|

|

市場調査レポート

商品コード

1719532

データセンター冷却の世界市場:製品・用途・国別の分析・予測 (2025~2035年)Data Center Cooling Market - A Global and Regional Analysis: Focus on Product, Application, and Country-Level Analysis - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| データセンター冷却の世界市場:製品・用途・国別の分析・予測 (2025~2035年) |

|

出版日: 2025年05月08日

発行: BIS Research

ページ情報: 英文 335 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

データセンター冷却の市場規模は、2024年の257億7,000万米ドルから、2035年には1,001億2,000万米ドルに達し、予測期間中はCAGR 12.55%で成長すると予測されています。

データセンター冷却市場は、データストレージ、処理、クラウドコンピューティングサービスへの需要の増加を背景に、急速な成長を遂げています。世界的にデータ生成が加速する中で、効率的な冷却ソリューションは、データセンターの最適な稼働性能と機器寿命を確保する上で不可欠となっています。この市場は、環境への配慮や炭素排出削減を目指す厳しい規制の影響もあり、エネルギー効率が高く持続可能な技術への需要によって大きく動かされています。急成長が続く一方で、高い初期導入コストや、システムの運用維持に伴う複雑さといった課題も存在します。しかし、冷却技術の継続的な進歩や、省エネルギーソリューションへのニーズの高まりにより、こうした課題は徐々に克服されていくと見込まれています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2035年 |

| 2025年評価 | 306億9,000万米ドル |

| 2035年予測 | 1,001億2,000万米ドル |

| CAGR | 12.55% |

エンドユーザー産業別では、IT・通信の部門が市場をリード:

5G、IoT、仮想現実 (VR) ・拡張現実 (AR) 、AIといった新技術の導入により、通信業界は大規模なデータ処理に対応する方向へと進化しています。その結果、通信業界のデータセンターも大容量データ処理や低遅延要件に対応するよう変化しており、冷却ニーズが高まっています。また、銀行・金融サービス・保険 (BFSI) 分野は、もっとも高い成長率が期待されているセグメントです。この分野では急速なデジタル化が進んでおり、最先端の技術導入によってデータセンターの利用が増加し、それに伴って冷却ソリューションの需要も拡大しています。

データセンタータイプ別では、集中型データセンターの部門が市場をリード:

集中型データセンター部門のリードは、データ量と処理能力のニーズの増加によりハイパースケールデータセンターの需要が高まっているためです。ハイパースケールデータセンターは、クラウドの導入により、必要に応じて仮想的に追加容量を提供するために必要とされています。これらのデータセンターは、巨大でミッションクリティカルな施設であり、高性能かつスケーラブルなアプリケーションの運用を効果的に支えるよう設計されています。Google、Amazon、Facebook、IBM、Microsoftといった大量のデータを生成する企業と密接に関係しています。また、エッジデータセンターは、データを生成・利用するエンドユーザーのデバイスに物理的に近い場所に設置されており、5Gの普及によってその需要が高まっています。このため、クラウドインターフェースや主要な計算処理をエッジに近づけることによって、データ伝送の遅延を削減する必要性があり、エッジデータセンターは最も高い成長率が見込まれる部門とされています。

地域別では、アジア太平洋地域が市場をリード:

アジア太平洋地域は、世界最大級のデータセンター市場のひとつであり、大規模な産業・商業企業の存在がこの地域におけるデータセンター需要に大きな影響を与えています。市場規模で見ると、アジア太平洋地域に続くのは北米と欧州です。さらに、アジア太平洋地域では、数多くのデータセンターの存在に加え、革新的な技術への需要やIT投資の増加が見られることから、データセンター冷却技術への需要も非常に高まると予測されています。

当レポートでは、世界のデータセンター冷却の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の動向、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

市場セグメンテーション

セグメンテーション1:エンドユーザー産業別

- IT・通信

- ヘルスケア

- 小売

- 銀行・金融サービス・保険

- 政府・公共機関

- 製造業

- その他

セグメンテーション2:データセンタータイプ別

- 集中型データセンター

- ハイパースケール

- コロケーション

- エンタープライズ

- エッジデータセンター

セグメンテーション3:用途別

- AI

- 高性能コンピューティング (HPC)

- クラウドコンピューティング

- エッジコンピューティング

- その他

セグメンテーション4:ソリューション別

- 空冷

- エアコン

- エアハンドリングユニット

- チラー

- 冷却塔

- エコノマイザーシステム

- その他

- 液冷

- 直接冷却

- リアドア式熱交換器 (RDHX)

- フリークーリング

セグメンテーション5:ラック密度別

- 低ラック密度 (1~4 kW)

- 中型ラック密度 (5~9 kW)

- 高ラック密度 (9 kW超)

セグメンテーション6:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

主要企業:

- Vertiv Group Corp.

- Schneider Electric

- Asetek, Inc.

- Submer

- Munters

- ZutaCore, Inc.

- Coolcentric (Heico Companies LLC)

- Midas Immersion Cooling

- PEZY Computing K.K.

- ALFA LAVAL

- Condair Group

- Fujitsu

- Danfoss

- Modine Manufacturing Company

- Boyd

- Johnson Controls International plc

- Carrier

- STLUZ GMBH

- LiquidStack Holding B.V.

- JETCOOL Technologies Inc (Flex Ltd.)

- Chilldyne, Inc.

- Accelsius LLC

- CoolIT Systems

- DCX Liquid Cooling Systems

- nVent

- Rittal GmbH & Co. KG

Data Center Cooling Market Overview

The data center cooling market is projected to reach $100.12 billion by 2035 from $25.77 billion in 2024, growing at a CAGR of 12.55% during the forecast period 2025-2035. The data center cooling market is witnessing substantial growth, fueled by the increasing demand for data storage, processing, and cloud computing services. As data generation accelerates globally, efficient cooling solutions have become essential to ensure the optimal performance and longevity of data centers. The market has been heavily influenced by the rising need for energy-efficient and sustainable technologies, driven by both environmental concerns and stringent regulations aimed at reducing carbon footprints. Despite its rapid expansion, the industry faces challenges, including high upfront costs and operational complexities associated with maintaining these systems. However, ongoing advancements in cooling technology, coupled with rising demand for energy-efficient solutions, are expected to mitigate these hurdles.

Introduction to Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $30.69 Billion |

| 2035 Forecast | $100.12 Billion |

| CAGR | 12.55% |

Data center cooling is crucial for maintaining the performance and efficiency of data centers, which are essential for cloud computing, data storage, and IT services. As data usage continues to rise, the need for energy-efficient, sustainable cooling solutions becomes increasingly important. The market has been influenced by technological innovations and environmental regulations aimed at reducing energy consumption and carbon footprints. Key regions driving growth include North America, Europe, and Asia-Pacific, with advancements in cooling technologies, such as liquid and free cooling systems, helping to meet the growing demands of the digital economy.

Market Introduction

Data center cooling plays a pivotal role in optimizing the operational efficiency of data centers, which supports the growing global demand for digital services. As the volume of data generation increases, ensuring reliable and cost-effective cooling solutions has become critical to prevent overheating and ensure the smooth functioning of IT infrastructure. The market is evolving with advancements in energy-efficient technologies and a shift toward sustainable practices in response to environmental concerns.

Industrial Impact

The data center cooling market has a significant impact on various industries, particularly those reliant on large-scale data storage and processing, such as cloud computing, e-commerce, and telecommunications. Efficient cooling systems are essential to prevent hardware malfunctions and downtime, thereby enhancing operational reliability and minimizing costs. With increasing data consumption, cooling solutions that reduce energy consumption and carbon emissions are increasingly valued for their sustainability. Industries are adopting cutting-edge cooling technologies such as liquid cooling and AI-driven systems to address growing power demands while complying with stringent environmental regulations. Additionally, the rising emphasis on green building certifications and eco-friendly operations is driving the demand for energy-efficient cooling solutions across industries. As data centers become more integral to the global economy, the evolution of cooling technologies is not only expected to improve operational efficiency but also shape the future of sustainable business practices.

Market Segmentation

Segmentation 1: by End-Use Industry

- IT and Telecom

- Healthcare

- Retail

- Banking, Financial Services, and Insurance

- Government and Public Sector

- Manufacturing

- Others

IT and Telecom to Lead the Market (by End-Use Industry)

Based on the end-use industry, the IT and telecom segment dominates the market. With the introduction of new technologies such as 5G, IoT, virtual and augmented reality, and artificial intelligence, the telecommunications industry has been evolving to cater to huge data processing. As a result, telecom data centers have also been transforming to handle high data volume and low latency needs. The banking, financial services, and insurance (BFSI) segment is expected to anticipate the highest growth rate due to being digitized, which involves utilizing the most cutting-edge technology, which will boost the data center usage, thereby augmenting the data center cooling solutions.

Segmentation 2: by Data Center Type

- Centralized Data Center

- Hyperscale

- Colocation

- Enterprise

- Edge Data Center

Centralized Data Center to Lead the Market (by Data Center Type)

Based on data center type, the centralized data center segment includes sub-segments such as hyperscale, colocation, and enterprise. The centralized data center segment dominates the market due to the demand for hyperscale data centers being driven by the need for more data and processing power. Hyperscale data centers are needed to deliver additional capacity virtually on demand because of cloud adoption. Hyperscale data centers, which are enormous, mission-critical buildings built to support robust, scalable applications effectively, are frequently connected to big data-generating firms such as Google, Amazon, Facebook, IBM, and Microsoft. The edge data centers, which are situated physically closer to end-user devices that are both generating and utilizing data, are therefore being driven by 5G. Due to this factor, edge data centers are expected to have the highest growth rate because the cloud interface and core compute closer to the edge are required to reduce transport latency.

Segmentation 3: by Application Area

- Artificial Intelligence (AI)

- High-Performance Computing (HPC)

- Cloud Computing

- Edge Computing

- Others

Others to Lead the Market (by Application Area)

Others category, encompassing industries such as aerospace and defense, blockchain, agriculture, and healthcare, is set to lead the data center cooling market, based on application area, due to their increasing reliance on data-intensive operations and real-time processing. As sectors such as cryptocurrency mining, smart grids, and AI-driven agriculture expand, they require advanced cooling technologies to manage growing data volumes and maintain operational efficiency. Additionally, industries such as financial services and government demand high reliability and compliance, further driving the need for innovative, scalable, and energy-efficient cooling solutions to ensure system stability and performance.

Segmentation 4: by Solution

- Air Cooling

- Air Conditioner

- Air Handling Unit

- Chiller

- Cooling Tower

- Economizer System

- Others

- Liquid Cooling

- Direct

- Rear Door Heat Exchangers (RDHX)

- Free Cooling

Air Cooling to Lead the Market (by Solution)

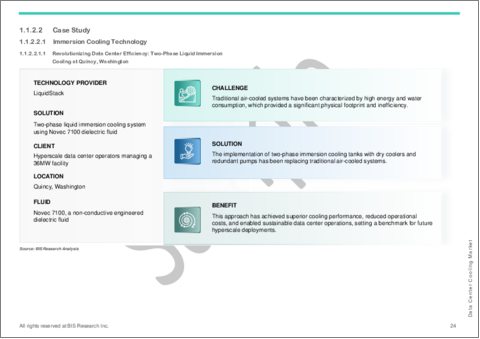

Based on solution, the air cooling market segment is expected to dominate the global data center cooling market because the majority of data centers are old currently and still continue to use air conditioners and other air cooling systems. Additionally, the retrofit data centers also adopt air cooling technologies. However, liquid cooling is expected to witness the highest growth rate from 2025 to 2035 as it efficiently cools the data center area, which results in less usage of fans, leading to better acoustics. The new data centers are gradually moving from conventional data centers or conventional cooling systems to new-age cooling systems, which helps them to improve their efficiency, decrease carbon emissions, and become green and carbon-neutral data centers. This is one of the major factors for the higher growth rate of liquid cooling. Furthermore, liquid cooling is a quieter technique compared to air cooling systems. According to an industry expert, the hyperscale segment is growing, which has been leading to a higher cooling capacity being required. Hence, immersion cooling is expected to be one of the market-leading solutions for data center cooling over the next five years.

Segmentation 5: by Rack Density

- Low Rack Density (1-4 kW)

- Medium Rack Density (5-9 kW)

- High Rack Density (Above 9 kW)

Medium Rack Density (5-9 kW) to Lead the Market (by Rack Density)

The medium rack density (5-9 kW) captures the significant market size of the global data center cooling market based on the rack density. This is because most of the data centers have adopted medium rack density. However, the high rack density segment is booming as it achieves better space utilization, and the response time of system failure is reduced significantly. A high rack density data center usually consumes more than 9 kW of power; hence, it needs better airflow management to ensure efficient cooling, driving the overall data center cooling market.

Segmentation 6: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Asia-Pacific Region to Lead the Market

Asia-Pacific is one of the largest data center markets in the world due to enormous industrial and commercial enterprises that have significantly impacted the demand for data centers in the region. Asia-Pacific is followed by North America and Europe in terms of market size. Moreover, Asia-Pacific is expected to have a massive demand for data center cooling technologies due to numerous data centers and the growing demand for innovative technologies and spending in the region.

Recent developments in the market:

- In October 2024, Schneider Electric acquired a 75% controlling stake in Motivair Corporation for $850 million, enhancing its capabilities in liquid cooling and thermal management solutions for high-performance computing systems.

- In June 2024, Danfoss partnered with Hewlett Packard Enterprise (HPE) to integrate its heat reuse technology into HPE's modular data centers. This collaboration aims to enhance energy efficiency and optimize energy production and distribution, leading to notable energy savings.

- In 2024, Boyd expanded its capabilities by acquiring the Durbin Group, a move aimed at bolstering its expertise in liquid cooling system technologies critical for high-performance computing and artificial intelligence applications. This strategic acquisition positions Boyd to address the evolving thermal management needs of modern data centers, ensuring the company remains competitive in an increasingly demanding market.

Demand - Drivers, Limitations, and Opportunities

Market Drivers

The data center cooling market has been primarily driven by the need for energy efficiency, cost reduction, and sustainability. Rising data center demand has intensified the adoption of advanced cooling solutions, including liquid cooling, AI-assisted systems, and free cooling technologies. These innovations optimize energy use, reduce operational costs, and lower carbon footprints. Additionally, the growing emphasis on water and power usage effectiveness (PUE and WUE) is encouraging the adoption of more efficient, environment-friendly cooling methods. As companies increasingly prioritize operational resilience and environmental goals, investments in energy-efficient cooling systems continue to rise.

Market Restraints

The data center cooling market faces significant restraints, including high initial costs for non-conventional cooling systems and the technical challenges of adapting existing infrastructure. Advanced systems such as immersion and free cooling can require substantial investment, making them less attractive for some businesses. Additionally, air cooling systems suffer from inefficiencies, higher operational costs, and noise pollution. The complexities of maintaining reliability, especially with immersion cooling, include risks of spills, microbial growth, and equipment damage. These factors, combined with the need for specialized infrastructure and higher operational costs, could limit the widespread adoption of innovative cooling technologies.

Market Opportunities

The data center cooling market presents significant opportunities driven by the growing need for retrofit data centers, power management through infrastructure optimization, and the rise of edge data centers. Retrofitting older facilities with advanced cooling technologies, such as liquid immersion systems, can enhance efficiency and reduce operational costs. Additionally, the increasing adoption of data center infrastructure management (DCIM) software enables improved energy use and cooling efficiency. The expansion of edge data centers, driven by digitalization and 5G, further creates demand for compact, efficient cooling solutions, presenting growth potential for innovative cooling technologies.

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a comprehensive product/innovation strategy for the data center cooling market, identifying opportunities for market entry, technology adoption, and sustainable growth. It offers actionable insights, helping organizations to meet environmental standards, gain a competitive edge, and capitalize on the increasing demand for eco-friendly solutions in various industries.

Growth/Marketing Strategy: This report offers a comprehensive growth and marketing strategy designed specifically for the data center cooling market. It presents a targeted approach to identifying specialized market segments, establishing a competitive advantage, and implementing creative marketing initiatives aimed at optimizing market share and financial performance. By harnessing these strategic recommendations, organizations can elevate their market presence, seize emerging prospects, and efficiently propel revenue expansion.

Competitive Strategy: This report crafts a strong competitive strategy tailored to the data center cooling market. It evaluates market rivals, suggests methods to stand out, and offers guidance for maintaining a competitive edge. By adhering to these strategic directives, companies can position themselves effectively in the face of market competition, ensuring sustained prosperity and profitability.

Research Methodology

Factors for Data Prediction and Modeling

- The scope of this report focuses on several types of applications and products.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2021 to April 2025 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major breakthroughs in technology.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the data center cooling market.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes has been explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the data center cooling market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study of the data center cooling market involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as ITU, Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled in the data center cooling market have been selected based on input gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Vertiv Group Corp.

- Schneider Electric

- Asetek, Inc.

- Submer

- Munters

- ZutaCore, Inc.

- Coolcentric (Heico Companies LLC)

- Midas Immersion Cooling

- PEZY Computing K.K.

- ALFA LAVAL

- Condair Group

- Fujitsu

- Danfoss

- Modine Manufacturing Company

- Boyd

- Johnson Controls International plc

- Carrier

- STLUZ GMBH

- LiquidStack Holding B.V.

- JETCOOL Technologies Inc (Flex Ltd.)

- Chilldyne, Inc.

- Accelsius LLC

- CoolIT Systems

- DCX Liquid Cooling Systems

- nVent

- Rittal GmbH & Co. KG

Companies that are not a part of the pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Attached in the mail