|

|

市場調査レポート

商品コード

1732579

再生木材プラスチック複合材の世界市場:用途・ポリマータイプ・地域の分析・予測 (2025-2034年)Global Recycled Wood Plastic Composites Sales Market: Focus on Application, Polymer Type, and Region - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 再生木材プラスチック複合材の世界市場:用途・ポリマータイプ・地域の分析・予測 (2025-2034年) |

|

出版日: 2025年05月26日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の再生木質プラスチック複合材 (WPC) の市場規模は、2024年の59億4,000万米ドルから、CAGR 7.72%で推移し、2034年には120億7,000万米ドルに達すると予測されています。

同市場の成長は、持続可能な建築材料と自動車部品に対する需要の増加が牽引すると予想されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2034年 |

| 2025年評価 | 61億8,000万米ドル |

| 2034年予測 | 120億7,000万米ドル |

| CAGR | 7.72% |

再生木材プラスチック複合材 (WPC) の市場は、持続可能性や環境配慮型素材を重視する産業の動きにより、著しい成長を遂げています。WPCは、再生木繊維とプラスチックポリマーの混合物で構成されており、従来の材料と比べて耐久性、多用途性、環境負荷の低減といった特長があります。主な用途は、建設分野 (デッキ材、外壁材) 、自動車分野 (内装部品) 、一般消費財 (家具、包装材) など多岐にわたります。この市場の成長要因には、グリーン建材の需要増加、カーボンフットプリント削減を求める規制圧力、リサイクル技術の進歩などが挙げられます。市場が進化を続ける中で、WPCは性能を損なうことなく持続可能な代替材を求める産業にとって、重要なソリューションとしての地位を確立しつつあります。

市場動向:持続可能な建築材料に対する需要の急増

持続可能な建築資材への需要の急増は、環境問題への意識の高まりや、より環境に優しくエネルギー効率の高い建築を推進する流れによって生じている成長動向です。消費者、政府、産業界が持続可能性を優先する中で、WPCのような環境配慮型かつ耐久性に優れた素材が注目を集めています。この流れは、省エネ建築を促進する政策やインセンティブによってさらに後押しされており、建設分野における持続可能なソリューションの広範な採用につながっています。今後もこれらの資材に対する需要は増加し続けると見込まれますが、コスト面やサプライチェーンの制約といった課題も伴うことが予想されます。

市場促進要因:自動車部品の採用増加

自動車部品への採用拡大が主要な成長要因の一つとなっています。自動車メーカーは、軽量で耐久性が高く、環境に配慮した素材を求めており、持続可能性の目標や規制要件を満たすためにWPCの導入を進めています。WPCは、車両重量の削減、燃費の向上、排出ガスの削減といった点で大きな利点を持っており、今後、自動車業界が持続可能性とカーボンフットプリントの削減を重視する中で、ダッシュボード、ドアパネル、内装トリムなどの内外装部品におけるWPCの需要はさらに拡大し、この分野での市場成長を後押しすると見込まれています。

当レポートでは、世界の再生木材プラスチック複合材の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の動向、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- サプライチェーンの概要

- バリューチェーン分析

- 価格予測

- R&Dレビュー

- 特許出願動向:国・企業別

- 規制状況

- ステークホルダー分析

- 使用事例

- エンドユーザーと購入基準

- 主要な世界的出来事の影響分析

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 再生木材プラスチック複合材市場:用途別

- 用途のセグメンテーション

- 用途のサマリー

- 再生木材プラスチック複合材市場:用途別

- 建築・建設

- 自動車

- 工業製品・消費財

- その他

第3章 再生木材プラスチック複合材市場:製品別

- 製品セグメンテーション

- 製品サマリー

- 再生木材プラスチック複合材市場:ポリマータイプ別

- ポリエチレン

- ポリプロピレン

- ポリ塩化ビニル

- その他

第4章 再生木材プラスチック複合材市場:地域別

- 再生木材プラスチック複合材市場:地域別

- 北米

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 米国

- カナダ

- メキシコ

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- ドイツ

- フランス

- 英国

- イタリア

- その他

- アジア太平洋

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 南米

- 中東・アフリカ

第5章 企業プロファイル

- 次のフロンティア

- 地理的評価

- Trex Company, Inc.

- Fiberon

- UPM

- Ecoste

- UFP Industries, Inc.

- The AZEK Company Inc.

- Foshan MexyTech Co., Ltd.

- FKuR

- Geolam Inc.

- INDOWUD

- Oldcastle APG a CRH Company

- Hosung WPC

- EKO TIMBER TECH WOOD PLASTIC COMPOSITES LLP

- Resysta International

- JELU-WERK J. Ehrler GmbH & Co. KG

第6章 調査手法

List of Figures

- Figure 1: Recycled Wood Plastic Composites Sales Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Recycled Wood Plastic Composites Sales Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 12: Canada Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 13: Mexico Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 14: Germany Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 15: France Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 16: U.K. Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 17: Italy Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 18: Rest-of-Europe Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 19: China Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 20: Japan Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 21: India Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 22: South Korea Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 23: Rest-of-Asia-Pacific Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 24: South America Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 25: Middle East and Africa Recycled Wood Plastic Composites Sales Market, $Billion, 2024-2034

- Figure 26: Strategic Initiatives (by Company), 2021-2025

- Figure 27: Share of Strategic Initiatives, 2021-2025

- Figure 28: Data Triangulation

- Figure 29: Top-Down and Bottom-Up Approach

- Figure 30: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Recycled Wood Plastic Composites Sales Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Recycled Wood Plastic Composites Sales Market (by Region), $Billion, 2024-2034

- Table 8: North America Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 9: North America Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 12: Canada Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 13: Canada Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 14: Mexico Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 16: Europe Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 17: Europe Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 18: Germany Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 19: Germany Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 20: France Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 21: France Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 22: U.K. Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 23: U.K. Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 24: Italy Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 25: Italy Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 26: Rest-of-Europe Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 27: Rest-of-Europe Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 28: Asia-Pacific Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 29: Asia-Pacific Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 30: China Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 31: China Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 32: Japan Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 33: Japan Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 34: India Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 35: India Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 36: South Korea Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 37: South Korea Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 38: Rest-of-Asia-Pacific Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 39: Rest-of-Asia-Pacific Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-the-World Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-the-World Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 42: South America Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 43: South America Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 44: Middle East and Africa Recycled Wood Plastic Composites Sales Market (by Application), $Billion, 2024-2034

- Table 45: Middle East and Africa Recycled Wood Plastic Composites Sales Market (by Product), $Billion, 2024-2034

- Table 46: Market Share

Global Recycled Wood Plastic Composites Sales Market Industry Overview

The global recycled wood plastic composites sales market was valued at $5.94 billion in 2024, which is expected to grow at a CAGR of 7.72% and reach $12.07 billion by 2034. The growth in the global recycled wood plastic composites sales market is expected to be driven by increasing demand for sustainable building materials and automotive components.

Introduction to Recycled Wood Plastic Composites Sales Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $6.18 Billion |

| 2034 Forecast | $12.07 Billion |

| CAGR | 7.72% |

The Recycled Wood Plastic Composites (WPCs) Sales Market is experiencing significant growth as industries increasingly prioritize sustainability and eco-friendly materials. Composed of a blend of recycled wood fibers and plastic polymers, WPCs offer durability, versatility, and reduced environmental impact compared to traditional materials. These composites are widely used in applications such as construction (decking, cladding), automotive (interior components), and consumer goods (furniture, packaging). The market is driven by the rising demand for green building materials, regulatory pressures for reducing carbon footprints, and advancements in recycling technologies. As the market continues to evolve, WPCs are poised to become a key solution for industries seeking sustainable alternatives without compromising on performance.

Recycled Wood Plastic Composites Sales Market Segmentation:

Segmentation 1: by Product (Polymer Type)

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

Based on polymer type, the global recycled wood plastic composites sales market is expected to be dominated by polyethylene-based WPCs, which combine cost-effectiveness, weather resistance, and broad suitability for outdoor construction and landscaping applications.

Segmentation 2: by Application

- Building and Construction

- Automotive

- Industrial and Consumer Goods

- Others

Based on application, the global recycled wood plastic composites sales market is expected to be dominated by building and construction, driven by the growing demand for sustainable materials in decking, cladding, and outdoor structures.

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Based on region, the global recycled wood plastic composites sales market is expected to be dominated by North America, fueled by strong demand in the construction and automotive sectors, along with a growing emphasis on sustainability and eco-friendly materials.

Market Trend: Surge in Demand for Sustainable Building Materials

The surge in demand for sustainable building materials is a growing trend driven by increasing awareness of environmental issues and the push for greener, more energy-efficient construction. As consumers, governments, and industries prioritize sustainability, materials like recycled wood plastic composites (WPCs) are gaining traction due to their eco-friendly nature and durability. This shift is further supported by regulatory policies and incentives promoting energy-efficient buildings, leading to widespread adoption of sustainable solutions in the construction sector. The demand for these materials is expected to continue rising, albeit with challenges such as cost and supply chain limitations.

Market Driver: Increasing Adoption of Automotive Components

The increasing adoption of automotive components is a key driver for the Recycled Wood Plastic Composites (WPCs) Sales Market, as automotive manufacturers seek lightweight, durable, and eco-friendly materials to meet sustainability goals and regulatory requirements. WPCs offer significant advantages in reducing vehicle weight, improving fuel efficiency, and lowering emissions. As the automotive industry continues to prioritize sustainability and carbon footprint reduction, the demand for WPCs in interior and exterior components, such as dashboards, door panels, and trim, is expected to grow, driving market expansion in this segment.

Market Challenge: High Initial Production Costs

High initial production costs pose a significant challenge to the growth of the recycled wood plastic composites (WPCs) sales market. The manufacturing process for WPCs involves expensive raw materials and complex production techniques, which results in higher costs compared to traditional materials. This makes it difficult for WPCs to compete in price-sensitive industries, particularly in developing markets. Additionally, the limited availability of raw recycled materials and the need for advanced technology to improve efficiency further contribute to these high production costs, hindering widespread adoption.

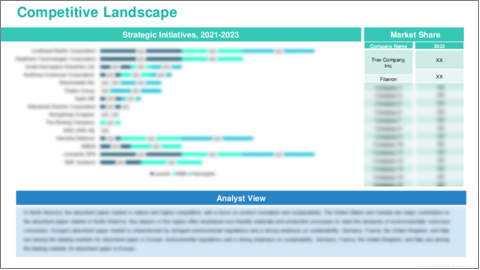

Key Market Players and Competition Synopsis of Recycled Wood Plastic Composites Sales

The companies that are profiled have been selected based on inputs gathered from primary experts, analyzing company coverage, product portfolio, and market penetration.

Trex Company, Inc., Fiberon, and UPM are some of the key players in the recycled wood plastic composites sales market.

Some of the strategies adopted by recycled wood plastic composites sales providers are business expansions, mergers and acquisitions, partnerships, and collaborations.

Some other prominent names established in recycled wood plastic composites sales market are:

- Ecoste

- UFP Industries, Inc.

- The AZEK Company Inc.

- Foshan MexyTech Co., Ltd.

- FKuR

- Geolam Inc.

- INDOWUD

- Oldcastle APG a CRH Company

- Hosung WPC

- EKO TIMBER TECH WOOD PLASTIC COMPOSITES LLP

- Resysta International

- JELU-WERK J. Ehrler GmbH & Co. KG

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Recycled Wood Plastic Composites Sales Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Recycled Wood Plastic Composites Sales Market (by Application)

- 2.3.1 Building and Construction

- 2.3.2 Automotive

- 2.3.3 Industrial and Consumer Goods

- 2.3.4 Others

3. Recycled Wood Plastic Composites Sales Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Recycled Wood Plastic Composites Sales Market (by Polymer Type)

- 3.3.1 Polyethylene

- 3.3.2 Polypropylene

- 3.3.3 Polyvinyl Chloride

- 3.3.4 Others

4. Recycled Wood Plastic Composites Sales Market (by Region)

- 4.1 Recycled Wood Plastic Composites Sales Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Trex Company, Inc.

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Fiberon

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 UPM

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 Ecoste

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 UFP Industries, Inc.

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 The AZEK Company Inc.

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Foshan MexyTech Co., Ltd.

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 FKuR

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Geolam Inc.

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 INDOWUD

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Oldcastle APG a CRH Company

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Hosung WPC

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 EKO TIMBER TECH WOOD PLASTIC COMPOSITES LLP

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Resysta International

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 JELU-WERK J. Ehrler GmbH & Co. KG

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.1 Trex Company, Inc.