|

|

市場調査レポート

商品コード

1747199

自律型緊急操舵システム市場- 世界と地域別分析:技術別、自動化レベル別、車両タイプ別、コンポーネント別、国別 - 分析と予測(2025年~2034年)Autonomous Emergency Steering Systems Market - A Global and Regional Analysis: Focus on Technology, Level of Automation, Vehicle Type, Components, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 自律型緊急操舵システム市場- 世界と地域別分析:技術別、自動化レベル別、車両タイプ別、コンポーネント別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月13日

発行: BIS Research

ページ情報: 英文 140 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

自律型緊急操舵システム市場は、より広範なADAS(先進運転支援システム)と自律走行車の技術展望の中で極めて重要な要素です。

車両の自動化が進化し続ける中、AESSのような安全システムは、ドライバー制御から完全な自律走行へのスムーズな移行を保証するために不可欠となっています。AESSは、緊急事態の際に介入し、衝突を回避したりその影響を軽減したりするために車両を自律的に操舵し、交通安全を大幅に向上させるように設計されています。

この業界の特徴は、急速な技術革新と、自動化と安全技術への投資の拡大にあります。AESSシステムは、高度なセンサー(LiDAR、レーダー、カメラなど)と洗練されたAIアルゴリズムを組み合わせて使用し、差し迫った危険を検知して、危険から車両を自律的に遠ざける。これらの技術は現在、半自律走行車に統合されつつあり、完全自律走行システムに向けてさらなる進歩が図られています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 18億米ドル |

| 2034年の予測 | 43億4,000万米ドル |

| CAGR | 10.27% |

自律型緊急操舵システム市場のライフサイクル段階

自律型緊急操舵システム市場は、研究開発の後期段階と商業化の初期段階にあり、技術成熟度(TRL)4~7の段階にあります。プロトタイプの改良、先進センサーの統合、信頼性の高い緊急操舵性能のためのAIアルゴリズムの開発に重点が置かれています。各社はコンセプト開発からエンジニアリング・パイロットへと移行しており、実環境でのテストと検証が優先課題となっています。

AESS技術がADAS(先進運転支援システム)を搭載した自動車に統合されるにつれ、自動車メーカー、技術プロバイダー、ティア1サプライヤーの協力が鍵となります。規制の枠組みや安全基準も、より広範な展開をサポートするために改良されています。

半自動運転車や自律走行車の安全性向上に対する需要の高まりに対応するためにメーカーが生産規模を拡大するにつれて、AESSの商業的展開が2020年代半ばになると予想されます。AESS技術の成功にはパートナーシップが不可欠であり、多額の資本が研究開発に投入されています。市場が成熟するにつれ、AESSは自律走行車や半自律走行車の標準機能となり、自動車の安全性に革命をもたらすと思われます。

自律型緊急操舵システム市場のセグメンテーション

セグメンテーション1:技術別

- ライダーベースAESS

- カメラベースAESS

- レーダーベースAESS

- センサーフュージョンベースAESS

セグメンテーション2:自動化レベル別

- 半自律型(レベル1~レベル3)

- 完全自律型(レベル4および5)

セグメント3:車両タイプ別

- 乗用車

- 商用車

セグメント4:コンポーネント別

- センサー

- コントロールユニット

- ステアリング・メカニズム

- ソフトウェア

- 通信システム

セグメンテーション5:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域- 中国、日本、韓国、インド、その他

- その他地域- 南米、中東・アフリカ

需要- 促進要因と抑制要因

自律緊急操舵システム市場の需要促進要因は以下の通りです:

- 高度な車両安全機能に対する需要の増加

- 半自動運転車および自律走行車の採用拡大

- センサー技術とAIアルゴリズムの進歩

自律型緊急操舵システム市場は、以下の課題によっていくつかの制限にも直面すると予想されます:

- 高い開発コストと生産コストによる値ごろ感の制限

- 地域別規制のばらつきが世界展開を複雑化

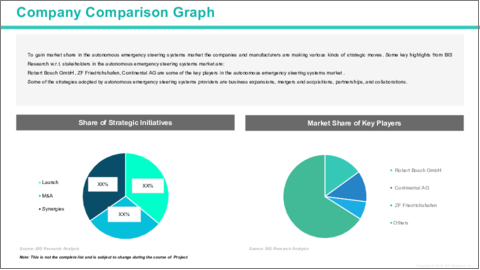

自律型緊急操舵システム市場の主要プレーヤーと競合の概要

自律型緊急操舵市場は、多国籍自動車大手と革新的技術ベンチャーの融合により、高い競合情勢が形成されています。Robert Bosch GmbH、ZF Friedrichshafen、Continental AGといった主要自動車企業は、ADAS(先進運転支援システム)を自社の運転支援技術ポートフォリオに組み込んでおり、最先端を走っています。技術面では、Autoliv Inc.と株式会社デンソーが、AI駆動ステアリングアルゴリズムとセンサーフュージョン技術を組み込んだ最先端の安全ソリューションに取り組んでいます。その他の主要企業では、Nexteer AutomotiveやValeoが、緊急操舵システムの機能と効率の向上に注力しています。一方、Hyundai MobisやMando Corporationのような企業は、高度なセンサー技術と制御システムで自律走行の安全性の限界を押し広げようとしています。一流自動車部品メーカーとの戦略的提携、学術機関との協力、ますます厳しくなる世界安全基準への適合を目指した政府出資の取り組みを通じて、競争はさらに激化しています。各参入企業が先進的なAESSソリューションの開発・展開にしのぎを削るなか、業界は自律型緊急操舵が世界的に自動車の標準機能となる未来に向けて急速に前進しています。

当レポートでは、世界の自律型緊急操舵システム市場について調査し、市場の概要とともに、技術別、自動化レベル別、車両タイプ別、コンポーネント別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 市場力学の概要

- 規制および政策影響分析

- 特許分析

- スタートアップの情勢

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

第2章 自律緊急操舵システム市場(技術別)

- ライダーベースのAESS

- カメラベースのAESS

- レーダーベースのAESS

- センサーフュージョンベースのAESS

第3章 自律緊急操舵システム市場(自動化レベル別)

- 半自律型(レベル1~レベル3)

- 完全自律走行(レベル4および5)

第4章 自律緊急操舵システム市場(車両タイプ別)

- 乗用車

- 商用車

第5章 自律緊急操舵システム市場(コンポーネント別)

- センサー

- 制御ユニット

- ステアリング機構

- ソフトウェア

- 通信システム

第6章 自律緊急操舵システム市場(地域別)

- 自律緊急操舵システム市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第7章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Robert Bosch GmbH

- ZF Friedrichshafen

- Continental AG

- Delphi Automotive

- Denso Corporation

- Autoliv Inc.

- Nissan Motor

- Infineon Technologies

- IMS Limited

- Knorr-Bremse AG

- Hyundai Mobis

- Calsonic Kansei Corporation

- Valeo

- Nexteer Automotive

- Mando Corporation

- その他の主要企業

第8章 調査手法

List of Figures

- Figure 1: Autonomous Emergency Steering Systems Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Autonomous Emergency Steering Systems Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024, 2027, and 2034

- Figure 4: Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024, 2027, and 2034

- Figure 5: Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024, 2027, and 2034

- Figure 6: Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024, 2027, and 2034

- Figure 7: Competitive Landscape Snapshot

- Figure 8: Supply Chain Analysis

- Figure 9: Value Chain Analysis

- Figure 10: Patent Analysis (by Country), January 2021-April 2025

- Figure 11: Patent Analysis (by Company), January 2021-April 2025

- Figure 12: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 13: U.S. Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 14: Canada Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 15: Mexico Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 16: Germany Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 17: France Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 18: Italy Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 19: Spain Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 20: U.K. Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 21: Rest-of-Europe Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 22: China Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 23: Japan Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 24: India Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 25: South Korea Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 26: Rest-of-Asia-Pacific Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 27: South America Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 28: Middle East and Africa Autonomous Emergency Steering Systems Market, $Billion, 2024-2034

- Figure 29: Strategic Initiatives (by Company), 2021-2025

- Figure 30: Share of Strategic Initiatives, 2021-2025

- Figure 31: Data Triangulation

- Figure 32: Top-Down and Bottom-Up Approach

- Figure 33: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Autonomous Emergency Steering Systems Market (by Region), $Billion, 2024-2034

- Table 5: Autonomous Emergency Steering Systems Market Pricing Forecast, 2024-2034

- Table 6: North America Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 7: North America Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 8: North America Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 9: North America Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 10: U.S. Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 11: U.S. Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 12: U.S. Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 13: U.S. Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 14: Canada Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 15: Canada Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 16: Canada Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 17: Canada Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 18: Mexico Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 19: Mexico Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 20: Mexico Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 21: Mexico Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 22: Europe Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 23: Europe Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 24: Europe Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 25: Europe Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 26: Germany Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 27: Germany Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 28: Germany Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 29: Germany Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 30: France Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 31: France Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 32: France Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 33: France Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 34: Italy Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 35: Italy Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 36: Italy Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 37: Italy Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 38: Spain Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 39: Spain Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 40: Spain Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 41: Spain Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 42: U.K. Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 43: U.K. Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 44: U.K. Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 45: U.K. Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 46: Rest-of-Europe Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 47: Rest-of-Europe Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 48: Rest-of-Europe Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 49: Rest-of-Europe Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 50: China Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 51: China Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 52: China Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 53: China Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 54: Japan Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 55: Japan Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 56: Japan Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 57: Japan Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 58: India Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 59: India Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 60: India Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 61: India Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 62: South Korea Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 63: South Korea Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 64: South Korea Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 65: South Korea Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 66: Rest-of-Asia-Pacific Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 67: Rest-of-Asia-Pacific Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 68: Rest-of-Asia-Pacific Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 69: Rest-of-Asia-Pacific Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 70: Rest-of-the-World Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 71: Rest-of-the-World Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 72: Rest-of-the-World Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 73: Rest-of-the-World Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 74: South America Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 75: South America Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 76: South America Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 77: South America Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 78: Middle East and Africa Autonomous Emergency Steering Systems Market (by Technology), $Billion, 2024-2034

- Table 79: Middle East and Africa Autonomous Emergency Steering Systems Market (by Level of Automation), $Billion, 2024-2034

- Table 80: Middle East and Africa Autonomous Emergency Steering Systems Market (by Vehicle Type), $Billion, 2024-2034

- Table 81: Middle East and Africa Autonomous Emergency Steering Systems Market (by Components), $Billion, 2024-2034

- Table 82: Market Share

Autonomous Emergency Steering Systems Market: Industry Overview

The autonomous emergency steering systems market is a crucial component within the broader Advanced Driver-Assistance Systems (ADAS) and autonomous vehicle technology landscape. As vehicle automation continues to evolve, safety systems such as AESS are becoming vital to ensuring the smooth transition from driver-controlled to fully autonomous driving. AESS is designed to intervene during emergency situations, autonomously steering the vehicle to avoid collisions or mitigate their impact, significantly enhancing road safety.

The industry is characterized by rapid technological innovation and growing investments in automation and safety technologies. AESS systems use a combination of advanced sensors (such as LiDAR, radar, and cameras) and sophisticated AI algorithms to detect imminent hazards and autonomously steer the vehicle away from danger. These technologies are now being integrated into semi-autonomous vehicles, with further advancements being made for fully autonomous systems.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $1.80 Billion |

| 2034 Forecast | $4.34 Billion |

| CAGR | 10.27% |

Autonomous Emergency Steering Systems Market Lifecycle Stage

The autonomous emergency steering systems market is in the late-stage R&D and early commercialization phase, with technologies at Technology Readiness Levels (TRLs) 4-7. The focus is on refining prototypes, integrating advanced sensors, and developing AI algorithms for reliable emergency steering performance. Companies are transitioning from concept development to engineering pilots, with real-world testing and validation a priority.

Collaborations between automotive manufacturers, technology providers, and tier-1 suppliers are key as AESS technologies are integrated into vehicles with advanced driver-assistance systems (ADAS). Regulatory frameworks and safety standards are also being refined to support broader deployment.

Commercial AESS deployment is expected in the mid-2020s, as manufacturers scale production to meet rising demand for enhanced safety in semi-autonomous and autonomous vehicles. Significant capital is flowing into R&D, with partnerships critical for the success of AESS technologies. As the market matures, AESS will become a standard feature in autonomous and semi-autonomous vehicles, revolutionizing automotive safety.

Autonomous Emergency Steering Systems Market Segmentation:

Segmentation 1: by Technology

- Lidar-Based AESS

- Camera-Based AESS

- Radar-Based AESS

- Sensor Fusion-Based AESS

Segmentation 2: by Level of Automation

- Semi-Autonomous (Level 1 to Level 3)

- Fully Autonomous (Level 4 and 5)

Segmentation 3: by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Segmentation 4: by Components

- Sensors

- Control Units

- Steering Mechanism

- Software

- Communication Systems

Segmentation 5: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Demand - Drivers and Limitations

The following are the demand drivers for the autonomous emergency steering systems market:

- Increasing demand for advanced vehicle safety features

- Growing adoption of semi-autonomous and autonomous vehicles

- Advancements in sensor technology and AI algorithms

The autonomous emergency steering systems market is expected to face some limitations as well due to the following challenges:

- High development and production costs limit affordability

- Regulatory variability across regions complicates global deployment

Autonomous Emergency Steering Systems Market Key Players and Competition Synopsis

The autonomous emergency steering market features a highly competitive landscape driven by a blend of multinational automotive giants and innovative technology ventures. Leading automotive companies such as Robert Bosch GmbH, ZF Friedrichshafen, and Continental AG are at the forefront, integrating advanced steering systems into their driver-assistance technology portfolios. On the tech side, Autoliv Inc. and Denso Corporation are working on cutting-edge safety solutions that incorporate AI-driven steering algorithms and sensor fusion technologies. Other notable players, including Nexteer Automotive and Valeo, are focused on enhancing the functionality and efficiency of emergency steering systems. Meanwhile, companies like Hyundai Mobis and Mando Corporation are pushing the boundaries of autonomous driving safety with advanced sensor technology and control systems. Competition is further intensified through strategic partnerships with tier-1 automotive suppliers, collaborations with academic institutions, and government-funded initiatives aimed at meeting increasingly stringent global safety standards. As each player races to develop and deploy advanced AESS solutions, the industry is rapidly advancing towards a future where autonomous emergency steering becomes a standard feature in vehicles globally.

Some prominent names established in the autonomous emergency steering systems market are:

- Robert Bosch GmbH

- ZF Friedrichshafen

- Continental AG

- Delphi Automotive

- Denso Corporation

- Autoliv Inc.

- Nissan Motor

- Infineon Technologies

- IMS Limited

- Knorr-Bremse AG

- Hyundai Mobis

- Calsonic Kansei Corporation

- Valeo

- Nexteer Automotive

- Mando Corporation

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Regulatory & Policy Impact Analysis

- 1.4 Patent Analysis

- 1.5 Start-Up Landscape

- 1.6 Investment Landscape and R&D Trends

- 1.7 Future Outlook and Market Roadmap

- 1.8 Value Chain Analysis

- 1.9 Global Pricing Analysis

- 1.10 Industry Attractiveness

2. Autonomous Emergency Steering Systems Market (by Technology)

- 2.1 Lidar-Based AESS

- 2.2 Camera-Based AESS

- 2.3 Radar-Based AESS

- 2.4 Sensor Fusion-Based AESS

3. Autonomous Emergency Steering Systems Market (by Level of Automation)

- 3.1 Semi-Autonomous (Level 1 to Level 3)

- 3.2 Fully Autonomous (Level 4 and 5)

4. Autonomous Emergency Steering Systems Market (by Vehicle Type)

- 4.1 Passenger Cars

- 4.2 Commercial Vehicles

5. Autonomous Emergency Steering Systems Market (by Components)

- 5.1 Sensors

- 5.2 Control Units

- 5.3 Steering Mechanism

- 5.4 Software

- 5.5 Communication Systems

6. Autonomous Emergency Steering Systems Market (by Region)

- 6.1 Autonomous Emergency Steering Systems Market (by Region)

- 6.2 North America

- 6.2.1 Regional Overview

- 6.2.2 Driving Factors for Market Growth

- 6.2.3 Factors Challenging the Market

- 6.2.4 Key Companies

- 6.2.5 Technology

- 6.2.6 Level of Automation

- 6.2.7 Vehicle Type

- 6.2.8 Components

- 6.2.9 North America (by Country)

- 6.2.9.1 U.S.

- 6.2.9.1.1 Market by Technology

- 6.2.9.1.2 Market by Level of Automation

- 6.2.9.1.3 Market by Vehicle Type

- 6.2.9.1.4 Market by Components

- 6.2.9.2 Canada

- 6.2.9.2.1 Market by Technology

- 6.2.9.2.2 Market by Level of Automation

- 6.2.9.2.3 Market by Vehicle Type

- 6.2.9.2.4 Market by Components

- 6.2.9.2.5 Market by End-User

- 6.2.9.3 Mexico

- 6.2.9.3.1 Market by Technology

- 6.2.9.3.2 Market by Level of Automation

- 6.2.9.3.3 Market by Vehicle Type

- 6.2.9.3.4 Market by Components

- 6.2.9.1 U.S.

- 6.3 Europe

- 6.3.1 Regional Overview

- 6.3.2 Driving Factors for Market Growth

- 6.3.3 Factors Challenging the Market

- 6.3.4 Key Companies

- 6.3.5 Technology

- 6.3.6 Level of Automation

- 6.3.7 Vehicle Type

- 6.3.8 Components

- 6.3.9 Europe (by Country)

- 6.3.9.1 Germany

- 6.3.9.1.1 Market by Technology

- 6.3.9.1.2 Market by Level of Automation

- 6.3.9.1.3 Market by Vehicle Type

- 6.3.9.1.4 Market by Components

- 6.3.9.2 France

- 6.3.9.2.1 Market by Technology

- 6.3.9.2.2 Market by Level of Automation

- 6.3.9.2.3 Market by Vehicle Type

- 6.3.9.2.4 Market by Components

- 6.3.9.3 Italy

- 6.3.9.3.1 Market by Technology

- 6.3.9.3.2 Market by Level of Automation

- 6.3.9.3.3 Market by Vehicle Type

- 6.3.9.3.4 Market by Components

- 6.3.9.4 Spain

- 6.3.9.4.1 Market by Technology

- 6.3.9.4.2 Market by Level of Automation

- 6.3.9.4.3 Market by Vehicle Type

- 6.3.9.4.4 Market by Components

- 6.3.9.5 U.K.

- 6.3.9.5.1 Market by Technology

- 6.3.9.5.2 Market by Level of Automation

- 6.3.9.5.3 Market by Vehicle Type

- 6.3.9.5.4 Market by Components

- 6.3.9.6 Rest-of-Europe

- 6.3.9.6.1 Market by Technology

- 6.3.9.6.2 Market by Level of Automation

- 6.3.9.6.3 Market by Vehicle Type

- 6.3.9.6.4 Market by Components

- 6.3.9.1 Germany

- 6.4 Asia-Pacific

- 6.4.1 Regional Overview

- 6.4.2 Driving Factors for Market Growth

- 6.4.3 Factors Challenging the Market

- 6.4.4 Key Companies

- 6.4.5 Technology

- 6.4.6 Level of Automation

- 6.4.7 Vehicle Type

- 6.4.8 Components

- 6.4.9 Asia-Pacific (by Country)

- 6.4.9.1 China

- 6.4.9.1.1 Market by Technology

- 6.4.9.1.2 Market by Level of Automation

- 6.4.9.1.3 Market by Vehicle Type

- 6.4.9.1.4 Market by Components

- 6.4.9.2 Japan

- 6.4.9.2.1 Market by Technology

- 6.4.9.2.2 Market by Level of Automation

- 6.4.9.2.3 Market by Vehicle Type

- 6.4.9.2.4 Market by Components

- 6.4.9.3 India

- 6.4.9.3.1 Market by Technology

- 6.4.9.3.2 Market by Level of Automation

- 6.4.9.3.3 Market by Vehicle Type

- 6.4.9.3.4 Market by Components

- 6.4.9.4 South Korea

- 6.4.9.4.1 Market by Technology

- 6.4.9.4.2 Market by Level of Automation

- 6.4.9.4.3 Market by Vehicle Type

- 6.4.9.4.4 Market by Components

- 6.4.9.5 Rest-of-Asia-Pacific

- 6.4.9.5.1 Market by Technology

- 6.4.9.5.2 Market by Level of Automation

- 6.4.9.5.3 Market by Vehicle Type

- 6.4.9.5.4 Market by Components

- 6.4.9.1 China

- 6.5 Rest-of-the-World

- 6.5.1 Regional Overview

- 6.5.2 Driving Factors for Market Growth

- 6.5.3 Factors Challenging the Market

- 6.5.4 Key Companies

- 6.5.5 Technology

- 6.5.6 Level of Automation

- 6.5.7 Vehicle Type

- 6.5.8 Components

- 6.5.9 Rest-of-the-World (by Region)

- 6.5.9.1 South America

- 6.5.9.1.1 Market by Technology

- 6.5.9.1.2 Market by Level of Automation

- 6.5.9.1.3 Market by Vehicle Type

- 6.5.9.1.4 Market by Components

- 6.5.9.2 Middle East and Africa

- 6.5.9.2.1 Market by Technology

- 6.5.9.2.2 Market by Level of Automation

- 6.5.9.2.3 Market by Vehicle Type

- 6.5.9.2.4 Market by Components

- 6.5.9.1 South America

7. Markets - Competitive Benchmarking & Company Profiles

- 7.1 Next Frontiers

- 7.2 Geographic Assessment

- 7.3 Company Profiles

- 7.3.1 Robert Bosch GmbH

- 7.3.1.1 Overview

- 7.3.1.2 Top Products/Product Portfolio

- 7.3.1.3 Top Competitors

- 7.3.1.4 Target Customers

- 7.3.1.5 Key Personnel

- 7.3.1.6 Analyst View

- 7.3.1.7 Market Share

- 7.3.2 ZF Friedrichshafen

- 7.3.2.1 Overview

- 7.3.2.2 Top Products/Product Portfolio

- 7.3.2.3 Top Competitors

- 7.3.2.4 Target Customers

- 7.3.2.5 Key Personnel

- 7.3.2.6 Analyst View

- 7.3.2.7 Market Share

- 7.3.3 Continental AG

- 7.3.3.1 Overview

- 7.3.3.2 Top Products/Product Portfolio

- 7.3.3.3 Top Competitors

- 7.3.3.4 Target Customers

- 7.3.3.5 Key Personnel

- 7.3.3.6 Analyst View

- 7.3.3.7 Market Share

- 7.3.4 Delphi Automotive

- 7.3.4.1 Overview

- 7.3.4.2 Top Products/Product Portfolio

- 7.3.4.3 Top Competitors

- 7.3.4.4 Target Customers

- 7.3.4.5 Key Personnel

- 7.3.4.6 Analyst View

- 7.3.4.7 Market Share

- 7.3.5 Denso Corporation

- 7.3.5.1 Overview

- 7.3.5.2 Top Products/Product Portfolio

- 7.3.5.3 Top Competitors

- 7.3.5.4 Target Customers

- 7.3.5.5 Key Personnel

- 7.3.5.6 Analyst View

- 7.3.5.7 Market Share

- 7.3.6 Autoliv Inc.

- 7.3.6.1 Overview

- 7.3.6.2 Top Products/Product Portfolio

- 7.3.6.3 Top Competitors

- 7.3.6.4 Target Customers

- 7.3.6.5 Key Personnel

- 7.3.6.6 Analyst View

- 7.3.6.7 Market Share

- 7.3.7 Nissan Motor

- 7.3.7.1 Overview

- 7.3.7.2 Top Products/Product Portfolio

- 7.3.7.3 Top Competitors

- 7.3.7.4 Target Customers

- 7.3.7.5 Key Personnel

- 7.3.7.6 Analyst View

- 7.3.7.7 Market Share

- 7.3.8 Infineon Technologies

- 7.3.8.1 Overview

- 7.3.8.2 Top Products/Product Portfolio

- 7.3.8.3 Top Competitors

- 7.3.8.4 Target Customers

- 7.3.8.5 Key Personnel

- 7.3.8.6 Analyst View

- 7.3.8.7 Market Share

- 7.3.9 IMS Limited

- 7.3.9.1 Overview

- 7.3.9.2 Top Products/Product Portfolio

- 7.3.9.3 Top Competitors

- 7.3.9.4 Target Customers

- 7.3.9.5 Key Personnel

- 7.3.9.6 Analyst View

- 7.3.9.7 Market Share

- 7.3.10 Knorr-Bremse AG

- 7.3.10.1 Overview

- 7.3.10.2 Top Products/Product Portfolio

- 7.3.10.3 Top Competitors

- 7.3.10.4 Target Customers

- 7.3.10.5 Key Personnel

- 7.3.10.6 Analyst View

- 7.3.10.7 Market Share

- 7.3.10.8 Share

- 7.3.11 Hyundai Mobis

- 7.3.11.1 Overview

- 7.3.11.2 Top Products/Product Portfolio

- 7.3.11.3 Top Competitors

- 7.3.11.4 Target Customers

- 7.3.11.5 Key Personnel

- 7.3.11.6 Analyst View

- 7.3.11.7 Market Share

- 7.3.11.8 Share

- 7.3.12 Calsonic Kansei Corporation

- 7.3.12.1 Overview

- 7.3.12.2 Top Products/Product Portfolio

- 7.3.12.3 Top Competitors

- 7.3.12.4 Target Customers

- 7.3.12.5 Key Personnel

- 7.3.12.6 Analyst View

- 7.3.12.7 Market Share

- 7.3.12.8 Share

- 7.3.13 Valeo

- 7.3.13.1 Overview

- 7.3.13.2 Top Products/Product Portfolio

- 7.3.13.3 Top Competitors

- 7.3.13.4 Target Customers

- 7.3.13.5 Key Personnel

- 7.3.13.6 Analyst View

- 7.3.13.7 Market Share

- 7.3.13.8 Share

- 7.3.14 Nexteer Automotive

- 7.3.14.1 Overview

- 7.3.14.2 Top Products/Product Portfolio

- 7.3.14.3 Top Competitors

- 7.3.14.4 Target Customers

- 7.3.14.5 Key Personnel

- 7.3.14.6 Analyst View

- 7.3.14.7 Market Share

- 7.3.14.8 Share

- 7.3.15 Mando Corporation

- 7.3.15.1 Overview

- 7.3.15.2 Top Products/Product Portfolio

- 7.3.15.3 Top Competitors

- 7.3.15.4 Target Customers

- 7.3.15.5 Key Personnel

- 7.3.15.6 Analyst View

- 7.3.15.7 Market Share

- 7.3.15.8 Share

- 7.3.1 Robert Bosch GmbH

- 7.4 Other Key Companies