|

|

市場調査レポート

商品コード

1742429

自動車用レーダーの世界市場 (~2032年):レンジ (短距離・中距離・長距離)・車両タイプ (PC・LCV・HCV)・周波数 (2X-GHz・7X-GHz)・EVタイプ (BEV・PHEV・FCEV・HEV)・搭載区分 (車内・外装)・用途・地域別Automotive Radar Market by Range (Short Range, Medium Range, Long Range), Vehicle Type (PC, LCV, HCV), Frequency (2X-GHz and 7X-GHz), EV Type (BEV, PHEV, FCEV, HEV), Mounting (In-cabin, Exterior), Application, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用レーダーの世界市場 (~2032年):レンジ (短距離・中距離・長距離)・車両タイプ (PC・LCV・HCV)・周波数 (2X-GHz・7X-GHz)・EVタイプ (BEV・PHEV・FCEV・HEV)・搭載区分 (車内・外装)・用途・地域別 |

|

出版日: 2025年05月30日

発行: MarketsandMarkets

ページ情報: 英文 319 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

自動車用レーダーの市場規模は、2025年の53億6,000万米ドルから、2025年から2032年にかけてはCAGR 23.0%で推移し、2032年には228億3,000万米ドルに達すると予測されています。

自動車業界では現在、車両性能や燃費効率の重視から、安全性と利便性への重点移行という大きな変化が起きています。インテリジェントパークアシスト、クロストラフィックアラート、自動緊急ブレーキといったアプリケーションは、正確な近距離検知のためにレーダー技術に依存しており、車両の安全性と操作性を高めています。さらに、市場では4Dイメージングレーダーシステムの登場も見られており、これらは長距離にわたる高解像度の物体検知が可能であり、自動運転技術の進化におけるレーダーの役割をさらに強固なものにしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2032年 |

| 単位 | 数量 (台) および金額 (米ドル) |

| セグメント | 周波数・EVタイプ・車両タイプ・レンジ・用途・搭載区分 |

| 対象地域 | アジア太平洋・欧州・北米・その他の地域 |

”予測期間中は7X-GHz周波数のセグメントが市場を独占"

特に77 GHzおよび79 GHzで動作する7X GHz帯のレーダーシステムは2025年の市場において支配的な地位を占めると予測されています。これは、先進運転支援システム (ADAS) や自動運転機能に不可欠な高い解像度と検知距離性能によって推進されるものです。これらの高周波レーダーは、物体検知および追跡精度が向上しており、アダプティブクルーズコントロール、レーンキーピングアシスト、自動緊急ブレーキなどのアプリケーションにとって重要な役割を果たします。さらに、政府による安全機能の義務化が需要を加速させています。たとえば、2024年7月から施行されたEUの車両一般安全規則では、インテリジェント速度支援、自動緊急ブレーキ、レーンキーピングアシストといったADAS機能の新車搭載が義務付けられ、7X GHz帯レーダーの導入を後押ししています。

"予測期間中は中距離レーダーが大きな市場シェアを占める"

中距離レーダーのセグメントは、性能とコストのバランスが良く、多様なアプリケーションに適していることから、自動車用レーダー市場において顕著なシェアを占めると予想されています。これらのレーダーは通常30~80メートルの範囲をカバーし、高速道路走行および都市部走行の両方における中距離検知に最適です。たとえば、Mercedes-Benz C-Class、Volkswagen ID.4、Toyota Camryといった車種には、中距離レーダーが搭載されており、アダプティブクルーズコントロール、車線変更アシスト、ブラインドスポットモニタリングなどの機能を実現しています。さまざまな気象条件や照明環境下でも確実に機能する性能や、中価格帯および高級車への採用の増加により、中距離レーダーの市場における優位性がさらに強化されています。これは、自動車メーカーが安全性およびセミオート機能を重視していることの表れです。

当レポートでは、世界の自動車用レーダーの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- エコシステム分析

- サプライチェーン分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIの影響

- 技術分析

- HSコード

- サプライヤー分析

- 関税と規制状況

- 2025-2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- 米国の2025年関税

第6章 自動車用レーダー市場:車両タイプ別

- 乗用車

- 小型商用車

- 大型商用車

- 主要な洞察

第7章 自動車用レーダー市場:周波数別

- 2X-GHz

- 7X-GHZ

- 主要な洞察

第8章 自動車用レーダー市場:レンジ別

- 短距離レーダー

- 中距離レーダー

- 長距離レーダー

- 主要な洞察

第9章 自動車用レーダー市場:EVタイプ別

- BEV

- PHEV

- FCEV

- HEV

- 主要な洞察

第10章 自動車用レーダー市場:搭載区分別

- 外装

- 車内

第11章 自動車用レーダー市場:用途別

- アダプティブクルーズコントロール (ACC)

- 自動緊急ブレーキ (AEB)

- ブラインドスポット検知 (BSD)

- 前方衝突警報システム (FCWS)

- インテリジェントパーキングアシスト (IPA)

- クロストラフィックアラート (CTA)

- 車線逸脱警報システム (LDWS)

- 渋滞支援システム (TJA)

第12章 地域別自動車用レーダー市場

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- タイ

- インドネシア

- その他

- 欧州

- マクロ経済見通し

- フランス

- ドイツ

- スペイン

- 英国

- ロシア

- トルコ

- その他

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- その他の地域

- マクロ経済見通し

- ブラジル

- イラン

- 南アフリカ

第13章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競争シナリオ

第14章 企業プロファイル

- 主要企業

- ROBERT BOSCH GMBH

- CONTINENTAL AG

- APTIV

- DENSO CORPORATION

- NXP SEMICONDUCTORS

- FICOSA INTERNACIONAL SA

- INFINEON TECHNOLOGIES AG

- VALEO

- ZF FRIEDRICHSHAFEN AG

- TEXAS INSTRUMENTS INCORPORATED

- MAGNA INTERNATIONAL INC.

