|

|

市場調査レポート

商品コード

1632498

米国の乳がん検診・診断市場:分析と予測(2024年~2030年)U.S. Breast Cancer Screening and Diagnostic Market: Analysis and Forecast, 2024-2030 |

||||||

カスタマイズ可能

|

|||||||

| 米国の乳がん検診・診断市場:分析と予測(2024年~2030年) |

|

出版日: 2025年01月15日

発行: BIS Research

ページ情報: 英文 288 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

米国の乳がん検診・診断の市場規模は、2024年に15億5,660万米ドルとなりました。

同市場は、予測期間の2024年~2030年に7.05%のCAGRで拡大し、2030年末までに23億4,220万米ドルに達すると予測されています。米国の乳がん検診・診断市場は、先進技術の導入が大きな原動力となり、目覚ましい2桁成長を続けています。デジタルマンモグラフィへの移行は急速に進んでおり、2021年現在、米国におけるマンモグラフィ検査の約90%がデジタルシステムで占められています。この移行は、特に若い女性や乳腺組織が密な女性にとって、デジタルマンモグラフィの感度がより高いことを示す調査によって支えられています。さらに、デジタル乳房トモシンセシス(DBT)は、従来の2Dマンモグラフィよりも多くのがんを検出し、偽陽性率も低いという研究結果もあり、より一般的になってきています。例えば、2021年9月に発表された'Comparative Effectiveness of Digital Breast Tomosynthesis and Mammography in Older Women'(高齢女性におけるデジタルブレストトモシンセシスとマンモグラフィの比較効果)と題する研究では、高齢女性において、DBTは2Dマンモグラフィと比較して、検診マンモグラフィ1,000枚あたり2.1枚多くのがんを同定することが明らかになっています。さらに、米国における乳がん罹患率の上昇と専門診断センターの増加が、米国の乳がん検診・診断市場の成長をさらに後押ししています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2030年 |

| 2024年の評価 | 15億5,660万米ドル |

| 2030年の予測 | 23億4,220万米ドル |

| CAGR | 7.05% |

米国の乳がん検診・診断市場は、乳房画像技術の進歩によって著しい成長を遂げています。重要な技術革新のひとつが3Dマンモグラフィ、すなわちデジタル乳房トモシンセシスであり、これは従来の2Dマンモグラフィを大幅に改善したものです。2D画像とは異なり、乳房トモシンセシスは異なる角度から複数の画像を撮影することで、放射線科医が精査できる乳房の詳細なレイヤービューを作成します。イェール大学医学部の研究者が13年間に272,000件以上の乳がん検診を分析した包括的な調査によると、3Dマンモグラフィは2Dマンモグラフィよりも乳がんをより頻繁に、より早期に発見することが明らかになっています。具体的には、2次元マンモグラフィの44%に対し、3次元マンモグラフィでは33%のがんが進行した段階で発見され、早期発見の著しい向上が示されました。同様に、光音響超音波(光音響イメージングとしても知られる)は、レーザー誘起イメージングと従来の超音波技術を組み合わせた革新的な診断ツールです。この方法は、乳がんの検出と診断、特に良性病変と悪性病変の鑑別を強化する上で大きな可能性を示しています。

Hologic、GE Healthcare、Siemens Healthineers AGなどの主要企業が牽引する米国の乳がん検診・診断市場は、乳がん検出の状況を一変させました。3Dマンモグラフィや光音響超音波などの先端技術を活用することで、これらの企業は早期発見を強化し、良性病変と悪性病変の鑑別精度を向上させる多様な診断ソリューションを提供しています。

当レポートでは、米国の乳がん検診・診断市場について調査し、市場の概要とともに、製品別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

市場の定義

主な質問への回答

調査手法

乳がんの概要

乳がんのスクリーニングと診断のガイドライン

米国の乳がんスクリーニングおよび診断、画像ベース市場

- X線

- 超音波

- MRIコイル

- その他

- 乳房生検

乳房画像診断と生検の新たな動向

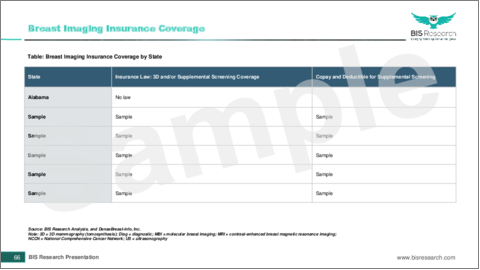

乳房画像診断の保険適用範囲

市場力学

- 主要な市場促進要因

- 主要な市場抑制要因

- 主要な市場機会

米国の乳房マンモグラフィ市場

- 従来の2Dマンモグラフィ

- 概要

- 設置ベース(州別)

- 撮影量(州別)

- 施設数(州別)

- 地域別の市場規模と成長可能性

- 従来の2Dマンモグラフィ(エンドユーザー別)

- 競合情勢

- デジタル乳房トモシンセシス

- 概要

- 設置ベース(州別)

- 撮影量(州別)

- 施設数(州別)

- 地域別の市場規模と成長可能性

- デジタル乳房トモシンセシス(エンドユーザー別)

- 競合情勢

- Hologic, Inc.

- Siemens Healthineers AG

- GE HealthCare Technologies Inc.

- FUJIFILM Holdings Corporation

- Canon Inc

- Metaltronica S.p.A

- Planmed Oy

- 造影デジタルマンモグラフィ

- 概要

- 撮影量(州別)

- 施設数(州別)

- 地域別の市場規模と成長可能性

- 競合情勢

- Hologic, Inc.

- Siemens Healthineers AG

- GE HealthCare Technologies Inc.

- FUJIFILM Holdings Corporation

米国の画像誘導乳腺生検市場

- 概要

- 市場規模と成長可能性(製品別)

- 市場規模と成長可能性(地域別)

- 市場規模と成長可能性(エンドユーザー別)

- 設置ベース(州別)

- 生検件数(州別)

- 施設数(州別)

- 競合情勢

- Hologic, Inc.

- Danaher Corporation (Mammotome)

- Becton, Dickinson and Company

造影マンモグラフィガイド下生検

An Introduction to U.S. Breast Cancer Screening and Diagnostic

The U.S. breast cancer screening and diagnostic market was valued at $1,556.6 million in 2024 and is anticipated to reach $2,342.2 million by the end of 2030, at a CAGR of 7.05% during the forecast period 2024-2030. The U.S. breast cancer screening and diagnostic market has been witnessing impressive double-digit growth, largely driven by the introduction of advanced technologies. The shift to digital mammography has been rapid, with digital systems now accounting for approximately 90% of all mammography procedures in the U.S. as of 2021.This transition has been supported by research showing that digital mammography has greater sensitivity, especially for younger women and those with dense breast tissue. Additionally, digital breast tomosynthesis (DBT) has become more common, as studies indicate it detects more cancers than traditional 2D mammography while also lowering false positive rates. For example, a study published in September 2021 titled 'Comparative Effectiveness of Digital Breast Tomosynthesis and Mammography in Older Women' found that DBT identified 2.1 more cancers per 1,000 screening mammograms compared to 2D mammography among older women. Moreover, the rising incidence of breast cancer and the increasing number of specialized diagnostic centers in the U.S. have been further propelling U.S. breast cancer screening and diagnostic market growth.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2030 |

| 2024 Evaluation | $1,556.6 Million |

| 2030 Forecast | $2,342.2 Million |

| CAGR | 7.05% |

The U.S. breast cancer screening and diagnostic market has been experiencing notable growth, driven by advancements in breast imaging technologies. One key innovation is 3-D mammography, or digital breast tomosynthesis, which represents a significant improvement over traditional 2-D mammography. Unlike 2-D images, breast tomosynthesis captures multiple images from different angles to create a detailed, layered view of the breast that radiologists can closely examine. A comprehensive study by researchers at Yale School of Medicine, analyzing over 272,000 breast cancer screenings over 13 years, found that 3-D mammograms identified breast cancer more frequently and at earlier stages than 2-D mammograms. Specifically, the study indicated that 3-D mammography detected 33% of cancers at advanced stages, compared to 44% for 2-D mammography, highlighting a marked improvement in early detection. Similarly, optoacoustic ultrasound, also known as photoacoustic imaging, is an innovative diagnostic tool that combines laser-induced imaging with traditional ultrasound technology. This method has shown significant promise in enhancing the detection and diagnosis of breast cancer, particularly in differentiating between benign and malignant lesions.

Industrial Impact

The U.S. breast cancer screening and diagnostic market, driven by leading companies such as Hologic, GE Healthcare, and Siemens Healthineers AG, has transformed the landscape of breast cancer detection. By leveraging advanced technologies such as 3-D mammography, and optoacoustic ultrasound, these companies provide a diverse range of diagnostic solutions that enhance early detection and improve accuracy in distinguishing between benign and malignant lesions.

The innovations in the U.S. breast cancer screening market have a significant impact that goes beyond just diagnosing individual cases. Improved screening methods, such as digital breast tomosynthesis (DBT) and advanced MRI, provide important data that inform clinical trials and drug development. This data helps create more effective treatment strategies tailored to the unique characteristics of each patient, which is especially vital in breast cancer, where identifying specific biomarkers can lead to targeted therapies that enhance patient outcomes.

Additionally, incorporating these advanced screening technologies into public health initiatives raises awareness and encourages more people to participate in screening programs. This increase in participation leads to higher rates of early detection and timely intervention, improving individual health and strengthening community health systems by reducing the number of late-stage diagnoses.

As these technologies continue to evolve and regulatory support grows, the influence of the breast cancer screening and diagnostic market in the U.S. becomes even more pronounced. By advancing precision medicine and providing deeper insights into breast cancer, U.S. breast cancer screening and diagnostic market plays a crucial role in transforming healthcare practices and improving patient outcomes across the country.

Market Segmentation of the U.S. breast cancer screening and diagnostic market:

Segmentation 1: by Technology

- Conventional 2D Mammography

- Digital Breast Tomosynthesis

- Contrast-Enhanced Digital Mammography

- Ultrasound

- MRI Coils

- Others

Digital Breast Tomosynthesis Segment to Dominate the U.S. Breast Cancer Screening and Diagnostic, Image-Based Market (by Technology)

Based on product, the U.S. breast cancer screening and diagnostic, image-based market was led by the digital breast tomosynthesis segment, which held a 49.93% share in 2023. The rising adoption of digital breast tomosynthesis (DBT) reflects a strong demand for advanced breast cancer screening technologies. DBT is particularly effective in improving detection rates for women with dense breast tissue, making it a vital tool for early diagnosis. This technology helps reduce false-positive results, leading to better patient experiences and outcomes. The growing recognition of DBT's benefits, supported by clinical guidelines and increased patient awareness, drives its integration into standard screening practices, ultimately advancing breast cancer detection and personalized healthcare solutions which in result propelling the growth of U.S. breast cancer screening and diagnostic market.

Recent Developments in the U.S. Breast Cancer Screening and Diagnostic Market

- In August 2024, Izotropic Corporation, a medical device company focused on the commercialization of IzoView, a breast computed tomography (CT) imaging system, announced its pursuit of a regulatory strategy in the U.S. and EU to launch IzoView as a diagnostic device for patients with dense breast tissue, a common variation that increases the risk of developing breast cancer. The company's updated regulatory approach aims to position IzoView Breast CT for market entry as a diagnostic imaging tool to be used alongside digital breast tomosynthesis (DBT), specifically for patients with dense breast tissue classified as BI-RADS C and D.

- In March 2024, Mammotome introduced the LumiMARK Biopsy Site Marker, a unique tissue marker designed to be distinct from every angle under ultrasound, mammography, and magnetic resonance.

- In November 2023, GE HealthCare launched a new all-in-one artificial intelligence (AI) application platform designed to assist clinicians in breast cancer detection and enhance workflow efficiency MyBreastAI Suite. This initial release includes three AI applications from iCAD, i.e., ProFound AI for DBT, SecondLook for 2D Mammography, and PowerLook Density Assessment. Together, these tools aim to support early detection, improve patient outcomes, and boost operational productivity in radiology departments.

- In February 2023, Neodynamics formed a partnership with Uniphar Group, a global leader in distribution and logistics. This collaboration aims to facilitate the U.S. launch of NeoNavia, their cutting-edge pulse biopsy system.

- In October 2020, FUJIFILM Medical Systems U.S.A., Inc. expanded its partnership with Volpara Solutions, a software company dedicated to preventing advanced-stage breast cancer. This collaboration aims to offer mammography facilities and clinicians enhanced breast imaging solutions that improve image quality, streamline workflow, and accurately assess patients' breast density.

Demand - Drivers, Challenges, and Opportunities in the U.S. breast cancer screening and diagnostic market

Market Drivers in the U.S. breast cancer screening and diagnostic market:

Growing Incidence of Breast Cancer: The increasing incidence of breast cancer in the U.S. has been a significant factor driving the growth of the breast cancer screening and diagnostic market. According to statistics published by the American Cancer Society in January 2024, there were over 300,000 new cases of breast cancer reported, alongside a continuing prevalence of 3.5 million cases. This trend heightens the demand for early detection technologies, prompting healthcare facilities to invest more in advanced diagnostic tools such as mammography, MRI, and ultrasound. Also, as breast cancer rates rise, the need for early and accurate detection becomes critical, contributing to substantial growth in the U.S. breast cancer screening and diagnostic market. Healthcare providers are thus motivated to enhance their diagnostic capabilities, ensuring better patient outcomes through timely and precise detection.

Market Challenges in the U.S. breast cancer screening and diagnostic market:

Shortage of Imaging Expertise Leading to Underutilization of Breast Cancer Imaging Solutions: Imaging plays a crucial role in ensuring quality cancer care, but it faces significant challenges in both developing and developed countries. Projections from the Association of American Medical Colleges (AAMC) indicate that the U.S. may encounter a physician shortage of between 37,800 and 124,000 by 2034, with radiology alone expected to see a deficit of 10,300 to 35,600 physicians. The AAMC also identifies issues such as physician burnout and an aging workforce as major factors contributing to these shortages. Additionally, research published in July 2023 by the American College of Radiology highlights the effects of these workforce challenges, specifically on radiology. For example, Montana reported the highest attrition rate, with 25.4% of radiologists, i.e., 16 out of 63, leaving the profession. This situation underscores the critical shortage and high turnover rates in radiology, reflecting broader national concerns about physician shortages and the urgent need for effective strategies to address these workforce issues.

Market Opportunities in the U.S. breast cancer screening and diagnostic market:

Utilization of Multi-Modality Imaging for Breast Cancer Screening: The integration of multi-modality imaging in breast cancer screening and diagnosis marks a significant advancement in the field. This approach enhances diagnostic accuracy, aids in precise surgical planning, and facilitates personalized patient care, ultimately leading to better outcomes for those with breast cancer. As technology continues to advance, the role of multi-modality imaging in managing breast cancer is expected to grow, further improving the quality and effectiveness of care. Additionally, the development and incorporation of multimodal diagnostic imaging systems have been driving major improvements in breast cancer screening and diagnosis. These systems combine various imaging techniques, such as mammography, ultrasound, and tomosynthesis, into a single platform, offering a comprehensive evaluation of breast tissue. This holistic approach boosts diagnostic accuracy, especially in challenging cases involving dense breast tissue, and enhances early detection rates.

How can U.S. breast cancer screening and diagnostic market report add value to an organization?

Product/Innovation Strategy: The U.S. breast cancer screening and diagnostic market has been extensively segmented based on technology. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: The U.S. breast cancer screening and diagnostic market has numerous established players with significant product portfolios. Key players in the breast cancer screening and diagnostic market analyzed and profiled in the study involve established players offering products for screening and diagnosis of breast cancer.

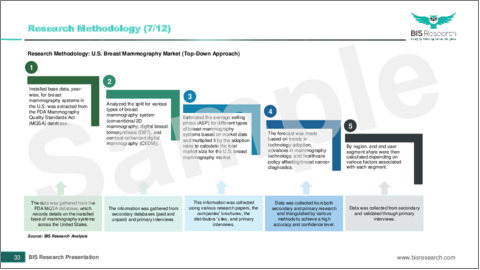

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the U.S. breast cancer screening and diagnostic market size is 2023. A historical year analysis has been done for the period FY2019-FY2022. The U.S. breast cancer screening and diagnostic market size has been estimated for FY2023 and projected for the period FY2024-FY2030.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. The U.S. breast cancer screening and diagnostic market report provides a market study of upstream and downstream products of the U.S. breast cancer screening and diagnostic market.

- The U.S. breast cancer screening and diagnostic market contribution of breast cancer screening and diagnostic is anticipated to be launched and calculated based on the historical analysis of the solutions.

- The company's revenue has been referenced from their annual reports for FY2022 and FY2023. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available breast cancer screening and diagnosis solutions in the U.S. All the key companies with significant offerings in this field have been considered and profiled in U.S. breast cancer screening and diagnostic market report.

Primary Research in the U.S. breast cancer screening and diagnostic market:

The primary sources involve industry experts in U.S. breast cancer screening and diagnostic, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by U.S. breast cancer screening and diagnostic market players

- Validation of the numbers of the different segments of the U.S. breast cancer screening and diagnostic market in focus

- Percentage split of individual markets for regional analysis

Secondary Research in the U.S. breast cancer screening and diagnostic market

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the U.S. breast cancer screening and diagnostic market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies profiled have been selected based on inputs gathered from primary experts, who have analyzed company coverage, product portfolio, and market penetration.

Some prominent names established in U.S. breast cancer screening and diagnostic market are:

- Koninklijke Philips N.V

- Canon Inc

- Planmed Oy

- Siemens Healthineers AG

- GE Healthcare

- FUJIFILM Holdings Corporation

- Hologic, Inc.

- Mammotome, a Danaher Corporation company

- Becton, Dickinson, and Company

- Metaltronica S.p.A

Table of Contents

Executive Summary

Market Definition

Key Questions Answered

Research Methodology

Breast Cancer Overview

- Breast Cancer Incidence (by Age Group)

- Breast Cancer Incidence (by Ethnicity)

- Breast Cancer Incidence (by State)

- Breast Cancer Prevalence (by Age Group)

- Breast Cancer Prevalence (by Ethnicity)

- Breast Cancer Prevalence (by State)

Breast Cancer Screening and Diagnosis Guidelines

- American Cancer Society

- NCCN Guidelines

U.S. Breast Cancer Screening and Diagnostic, Image-Based Market

- X-Ray

- Ultrasound

- MRI Coils

- Others

- Breast Biopsy

Breast Imaging and Biopsy Emerging Trends

Breast Imaging Insurance Coverage

Market Dynamics

- Key Market Drivers

- Key Market Restraints

- Key Market Opportunities

U.S. Breast Mammography Market

- Conventional 2D Mammography

- Overview

- Installed base (by State)

- Imaging Volume (by State)

- Facility Count (by State)

- Market Size and Growth Potential by Region

- Conventional 2D Mammography (by End User)

- Competitive Landscape

- Digital Breast Tomosynthesis

- Overview

- Installed base (by State)

- Imaging Volume (by State)

- Facility Count (by State)

- Market Size and Growth Potential by Region

- Digital Breast Tomosynthesis (by End User)

- Competitive Landscape

- Hologic, Inc.

- Siemens Healthineers AG

- GE HealthCare Technologies Inc.

- FUJIFILM Holdings Corporation

- Canon Inc

- Metaltronica S.p.A

- Planmed Oy

- Contrast-Enhanced Digital Mammography

- Overview

- Imaging Volume (by State)

- Facility Count (by State)

- Market Size and Growth Potential by Region

- Competitive Landscape

- Hologic, Inc.

- Siemens Healthineers AG

- GE HealthCare Technologies Inc.

- FUJIFILM Holdings Corporation

U.S. Image-Guided Breast Biopsy Market

- Overview

- Market Size and Growth Potential (by Product)

- Market Size and Growth Potential ( by Region)

- Market Size and Growth Potential (by End User)

- Installed base (by State)

- Biopsy Volume (by State)

- Facility Count (by State)

- Competitive Landscape

- Hologic, Inc.

- Danaher Corporation (Mammotome)

- Becton, Dickinson and Company