|

|

市場調査レポート

商品コード

1681011

グリーンメタノール市場- 世界および地域別分析:最終用途産業別、用途別、メタノールタイプ別、地域別 - 分析と予測(2025年~2034年)Green Methanol Market - A Global and Regional Analysis: Focus on End-Use Industry, Application, Methanol Type, and Region - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| グリーンメタノール市場- 世界および地域別分析:最終用途産業別、用途別、メタノールタイプ別、地域別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年03月18日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

グリーンメタノールまたは再生可能メタノールは、林業廃棄物や農業廃棄物を含むバイオマス、製品別、バイオガス、下水、都市固形廃棄物(MSW)、パルプ・製紙産業からの黒液、二酸化炭素、再生可能電力で生産されるグリーン水素など、様々な供給源から生産されます。

バイオマスから製造されるメタノールはバイオメタノールと呼ばれ、二酸化炭素、グリーン水素、再生可能電力から製造されるものはeメタノールと呼ばれます。

グリーンメタノールは、CRI、OCI N.V.、Chemrec ABといった企業がいち早く市場に参入しています。Carbon Recycling International (CRI)は、2010年から11年にかけてアイスランドに世界初のeメタノール実証プラントを設置し、2012年にはVulcanolというブランド名でeメタノールの商業生産を開始した最初の企業となっています。OCI N.V.の子会社BioMCNは、バイオメタノール生産に参入した最初の企業であり、最初のプロジェクトは2010年にオランダで年産200KTの生産能力で開始されました。

それ以来、海運業界における厳しい二酸化炭素排出規制や政府によるバイオ燃料重視の高まりにより、需要は日々増加し、市場は大きく成長しています。海事産業、バイオ燃料、政府からの支援が、予測期間中の市場成長をさらに促進すると予想されます。

グリーンメタノール市場の成長は、クリーンで持続可能な燃料源として、海事産業からのグリーンメタノール需要の高まりと密接に結びついています。海運業界からのグリーンメタノールに対する需要の高まりにより、世界中でグリーンメタノールのプロジェクト発表が増加しています。さらに、メタノールを燃料とする船舶をポートフォリオに加えることを発表する海運会社や物流会社も増えています。例えば、2022年9月、China MerchantsとCOSCO Shipping Bulkの会長は、自社船舶の主要燃料源としてメタノールを将来的に研究の最前線に据えると発表しました。

当レポートでは、世界のグリーンメタノール市場について調査し、市場の概要とともに、最終用途産業別、用途別、メタノールタイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- ステークホルダー分析

- 市場力学の概要

- 規制状況

- 特許分析

- スタートアップの情勢

- 資金調達分析

- サプライチェーン分析

- バリューチェーン分析

- 将来の市場予測と成長シナリオ

- 世界価格分析

- 業界の魅力

- 各国のバイオ燃料政策のサマリーとグリーンメタノール市場への影響

- 水電解市場のスナップショット

- グリーンアンモニア市場のスナップショット

- 炭素回収・利用・貯留(CCUS)市場のスナップショット

- 世界のメタノール需要と供給の分析

第2章 グリーンメタノール市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- グリーンメタノール市場(用途別)

- グリーンメタノール市場(最終用途産業別)

第3章 グリーンメタノール市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- グリーンメタノール市場(メタノールタイプ別)

第4章 グリーンメタノール市場(地域別)

- グリーンメタノール市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- BASF SE

- Carbon Recycling International (CRI)

- OCI N.V.

- Eni S.p.A.

- A.P. Moller - Maersk

- Methanex Corporation

- Mitsubishi Gas Chemical Company, Inc. (MCG)

- European Energy

- Sodra

- Enerkem

- VarmlandsMetanol AB

- Liquid Wind AB

- GIDARA Energy

- Nordic Green ApS

- Synhelion SA

- HIF Global

- WasteFuel

- Glocal Green

- ABEL Energy Pty Ltd.

- Southern Green Gas Limited

第6章 調査手法

Green Methanol Market Industry Overview

Green methanol or renewable methanol is produced from a variety of sources such as biomasses, including forestry and agricultural waste, byproducts, biogas, sewage, municipal solid waste (MSW), black liquor from the pulp and paper industry, carbon dioxide, and green hydrogen produced with renewable electricity. Methanol produced from biomass is called bio-methanol, and the one produced from CO2, green hydrogen, and renewable electricity is known as e-methanol.

Market Lifecycle Stage

Green methanol has been around for years now, with companies such as CRI, OCI N.V., and Chemrec AB being some of the earliest players in the market. Carbon Recycling International (CRI) set up a first-of-its-kind e-methanol demonstration plant in 2010-11 in Iceland and became the first company to start commercial production of e-methanol in 2012 under the brand name Vulcanol. OCI N.V.'s subsidiary BioMCN was the first company to enter bio-methanol production, with the first project starting in 2010 in the Netherlands with a capacity of 200 KT/year.

Since then, the market has grown significantly, with demand increasing every day owing to strict carbon-emission regulations in the maritime industry and growing emphasis on biofuels from the governments. The maritime industry, biofuels, and support from the government are expected to further drive the growth of the market during the forecast period.

Industrial Impact

The growth of the green methanol market is closely tied to the growing demand for green methanol from the maritime industry as a clean and sustainable fuel source. Growing demand for green methanol from the maritime industry has led to a growing number of project announcements for green methanol around the globe. Additionally, a growing number of maritime shipping and logistic companies have announced the decision to include methanol-powered ships in their portfolio. For instance, in September 2022, the chairmen of China Merchants and COSCO Shipping Bulk announced that methanol as a primary source of fuel for their ships would be at the forefront of their research in the future.

Market Segmentation:

Segmentation 1: by End-Use Industry

- Transportation/Mobility

- Chemical Industry

- Power Generation

- Other End-Use Industry

The transportation/mobility segment is the largest end-use industry and is expected to dominate the market during the forecast period 2025-2034. Transportation/mobility is witnessing the growing adoption of green methanol due to the rising emphasis on the decarbonization of the marine industry. Companies such as A.P. Moller - Maersk and Stena have invested heavily in adopting green methanol as a primary fuel for marine vessels. For instance, A.P. Moller - Maersk signed an agreement with Orsted in March 2022 for 300,000 tons of e-methanol per year for its newly ordered fleet of 12 methanol-powered vehicles.

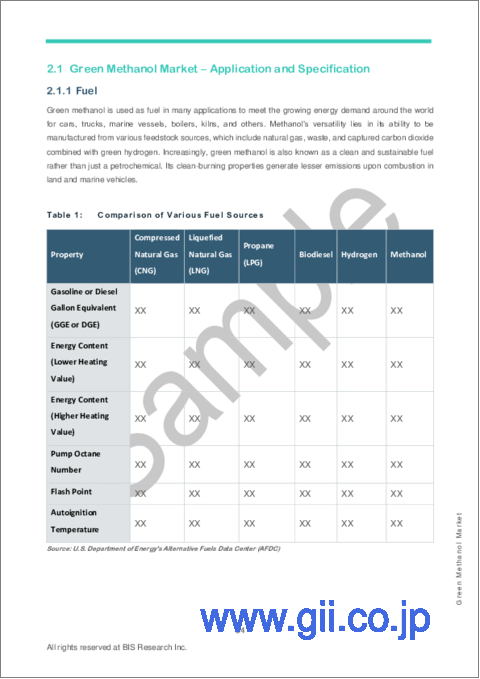

Segmentation 2: by Application

- Fuel

- Chemical Feedstock

- Other Application

The fuel segment is the largest application segment and is expected to dominate the market during the forecast period 2025-2034. Green methanol is being used as a fuel, primarily in the maritime industry, owing to strict regulations and growing emphasis on the decarbonization of the maritime industry. The International Maritime Organization (IMO) has set an ambitious target of reducing international shipping carbon emissions per transport work by at least 40% by 2030 from 2008 levels. IMO is aiming to further reduce carbon emissions by 70% by 2050 from 2008 levels. This is expected to be one of the major drivers of the growing application of green methanol as fuel in the maritime industry.

Segmentation 3: by Methanol Type

- Bio-Methanol

- E-Methanol

The bio-methanol segment is the largest in methanol type and is expected to dominate the market during the forecast period 2025-2034. Bio-methanol is produced from biological feedstock such as forest residue, municipal solid waste (MSW), biogas, and biomass. Bio-methanol production has been around for decades and does not require large investments, unlike e-methanol production, which requires large investments to set up green hydrogen and carbon capture plants. During the forecast period, e-methanol production is expected to grow at a faster rate than bio-methanol production, owing to growing investment in green hydrogen, renewable energy, and power-to-x technology.

Segmentation 4: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, Denmark, Sweden, U.K., Netherlands, and Rest-of-Europe

- Asia-Pacific- China, Japan, India, South Korea, Australia, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and the Middle East and Africa

Europe dominates the green methanol market due to the presence of several leading companies, such as Carbon Recycling International (CRI), European Energy, and Liquid Wind AB, in the region. A highly developed renewable energy market and growing investment from shipping companies such as Auramarine and A.P. Moller - Maersk are also contributing to the dominant share of Europe in the market. Additionally, European countries were among the early adopters of green methanol technology as fuel for the marine industry, and according to the International Renewable Energy Agency (IRENA), Europe had more than 18,000 units in operations for bio-methanol production. Additionally, there is growing investment in e-methanol in Europe, and it is expected to be one of the major drivers of the growth of the market.

Recent Developments in the Green Methanol Market

- In September 2022, Sanlorenzo - an Italian yacht builder, and Rolls-Royce announced their plans to develop and build a large luxury yacht equipped with a methanol-powered engine propulsion system that would be running on carbon-neutral green methanol. The first yacht built under this partnership will be equipped with two MTU (a core brand of Rolls-Royce) methanol engines from Rolls-Royce and is expected to set sail in 2026.

- In August 2022, European Energy signed an agreement with Anaergia for the supply of up to 60,000 metric tons per year of liquefied biogenic carbon dioxide (CO2) for a period of the next ten years. European Energy will use this CO2 to produce e-methanol for A.P. Moller - Maersk as part of their previously signed agreement in March 2022.

- In March 2022, OCI N.V. signed a partnership with NortH2 to develop the first integrated large-scale green ammonia and green methanol value chain through green hydrogen supply by NortH2 to OCI N.V. plants in the Netherlands.

- In March 2022, Mitsubishi Gas Chemical Company, Inc. and JFE Engineering Corporation announced that they had succeeded in producing methanol from CO2 recovered from waste incineration exhaust gas using the carbon capture and utilization (CCU) process. The pilot plant was set up at Mitsubishi Gas Chemical Niigata Research Laboratory, and the companies have announced that they will continue to collaborate to create a decarbonized society.

- In February 2022, Carbon Recycling International installed the largest CO2-to-methanol reactor in CRI's Anyang project, Henan province, China. The installed reactor is designed on Carbon Recycling International's emissions-to-liquid (ETL) process technology.

- In September 2021, A.P. Moller - Maersk invested in California-based WasteFuel to develop green bio-methanol in North America and Asia. Maersk's investment will be used by WasteFuel for developing the infrastructure for bio-refineries, which will enable the company to utilize the most effective technologies available to produce sustainable fuels from unrecoverable waste.

Demand - Drivers and Limitations

Following are the demand drivers for the green methanol market:

- Increasing demand for green methanol from the maritime industry

- Increasing government activities toward low-carbon infrastructure

- Decreasing cost of renewable energy and green methanol technology

The market is expected to face some limitations as well due to the following challenges:

- Expensive green hydrogen production technology

- High investment requirement of carbon capture and utilization (CCU) technology

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of green methanol produced and their potential globally. Moreover, the study provides the reader with a detailed understanding of the green methanol market by end-use industry (transportation/mobility, chemical industry, power generation, and other end-use industry), by application (fuel, chemical feedstock, other application), and by methanol type (bio-methanol and e-methanol).

Growth/Marketing Strategy: The green methanol market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint ventures. The favored strategy for the companies has been partnerships and joint ventures to strengthen their position in the green methanol market. For instance, in September 2022, Winterthur Gas & Diesel (WinGD) and HSD Engine (HSD) announced that the companies would partner to develop an engine capable of running on green methanol by 2024.

Competitive Strategy: Key players in the green methanol market analyzed and profiled in the study involve major green methanol producers. Moreover, a detailed competitive benchmarking of the players operating in the green methanol market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

Company Type 1: Bio-Methanol Producers

- BASF SE

- Sodra

- OCI N.V.

- Enerkem

- GIDARA Energy

- Global Green

- Others

Company Type 2: e-Methanol Producers

- European Energy

- Carbon Recycling International (CRI)

- Eni S.p.A.

- Liquid Wind AB

- HIF Global

- Others

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Regulatory Landscape

- 1.5 Patent Analysis

- 1.6 Start-Up Landscape

- 1.7 Funding Analysis

- 1.8 Supply Chain Analysis

- 1.9 Value Chain Analysis

- 1.10 Future Market Projections and Growth Scenarios

- 1.11 Global Pricing Analysis

- 1.12 Industry Attractiveness

- 1.13 Summary of Biofuel Policies in Various Countries and their Effectiveness on the Green Methanol Market

- 1.14 Snapshot of the Water Electrolysis Market

- 1.15 Snapshot of the Green Ammonia Market

- 1.16 Snapshot of the Carbon Capture Utilization and Storage (CCUS) Market

- 1.17 Global Methanol Demand-Supply Analysis

2. Green Methanol Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Green Methanol Market (by Application)

- 2.3.1 Fuel

- 2.3.2 Chemical Feedstock

- 2.3.2.1 Methanol-to-Olefins (MTO)

- 2.3.2.2 Formaldehyde

- 2.3.2.3 Methyl Tert-Butyl Ether (MTBE)

- 2.3.2.4 Dimethyl Ether (DME)

- 2.3.3 Other Application

- 2.3.3.1 Acetic acid

- 2.3.3.2 Antifreeze

- 2.3.3.3 Solvent

- 2.4 Green Methanol Market (by End-Use Industry)

- 2.4.1 Transportation/Mobility

- 2.4.1.1 Methanol Powered Vehicles in Marine Industry

- 2.4.2 Chemical Industry

- 2.4.3 Power Generation

- 2.4.4 Other End-Use Industry

- 2.4.4.1 Construction

- 2.4.4.2 Electronics Industry

- 2.4.4.3 Paints Industry

- 2.4.1 Transportation/Mobility

3. Green Methanol Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Green Methanol Market (by Methanol Type)

- 3.3.1 Bio-Methanol

- 3.3.1.1 Forestry and Agricultural Waste

- 3.3.1.2 Biogas/Biomass

- 3.3.1.3 Municipal Solid Waste (MSW)

- 3.3.1.4 Others (Sewage and by-products)

- 3.3.1.4.1 Sewage

- 3.3.1.4.2 By-Products

- 3.3.2 e-Methanol

- 3.3.1 Bio-Methanol

4. Green Methanol Market (by Region)

- 4.1 Green Methanol Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Application

- 4.2.6 Product

- 4.2.7 U.S.

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Canada

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.2.9 Mexico

- 4.2.9.1 Market by Application

- 4.2.9.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 Germany

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 Sweden

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Denmark

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 U.K.

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.3.11 The Netherlands

- 4.3.11.1 Market by Application

- 4.3.11.2 Market by Product

- 4.3.12 Rest-of-Europe

- 4.3.12.1 Market by Application

- 4.3.12.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 China

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 Japan

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 India

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 South Korea

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.4.11 Australia

- 4.4.11.1 Market by Application

- 4.4.11.2 Market by Product

- 4.4.12 Rest-of-Asia-Pacific

- 4.4.12.1 Market by Application

- 4.4.12.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 South America

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

- 4.5.8 Middle East and Africa

- 4.5.8.1 Market by Application

- 4.5.8.2 Market by Product

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 BASF SE

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Carbon Recycling International (CRI)

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 OCI N.V.

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Eni S.p.A.

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 A.P. Moller - Maersk

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Methanex Corporation

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Mitsubishi Gas Chemical Company, Inc. (MCG)

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 European Energy

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Sodra

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Enerkem

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 VarmlandsMetanol AB

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Liquid Wind AB

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 GIDARA Energy

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Nordic Green ApS

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 Synhelion SA

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.16 HIF Global

- 5.3.16.1 Overview

- 5.3.16.2 Top Products/Product Portfolio

- 5.3.16.3 Top Competitors

- 5.3.16.4 Target Customers

- 5.3.16.5 Key Personnel

- 5.3.16.6 Analyst View

- 5.3.16.7 Market Share

- 5.3.17 WasteFuel

- 5.3.17.1 Overview

- 5.3.17.2 Top Products/Product Portfolio

- 5.3.17.3 Top Competitors

- 5.3.17.4 Target Customers

- 5.3.17.5 Key Personnel

- 5.3.17.6 Analyst View

- 5.3.17.7 Market Share

- 5.3.18 Glocal Green

- 5.3.18.1 Overview

- 5.3.18.2 Top Products/Product Portfolio

- 5.3.18.3 Top Competitors

- 5.3.18.4 Target Customers

- 5.3.18.5 Key Personnel

- 5.3.18.6 Analyst View

- 5.3.18.7 Market Share

- 5.3.19 ABEL Energy Pty Ltd.

- 5.3.19.1 Overview

- 5.3.19.2 Top Products/Product Portfolio

- 5.3.19.3 Top Competitors

- 5.3.19.4 Target Customers

- 5.3.19.5 Key Personnel

- 5.3.19.6 Analyst View

- 5.3.19.7 Market Share

- 5.3.20 Southern Green Gas Limited

- 5.3.20.1 Overview

- 5.3.20.2 Top Products/Product Portfolio

- 5.3.20.3 Top Competitors

- 5.3.20.4 Target Customers

- 5.3.20.5 Key Personnel

- 5.3.20.6 Analyst View

- 5.3.20.7 Market Share

- 5.3.1 BASF SE