|

|

市場調査レポート

商品コード

1667213

軽量屋根設置型ソーラーPVの世界市場:商業用・産業用・地域別の分析Lightweight Rooftop Solar PV Market - A Global and Regional Analysis: Focus on Commercial and Industrial Installation |

||||||

カスタマイズ可能

|

|||||||

| 軽量屋根設置型ソーラーPVの世界市場:商業用・産業用・地域別の分析 |

|

出版日: 2025年03月04日

発行: BIS Research

ページ情報: 英文 191 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

軽量屋根設置型ソーラーPVの市場は、商業・産業分野での採用拡大、軽量素材の進歩、規制政策の後押しなどにより、大きな成長を遂げています。

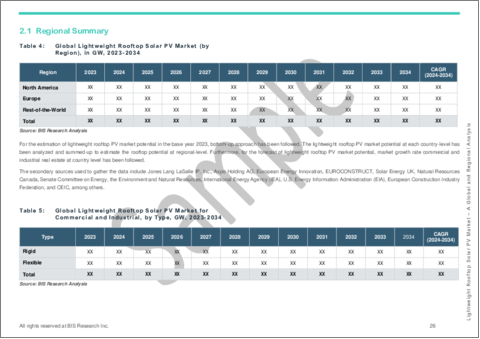

世界の軽量屋根設置型ソーラーPVの市場は大幅に拡大すると予測されており、北米は2023年の569.6GWから2034年には932.8GWに、欧州は674.5GWから1,037.7GWに、その他の地域は2023年の1,934.6GWから2034年には2,611.7GWに、それぞれ拡大すると見られています。

この成長を促進する主な要因には、政府のインセンティブ、再生可能エネルギー目標の上昇、太陽電池の技術革新への投資の増加などがあります。一方で、従来のパネルに比べて効率が低い、耐久性に不安があるなどの課題も残っています。建築物一体型太陽光発電 (BIPV) が普及し、薄膜ソーラーパネルやフレームレスソーラーパネルが進歩したことで、業界では急速に拡張性が高まり、幅広い普及に向かっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2034年 |

| 2024年評価 | 3,297.5 MW |

| 2034年予測 | 4,582.2 MW |

| CAGR | 3.34% |

軽量屋根設置型ソーラーPVの市場は、材料技術の進歩、持続可能性への取り組み、再生可能エネルギー導入に対する世界の優遇措置などを背景に大きな成長を遂げています。従来のソーラーパネルとは異なり、軽量PVシステムは薄膜技術やポリマーベースの基板などの革新的な材料を使って設計されているため、効率を維持しながら30~60%軽量化できます。これらのパネルは、構造上の制約がある商業ビルや産業ビルにとって特に有益であり、都市環境全体への普及を可能にしています。建物一体型太陽光発電 (BIPV) の採用の拡大、税額控除などの金融優遇措置、米国のインフレ抑制法 (IRA) や欧州のグリーンディールなどの支援政策が、市場拡大をさらに後押ししています。市場には効率低下や耐久性への懸念といった課題が残るもの、継続的な技術革新により性能は向上しており、軽量屋根設置型ソーラーPVは世界的に分散型再生可能エネルギー発電を強化するための重要なソリューションとなっています。

タイプ別では、硬質セグメントが市場で優位に:

軽量屋根設置型ソーラーPV市場の主要セグメントは商業・産業 (C&I) 分野であり、エネルギーコストの削減と持続可能性目標の達成を目指す企業での採用が増加しています。この中では、軟質パネルに比べて耐久性、効率、費用対効果のバランスが取れている硬質の軽量ソーラーパネルが優位を占めています。建築物一体型太陽光発電 (BIPV) 分野も、特に建築資材を統合することで機能性と美観を向上させる都市環境において急成長を遂げています。

地域別では、欧州が市場をリード:

欧州は政府の強力な奨励策、持続可能性への取り組み、産業用・商業用ビルでの普及が追い風となり、軽量屋根設置型ソーラーPV市場をリードしています。ドイツ、フランス、オランダといった国々は、固定価格買取制度や軽量ソーラー技術への補助金といった有利な政策によって最前線を走っています。北米、特に米国は、インフレ抑制法 (IRA) に基づく投資税額控除 (ITC) などの金融優遇措置でこれに追随しています。中国、日本、インドに代表されるアジア太平洋地域も、産業化とエネルギー需要の増加に加え、軽量ソーラーPV製造の技術革新により急速に拡大しています。

市場セグメンテーション

セグメンテーション1:タイプ別

- 硬質

- 軟質

セグメンテーション2:地域別

- 北米 (米国、カナダ、メキシコ)

- 欧州 (ドイツ、フランス、イタリア、ベルギー、ギリシャ、英国、オランダ、ポーランド、ルーマニア、ブルガリア、オーストリア、スイス、ハンガリー、その他)

- その他の地域 (日本、その他)

当レポートでは、世界の軽量屋根設置型ソーラーPVの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の動向、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 動向:現在および将来の影響評価

- BIPVの導入拡大

- 屋上への負荷を軽減する軽量で耐久性のある素材の革新

- サプライチェーンの概要

- バリューチェーン分析

- 価格予測

- 研究開発レビュー

- 特許出願動向 (国別、企業別)

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 資金調達と投資分析

- 国別の政府資金 (予算配分を含む)

- プライベートエクイティ投資

- スタートアップ資金調達

第2章 地域

- 地域別概要

- 北米

- 市場

- 北米 (国別)

