|

|

市場調査レポート

商品コード

1748472

欧州の鉱業・鉄鋼業:最終用途・製造手法・最終製品・国別の分析・予測 (2025-2035年)Europe Mining Steel Industry Market: Focus on End-User Application, Production Methodology, End Products, and Country - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の鉱業・鉄鋼業:最終用途・製造手法・最終製品・国別の分析・予測 (2025-2035年) |

|

出版日: 2025年06月16日

発行: BIS Research

ページ情報: 英文 123 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の鉱業・鉄鋼業の市場規模は、2024年の1,242億米ドルから、CAGR 5.17%で推移し、2035年には2,176億米ドルの規模に成長すると予測されています。

欧州の鉄鋼市場は、インフラ、自動車、建設などの重要産業からの需要増加により堅調に拡大しています。同地域では、電気アーク炉 (EAF)、直接還元鉄 (DRI) 技術の利用拡大、再生可能エネルギーの導入など、より環境に優しい製造への取り組みがこの動向を支えています。こうした開発を支えるため、欧州では、原料炭や鉄鉱石などの原料供給網への投資が増加し、鉄鋼製造技術も飛躍的に向上しています。業界が低炭素でエネルギー効率の高い製鉄へのシフトを加速させる中、欧州は今後数年間で、世界の鉱業・鉄鋼シーンにおける地位を確固たるものにする好位置につけています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2035年 |

| 2025年評価 | 1,315億米ドル |

| 2035年予測 | 2,176億米ドル |

| CAGR | 5.17% |

欧州の鉱業・鉄鋼業は、同地域のインフラ、産業基盤の成長、低炭素経済への移行に不可欠です。欧州の鉄鋼市場は、機械、建築、エネルギー、自動車などの重要産業からの需要に牽引され、経済活動の重要な構成要素であり続けています。同地域が輸入に依存し続けているにもかかわらず、鉱業部門は鉄鉱石、原料炭、主要鉱物を含む重要な原材料の安定供給を保証しています。

気候目標と環境規則が、この事業の大幅な転換を促しています。電気アーク炉 (EAF)、水素ベースの直接還元鉄 (DRI)、鉄鋼リサイクルのような循環経済技術は、欧州の鉄鋼製造業者が段階的に導入している持続可能な製造技術のひとつです。これらの取り組みは、Fit for 55パッケージやGreen Dealなど、産業の回復力を向上させ、二酸化炭素排出量を削減することを目的としたEUの政策枠組みに沿ったものです。

自動化、デジタル化、技術革新はすべて、バリューチェーン全体の製造性と競争力の向上に寄与しています。しかし、エネルギーコストの高騰、国際貿易からの圧力、規制遵守は、ビジネスが直面する困難の一部です。こうした障害にもかかわらず、欧州の鉱業・鉄鋼業は、賢明な投資、法的支援、持続可能な素材へのニーズの高まりに支えられ、持続的な拡大に向かっています。

セグメンテーション1:最終用途別

- 輸送 (自動車およびその他の輸送)

- 建築・建設・インフラ

- 消費財・家電

- 産業機器・製造

- 包装

- その他

セグメンテーション2:製造手法別

- 高炉-基礎酸素炉 (BF-BOF)

- 直接還元鉄-電気アーク炉 (DRI-EAF)

- その他の新技術

セグメンテーション3:最終製品別

- 炭素鋼

- 合金鋼

- ステンレス鋼

- 高強度鋼

- その他

セグメンテーション4:地域別

- ドイツ、フランス、オーストリア、イタリア、英国、その他

欧州の鉱業・鉄鋼業の市場動向と促進要因・課題

動向

- EAFと水素ベースDRIによる低炭素鉄鋼製造へのシフト

- リサイクル鉄鋼の使用と循環型経済慣行の増加

- AI、自動化、IoTなどのデジタル技術の採鉱・製鉄プラントへの導入

- 建設、自動車、再生可能エネルギー部門からの需要の伸び

- 原料確保のための戦略的パートナーシップと合弁事業

- 輸入への依存を減らすための国内鉱業への投資の増加

促進要因

- 脱炭素化を推進するEU Green DealとFit for 55イニシアティブ

- 高品質で持続可能な方法で製造される鉄鋼への旺盛な需要

- グリーンスチール技術に対する政府の優遇措置と資金援助

- インフラ開発と再生可能エネルギー導入の拡大

- 電気自動車製造の拡大が先進鉄鋼需要を押し上げる

- 製造における資源効率とエネルギー最適化の重視

課題

- 世界の競合他社に比べて高いエネルギーコストと操業コスト

- 環境および炭素コンプライアンスをめぐる複雑な規制

- 鉄鉱石や原料炭などの輸入原材料への依存

- 世界の鉄鋼製造能力の過剰と関税による貿易圧力

- クリーン製造技術への大規模投資の必要性

- デジタルトランスフォーメーションへの適応に必要な労働力のスキルアップ

当レポートでは、欧州の鉱業・鉄鋼業を調査し、主要動向、市場影響因子の分析、技術・特許の分析、製造動向、法規制環境、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 動向:現状と将来への影響評価

- 鉱業および鉄鋼製造プロセスの自動化

- 新興市場からの需要増加

- サプライチェーンの概要

- バリューチェーン分析

- サプライチェーンの制約

- 価格分析

- マーケットマップ (バリューチェーン全体のステークホルダーマッピング)

- 特許出願動向 (国・企業別)

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

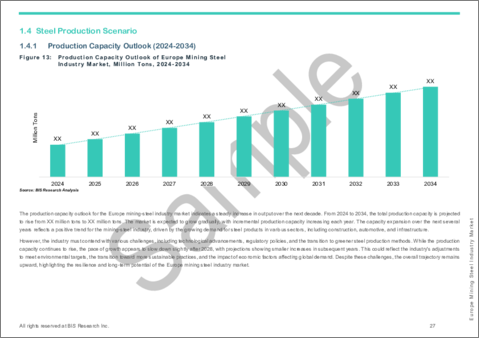

- 鉄鋼製造シナリオ

- 製造能力の見通し

- 規制状況

- ステークホルダー分析

- 製造プロセス別の設備容量 (高炉-BOFおよびDRI-EAF)

- 今後のプロジェクトと容量増加

- 進行中の投資

- スクラップリサイクル市場概要

- 排出削減イニシアチブ (鉱業から鉄鋼業への移行)

- グリーンスチール市場の見通し

- 市場規模と成長予測

- グリーンスチールが従来の鉄鋼市場に与える影響

- グリーンスチール導入の課題と促進要因

- 主要なグリーンスチールプロジェクトとイニシアチブ

第2章 地域

- 地域サマリー

- 欧州

- 市場

- 用途

- 製品

- 鉱業・鉄鋼業の製造シナリオ

- 欧州 (国別)

第3章 市場:競合ベンチマーキングと企業プロファイル

- 次のフロンティア

- 地理的評価

- 企業プロファイル

- ArcelorMittal

- thyssenkrupp AG

- Salzgitter AG

第4章 調査手法

List of Figures

- Figure 1: Europe Mining Steel Industry Market (by Scenario), $Billion, 2025, 2028, and 2035

- Figure 2: Mining-Steel Industry Market (by Region), $Billion, 2024, 2028, and 2035

- Figure 3: Europe Mining Steel Industry Market (by End-Use Application), $Billion, 2024, 2028, and 2035

- Figure 4: Europe Mining Steel Industry Market (by Production Methodology), $Billion, 2024, 2028, and 2035

- Figure 5: Europe Mining Steel Industry Market (by End Products), $Billion, 2024, 2028, and 2035

- Figure 6: Key Events

- Figure 7: Cumulative Growth of Autonomous Haulage System (AHS) Trucks in Open-Pit Mining Operations, 2019-2023

- Figure 8: Supply Chain

- Figure 9: Value Chain

- Figure 10: Key Iron Ore Producing Countries and their Mining Capacity, Million Tons, 2023

- Figure 11: Key Coking Coal Exporting Nations, % Share, 2023

- Figure 12: Pricing Analysis of the Europe Mining Steel Industry Market, $/Ton, 2024-2035

- Figure 13: Stakeholder Mapping across Value Chain

- Figure 14: Patent Analysis (by Country), January 2022-March 2025

- Figure 15: Patent Analysis (by Company), January 2022-March 2025

- Figure 16: Global Population Living in Urban and Rural Areas, $Billion, 2019-2023

- Figure 17: Regional Private Participation in Infrastructure, $Billion, 2022 and 2023

- Figure 18: Additional Financing Included in the Bipartisan Infrastructure Law, $Billion

- Figure 19: Estimated Capital Expenditures for Top Six Large Steel Companies, $Billion

- Figure 20: Production Capacity Outlook of Europe Mining Steel Industry Market, Million Tons, 2024-2034

- Figure 21: Stakeholder Analysis in the Europe Mining Steel Industry Market

- Figure 22: Estimated Installed Capacity by Blast Furnace-BOF Process in Different Regions, Million Tons, 2021-2024

- Figure 23: Estimated Installed Capacity by DRI-EAF Process in Different Regions, Million Tons, 2021-2024

- Figure 24: Estimated Steel Capacity (TTPA) by Development Status in Each Region, Million Tons, 2025

- Figure 25: Steel Production Output

- Figure 26: Green Steel Market (by Scenario), $Billion, 2023, 2026, and 2034

- Figure 27: Conventional Steel Overview

- Figure 28: Production Process Overview

- Figure 29: Companies Across the Green Steel Value Chain

- Figure 30: Major Steel Producers in Europe: Headquarters and 2023 Steel Production

- Figure 31: Estimated Crude Steel Production Capacity and Actual Crude Steel Production in Europe, Million Tons, 2021-2024

- Figure 32: Germany Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 33: Total Crude Steel Production, Germany, Thousand Tons, 2021-2024

- Figure 34: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 35: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 36: External Steel Scrap Exports, Germany, 2020-2021

- Figure 37: Raw Materials Import Countries/Location

- Figure 38: France Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 39: Total Crude Steel Production, France, Thousand Tons, 2021-2024

- Figure 40: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 41: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 42: Main Steel Scrap Export, France, Million Tons, 2020-2021

- Figure 43: Raw Materials Import Countries/Location

- Figure 44: Austria Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 45: Total Crude Steel Production, Austria, Thousand Tons, 2021-2024

- Figure 46: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 47: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 48: Main Steel Scrap Export, Austria, Million Tons, 2020-2021

- Figure 49: Raw Materials Import Countries/Location

- Figure 50: Italy Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 51: Total Crude Steel Production, Italy, Thousand Tons, 2021-2024

- Figure 52: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 53: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 54: Raw Materials Import Countries/Location

- Figure 55: U.K. Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 56: Total Crude Steel Production, U.K., Thousand Tons, 2021-2024

- Figure 57: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 58: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 59: Steel Scrap Export, U.K., Million Tons, 2020-2021

- Figure 60: Raw Materials Import Countries/Location

- Figure 61: Rest-of-Europe Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 62: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 63: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 64: Raw Materials Import Countries/Location

- Figure 65: Strategic Initiatives, January 2022-March 2025

- Figure 66: Share of Strategic Initiatives, 2023

- Figure 67: Data Triangulation

- Figure 68: Top-Down and Bottom-Up Approach

- Figure 69: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends Overview

- Table 5: Impact Analysis of Market Navigating Factors, 2024-2035

- Table 6: Major Infrastructure Projects and Expected Steel Demand Increase

- Table 7: Regulations/Standards in the Europe Mining Steel Industry

- Table 8: Upcoming Projects and Capacity Additions in the Mining Steel Industry Market

- Table 9: World's Largest Iron Ore Producers and their Capacity

- Table 10: Ongoing Investments in the Europe Mining Steel Industry Market

- Table 11: Lifespan of Steel Products and their Recycling Rates

- Table 12: Recycled Steel Use in Crude Steel Production, Million Tons, 2022

- Table 13: Climate Targets of Global Steel Manufacturers

- Table 14: Green Steelmaking Initiatives

- Table 15: Mining-Steel Industry Market (by Region), $Billion, 2024-2035

- Table 16: Europe Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 17: Europe Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 18: Europe Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 19: Germany Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 20: Germany Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 21: Germany Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 22: List of Upcoming Projects in Germany

- Table 23: Investment Scenario in Germany

- Table 24: France Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 25: France Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 26: France Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 27: List of Upcoming Projects in France

- Table 28: Investment Scenario in France

- Table 29: Austria Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 30: Austria Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 31: Austria Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 32: List of Upcoming Projects in Austria

- Table 33: Investment Scenario in Austria

- Table 34: Italy Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 35: Italy Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 36: Italy Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 37: List of Upcoming Projects in Italy

- Table 38: Investment Scenario in Italy

- Table 39: U.K. Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 40: U.K. Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 41: U.K. Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 42: List of Upcoming Projects in U.K.

- Table 43: Investment Scenario in U.K.

- Table 44: Rest-of-Europe Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 45: Rest-of-Europe Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 46: Rest-of-Europe Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 47: List of Upcoming Projects in Rest-of-Europe

- Table 48: Investment Scenario in Rest-of-Europe

- Table 49: Market Share

Introduction to Europe Mining Steel Industry Market

The Europe mining steel industry market was valued at $124.2 billion in 2024 and is projected to grow at a CAGR of 5.17%, reaching $217.6 billion by 2035. The steel market in Europe is expanding steadily due to increased demand from important industries like infrastructure, automotive, and construction. The region's drive for greener manufacturing-which includes a greater use of electric arc furnaces (EAF), direct reduced iron (DRI) technology, and the incorporation of renewable energy sources-supports this trend. In order to support these developments, Europe is seeing an increase in investment in supply networks for raw materials, such as coking coal and iron ore, as well as breakthroughs in steel production techniques. Europe is well-positioned to solidify its place in the global mining and steel scene in the upcoming years as the industry quickens its shift to low-carbon and energy-efficient steelmaking.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $131.5 Billion |

| 2035 Forecast | $217.6 Billion |

| CAGR | 5.17% |

The mining and steel sector in Europe is essential to the growth of the region's infrastructure, industrial base, and shift to a low-carbon economy. The European steel market continues to be a vital component of economic activity, driven by demand from important industries like machinery, building, energy, and automobiles. Despite the region's continued reliance on imports, the mining sector guarantees a steady supply of vital raw materials including iron ore, coking coal, and key minerals.

Climate goals and environmental rules are driving a substantial transition in the business. Electric arc furnaces (EAF), hydrogen-based direct reduced iron (DRI), and circular economy techniques like steel recycling are among the sustainable production techniques that European steelmakers are progressively implementing. These initiatives are in line with EU policy frameworks that aim to improve industrial resilience and reduce carbon emissions, such as the Fit for 55 package and the Green Deal.

Automation, digitisation, and technological innovation are all contributing to increased productivity and competitiveness throughout the value chain. High energy costs, pressures from international trade, and regulatory compliance are some of the difficulties the business faces, though. Notwithstanding these obstacles, the mining and steel sector in Europe is poised for sustained expansion, bolstered by smart investments, legislative backing, and the growing need for sustainable materials.

Market Segmentation

Segmentation 1: by End-Use Application

- Transportation (Automotive and Other Transportation)

- Building, Construction, and Infrastructure

- Consumer Goods and Appliances

- Industrial Equipment and Manufacturing

- Packaging

- Others

Segmentation 2: by Production Methodology

- Blast Furnace-Basic Oxygen Furnace (BF-BOF)

- Direct Reduced Iron - Electric Arc Furnace (DRI-EAF)

- Other Emerging Technologies

Segmentation 3: by End Products

- Carbon Steel

- Alloy Steel

- Stainless Steel

- High-Strength Steel

- Others

Segmentation 4: by Region

- Europe: Germany, France, Austria, Italy, U.K., and Rest-of-Europe

Europe Mining Steel Industry Market Trends, Drivers and Challenges

Trends

- Shift toward low-carbon steel production using EAFs and hydrogen-based DRI

- Increasing use of recycled steel and circular economy practices

- Adoption of digital technologies like AI, automation, and IoT in mining and steel plants

- Growth in demand from construction, automotive, and renewable energy sectors

- Strategic partnerships and joint ventures for raw material security

- Rising investment in domestic mining to reduce reliance on imports

Drivers

- EU Green Deal and Fit for 55 initiative pushing for decarbonization

- Strong demand for high-quality, sustainably produced steel

- Government incentives and funding for green steel technologies

- Growing infrastructure development and renewable energy installations

- Expansion of electric vehicle production boosting advanced steel demand

- Focus on resource efficiency and energy optimization in manufacturing

Challenges

- High energy and operational costs compared to global competitors

- Regulatory complexities around environmental and carbon compliance

- Dependency on imported raw materials like iron ore and coking coal

- Trade pressures due to global steel overcapacity and tariffs

- Need for large-scale investment in clean production technologies

- Workforce upskilling required to adapt to digital transformation

How can this report add value to an organization?

Product/Innovation Strategy: The Europe mining steel industry market is segmented based on various applications, production methodology, and end-products, which provides valuable insights. By end-use application segment includes transportation (automotive and other transportation), building, construction, and infrastructure, consumer goods and appliances, industrial equipment and manufacturing, packaging, and others. By production methodology, the market is categorized into a blast furnace-basic oxygen furnace (BF-BOF), direct reduced iron-electric arc furnace (DRI-EAF), and other emerging technologies. Lastly, the end products include carbon steel, alloy steel, stainless steel, high-strength steel, and others.

Growth/Marketing Strategy: The Europe mining steel industry market has been growing. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development.

Competitive Strategy: The key players in the Europe mining steel industry market analyzed and profiled in the study include professionals with expertise in the mining and steel industry. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled in the Europe mining steel industry market have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- ArcelorMittal

- thyssenkrupp AG

- Salzgitter AG

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Automation in Mining and Steel Production Processes

- 1.1.2 Increased Demand from Emerging Markets

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.1.1 Key Iron Ore Producing Nations and Mining Capacity

- 1.2.1.2 Key Coking Coal Exporting Nations

- 1.2.2 Supply Chain Constraints

- 1.2.3 Pricing Analysis

- 1.2.4 Market Map (Stakeholder Mapping across Value Chain)

- 1.2.1 Value Chain Analysis

- 1.3 Patent Filing Trend (by Country, Company)

- 1.4 Market Dynamics Overview

- 1.4.1 Market Drivers

- 1.4.1.1 Urbanization and Infrastructure Growth

- 1.4.1.2 Public-Private Investments in Infrastructure

- 1.4.2 Market Restraints

- 1.4.2.1 Volatility in Raw Material Prices

- 1.4.2.2 Geopolitical and Trade Tensions

- 1.4.3 Market Opportunities

- 1.4.3.1 Growing Demand for Specialty Steel Products

- 1.4.3.2 Technological Innovation in Steelmaking

- 1.4.1 Market Drivers

- 1.5 Steel Production Scenario

- 1.5.1 Production Capacity Outlook (2024-2034)

- 1.5.2 Regulatory Landscape

- 1.5.3 Stakeholder Analysis

- 1.5.4 Installed Capacity by Production Process (Blast Furnace-BOF and DRI-EAF)

- 1.5.5 Upcoming Projects and Capacity Additions (2025-2035)

- 1.5.6 Ongoing Investments

- 1.5.7 Scrap Recycling Market Overview

- 1.5.8 Emission Reduction Initiatives (Mining Steel Industry Transition)

- 1.6 Green-Steel Market Outlook

- 1.6.1 Market Size and Growth Forecast (2024-2034)

- 1.6.2 Impact of Green Steel on Conventional Steel Market

- 1.6.3 Challenges and Enablers for Green-Steel Adoption

- 1.6.4 Key Green-Steel Projects and Initiatives

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Markets

- 2.2.1.1 Key Market Participants in Europe

- 2.2.1.2 Driving Factors for Market Growth

- 2.2.1.3 Factors Challenging the Market

- 2.2.2 Application

- 2.2.3 Product

- 2.2.4 Mining-Steel Industry Production Scenario

- 2.2.5 Europe (by Country)

- 2.2.5.1 Germany

- 2.2.5.1.1 Application

- 2.2.5.1.2 Product

- 2.2.5.1.3 Installed Capacity and Production by Process

- 2.2.5.1.3.1 Upcoming Projects

- 2.2.5.1.3.2 Ongoing Investments

- 2.2.5.1.3.3 Scrap Recycling Overview

- 2.2.5.1.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 2.2.5.1.4.1 Consumption by Key Companies

- 2.2.5.1.4.2 Import Locations/Countries

- 2.2.5.2 France

- 2.2.5.2.1 Application

- 2.2.5.2.2 Product

- 2.2.5.2.3 Installed Capacity and Production by Process

- 2.2.5.2.3.1 Upcoming Projects

- 2.2.5.2.3.2 Ongoing Investments

- 2.2.5.2.3.3 Scrap Recycling Overview

- 2.2.5.2.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 2.2.5.2.4.1 Consumption by Key Companies

- 2.2.5.2.4.2 Import Locations/Countries

- 2.2.5.3 Austria

- 2.2.5.3.1 Application

- 2.2.5.3.2 Product

- 2.2.5.3.3 Installed Capacity and Production by Process

- 2.2.5.3.3.1 Upcoming Projects

- 2.2.5.3.3.2 Ongoing Investments

- 2.2.5.3.3.3 Scrap Recycling Overview

- 2.2.5.3.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 2.2.5.3.4.1 Consumption by Key Companies

- 2.2.5.3.4.2 Import Locations/Countries

- 2.2.5.4 Italy

- 2.2.5.4.1 Application

- 2.2.5.4.2 Product

- 2.2.5.4.3 Installed Capacity and Production by Process

- 2.2.5.4.3.1 Upcoming Projects

- 2.2.5.4.3.2 Ongoing Investments

- 2.2.5.4.3.3 Scrap Recycling Overview

- 2.2.5.4.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 2.2.5.4.4.1 Consumption by Key Companies

- 2.2.5.4.4.2 Import Locations/Countries

- 2.2.5.5 U.K.

- 2.2.5.5.1 Application

- 2.2.5.5.2 Product

- 2.2.5.5.3 Installed Capacity and Production by Process

- 2.2.5.5.3.1 Upcoming Projects

- 2.2.5.5.3.2 Ongoing Investments

- 2.2.5.5.3.3 Scrap Recycling Overview

- 2.2.5.5.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 2.2.5.5.4.1 Consumption by Key Companies

- 2.2.5.5.4.2 Import Locations/Countries

- 2.2.5.6 Rest-of-Europe

- 2.2.5.6.1 Application

- 2.2.5.6.2 Product

- 2.2.5.6.3 Installed Capacity and Production by Process

- 2.2.5.6.3.1 Upcoming Projects

- 2.2.5.6.3.2 Ongoing Investments

- 2.2.5.6.3.3 Scrap Recycling Overview

- 2.2.5.6.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 2.2.5.6.4.1 Consumption by Key Companies

- 2.2.5.6.4.2 Import Locations/Countries

- 2.2.5.1 Germany

- 2.2.1 Markets

3 Markets - Competitive Benchmarking and Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.3 Company Profiles

- 3.3.1 ArcelorMittal

- 3.3.1.1 Overview

- 3.3.1.2 Top Products/Product Portfolio

- 3.3.1.3 Top Competitors

- 3.3.1.4 End-Use Industry

- 3.3.1.5 Key Personnel

- 3.3.1.6 Analyst View

- 3.3.1.7 Market Share, 2023

- 3.3.2 thyssenkrupp AG

- 3.3.2.1 Overview

- 3.3.2.2 Top Products/Product Portfolio

- 3.3.2.3 Top Competitors

- 3.3.2.4 End-Use Industry

- 3.3.2.5 Key Personnel

- 3.3.2.6 Analyst View

- 3.3.2.7 Market Share, 2023

- 3.3.3 Salzgitter AG

- 3.3.3.1 Overview

- 3.3.3.2 Top Products/Product Portfolio

- 3.3.3.3 Top Competitors

- 3.3.3.4 End-Use Industry

- 3.3.3.5 Key Personnel

- 3.3.3.6 Analyst View

- 3.3.3.7 Market Share, 2023

- 3.3.1 ArcelorMittal

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast