|

|

市場調査レポート

商品コード

1532309

自動車用レーダー市場- 世界および地域別分析:用途別、車両タイプ別、推進力別、距離別、周波数別、地域別 - 分析と予測(2024年~2034年)Automotive Radar Market - A Global and Regional Analysis: Focus on Application, Vehicle Type, Propulsion, Range, Frequency, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用レーダー市場- 世界および地域別分析:用途別、車両タイプ別、推進力別、距離別、周波数別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年08月13日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

自動車用レーダーの市場規模は、様々な市場促進要因に後押しされ、著しい成長を遂げています。

楽観的シナリオでは、2024年の市場規模は70億米ドルとなるとみられ、CAGR 21.65%で拡大し、2034年には497億米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 70億米ドル |

| 2034年の予測 | 497億米ドル |

| CAGR | 21.65% |

自動車用レーダー市場の成長の主な促進要因は、ADAS(先進運転支援システム)や自律走行技術に対する需要の高まりです。自動車用レーダーシステムは、正確な物体検知、車線維持支援、衝突回避を提供することで、自動車の安全性を高める上で重要な役割を果たしています。消費者とメーカーが自動車の安全性を優先するにつれ、自動車用レーダーシステムの需要は増加の一途をたどっています。

同市場は、自動車に高度な安全機能を搭載することを義務付ける厳しい政府規制によって需要が高まっています。こうした規制は交通事故を減らし、乗客の安全性を高めることを目的としており、レーダーシステムの採用を後押ししています。さらに、レーダー技術の進歩により、高分解能化や飛距離の向上など、レーダーシステムの性能と信頼性が向上し、自動車メーカーにとって魅力的なものとなっています。

自動車用レーダー市場のもう一つの促進要因は、自律走行車の急速な市場開拓です。レーダーシステムは自律走行機能にとって不可欠であり、ナビゲーションや障害物検知に必要なデータを提供します。大手自動車会社による自律走行車技術への投資の拡大が、先進レーダーシステムの需要を後押ししています。

さらに、電動スクーター市場は、持続可能な都市交通ソリューションに対する需要の高まりに牽引され、電気自動車製造における技術の進歩と革新に支えられて、力強い成長を遂げています。バッテリー技術の革新、スマートな機能、性能の向上により、電動スクーターは消費者にとってより魅力的なものとなり、市場の拡大にさらに拍車をかけています。

当レポートでは、世界の自動車用レーダー市場について調査し、市場の概要とともに、用途別、車両タイプ別、推進力別、距離別、周波数別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 車載レーダー市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 自動車用レーダー市場(用途別)

- 自動車用レーダー市場(車両タイプ別)

- 自動車用レーダー市場(推進力別)

第3章 車載レーダー市場(製品別)

- 製品セグメンテーション

- 製品概要

- 自動車用レーダー市場(距離別)

- 自動車用レーダー市場(周波数別)

第4章 自動車用レーダー市場(地域別)

- 自動車用レーダー市場- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- Robert Bosch GmbH

- Continental AG

- Aptiv

- DENSO CORPORATION

- NXP Semiconductors

- Autoliv

- HELLA GmbH & Co. KGaA

- Texas Instruments Incorporated

- Infineon Technologies AG

- Analog Devices, Inc.

- VALEO

- Mitsubishi Electric Corporation

- Renesas Electronics Corporation

- Veoneer US Safety Systems, LLC.

- ZF Friedrichshafen AG

第6章 調査手法

Introduction to the Automotive Radar Market

The automotive radar market has been undergoing significant growth, driven by various key factors and market drivers. In an optimistic scenario, the market would be valued at $7.00 billion in 2024 and is projected to expand at a CAGR of 21.65% to reach $49.70 billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $7.00 Billion |

| 2034 Forecast | $49.70 Billion |

| CAGR | 21.65% |

A primary driver for the growth of the automotive radar market has been the increasing demand for advanced driver assistance systems (ADAS) and autonomous driving technologies. Automotive radar systems play a crucial role in enhancing vehicle safety by providing precise object detection, lane-keeping assistance, and collision avoidance. As consumers and manufacturers prioritize vehicle safety, the demand for automotive radar systems continues to rise.

The market has been witnessing heightened demand due to stringent government regulations mandating the inclusion of advanced safety features in vehicles. These regulations are aimed at reducing road accidents and enhancing passenger safety, thereby driving the adoption of radar systems. Additionally, advancements in radar technology, such as higher resolution and improved range, are enhancing the performance and reliability of these systems, making them more attractive to automakers.

Another driving factor in the automotive radar market has been the rapid development of autonomous vehicles. Radar systems are integral to the functionality of autonomous driving, providing the necessary data for navigation and obstacle detection. The growing investment in autonomous vehicle technology by major automotive companies has been propelling the demand for advanced radar systems.

Furthermore, the electric scooter market has been witnessing robust growth, driven by the increasing demand for sustainable urban transportation solutions and supported by technological advancements and innovations in electric vehicle manufacturing. Innovations in battery technology, smart features, and enhanced performance are making electric scooters more attractive to consumers, further fueling market expansion.

Overall, the automotive radar market has been witnessing robust growth, driven by the increasing demand for advanced vehicle safety features and supported by technological advancements and innovations in radar technology. Innovations in radar resolution, range, and integration with other vehicle systems are making automotive radar systems more attractive to automakers, further fueling market expansion.

Market Segmentation:

Segmentation 1: by Application

- Adaptive Cruise Control (ACC)

- Autonomous Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Forward Collision Warning System (FCWS)

- Intelligent Parking Assistance (IPA)

- Cross Traffic Alert (CTA)

- Lane Departure Warning (LDW) System

- Traffic Jam Assist (TJA)

- Others

Segmentation 2: by Range

- Short-Range Radar

- Medium-Range Radar

- Long-Range Radar

Segmentation 3: by Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Segmentation 4: by Frequency

- 2X-GHz

- 7X-GHz

Segmentation 5: by Propulsion

- ICE Vehicles

- Electric Vehicles

Segmentation 6: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global automotive radar market has been extensively segmented based on various categories, such as application, range, vehicle type, frequency, and propulsion. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global automotive radar market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- Robert Bosch GmbH

- Continental AG

- Aptiv

- DENSO CORPORATION

- NXP Semiconductors

- Autoliv

- HELLA GmbH & Co. KGaA

- VALEO

- Renesas Electronics Corporation

- ZF Friedrichshafen AG

Key Questions Answered in this Report:

- What are the main factors driving the demand for the automotive radar market?

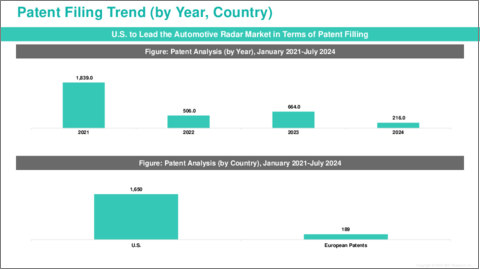

- What are the major patents filed by the companies active in the automotive radar market?

- Who are the key players in the automotive radar market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the automotive radar market?

- What are the strategies adopted by the key companies to gain a competitive edge in the automotive radar market?

- What is the futuristic outlook for the automotive radar market in terms of growth potential?

- What is the current estimation of the automotive radar market, and what growth trajectory is projected from 2024 to 2034?

- Which application and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for the automotive radar market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Increasing Demand for Advanced Driver Assistance Systems (ADAS)

- 1.1.2 Advancements In Radar Technology

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Automotive Radar Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Automotive Radar Market (by Application)

- 2.3.1 Adaptive Cruise Control (ACC)

- 2.3.2 Autonomous Emergency Braking (AEB)

- 2.3.3 Blind Spot Detection (BSD)

- 2.3.4 Forward Collision Warning System (FCWS)

- 2.3.5 Intelligent Parking Assistance (IPA)

- 2.3.6 Cross Traffic Alert (CTA)

- 2.3.7 Lane Departure Warning System (LDW)

- 2.3.8 Traffic Jam Assist (TJA)

- 2.3.9 Others

- 2.4 Automotive Radar Market (by Vehicle Type)

- 2.4.1 Passenger Cars

- 2.4.2 Commercial Vehicles

- 2.4.2.1 Light Commercial Vehicles

- 2.4.2.2 Heavy Commercial Vehicles

- 2.5 Automotive Radar Market (by Propulsion)

- 2.5.1 ICE Vehicle

- 2.5.2 Electric Vehicle

3. Automotive Radar Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Automotive Radar Market (by Range)

- 3.3.1 Short-Range Radar

- 3.3.2 Medium-Range Radar

- 3.3.3 Long-Range Radar

- 3.4 Automotive Radar Market (by Frequency)

- 3.4.1 2X-GHz

- 3.4.2 7X-GHz

4. Automotive Radar Market (by Region)

- 4.1 Automotive Radar Market- by Region

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Robert Bosch GmbH

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Continental AG

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Aptiv

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 DENSO CORPORATION

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 NXP Semiconductors

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Autoliv

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 HELLA GmbH & Co. KGaA

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Texas Instruments Incorporated

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Infineon Technologies AG

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Analog Devices, Inc.

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 VALEO

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Mitsubishi Electric Corporation

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Renesas Electronics Corporation

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Veoneer US Safety Systems, LLC.

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 ZF Friedrichshafen AG

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.1 Robert Bosch GmbH