- 欧州

- 市場

- 欧州 (国別)

- その他の地域

- 市場

- その他の地域 (主要国別)

第3章 調査手法

List of Figures

- Figure 1: Lightweight Rooftop Solar PV Market, GW, 2023, 2028, and 2034

- Figure 2: Share of Rooftop Solar PVs in Annual Solar PV Installations, 2010-2021

- Figure 3: Share of Building Integrated Solar PVs in Austria in 2022

- Figure 4: Current Market Scenario of Building-Integrated Photovoltaic (BIPV) Products

- Figure 5: Different Technologies Utilized to Produce High-Efficiency Solar Panels

- Figure 6: Supply Chain

- Figure 7: Value Chain Analysis

- Figure 8: Lightweight Solar Pannel Pricing Forecast, 2023-2034, $/Watt

- Figure 9: Patent Analysis (by Country), January 2021-August 2024

- Figure 10: Patent Analysis (by Company), January 2021-August 2024

- Figure 11: Impact Analysis of Market Navigating Factors, 2023-2034

- Figure 12: Expected (2028) and Achieved (2021-2023) Share of Electricity Generation from Solar PVs and All Renewables

- Figure 13: Global CO2 Emissions from Buildings, including Embodied Emissions from New Construction, 2022

- Figure 14: Efficiency Comparison Technologies (Crystalline Silicone, Thin Film, and New Concepts)

- Figure 15: Price, Durability, and Efficiency Comparison of Different Types of Solar Panels

- Figure 16: Source of Electricity Generation in Africa, 2021

- Figure 17: Private Equity Investments in Solar Technologies

- Figure 18: North America Electricity Generation (by Source), 2022

- Figure 19: Solar Energy Penetration in North America (by Country), 2022

- Figure 20: U.S. Electricity Generation (by Source), 2022

- Figure 21: U.S. Porters Five Forces Analysis

- Figure 22: U.S. Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 23: U.S. Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 24: Canada Electricity Generation (by Source), 2022

- Figure 25: Mexico Electricity Generation (by Source), 2022

- Figure 26: Canada and Mexico Porters Five Forces Analysis

- Figure 27: Canada and Mexico Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 28: Canada and Mexico Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 29: Top 10 EU27 Solar Markets, 2022-2023

- Figure 30: Solar Energy Penetration in European Countries, 2022

- Figure 31: Europe Lightweight Rooftop Solar PV Market (by Country), GW, 2023, 2027, 2034

- Figure 32: Europe Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 33: Europe Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 34: Electricity Generation in Germany from Different Sources, 2022

- Figure 35: Annual Installed Solar Capacity in Germany, 2019-2023, GW

- Figure 36: Germany Porters Five Forces Analysis

- Figure 37: Germany Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 38: Germany Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 39: Germany Building-Integrated Photovoltaics Market, 2023, MW

- Figure 40: Electricity Generation in France from Different Sources, 2023

- Figure 41: Annual Installed Solar Capacity in France, 2019-2023, GW

- Figure 42: France Porters Five Forces Analysis

- Figure 43: France Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 44: France Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 45: France Building-Integrated Photovoltaics Market, 2023, MW

- Figure 46: Electricity Generation in Italy from Different Sources, 2023

- Figure 47: Annual Installed Solar Capacity in Italy, 2019-2023, GW

- Figure 48: Italy Porters Five Forces Analysis

- Figure 49: Italy Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 50: Italy Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 51: Electricity Generation in Belgium from Different Sources, 2023

- Figure 52: Annual Installed Solar Capacity in Belgium, 2019-2023, GW

- Figure 53: Belgium Porters Five Forces Analysis

- Figure 54: Belgium Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 55: Belgium Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 56: Belgium Building-Integrated Photovoltaics Market, 2023, MW

- Figure 57: Electricity Generation in Greece from Different Sources, 2023

- Figure 58: Annual Installed Solar Capacity in Greece, 2019-2023, GW

- Figure 59: Greece Porters Five Forces Analysis

- Figure 60: Greece Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 61: Greece Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 62: Electricity Generation in the U.K. from Different Sources, 2022

- Figure 63: Seasonal Solar Panel Energy Production

- Figure 64: U.K. Porters Five Forces Analysis

- Figure 65: U.K. Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 66: U.K. Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 67: U.K. Building-Integrated Photovoltaics Market, 2023, MW

- Figure 68: Electricity Generation in the Netherlands from Different Sources, 2022

- Figure 69: Annual Installed Solar Capacity in the Netherlands, 2019-2023, GW

- Figure 70: Netherlands Porters Five Forces Analysis

- Figure 71: Netherlands Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 72: Netherlands Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 73: Netherlands Building-Integrated Photovoltaics Market, 2023, MW

- Figure 74: Electricity Generation in Poland from Different Sources, 2022

- Figure 75: Annual Installed Solar Capacity in Poland, 2019-2023, GW

- Figure 76: Poland Porters Five Forces Analysis

- Figure 77: Poland Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 78: Poland Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 79: Romania's Energy Mix, 2022

- Figure 80: Romania Porters Five Forces Analysis

- Figure 81: Romania Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 82: Romania Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 83: Bulgaria Energy Mix, 2022

- Figure 84: Bulgaria Porters Five Forces Analysis

- Figure 85: Bulgaria Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 86: Bulgaria Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 87: Electricity Generation from Different Sources in Austria, GWh, 2022

- Figure 88: Total Electricity Production in Austria, 2018-2022, GWh

- Figure 89: Annual Installed Solar Capacity in Austria, 2021-2023, GW

- Figure 90: Austria Porters Five Forces Analysis

- Figure 91: Austria Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 92: Austria Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 93: Electricity Generation from Different Sources, in Switzerland, 2022

- Figure 94: Total Energy Consumption in Switzerland, 2022 and 2023, GWh

- Figure 95: Switzerland Porters Five Forces Analysis

- Figure 96: Switzerland Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 97: Switzerland Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 98: Electricity Generation from Different Sources in Hungary, 2022

- Figure 99: Annual Installed Solar Capacity in Hungary, 2019-2023, GW

- Figure 100: Hungary Porters Five Forces Analysis

- Figure 101: Hungary Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 102: Hungary Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 103: Annual Installed Solar Capacity in Spain, 2019-2023, GW

- Figure 104: Cumulative Solar PV Installed Capacity, Rest-of-Europe, GW, 2019-2022

- Figure 105: Solar PV Penetration in Rest-of-Europe, 2022

- Figure 106: Rest-of-Europe Porters Five Forces Analysis

- Figure 107: Rest-of-Europe Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 108: Rest-of-Europe Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 109: Electricity Generation Sources in Japan, 2022

- Figure 110: Japan Porters Five Forces Analysis

- Figure 111: Japan Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 112: Japan Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 113: Electricity Generation Sources in China, 2022

- Figure 114: Electricity Generation Sources in India, 2022

- Figure 115: Solar PV Penetration in Others of Rest-of-the-World Countries, 2022

- Figure 116: Others of Rest-of-the-World Porters Five Forces Analysis

- Figure 117: Others of Rest-of-the-World Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 118: Others of Rest-of-the-World Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 119: India Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 120: India Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 121: China Lightweight Solar Panel Pricing Analysis, 2023 - 2034, $/Watt

- Figure 122: China Lightweight Solar Panel Cost Analysis, 2023 - 2034, $/Watt

- Figure 123: Data Triangulation

- Figure 124: Top-Down and Bottom-Up Approach

- Figure 125: Assumptions and Limitations

List of Tables

- Table 1: Trends Overview

- Table 2: Global Incentives and Investments for Solar PV

- Table 3: Funding and Budget Allocation (by Different Countries)

- Table 4: Funding Summary of Different Start-ups

- Table 5: Global Lightweight Rooftop Solar PV Market (by Region), in GW, 2023-2034

- Table 6: Global Lightweight Rooftop Solar PV Market for Commercial and Industrial, by Type, GW, 2023-2034

- Table 7: North America Lightweight Rooftop Solar PV Market for Commercial and Industrial, by Country, GW, 2023-2034

- Table 8: North America Lightweight Rooftop Solar PV Market for Commercial and Industrial, by Type, GW, 2023-2034

- Table 9: Expected Prices for Different PV Systems Ranging from 4 to 10 Kilowatts

- Table 10: U.S. Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 11: Policies and Regulations in U.S.

- Table 12: Different National/State Incentive Schemes for Solar PVs in the U.S.

- Table 13: Supplier Certifications in U.S.

- Table 14: Average Cost of Solar Systems Per Installed Watt by Province in Canada

- Table 15: Canada and Mexico Lightweight Rooftop Solar PV Market for Commercial and Industrial, GW, 2023-2034

- Table 16: Policies and Regulations in Canada and Mexico

- Table 17: Different National/State Incentive Schemes for Solar PVs in Canada

- Table 18: Different National/State Incentive Schemes for Solar PVs in Mexico

- Table 19: Supplier Certifications in Canada

- Table 20: Supplier Certifications in Mexico

- Table 21: Europe Lightweight Rooftop Solar PV Market (by Country), GW, 2023-2034

- Table 22: Europe Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 23: Cost of Solar Panels (by System Size)

- Table 24: Germany Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 25: Policies and Regulations in Germany

- Table 26: Different National/State Incentive Schemes for Solar PVs in Germany

- Table 27: Supplier Certifications in Germany

- Table 28: France Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 29: Policies and Regulations in France

- Table 30: Different National/State Incentive Schemes for Solar PVs in France

- Table 31: Supplier Certifications in France

- Table 32: Italy Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 33: Policies and Regulations in Italy

- Table 34: Different National/State Incentive Schemes for Solar PVs in Italy

- Table 35: Supplier Certifications in Italy

- Table 36: Belgium Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 37: Policies and Regulations in Belgium

- Table 38: Different National/State Incentive Schemes for Solar PVs in Belgium

- Table 39: Supplier Certifications in Belgium

- Table 40: Greece Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 41: Policies and Regulations in Greece

- Table 42: Different National/State Incentive Schemes for Solar PVs in Greece

- Table 43: Supplier Certifications in Greece

- Table 44: Difference in Annual Output by Solar Panel Systems (by Locations in U.K.)

- Table 45: Cost of Solar Panel Systems with Expected Savings in the U.K. in 2024

- Table 46: U.K. Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 47: Policies and Regulations in U.K.

- Table 48: Different National/State Incentive Schemes for Solar PVs in U.K.

- Table 49: Supplier Certifications in U.K.

- Table 50: Netherlands Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 51: Policies and Regulations in the Netherlands

- Table 52: Different National/State Incentive Schemes for Solar PVs in the Netherlands

- Table 53: Supplier Certifications in the Netherlands

- Table 54: Poland Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 55: Policies and Regulations in Poland

- Table 56: Different National/State Incentive Schemes for Solar PVs in Poland

- Table 57: Supplier Certifications in Poland

- Table 58: Romania Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 59: Policies and Regulations in Romania

- Table 60: Different National/State Incentive Schemes for Solar PVs in Romania

- Table 61: Supplier Certifications in Romania

- Table 62: Bulgaria Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 63: Policies and Regulations in Bulgaria

- Table 64: Different National/State Incentive Schemes for Solar PVs in Bulgaria

- Table 65: Supplier Certifications in Bulgaria

- Table 66: Austria Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 67: Policies and Regulations in Austria

- Table 68: Different National/State Incentive Schemes for Solar PVs in Austria

- Table 69: Supplier Certifications in Austria

- Table 70: Switzerland Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 71: Policies and Regulations in Switzerland

- Table 72: Different National/State Incentive Schemes for Solar PVs in Switzerland

- Table 73: Supplier Certifications in Switzerland

- Table 74: Hungary Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 75: Policies and Regulations in Hungary

- Table 76: Different National/State Incentive Schemes for Solar PVs in Hungary

- Table 77: Supplier Certifications in Hungary

- Table 78: Rest-of-Europe Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 79: Policies and Regulations in Other Countries in Europe

- Table 80: Different National/State Incentive Schemes for Solar PVs in Other Countries in Europe

- Table 81: Supplier Certifications in Other Countries in Europe

- Table 82: Rest-of-the-World Lightweight Rooftop Solar PV Market, by Country, GW, 2023-2034

- Table 83: Rest-of-the-World Lightweight Rooftop Solar PV Market, by Type, GW, 2023-203

- Table 84: Japan Lightweight Rooftop Solar PV Market, by Type GW, 2023-2034

- Table 85: Policies and Regulations in Japan

- Table 86: Different National/State Incentive Schemes for Solar PVs in Japan

- Table 87: Supplier Certifications in Japan

- Table 88: India of Rest-of-the-World Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 89: China of Rest-of-the-World Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 90: Rest-of-the-World of Rest-of-the-World Lightweight Rooftop Solar PV Market, by Type, GW, 2023-2034

- Table 91: Policies and Regulations in Other Countries in Rest-of-the-World

- Table 92: Different National/State Incentive Schemes for Solar PVs in Other Countries in Rest-of-the-World

- Table 93: Supplier Certifications in Other Countries in Rest-of-the-World

Lightweight Rooftop Solar PV Market Overview

The lightweight rooftop solar PV market has been experiencing significant growth, driven by increasing adoption in commercial and industrial sectors, advancements in lightweight materials, and supportive regulatory policies. The global lightweight rooftop solar PV market is projected to expand substantially, with North America growing from 569.6 GW in 2023 to 932.8 GW by 2034, Europe rising from 674.5 GW to 1,037.7 GW, and the Rest-of-the-World witnessing the largest expansion from 1,934.6 GW in 2023 to 2,611.7 GW by 2034. Key factors driving this growth include government incentives, rising renewable energy targets, and increasing investments in solar technology innovation. However, challenges such as lower efficiency compared to traditional panels and durability concerns persist. With building-integrated photovoltaics (BIPV) gaining traction and advancements in thin-film and frameless solar panels, the industry is moving toward rapid scalability and widespread adoption.

Introduction of Lightweight Rooftop Solar PV Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | 3,297.5 MW |

| 2034 Forecast | 4,582.2 MW |

| CAGR | 3.34% |

The lightweight rooftop solar PV market has been experiencing significant growth, driven by advancements in materials technology, sustainability initiatives, and global incentives for renewable energy adoption. Unlike traditional solar panels, lightweight photovoltaic (PV) systems are designed with innovative materials such as thin-film technology and polymer-based substrates, making them 30-60% lighter while maintaining efficiency. These panels are particularly beneficial for commercial and industrial buildings with structural limitations, enabling wider adoption across urban environments. The increasing adoption of building-integrated photovoltaics (BIPV), financial incentives such as tax credits, and supportive policies such as the Inflation Reduction Act (IRA) in the U.S. and the European Green Deal further boost market expansion. While challenges such as lower efficiency and durability concerns remain in the lightweight rooftop solar PV market, ongoing innovations are improving performance, making lightweight rooftop solar PV a crucial solution for enhancing distributed renewable energy generation worldwide.

Market Introduction

The lightweight rooftop solar PV market has been witnessing rapid growth, driven by advancements in durable, lightweight materials and the increasing adoption of building-integrated photovoltaics (BIPV). The lightweight rooftop solar PV market has been gaining traction due to the growing emphasis on sustainability, energy efficiency, and government incentives promoting solar energy adoption. Key trends include the shift toward thin-film and frameless solar panels, reducing installation constraints on commercial and industrial rooftops with limited load-bearing capacity. Additionally, emerging technologies such as ventilated BIPV systems are enhancing efficiency by lowering operating temperatures. The lightweight rooftop solar PV market is expected to expand significantly, with North America, Europe, and the Rest-of-the-World projected to see substantial gigawatt capacity growth from 2024 to 2034.

Industrial Impact

The industrial impact of the lightweight rooftop solar PV market is substantial, driven by increasing adoption in commercial and industrial sectors due to advancements in lightweight materials, regulatory incentives, and sustainability initiatives. The shift toward lightweight photovoltaic (PV) solutions enables industries to install solar panels on rooftops that previously could not support conventional systems, thus expanding the market reach. Key industries in the lightweight rooftop solar PV market, including manufacturing, logistics, retail, and real estate, are leveraging these innovations to reduce operational energy costs and carbon footprints, aligning with global net-zero emission targets. The growing preference for building-integrated photovoltaics (BIPV) in urban development further enhances the sector's integration into industrial infrastructure. Additionally, financial incentives such as tax credits, subsidies, and investment grants in regions such as North America and Europe have accelerated market penetration, fostering competition and innovation among key players. However, challenges such as lower efficiency compared to traditional panels and concerns over durability remain, prompting ongoing research and development efforts to improve panel performance. Overall, the industrial sector is set for significant transformation, as lightweight solar PV technology supports sustainable energy solutions while unlocking new business opportunities in decentralized energy generation.

Market Segmentation:

Segmentation 1: by Type

- Rigid

- Flexible

Rigid Segment to Dominate the Lightweight Rooftop Solar PV Market (by Type)

The leading segment in the lightweight rooftop solar PV market is the commercial and industrial (C&I) sector, driven by increasing adoption among businesses aiming to reduce energy costs and meet sustainability targets. Within this, rigid, lightweight solar panels dominate due to their balance of durability, efficiency, and cost-effectiveness compared to flexible panels. The building-integrated photovoltaics (BIPV) segment is also witnessing rapid growth, particularly in urban environments where integrating building materials enhances functionality and aesthetics.

Segmentation 2: by Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, Italy, Belgium, Greece, U.K., Netherlands, Poland, Romania, Bulgaria, Austria, Switzerland, Hungary, and Rest-of-Europe)

- Rest-of-the-World (Japan and Others of Rest-of-the-World)

Europe to Dominate the Lightweight Rooftop Solar PV Market (by Region)

Europe leads the lightweight rooftop solar PV market, driven by strong government incentives, sustainability commitments, and widespread adoption in industrial and commercial buildings. Countries such as Germany, France, and the Netherlands are at the forefront due to favorable policies such as feed-in tariffs and subsidies for lightweight solar technologies. North America, particularly the U.S., follows closely with financial incentives such as the Investment Tax Credit (ITC) under the Inflation Reduction Act (IRA), which significantly boosts installations. The Asia-Pacific region, led by China, Japan, and India, is also expanding rapidly due to increasing industrialization and energy demand, alongside innovations in lightweight solar PV manufacturing.

Recent Developments in the Lightweight Rooftop Solar PV Market

- In June 2024, GAF Energy, a division of Standard Industries and one of the leading providers of solar roofing solutions in North America, announced plans to establish a cutting-edge testing facility for solar roofing. This new initiative, supported in part by a U.S. Department of Energy (DOE) investment, will focus on advancing building integrated photovoltaics (BIPV). The project aims to develop, evaluate, and refine a range of optical, thermal, and energy models for roof-integrated solar shingles to enhance understanding of how these shingles impact home heating and cooling efficiency. The facility will feature comprehensive monitoring systems for weather, photovoltaic performance, and temperature.

- In September 2024, researchers from Nanjing University of Science and Technology introduced a ventilated building-integrated photovoltaic (VL-BIPV) system designed for rooftops with load capacities under 15 kg/m2. This innovative system features flexible solar modules weighing only 6 kg/m2 and incorporates an airflow channel to lower operating temperatures and enhance power yield. The modules, utilizing a polymer front layer instead of heavy glass, weigh approximately 3 kg/m2 and are 1.8 mm thick, offering a PV efficiency of 21.04%. The VL-BIPV system's combination of lightweight materials and effective thermal management provides significant efficiency, stability, and cost advantages, making it a promising solution for practical applications.

- In December 2023, AGC Inc., based in Tokyo, Japan, exemplified the growing trend of Building-Integrated Photovoltaics (BIPV) with its Sunjoule BIPV glass installation at Shizuoka Station's North Exit Square bicycle parking facility. This project, executed by TOKAI Cable Network Corporation, highlights the increasing adoption of BIPV systems that seamlessly integrate solar technology into building structures. The Sunjoule system, which will generate up to 3.7 kW of solar power, represents a significant step toward incorporating renewable energy solutions directly into building materials.

Demand - Drivers, Limitations, and Opportunities

Market Demand Drivers: Rising Focus on Renewable Energy Targets and Sustainability Driving the Adoption of Efficient Solar System

The rising focus on renewable energy targets and sustainability is a key driver in the adoption of lightweight rooftop solar PV systems. Governments and organizations worldwide are implementing aggressive renewable energy policies and sustainability goals to reduce carbon emissions and transition to cleaner energy sources. Lightweight solar panels offer a practical solution for buildings with structural load limitations, allowing a broader range of structures to comply with sustainability mandates without the need for major renovations. This focus on meeting renewable energy targets while reducing environmental impact is accelerating the demand for efficient, easy-to-install solar PV systems in both industrial and commercial buildings.

Market Challenges: Durability and Longevity Issues with Lightweight Materials

A significant challenge in the lightweight rooftop solar PV market is the durability and longevity of the materials used. Lightweight panels, often made from advanced polymers, thin films, or flexible substrates, are more prone to wear and tear than traditional solar panels, typically encased in durable glass and framed with aluminum. The reduced structural strength in lightweight panels can lead to faster degradation, particularly in harsh environmental conditions such as extreme heat, high winds, heavy snow, or hail. This can impact the overall lifespan of the solar system, reducing its efficiency over time and increasing the frequency of maintenance or replacement, which can be a financial burden for consumers. Additionally, despite their flexibility and reduced weight, thin-film technologies such as CIGS and CdTe solar panels degrade more quickly than their crystalline counterparts. These panels often come with shorter warranties, reflecting concerns about their long-term reliability and performance under challenging environmental conditions.

