|

|

市場調査レポート

商品コード

1606242

欧州の宇宙仕様プロペラントタンク市場:プラットフォーム別、プロペラントタンク別、国別 - 分析と予測(2023年~2033年)Europe Space-Qualified Propellant Tank Market: Focus on Platform, Propellant Tank, and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の宇宙仕様プロペラントタンク市場:プラットフォーム別、プロペラントタンク別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年12月06日

発行: BIS Research

ページ情報: 英文 57 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の宇宙仕様プロペラントタンクの市場規模は、2023年に4億320万米ドルとなりました。

同市場は、予測期間の2023年~2033年に2.21%のCAGRで拡大し、2033年末には5億180万米ドルに達すると予測されています。宇宙ミッションの厳しい要件に耐えるように作られた宇宙仕様のプロペラントタンクは、欧州の航空宇宙工学にとって極めて重要な部品です。宇宙船の推進に必要な燃料はこれらのタンクに貯蔵され、深宇宙探査、軌道修正、軌道離脱などの作業を可能にします。宇宙という厳しい環境下での信頼性、安全性、有効性を保証するため、その設計と製造には最先端の材料と技術が必要とされます。

最近の材料科学の動向により、高圧、高温、さまざまな推進剤の腐食性に耐えるタンクが開発されています。宇宙ミッションが環境に与える影響を軽減するため、Benchmark Space Systemsのような大手メーカーやLukasiewicz Institute of Aviationのような研究機関は、ハイテスト過酸化物(HTP)のようなグリーン推進剤を使用する推進システムの技術革新の先頭に立っています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 4億320万米ドル |

| 2033年の予測 | 5億180万米ドル |

| CAGR | 2.21% |

欧州の宇宙ミッションにおけるこれらのタンクの成功は、衛星技術と惑星間探査が拡大し続ける中で、信頼性の高い推進剤貯蔵ソリューションの重要性を強調しています。ミッションの成功には、性能、コスト、製造性のバランスをとりながら、材料の選択や構造的完全性などの設計上の考慮が不可欠です。欧州の宇宙産業が持続可能性と効率性を重視する中、宇宙仕様のプロペラントタンクは次世代宇宙船の動力源として不可欠であり続け、宇宙空間のさらなる探査と利用をサポートします。

欧州の宇宙仕様プロペラントタンク市場は、宇宙ミッション用の高度な推進システムに対するニーズの高まりにより、急速に拡大しています。軌道修正、軌道離脱、深宇宙探査を含む宇宙船推進に必要な推進剤を保持するために設計されたこれらのタンクは、航空工学に不可欠な部品です。惑星間ミッションの増加、衛星打ち上げ、宇宙探査の技術開発が市場を牽引しています。

宇宙仕様のプロペラントタンクが、高圧、温度変化、腐食性推進剤への暴露といった宇宙の過酷な条件に耐えるためには、厳しい性能、安全性、信頼性要件を満たす必要があります。効率を維持し、環境への影響を軽減しながら、このような厳しい条件に耐えうるタンクは、最近の材料科学の進歩の結果として開発されてきました。Benchmark Space Systemsを含む欧州のメーカーや、Lukasiewicz Institute of Aviatioなどの研究機関は、グリーン推進剤や持続可能な技術を推進システムに統合する先駆的な取り組みを行っています。

宇宙探査が拡大し続けるにつれ、宇宙仕様のプロペラントタンクの役割はさらに重要になります。これらのタンクは、人工衛星の配備、科学研究、惑星間探査を含む宇宙ミッションの成功を確実にするために不可欠です。欧州の宇宙産業では、持続可能性、費用対効果、性能を重視する傾向が強まっており、革新的な推進剤貯蔵ソリューションへの需要がさらに加速しています。

当レポートでは、欧州の宇宙仕様プロペラントタンク市場について調査し、市場の概要とともに、プラットフォーム別、プロペラントタンク別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- 規制状況(国別)

- 英国

- フランス

- ドイツ

- ロシア

- エコシステム/進行中のプログラム

- 宇宙用燃料タンクの製造業者と規格

- 新たな宇宙ビジネスシナリオ:宇宙対応プロペラントタンク市場における新たな機会

- スタートアップと投資情勢

- 市場力学の概要

- サプライチェーンの概要

第2章 地域

- 地域別概要

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- AIRBUS

- ArianeGroup

- OHB SE

第4章 調査手法

List of Figures

- Figure 1: Space-Qualified Propellant Tank Market (by Region), $Million, 2022, 2023, and 2033

- Figure 2: Europe Space-Qualified Propellant Tank Market (by Platform, $Million, 2022 and 2033

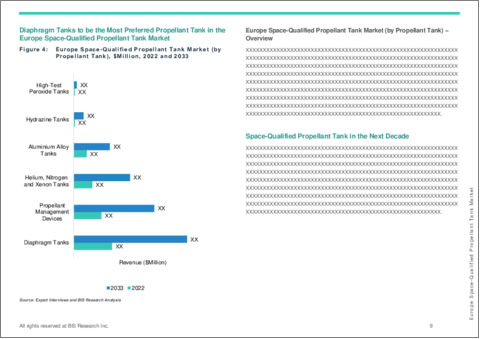

- Figure 3: Europe Space-Qualified Propellant Tank Market (by Propellant Tank), $Million, 2022 and 2033

- Figure 4: Space-Qualified Propellant Tank, Recent Developments

- Figure 5: Small Satellite Market Scenarios (101-2,200 Kg), 2022-2033

- Figure 6: Small Launch Vehicle Scenarios, 2022-2026

- Figure 7: Impact Analysis of Market Navigating Factors, 2022-2033

- Figure 8: Upcoming Deep Space Missions

- Figure 9: Supply Chain and Risks within the Supply Chain

- Figure 10: France Space-Qualified Propellant Tank Market, $Million, 2022-2033

- Figure 11: Germany Space-Qualified Propellant Tank Market, $Million, 2022-2033

- Figure 12: U.K. Space-Qualified Propellant Tank Market, $Million, 2022-2033

- Figure 13: Russia Space-Qualified Propellant Tank Market, $Million, 2022-2033ple

- Figure 14: Rest-of-Europe Space-Qualified Propellant Tank Market, $Million, 2022-2033

- Figure 15: Strategic Initiatives, 2020-2023

- Figure 16: Share of Strategic Initiatives, 2020-2023

- Figure 17: Data Triangulation

- Figure 18: Top-Down and Bottom-Up Approach

- Figure 19: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Space-Qualified Propellant Tank Market Opportunities across Regions

- Table 3: Other Sections Under the Regulations for Propulsion Systems

- Table 4: List of Certification

- Table 5: Funding and Investment Scenario, January 2019-January 2024

- Table 6: Space-Qualified Propellant Tank Market (by Region), $Million, 2022-2033

- Table 7: Europe Space-Qualified Propellant Tank Market (by Platform), $Million, 2022-2033

- Table 8: Europe Space-Qualified Propellant Tank Market (by Propellant Tank), $Million, 2022-2033

- Table 9: France Space-Qualified Propellant Tank Market (by Platform), $Million, 2022-2033

- Table 10: France Space-Qualified Propellant Tank Market (by Propellant Tank), $Million, 2022-2033

- Table 11: Germany Space-Qualified Propellant Tank Market (by Platform), $Million, 2022-2033

- Table 12: Germany Space-Qualified Propellant Tank Market (by Propellant Tank), $Million, 2022-2033

- Table 13: U.K. Space-Qualified Propellant Tank Market (by Platform), $Million, 2022-2033

- Table 14: U.K. Space-Qualified Propellant Tank Market (by Propellant Tank), $Million, 2022-2033

- Table 15: Russia Space-Qualified Propellant Tank Market (by Platform), $Million, 2022-2033

- Table 16: Russia Space-Qualified Propellant Tank Market (by Propellant Tank), $Million, 2022-2033

- Table 17: Rest-of-Europe Space-Qualified Propellant Tank Market (by Platform), $Million, 2022-2033

- Table 18: Rest-of-Europe Space-Qualified Propellant Tank Market (by Propellant Tank), $Million, 2022-2033

- Table 19: Market Share

Introduction to Europe Space-Qualified Propellant Tank Market

In 2023, the Europe space-qualified propellant tank market was valued at $403.2 million and is expected to reach $501.8 million by the end of 2033, growing at a CAGR of 2.21% during the forecast period 2023-2033. Space-qualified propellant tanks, which are made to withstand the demanding requirements of space missions, are crucial parts of European aerospace engineering. The fuel required for spaceship propulsion is stored in these tanks, allowing for operations like deep space exploration, orbit modifications, and deorbiting. To guarantee dependability, safety, and effectiveness in the demanding environment of space, their design and production need for cutting-edge materials and technology.

Tanks that can endure high pressures, temperatures, and the corrosive character of different propellants have been developed as a result of recent developments in materials science. In an effort to lessen the environmental impact of space missions, leading manufacturers like Benchmark Space Systems and research institutes like the Lukasiewicz Institute of Aviation are spearheading innovation in propulsion systems employing green propellants like high-test peroxide (HTP).

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $403.2 Million |

| 2033 Forecast | $501.8 Million |

| CAGR | 2.21% |

The successful use of these tanks in European space missions underscores the importance of reliable propellant storage solutions as satellite technology and interplanetary exploration continue to expand. Design considerations, including material selection and structural integrity, are critical for mission success, balancing performance, cost, and manufacturability. As the European space industry focuses on sustainability and efficiency, space-qualified propellant tanks will remain essential in powering the next generation of spacecraft, supporting further exploration and utilization of outer space.

Market Introduction

The market for space-qualified propellant tanks in Europe is expanding rapidly due to the rising need for sophisticated propulsion systems for space missions. Designed to hold propellants required for spacecraft propulsion, including orbital corrections, deorbiting, and deep space exploration, these tanks are essential parts of aeronautical engineering. The increasing number of interplanetary missions, satellite launches, and technological developments in space exploration are driving the market.

For space-qualified propellant tanks to withstand the harsh conditions of space, such as high pressures, temperature swings, and exposure to corrosive propellants, they must fulfill strict performance, safety, and reliability requirements. Tanks that can survive these challenging conditions while preserving efficiency and lessening their environmental impact have been developed as a result of recent advancements in materials science. Manufacturers in Europe, including Benchmark Space Systems, and research institutions like the Lukasiewicz Institute of Aviation, are pioneering efforts to integrate green propellants and sustainable technologies into propulsion systems.

As space exploration continues to expand, the role of space-qualified propellant tanks becomes even more critical. These tanks are essential for ensuring the success of space missions, including satellite deployment, scientific research, and the push for interplanetary exploration. The increasing emphasis on sustainability, cost-effectiveness, and performance within the European space industry further accelerates the demand for innovative propellant storage solutions, positioning the market for continued growth.

Market Segmentation

Segmentation 1: by Platform

- Satellite

- 0-500 kg

- 501-1,000 kg

- 1,001 kg and Above

- Launch Vehicle

- Small Lift Launch Vehicle (0-2,200 kg)

- Medium and Heavy Lift Launch Vehicle (2,201 kg and Above)

Segmentation 2: by Propellant Tank

- Diaphragm Tanks

- Propellant Management Devices

- Helium, Nitrogen and Xenon Tanks

- Aluminum Alloy Tanks

- Hydrazine Tanks

- HTP Tanks

Segmentation 3: by Region

- Europe - U.K., Germany, France, Russia, and Rest-of-the-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available for deployment in Europe Region. Moreover, the study provides the reader with a detailed understanding of the Europe space-qualified propellant tank market based on platform (satellite and launch vehicle).

Growth/Marketing Strategy: The Europe space-qualified propellant tank market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The company's favored strategy has been partnerships and contracts to strengthen its position in the Europe space-qualified propellant tank market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- Airbus S.A.S.

- Ariane Group

- OHB SE

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Increasing Focus on Sustainability

- 1.1.2 On-Orbit Servicing and Refueling Technologies

- 1.2 Regulatory Landscape (by Country)

- 1.2.1 U.K.

- 1.2.2 France

- 1.2.3 Germany

- 1.2.4 Russia

- 1.3 Ecosystem/Ongoing Programs

- 1.3.1 The ASTRIS Mission

- 1.3.2 SpaceTank Project

- 1.4 Space-Qualified Propellant Tank Manufacturers and Standards

- 1.5 New Space Business Scenario: An Emerging Opportunity for the Space-Qualified Propellant Tank Market

- 1.5.1 Growth in Small Satellite Market

- 1.5.2 Growth in Small Launch Vehicle Market

- 1.6 Start-Ups and Investment Landscape

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Advancements in Materials and Manufacturing Processes

- 1.7.1.2 Increasing Deployment of Satellite Constellation

- 1.7.2 Market Restraints

- 1.7.2.1 Risk of Orbital Debris Colliding with Propellant Tanks

- 1.7.3 Market Opportunities

- 1.7.3.1 Modular and Reusable Propellant Tank Systems

- 1.7.3.2 Increasing Deep Space Mission

- 1.7.1 Market Drivers

- 1.8 Supply Chain Overview

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application (by Platform)

- 2.2.5 Product (by Propellant Tank)

- 2.2.6 France

- 2.2.6.1 Application (by Platform)

- 2.2.6.2 Product (by Propellant Tank)

- 2.2.7 Germany

- 2.2.7.1 Application (by Platform)

- 2.2.7.2 Product (by Propellant Tank)

- 2.2.8 U.K.

- 2.2.8.1 Application (by Platform)

- 2.2.8.2 Product (by Propellant Tank)

- 2.2.9 Russia

- 2.2.9.1 Application (by Platform)

- 2.2.9.2 Product (by Propellant Tank)

- 2.2.10 Rest-of-Europe

- 2.2.10.1 Application (by Platform)

- 2.2.10.2 Product (by Propellant Tank)

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 AIRBUS

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2022

- 3.2.2 ArianeGroup

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2022

- 3.2.3 OHB SE

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share, 2022

- 3.2.1 AIRBUS

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast