|

|

市場調査レポート

商品コード

1735901

欧州のオフハイウェイ電気自動車市場:用途別、推進タイプ別、車両タイプ別、国別 - 分析と予測(2024年~2034年)Europe Off-Highway Electric Vehicle Market: Focus on Application, Propulsion Type, Vehicle Type, and Country-Level Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のオフハイウェイ電気自動車市場:用途別、推進タイプ別、車両タイプ別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年05月30日

発行: BIS Research

ページ情報: 英文 96 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のオフハイウェイ電気自動車の市場規模は、2024年の13億9,330万米ドルから2034年には137億8,200万米ドルに成長すると予測され、予測期間の2024年~2034年のCAGRは25.76%と堅調な伸びを示すとみられています。

オフハイウェイ電気自動車(EV)市場は、鉱業、建設業、農業における電気機器の使用増加により、欧州で急速に拡大しています。環境基準の変化に伴い、企業は排出ガスと長期的な運転経費を削減するために、電動代替車の利用を増やしています。

オフハイウェイ電気自動車の実現可能性と魅力は、特にバッテリー効率、充電インフラ、車両性能の分野における技術開発によって大きく向上しています。同時に、欧州連合(EU)の厳しい排出規制と積極的な気候変動目標によって、公共部門と商業部門は、よりクリーンで持続可能な産業慣行へと押し上げられています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 13億9,330万米ドル |

| 2034年予測 | 137億8,200万米ドル |

| CAGR | 25.76% |

電動機器への転換は、政府のインセンティブ、グリーン調達法、企業のESG誓約によっても加速しています。欧州企業が気候変動目標の達成と事業の脱炭素化に向けた取り組みを強化する中、電動オフハイウェイ車は、この地域の持続可能な産業モビリティへの移行において重要な役割を果たすと予想されます。

欧州のオフハイウェイ電気自動車(OHEV)市場は、鉱業、農業、建設業がより環境に優しく持続可能な技術を採用するにつれて大きく拡大しています。EUの厳格な環境規制、積極的な気候変動目標、二酸化炭素排出量削減への圧力の高まりにより、企業はディーゼルエンジン搭載機器から電動代替機器への切り替えを進めています。この転換は、エネルギー効率の高いビジネスと低排出モビリティを奨励する欧州グリーンディールの大きな目標に沿ったものです。

オフハイウェイ電気自動車のメリットは明らかで、テールパイプ排出ゼロ、運転コストの削減、騒音の低減などが挙げられます。充電時間の短縮、バッテリー性能の向上、車両寿命の延長といった技術的なブレークスルーのおかげで、電気機械は要求の厳しい産業用途でますます実現可能になってきています。バッテリー航続距離や遠隔操作の制限を回避するため、ハイブリッドや航続距離延長装置も生産されています。

メーカーやエンドユーザーは、EUが支援する各国政府の奨励策や環境イニシアティブによって、電動ソリューションへの投資を促されています。東欧や南欧が徐々に追いつきつつある一方で、ドイツ、フランス、北欧などの西欧諸国がこの変化をリードしています。

欧州のOHEV市場は、脱炭素化の推進が過熱し、長期的な効率性、規制遵守、環境責任を促す中で、この地域の業界情勢を変える重要な役割を果たすと考えられています。

市場セグメンテーション

セグメンテーション1:用途別

- 建設

- 鉱業

- 農業

- その他

セグメンテーション12:推進タイプ別

- バッテリー電気自動車(BEV)

- ハイブリッド電気自動車(HEV)

セグメンテーション13:車両タイプ別

- 掘削機

- トラック

- ローダー

- その他(トラクター、スノーグルーミングなど)

セグメンテーション4:国別

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- その他

欧州オフハイウェイ電気自動車(OHEV)市場動向と促進要因・課題

動向

- エネルギー密度と充電速度を向上させるバッテリー技術の進歩

- 建設、鉱業、農業の各分野に特化した電動ソリューションの採用拡大

- 再生可能エネルギーの統合と循環型設計別持続可能性の重視

- 既存のディーゼル車両の電気システムへの改造の増加

- 航続距離の制限を克服するためのハイブリッド車や航続距離延長モデルの開発

促進要因

- EUの厳しい排ガス規制が電気機械へのシフトを促進

- 電気自動車導入を支援する政府のインセンティブと補助金

- 燃料費の高騰により、電気自動車の選択肢が経済的に魅力的なものに

- グリーン調達を推進する企業の持続可能性とESGへのコミットメント

- ドライブトレインの効率と車両の信頼性を向上させる技術革新

課題

- 電気自動車と関連インフラの初期費用が高い

- 遠隔地や非電化の職場環境では充電インフラが限られている

- 過酷で険しい地形での運用信頼性への懸念

- バッテリーのライフサイクル、リサイクル、環境持続可能性の問題

- 電気システムのための労働力の再教育と専門トレーニングの必要性

製品/イノベーション戦略:当レポートは、欧州オフハイウェイ電気自動車市場の包括的な製品・イノベーション戦略を提供し、市場参入の機会、技術的進歩、持続可能な実践に焦点を当てています。企業が二酸化炭素削減目標を達成し、さまざまな分野で高まるオフハイウェイ電気自動車の需要を活用できるよう、実用的な洞察を提供します。

成長/マーケティング戦略:当レポートでは、欧州オフハイウェイ電気自動車市場に特化した強固な成長・マーケティング戦略を概説しています。ニッチ市場セグメントを特定し、競合優位性を確立し、革新的なマーケティング施策を実施することで、市場シェアと財務実績を最適化するための的を絞ったアプローチを強調しています。これらの戦略的提言を活用することで、企業は市場でのプレゼンスを強化し、新たな機会を開拓し、効率的に収益成長を推進することができます。

競合戦略:当レポートは、欧州オフハイウェイ電気自動車市場向けに設計された強力な競争戦略を策定しています。主要市場プレイヤーを評価し、差別化戦術を提案し、競争力を維持するための指針を提供します。これらの戦略的指示に従うことで、企業は競合他社に対して効果的なポジションを確立し、急速に進化する市場での長期的な成功と収益性を確保することができます。

当レポートでは、欧州のオフハイウェイ電気自動車市場について調査し、市場の概要とともに、用途別、推進タイプ別、車両タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現状と将来への影響評価

- サプライチェーンの概要

- R&Dレビュー

- ステークホルダー分析

- 市場力学の概要

- ディーゼルと電気のオフハイウェイ車両の包括的な分析

- オフハイウェイ車両市場の電動化の将来動向、2023年~2030年

- オンハイウェイとオフハイウェイの電動化の新たな類似点

第2章 地域

- 地域サマリー

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 用途

- 製品

- 欧州(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- AB Volvo

- PristenBully (Kassbohrer Gelandefahrzeug AG)

- CNH Industrial N.V.

- Epiroc AB

- J C Bamford Excavators Ltd.

- Sandvik AB

- Liebherr Group

- Prinoth AG (HTI Group)

- CM DUPON - ICECAT

- xelom

第4章 調査手法

List of Figures

- Figure 1: Europe Off-Highway Electric Vehicle Market (by Scenario), $Million, 2024, 2027, and 2034

- Figure 2: Off-Highway Electric Vehicle Market (by Region), $Million, 2023, 2027, and 2034

- Figure 3: Europe Off-Highway Electric Vehicle Market (by Application), $Million, 2023, 2027, and 2034

- Figure 4: Europe Off-Highway Electric Vehicle Market (by Propulsion Type), $Million, 2023, 2027, and 2034

- Figure 5: Europe Off-Highway Electric Vehicle Market (by Vehicle Type), $Million, 2023, 2027, and 2034

- Figure 6: Key Events

- Figure 7: Failure Rate of Batteries, 2011-2023

- Figure 8: Number of Mining Fatalities, 2010-2023

- Figure 9: Supply Chain and Risks within the Supply Chain

- Figure 10: Value Chain of Off-Highway Electric Vehicle Market

- Figure 11: Off-Highway Electric Vehicle Market, by Vehicle Type, ($US/Unit), 2023, 2027, and 2034

