|

|

市場調査レポート

商品コード

1728624

グリーンメタノールの世界市場:原料別、誘導体別、用途別、地域別 - 2030年までの予測Green Methanol Market by Feedstock (Biomass, Green Hydrogen, CCS), Derivative (Formaldehyde, Dimethyl Ether & Methyl Tert-Butyl Ether, Gasoline, Methanol-to-Olefin, Solvents), Application (Chemical Feedstock, Fuel), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| グリーンメタノールの世界市場:原料別、誘導体別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月12日

発行: MarketsandMarkets

ページ情報: 英文 199 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のグリーンメタノールの市場規模は、2025年の25億9,000万米ドルから2030年には111億8,000万米ドルに拡大し、2025年から2030年までのCAGRは34.0%になると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル)、数量(キロトン) |

| セグメント | 原料別、誘導体別、用途別、地域別 |

| 対象地域 | 欧州、アジア太平洋、南米、北米、中東・アフリカ |

二酸化炭素排出量の削減と気候変動対策を目的とした政府の厳しい規制が、この成長を後押ししています。回収された二酸化炭素や再生可能な水素などの再生可能な資源から生産されるグリーンメタノールは、化石燃料由来の従来のメタノールに代わる持続可能な代替品としての役割を果たします。このような規制環境は、産業界がグリーンメタノールを採用するインセンティブとなっています。

炭素回収・貯留(CCS)は、二酸化炭素排出量を削減し、メタノール生産に持続可能な二酸化炭素(CO2)源を提供できることから、グリーンメタノールの主要原料として急速に台頭しています。CCS技術は、産業施設や大気から直接CO2を回収し、気候変動に寄与しないよう地下に貯蔵し、再生可能な水素と結合させてメタノールを生産します。

CCSの成長は、厳しい環境規制を遵守しながらメタノール生産用のCO2を調達できる、費用対効果の高い手法によるところが大きいです。各国政府は、インセンティブや税制優遇措置を通じてCCSを積極的に支援し、その導入を促進しています。産業と経済がますます排出削減を優先するようになる中、CCSはグリーンメタノールの生産に不可欠な要素となりつつあり、産業がより高い持続可能性を達成するのに役立っています。

環境規制の強化や持続可能なエネルギーへのシフトにより、2025年から2030年にかけて、燃料がグリーンメタノール市場で最も急成長する応用分野になると予測されています。グリーンメタノールは、海運、輸送(ガソリンとの混合または特定のエンジンでの使用)、発電などの分野に低炭素の代替燃料を提供します。エネルギー密度が高く、既存のインフラに適合するため、輸送部門にとって魅力的な選択肢となり、インフラを大幅に変更することなく容易に導入することができます。

北米は、持続可能性への強いコミットメント、政府のインセンティブ、再生可能エネルギーへの投資の増加により、予測期間中にグリーンメタノール市場で最高のCAGRを示すと予測されています。北米企業は、グリーンメタノール生産技術とインフラ開発で主要企業をリードしており、より大きな市場シェアを獲得する上で有利な立場にあります。米国は、税額控除や再生可能燃料の義務化など、グリーンメタノール生産の成長を促す支援政策でリードしています。さらに、炭素回収と再生可能水素の技術的進歩が、この地域のクリーン燃料へのシフトを加速しており、今後数年間の市場拡大の主な要因となっています。

当レポートでは、世界のグリーンメタノール市場について調査し、原料別、誘導体別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 価格分析

- バリューチェーン分析

- 生態系マップ

- 規制状況

- 技術分析

- 2024年~2025年の主な会議とイベント

- 貿易分析

- 主要な利害関係者と購入基準

- 特許分析

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

- 2025年の米国関税がグリーンメタノール市場に与える影響

第6章 グリーンメタノール市場(原料別)

- イントロダクション

- バイオマス

- グリーン水素

- 炭素回収・貯留

第7章 グリーンメタノール市場(誘導体別)

- イントロダクション

- ホルムアルデヒド

- ガソリン

- グリーンメタノールからオレフィン/グリーンメタノールからプロピレン

- メチルtert-ブチルエーテル

- 酢酸

- ジメチルエーテル

- メタクリル酸メチル

- バイオディーゼル

- その他

第8章 グリーンメタノール市場(用途別)

- イントロダクション

- 化学原料

- 燃料

- その他

第9章 グリーンメタノール市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他

- 欧州

- ドイツ

- オランダ

- スウェーデン

- その他

- 中東・アフリカ

- GCC諸国

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェアとランキング分析

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- PETROLIAM NASIONAL BERHAD(PETRONAS)

- CARBON RECYCLING INTERNATIONAL

- SUNGAS RENEWABLES

- ABEL ENERGY PTY LTD.

- METHANEX CORPORATION

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- ENERKEM

- ALBERTA PACIFIC FOREST INDUSTRIES INC.

- ENVISION ENERGY

- SODRA

- PROMAN

- その他の企業

- AVAADA

- C1 GREEN CHEMICALS AG

- VARMSLAND METHANOL

- IBERDROLA, S.A.

- LOWLANDS METHANOL B.V.

- SWISS LIQUID FUTURE AG

- LIQUID WIND AB

- RENEWABLE HYDROGEN CANADA CORPORATION

- EUROPEAN ENERGY A/S

第12章 隣接市場と関連市場

第13章 付録

List of Tables

- TABLE 1 GREEN METHANOL MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 GREEN METHANOL MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 3 GREEN METHANOL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INDICATIVE PRICING ANALYSIS OF GREEN METHANOL OFFERED BY KEY PLAYERS, 2021-2023 (USD/TON)

- TABLE 5 INDICATIVE PRICING ANALYSIS OF GREEN METHANOL, BY FEEDSTOCK TYPE, 2024 (USD/TON)

- TABLE 6 AVERAGE SELLING PRICE TREND OF GREEN METHANOL, BY REGION, 2022-2030 (USD/TON)

- TABLE 7 GREEN METHANOL MARKET: ROLE IN ECOSYSTEM

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 GREEN METHANOL MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 12 IMPORT DATA FOR METHANOL, BY COUNTRY, 2019-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR METHANOL, BY COUNTRY, 2019-2024 (USD THOUSAND)

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 16 GREEN METHANOL MARKET: MAJOR PATENTS

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 GREEN METHANOL MARKET, BY FEEDSTOCK, 2021-2024 (KILOTON)

- TABLE 19 GREEN METHANOL MARKET, BY FEEDSTOCK, 2025-2030 (KILOTON)

- TABLE 20 BIOMASS: GREEN METHANOL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 21 BIOMASS: GREEN METHANOL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 22 GREEN HYDROGEN: GREEN METHANOL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 23 GREEN HYDROGEN: GREEN METHANOL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 24 CARBON CAPTURE & STORAGE: GREEN METHANOL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 25 CARBON CAPTURE & STORAGE: GREEN METHANOL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 26 GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 27 GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 29 GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 30 CHEMICAL FEEDSTOCK: GREEN METHANOL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 CHEMICAL FEEDSTOCK: GREEN METHANOL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 CHEMICAL FEEDSTOCK: GREEN METHANOL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 33 CHEMICAL FEEDSTOCK: GREEN METHANOL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 34 FUEL: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 35 FUEL: GREEN METHANOL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 FUEL: GREEN METHANOL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 37 FUEL: GREEN METHANOL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 38 OTHERS: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 39 OTHERS: GREEN METHANOL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 OTHERS: GREEN METHANOL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 41 OTHERS: GREEN METHANOL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 42 GREEN METHANOL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 GREEN METHANOL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 GREEN METHANOL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 45 GREEN METHANOL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 46 NORTH AMERICA: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 NORTH AMERICA: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 49 NORTH AMERICA: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 50 NORTH AMERICA: GREEN METHANOL MARKET, BY FEEDSTOCK, 2021-2024 (KILOTON)

- TABLE 51 NORTH AMERICA: GREEN METHANOL MARKET, BY FEEDSTOCK, 2025-2030 (KILOTON)

- TABLE 52 NORTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 53 NORTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 55 NORTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 56 US: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 57 US: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 US: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 59 US: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 60 CANADA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 61 CANADA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 62 CANADA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 63 CANADA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 64 MEXICO: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 65 MEXICO: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 MEXICO: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 67 MEXICO: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 68 ASIA PACIFIC: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 69 ASIA PACIFIC: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 71 ASIA PACIFIC: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 72 ASIA PACIFIC: GREEN METHANOL MARKET, BY FEEDSTOCK, 2021-2024 (KILOTON)

- TABLE 73 ASIA PACIFIC: GREEN METHANOL MARKET, BY FEEDSTOCK, 2025-2030 (KILOTON)

- TABLE 74 ASIA PACIFIC: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 75 ASIA PACIFIC: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 77 ASIA PACIFIC: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 78 INDIA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 79 INDIA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 80 INDIA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 81 INDIA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 82 CHINA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 83 CHINA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 84 CHINA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 85 CHINA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 86 JAPAN: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 JAPAN: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 JAPAN: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 89 JAPAN: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 90 SOUTH KOREA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 91 SOUTH KOREA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 92 SOUTH KOREA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 93 SOUTH KOREA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 94 REST OF ASIA PACIFIC: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 97 REST OF ASIA PACIFIC: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 98 EUROPE: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 99 EUROPE: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 101 EUROPE: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 102 EUROPE: GREEN METHANOL MARKET, BY FEEDSTOCK, 2021-2024 (KILOTON)

- TABLE 103 EUROPE: GREEN METHANOL MARKET, BY FEEDSTOCK, 2025-2030 (KILOTON)

- TABLE 104 EUROPE: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 EUROPE: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 107 EUROPE: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 108 GERMANY: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 GERMANY: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 GERMANY: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 111 GERMANY: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 112 NETHERLANDS: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 NETHERLANDS: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 NETHERLANDS: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 115 NETHERLANDS: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 116 SWEDEN: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 SWEDEN: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 SWEDEN: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 119 SWEDEN: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 120 REST OF EUROPE: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 REST OF EUROPE: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 123 REST OF EUROPE: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 124 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 127 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY FEEDSTOCK, 2021-2024 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY FEEDSTOCK, 2025-2030 (KILOTON)

- TABLE 130 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 133 MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 134 SAUDI ARABIA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 SAUDI ARABIA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 SAUDI ARABIA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 137 SAUDI ARABIA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 138 UAE: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 UAE: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 UAE: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 141 UAE: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 142 REST OF GCC COUNTRIES: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 REST OF GCC COUNTRIES: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 REST OF GCC COUNTRIES: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 145 REST OF GCC COUNTRIES: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 150 SOUTH AMERICA: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 SOUTH AMERICA: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 SOUTH AMERICA: GREEN METHANOL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 153 SOUTH AMERICA: GREEN METHANOL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 154 SOUTH AMERICA: GREEN METHANOL MARKET, BY FEEDSTOCK, 2021-2024 (KILOTON)

- TABLE 155 SOUTH AMERICA: GREEN METHANOL MARKET, BY FEEDSTOCK, 2025-2030 (KILOTON)

- TABLE 156 SOUTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 157 SOUTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 159 SOUTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 160 BRAZIL: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 BRAZIL: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 BRAZIL: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 163 BRAZIL: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 164 ARGENTINA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 165 ARGENTINA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 ARGENTINA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 167 ARGENTINA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 168 REST OF SOUTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 171 REST OF SOUTH AMERICA: GREEN METHANOL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 172 GREEN METHANOL MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- TABLE 173 GREEN METHANOL MARKET: DEGREE OF COMPETITION

- TABLE 174 GREEN METHANOL MARKET: REGION FOOTPRINT

- TABLE 175 GREEN METHANOL MARKET: DERIVATIVE FOOTPRINT

- TABLE 176 GREEN METHANOL MARKET: APPLICATION FOOTPRINT

- TABLE 177 GREEN METHANOL MARKET: FEEDSTOCK FOOTPRINT

- TABLE 178 GREEN METHANOL MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 179 GREEN METHANOL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 180 GREEN METHANOL MARKET: DEALS, JANUARY 2019-MAY 2024

- TABLE 181 PETROLIAM NASIONAL BERHAD (PETRONAS)

- TABLE 182 PETROLIAM NASIONAL BERHAD (PETRONAS): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 183 PETROLIAM NASIONAL BERHAD (PETRONAS): DEALS

- TABLE 184 CARBON RECYCLING INTERNATIONAL: COMPANY OVERVIEW

- TABLE 185 CARBON RECYCLING INTERNATIONAL: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 186 CARBON RECYCLING INTERNATIONAL: DEALS

- TABLE 187 SUNGAS RENEWABLES: COMPANY OVERVIEW

- TABLE 188 SUNGAS RENEWABLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 SUNGAS RENEWABLES: DEALS

- TABLE 190 SUNGAS RENEWABLES: EXPANSIONS

- TABLE 191 ABEL ENERGY PTY LTD.: COMPANY OVERVIEW

- TABLE 192 ABEL ENERGY PTY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 ABEL ENERGY PTY LTD.: DEALS

- TABLE 194 METHANEX CORPORATION: COMPANY OVERVIEW

- TABLE 195 METHANEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 METHANEX CORPORATION.: DEALS

- TABLE 197 MITSUBISHI GAS CHEMICAL COMPANY, INC.: COMPANY OVERVIEW

- TABLE 198 MITSUBISHI GAS CHEMICAL COMPANY, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 199 MITSUBISHI GAS CHEMICAL COMPANY, INC.: DEALS

- TABLE 200 ENERKEM: COMPANY OVERVIEW

- TABLE 201 ENERKEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 ENERKEM: DEALS

- TABLE 203 ALBERTA-PACIFIC FOREST INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 204 ALBERTA-PACIFIC FOREST INDUSTRIES INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 205 ENVISION ENERGY: COMPANY OVERVIEW

- TABLE 206 ENVISION ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 ENVISION ENERGY: DEALS

- TABLE 208 SODRA: COMPANY OVERVIEW

- TABLE 209 SODRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 SODRA: DEALS

- TABLE 211 PROMAN: COMPANY OVERVIEW

- TABLE 212 PROMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 PROMAN: DEALS

- TABLE 214 AVAADA: COMPANY OVERVIEW

- TABLE 215 C1 GREEN CHEMICALS AG: COMPANY OVERVIEW

- TABLE 216 VARMSLAND METHANOL: COMPANY OVERVIEW

- TABLE 217 IBERDROLA, S.A.: COMPANY OVERVIEW

- TABLE 218 LOWLANDS METHANOL B.V.: COMPANY OVERVIEW

- TABLE 219 SWISS LIQUID FUTURE AG: COMPANY OVERVIEW

- TABLE 220 LIQUID WIND AB: COMPANY OVERVIEW

- TABLE 221 RENEWABLE HYDROGEN CANADA CORPORATION: COMPANY OVERVIEW

- TABLE 222 EUROPEAN ENERGY A/S: COMPANY OVERVIEW

- TABLE 223 GREEN HYDROGEN MARKET, BY TECHNOLOGY, 2019-2021 (KILOTON)

- TABLE 224 GREEN HYDROGEN MARKET, BY TECHNOLOGY, 2022-2030 (KILOTON)

- TABLE 225 GREEN HYDROGEN MARKET, BY TECHNOLOGY, 2019-2021 (USD MILLION)

- TABLE 226 GREEN HYDROGEN MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- TABLE 227 METHANOL MARKET, BY FEEDSTOCK, 2016-2022 (USD MILLION)

- TABLE 228 METHANOL MARKET, BY FEEDSTOCK, 2023-2028 (USD MILLION)

- TABLE 229 METHANOL MARKET, BY FEEDSTOCK, 2016-2022 (THOUSAND METRIC TONS)

- TABLE 230 METHANOL MARKET, BY FEEDSTOCK, 2023-2028 (THOUSAND METRIC TONS)

List of Figures

- FIGURE 1 GREEN METHANOL MARKET SEGMENTATION

- FIGURE 2 GREEN METHANOL MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR GREEN METHANOL

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF GREEN METHANOL MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF GREEN METHANOL MARKET (2/2)

- FIGURE 8 GREEN METHANOL MARKET: DATA TRIANGULATION

- FIGURE 9 CHEMICAL FEEDSTOCK SEGMENT TO HOLD MAJOR MARKET SHARE IN 2030

- FIGURE 10 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 RISING DEMAND FOR SUSTAINABLE AND RENEWABLE ENERGY SOURCES IN AUTOMOTIVE AND CONSTRUCTION INDUSTRIES TO CREATE LUCRATIVE OPPORTUNTIES FOR MARKET PLAYERS

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 13 CHEMICAL FEEDSTOCK SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 14 BIOMASS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 15 MARKET IN US TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 GREEN METHANOL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS: GREEN METHANOL MARKET

- FIGURE 18 AVERAGE SELLING PRICE TREND OF GREEN METHANOL OFFERED BY KEY PLAYERS, 2021-2023 (USD/TON)

- FIGURE 19 AVERAGE SELLING PRICE TREND OF GREEN METHANOL, BY FEEDSTOCK, 2024 (USD/TON)

- FIGURE 20 AVERAGE SELLING PRICE TREND OF GREEN METHANOL, BY REGION, 2022-2030 (USD/TON)

- FIGURE 21 GREEN METHANOL MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 GREEN METHANOL MARKET: ECOSYSTEM MAP

- FIGURE 23 BIO-METHANOL AND E-METHANOL: PRODUCTION PROCESS

- FIGURE 24 GREY, BROWN, AND BLUE METHANOL: PRODUCTION PROCESS

- FIGURE 25 CARBON CAPTURE AND UTILIZATION: PRODUCTION PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 28 LIST OF MAJOR PATENTS FOR GREEN METHANOL

- FIGURE 29 INVESTMENT & FUNDING OF STARTUPS/SMES FOR GREEN METHANOL

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 CARBON CAPTURE & STORAGE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 32 FUEL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 33 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 34 NORTH AMERICA: GREEN METHANOL MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: GREEN METHANOL MARKET SNAPSHOT

- FIGURE 36 EUROPE: GREEN METHANOL MARKET SNAPSHOT

- FIGURE 37 GREEN METHANOL MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2024 (USD BILLION)

- FIGURE 38 GREEN METHANOL MARKET: RANKING OF TOP PLAYERS, 2024

- FIGURE 39 GREEN METHANOL MARKET SHARE ANALYSIS, 2024

- FIGURE 40 BRAND/PRODUCT COMPARISON

- FIGURE 41 GREEN METHANOL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 GREEN METHANOL MARKET: COMPANY FOOTPRINT

- FIGURE 43 GREEN METHANOL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 GREEN METHANOL MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 45 GREEN METHANOL MARKET: FINANCIAL MATRIX, 2024 (EV/EBITDA)

- FIGURE 46 GREEN METHANOL MARKET: YEAR TO DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS, 2024

- FIGURE 47 PETROLIAM NASIONAL BERHAD (PETRONAS): COMPANY SNAPSHOT

- FIGURE 48 METHANEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 MITSUBISHI GAS CHEMICAL COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 50 SODRA: COMPANY SNAPSHOT

The global green methanol market is anticipated to expand from USD 2.59 billion in 2025 to USD 11.18 billion by 2030, registering a CAGR of 34.0% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billions), Volume (Kilotons) |

| Segments | Green Methanol by region, feedstock, application, and derivatives |

| Regions covered | Europe, Asia Pacific, South America, North America, Middle East & Africa |

Stringent government regulations aimed at reducing carbon dioxide emissions and combating climate change propel this growth. Green methanol, produced from renewable sources such as captured CO2 and renewable hydrogen, serves as a sustainable alternative to conventional methanol derived from fossil fuels. This regulatory environment incentivizes industries to adopt green methanol.

"By feedstock, the carbon capture and storage is projected to be the fastest-growing segment of the green methanol market during 2025 to 2030, in terms of volume."

Carbon capture and storage (CCS) is rapidly emerging as a key feedstock for green methanol due to its ability to reduce carbon emissions and provide a sustainable source of carbon dioxide (CO2) for methanol production. CCS technology captures CO2 from industrial facilities or directly from the atmosphere, stores it underground to prevent it from contributing to climate change, and then combines it with renewable hydrogen to produce methanol.

The growth of CCS is largely attributed to its cost-effective method of sourcing CO2 for methanol production while adhering to stringent environmental regulations. Governments are actively supporting CCS through incentives and tax benefits to promote its adoption. As industries and economies increasingly prioritize emission reduction, CCS is becoming an essential component in the production of green methanol, helping industries achieve greater sustainability.

"By application, fuel is estimated to be the fastest-growing segment of the green methanol market from 2025 to 2030."

Fuel is expected to be the fastest-growing application segment in the green methanol market from 2025 to 2030 due to stricter environmental regulations and a shift toward sustainable energy. Green methanol provides a lower-carbon alternative for sectors like shipping, transportation (either blended with gasoline or used in specific engines), and power generation. Its high energy density and compatibility with existing infrastructure make it an attractive option for the transportation sector, facilitating easier adoption without significant infrastructure changes.

"The green methanol market in the North America region is projected to witness the highest CAGR during the forecast period."

North America is projected to witness the highest CAGR in the green methanol market during the forecast period due to its strong commitment to sustainability, government incentives, and increasing investments in renewable energy. North American companies are leading in green methanol production technology and infrastructure development, positioning them well to capture a larger market share. The US is leading the charge with supportive policies, such as tax credits and renewable fuel mandates, which encourage the growth of green methanol production. Moreover, technological advancements in carbon capture and renewable hydrogen are accelerating the region's shift toward cleaner fuels, making it a key driver of market expansion in the coming years.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 40%, Tier 2 - 20%, and Tier 3 - 40%

- By Designation: C-level Executives - 20%, Directors - 50%, and Others - 30%

- By Region: North America - 20%, Europe - 40%, Asia Pacific - 30%, the Middle East & Africa- 5%, and South America - 5%

Key players in the green methanol market include OCI (The Netherlands), Proman (Switzerland), Sodra (Sweden), SunGas Renewables Inc. (US), ABEL Energy Pty Ltd. (Australia), Carbon Recycling International Inc. (Iceland), Petroliam Nasional Berhad (PETRONAS)(Malaysia), Mitsubishi Gas Chemical Company, Inc. (Japan), Methanex Corporation (Canada), Envision Energy (China), Alberta-Pacific Forest Industries Inc. (Canada), Enerkem (Canada), and others.

Research Coverage:

The report outlines, categorizes, and forecasts the green methanol market size across derivatives, sub-derivatives, end-uses, and geographical regions. It provides strategic profiles of major players, thoroughly examining their market presence and key strengths. Additionally, the report monitors and evaluates competitive activities such as acquisitions, agreements, investments, joint ventures, mergers, product launches, expansions, divestments, and partnerships undertaken by these players within the market.

Reasons to Buy the Report:

The report aims to assist market leaders and newcomers by offering precise revenue estimations for the green methanol market and its segments. It also provides stakeholders with a clearer view of the market's competitive landscape, helping them enhance their business positions and develop effective market strategies. Furthermore, the report enables stakeholders to grasp the market dynamics by highlighting key drivers, obstacles, challenges, and opportunities. Key insights provided by the report include:

- Analysis of key drivers (growing demand for sustainable fuels, increasing support for renewable energy sources), restraints (high production costs), opportunities (use of green methanol as an alternative fuel in marine and manufacturing industries technological advancements), and challenges (capital-intensive environment, volatility in feedstock prices) influencing the growth of the green methanol market.

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the green methanol market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the green methanol market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the green methanol market.

- Competitive Assessment: Detailed analysis of market share, growth strategies, and service offerings of top players such as Proman (Switzerland), Sodra (Sweden), OCI (Netherlands), SunGas Renewables Inc. (US), ABEL Energy Pty Ltd. (Australia), Carbon Recycling International Inc. (Iceland), Petroliam Nasional Berhad (PETRONAS)(Malaysia), Mitsubishi Gas Chemical Company, Inc. (Japan), Methanex Corporation (Canada), Envision Energy (China), Alberta-Pacific Forest Industries Inc. (Canada), and Enerkem (Canada), among others, in the green methanol market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 COMPETITIVE INTELLIGENCE

- 1.3 MARKET DEFINITION

- 1.4 STUDY SCOPE

- 1.4.1 YEARS CONSIDERED

- 1.4.2 INCLUSIONS AND EXCLUSIONS

- 1.4.3 CURRENCY CONSIDERED

- 1.4.4 UNIT CONSIDERED

- 1.5 RESEARCH LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Calculations for supply-side analysis

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 IMPACT OF RECESSION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GREEN METHANOL MARKET

- 4.2 GREEN METHANOL MARKET, BY REGION

- 4.3 GREEN METHANOL MARKET, BY APPLICATION

- 4.4 GREEN METHANOL MARKET, BY FEEDSTOCK

- 4.5 GREEN METHANOL MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for sustainable and renewable energy

- 5.2.1.2 Demand for green methanol in automotive and construction industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Competing fuel options - ethanol, hydrogen, and biodiesel

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Green methanol as alternative fuel in marine and manufacturing industries

- 5.2.3.2 Green methanol fuel cells in transportation and energy sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Cost competitiveness to produce green methanol

- 5.2.4.2 Low consumer awareness about green methanol benefits

- 5.2.4.3 Infrastructure, scale, and efficiency limitations for production

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, 2021-2023

- 5.4.2 AVERAGE SELLING PRICE TREND, BY FEEDSTOCK, 2024

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM MAP

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Bio-methanol and e-methanol production technologies

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Grey, brown, and blue methanol production technologies

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Carbon capture and utilization of methanol production technologies

- 5.8.1 KEY TECHNOLOGIES

- 5.9 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 290511)

- 5.10.2 EXPORT SCENARIO (HS CODE 290511)

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 MAJOR PATENTS RELATED TO GREEN METHANOL

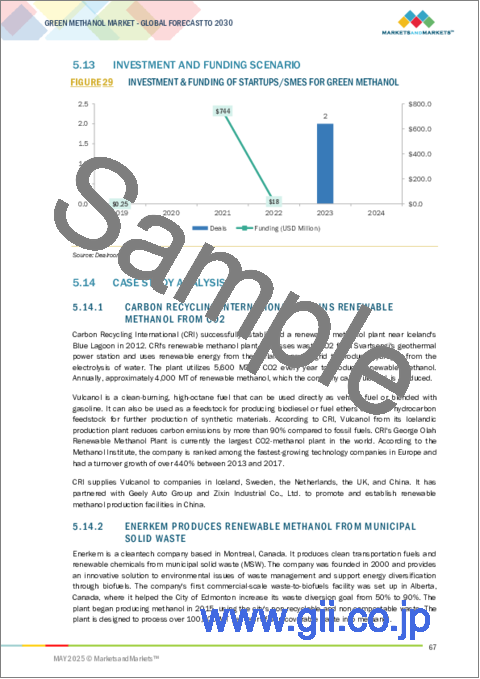

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CARBON RECYCLING INTERNATIONAL OBTAINS RENEWABLE METHANOL FROM CO2

- 5.14.2 ENERKEM PRODUCES RENEWABLE METHANOL FROM MUNICIPAL SOLID WASTE

- 5.14.3 BIOMCN PROCESSES RENEWABLE METHANOL FROM BIOGAS

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 IMPACT OF 2025 US TARIFF ON GREEN METHANOL MARKET

- 5.16.1 KEY TARIFF RATES

- 5.16.1.1 Key product-related tariffs effective for green methanol

- 5.16.2 PRICE IMPACT ANALYSIS

- 5.16.3 IMPACT ON COUNTRY/REGION

- 5.16.3.1 US

- 5.16.3.2 Europe

- 5.16.3.3 Asia Pacific

- 5.16.4 IMPACT ON APPLICATIONS

- 5.16.4.1 Chemical feedstock

- 5.16.4.2 Fuel

- 5.16.4.3 Other applications

- 5.16.1 KEY TARIFF RATES

6 GREEN METHANOL MARKET, BY FEEDSTOCK

- 6.1 INTRODUCTION

- 6.2 BIOMASS

- 6.2.1 RENEWABLE NATURE AND EMISSION-REDUCING POTENTIAL - KEY DRIVERS

- 6.2.2 FORESTRY AND AGRICULTURAL WASTE

- 6.2.3 BIOGAS FROM LANDFILLS

- 6.2.4 SEWAGE

- 6.2.5 MUNICIPAL SOLID WASTE

- 6.2.6 BLACK LIQUOR FROM PAPER & PULP INDUSTRY

- 6.3 GREEN HYDROGEN

- 6.3.1 GOVERNMENT INCENTIVES FOR RENEWABLE ENERGY TO DRIVE MARKET

- 6.4 CARBON CAPTURE & STORAGE

- 6.4.1 INCREASING NEED FOR CARBON REDUCTION AND CLEANER ENERGY SOLUTIONS TO BOOST MARKET

7 GREEN METHANOL MARKET, BY DERIVATIVE

- 7.1 INTRODUCTION

- 7.2 FORMALDEHYDE

- 7.2.1 GROWING DEMAND FROM CONSTRUCTION INDUSTRY

- 7.3 GASOLINE

- 7.3.1 INCREASING USE IN TRANSPORTATION SECTOR

- 7.4 GREEN METHANOL-TO-OLEFINS/GREEN METHANOL-T0-PROPYLENE

- 7.4.1 HIGH DEMAND FOR PLASTICS IN END-USE INDUSTRIES

- 7.5 METHYL TERT-BUTYL ETHER

- 7.5.1 HIGH DEMAND FROM CHINA FOR USE ACROSS INDUSTRIES

- 7.6 ACETIC ACID

- 7.6.1 IMPORTANT RAW MATERIAL FOR DOWNSTREAM CHEMICALS

- 7.7 DIMETHYL ETHER

- 7.7.1 GROWING DEMAND FOR HEATING AND COOKING PURPOSES

- 7.8 METHYL METHACRYLATE

- 7.8.1 HIGH CONSUMPTION IN ELECTRONICS INDUSTRY

- 7.9 BIODIESEL

- 7.9.1 DRIVEN BY COMPETITIVE PRICING AND ENVIRONMENTAL REGULATIONS

- 7.10 OTHERS

8 GREEN METHANOL MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CHEMICAL FEEDSTOCK

- 8.2.1 SUSTAINABLE MANUFACTURING PRACTICES TO DRIVE MARKET

- 8.3 FUEL

- 8.3.1 INCREASING APPLICATION IN MARITIME TRANSPORT PROPELS MARKET

- 8.4 OTHERS

- 8.4.1 VERSATILITY IN POWER GENERATION AND ENERGY STORAGE ACCELERATES ADOPTION

9 GREEN METHANOL MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Increasing focus on sustainability and technological advancements to surge market growth

- 9.2.2 CANADA

- 9.2.2.1 Stringent environmental regulations and government support to boost production

- 9.2.3 MEXICO

- 9.2.3.1 Abundant renewable resources and strategic geographic location to boost market

- 9.2.1 US

- 9.3 ASIA PACIFIC

- 9.3.1 INDIA

- 9.3.1.1 Market growth driven by government initiatives and technological advancements

- 9.3.2 CHINA

- 9.3.2.1 Substantial renewable energy resources and commitment to reducing carbon emissions to boost market

- 9.3.3 JAPAN

- 9.3.3.1 Government policies and initiatives to boost market

- 9.3.4 SOUTH KOREA

- 9.3.4.1 Industrial development and government initiatives to boost market

- 9.3.5 REST OF ASIA PACIFIC

- 9.3.1 INDIA

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Propelled by growing demand from the automotive industry

- 9.4.2 NETHERLANDS

- 9.4.2.1 Market driven by advanced infrastructure, strategic location, and strong commitment to renewable energy

- 9.4.3 SWEDEN

- 9.4.3.1 Strategic partnerships and increasing demand from eco-conscious industries fuel market growth

- 9.4.4 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Ambitious sustainability and economic diversification plan to grow the market

- 9.5.1.2 UAE

- 9.5.1.2.1 Government initiatives to increase green methanol production to fuel market

- 9.5.1.3 Rest of GCC Countries

- 9.5.1.1 Saudi Arabia

- 9.5.2 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Strong emphasis on renewable energy and sustainable practices to propel market

- 9.6.2 ARGENTINA

- 9.6.2.1 Strong government support and increasing international interest - key market drivers

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE AND RANKING ANALYSIS

- 10.4.1 RANKING ANALYSIS OF KEY PLAYERS

- 10.4.2 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 10.4.2.1 Methanex Corporation (Canada)

- 10.4.2.2 Carbon Recycling International (Iceland)

- 10.4.2.3 Proman (Switzerland)

- 10.4.2.4 Sodra (Sweden)

- 10.4.2.5 Enerkem (Canada)

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 GREEN METHANOL BY ENERKEM

- 10.5.2 GREEN METHANOL BY CARBON RECYCLING INTERNATIONAL

- 10.5.3 GREEN METHANOL BY METHANEX CORPORATION

- 10.5.4 GREEN METHANOL BY PROMAN

- 10.5.5 GREEN METHANOL BY SODRA

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Derivative footprint

- 10.6.5.4 Application footprint

- 10.6.5.5 Feedstock footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES,2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 PETROLIAM NASIONAL BERHAD (PETRONAS)

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 CARBON RECYCLING INTERNATIONAL

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 SUNGAS RENEWABLES

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 ABEL ENERGY PTY LTD.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 METHANEX CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Key strengths

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses/Competitive threats

- 11.1.7 ENERKEM

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.4 MnM view

- 11.1.7.4.1 Key strengths

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses/Competitive threats

- 11.1.8 ALBERTA PACIFIC FOREST INDUSTRIES INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.9 ENVISION ENERGY

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 SODRA

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 PROMAN

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.1 PETROLIAM NASIONAL BERHAD (PETRONAS)

- 11.2 OTHER PLAYERS

- 11.2.1 AVAADA

- 11.2.2 C1 GREEN CHEMICALS AG

- 11.2.3 VARMSLAND METHANOL

- 11.2.4 IBERDROLA, S.A.

- 11.2.5 LOWLANDS METHANOL B.V.

- 11.2.6 SWISS LIQUID FUTURE AG

- 11.2.7 LIQUID WIND AB

- 11.2.8 RENEWABLE HYDROGEN CANADA CORPORATION

- 11.2.9 EUROPEAN ENERGY A/S

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 GREEN METHANOL INTERCONNECTED MARKET

- 12.4 GREEN HYDROGEN MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- 12.4.2.1 Alkaline electrolysis

- 12.4.2.2 PEM electrolysis

- 12.5 METHANOL MARKET

- 12.5.1 MARKET DEFINITION

- 12.5.2 MARKET OVERVIEW

- 12.5.2.1 Natural gas

- 12.5.2.2 Coal

- 12.5.2.3 Others

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS