|

|

市場調査レポート

商品コード

1749758

アルコール関連肝疾患の世界市場:適応症・地域・国別の分析・予測 (2025-2035年)Alcohol Related Liver Disease Market - A Global and Regional Analysis: Focus on Indication, Country, and Region - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| アルコール関連肝疾患の世界市場:適応症・地域・国別の分析・予測 (2025-2035年) |

|

出版日: 2025年06月18日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アルコール関連肝疾患 (ARLD) 市場の主な促進要因の一つは、世界的に過度のアルコール摂取が増加していることです。

暴飲暴食やアルコールの大量摂取が特に若年層で増加し続けているため、アルコール性脂肪肝 (AFLD) やアルコール性肝炎、肝硬変、肝不全などの肝臓関連疾患の発生率も高まっています。この動向は、効果的な治療オプションや介入に対する需要の高まりにつながり、同市場を牽引しています。さらに、アルコールによる肝臓への悪影響に関する社会的認知の高まりや、診断技術や医薬品開発の進展が早期発見と治療を後押しし、市場成長をさらに促進しています。

一方で、ARLD市場の成長にはいくつかの課題も存在します。最大の課題の一つが、診断の遅れと疾患の過少報告です。特にアルコール性脂肪肝 (AFLD) などの初期段階では自覚症状がほとんどないため、多くの人が病気に気づかず、肝炎や肝硬変といった深刻な段階に進行してから診断されることが少なくありません。このような診断の遅れは、早期介入の効果を制限し、肝移植といった高額かつ侵襲的な治療が必要になるリスクを高めます。さらに、アルコール依存や肝疾患に対する社会的偏見が、患者の受診をためらわせる要因にもなっています。このような背景から、高度な治療法が開発されつつある一方で、広範な早期発見の欠如が市場成長の大きな障壁となっています。

市場の分類

セグメンテーション1:適応症別

- アルコール性脂肪肝

- アルコール性肝炎

- 肝線維症

- 肝硬変

セグメンテーション2:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

当レポートでは、世界のアルコール関連肝疾患の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の分析、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 世界のアルコール関連肝疾患市場:業界の展望

- 市場動向

- 規制の枠組み

- 疫学分析

- 臨床試験分析

- 市場力学

- 影響分析

- 市場促進要因

- 市場の課題

- 市場機会

第2章 世界のアルコール関連肝疾患市場:適応症別

- アルコール性脂肪肝

- アルコール性肝炎

- 肝線維症

- 肝硬変

第3章 世界のアルコール関連肝疾患市場:地域別

- 北米

- 欧州

- アジア太平洋

- 主な調査結果

- 市場力学

- 市場規模・予測

第4章 世界のアルコール関連肝疾患市場:競合情勢と企業プロファイル

- 主要戦略と開発

- M&A

- 相乗効果のある活動

- 事業拡大と資金調達

- 製品の発売と承認

- その他の活動

- 企業プロファイル

- Merck KGaA

- Pfizer Inc.

- Novartis AG

- AbbVie Inc.

- Gilead Sciences Inc.

- Intercept Pharmaceuticals

- Durect

第5章 調査手法

List of Figures

- Figure: Global Alcohol Related Liver Disease Market (by Region), $Billion, 2024 and 2035

- Figure: Global Alcohol Related Liver Disease Market Key Trends, Analysis

List of Tables

- Table: Global Alcohol Related Liver Disease Market Dynamics, Impact Analysis

- Table: Global Alcohol Related Liver Disease Market (by Region), $Billion, 2024-2035

- Table: Global Alcohol Related Liver Disease Market (by Indication), $Billion, 2024-2035

Global Alcohol Related Liver Disease Market, Analysis and Forecast: 2025-2035

Alcohol-related liver disease (ARLD) is a spectrum of liver conditions that develop due to excessive alcohol consumption over time. The disease ranges from early-stage conditions such as alcoholic fatty liver disease (AFLD) to more advanced stages, such as alcoholic hepatitis, liver fibrosis, and cirrhosis. Alcohol-related liver disease occurs because the liver, which is responsible for processing alcohol, becomes overwhelmed and damaged by excessive intake. In the early stages, fatty deposits build up in the liver cells (AFLD), but as the disease progresses, it can lead to inflammation (alcoholic hepatitis), scarring (fibrosis), and eventually irreversible damage (cirrhosis), which severely impairs liver function. If left untreated, Alcohol-related liver disease can result in liver failure and increase the risk of liver cancer. Early diagnosis and lifestyle changes, such as reducing or ceasing alcohol consumption, are crucial for managing the disease and preventing its progression to more severe stages.

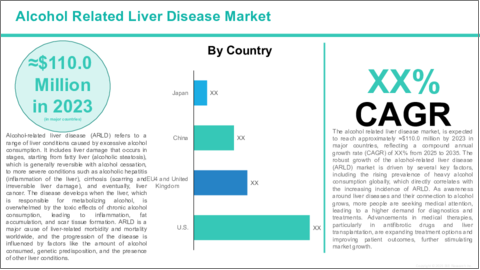

One of the key drivers of the alcohol-related liver disease (ARLD) market is the increasing prevalence of excessive alcohol consumption worldwide. As binge drinking and heavy alcohol use continue to rise, particularly among younger populations, the incidence of liver-related diseases such as alcoholic fatty liver disease (AFLD), alcoholic hepatitis, cirrhosis, and liver failure is also growing. This trend is leading to higher demand for effective treatment options and interventions, driving the market for Alcohol-related liver disease therapies. Additionally, greater public awareness of the harmful effects of alcohol on liver health, combined with advancements in diagnostic technologies and drug development, is encouraging early detection and treatment, further boosting market growth.

Despite the growth of the alcohol-related liver disease (ARLD) market, several challenges continue to impede its full potential. One major challenge is the late-stage diagnosis and underreporting of the disease. Alcohol-related liver disease, particularly in its early stages such as alcoholic fatty liver disease (AFLD), often presents with no symptoms, leading many individuals to remain unaware of their condition until it progresses to more severe stages such as alcoholic hepatitis or cirrhosis. This delay in diagnosis limits the effectiveness of early intervention, which is crucial for preventing further liver damage and reducing the need for costly treatments such as liver transplantation. Additionally, the social stigma surrounding alcohol use and liver disease can discourage individuals from seeking medical help, further exacerbating the problem. As a result, while treatments for advanced Alcohol-related liver disease are improving, the lack of widespread early detection remains a significant barrier to realizing the full potential of the market.

The global alcohol-related liver disease (ARLD) market is highly competitive, with several key players driving innovation and market growth. Leading companies such as Merck KGaA, Pfizer Inc., Novartis AG, AbbVie Inc., Gilead Sciences Inc., Intercept Pharmaceuticals, and Durect are at the forefront of developing cutting-edge therapies and advancing research. These companies are focusing on expanding their product portfolios to include novel drugs targeting the various stages of alcohol-related liver disease, including antifibrotic agents, anti-inflammatory treatments, and liver-protective therapies. Their commitment to innovation, alongside strategic partnerships and collaborations, is helping accelerate the development of effective treatments for alcohol-related liver disease. With the increasing prevalence of alcohol consumption and growing awareness of liver health, these industry leaders are well-positioned to capture a significant share of the alcohol-related liver disease market while improving patient outcomes through advanced therapeutic options.

Market Segmentation:

Segmentation 1: by Indication

- Alcoholic Fatty Liver Disease

- Alcoholic Liver Hepatitis

- Liver Fibrosis

- Liver Cirrhosis

Segmentation 2: by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

The global alcohol-related liver disease (ARLD) market is experiencing several key emerging trends that are reshaping the landscape, driving growth, and improving patient outcomes. One of the most significant trends is the growing focus on early diagnosis and detection. With advancements in non-invasive diagnostic technologies, such as biomarker-based blood tests and advanced imaging techniques, healthcare providers are now able to identify liver conditions such as alcoholic fatty liver disease (AFLD) at earlier stages, allowing for timely interventions. Another key trend is the development of targeted therapies, particularly antifibrotic agents for cirrhosis and novel treatments for alcoholic hepatitis, which are expanding the treatment options available to patients. Additionally, there is an increased emphasis on personalized medicine, with therapies being tailored to individual patients based on their unique genetic profiles and disease progression. The market is also being reshaped by rising public awareness of the impact of alcohol on liver health, coupled with public health initiatives aimed at reducing excessive alcohol consumption. Finally, the growing availability of liver transplantation and advancements in regenerative medicine are offering hope for patients with end-stage liver disease, contributing to the market's overall expansion.

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Inclusion and Exclusion

Key Questions Answered

Analysis and Forecast Note

1. Global Alcohol Related Liver Disease Market: Industry Outlook

- 1.1 Introduction

- 1.2 Market Trends

- 1.3 Regulatory Framework

- 1.4 Epidemiology Analysis

- 1.5 Clinical Trial Analysis

- 1.6 Market Dynamics

- 1.6.1 Impact Analysis

- 1.6.2 Market Drivers

- 1.6.3 Market Challenges

- 1.6.4 Market Opportunities

2. Global Alcohol Related Liver Disease Market (Indication), ($Billion), 2023-2035

- 2.1 Alcoholic Fatty Liver Disease

- 2.2 Alcoholic Liver Hepatitis

- 2.3 Liver Fibrosis

- 2.4 Liver Cirrhosis

3. Global Alcohol Related Liver Disease Market (Region), ($Billion), 2023-2035

- 3.1 North America

- 3.1.1 Key Findings

- 3.1.2 Market Dynamics

- 3.1.3 Market Sizing and Forecast

- 3.1.3.1 North America Alcohol Related Liver Disease Market, by Country

- 3.1.3.1.1 U.S.

- 3.1.3.1 North America Alcohol Related Liver Disease Market, by Country

- 3.2 Europe

- 3.2.1 Key Findings

- 3.2.2 Market Dynamics

- 3.2.3 Market Sizing and Forecast

- 3.2.3.1 Europe Alcohol Related Liver Disease Market, by Country

- 3.2.3.1.1 Germany

- 3.2.3.1.2 U.K.

- 3.2.3.1.3 France

- 3.2.3.1.4 Italy

- 3.2.3.1 Europe Alcohol Related Liver Disease Market, by Country

- 3.3 Asia Pacific

- 3.3.1 Key Findings

- 3.3.2 Market Dynamics

- 3.3.3 Market Sizing and Forecast

- 3.3.3.1 Asia Pacific Alcohol Related Liver Disease Market, by Country

- 3.3.3.1.1 China

- 3.3.3.1.2 Japan

- 3.3.3.1 Asia Pacific Alcohol Related Liver Disease Market, by Country

4. Global Alcohol Related Liver Disease Market: Competitive Landscape and Company Profiles

- 4.1 Key Strategies and Development

- 4.1.1 Mergers and Acquisitions

- 4.1.2 Synergistic Activities

- 4.1.3 Business Expansions and Funding

- 4.1.4 Product Launches and Approvals

- 4.1.5 Other Activities

- 4.2 Company Profiles

- 4.2.1 Merck KGaA

- 4.2.1.1 Overview

- 4.2.1.2 Top Products / Product Portfolio

- 4.2.1.3 Top Competitors

- 4.2.1.4 Target Customers/End-Users

- 4.2.1.5 Key Personnel

- 4.2.1.6 Analyst View

- 4.2.2 Pfizer Inc.

- 4.2.2.1 Overview

- 4.2.2.2 Top Products / Product Portfolio

- 4.2.2.3 Top Competitors

- 4.2.2.4 Target Customers/End-Users

- 4.2.2.5 Key Personnel

- 4.2.2.6 Analyst View

- 4.2.3 Novartis AG

- 4.2.3.1 Overview

- 4.2.3.2 Top Products / Product Portfolio

- 4.2.3.3 Top Competitors

- 4.2.3.4 Target Customers/End-Users

- 4.2.3.5 Key Personnel

- 4.2.3.6 Analyst View

- 4.2.4 AbbVie Inc.

- 4.2.4.1 Overview

- 4.2.4.2 Top Products / Product Portfolio

- 4.2.4.3 Top Competitors

- 4.2.4.4 Target Customers/End-Users

- 4.2.4.5 Key Personnel

- 4.2.4.6 Analyst View

- 4.2.5 Gilead Sciences Inc.

- 4.2.5.1 Overview

- 4.2.5.2 Top Products / Product Portfolio

- 4.2.5.3 Top Competitors

- 4.2.5.4 Target Customers/End-Users

- 4.2.5.5 Key Personnel

- 4.2.5.6 Analyst View

- 4.2.6 Intercept Pharmaceuticals

- 4.2.6.1 Overview

- 4.2.6.2 Top Products / Product Portfolio

- 4.2.6.3 Top Competitors

- 4.2.6.4 Target Customers/End-Users

- 4.2.6.5 Key Personnel

- 4.2.6.6 Analyst View

- 4.2.7 Durect

- 4.2.7.1 Overview

- 4.2.7.2 Top Products / Product Portfolio

- 4.2.7.3 Top Competitors

- 4.2.7.4 Target Customers/End-Users

- 4.2.7.5 Key Personnel

- 4.2.7.6 Analyst View

- 4.2.1 Merck KGaA