- RENESAS ELECTRONICS CORPORATION

- その他の企業

- HL KLEMOVE

- AMBARELLA INTERNATIONAL LP

- ASTEMO, LTD.

- KYOCERA CORPORATION

- SAMSUNG ELECTRO-MECHANICS

- HYUNDAI MOBIS

- STONKAM CO., LTD.

- BRIGADE ELECTRONICS GROUP PLC

- LG ELECTRONICS

- VAYYAR AUTOMOTIVE

- STMICROELECTRONICS

- NOVELIC

- HUAWEI TECHNOLOGIES CO., LTD.

- HELLA GMBH & CO. KGAA

- SPARTAN RADAR, INC.

- BITSENSING INC.

- ALTOS RADAR

- LUNEWAVE INC.

- NPS (NEURAL PROPULSION SYSTEMS, INC)

第15章 MARKETSANDMARKETSによる提言

- 欧州が自動車用レーダーの主要市場に

- 7X-GHZレーダー技術の技術開発が市場成長に影響を与える

- ADAS (先進運転支援システム) の需要が自動車用レーダーシステムの必要性を促進

- 結論

第16章 付録

List of Tables

- TABLE 1 AUTOMOTIVE RADAR MARKET DEFINITION, BY RANGE

- TABLE 2 AUTOMOTIVE RADAR MARKET DEFINITION, BY APPLICATION

- TABLE 3 AUTOMOTIVE RADAR MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 4 AUTOMOTIVE RADAR MARKET DEFINITION, BY FREQUENCY

- TABLE 5 AUTOMOTIVE RADAR MARKET DEFINITION, BY EV TYPE

- TABLE 6 AUTOMOTIVE RADAR MARKET DEFINITION, BY MOUNTING

- TABLE 7 USD EXCHANGE RATES, 2021-2025

- TABLE 8 COMPARISON BETWEEN WAVE-BASED RADAR, IMAGE-BASED CAMERA, AND LIGHT-BASED LIDAR SENSING TECHNOLOGIES

- TABLE 9 COMPARISON BETWEEN RADAR AND LIDAR

- TABLE 10 MARKET DYNAMICS: IMPACT ANALYSIS

- TABLE 11 AVERAGE SELLING PRICES OF KEY PLAYERS, BY RANGE, 2024

- TABLE 12 AVERAGE SELLING PRICE TREND, BY RANGE, 2022-2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE, BY REGION, 2022-2024 (USD)

- TABLE 14 AUTOMOTIVE RADAR MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 15 FUNDING DETAILS OF KEY PLAYERS, 2023-2024

- TABLE 16 LIST OF MAJOR PATENTS, 2024

- TABLE 17 SUPERIORITY OF RADAR OVER OTHER AUTOMOTIVE SENSORS

- TABLE 18 IMPORT DATA FOR HS CODE 900211-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 19 EXPORT DATA FOR HS CODE 900211-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 20 SUPPLIER ANALYSIS

- TABLE 21 IMPORT TARIFFS ON ADAS COMPONENTS IN EUROPEAN UNION

- TABLE 22 IMPORT TARIFFS ON ADAS COMPONENTS IN US

- TABLE 23 IMPORT TARIFFS ON ADAS COMPONENTS IN INDIA

- TABLE 24 IMPORT TARIFFS ON ADAS COMPONENTS IN CHINA

- TABLE 25 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE (%)

- TABLE 30 KEY BUYING CRITERIA FOR AUTOMOTIVE RADAR, BY VEHICLE TYPE

- TABLE 31 US TOTAL IMPORTS (2024) AND ADJUSTED RECIPROCAL TARIFFS

- TABLE 32 US AUTOMOTIVE IMPORTS (2024) AND ADJUSTED RECIPROCAL TARIFFS

- TABLE 33 PRICE IMPACT ANALYSIS

- TABLE 34 CHINA: EXPORTS TO US AND MEXICO, 2022-2024

- TABLE 35 AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 36 AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 37 AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 38 AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 39 PASSENGER CAR: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 40 PASSENGER CAR: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 41 PASSENGER CAR: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 PASSENGER CAR: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 44 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 45 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 48 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 49 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 51 COMPARISON BETWEEN 24-GHZ, 77-GHZ, AND 79-GHZ AUTOMOTIVE RADAR

- TABLE 52 AUTOMOTIVE RADAR MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 53 AUTOMOTIVE RADAR MARKET, BY FREQUENCY, 2025-2032 (THOUSAND UNITS)

- TABLE 54 AUTOMOTIVE RADAR MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 55 AUTOMOTIVE RADAR MARKET, BY FREQUENCY, 2025-2032 (USD MILLION)

- TABLE 56 2X-GHZ: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 57 2X-GHZ: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 58 2X-GHZ: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 2X-GHZ: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 60 7X-GHZ: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 61 7X-GHZ: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 62 7X-GHZ: AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 7X-GHZ: AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 64 CHARACTERISTICS OF AUTOMOTIVE RADAR BASED ON RECOMMENDATION OF INTERNATIONAL TELECOMMUNICATION UNION (ITU)

- TABLE 65 AUTOMOTIVE RADAR MARKET, BY RANGE, 2021-2024 (THOUSAND UNITS)

- TABLE 66 AUTOMOTIVE RADAR MARKET, BY RANGE, 2025-2032 (THOUSAND UNITS)

- TABLE 67 AUTOMOTIVE RADAR MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 68 AUTOMOTIVE RADAR MARKET, BY RANGE, 2025-2032 (USD MILLION)

- TABLE 69 ADVANTAGES OF SHORT-RANGE RADAR IN AUTOMOTIVE APPLICATIONS

- TABLE 70 SHORT-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 71 SHORT-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 72 SHORT-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 73 SHORT-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 74 MEDIUM-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 75 MEDIUM-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 76 MEDIUM-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 77 MEDIUM-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 78 LONG-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 79 LONG-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 80 LONG-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 81 LONG-RANGE AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 82 AUTOMOTIVE RADAR MARKET, BY EV TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 83 AUTOMOTIVE RADAR MARKET, BY EV TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 84 AUTOMOTIVE RADAR MARKET, BY EV TYPE, 2021-2024 (USD MILLION)

- TABLE 85 AUTOMOTIVE RADAR MARKET, BY EV TYPE, 2025-2032 (USD MILLION)

- TABLE 86 AUTOMOTIVE EXTERIOR RADAR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 87 AUTOMOTIVE EXTERIOR RADAR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 88 AUTOMOTIVE EXTERIOR RADAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 AUTOMOTIVE EXTERIOR RADAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 VEHICLE MODELS EQUIPPED WITH EXTERIOR RADAR, 2024

- TABLE 91 VEHICLE MODELS EQUIPPED WITH IN-CABIN RADAR, 2024

- TABLE 92 DEVELOPMENTS IN AUTOMOTIVE IN-CABIN RADAR MARKET, JUNE 2022-JANUARY 2025

- TABLE 93 AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 94 AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 95 AUTOMOTIVE RADAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 AUTOMOTIVE RADAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 97 ASIA PACIFIC: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 98 ASIA PACIFIC: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 99 ASIA PACIFIC: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 101 CHINA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 102 CHINA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 103 CHINA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 104 CHINA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 105 JAPAN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 106 JAPAN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 107 JAPAN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 108 JAPAN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 109 INDIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 110 INDIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 111 INDIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 112 INDIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 113 SOUTH KOREA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 114 SOUTH KOREA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 115 SOUTH KOREA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 116 SOUTH KOREA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 117 THAILAND: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 118 THAILAND: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 119 THAILAND: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 120 THAILAND: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 121 INDONESIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 122 INDONESIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 123 INDONESIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 124 INDONESIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 126 REST OF ASIA PACIFIC: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 127 REST OF ASIA PACIFIC: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 129 EUROPE: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 130 EUROPE: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 131 EUROPE: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 133 FRANCE: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 134 FRANCE: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 135 FRANCE: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 136 FRANCE: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 137 GERMANY: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 138 GERMANY: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 139 GERMANY: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 140 GERMANY: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 141 SPAIN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 142 SPAIN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 143 SPAIN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 144 SPAIN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 145 UK: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 146 UK: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 147 UK: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 148 UK: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 149 RUSSIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 150 RUSSIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 151 RUSSIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 152 RUSSIA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 153 TURKEY: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 154 TURKEY: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 155 TURKEY: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 156 TURKEY: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 157 REST OF EUROPE: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 158 REST OF EUROPE: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 159 REST OF EUROPE: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 160 REST OF EUROPE: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 161 NORTH AMERICA: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 162 NORTH AMERICA: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 163 NORTH AMERICA: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 NORTH AMERICA: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 165 US: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 166 US: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 167 US: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 168 US: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 169 CANADA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 170 CANADA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 171 CANADA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 172 CANADA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 173 MEXICO: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 174 MEXICO: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 175 MEXICO: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 176 MEXICO: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 177 REST OF THE WORLD: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 178 REST OF THE WORLD: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 179 REST OF THE WORLD: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 REST OF THE WORLD: AUTOMOTIVE RADAR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 181 BRAZIL: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 182 BRAZIL: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 183 BRAZIL: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 184 BRAZIL: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 185 IRAN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 186 IRAN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 187 IRAN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 188 IRAN: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 189 SOUTH AFRICA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 190 SOUTH AFRICA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 191 SOUTH AFRICA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 192 SOUTH AFRICA: AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 193 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 194 DEGREE OF COMPETITION

- TABLE 195 REGION FOOTPRINT

- TABLE 196 FREQUENCY FOOTPRINT

- TABLE 197 RANGE FOOTPRINT

- TABLE 198 AUTOMOTIVE RADAR MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 199 AUTOMOTIVE RADAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 200 AUTOMOTIVE RADAR MARKET: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 201 AUTOMOTIVE RADAR MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 202 AUTOMOTIVE RADAR MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 203 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 204 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 205 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 206 ROBERT BOSCH GMBH: DEALS

- TABLE 207 ROBERT BOSCH GMBH: EXPANSIONS

- TABLE 208 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 209 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 210 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 211 CONTINENTAL AG: DEALS

- TABLE 212 CONTINENTAL AG: EXPANSIONS

- TABLE 213 CONTINENTAL AG: OTHER DEVELOPMENTS

- TABLE 214 APTIV: COMPANY OVERVIEW

- TABLE 215 APTIV: PRODUCTS OFFERED

- TABLE 216 APTIV: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 217 APTIV: DEALS

- TABLE 218 APTIV: EXPANSIONS

- TABLE 219 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 220 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 221 DENSO CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 222 DENSO CORPORATION: DEALS

- TABLE 223 DENSO CORPORATION: EXPANSIONS

- TABLE 224 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 225 NXP SEMICONDUCTORS: PRODUCTS OFFERED

- TABLE 226 NXP SEMICONDUCTORS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 227 NXP SEMICONDUCTORS: DEALS

- TABLE 228 FICOSA INTERNACIONAL SA: COMPANY OVERVIEW

- TABLE 229 FICOSA INTERNACIONAL SA: PRODUCTS OFFERED

- TABLE 230 FICOSA INTERNACIONAL SA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 231 FICOSA INTERNACIONAL SA: DEALS

- TABLE 232 FICOSA INTERNACIONAL SA: EXPANSIONS

- TABLE 233 FICOSA INTERNACIONAL SA: OTHER DEVELOPMENTS

- TABLE 234 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 235 INFINEON TECHNOLOGIES AG: PRODUCTS OFFERED

- TABLE 236 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 237 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 238 VALEO: COMPANY OVERVIEW

- TABLE 239 VALEO: PRODUCTS OFFERED

- TABLE 240 VALEO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 241 VALEO: DEALS

- TABLE 242 VALEO: EXPANSIONS

- TABLE 243 VALEO: OTHER DEVELOPMENTS

- TABLE 244 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 245 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 246 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 247 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 248 ZF FRIEDRICHSHAFEN AG: EXPANSIONS

- TABLE 249 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 250 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS OFFERED

- TABLE 251 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 252 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 253 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 254 MAGNA INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 255 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 256 MAGNA INTERNATIONAL INC.: EXPANSIONS

- TABLE 257 MAGNA INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 258 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 259 RENESAS ELECTRONICS CORPORATION: PRODUCTS OFFERED

- TABLE 260 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 261 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 262 HL KLEMOVE: COMPANY OVERVIEW

- TABLE 263 AMBARELLA INTERNATIONAL LP: COMPANY OVERVIEW

- TABLE 264 ASTEMO, LTD.: COMPANY OVERVIEW

- TABLE 265 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 266 SAMSUNG ELECTRO-MECHANICS: COMPANY OVERVIEW

- TABLE 267 HYUNDAI MOBIS: COMPANY OVERVIEW

- TABLE 268 STONKAM CO., LTD.: COMPANY OVERVIEW

- TABLE 269 BRIGADE ELECTRONICS GROUP PLC: COMPANY OVERVIEW

- TABLE 270 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 271 VAYYAR AUTOMOTIVE: COMPANY OVERVIEW

- TABLE 272 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 273 NOVELIC: COMPANY OVERVIEW

- TABLE 274 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 275 HELLA GMBH & CO. KGAA: COMPANY OVERVIEW

- TABLE 276 SPARTAN RADAR, INC.: COMPANY OVERVIEW

- TABLE 277 BITSENSING INC.: COMPANY OVERVIEW

- TABLE 278 ALTOS RADAR: COMPANY OVERVIEW

- TABLE 279 LUNEWAVE INC.: COMPANY OVERVIEW

- TABLE 280 NPS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 AUTOMOTIVE RADAR MARKET: BOTTOM-UP APPROACH

- FIGURE 7 AUTOMOTIVE RADAR MARKET: TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE RADAR MARKET ESTIMATION NOTES

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 11 AUTOMOTIVE RADAR MARKET OVERVIEW

- FIGURE 12 AUTOMOTIVE RADAR MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 13 AUTOMOTIVE RADAR MARKET, BY RANGE, 2025 VS. 2032 (USD MILLION)

- FIGURE 14 RISING NEED FOR ENHANCED SAFETY AND CONVENIENCE IN VEHICLES TO DRIVE MARKET

- FIGURE 15 LONG-RANGE RADAR SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2032

- FIGURE 16 PASSENGER CAR SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 17 7X-GHZ SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 BATTERY ELECTRIC VEHICLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 AUTOMOTIVE RADAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 ACCELERATION IN LEVEL 1-2+ PASSENGER VEHICLES

- FIGURE 22 CASES WHERE DOPPLER RADAR IS USED

- FIGURE 23 TECHNOLOGY ROADMAP OF AUTOMOTIVE RADAR, 1990-2030

- FIGURE 24 INTEGRATED SENSOR FUSION BASED ON 4D MIMO RADAR

- FIGURE 25 OPTICS IN AUTONOMOUS VEHICLES

- FIGURE 26 CURRENT RADAR VS. 4D IMAGING RADAR

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AVERAGE SELLING PRICE, BY RANGE, 2022-2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- FIGURE 30 AUTOMOTIVE RADAR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 AUTOMOTIVE RADAR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 32 INVESTMENT SCENARIO, 2022-2024

- FIGURE 33 NUMBER OF PATENTS GRANTED, 2012-2024

- FIGURE 34 MULTI-RADAR SYSTEM IN VEHICLES

- FIGURE 35 SENSING SYSTEM FOR AUTONOMOUS VEHICLES

- FIGURE 36 BIT RATES FOR DIFFERENT NETWORKS

- FIGURE 37 IMPORT DATA FOR HS CODE 900211-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 38 EXPORT DATA FOR HS CODE 900211-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 40 KEY BUYING CRITERIA FOR AUTOMOTIVE RADAR, BY VEHICLE TYPE

- FIGURE 41 PASSENGER CAR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 AUTONOMOUS RADAR COMPONENTS IN HEAVY COMMERCIAL VEHICLES

- FIGURE 43 FREQUENCY BANDS FOR AUTOMOTIVE RADAR

- FIGURE 44 7X-GHZ SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 45 BLOCK DIAGRAM OF 24-GHZ AUTOMOTIVE RADAR SYSTEM

- FIGURE 46 RANGE AND FIELD OF VIEW FOR AUTOMOTIVE RADAR

- FIGURE 47 LONG-RANGE RADAR SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 48 BATTERY ELECTRIC VEHICLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 49 AUTOMOTIVE EXTERIOR RADAR MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 50 AUTOMOTIVE IN-CABIN RADAR MARKET, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 51 AUTOMOTIVE IN-CABIN RADAR MARKET, 2025 VS. 2032 (USD MILLION)

- FIGURE 52 ARCHITECTURE OF ADAPTIVE CRUISE CONTROL (ACC) SYSTEM

- FIGURE 53 AUTOMATIC EMERGENCY BRAKING (AEB) STAGES

- FIGURE 54 BLIND SPOT DETECTION (BSD) SYSTEM

- FIGURE 55 STAGES OF FORWARD COLLISION WARNING SYSTEM (FCWS)

- FIGURE 56 SYSTEM CONFIGURATION OF INTELLIGENT PARKING ASSISTANT (IPA) SYSTEM

- FIGURE 57 CROSS TRAFFIC ALERT (CTA) SYSTEM

- FIGURE 58 ARCHITECTURE OF LANE DEPARTURE WARNING SYSTEM (LDWS)

- FIGURE 59 WORKING OF TRAFFIC JAM ASSIST (TJA) SYSTEM

- FIGURE 60 ASIA PACIFIC TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 61 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 62 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 63 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 64 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 65 ASIA PACIFIC: AUTOMOTIVE RADAR MARKET SNAPSHOT

- FIGURE 66 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 67 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 68 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 69 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 70 GERMANY TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 71 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 72 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 73 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 74 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 75 NORTH AMERICA: AUTOMOTIVE RADAR MARKET SNAPSHOT

- FIGURE 76 REST OF THE WORLD: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 77 REST OF THE WORLD: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 78 REST OF THE WORLD: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 79 REST OF THE WORLD: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 80 BRAZIL TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 81 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 82 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 83 COMPANY VALUATION OF KEY PLAYERS, 2025

- FIGURE 84 FINANCIAL METRICS OF KEY PLAYERS, 2025

- FIGURE 85 BRAND/PRODUCT COMPARISON

- FIGURE 86 AUTOMOTIVE RADAR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 87 COMPANY FOOTPRINT

- FIGURE 88 AUTOMOTIVE RADAR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 89 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 90 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 91 CONTINENTAL AG: WORLDWIDE PRESENCE

- FIGURE 92 APTIV: COMPANY SNAPSHOT

- FIGURE 93 MILLIMETER-WAVE RADAR SYSTEMS AND VISION SENSORS PRODUCED

- FIGURE 94 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 95 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 96 FICOSA INTERNACIONAL SA: COMPANY SNAPSHOT

- FIGURE 97 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 98 VALEO: COMPANY SNAPSHOT

- FIGURE 99 VALEO: GLOBAL R&D CENTERS, 2024

- FIGURE 100 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 101 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 102 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 103 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

The automotive radar market is estimated to be USD 5.36 billion in 2025 and is projected to reach USD 22.83 billion by 2032 at a CAGR of 23.0% from 2025 to 2032. The automotive sector is witnessing a major shift from emphasizing vehicle performance and fuel efficiency to focusing on safety and convenience. Applications such as intelligent park assist, cross traffic alert, and autonomous emergency braking rely on radar technology for precise short-range detection, enhancing vehicle safety and maneuverability. Further, the market is also witnessing the emergence of 4D imaging radar systems, capable of high-resolution object detection over extended ranges, further solidifying radar's role in the evolution of autonomous driving technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Thousand Units) and Value (USD Million) |

| Segments | Frequency, EV Type, Vehicle Type, Range, Application, Mounting |

| Regions covered | Asia Pacific, Europe, North America, Rest of the World |

"The 7X-GHz frequency segment to dominate market during the forecast period"

The 7X-GHz radar systems, particularly those operating at 77 GHz and 79 GHz, are poised to dominate the automotive radar market in 2025, driven by their superior resolution and range capabilities essential for advanced driver-assistance system (ADAS) and autonomous driving features. These high-frequency radars offer enhanced object detection and tracking precision, making them critical for applications like adaptive cruise control, lane keeping assist, and automatic emergency braking. The surge in demand is further fueled by stringent government regulations mandating vehicle safety features; for instance, the European Union's Vehicle General Safety Regulations, effective from July 2024, require all new vehicles to incorporate specific ADAS functionalities such as intelligent speed assistance, automatic emergency braking, and lane keeping assist, thereby accelerating the adoption of 7X-GHz radar systems. In response to this growing demand, companies are innovating products; for instance, in November 2024, at the electronica 2024 trade fair in Munich, with its SX600 and SX601, Bosch offered system-on-a-chip (SoC) solutions for radar systems that operate in the 77 GHz band. Such advancements underscore the pivotal role of 7X-GHz radar technology in shaping the future of vehicular safety and automation.

"Medium-range radar to hold significant market share during forecast period"

The medium-range radar segment is projected to hold a prominent share of the automotive radar market due to its optimal balance between performance and cost, making it suitable for a wide range of applications such as adaptive cruise control, blind spot detection, and lane change assistance. These radars typically cover a range of 30 to 80 meters, which is ideal for mid-range detection scenarios required in both highway and urban driving environments. Models such as the Mercedes-Benz C-Class, Volkswagen ID.4, and Toyota Camry integrate medium-range radar for functions like adaptive cruise control, lane change assist, and blind spot monitoring. Their ability to function effectively in various weather and lighting conditions, along with increasing integration in mid-range and premium vehicles, further supports their dominant market position as automakers prioritize safety and semi-autonomous features.

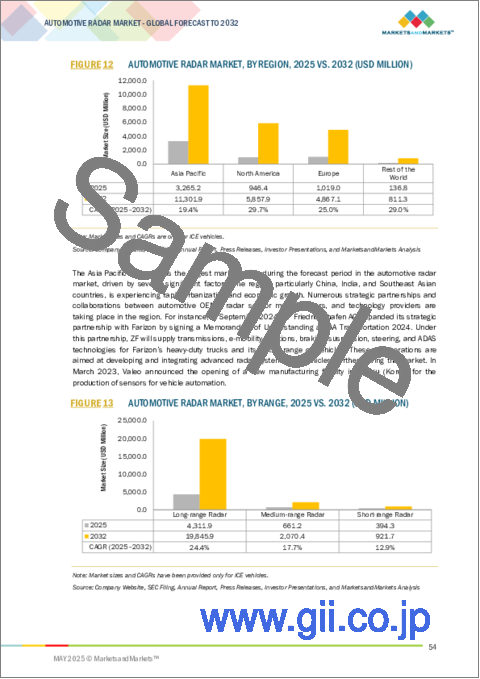

"China to hold largest market share in Asia Pacific during forecast period"

China continues to dominate the Asia Pacific automotive radar market, driven by rapid advancements in 4D millimeter-wave (mmWave) radar technology and a surge in domestic production. For instance, NIO's second brand, Lixiang L60, launched in 2024 with all models equipped with 4D imaging millimeter-wave radar, was developed by SAEON Lingdong. This technology, backed by investments from Xiaomi and NIO Capital, enhances the perception capabilities of intelligent driving systems. Further, in April 2025, BYD Auto recently unveiled its new self-driving system called the God's Eye. The company says it will integrate the solution across all of its models, including its subsidiary brands like Denza, Fangcheng Bao, and Yangwang. BYD's strategy of developing its own SoC for the God's Eye system while partnering with NVIDIA and Horizon Robotics for computing has produced a cost-effective ADAS for entry-level EVs under USD 10,000. This move is likely to intensify price competition in China's EV market and push competitors to offer ADAS in budget models, accelerating ADAS adoption nationwide and positively impacting market growth. Also, Chinese OEMs such as BYD, NIO, and Li Auto are increasingly adopting a 5-radar (5R) approach for ADAS to enhance features like Navigation on Autopilot (NOA) and Level 3 (L3) autonomous driving. Such developments would drive automotive radar market growth during the forecast period.

Breakup of Primary Interviews:

In-depth interviews have been conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 41%, Tier II - 24%, and OEMs - 35%

- By Designation: C Level - 35%, D Level - 49%, and Others - 16%

- By Region: Asia Pacific-37%, Europe-36%, North America-24%, Rest of the World-7%

The automotive radar market is dominated by key players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Aptiv (Ireland), Denso Corporation (Japan), and NXP Semiconductors (Netherlands).

The study includes an in-depth competitive analysis of these key players in the automotive radar market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the automotive radar market By range (short-range radar, medium-range radar, and long-range radar), by vehicle type (passenger car, light commercial vehicle, heavy commercial vehicle), by frequency (2X-GHz and 7X-GHz), by EV type (BEV, PHEV, FCEV, and HEV), by application [adaptive cruise control (ACC), autonomous emergency braking (AEB), blind spot detection (BSD), forward collision warning system (FCWS), intelligent parking assistance (IPA), cross traffic alert (CTA), lane departure warning system (LDW) and traffic jam assist (TJA)], by mounting (in-cabin and exterior) and by region (North America, Europe, Asia Pacific, and the Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions & services, key strategies, contracts, partnerships, agreements, new product & service launches, mergers & acquisitions, and recent developments associated with the automotive radar market. Competitive analysis of upcoming startups in the automotive radar market ecosystem has been covered in this report.

Reasons to Buy this Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall automotive radar market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing consumer demand for ADAS in vehicles, increasing reliance on Doppler frequency shift technology impacting the market growth, advancements in 7X-GHZ radar technology driving the market growth, integration with electric and connected vehicles ), restraints (inability to distinguish multiple targets, varying climate conditions affecting radar performance and reliability), opportunities (growing push for autonomous vehicles, unlocking new business models and smart mobility solutions with automotive radar technology models, growing adoption of 4D imaging radar for enhanced safety, autonomy, and cost-effective sensor fusion in next-gen vehicles), and challenges (competition from alternate technologies, fluctuating raw material prices and supply chain disruptions) influencing the growth of the automotive radar market

- Product Development/Innovation: Detailed insights into upcoming technologies and research & development activities in the automotive radar market

- Market Development: Comprehensive information about lucrative markets (the report analyses the automotive radar market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive radar market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players: Robert Bosch GmbH (Germany), Continental AG (Germany), Aptiv (Ireland), Denso Corporation (Japan), and NXP Semiconductors (Netherlands), among others, in the automotive radar market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: Demand and supply sides

- 2.1.2.2 Primary participants

- 2.1.2.3 Objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE RADAR MARKET

- 4.2 AUTOMOTIVE RADAR MARKET, BY RANGE

- 4.3 AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE

- 4.4 AUTOMOTIVE RADAR MARKET, BY FREQUENCY

- 4.5 AUTOMOTIVE RADAR MARKET, BY EV TYPE

- 4.6 AUTOMOTIVE RADAR MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for ADAS and technological advancements to drive growth

- 5.2.1.2 Increasing reliance on Doppler frequency shift technology

- 5.2.1.3 Advancements in 7X-GHZ radar technology

- 5.2.1.4 Integration with electric and connected vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inability to distinguish multiple targets

- 5.2.2.2 Varying weather conditions affecting radar performance and reliability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for autonomous vehicles

- 5.2.3.2 Unlocking new business models and smart mobility solutions with automotive radar technology models

- 5.2.3.3 Growing adoption of 4D imaging radar for enhanced safety, autonomy, and cost-effective sensor fusion in next-gen vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Competition from substitute technologies

- 5.2.4.2 Fluctuating raw material prices and supply chain disruptions

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY RANGE

- 5.4.2 AVERAGE SELLING PRICE, BY REGION

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CONTINENTAL IMPLEMENTED 4D IMAGING RADAR TECHNOLOGY WITH SOPHISTICATED MIMO ARCHITECTURE

- 5.7.2 NXP DEVELOPED SAF85XX FAMILY OF RADAR SOCS TO OVERCOME LIMITATIONS OF EXISTING RADAR SYSTEMS

- 5.7.3 ROBERT BOSCH LEVERAGED SYNTHETIC APERTURE RADAR (SAR) TECHNOLOGY TO OVERCOME LIMITATIONS OF TRADITIONAL AUTOMOTIVE RADAR SYSTEMS

- 5.7.4 VECTOR & ROHDE AND SCHWARZ HIL SYSTEM COLLABORATED TO OFFER SOLUTION FOR COMPREHENSIVE TESTING ENVIRONMENT

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 TOP PATENT APPLICANTS

- 5.10 IMPACT OF AI/GEN AI

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Multi-radar systems

- 5.11.1.1.1 Functions of multi-radar systems

- 5.11.1.2 AI-integrated radar

- 5.11.1.3 Radar systems for autonomous vehicles

- 5.11.1.1 Multi-radar systems

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Sub-Terahertz radar

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 5G network on machine-to-machine communication

- 5.11.1 KEY TECHNOLOGIES

- 5.12 HS CODES

- 5.12.1 IMPORT SCENARIO

- 5.12.2 EXPORT SCENARIO

- 5.13 SUPPLIER ANALYSIS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF DATA

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES & EVENTS, 2025-2026

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 US 2025 TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 North America

- 5.17.4.1.1 United States-Mexico-Canada Agreement (USMCA)

- 5.17.4.2 Europe

- 5.17.4.2.1 Germany

- 5.17.4.2.2 UK

- 5.17.4.2.3 Slovakia

- 5.17.4.2.4 Belgium

- 5.17.4.2.5 Other countries

- 5.17.4.3 Asia Pacific

- 5.17.4.3.1 China

- 5.17.4.3.2 Japan

- 5.17.4.3.3 South Korea

- 5.17.4.3.4 India

- 5.17.4.1 North America

- 5.17.5 IMPACT ON END USE INDUSTRY

- 5.17.5.1 Strategies followed by OEMs/Automotive component manufacturers

6 AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 PASSENGER CAR

- 6.2.1 REGULATORY MANDATES AND ADAS INTEGRATION DRIVE RADAR ADOPTION IN PASSENGER VEHICLES

- 6.3 LIGHT COMMERCIAL VEHICLE

- 6.3.1 RISING DEMAND FOR SAFETY FEATURES IN LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

- 6.4 HEAVY COMMERCIAL VEHICLE

- 6.4.1 ADVANCED RADAR ENHANCES SAFETY, AUTOMATION, AND EFFICIENCY IN HEAVY COMMERCIAL VEHICLES

- 6.5 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE RADAR MARKET, BY FREQUENCY

- 7.1 INTRODUCTION

- 7.2 2X-GHZ

- 7.2.1 2X-GHZ RADAR IS COST-EFFECTIVE IN MID-RANGE AND ENTRY-LEVEL VEHICLES

- 7.3 7X-GHZ

- 7.3.1 NEED FOR HIGH RESOLUTION AND ACCURACY TO DRIVE DEMAND FOR 7X-GHZ RADAR SYSTEM

- 7.4 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE RADAR MARKET, BY RANGE

- 8.1 INTRODUCTION

- 8.2 SHORT-RANGE RADAR

- 8.2.1 NEED FOR QUICK AND PRECISE RESPONSES TO IMPROVE SAFETY TO DRIVE MARKET

- 8.3 MEDIUM-RANGE RADAR

- 8.3.1 FOCUS ON MAINTAINING BALANCE BETWEEN CLOSE-RANGE PRECISION OF SHORT-RANGE RADAR AND EXTENDED REACH OF LONG-RANGE RADAR TO DRIVE DEMAND

- 8.4 LONG-RANGE RADAR

- 8.4.1 INCREASING DEMAND FOR LEVELS 2 AND 3 AUTONOMY TO DRIVE GROWTH

- 8.5 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE RADAR MARKET, BY EV TYPE

- 9.1 INTRODUCTION

- 9.2 BATTERY ELECTRIC VEHICLE

- 9.2.1 INCREASING SAFETY REGULATIONS TO DRIVE ADOPTION OF RADAR SYSTEMS IN BATTERY ELECTRIC VEHICLES

- 9.3 PLUG-IN HYBRID ELECTRIC VEHICLE

- 9.3.1 DEMAND FOR LEVELS 2 AND 3 DRIVING CAPABILITIES TO BOOST ADOPTION OF RADAR SYSTEMS IN PLUG-IN HYBRID ELECTRIC VEHICLES

- 9.4 FUEL CELL ELECTRIC VEHICLE

- 9.4.1 FOCUS ON INTEGRATING ADAS WITH AUTONOMOUS DRIVING TECHNOLOGIES TO FUEL ADOPTION OF RADAR SYSTEMS IN FUEL CELL ELECTRIC VEHICLES

- 9.5 HYBRID ELECTRIC VEHICLE

- 9.5.1 RISING DEMAND FOR ADOPTION OF ADAS IN HYBRID ELECTRIC VEHICLES TO BOOST GROWTH

- 9.6 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE RADAR MARKET, BY MOUNTING

- 10.1 INTRODUCTION

- 10.2 EXTERIOR

- 10.2.1 DEMAND FOR VEHICLES WITH HIGH-RESOLUTION OBJECT DETECTION AND TRACKING CAPABILITIES TO DRIVE MARKET

- 10.3 IN-CABIN

- 10.3.1 FOCUS ON ENHANCING CABIN SAFETY, COMFORT, AND CONVENIENCE TO DRIVE MARKET

11 AUTOMOTIVE RADAR MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 ADAPTIVE CRUISE CONTROL (ACC)

- 11.3 AUTOMATIC EMERGENCY BRAKING (AEB)

- 11.4 BLIND SPOT DETECTION (BSD)

- 11.5 FORWARD COLLISION WARNING SYSTEM (FCWS)

- 11.6 INTELLIGENT PARKING ASSISTANCE (IPA)

- 11.7 CROSS TRAFFIC ALERT (CTA)

- 11.8 LANE DEPARTURE WARNING SYSTEM (LDWS)

- 11.9 TRAFFIC JAM ASSIST (TJA)

12 AUTOMOTIVE RADAR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Rising demand for ADAS features in passenger cars to drive market

- 12.2.3 JAPAN

- 12.2.3.1 Government initiatives to enhance ADAS features to drive market

- 12.2.4 INDIA

- 12.2.4.1 Rising focus on affordable safety solutions and technologies to drive market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Introduction of new vehicle models equipped with ADAS to drive market

- 12.2.6 THAILAND

- 12.2.6.1 Rising demand for electric vehicles to drive market

- 12.2.7 INDONESIA

- 12.2.7.1 Local ADAS production and strategic partnerships by OEMs to drive growth

- 12.2.8 REST OF ASIA PACIFIC

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 FRANCE

- 12.3.2.1 Stringent government policies for vehicle and passenger safety to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Increasing sales of luxury vehicles with advanced safety features to drive market

- 12.3.4 SPAIN

- 12.3.4.1 Focus on enhanced road safety to drive market

- 12.3.5 UK

- 12.3.5.1 Focus on innovation and high-tech manufacturing to drive market

- 12.3.6 RUSSIA

- 12.3.6.1 Growing adoption of ADAS in passenger car models to drive market

- 12.3.7 TURKEY

- 12.3.7.1 Government support to modernize automotive sector to drive market

- 12.3.8 REST OF EUROPE

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Rising need for adopting high-quality radar across various vehicle segments to drive market

- 12.4.3 CANADA

- 12.4.3.1 Increasing consumer demand for vehicles equipped with advanced features to drive market

- 12.4.4 MEXICO

- 12.4.4.1 Stringent safety standards to drive demand for automotive radar systems

- 12.5 REST OF THE WORLD

- 12.5.1 MACROECONOMIC OUTLOOK

- 12.5.2 BRAZIL

- 12.5.2.1 Strategic investments by automotive giants to drive market

- 12.5.3 IRAN

- 12.5.3.1 Policies promoting adoption of radar technology in commercial vehicles to drive market

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Shift in preference toward electric and connected vehicles to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Frequency footprint

- 13.7.5.4 Range footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.9 COMPETITIVE SCENARIOS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ROBERT BOSCH GMBH

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/developments

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 CONTINENTAL AG

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches/developments

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 APTIV

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches/developments

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 DENSO CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches/developments

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 NXP SEMICONDUCTORS

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches/developments

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 FICOSA INTERNACIONAL SA

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches/developments

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.6.3.4 Other developments

- 14.1.7 INFINEON TECHNOLOGIES AG

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches/developments

- 14.1.7.3.2 Deals

- 14.1.8 VALEO

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches/developments

- 14.1.8.3.2 Deals

- 14.1.8.3.3 Expansions

- 14.1.8.3.4 Other developments

- 14.1.9 ZF FRIEDRICHSHAFEN AG

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches/developments

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.10 TEXAS INSTRUMENTS INCORPORATED

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches/developments

- 14.1.10.3.2 Deals

- 14.1.11 MAGNA INTERNATIONAL INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.11.3.3 Other developments

- 14.1.12 RENESAS ELECTRONICS CORPORATION

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches/developments

- 14.1.12.3.2 Deals

- 14.1.1 ROBERT BOSCH GMBH

- 14.2 OTHER PLAYERS

- 14.2.1 HL KLEMOVE

- 14.2.2 AMBARELLA INTERNATIONAL LP

- 14.2.3 ASTEMO, LTD.

- 14.2.4 KYOCERA CORPORATION

- 14.2.5 SAMSUNG ELECTRO-MECHANICS

- 14.2.6 HYUNDAI MOBIS

- 14.2.7 STONKAM CO., LTD.

- 14.2.8 BRIGADE ELECTRONICS GROUP PLC

- 14.2.9 LG ELECTRONICS

- 14.2.10 VAYYAR AUTOMOTIVE

- 14.2.11 STMICROELECTRONICS

- 14.2.12 NOVELIC

- 14.2.13 HUAWEI TECHNOLOGIES CO., LTD.

- 14.2.14 HELLA GMBH & CO. KGAA

- 14.2.15 SPARTAN RADAR, INC.

- 14.2.16 BITSENSING INC.

- 14.2.17 ALTOS RADAR

- 14.2.18 LUNEWAVE INC.

- 14.2.19 NPS (NEURAL PROPULSION SYSTEMS, INC)

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 EUROPE TO BE PROMINENT MARKET FOR AUTOMOTIVE RADAR

- 15.2 TECHNICAL DEVELOPMENTS IN 7X-GHZ RADAR TECHNOLOGY TO IMPACT MARKET GROWTH

- 15.3 DEMAND FOR ADVANCED DRIVER ASSISTANCE SYSTEMS TO DRIVE NEED FOR AUTOMOTIVE RADAR SYSTEMS

- 15.4 CONCLUSION

16 APPENDIX

- 16.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.4.1 COMPANY PROFILES

- 16.4.1.1 Profiling of Additional Market Players (Up to 5)

- 16.4.2 AUTOMOTIVE RADAR MARKET, BY RANGE, AT COUNTRY LEVEL

- 16.4.3 AUTOMOTIVE RADAR MARKET, BY FREQUENCY, AT COUNTRY LEVEL

- 16.4.1 COMPANY PROFILES

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS