|

|

市場調査レポート

商品コード

1606244

欧州の海事衛星市場:エンドユーザー別、サービス別、ソリューション別、国別 - 分析と予測(2023年~2033年)Europe Maritime Satellite Market: Focus on End User, Service, Solution, and Country-Wise Analysis - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の海事衛星市場:エンドユーザー別、サービス別、ソリューション別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年12月06日

発行: BIS Research

ページ情報: 英文 66 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の海事衛星の市場規模は、2023年の10億4,600万米ドルから2033年には26億90万米ドルに達し、予測期間の2023年~2033年のCAGRは9.54%になると予測されています。

海事衛星として知られる特殊な衛星通信分野は、欧州と世界の海における海上業務の特殊なニーズを満たすために作られました。これらの衛星は、高速インターネット、音声・データ転送、ナビゲーション、安全機能などの重要なサービスを提供することで、商業貨物船、クルーズ船、個人所有のヨット、海軍に役立っています。

海事衛星は、孤立した海域でも信頼できる接続性を提供することで、欧州の海事産業の業務効率、安全性、規制遵守を向上させています。海事衛星は、海事産業のデジタル化、救助活動の支援、世界貿易の促進に不可欠です。現代の海洋通信の基盤として機能するこれらの衛星は、この地域の経済的安定だけでなく、より技術的に高度で相互接続された海洋生態系の発展にも不可欠です。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 10億4,600万米ドル |

| 2033年の予測 | 26億90万米ドル |

| CAGR | 9.54% |

この地域の広範な海事産業において、信頼できる通信ソリューションへの需要が高まっていることが、欧州海事衛星市場の着実な成長を後押ししています。商業貨物船、クルーズ・ライナー、プライベート・ヨット、海軍など様々な船舶に対応するため、海事衛星は高速インターネット、音声・データ・トランスミッション、ナビゲーション、安全対策など重要なサービスを提供しています。

これらの衛星は、世界貿易と海事産業がよりデジタル化されるにつれて、遠隔の海洋地域であっても、業務効率の改善、リアルタイムのデータ共有、規制遵守を促進します。欧州の海事産業にとって衛星通信は、安全性の向上、より良い船隊管理、海上での中断のない接続性のために、ますます重要になってきています。

業界をさらに牽引しているのは、より迅速で信頼性の高い通信を提供する低軌道(LEO)システムなどの衛星技術の発展です。欧州がデジタル・トランスフォーメーションと海上安全を優先する中、革新的な衛星通信ソリューションの需要は大幅に増加するとみられます。

当レポートでは、欧州の海事衛星市場について調査し、市場の概要とともに、エンドユーザー別、サービス別、ソリューション別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 規制と環境に関する考慮事項

- 今後の小型衛星通信コンステレーション:欧州の海事衛星市場の成長要因

- エコシステム/進行中のプログラム

- スタートアップ資金調達の概要

- 市場力学の概要

第2章 地域

- 地域別概要

- 促進要因と抑制要因

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Inmarsat Global Limited

- NSSLGlobal

- Marlink B.V.

- Satcom Global

- GT Maritime

第4章 調査手法

List of Figures

- Figure 1: Europe Maritime Satellite Market (by End User), 2022, 2026, and 2033

- Figure 2: Europe Maritime Satellite Market (by Service), 2022, 2026, and 2033

- Figure 3: Europe Maritime Satellite Market (by Solution), 2022, 2026, and 2033

- Figure 4: Maritime Satellite, Recent Developments

- Figure 5: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 6: U.K. Maritime Satellite Market, $Million, 2022-2033

- Figure 7: Germany Maritime Satellite Market, $Million, 2022-2033

- Figure 8: France Maritime Satellite Market, $Million, 2022-2033

- Figure 9: Russia Maritime Satellite Market, $Million, 2022-2033

- Figure 10: Rest-of-Europe Maritime Satellite Market, $Million, 2022-2033

- Figure 11: Strategic Initiatives, 2020-2024

- Figure 12: Share of Strategic Initiatives

- Figure 13: Data Triangulation

- Figure 14: Top-Down and Bottom-Up Approach

- Figure 15: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Maritime Satellite Market, Opportunities across Regions

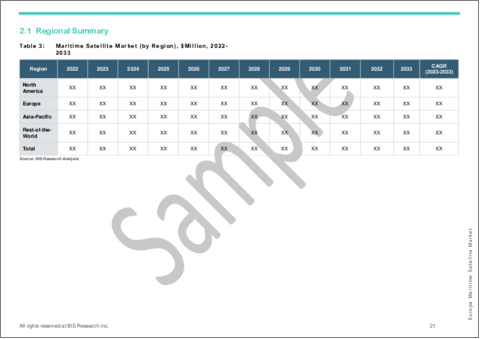

- Table 3: Maritime Satellite Market (by Region), $Million, 2022-2033

- Table 4: Europe Maritime Satellite Market (by End User), $Million, 2022-2033

- Table 5: Europe Maritime Satellite Market (by Service), $Million, 2022-2033

- Table 6: Europe Maritime Satellite Market (by Solution), $Million, 2022-2033

- Table 7: U.K. Maritime Satellite Market (by End User), $Million, 2022-2033

- Table 8: U.K. Maritime Satellite Market (by Service), $Million, 2022-2033

- Table 9: U.K. Maritime Satellite Market (by Solution), $Million, 2022-2033

- Table 10: Germany Maritime Satellite Market (by End User), $Million, 2022-2033

- Table 11: Germany Maritime Satellite Market (by Service), $Million, 2022-2033

- Table 12: Germany Maritime Satellite Market (by Solution), $Million, 2022-2033

- Table 13: France Maritime Satellite Market (by End User), $Million, 2022-2033

- Table 14: France Maritime Satellite Market (by Service), $Million, 2022-2033

- Table 15: France Maritime Satellite Market (by Solution), $Million, 2022-2033

- Table 16: Russia Maritime Satellite Market (by End User), $Million, 2022-2033

- Table 17: Russia Maritime Satellite Market (by Service), $Million, 2022-2033

- Table 18: Russia Maritime Satellite Market (by Solution), $Million, 2022-2033

- Table 19: Rest-of-Europe Maritime Satellite Market (by End User), $Million, 2022-2033

- Table 20: Rest-of-Europe Maritime Satellite Market (by Service), $Million, 2022-2033

- Table 21: Rest-of-Europe Maritime Satellite Market (by Solution), $Million, 2022-2033

Introduction to Europe Maritime Satellite Market

The Europe maritime satellite market is estimated to reach $2,600.9 million by 2033 from $1,046.0 million in 2023, growing at a CAGR of 9.54% during the forecast period 2023-2033. The specialized satellite communication sector known as marine satellites was created to satisfy the particular needs of maritime operations throughout the seas of Europe and the world. These satellites serve commercial cargo ships, cruise ships, private yachts, and naval forces by offering vital services like high-speed internet, voice and data transfer, navigation, and safety features.

Maritime satellites improve operational effectiveness, safety, and regulatory compliance in the European maritime industry by providing dependable connectivity even in isolated maritime regions. They are essential to the digital development of the maritime industry, aiding in rescue efforts, and promoting global trade. These satellites, which serve as the foundation of contemporary marine communication, are essential to the economic stability of the area as well as the development of a more technologically advanced and interconnected maritime ecosystem.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $1,046.0 Million |

| 2033 Forecast | $2,600.9 Million |

| CAGR | 9.54% |

Market Introduction

The growing demand for dependable communication solutions throughout the region's extensive maritime industry is propelling the Europe maritime satellite market's steady growth. In order to accommodate a variety of boats, including commercial cargo ships, cruise liners, private yachts, and naval forces, maritime satellites offer crucial services including high-speed internet, voice and data transmission, navigation, and safety measures.

These satellites facilitate improved operational efficiency, real-time data sharing, and regulatory compliance-even in remote marine regions-as global trade and the maritime industry become more digitalized. Satellite communication is becoming more and more important to the European maritime industry for enhanced safety, better fleet management, and uninterrupted connectivity when at sea.

Further driving the industry are developments in satellite technology, such as low Earth orbit (LEO) systems, which provide quicker and more reliable communication. As Europe prioritizes digital transformation and maritime safety, the demand for innovative satellite communication solutions is set to rise significantly.

Market Segmentation

Segmentation 1: by End User

- Merchant Shipping

- Fishing

- Passenger Ship

- Offshore

- Government

- Others

Segmentation 2: by Service

- Tracking and Monitoring

- Voice

- Video

- Data

Segmentation 3: by Solution

- Very Small Aperture Terminal (VSAT)

- Mobile Satellite Service (MSS)

Segmentation 4: by Region

- Europe - U.K., Germany, France, Russia, and Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of solutions available for deployment and their potential in Europe region. Moreover, the study provides the reader with a detailed understanding of the maritime satellite market (by application) on the basis of the end user (merchant shipping, fishing, passenger ship, offshore, government, and others) and on the basis of service (tracking and monitoring, voice, video, and data), and product on the basis of solution (very small aperture terminal (VSAT), and mobile satellite service (MSS)).

Growth/Marketing Strategy: The Europe maritime satellite market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been partnerships and contracts to strengthen their position in the maritime satellite market.

Competitive Strategy: Key players in the Europe maritime satellite market analyzed and profiled in the study involve major companies offering maritime satellite services designed for various applications. Moreover, a detailed competitive benchmarking of the players operating in the maritime satellite market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- Inmarsat Global Limited

- NSSLGlobal

- Marlink B.V.

- Satcom Global

- GT Maritime

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Rise of High-Throughput Satellite (HTS)

- 1.1.2 Integration of the Internet of Things (IoT) in Maritime Communication

- 1.1.3 Migration to Flat-Panel Antennas

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 Regulatory and Environmental Considerations

- 1.3.1 Regulatory Implications

- 1.4 Upcoming Small Satellite Communication Constellation: A Growth Factor in Europe Maritime Satellite Market

- 1.5 Ecosystem/Ongoing Programs

- 1.5.1 Blue Justice Community

- 1.6 Startup Funding Summary

- 1.7 Market Dynamics Overview

- 1.7.1 Business Drivers

- 1.7.1.1 Enhanced Maritime Communication Needs

- 1.7.1.2 Globalization of Trade and Increasing Sea Traffic

- 1.7.1.3 Advancements in Satellite Technology

- 1.7.2 Business Challenges

- 1.7.2.1 Increasing Concerns about Cybersecurity Threats

- 1.7.2.2 Competition from Alternative Technologies

- 1.7.2.3 High Investment and Operating Cost

- 1.7.3 Business Opportunities

- 1.7.3.1 Integration with IoT and Big Data Analytics

- 1.7.3.2 Hybrid Satellite Networks

- 1.7.1 Business Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Europe

- 2.3.1 Regional Overview

- 2.3.2 Driving Factors for Market Growth

- 2.3.3 Factors Challenging the Market

- 2.3.4 Application

- 2.3.5 Product

- 2.3.6 U.K.

- 2.3.7 Application

- 2.3.8 Product

- 2.3.9 Germany

- 2.3.10 Application

- 2.3.11 Product

- 2.3.12 France

- 2.3.13 Application

- 2.3.14 Product

- 2.3.15 Russia

- 2.3.16 Application

- 2.3.17 Product

- 2.3.18 Rest-of-Europe

- 2.3.19 Application

- 2.3.20 Product

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 Inmarsat Global Limited

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2022

- 3.2.2 NSSLGlobal

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2022

- 3.2.3 Marlink B.V.

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share, 2022

- 3.2.4 Satcom Global

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share, 2022

- 3.2.5 GT Maritime

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2022

- 3.2.1 Inmarsat Global Limited

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast