|

|

市場調査レポート

商品コード

1735558

持続可能化学品向け次世代原料の世界市場:製品・用途・地域・国別の分析・予測 (2025-2034年)Next-Gen Feedstocks for Sustainable Chemicals Market - A Global and Regional Analysis: Focus on Product, Application, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 持続可能化学品向け次世代原料の世界市場:製品・用途・地域・国別の分析・予測 (2025-2034年) |

|

出版日: 2025年05月29日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の持続可能化学品向け次世代原料の市場は、産業界が持続可能な取り組みや循環型経済の原則を積極的に採用する中で、大きな変革期を迎えています。

この市場は、化学品、ポリマー、燃料を製造するためのバイオマス、廃棄物、回収二酸化炭素などの代替原料の開発と利用に焦点を当てています。

市場成長を後押しする主な要因には、環境問題への懸念の高まり、排出規制の強化、環境に配慮した製品に対する消費者ニーズの拡大などがあります。企業は、従来の化石燃料由来の原料から、再生可能で循環型の代替原料へと転換するよう求められています。また、二酸化炭素回収(CCU)、ケミカルリサイクル、合成生物学といった分野での技術革新により、廃棄物やその他の非従来型原料を効率的に有用な化学品へと転換することが可能になってきています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2034年 |

| 2025年評価 | 5億3,280万米ドル |

| 2034年予測 | 21億3,350万米ドル |

| CAGR | 16.67% |

NesteやEnerkemなどの大手企業は、廃棄物からの化学品製造技術において先導的な役割を果たしており、持続可能な原料ソリューションの重要性が高まっていることを示しています。一方で、バイオ由来原料の高コスト、スケーラビリティの課題、インフラの未整備といった問題も依然として存在しています。それでもなお、産業界が持続可能性目標と一致した方向に進み、新技術を導入し続ける中で、本市場には大きなイノベーションの可能性が広がっています。次世代原料への移行は、化学産業の持続可能な未来を築くための重要なステップと見なされています。

持続可能化学品向け次世代原料市場の分類:

セグメンテーション1:エンドユーザー別

- 化学・石油化学

- 医薬品

- エネルギー

- 紙・パルプ

- 建築・建設

- その他

セグメンテーション2:原料別

- バイオベース原料

- リグノセルロース系

- 非リグノセルロース系

- 都市廃棄物

- 農林廃棄物

- 炭素回収利用

- その他

セグメンテーション3:地域別

- 北米:米国、カナダ、メキシコ

- 欧州:ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域:中国、日本、韓国、インド、その他

- その他の地域:南米、中東・アフリカ

当レポートでは、世界の持続可能化学品向け次世代原料の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の分析、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 使用事例

- エンドユーザーと購入基準

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 規制および政策の影響分析

- 技術革新

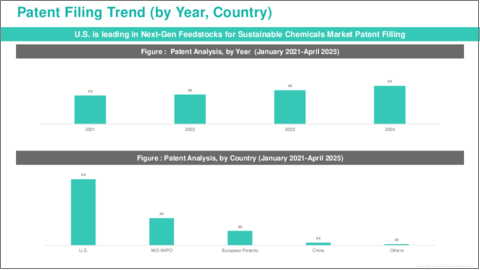

- 特許分析

- スタートアップの情勢

- 投資情勢と研究開発動向

- 将来の展望と市場ロードマップ

- サプライチェーン分析

- バリューチェーン分析

- 世界の価格分析

- 業界の魅力

第2章 持続可能化学品向け次世代原料市場:用途別

- 用途のセグメンテーション

- 用途のサマリー

- 持続可能化学品向け次世代原料市場:エンドユーザー別

- 化学・石油化学製品

- 医薬品

- エネルギー

- 紙・パルプ

- 建築・建設

- その他

第3章 持続可能化学品向け次世代原料市場:製品別

- 製品セグメンテーション

- 製品サマリー

- 持続可能化学品向け次世代原料市場:原料別

- バイオベース原料

- 都市廃棄物

- 農林業廃棄物

- 炭素回収・利用

- その他

第4章 持続可能化学品向け次世代原料市場:地域別

- 持続可能化学品向け次世代原料市場:地域別

- 北米

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 北米(国別)

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 欧州(国別)

- アジア太平洋

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- アジア太平洋(国別)

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- その他の地域(地域別)

第5章 市場-競合ベンチマーキングと企業プロファイル

- 次のフロンティア

- 地理的評価

- 企業プロファイル

- NatureWorks LLC

- Aker Carbon Capture ASA

- Darling Ingredients Inc.

- Drax Group PLC

- Enerkem

- Genan Holding A/S

- Neste Oyj

- Poet, LLC

- Resourceco

- Sustainable Feedstocks Group

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Next-Gen Feedstocks for Sustainable Chemicals Market (by Scenario), $Million, 2025, 2028, and 2034

- Figure 2: Next-Gen Feedstocks for Sustainable Chemicals Market (by Region), $Million, 2024, 2027, and 2034

- Figure 3: Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024, 2027, and 2034

- Figure 4: Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 12: Canada Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 13: Mexico Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 14: Germany Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 15: France Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 16: Italy Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 17: Spain Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 18: U.K. Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 19: Rest-of-Europe Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 20: China Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 21: Japan Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 22: India Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 23: South Korea Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 25: South America Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 26: Middle East and Africa Next-Gen Feedstocks for Sustainable Chemicals Market, $Million, 2024-2034

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Next-Gen Feedstocks for Sustainable Chemicals Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Next-Gen Feedstocks for Sustainable Chemicals Market (by Region), $Million, 2024-2034

- Table 8: North America Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 9: North America Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 10: U.S. Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 11: U.S. Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 12: Canada Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 13: Canada Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 14: Mexico Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 15: Mexico Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 16: Europe Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 17: Europe Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 18: Germany Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 19: Germany Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 20: France Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 21: France Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 22: Italy Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 23: Italy Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 24: Spain Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 25: Spain Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 26: U.K. Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 27: U.K. Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 28: Rest-of-Europe Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 29: Rest-of-Europe Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 30: Asia-Pacific Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 31: Asia-Pacific Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 32: China Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 33: China Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 34: Japan Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 35: Japan Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 36: India Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 37: India Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 38: South Korea Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 39: South Korea Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 40: Rest-of-Asia-Pacific Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 41: Rest-of-Asia-Pacific Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 42: Rest-of-the-World Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 43: Rest-of-the-World Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 44: South America Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 45: South America Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 46: Middle East and Africa Next-Gen Feedstocks for Sustainable Chemicals Market (by Application), $Million, 2024-2034

- Table 47: Middle East and Africa Next-Gen Feedstocks for Sustainable Chemicals Market (by Product), $Million, 2024-2034

- Table 48: Market Share

Global Next-Gen Feedstocks for Sustainable Chemicals Market: Industry Overview

The global next-gen feedstocks for sustainable chemicals market is experiencing significant transformation as industries increasingly embrace sustainable practices and circular economy principles. This market focuses on the development and utilization of alternative raw materials such as biomass, waste, and captured carbon dioxide to produce chemicals, polymers, and fuels.

Key factors driving market growth include growing environmental concerns, tightening regulations on emissions, and heightened consumer demand for eco-friendly products. Companies are under pressure to shift from traditional fossil-based feedstocks to renewable and circular alternatives. Technological advancements in areas like carbon capture, chemical recycling, and synthetic biology are enabling the efficient conversion of waste and other unconventional materials into valuable chemicals.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $532.8 Million |

| 2034 Forecast | $2,133.5 Million |

| CAGR | 16.67% |

Major companies, such as Neste and Enerkem, are leading efforts in waste-to-chemical technologies, underscoring the growing importance of sustainable feedstock solutions. However, challenges such as the high cost of bio-based feedstocks, scalability issues, and infrastructure gaps persist. Despite these hurdles, the market presents considerable opportunities for innovation, especially as industries continue to align with sustainability goals and advance new technologies. The transition to next-gen feedstocks is seen as a crucial step in building a sustainable future for the chemicals industry.

Market Lifecycle Stage

The next-gen feedstocks for sustainable chemicals Market is currently in the growth stage of its lifecycle. While the concept of sustainable feedstocks is not new, the market has seen a rapid increase in investments, technological advancements, and commercial interest in recent years. This growth is largely driven by the urgent need to transition away from fossil-based resources toward renewable and circular alternatives due to mounting environmental concerns and stricter regulations.

Technological innovations in areas such as bio-based chemicals, chemical recycling, and carbon capture are making these feedstocks more viable for large-scale production. Additionally, corporate sustainability commitments and rising consumer demand for eco-friendly products are propelling the adoption of next-gen feedstocks across various industries.

Next-Gen Feedstocks for Sustainable Chemicals Market Segmentation:

Segmentation 1: by End-User

- Chemicals and Petrochemicals

- Pharmaceuticals

- Energy

- Paper and Pulp

- Building and Construction

- Others

The Chemicals and Petrochemicals is one of the prominent application segments in the global next-gen feedstocks for sustainable chemicals market.

Segmentation 2: by Feedstock

- Bio-based Feedstock

- Lignocellulosic

- Non-Lignocellulosic

- Municipal Waste

- Agricultural and Forestry Waste

- Carbon Capture and Utilization

- Others

The global next-gen feedstocks for sustainable chemicals market is estimated to be led by the Bio-based Feedstock segment in terms of type.

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific and Japan

- Rest-of-the-World - South America and Middle East and Africa

In the next-gen feedstocks for sustainable chemicals market, North America is anticipated to gain traction in terms of Next-Gen feedstocks production, owing to the continuous growth in the adoption of sustainable chemicals and the presence of key manufacturers in the regions.

Demand - Drivers and Limitations

The following are the demand drivers for the global Next-Gen Feedstocks for Sustainable Chemicals market:

- Growing Demand for Sustainable and Eco-friendly Products

- Increasing Regulatory Pressure for Sustainable Practices

The global Next-Gen Feedstocks for Sustainable Chemicals market is expected to face some limitations as well due to the following challenges:

- High Production Costs of Bio-based Feedstocks

- Limited Recycling Infrastructure

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

The next-gen feedstocks for sustainable chemicals market comprises key players who have established themselves thoroughly and have the proper understanding of the market, accompanied by start-ups who are looking forward to establishing themselves in this highly competitive next-gen feedstocks for sustainable chemicals market. With the growth in advancements in recycling technologies among the nations, more players will enter the global next-gen feedstocks for sustainable chemicals market with each passing year.

Some of the prominent established names in the next-gen feedstocks for sustainable chemicals market are:

- NatureWorks LLC

- Aker Carbon Capture ASA

- Darling Ingredients Inc.

- Drax Group PLC

- Enerkem

- Genan Holding A/S

- Neste Oyj

- Poet, LLC

- Resourceco

- Sustainable Feedstocks Group

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the next-gen feedstocks for sustainable chemicals market report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Regulatory & Policy Impact Analysis

- 1.5 Technological Innovations

- 1.5.1 Green chemistry principles

- 1.5.2 Circular economy approaches

- 1.5.3 Advanced recycling technologies

- 1.5.4 Electrification of chemical processes

- 1.5.5 Digitalization and AI in chemical design

- 1.5.6 Synthetic biology and metabolic engineering

- 1.6 Patent Analysis

- 1.7 Start-Up Landscape

- 1.8 Investment Landscape and R&D Trends

- 1.9 Future Outlook and Market Roadmap

- 1.10 Supply Chain Analysis

- 1.11 Value Chain Analysis

- 1.12 Global Pricing Analysis

- 1.13 Industry Attractiveness

2. Next-Gen Feedstocks for Sustainable Chemicals Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Next-Gen Feedstocks for Sustainable Chemicals Market (by End-User)

- 2.3.1 Chemicals and Petrochemicals

- 2.3.2 Pharmaceuticals

- 2.3.3 Energy

- 2.3.4 Paper and Pulp

- 2.3.5 Building and Construction

- 2.3.6 Others

3. Next-Gen Feedstocks for Sustainable Chemicals Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Next-Gen Feedstocks for Sustainable Chemicals Market (by Feedstock)

- 3.3.1 Bio-based Feedstock

- 3.3.1.1 Lignocellulosic

- 3.3.1.2 Non-Lignocellulosic

- 3.3.2 Municipal Waste

- 3.3.3 Agricultural and Forestry Waste

- 3.3.4 Carbon Capture and Utilization

- 3.3.5 Others

- 3.3.1 Bio-based Feedstock

4. Next-Gen Feedstocks for Sustainable Chemicals Market (by Region)

- 4.1 Next-Gen Feedstocks for Sustainable Chemicals Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Market by Application

- 4.2.6.1.2 Market by Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Market by Application

- 4.2.6.2.2 Market by Product

- 4.2.6.3 Mexico

- 4.2.6.3.1 Market by Application

- 4.2.6.3.2 Market by Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 France

- 4.3.6.2.1 Market by Application

- 4.3.6.2.2 Market by Product

- 4.3.6.3 Italy

- 4.3.6.3.1 Market by Application

- 4.3.6.3.2 Market by Product

- 4.3.6.4 Spain

- 4.3.6.4.1 Market by Application

- 4.3.6.4.2 Market by Product

- 4.3.6.5 U.K.

- 4.3.6.5.1 Market by Application

- 4.3.6.5.2 Market by Product

- 4.3.6.6 Rest-of-Europe

- 4.3.6.6.1 Market by Application

- 4.3.6.6.2 Market by Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Market by Application

- 4.4.6.2.2 Market by Product

- 4.4.6.3 India

- 4.4.6.3.1 Market by Application

- 4.4.6.3.2 Market by Product

- 4.4.6.4 South Korea

- 4.4.6.4.1 Market by Application

- 4.4.6.4.2 Market by Product

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.5.1 Market by Application

- 4.4.6.5.2 Market by Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 NatureWorks LLC

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Aker Carbon Capture ASA

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Darling Ingredients Inc.

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Drax Group PLC

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Enerkem

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Genan Holding A/S

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Neste Oyj

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Poet, LLC

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Resourceco

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Sustainable Feedstocks Group

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.1 NatureWorks LLC

- 5.4 Other Key Companies