|

|

市場調査レポート

商品コード

1700015

欧州の電気式蒸気クラッカー市場:最終用途産業別、最終製品別、国別 - 分析と予測(2025年~2040年)Europe Electric Steam Cracker Market: Focus on End-Use Industry, End-Product, and Country-Level Analysis - Analysis and Forecast, 2025-2040 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の電気式蒸気クラッカー市場:最終用途産業別、最終製品別、国別 - 分析と予測(2025年~2040年) |

|

出版日: 2025年04月10日

発行: BIS Research

ページ情報: 英文 87 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の電気式蒸気クラッカーの市場規模は、2025年には2,603万米ドルになるとみられています。

同市場は、51.91%のCAGRで拡大し、2040年には137億7,839万米ドルに達すると予測されています。環境規制の厳格化と産業プロセスの脱炭素化に向けたイニシアチブの高まりが、欧州の電気式蒸気クラッカー市場を牽引しています。産業界の強力なパートナーシップと電気技術の進歩が、より経済的で環境に優しい生産技術の使用を後押ししています。石油化学業界では、より厳しい排出要件を満たすために企業が取り組んでおり、この変化は最も顕著です。低排出ソリューションへの需要が高まる中、持続可能性と技術進歩を中心とした市場の継続的な革新によって、二酸化炭素排出量を削減し、よりクリーンな産業運営に向かう欧州のコミットメントが強化されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2040年 |

| 2025年の評価 | 2,603万米ドル |

| 2040年の予測 | 137億7,839万米ドル |

| CAGR | 51.91% |

欧州の電気式蒸気クラッカー市場は、二酸化炭素排出量の削減と環境に優しい工業プロセスへの移行に向けた同地域の強いコミットメントにより、大きく拡大しています。炭化水素を分解し、エチレンやプロピレンのような重要な化学物質を生産するために、スチームクラッカーは石油化学産業にとって極めて重要です。従来の化石燃料ベースのクラッカーの代わりに、再生可能な電力で稼働する電気式蒸気クラッカーに切り替えることで、企業は二酸化炭素排出量を大幅に削減することができます。

欧州連合(EU)の高い気候目標やカーボンニュートラル目標、その他の厳しい環境規則が、低排出技術の採用を促進しています。電気式スチーム・クラッカーの開発と導入を急ぐために、各国政府から資金援助とインセンティブが提供されています。さらに、石油化学企業、技術開発者、エネルギー供給者間のパートナーシップが、電化ソリューションの技術革新を促進しています。

風力や太陽光などの再生可能エネルギーの統合は、電気式蒸気クラッカーの持続可能性をさらに後押ししています。電気加熱技術の進歩もまた、運転効率を高め、全体的なエネルギー消費を削減しています。産業界がより厳しい排出基準を遵守しようとし、消費者がより環境に優しい製品を求める中、欧州の電気式蒸気クラッカー市場は着実に拡大する態勢にあります。この移行は、石油化学部門の脱炭素化と欧州のクリーンエネルギーの未来に貢献するための重要なステップです。

石油化学、精製、化学、その他を含む様々なセクターにおける電気式蒸気クラッカー技術の様々な用途を理解するのに役立ちます。また、電気加熱、再生可能エネルギー統合、排出制御技術などの技術の進歩も取り上げています。さらに、触媒、プロセス自動化ツール、エネルギー貯蔵システムなどの主要消耗品についても取り上げています。ISO、ASTM、その他を含む業界を指導する方法と規格については、コンプライアンスと運用プロトコルの包括的な見解を提供するために議論されています。欧州の電気式蒸気クラッカー市場は、継続的な技術革新、持続可能な製造への投資の増加、化学セクターにおける電化の環境的利点に対する意識の高まりにより、大幅な成長が見込まれています。その結果、電気式スチーム・クラッカー業界は、高投資・高収益のビジネスモデルとなります。

欧州の電気式蒸気クラッカー市場は急速に拡大しており、既存および新規の市場参入企業に大きな機会を提供しています。このセグメントで論じている主な成長戦略には、M&A、新製品投入、戦略的パートナーシップ、地理的事業拡大などが含まれます。市場競争力を強化するため、各社は製品開拓や持続可能な技術の導入にますます力を入れています。

当レポートでは、欧州の電気式蒸気クラッカー市場の主要企業を、電気式クラッカー技術プロバイダーやシステムインテグレーターを含めて紹介しています。読者が市場内の未開拓の収益機会を特定できるよう、提携、合意、協力関係を含む詳細な競合情勢分析を掲載しています。この分析は、市場参入企業が技術革新と戦略的提携を通じて自社の地位を維持・強化するための指針となることを目的としています。

当レポートでは、欧州の電気式蒸気クラッカー市場について調査し、市場の概要とともに、最終用途産業別、最終製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 欧州の電気式蒸気クラッカー市場:現状と将来

- 研究開発レビュー

- 規制状況

- ステークホルダー分析

- パイロットプロジェクト/進行中の分析

- 市場力学:概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 水蒸気分解における排出削減のための低炭素技術

- 電気式と従来式の動作比較

- 投資と資金調達のシナリオ

- 再生可能エネルギーエコシステム

- 地域別スチームクラッカー生産能力(100万トン)、2025年、2030年、2035年、2040年

- 主要経済国別のクラッカーの平均年齢

- コスト構造分析

- 石油化学市場の見通し

第2章 地域

- 電気式蒸気クラッカー市場(地域別)

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 用途

- 製品

- 欧州(国別)

第3章 企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル(設計・EPC企業)

- 企業プロファイル(炉設置企業)

- 企業プロファイル(潜在的企業)

- 研究機関

第4章 調査手法

List of Figures

- Figure 1: Europe Electric Steam Cracker Market, Million Tons, 2025, 2030, 2035, and 2040

- Figure 2: Electric Steam Cracker Market (by Region), Million Tons, 2025, 2030, 2035, and 2040

- Figure 3: Europe Electric Steam Cracker Market (by End-Use Industry), Million Tons, 2025, 2030, 2035, and 2040

- Figure 4: Europe Electric Steam Cracker Market (by End-Product), Million Tons, 2025, 2030, 2035, and 2040

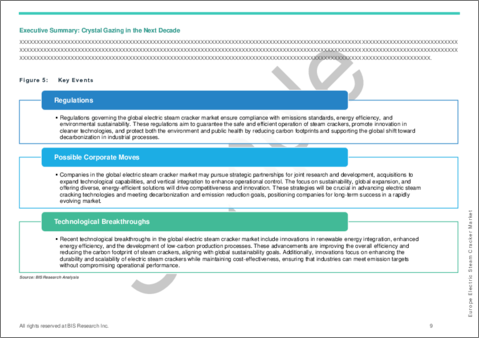

- Figure 5: Key Events

- Figure 6: Patent Analysis (by Country), January 2021-July 2024

- Figure 7: Patent Analysis (by Company), January 2021-July 2024

- Figure 8: Impact Analysis of Market Navigating Factors, 2025-2040

- Figure 9: Renewable Energy Production by Region, TWh, 2015-2022

- Figure 10: Renewable Energy Production by Source, TWh, 2015-2022

- Figure 11: Wind Energy Production by Region, TWh, 2015-2022

- Figure 12: Solar Energy Production by Region, TWh, 2015-2022

- Figure 13: Weighted Average Levelized Cost of Electricity (LCOE) for Onshore Wind by Country, $/kWh, 2020-2023

- Figure 14: Estimated Steam Cracker capacity, by Region Million Tons, 2025, 2030, 2035, and 2040

- Figure 15: Average Age of Cracker by Key Economies, Years, 2023

- Figure 16: Global Olefins Market Demand Outlook, Million Tons, 2020-2030

- Figure 17: Global Aromatics Market Demand Outlook, Million Tons, 2020-2030

- Figure 18: Germany Electric Steam Cracker Market (Minimum and Maximum), Million Tons, 2025-2040

- Figure 19: Germany Conventional and Solar Electricity Prices, $/kWh, 2019-2023

- Figure 20: France Electric Steam Cracker Market (Minimum and Maximum), Million Tons, 2025-2040

- Figure 21: France Conventional and Solar Electricity Prices, $/kWh, 2019-2023

- Figure 22: Netherlands Electric Steam Cracker Market (Minimum and Maximum), Million Tons, 2025-2040

- Figure 23: Netherlands Conventional and Solar Electricity Prices, $/kWh, 2019-2023

- Figure 24: Rest-of-Europe Electric Steam Cracker Market (Minimum and Maximum), Million Tons, 2025-2040

- Figure 25: Data Triangulation

- Figure 26: Top-Down and Bottom-Up Approach

- Figure 27: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends: Overview

- Table 5: Comparative Analysis of ImProof and Cracker of the Future:

- Table 6: Global Research Initiatives

- Table 7: Regulatory Landscape for Electric Steam Cracker Market

- Table 8: Emission Targets Adopted in Different Regions

- Table 9: Economic Parameters for Conventional and Electrified Cracker Plants

- Table 10: Comparison of CO2 Emissions in Conventional vs. Electric Steam Crackers

- Table 11: Cost Structure Analysis for Conventional and Electrified Cracker End-Product

- Table 12: Electric Steam Cracker Market (by Region), Million Tons, 2025-2040

- Table 13: Europe Electric Steam Cracker Market (by End-Use Industry), Million Tons, 2025-2040

- Table 14: Europe Electric Steam Cracker Market (by End-Product), Million Tons, 2025-2040

- Table 15: Germany Ethylene Imports and Exports, Kilo Tons and $Million, 2023 and 2022

- Table 16: Germany Electric Steam Cracker Market (by End-Use Industry), Million Tons, 2025-2040

- Table 17: Germany Electric Steam Cracker Market (by End-Product), Million Tons, 2025-2040

- Table 18: France Ethylene Imports and Exports, Kilo Tons and $Million, 2023 and 2022

- Table 19: France Electric Steam Cracker Market (by End-Use Industry), Million Tons, 2025-2040

- Table 20: France Electric Steam Cracker Market (by End-Product), Million Tons, 2025-2040

- Table 21: Netherlands Ethylene Imports and Exports, Kilo Tons and $Million, 2023 and 2022

- Table 22: Netherlands Electric Steam Cracker Market (by End-Use Industry), Million Tons, 2025-2040

- Table 23: Netherlands Electric Steam Cracker Market (by End-Product), Million Tons, 2025-2040

- Table 24: Key Countries in Rest-of-Europe Ethylene Imports and Exports, Kilo Tons and $Million, 2023 and 2022

- Table 25: Rest-of-Europe Electric Steam Cracker Market (by End-Use Industry), Million Tons, 2025-2040

- Table 26: Rest-of-Europe Electric Steam Cracker Market (by End-Product), Million Tons, 2025-2040

Introduction to Europe Electric Steam Cracker Market

The Europe electric steam cracker market is expected to be valued at $26.03 million in 2025 and is projected to grow at a CAGR of 51.91%, reaching $13,778.39 million by 2040. Stricter environmental restrictions and growing initiatives to decarbonise industrial processes are driving the market for electric steam crackers in Europe. Strong industrial partnerships and electrical technology advancements are propelling the use of more economical and environmentally friendly production techniques. In the petrochemical industry, where businesses are working to satisfy more stringent emission requirements, this change is most noticeable. Europe's commitment to lowering its carbon footprint and moving towards cleaner industrial operations is being reinforced by the market's ongoing innovation centred on sustainability and technological advancement as the demand for low-emission solutions rises.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2040 |

| 2025 Evaluation | $26.03 Million |

| 2040 Forecast | $13,778.39 Million |

| CAGR | 51.91% |

The market for electric steam crackers in Europe is expanding significantly because to the region's strong commitment to cutting carbon emissions and moving towards environmentally friendly industrial processes. In order to break down hydrocarbons and produce important chemicals like ethylene and propylene, steam crackers are crucial to the petrochemical industry. Businesses can drastically lower their carbon footprint by switching to electric steam crackers that run on renewable electricity instead of conventional fossil fuel-based crackers.

The European Union's lofty climate goals and carbon neutrality targets, along with other strict environmental rules, are promoting the adoption of low-emission technologies. Funding and incentives are being provided by governments to hasten the development and implementation of electric steam crackers. Furthermore, partnerships among petrochemical firms, technology developers, and energy providers are propelling innovation in electrification solutions.

The integration of renewable energy sources, such as wind and solar, further supports the sustainability of electric steam crackers. Advancements in electric heating technology are also enhancing operational efficiency and reducing overall energy consumption. As industries seek to comply with stricter emission standards and consumers demand more eco-friendly products, the market for electric steam crackers in Europe is poised for steady expansion. This transition marks a critical step in decarbonizing the petrochemical sector and contributing to Europe's clean energy future.

Market Segmentation:

Segmentation 1: by End-Use Industry

- Petrochemical Industry

- Oil Refining

Segmentation 2: by End-Product

- Olefins

- Aromatics

Segmentation 3: by Region

- Europe: Germany, France, Netherlands, and Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: This segment helps the reader understand the different applications of electric steam cracker technology across various sectors, including petrochemicals, refining, chemicals, and others. It also highlights the advancements in techniques such as electric heating, renewable energy integration, and emissions control technologies. Additionally, the report covers key consumables such as catalysts, process automation tools, and energy storage systems. The methods and standards guiding the industry, including ISO, ASTM, and others, are discussed to provide a comprehensive view of compliance and operational protocols. The Europe electric steam cracker market is poised for substantial growth, driven by continuous technological innovations, increased investments in sustainable manufacturing, and rising awareness of the environmental benefits of electrification in the chemical sector. As a result, the electric steam cracker industry represents a high-investment, high-revenue generating business model.

Growth/Marketing Strategy: The Europe electric steam cracker market has been expanding rapidly, offering significant opportunities for both established and new market players. Key growth strategies discussed in this segment include mergers and acquisitions, new product launches, strategic partnerships, and geographic business expansions. Companies are increasingly focusing on product development and the adoption of sustainable technologies to enhance their competitive edge in the market.

Competitive Strategy: The major players in the Europe electric steam cracker market are profiled in the report, including electric cracker technology providers and system integrators. A detailed competitive landscape analysis, including partnerships, agreements, and collaborations, is presented to help readers identify untapped revenue opportunities within the market. This analysis aims to guide market participants in maintaining and strengthening their position through innovation and strategic alliances.

Key Market Players and Competition Synopsis

The companies profiled in the Europe electric steam cracker market have been selected based on inputs gathered from primary experts and through analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Technip Energies N.V.

- Linde PLC

- Coolbrook

- BASF

- Repsol

- Total Energies

- BP p.l.c.

- Versalis S.p.A.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Europe Electric Steam Cracker Market: Current and Future

- 1.1.1 Sustainability in Petrochemical Refining

- 1.1.2 Steam Cracking Output (by Country)

- 1.1.3 Emission Reduction Initiatives (by Companies)

- 1.2 Research and Development Review

- 1.2.1 Projects on Electrification

- 1.2.1.1 IMPROOF Project

- 1.2.1.2 Cracker of the Future Consortium

- 1.2.2 Research Initiatives Globally

- 1.2.3 Patent Filing Trend (by Country and Company)

- 1.2.1 Projects on Electrification

- 1.3 Regulatory Landscape

- 1.4 Stakeholder Analysis

- 1.4.1 Pilot Projects/Ongoing Analysis

- 1.5 Market Dynamics: Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Rising Regulatory Pressures and Emission Targets

- 1.5.1.2 Increasing Demand for Sustainable Petrochemical Products

- 1.5.2 Market Restraints

- 1.5.2.1 High Capital Costs for Infrastructure Upgrades

- 1.5.2.2 Fluctuations in the Availability and Cost of Renewable Energy

- 1.5.3 Market Opportunities

- 1.5.3.1 Growth in Technological Advancements and Innovation

- 1.5.3.2 Increase in the Collaboration and Industry Partnerships

- 1.5.1 Market Drivers

- 1.6 Low-Carbon Technologies for Emission Reduction in Steam Cracking

- 1.6.1 Hydrogen Firing or Hydrogen Steam Cracking

- 1.6.2 Selective Process Electrification

- 1.6.3 Carbon Capture Integration

- 1.6.4 Blue Hydrogen Integration

- 1.6.5 Unconventional Feed Cracking

- 1.7 Operation Comparison of Electric vs. Conventional

- 1.7.1 CAPEX and OPEX

- 1.7.2 Emissions

- 1.7.3 Output

- 1.8 Investment and Funding Scenario

- 1.9 Renewable Energy Ecosystem

- 1.9.1 Renewable Energy Production by Region, TWh, 2015-2022

- 1.9.2 Renewable Energy Production by Source, TWh, 2015-2022

- 1.9.3 Wind Energy Production by Region, TWh, 2015-2022

- 1.9.4 Solar Energy Production by Region, TWh, 2015-2022

- 1.9.5 Weighted Average Levelized Cost of Electricity (LCOE) for Onshore Wind by Country, $/kWh, 2020-2023

- 1.1 Steam Cracker Capacity by Region Million Tons, 2025, 2030, 2035, and 2040

- 1.11 Average Age of Cracker by Key Economies

- 1.12 Cost Structure Analysis

- 1.13 Petrochemical Market Outlook

- 1.13.1 Global Olefins Market Demand Outlook, Million Tons, 2020-2030

- 1.13.2 Global Aromatics Market Demand Outlook, Million Tons, 2020-2030

2 Regions

- 2.1 Electric Steam Cracker Market (by Region)

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application

- 2.2.5 Product

- 2.2.6 Europe (by Country)

- 2.2.6.1 Germany

- 2.2.6.2 France

- 2.2.6.3 Netherlands

- 2.2.6.4 Rest-of-Europe

3 Company Profile

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.3 Company Profiles (Designing and EPC Companies)

- 3.3.1 Technip Energies N.V.

- 3.3.1.1 Overview

- 3.3.1.2 Top Products/Product Portfolio

- 3.3.1.3 Target Customers/End Users

- 3.3.1.4 Key Personnel

- 3.3.1.5 Analyst View

- 3.3.2 Linde PLC

- 3.3.2.1 Overview

- 3.3.2.2 Top Products/Product Portfolio

- 3.3.2.3 Target Customers/End Users

- 3.3.2.4 Key Personnel

- 3.3.2.5 Analyst View

- 3.3.3 Coolbrook Technologies Ltd.

- 3.3.3.1 Overview

- 3.3.3.2 Top Products/Product Portfolio

- 3.3.3.3 Target Customers/End Users

- 3.3.3.4 Key Personnel

- 3.3.3.5 Analyst View

- 3.3.1 Technip Energies N.V.

- 3.4 Company Profiles (Companies Installing Furnace)

- 3.4.1 BASF

- 3.4.1.1 Overview

- 3.4.1.2 Top Products/Product Portfolio

- 3.4.1.3 Target Customers/End Users

- 3.4.1.4 Key Personnel

- 3.4.1.5 Analyst View

- 3.4.2 Repsol

- 3.4.2.1 Overview

- 3.4.2.2 Top Products/Product Portfolio

- 3.4.2.3 Target Customers/End Users

- 3.4.2.4 Key Personnel

- 3.4.2.5 Analyst View

- 3.4.3 BP p.l.c.

- 3.4.3.1 Overview

- 3.4.3.2 Top Products/Product Portfolio

- 3.4.3.3 Target Customers/End Users

- 3.4.3.4 Key Personnel

- 3.4.3.5 Analyst View

- 3.4.4 TotalEnergies

- 3.4.4.1 Overview

- 3.4.4.2 Top Products/Product Portfolio

- 3.4.4.3 Target Customers/End Users

- 3.4.4.4 Key Personnel

- 3.4.4.5 Analyst View

- 3.4.5 Versalis S.p.A.

- 3.4.5.1 Overview

- 3.4.5.2 Top Products/Product Portfolio

- 3.4.5.3 Target Customers/End Users

- 3.4.5.4 Key Personnel

- 3.4.5.5 Analyst View

- 3.4.1 BASF

- 3.5 Company Profiles (Possible Companies)

- 3.5.1 Shell

- 3.5.1.1 Overview

- 3.5.1.2 Top Products/Product Portfolio

- 3.5.1.3 Target Customers/End Users

- 3.5.1.4 Key Personnel

- 3.5.1.5 Analyst View

- 3.5.1 Shell

- 3.6 Research Institutes

- 3.6.1 ISPT

- 3.6.1.1 Overview

- 3.6.1.2 Ongoing Programs

- 3.6.1.3 Ongoing Projects

- 3.6.2 ISC3

- 3.6.2.1 Overview

- 3.6.2.2 Ongoing Project

- 3.6.3 TNO

- 3.6.3.1 Overview

- 3.6.3.2 Ongoing Projects

- 3.6.1 ISPT

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast

- 4.2.1 Assumptions and Limitations