to the offering, application, end user, and region were then estimated for each market player based on fact-based proxy indicators, as well as primary inputs.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report provides a market study of robotic neurosurgery.

- The market contribution of robotic neurosurgery, anticipated to be launched in the future, has been calculated based on historical analysis. This analysis has been supported by proxy factors, including the innovation scale of the companies, funding status, collaborations, customer base, and patent scenario.

- The scope of availability of robotic neurosurgery products and services in a particular region has been assessed through a comprehensive analysis of companies' prospects, regional end-user perceptions, and other factors influencing the launch of robotic neurosurgery products and services in that region.

- The base year considered for the calculation of the market size is 2024. A historical year analysis has been done for the period FY2021-FY2023. The market size has been estimated for FY2024 and projected for the period from FY2025 to FY2035.

- Revenues of the companies have been referenced from their annual reports for FY2021-FY2024. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, product approval status, market collaborations, and operational history.

- The regional distribution of market revenue has been estimated based on the number of companies in each region and the adoption rate of robotic neurosurgery. All the numbers have been adjusted to a single digit after the decimal for better presentation in the report. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. The CAGR has been calculated for the period 2025-2035.

- The market has been mapped based on the available robotic neurosurgery. All the key companies with significant offerings in this field have been considered and profiled in this report.

- Market strategies and developments of key players have been taken into account for calculating the market potential in the forecast period.

Primary Research:

The primary sources involve industry experts in the robotic neurosurgery market, including the market players offering robotic neurosurgery solutions. Resources, including CXOs, vice presidents, product managers, directors, territory managers, and business development professionals, have been interviewed to gather and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings for robotic neurosurgery

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- European Medicines Agency (EMA), American Chemical Society (ACS), Frontiers, World Health Organization (WHO), and National Center for Biotechnology Information (NCBI), among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolios

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentation and percentage share estimates

- Company and country understanding and data for market value estimation

- Key industry/market trends

- Developments among top players

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, type portfolio, and market penetration.

Some prominent names in the global robotic neurosurgery market include:

- Brainlab AG

- Renishaw plc

- Zimmer Biomet Holding, Inc.

- Medical Microinstruments, Inc.

- Monteris Medical Corporation

- Medtronic plc.

- Globus Medical Inc.

- Accuray Incorporated

Table of Contents

Executive Summary

Scope and Definition

1 Global Robotic Neurosurgery Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Increasing Adoption of Robotic Neurosurgery Procedures

- 1.1.2 Significant Number of Collaborations among Market Players

- 1.1.3 Growing Number of Product Launch and Regulatory Approvals

- 1.2 Supply Chain Overview

- 1.3 Regulatory Framework

- 1.3.1 U.S.

- 1.3.2 European Union (EU)

- 1.3.3 U.K.

- 1.3.4 Japan

- 1.3.5 China

- 1.3.6 Rest-of-the-World (RoW)

- 1.4 Reimbursement Scenario

- 1.4.1 Reimbursement Scenario in the U.S.

- 1.5 Patent Analysis

- 1.5.1 Patent Filing Trend (by Country, Year)

- 1.6 Pricing Analysis

- 1.7 Case Studies

- 1.7.1 Case Study: First Use of Mazor X Stealth Edition Robotic Guidance Platform at an Outpatient Surgery Center in Ohio

- 1.7.2 Case Study: Brain Navi's NaoTrac Reaches 100 Neurosurgical Procedures Milestone

- 1.8 Funding Scenario

- 1.9 Market Dynamics

- 1.9.1 Market Drivers

- 1.9.1.1 Advantages of Robotic Neurosurgical Procedures Over Conventional Open Surgical Procedures

- 1.9.1.2 Rising Prevalence of Neurological Disorders

- 1.9.1.3 Continuous Technological Advancements in Robotic Neurosurgery

- 1.9.2 Market Restraints

- 1.9.2.1 High Cost of Investment

- 1.9.2.2 Lack of Skilled Professionals

- 1.9.3 Market Opportunities

- 1.9.3.1 Development of Long-Distance Teleoperated Surgical Robotic Systems

- 1.9.1 Market Drivers

2 Global Robotic Neurosurgery Market (by Product Type), $Million, 2023-2035

- 2.1 Robotic Systems

- 2.2 Instruments and Accessories

- 2.3 Services

3 Global Robotic Neurosurgery Market (by Application), $Million, 2023-2035

- 3.1 Spinal Neurosurgery

- 3.2 Cranial Neurosurgery

4 Global Robotic Neurosurgery Market (by End User), $Million, 2023-2035

- 4.1 Hospitals

- 4.2 Ambulatory Surgical Centers

5 Global Robotic Neurosurgery Market (by Region), $Million, 2023-2035

- 5.1 Regional Summary

- 5.2 North America

- 5.2.1 Regional Overview

- 5.2.2 Driving Factors for Market Growth

- 5.2.3 Factors Challenging the Market

- 5.2.4 Procedure Volume

- 5.2.5 U.S.

- 5.2.6 Canada

- 5.3 Europe

- 5.3.1 Regional Overview

- 5.3.2 Driving Factors for Market Growth

- 5.3.3 Factors Challenging the Market

- 5.3.4 Procedure Volume

- 5.3.5 Germany

- 5.3.6 Spain

- 5.3.7 U.K.