- Figure 12: Patent Analysis (by Country), 2021-December 2024

- Figure 13: Patent Analysis (by Company), January 2021-February 2025

- Figure 14: End User and Buying Criteria in the Off-Highway Electric Vehicle Market

- Figure 15: Impact Analysis of Market Navigating Factors, 2023-2034

- Figure 16: Estimated Annual Emission (by Vehicle Type)

- Figure 17: Announced Electric Vehicle Battery Manufacturing Capacity by Region and Manufacturing Capacity Needed in The Net Zero Scenario, 2025 and 2030

- Figure 18: Mining Energy Intensity, Ventilation, and Cooling (by Energy Type), MJ/Ton

- Figure 19: Performance Comparison when Loaded (by Vehicle Type)

- Figure 20: Total Cost of Ownership, Net Present Cost ($), 2023

- Figure 21: Total Cost of Ownership Savings, Percentage (%)

- Figure 22: On-Highway vs. Off-Highway Compound Annual Growth Rate, Percentage, 2024-2034

- Figure 23: Share of Battery Electric Vehicles of All Vehicle Sales

- Figure 24: France Off-Highway Electric Vehicle Market, $Million, 2023-2034

- Figure 25: Germany Off-Highway Electric Vehicle Market, $Million, 2023-2034

- Figure 26: U.K. Off-Highway Electric Vehicle Market, $Million, 2023-2034

- Figure 27: Spain Off-Highway Electric Vehicle Market, $Million, 2023-2034

- Figure 28: Italy Off-Highway Electric Vehicle Market, $Million, 2023-2034

- Figure 29: Rest-of-Europe Off-Highway Electric Vehicle Market, $Million, 2023-2034

- Figure 30: Strategic Initiatives, January 2022-February 2025

- Figure 31: Share of Strategic Initiatives, 2023

- Figure 32: Data Triangulation

- Figure 33: Top-Down and Bottom-Up Approach

- Figure 34: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

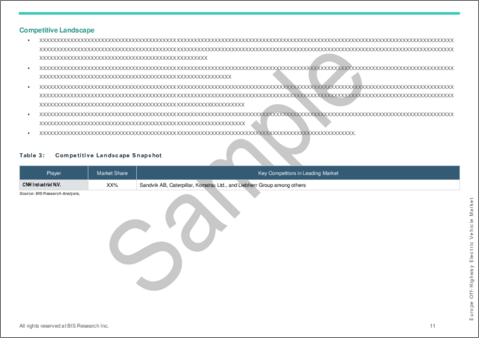

- Table 3: Competitive Landscape Snapshot

- Table 4: Future Outlook

- Table 5: Regulatory Landscape

- Table 6: Country-Wise Targets

- Table 7: Electrification Rate (by Vehicle Type), 2023 and 2030

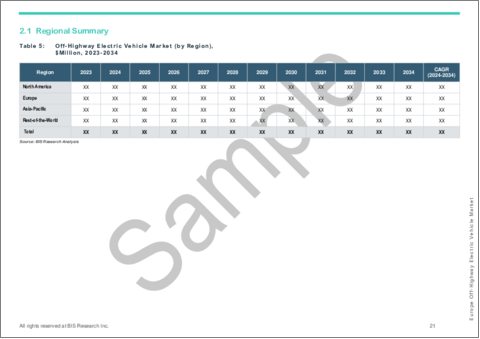

- Table 8: Off-Highway Electric Vehicle Market (by Region), $Million, 2023-2034

- Table 9: Europe Off-Highway Electric Vehicle Market (by Application), $Million, 2023-2034

- Table 10: Europe Off-Highway Electric Vehicle Market (by Propulsion Type), $Million, 2023-2034

- Table 11: Europe Off-Highway Electric Vehicle Market (by Vehicle Type), $Million, 2023-2034

- Table 12: France Off-Highway Electric Vehicle Market (by Application), $Million, 2023-2034

- Table 13: France Off-Highway Electric Vehicle Market (by Propulsion Type), $Million, 2023-2034

- Table 14: France Off-Highway Electric Vehicle Market (by Vehicle Type), $Million, 2023-2034

- Table 15: Germany Off-Highway Electric Vehicle Market (by Application), $Million, 2023-2034

- Table 16: Germany Off-Highway Electric Vehicle Market (by Propulsion Type), $Million, 2023-2034

- Table 17: Germany Off-Highway Electric Vehicle Market (by Vehicle Type), $Million, 2023-2034

- Table 18: U.K. Off-Highway Electric Vehicle Market (by Application), $Million, 2023-2034

- Table 19: U.K. Off-Highway Electric Vehicle Market (by Propulsion Type), $Million, 2023-2034

- Table 20: U.K. Off-Highway Electric Vehicle Market (by Vehicle Type), $Million, 2023-2034

- Table 21: Spain Off-Highway Electric Vehicle Market (by Application), $Million, 2023-2034

- Table 22: Spain Off-Highway Electric Vehicle Market (by Propulsion Type), $Million, 2023-2034

- Table 23: Spain Off-Highway Electric Vehicle Market (by Vehicle Type), $Million, 2023-2034

- Table 24: Italy Off-Highway Electric Vehicle Market (by Application), $Million, 2023-2034

- Table 25: Italy Off-Highway Electric Vehicle Market (by Propulsion Type), $Million, 2023-2034

- Table 26: Italy Off-Highway Electric Vehicle Market (by Vehicle Type), $Million, 2023-2034

- Table 27: Rest-of-Europe Off-Highway Electric Vehicle Market (by Application), $Million, 2023-2034

- Table 28: Rest-of-Europe Off-Highway Electric Vehicle Market (by Propulsion Type), $Million, 2023-2034

- Table 30: Rest-of-Europe Off-Highway Electric Vehicle Market (by Vehicle Type), $Million, 2023-2034

- Table 31: Market Share

Introduction to Europe Off-Highway Electric Vehicle Market

The Europe off-highway electric vehicle market is projected to grow from $1,393.3 million in 2024 to $13,782.0 million by 2034, showing a robust CAGR of 25.76% during the forecast period 2024-2034. The market for off-highway electric vehicles (EVs) is rising quickly in Europe due to the increasing use of electric equipment in the mining, construction, and agricultural industries. In keeping with changing environmental standards, businesses are increasingly using electric alternatives to cut emissions and long-term operating expenses.

The feasibility and attractiveness of electric off-highway vehicles are being greatly increased by technological developments, especially in the areas of battery efficiency, charging infrastructure, and vehicle performance. At the same time, the public and commercial sectors are being pushed towards cleaner, more sustainable industrial practices by the European Union's strict emissions laws and aggressive climate targets.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $1,393.3 Million |

| 2034 Forecast | $13,782.0 Million |

| CAGR | 25.76% |

The switch to electric-powered equipment is also being accelerated by government incentives, green procurement laws, and company ESG pledges. Electric off-highway vehicles are expected to play a key role in the region's transition to sustainable industrial mobility as European firms step up their efforts to fulfil climate goals and decarbonise operations.

Market Introduction

The market for off-highway electric vehicles (OHEVs) in Europe is expanding significantly as mining, agriculture, and construction adopt greener and more sustainable technology. Businesses are switching from diesel-powered equipment to electric alternatives due to strict EU environmental rules, aggressive climate targets, and mounting pressure to lower carbon emissions. This shift is in line with the larger goals of the European Green Deal, which encourage energy-efficient businesses and low-emission mobility.

The benefits of electric off-highway vehicles are obvious and include zero tailpipe emissions, lower operating costs, and less noise. Electric machinery is becoming more and more feasible for demanding industrial applications thanks to technological breakthroughs like faster charging times, better battery performance, and longer vehicle lifespans. To get around restrictions on battery range and remote operation, hybrid and range-extended devices are also being produced.

Manufacturers and end users are being encouraged to invest in electric solutions by national government incentives and environmental initiatives supported by the EU. While Eastern and Southern Europe are slowly catching up, Western European nations-such as Germany, France, and the Nordics-are leading the way in this change.

The European OHEV market is positioned to play a significant role in changing the industrial mobility landscape of the region as the drive towards decarbonisation heats up, encouraging long-term efficiency, regulatory compliance, and environmental responsibility.

Market Segmentation

Segmentation 1: by Application

- Construction

- Mining

- Agriculture

- Others

Segmentation 2: by Propulsion Type

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

Segmentation 3: by Vehicle Type

- Excavators

- Trucks

- Loaders

- Others (Tractors, Snow Grooming, etc.)

Segmentation 4: by Country

- Germany

- Italy

- France

- U.K.

- Spain

- Rest-of-Europe

Europe Off-Highway Electric Vehicle (OHEV) Market Trends, Drivers and Challenges

Trends

- Advancements in battery technology enhancing energy density and charging speed

- Growing adoption of sector-specific electric solutions for construction, mining, and agriculture

- Emphasis on sustainability through renewable energy integration and circular design

- Increasing retrofitting of existing diesel fleets to electric systems

- Development of hybrid and range-extended models to overcome range limitations

Drivers

- Stringent EU emission regulations pushing the shift toward electric machinery

- Government incentives and subsidies supporting electric vehicle adoption

- Rising fuel costs making electric options more economically attractive

- Corporate sustainability and ESG commitments driving green procurement

- Technological innovations improving drivetrain efficiency and vehicle reliability

Challenges

- High upfront costs for electric vehicles and related infrastructure

- Limited charging infrastructure in remote and off-grid work environments

- Operational reliability concerns in harsh or rugged terrains

- Battery lifecycle, recycling, and environmental sustainability issues

- Need for workforce reskilling and specialized training for electric systems

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a comprehensive product and innovation strategy for the Europe off-highway electric vehicle market, highlighting opportunities for market entry, technological advancements, and sustainable practices. It offers actionable insights that enable organizations to meet carbon reduction goals and capitalize on the increasing demand for off-highway electric vehicles across various sectors.

Growth/Marketing Strategy: This report outlines a robust growth and marketing strategy specifically tailored for the Europe off-highway electric vehicle market. It emphasizes a targeted approach to identifying niche market segments, establishing competitive advantages, and implementing innovative marketing initiatives to optimize market share and financial performance. By leveraging these strategic recommendations, organizations can strengthen their market presence, exploit emerging opportunities, and drive revenue growth effectively.

Competitive Strategy: This report formulates a strong competitive strategy designed for the Europe off-highway electric vehicle market. It assesses key market players, suggests differentiation tactics, and provides guidance for maintaining a competitive edge. By following these strategic directives, companies can effectively position themselves against competitors, ensuring long-term success and profitability in a rapidly evolving market.

Key Market Players and Competition Synopsis

The companies that are profiled in the Europe off-highway electric vehicle market have been selected based on input gathered from primary experts and analyzing company coverage, project portfolio, and market penetration.

Some of the prominent names in this market are:

- AB Volvo

- PristenBully (Kassbohrer Gelandefahrzeug AG )

- CNH Industrial N.V.

- Epiroc AB

- J C Bamford Excavators Ltd.