Market Opportunities: Off-Grid and Mobile Applications

Off-grid and mobile applications present a convincing opportunity in the lightweight rooftop solar PV market, driven by the increasing demand for portable, flexible, and reliable energy solutions. Unlike traditional solar panels, which can be heavy and difficult to transport, lightweight solar PV systems are designed to offer mobility and ease of installation, making them ideal for remote areas, mobile homes, boats, and off-grid living. As more consumers and businesses look for sustainable and autonomous energy solutions, lightweight solar panels provide an opportunity to expand into sectors where traditional grid access is either impractical or unavailable. This opens new markets for manufacturers, including rural communities, mobile applications, and disaster relief operations.

Several industry players in the lightweight rooftop solar PV market are already capitalizing on this opportunity. For instance, FlexSolar's FlexWatt lightweight flexible solar panel and FlexSolar F Series Solar Panel have been designed specifically for portable and off-grid applications, offering flexibility, durability, and efficiency in powering RVs, boats, and remote cabins.

How can this report add value to an organization?

This report adds value to an organization by providing comprehensive insights into the evolving lightweight rooftop solar PV market, enabling data-driven decision-making and strategic planning for sustainable growth. It highlights key market trends, technological advancements, and competitive dynamics, helping businesses identify emerging opportunities in sectors such as commercial and industrial buildings, real estate, logistics, and urban infrastructure. The report's detailed segmentation by type and region allows organizations to target specific markets, optimize product offerings, and refine business strategies. Additionally, its coverage of government incentives, regulatory frameworks, and sustainability policies ensures companies remain compliant with evolving energy regulations. By leveraging this report, organizations can make informed investment decisions in lightweight solar technology, enhance operational efficiency, and gain a competitive edge in the rapidly expanding renewable energy sector, ensuring long-term growth and leadership in the market.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate was taken from the historical exchange rate on the Oanda website.

- Nearly all the recent developments from January 2021 to November 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the lightweight rooftop solar PV market.

The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the lightweight rooftop solar PV market in Asia-Pacific and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as the Census Bureau, OICA, and ACEA.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Growing Adoption of Building-Integrated Photovoltaics (BIPV)

- 1.1.2 Innovations in Lightweight and Durable Materials to Reduce Rooftop Load

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country, by Company)

- 1.4 Market Dynamics Overview

- 1.4.1 Market Drivers

- 1.4.1.1 Rising Focus on Renewable Energy Targets and Sustainability Driving the Adoption of Efficient Solar System

- 1.4.1.2 Financial Incentives, Subsidies, and Tax Breaks for Adopting Solar Technology Encouraging Investment in Lightweight Options

- 1.4.1.3 Growing Awareness of Green Building Practices

- 1.4.2 Market Restraints

- 1.4.2.1 Lower Efficiency Compared to Traditional Panels

- 1.4.2.2 Durability and Longevity Issues with Lightweight Materials

- 1.4.3 Market Opportunities

- 1.4.3.1 Off-Grid and Mobile Applications

- 1.4.3.2 Growth of Solar Power in Emerging Markets

- 1.4.1 Market Drivers

- 1.5 Funding and Investment Analysis

- 1.5.1 Government Funding by Country (including Budget Allocation)

- 1.5.2 Private Equity Investments

- 1.5.3 Startup Funding

2 Regions

- 2.1 Regional Summary

- 2.2 North America

- 2.2.1 Markets

- 2.2.1.1 Business Drivers

- 2.2.1.2 Business Challenges

- 2.2.2 North America (by Country)

- 2.2.2.1 U.S.

- 2.2.2.1.1 Key Trends

- 2.2.2.1.1.1 Electricity Generation

- 2.2.2.1.1.2 Solar Energy Penetration

- 2.2.2.1.1.3 Energy Costs

- 2.2.2.1.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.2.2.1.3 Porters Five Forces Analysis

- 2.2.2.1.4 Policies and Regulations

- 2.2.2.1.5 Incentive Schemes (National and State)

- 2.2.2.1.6 Certifications for Suppliers

- 2.2.2.1.7 Costs and Pricing Analysis

- 2.2.2.1.1 Key Trends

- 2.2.2.2 Canada and Mexico

- 2.2.2.2.1 Key Trends

- 2.2.2.2.1.1 Electricity Generation

- 2.2.2.2.1.2 Solar Energy Penetration

- 2.2.2.2.1.3 Energy Costs

- 2.2.2.2.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.2.2.2.3 Porters Five Forces Analysis

- 2.2.2.2.4 Policies and Regulations

- 2.2.2.2.5 Incentive Schemes (National and State)

- 2.2.2.2.6 Certifications for Suppliers

- 2.2.2.2.7 Costs and Pricing Analysis

- 2.2.2.2.1 Key Trends

- 2.2.2.1 U.S.

- 2.2.1 Markets

- 2.3 Europe

- 2.3.1 Markets

- 2.3.1.1 Business Drivers

- 2.3.1.2 Business Challenges

- 2.3.2 Europe (by Country)

- 2.3.2.1 Germany

- 2.3.2.1.1 Key Trends

- 2.3.2.1.1.1 Electricity Generation

- 2.3.2.1.1.2 Solar Energy Penetration

- 2.3.2.1.1.3 Energy Costs

- 2.3.2.1.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.1.3 Porters Five Forces Analysis

- 2.3.2.1.4 Policies and Regulations

- 2.3.2.1.5 Incentive Schemes (National and State)

- 2.3.2.1.6 Certifications for Suppliers

- 2.3.2.1.7 Costs and Pricing Analysis

- 2.3.2.1.8 Building-Integrated Photovoltaics Market

- 2.3.2.1.1 Key Trends

- 2.3.2.2 France

- 2.3.2.2.1 Key Trends

- 2.3.2.2.1.1 Electricity Generation

- 2.3.2.2.1.2 Solar Energy Penetration

- 2.3.2.2.1.3 Energy Costs

- 2.3.2.2.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.2.3 Porters Five Forces Analysis

- 2.3.2.2.4 Policies and Regulations

- 2.3.2.2.5 Incentive Schemes (National and State)

- 2.3.2.2.6 Certifications for Suppliers

- 2.3.2.2.7 Costs and Pricing Analysis

- 2.3.2.2.8 Building-Integrated Photovoltaics Market

- 2.3.2.2.1 Key Trends

- 2.3.2.3 Italy

- 2.3.2.3.1 Key Trends

- 2.3.2.3.1.1 Electricity Generation

- 2.3.2.3.1.2 Solar Energy Penetration

- 2.3.2.3.1.3 Energy Costs

- 2.3.2.3.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.3.3 Porters Five Forces Analysis

- 2.3.2.3.4 Policies and Regulations

- 2.3.2.3.5 Incentive Schemes (National and State)

- 2.3.2.3.6 Certifications for Suppliers

- 2.3.2.3.7 Costs and Pricing Analysis

- 2.3.2.3.1 Key Trends

- 2.3.2.4 Belgium

- 2.3.2.4.1 Key Trends

- 2.3.2.4.1.1 Electricity Generation

- 2.3.2.4.1.2 Solar Energy Penetration

- 2.3.2.4.1.3 Energy Costs

- 2.3.2.4.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.4.3 Porters Five Forces Analysis

- 2.3.2.4.4 Policies and Regulations

- 2.3.2.4.5 Incentive Schemes (National and State)

- 2.3.2.4.6 Certifications for Suppliers

- 2.3.2.4.7 Costs and Pricing Analysis

- 2.3.2.4.8 Building-Integrated Photovoltaics Market

- 2.3.2.4.1 Key Trends

- 2.3.2.5 Greece

- 2.3.2.5.1 Key Trends

- 2.3.2.5.1.1 Electricity Generation

- 2.3.2.5.1.2 Solar Energy Penetration

- 2.3.2.5.1.3 Energy Costs

- 2.3.2.5.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.5.3 Porters Five Forces Analysis

- 2.3.2.5.4 Policies and Regulations

- 2.3.2.5.5 Incentive Schemes (National and State)

- 2.3.2.5.6 Certification for Suppliers

- 2.3.2.5.7 Costs and Pricing Analysis

- 2.3.2.5.1 Key Trends

- 2.3.2.6 U.K.

- 2.3.2.6.1 Key Trends

- 2.3.2.6.1.1 Electricity Generation

- 2.3.2.6.1.2 Solar Energy Penetration

- 2.3.2.6.1.3 Energy Costs

- 2.3.2.6.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.6.3 Porters Five Forces Analysis

- 2.3.2.6.4 Policies and Regulations

- 2.3.2.6.5 Incentive Schemes (National and State)

- 2.3.2.6.6 Certifications for Suppliers

- 2.3.2.6.7 Costs and Pricing Analysis

- 2.3.2.6.8 Building-Integrated Photovoltaics Market

- 2.3.2.6.1 Key Trends

- 2.3.2.7 Netherlands

- 2.3.2.7.1 Key Trends

- 2.3.2.7.1.1 Electricity Generation

- 2.3.2.7.1.2 Solar Energy Penetration

- 2.3.2.7.1.3 Energy Costs

- 2.3.2.7.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.7.3 Porters Five Forces Analysis

- 2.3.2.7.4 Policies and Regulations

- 2.3.2.7.5 Incentive Schemes (National and State)

- 2.3.2.7.6 Certifications for Suppliers

- 2.3.2.7.7 Costs and Pricing Analysis

- 2.3.2.7.8 Building-Integrated Photovoltaics Market

- 2.3.2.7.1 Key Trends

- 2.3.2.8 Poland

- 2.3.2.8.1 Key Trends

- 2.3.2.8.1.1 Electricity Generation

- 2.3.2.8.1.2 Solar Energy Penetration

- 2.3.2.8.1.3 Energy Costs

- 2.3.2.8.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.8.3 Porters Five Forces Analysis

- 2.3.2.8.4 Policies and Regulations

- 2.3.2.8.5 Incentive Schemes (National and State)

- 2.3.2.8.6 Certifications for Suppliers

- 2.3.2.8.7 Costs and Pricing Analysis

- 2.3.2.8.1 Key Trends

- 2.3.2.9 Romania

- 2.3.2.9.1 Key Trends

- 2.3.2.9.1.1 Electricity Generation

- 2.3.2.9.1.2 Solar Energy Penetration

- 2.3.2.9.1.3 Energy Costs

- 2.3.2.9.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.9.3 Porters Five Forces Analysis

- 2.3.2.9.4 Policies and Regulations

- 2.3.2.9.5 Incentive Schemes (National and State)

- 2.3.2.9.6 Certifications for Suppliers

- 2.3.2.9.7 Costs and Pricing Analysis

- 2.3.2.9.1 Key Trends

- 2.3.2.10 Bulgaria

- 2.3.2.10.1 Key Trends

- 2.3.2.10.1.1 Electricity Generation

- 2.3.2.10.1.2 Solar Energy Penetration

- 2.3.2.10.1.3 Energy Costs

- 2.3.2.10.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.10.3 Porters Five Forces Analysis

- 2.3.2.10.4 Policies and Regulations

- 2.3.2.10.5 Incentive Schemes (National and State)

- 2.3.2.10.6 Certifications for Suppliers

- 2.3.2.10.7 Costs and Pricing Analysis

- 2.3.2.10.1 Key Trends

- 2.3.2.11 Austria

- 2.3.2.11.1 Key Trends

- 2.3.2.11.1.1 Electricity Generation

- 2.3.2.11.1.2 Solar Energy Penetration

- 2.3.2.11.1.3 Energy Costs

- 2.3.2.11.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.11.3 Porters Five Forces Analysis

- 2.3.2.11.4 Policies and Regulations

- 2.3.2.11.5 Incentive Schemes (National and State)

- 2.3.2.11.6 Certifications for Suppliers

- 2.3.2.11.7 Costs and Pricing Analysis

- 2.3.2.11.1 Key Trends

- 2.3.2.12 Switzerland

- 2.3.2.12.1 Key Trends

- 2.3.2.12.1.1 Electricity Generation

- 2.3.2.12.1.2 Solar Energy Penetration

- 2.3.2.12.1.3 Energy Costs

- 2.3.2.12.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.12.3 Porters Five Forces Analysis

- 2.3.2.12.4 Policies and Regulations

- 2.3.2.12.5 Incentive Schemes (National and State)

- 2.3.2.12.6 Certifications for Suppliers

- 2.3.2.12.7 Costs and Pricing Analysis

- 2.3.2.12.1 Key Trends

- 2.3.2.13 Hungary

- 2.3.2.13.1 Key Trends

- 2.3.2.13.1.1 Electricity Generation

- 2.3.2.13.1.2 Solar Energy Penetration

- 2.3.2.13.1.3 Energy Costs

- 2.3.2.13.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.13.3 Porters Five Forces Analysis

- 2.3.2.13.4 Policies and Regulations

- 2.3.2.13.5 Incentive Schemes (National and State)

- 2.3.2.13.6 Certifications for Suppliers

- 2.3.2.13.7 Costs and Pricing Analysis

- 2.3.2.13.1 Key Trends

- 2.3.2.14 Rest-of-Europe

- 2.3.2.14.1 Key Trends

- 2.3.2.14.1.1 Electricity Generation

- 2.3.2.14.1.2 Solar Energy Penetration

- 2.3.2.14.1.3 Energy Costs

- 2.3.2.14.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.3.2.14.3 Porters Five Forces Analysis

- 2.3.2.14.4 Policies and Regulations

- 2.3.2.14.5 Incentive Schemes (National and State)

- 2.3.2.14.6 Certifications for Suppliers

- 2.3.2.14.7 Costs and Pricing Analysis

- 2.3.2.14.1 Key Trends

- 2.3.2.1 Germany

- 2.3.1 Markets

- 2.4 Rest-of-the-World

- 2.4.1 Markets

- 2.4.1.1 Business Drivers

- 2.4.1.2 Business Challenges

- 2.4.2 Rest-of-the-World (by Key Country)

- 2.4.2.1 Japan

- 2.4.2.1.1 Key Trends

- 2.4.2.1.1.1 Electricity Generation

- 2.4.2.1.1.2 Solar Energy Penetration

- 2.4.2.1.1.3 Energy Costs

- 2.4.2.1.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.4.2.1.3 Porters Five Forces Analysis

- 2.4.2.1.4 Policies and Regulations

- 2.4.2.1.5 Incentive Schemes (National and State)

- 2.4.2.1.6 Certifications for Suppliers

- 2.4.2.1.7 Costs and Pricing Analysis

- 2.4.2.1.1 Key Trends

- 2.4.2.2 Others of Rest-of-the-World

- 2.4.2.2.1 Key Trends

- 2.4.2.2.1.1 Electricity Generation

- 2.4.2.2.1.2 Solar Energy Penetration

- 2.4.2.2.1.3 Energy Costs

- 2.4.2.2.2 Total Addressable Market for Lightweight Solar PV for Commercial and Industrial

- 2.4.2.2.3 Porters Five Forces Analysis

- 2.4.2.2.4 Policies and Regulations

- 2.4.2.2.5 Incentive Schemes (National and State)

- 2.4.2.2.6 Certifications for Suppliers

- 2.4.2.2.7 Costs and Pricing Analysis

- 2.4.2.2.8 India Costs and Pricing Analysis

- 2.4.2.2.9 China Costs and Pricing Analysis

- 2.4.2.2.1 Key Trends

- 2.4.2.1 Japan

- 2.4.1 Markets

3 Research Methodology

- 3.1 Data Sources

- 3.1.1 Primary Data Sources

- 3.1.2 Secondary Data Sources

- 3.1.3 Data Triangulation

- 3.2 Market Estimation and Forecast