- 5.3.8 Rest-of-Europe

- 5.4 Asia-Pacific

- 5.4.1 Regional Overview

- 5.4.2 Driving Factors for Market Growth

- 5.4.3 Factors Challenging the Market

- 5.4.4 Procedure Volume

- 5.4.5 China

- 5.4.6 Japan

- 5.4.7 India

- 5.4.8 Australia

- 5.4.9 South Korea

- 5.4.10 Rest-of-Asia-Pacific

- 5.5 Rest-of-the-World

- 5.5.1 Regional Overview

- 5.5.2 Driving Factors for Market Growth

- 5.5.3 Factors Challenging the Market

- 5.5.4 Procedure Volume

6 Markets - Product Profiles

- 6.1 Medtronic plc

- 6.1.1 Product Overview

- 6.1.2 Launch Year

- 6.1.3 Key Features

- 6.1.4 Key Parameter

- 6.1.5 Installed Base

- 6.1.6 Unit Sold

- 6.2 Globus Medical, Inc.

- 6.2.1 Product Overview

- 6.2.2 Launch Year

- 6.2.3 Key Features

- 6.2.4 Key Parameter

- 6.2.5 Installed Base

- 6.2.6 Unit Sold

- 6.3 Renishaw plc

- 6.3.1 Product Overview

- 6.3.2 Launch Year

- 6.3.3 Key Features

- 6.3.4 Key Parameter

- 6.3.5 Installed Base

- 6.3.6 Unit Sold

- 6.4 Zimmer Biomet Holdings, Inc.

- 6.4.1 Product Overview

- 6.4.2 Launch Year

- 6.4.3 Key Features

- 6.4.4 Key Parameter

- 6.4.5 Installed Base

- 6.4.6 Unit Sold

7 Markets - Competitive Benchmarking & Company Profiles

- 7.1 Product Benchmarking

- 7.2 Key Strategies and Development

- 7.3 Company Profiles

- 7.3.1 Brainlab AG

- 7.3.1.1 Overview

- 7.3.1.2 Top Products/Product Portfolio

- 7.3.1.3 Top Competitors

- 7.3.1.4 Target Customers

- 7.3.1.5 Key Personal

- 7.3.1.6 Analyst View

- 7.3.2 Renishaw plc

- 7.3.2.1 Overview

- 7.3.2.2 Top Products/Product Portfolio

- 7.3.2.3 Top Competitors

- 7.3.2.4 Target Customers

- 7.3.2.5 Key Personal

- 7.3.2.6 Analyst View

- 7.3.3 Globus Medical, Inc.

- 7.3.3.1 Overview

- 7.3.3.2 Top Products/Product Portfolio

- 7.3.3.3 Top Competitors

- 7.3.3.4 Target Customers

- 7.3.3.5 Key Personal

- 7.3.3.6 Analyst View

- 7.3.4 Zimmer Biomet Holdings, Inc.

- 7.3.4.1 Overview

- 7.3.4.2 Top Products/Product Portfolio

- 7.3.4.3 Top Competitors

- 7.3.4.4 Target Customers

- 7.3.4.5 Key Personal

- 7.3.4.6 Analyst View

- 7.3.5 Medical Microinstruments, Inc.

- 7.3.5.1 Overview

- 7.3.5.2 Top Products/Product Portfolio

- 7.3.5.3 Top Competitors

- 7.3.5.4 Target Customers

- 7.3.5.5 Key Personal

- 7.3.5.6 Analyst View

- 7.3.6 Monteris Medical Corporation

- 7.3.6.1 Overview

- 7.3.6.2 Top Products/Product Portfolio

- 7.3.6.3 Top Competitors

- 7.3.6.4 Target Customers

- 7.3.6.5 Key Personal

- 7.3.6.6 Analyst View

- 7.3.7 Medtronic plc

- 7.3.7.1 Overview

- 7.3.7.2 Top Products/Product Portfolio

- 7.3.7.3 Top Competitors

- 7.3.7.4 Target Customers

- 7.3.7.5 Key Personal

- 7.3.7.6 Analyst View

- 7.3.8 Accuray Incorporated

- 7.3.8.1 Overview

- 7.3.8.2 Top Products/Product Portfolio

- 7.3.8.3 Top Competitors

- 7.3.8.4 Target Customers

- 7.3.8.5 Key Personal

- 7.3.8.6 Analyst View

- 7.3.9 AiM Medical Robotics

- 7.3.9.1 Overview

- 7.3.9.2 Top Products/Product Portfolio

- 7.3.9.3 Top Competitors

- 7.3.9.4 Target Customers

- 7.3.9.5 Key Personal

- 7.3.9.6 Analyst View

- 7.3.10 KUKA AG (Midea Group)

- 7.3.10.1 Overview

- 7.3.10.2 Top Products/Product Portfolio

- 7.3.10.3 Top Competitors

- 7.3.10.4 Target Customers

- 7.3.10.5 Key Personal

- 7.3.10.6 Analyst View

- 7.3.11 Beijing Baihui Weikang Technology Co., Ltd.

- 7.3.11.1 Overview

- 7.3.11.2 Top Products/Product Portfolio

- 7.3.11.3 Top Competitors

- 7.3.11.4 Target Customers

- 7.3.11.5 Key Personal

- 7.3.11.6 Analyst View

- 7.3.12 Brain Navi Biotechnology Co. Ltd

- 7.3.12.1 Overview

- 7.3.12.2 Top Products/Product Portfolio

- 7.3.12.3 Top Competitors

- 7.3.12.4 Target Customers

- 7.3.12.5 Key Personal

- 7.3.12.6 Analyst View

- 7.3.13 Beijing Tinavi Medical Technologies Co., Ltd.

- 7.3.13.1 Overview

- 7.3.13.2 Top Products/Product Portfolio

- 7.3.13.3 Top Competitors

- 7.3.13.4 Target Customers

- 7.3.13.5 Key Personal

- 7.3.13.6 Analyst View

- 7.3.1 Brainlab AG

8 Research Methodology

- 8.1 Data Sources

- 8.1.1 Primary Data Sources

- 8.1.2 Secondary Data Sources

- 8.1.3 Data Triangulation

- 8.2 Market Estimation and Forecast