- Sandvik AB

- Liebherr Group

- Prinoth AG (HTI Group)

- CM DUPON - ICECAT

- xelom

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends Overview

- 1.1.2 Technology Development in Off-Highway Electric Vehicles

- 1.1.3 Integration of Autonomy in Mining Vehicles

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Market Map

- 1.2.2.1 Excavators

- 1.2.2.2 Trucks

- 1.2.2.3 Loaders

- 1.2.2.4 Others

- 1.2.3 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend (by Country and Company)

- 1.3.2 Regulatory Landscape

- 1.4 Stakeholder Analysis

- 1.4.1 Use Case

- 1.4.2 End-User Buying Criteria

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Increased Focus toward Emission and Noise Reduction

- 1.5.1.2 Compliance with Emission Regulations

- 1.5.2 Market Restraints

- 1.5.2.1 Energy Storage and Range Limitations

- 1.5.2.2 High Initial Costs and Economic Viability

- 1.5.3 Market Opportunities

- 1.5.3.1 Mobile Charging Solutions to Support OHEV Adoption

- 1.5.3.2 Renewable Energy Integration with OHEV Systems

- 1.5.1 Market Drivers

- 1.6 Comprehensive Analysis of Diesel vs. Electric Off-Highway Vehicles

- 1.7 Future Trends in the Electrification of Off-Highway Vehicle Market, 2023-2030

- 1.8 The Emerging Parallels Between On-Highway and Off-Highway Electrification

2 Region

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application

- 2.2.5 Product

- 2.2.6 Europe (by Country)

- 2.2.6.1 France

- 2.2.6.1.1 Application

- 2.2.6.1.2 Product

- 2.2.6.2 Germany

- 2.2.6.2.1 Application

- 2.2.6.2.2 Product

- 2.2.6.3 U.K.

- 2.2.6.3.1 Application

- 2.2.6.3.2 Product

- 2.2.6.4 Spain

- 2.2.6.4.1 Application

- 2.2.6.4.2 Product

- 2.2.6.5 Italy

- 2.2.6.5.1 Application

- 2.2.6.5.2 Product

- 2.2.6.6 Rest-of-Europe

- 2.2.6.6.1 Application

- 2.2.6.6.2 Product

- 2.2.6.1 France

3 Markets - Competitive Benchmarking and Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 AB Volvo

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers/End Users

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2023

- 3.2.2 PristenBully (Kassbohrer Gelandefahrzeug AG)

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers/End Users

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2023

- 3.2.3 CNH Industrial N.V.

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers/End Users

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share, 2023

- 3.2.4 Epiroc AB

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers/End Users

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share, 2023

- 3.2.5 J C Bamford Excavators Ltd.

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers/End Users

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2023

- 3.2.6 Sandvik AB

- 3.2.6.1 Overview

- 3.2.6.2 Top Products/Product Portfolio

- 3.2.6.3 Top Competitors

- 3.2.6.4 Target Customers/End Users

- 3.2.6.5 Key Personnel

- 3.2.6.6 Analyst View

- 3.2.6.7 Market Share, 2023

- 3.2.7 Liebherr Group

- 3.2.7.1 Overview

- 3.2.7.2 Top Products/Product Portfolio

- 3.2.7.3 Top Competitors

- 3.2.7.4 Target Customers/End Users

- 3.2.7.5 Key Personnel

- 3.2.7.6 Analyst View

- 3.2.7.7 Market Share, 2023

- 3.2.8 Prinoth AG (HTI Group)

- 3.2.8.1 Overview

- 3.2.8.2 Top Products/Product Portfolio

- 3.2.8.3 Top Competitors

- 3.2.8.4 Target Customers/End Users

- 3.2.8.5 Key Personnel

- 3.2.8.6 Analyst View

- 3.2.8.7 Market Share, 2023

- 3.2.9 CM DUPON - ICECAT

- 3.2.9.1 Overview

- 3.2.9.2 Top Products/Product Portfolio

- 3.2.9.3 Top Competitors

- 3.2.9.4 Target Customers/End Users

- 3.2.9.5 Key Personnel

- 3.2.9.6 Analyst View

- 3.2.9.7 Market Share, 2023

- 3.2.10 xelom

- 3.2.10.1 Overview

- 3.2.10.2 Top Products/Product Portfolio

- 3.2.10.3 Top Competitors

- 3.2.10.4 Target Customers/End Users

- 3.2.10.5 Key Personnel

- 3.2.10.6 Analyst View

- 3.2.10.7 Market Share, 2023

- 3.2.1 AB Volvo

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast