|

|

市場調査レポート

商品コード

1729043

自動車用先進高張力鋼板(AHSS)市場- 世界および地域別分析:製品別、用途別、国別 - 分析と予測(2025年~2034年)Automotive Advanced High-Strength Steel (AHSS) Market - A Global and Regional Analysis: Focus on Product, Application, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用先進高張力鋼板(AHSS)市場- 世界および地域別分析:製品別、用途別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年05月21日

発行: BIS Research

ページ情報: 英文 130 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の自動車用先進高張力鋼板(AHSS)の市場規模は、軽量で燃費の良い自動車への需要の高まりにより、大きな成長を遂げています。

AHSSは高強度と軽量化を両立させ、自動車の安全性と性能を向上させる理想的な材料です。この市場の特徴は、第三世代AHSSのような鋼種の進歩と、バッテリー保護と構造的完全性を向上させるための電気自動車(EV)へのAHSSの統合です。業界の主要参入企業には、ArcelorMittal、POSCO、SSAB、Tata Steel、ThyssenKruppなどが含まれ、市場ポジションを強化するために製品革新と戦略的パートナーシップに注力しています。地域別では北米、欧州、アジア太平洋での成長が顕著であり、自動車製造への投資の増加と厳しい規制基準が自動車生産におけるAHSSの採用を促進しています。

自動車用AHSS市場のライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価額 | 262億6,000万米ドル |

| 2034年の予測 | 481億3,000万米ドル |

| CAGR | 6.96% |

自動車用先進高張力鋼板(AHSS)市場は現在、ライフサイクルの成長段階にあります。この段階の特徴は、厳格な自動車安全基準と排ガス基準に後押しされた採用の増加です。自動車メーカーは、車両の軽量化と燃費向上のためにAHSSの採用を増やしており、これは世界の環境規制と経済的な自動車に対する消費者の需要を満たす上で極めて重要です。この市場は、イノベーションを促進し、アプリケーションポートフォリオを拡大するために、鉄鋼メーカーと自動車OEMの間で重要な提携や合弁事業が行われていることが特徴です。将来的には、電気自動車(EV)や自律走行車(AV)の採用がAHSS市場に新たな機会をもたらすでしょう。

自動車用AHSS市場において、アジア太平洋は、自動車の軽量化の継続的な進展と主要メーカーの存在により、生産面で牽引力を増すと予想されます。

需要- 促進要因と限界

自動車用AHSSの世界市場における需要促進要因は以下の通り:

- 軽量車両への高い需要

- 鉄鋼生産における技術の進歩

自動車用AHSSの世界市場は、以下の課題によりいくつかの制限にも直面すると予想されます:

- 代替材料との競合

- 限られたリサイクルインフラ

自動車用AHSS市場の主要参入企業と競合情勢

世界の自動車用先進高張力鋼板(AHSS)市場は、複数の有力参入企業を擁する競合環境が特徴です。大手鉄鋼メーカーであるArcelorMittalは大きな市場シェアを持ち、AHSS生産における革新性で認められており、General Motors、Ford、Hondaといった大手自動車メーカーに先進的な鋼材ソリューションを供給しています。もう一つの主要参入企業であるPOSCOは、軽量化と安全性を重視し、電気自動車に適した高強度鋼種を開発しました。ThyssenkruppはJFE Steel Corporationと共同で、複雑な自動車部品向けに延性と強度を強化したjetQ鋼を発表しました。SSABは、安全性と軽量化に重点を置き、様々な自動車用途向けに設計されたDocol鋼を含むAHSS製品群を提供しています。United States Steel Corporationは、XG3鋼のような先進的な鋼材ソリューションを提供しており、安全性と燃費を向上させる最適な強度対重量比を実現し、自動車用AHSS市場全体に影響を与えています。これらの企業は、製品の革新、戦略的パートナーシップ、持続可能性への取り組みといった戦略を採用し、自動車用AHSS市場における地位を強化しています。

当レポートでは、世界の自動車用先進高張力鋼板(AHSS)市場について調査し、市場の概要とともに、製品別、用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 市場力学の概要

- 規制および政策影響分析

- 特許分析

- スタートアップの情勢

- 総アドレス可能市場

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

- サプライチェーン分析

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

第2章 自動車用AHSS市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- 自動車用AHSS市場(最終用途産業別)

- 乗用車

- 商用車

- その他

第3章 自動車用AHSS市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- 自動車用AHSS市場(グレード別)

- 二相鋼(DP鋼)

- 変態誘起塑性(TRIP)鋼

- 複合相(CP)鋼

- マルテンサイト(MS)鋼

- フェライトベイナイト(FB)鋼

- プレスハードン鋼(PHS)

- 自動車用AHSS市場(コンポーネント別)

- ホワイトボディ(BIW)

- シャーシとサスペンション

- バンパーと補強材

- ドアと閉鎖

- パワートレインコンポーネント

- その他

第4章 自動車用AHSS市場(地域別)

- 自動車用AHSS市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- ArcelorMittal

- SSAB

- POSCO

- thyssenkrupp Steel

- United States Steel Corporation

- Kobe Steel, Ltd.

- Baosteel Co.,Ltd.

- JFE Steel Corporation

- Tata Steel

- Cleveland-Cliffs Inc.

- voestalpine Stahl GmbH

- JSW

- NATIONAL MATERIAL COMPANY, LLC

- Kloeckner Metals Corporation

- Nucor Corporation

- AK Steel International B.V.

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Automotive AHSS Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Automotive AHSS Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Automotive AHSS Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Automotive AHSS Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Automotive AHSS Market, $Billion, 2024-2034

- Figure 12: Canada Automotive AHSS Market, $Billion, 2024-2034

- Figure 13: Mexico Automotive AHSS Market, $Billion, 2024-2034

- Figure 14: Germany Automotive AHSS Market, $Billion, 2024-2034

- Figure 15: France Automotive AHSS Market, $Billion, 2024-2034

- Figure 16: Italy Automotive AHSS Market, $Billion, 2024-2034

- Figure 17: Spain Automotive AHSS Market, $Billion, 2024-2034

- Figure 18: U.K. Automotive AHSS Market, $Billion, 2024-2034

- Figure 19: Rest-of-Europe Automotive AHSS Market, $Billion, 2024-2034

- Figure 20: China Automotive AHSS Market, $Billion, 2024-2034

- Figure 21: Japan Automotive AHSS Market, $Billion, 2024-2034

- Figure 22: India Automotive AHSS Market, $Billion, 2024-2034

- Figure 23: South Korea Automotive AHSS Market, $Billion, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Automotive AHSS Market, $Billion, 2024-2034

- Figure 25: South America Automotive AHSS Market, $Billion, 2024-2034

- Figure 26: Middle East and Africa Automotive AHSS Market, $Billion, 2024-2034

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Automotive AHSS Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Automotive AHSS Market (by Region), $Billion, 2024-2034

- Table 8: North America Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 9: North America Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 12: Canada Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 13: Canada Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 14: Mexico Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 16: Europe Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 17: Europe Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 18: Germany Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 19: Germany Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 20: France Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 21: France Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 22: Italy Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 23: Italy Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 24: Spain Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 25: Spain Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 26: U.K. Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 27: U.K. Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 28: Rest-of-Europe Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 29: Rest-of-Europe Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 30: Asia-Pacific Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 31: Asia-Pacific Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 32: China Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 33: China Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 34: Japan Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 35: Japan Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 36: India Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 37: India Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 38: South Korea Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 39: South Korea Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-Asia-Pacific Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-Asia-Pacific Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 42: Rest-of-the-World Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 43: Rest-of-the-World Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 44: South America Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 45: South America Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 46: Middle East and Africa Automotive AHSS Market (by Application), $Billion, 2024-2034

- Table 47: Middle East and Africa Automotive AHSS Market (by Product), $Billion, 2024-2034

- Table 48: Market Share

Global Automotive AHSS Market: Industry Overview

The global automotive advanced high-strength steel (AHSS) market is experiencing significant growth, driven by the increasing demand for lightweight and fuel-efficient vehicles. AHSS offers a combination of high strength and reduced weight, making it an ideal material for enhancing vehicle safety and performance. The market is characterized by advancements in steel grades, such as third-generation AHSS, and the integration of AHSS in electric vehicles (EVs) to improve battery protection and structural integrity. Key players in the industry include ArcelorMittal, POSCO, SSAB, Tata Steel, and ThyssenKrupp, who are focusing on product innovation and strategic partnerships to strengthen their market positions. Regional growth is prominent in North America, Europe, and Asia-Pacific, with increasing investments in automotive manufacturing and stringent regulatory standards driving the adoption of AHSS in vehicle production.

Automotive AHSS Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $26.26 Billion |

| 2034 Forecast | $48.13 Billion |

| CAGR | 6.96% |

The automotive advanced high-strength steel (AHSS) market is currently in the growth phase of its lifecycle. This phase is characterized by increasing adoption driven by stringent vehicle safety and emission standards. Automakers are increasingly adopting AHSS to reduce vehicle weight and improve fuel efficiency, which is critical in meeting global environmental regulations and consumer demand for economical cars. The market is characterized by significant collaborations and joint ventures between steel producers and automotive OEMs to foster innovation and expand application portfolios. Looking forward, the adoption of electric vehicles (EVs) and autonomous vehicles (AVs) presents new opportunities for the AHSS market, as these vehicles require robust architectures for battery protection and structural integrity.

Automotive AHSS Market Segmentation:

Segmentation 1: by End-Use Industry

- Passenger Vehicle

- Commercial Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Others

Passenger Vehicle is one of the prominent application segments in the global automotive AHSS market.

Segmentation 2: by Grade

- Dual Phase (DP) Steels

- Transformation-Induced Plasticity (TRIP) Steels

- Complex Phase (CP) Steels

- Martensitic (MS) Steels

- Ferritic-Bainitic (FB) Steels

- Press-Hardened Steels (PHS)

The global automotive AHSS market is estimated to be led by the Dual Phase (DP) Steels segment in terms of grade.

Segmentation 3: by Component

- Body-in-White (BIW)

- Chassis and Suspension

- Bumpers and Reinforcements

- Doors and Closures

- Powertrain Components

- Other

The global automotive AHSS market is estimated to be led by the body-in-white segment in terms of component.

Segmentation 4: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

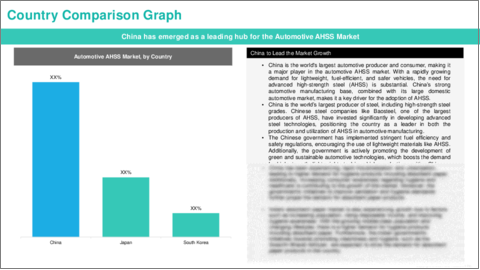

In the automotive AHSS market, Asia-Pacific is anticipated to gain traction in terms of production, owing to the continuous growth in the adoption of lighter vehicles and the presence of key manufacturers in the region.

Demand - Drivers and Limitations

The following are the demand drivers for the global automotive AHSS market:

- High Demand for Lightweight Vehicles

- Technological Advancements in Steel Production

The global automotive AHSS market is expected to face some limitations as well due to the following challenges:

- Competition from Alternative Materials

- Limited Recycling Infrastructure

Automotive AHSS Market Key Players and Competition Synopsis

The global automotive advanced high-strength steel (AHSS) market is characterized by a competitive landscape featuring several prominent players. ArcelorMittal, a leading steel manufacturer, holds a significant market share and is recognized for its innovation in AHSS production, supplying advanced steel solutions to major automakers such as General Motors, Ford, and Honda. POSCO, another key player, has developed high-strength steel grades tailored for electric vehicles, emphasizing lightweight and safety features. Thyssenkrupp, in collaboration with JFE Steel Corporation, introduced jetQ steels, which offer enhanced ductility and strength for complex automotive components. SSAB provides a range of AHSS products, including Docol steels, designed for various automotive applications, focusing on safety and weight reduction. United States Steel Corporation offers advanced steel solutions like XG3 steel, which provides an optimal strength-to-weight ratio for improved safety and fuel efficiency which impact the overall automotive ahss market. These companies employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions in the automotive AHSS market.

Some prominent names established in the automotive AHSS market are:

- ArcelorMittal

- SSAB

- POSCO

- thyssenkrupp Steel

- United States Steel Corporation

- Kobe Steel, Ltd.

- Baosteel Co., Ltd.

- JFE Steel Corporation

- Tata Steel

- Cleveland-Cliffs Inc.

- voestalpine Stahl GmbH

- JSW

- NATIONAL MATERIAL COMPANY, LLC

- Kloeckner Metals Corporation

- Nucor Corporation

- AK Steel International B.V.

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Regulatory & Policy Impact Analysis

- 1.5 Patent Analysis

- 1.6 Start-Up Landscape

- 1.7 Total Addressable Market

- 1.8 Investment Landscape and R&D Trends

- 1.9 Future Outlook and Market Roadmap

- 1.10 Supply Chain Analysis

- 1.11 Value Chain Analysis

- 1.12 Global Pricing Analysis

- 1.13 Industry Attractiveness

2. Automotive AHSS Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Automotive AHSS Market (by End-Use Industry)

- 2.3.1 Passenger Vehicles

- 2.3.2 Commercial Vehicles

- 2.3.2.1 Light Commercial Vehicles

- 2.3.2.2 Heavy Commercial Vehicles

- 2.3.3 Others

3. Automotive AHSS Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Automotive AHSS Market (by Grade)

- 3.3.1 Dual Phase (DP) Steels

- 3.3.2 Transformation-Induced Plasticity (TRIP) Steels

- 3.3.3 Complex Phase (CP) Steels

- 3.3.4 Martensitic (MS) Steels

- 3.3.5 Ferritic-Bainitic (FB) Steels

- 3.3.6 Press-Hardened Steels (PHS)

- 3.4 Automotive AHSS Market (by Component)

- 3.4.1 Body-in-White (BIW)

- 3.4.2 Chassis and Suspension

- 3.4.3 Bumpers and Reinforcements

- 3.4.4 Doors and Closures

- 3.4.5 Powertrain Components

- 3.4.6 Other

4. Automotive AHSS Market (by Region)

- 4.1 Automotive AHSS Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Application

- 4.2.6 Product

- 4.2.7 North America (by Country)

- 4.2.7.1 U.S.

- 4.2.7.1.1 Market by Application

- 4.2.7.1.2 Market by Product

- 4.2.7.2 Canada

- 4.2.7.2.1 Market by Application

- 4.2.7.2.2 Market by Product

- 4.2.7.3 Mexico

- 4.2.7.3.1 Market by Application

- 4.2.7.3.2 Market by Product

- 4.2.7.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 Europe (by Country)

- 4.3.7.1 Germany

- 4.3.7.1.1 Market by Application

- 4.3.7.1.2 Market by Product

- 4.3.7.2 France

- 4.3.7.2.1 Market by Application

- 4.3.7.2.2 Market by Product

- 4.3.7.3 Italy

- 4.3.7.3.1 Market by Application

- 4.3.7.3.2 Market by Product

- 4.3.7.4 Spain

- 4.3.7.4.1 Market by Application

- 4.3.7.4.2 Market by Product

- 4.3.7.5 U.K.

- 4.3.7.5.1 Market by Application

- 4.3.7.5.2 Market by Product

- 4.3.7.6 Rest-of-Europe

- 4.3.7.6.1 Market by Application

- 4.3.7.6.2 Market by Product

- 4.3.7.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 Asia-Pacific (by Country)

- 4.4.7.1 China

- 4.4.7.1.1 Market by Application

- 4.4.7.1.2 Market by Product

- 4.4.7.2 Japan

- 4.4.7.2.1 Market by Application

- 4.4.7.2.2 Market by Product

- 4.4.7.3 India

- 4.4.7.3.1 Market by Application

- 4.4.7.3.2 Market by Product

- 4.4.7.4 South Korea

- 4.4.7.4.1 Market by Application

- 4.4.7.4.2 Market by Product

- 4.4.7.5 Rest-of-Asia-Pacific

- 4.4.7.5.1 Market by Application

- 4.4.7.5.2 Market by Product

- 4.4.7.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 Rest-of-the-World (by Region)

- 4.5.7.1 South America

- 4.5.7.1.1 Market by Application

- 4.5.7.1.2 Market by Product

- 4.5.7.2 Middle East and Africa

- 4.5.7.2.1 Market by Application

- 4.5.7.2.2 Market by Product

- 4.5.7.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 ArcelorMittal

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 SSAB

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 POSCO

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 thyssenkrupp Steel

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 United States Steel Corporation

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Kobe Steel, Ltd.

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Baosteel Co.,Ltd.

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 JFE Steel Corporation

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Tata Steel

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Cleveland-Cliffs Inc.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 voestalpine Stahl GmbH

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 JSW

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 NATIONAL MATERIAL COMPANY, LLC

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Kloeckner Metals Corporation

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 Nucor Corporation

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.16 AK Steel International B.V.

- 5.3.16.1 Overview

- 5.3.16.2 Top Products/Product Portfolio

- 5.3.16.3 Top Competitors

- 5.3.16.4 Target Customers

- 5.3.16.5 Key Personnel

- 5.3.16.6 Analyst View

- 5.3.16.7 Market Share

- 5.3.1 ArcelorMittal

- 5.4 Other Key Companies