|

|

市場調査レポート

商品コード

1514760

欧州の臨床バイオマーカー市場 - 分析と予測(2023年~2033年)Europe Clinical Biomarkers Market - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の臨床バイオマーカー市場 - 分析と予測(2023年~2033年) |

|

出版日: 2024年07月18日

発行: BIS Research

ページ情報: 英文 70 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の臨床バイオマーカーの市場規模は、2023年に71億9,000万米ドルとなりました。

同市場は、2023年から2033年にかけて7.52%のCAGRで拡大し、2033年には148億4,000万米ドルに達すると予測されています。臨床バイオマーカーとは、疾患の早期診断や経過の把握に役立つ測定可能な生物学的因子のことです。これらの分子バイオマーカーは、疾患の研究や治療薬の開発に新たな道を提供します。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 71億9,000万米ドル |

| 2033年の予測 | 148億4,000万米ドル |

| CAGR | 7.52% |

欧州の臨床バイオマーカー市場は、バイオテクノロジーと分子生物学の発展に後押しされて大きく拡大しています。臨床バイオマーカーとは、測定可能な生物学的因子のことです。病気の経過を把握し、早期診断に役立て、新たな治療標的を発見するために不可欠です。予後バイオマーカー、予測バイオマーカー、診断バイオマーカーは、この分野で利用可能な数多くのバイオマーカーに基づく検査や関連サービスのほんの一部に過ぎないです。研究開発への投資の増加、個別化治療への要望の高まり、慢性疾患の有病率の上昇という3つの主要な促進要因が業界を牽引しています。さらに、欧州の規制環境は、新規バイオマーカー技術の創出と応用を促進するように変化しています。需要の増加に対応するため、トップメーカーやサービスプロバイダーは、製品ラインナップの拡充と技術力の向上に注力しています。

当レポートでは、欧州の臨床バイオマーカー市場について調査し、市場の概要とともに、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

第2章 市場の範囲

第3章 調査手法

第4章 市場概要

- イントロダクション

- 精密医療における臨床バイオマーカーアプローチ

- 臨床バイオマーカーの市場規模の可能性、2022年~2033年

- COVID-19が臨床バイオマーカー市場に与える影響

- 市場動向

第5章 地域

- 概要

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

第6章 市場-企業プロファイル

- 概要

- ALCEN

- bioMerieux S.A.

- CENTOGENE N.V.

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- QIAGEN N.V.

List of Figures

- Figure 1: Clinical Biomarkers Market (by Region), $Billion, 2022 and 2033

- Figure 2: Europe Clinical Biomarkers Market Research Methodology

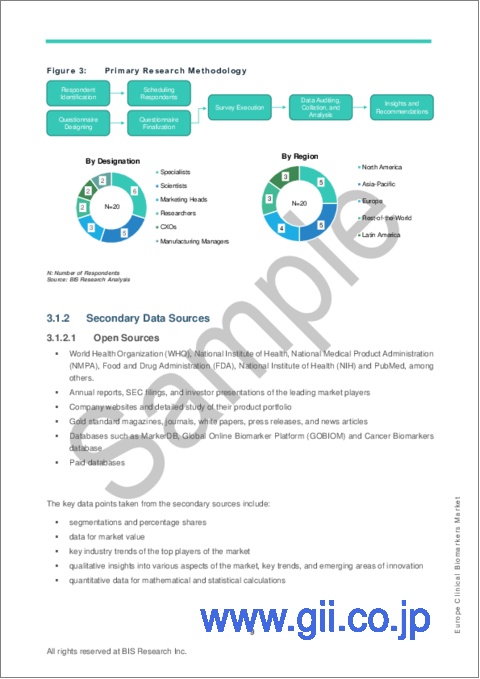

- Figure 3: Primary Research Methodology

- Figure 4: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 5: Top-Down Approach (Segment-Wise Analysis)

- Figure 6: Biomarkers Used in Various Clinical Areas

- Figure 7: Europe Clinical Biomarkers Market, $Billion, 2022-2033

- Figure 8: Impact of COVID-19 on Clinical Biomarkers Market

- Figure 9: Usage of Artificial Intelligence (AI) in Biomarker Discovery

- Figure 10: Use of Clinical Biomarkers in Personalized Medicine

- Figure 11: Prevalence vs. Age-Standardized Death Rate of Cancer Globally, % Share, 2010-2019

- Figure 12: Clinical Biomarkers Market Snapshot (by Region), $Billion, 2022-2033

- Figure 13: Clinical Biomarkers Market (by Region), $Billion, 2022-2033

- Figure 14: Clinical Biomarkers Market (by Region), $Billion, 2022 and 2033

- Figure 15: Europe Clinical Biomarkers Market, $Billion, 2022-2033

- Figure 16: Europe: Market Dynamics

- Figure 17: Europe Clinical Biomarkers Market (by Country), $Billion, 2022-2033

- Figure 18: Germany Clinical Biomarkers Market, $Billion, 2022-2033

- Figure 19: Share of Cancer Cases in Germany, 2020

- Figure 20: France Clinical Biomarkers Market, $Billion, 2022-2033

- Figure 21: U.K. Clinical Biomarkers Market, $Billion, 2022-2033

- Figure 22: Italy Clinical Biomarkers Market, $Billion, 2022-2033

- Figure 23: Spain Clinical Biomarkers Market, $Billion, 2022-2033

- Figure 24: Rest-of-Europe Clinical Biomarkers Market, $Billion, 2022-2033

- Figure 25: Total Number of Companies Profiled

- Figure 26: ALCEN: Service Portfolio

- Figure 27: bioMerieux S.A.: Product Portfolio

- Figure 28: bioMerieux S.A.: Overall Financials, $Million, 2020-2022

- Figure 29: bioMerieux S.A.: Revenue (by Segment), $Million, 2020-2022

- Figure 30: CENTOGENE N.V.: Service Portfolio

- Figure 31: CENTOGENE N.V.: Overall Financials, $Million, 2020-2022

- Figure 32: Eurofins Scientific: Service Portfolio

- Figure 33: Eurofins Scientific: Overall Financials, $Million, 2020-2022

- Figure 34: F. Hoffmann-La Roche Ltd: Product Portfolio

- Figure 35: F. Hoffmann-La Roche Ltd: Overall Financials, $Million, 2020-2022

- Figure 36: F. Hoffmann-La Roche Ltd: Revenue (by Segment), $Million, 2020-2022

- Figure 37: F. Hoffmann-La Roche Ltd: R&D Expenditure, $Million, 2020-2022

- Figure 38: QIAGEN N.V.: Product Portfolio

- Figure 39: QIAGEN N.V.: Overall Financials, $Million, 2020-2022

- Figure 40: QIAGEN N.V.: Revenue (by Segment), $Million, 2020-2022

- Figure 41: QIAGEN N.V.: Revenue (by Region), $Million, 2020-2022

- Figure 42: QIAGEN N.V.: R&D Expenditure, $Million, 20202022

List of Tables

- Table 1: COVID-19 Impact on Clinical Biomarkers Market, 2020-2033

- Table 2: List of Product/Service Offered and its Technology

Introduction to Europe Clinical Biomarkers Market

The Europe clinical biomarkers market was valued at $7.19 billion in 2023 and is expected to reach $14.84 billion by 2033, growing at a CAGR of 7.52% between 2023 and 2033. Clinical biomarkers are biological factors that can be measured to help in early diagnosis and understanding of the course of a disease. These molecular biomarkers provide new avenues for the study of diseases and the development of therapeutics. The producers of numerous biomarker-based tests, such as prognostic, predictive, and diagnostic biomarkers, as well as associated services, are highlighted in this research.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $7.19 Billion |

| 2033 Forecast | $14.84 Billion |

| CAGR | 7.52% |

Market Introduction

The market for clinical biomarkers in Europe is expanding significantly, propelled by developments in biotechnology and molecular biology. Clinical biomarkers are biological factors that may be measured. They are essential for comprehending the course of disease, helping with early diagnosis, and discovering novel targets for treatment. Prognostic, predictive, and diagnostic biomarkers are only a few of the many biomarker-based tests available in this sector, along with associated services. Three major drivers are driving the industry forward: increased investments in research and development, growing desire for personalized treatment, and rising prevalence of chronic diseases. Furthermore, Europe's regulatory environment is changing to facilitate the creation and application of novel biomarker technologies. To meet the increasing demand, top manufacturers and service providers are concentrating on broadening their product offerings and improving their technological prowess. This report delves into the current market dynamics, key players, and future trends shaping the European clinical biomarkers market.

Market Segmentation

Segmentation 1: by Country

- Germany

- U.K.

- France

- Italy

- Spain

- Rest-of-Europe

How can this report add value to an organization?

Growth/Marketing Strategy: Product launches and upgradations accounted for the maximum number of key developments, at nearly 59% of the total developments in the clinical biomarkers market between January 2019 and December 2023. Numerous synergistic activities, fundings, and acquisitions of the market have also been tracked during the same time period.

Competitive Strategy: The Europe clinical biomarkers market is a highly fragmented market, with many smaller and private companies constantly entering the market. Key players in the clinical biomarkers market analyzed and profiled in the study involve established players that offer various kinds of products and services.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are

- ALCEN

- bioMerieux S.A.

- CENTOGENE N.V.

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- QIAGEN N.V.

Table of Contents

Executive Summary

1 Market

- 1.1 Product Definition

- 1.2 Inclusion and Exclusion

2 Market Scope

- 2.1 Key Questions Answered in the Report

3 Research Methodology

- 3.1 Data Sources

- 3.1.1 Primary Data Source

- 3.1.2 Secondary Data Sources

- 3.1.2.1 Open Sources

- 3.2 Market Estimation Model

- 3.3 Criteria for Company Profiling

4 Market Overview

- 4.1 Introduction

- 4.2 Clinical Biomarkers Approaches in Precision Medicine

- 4.3 Market Size Potential for Clinical Biomarkers, 2022-2033

- 4.4 COVID-19 Impact on Clinical Biomarkers Market

- 4.4.1 COVID-19 Impact on Market Size

- 4.5 Market Trends

- 4.5.1 Integration of Artificial Intelligence in Biomarker Discovery

- 4.5.2 Increasing Biomarkers Usage in Precision Medicine

- 4.5.3 Technologies Being Used in Clinical Biomarker Testing

- 4.5.4 Clinical Biomarker Discovery Making Early Disease Diagnosis Possible

5 Region

- 5.1 Overview

- 5.2 Europe

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 U.K.

- 5.2.4 Italy

- 5.2.5 Spain

- 5.2.6 Rest-of-Europe

6 Market - Company Profiles

- 6.1 Overview

- 6.2 ALCEN

- 6.2.1 Company Overview

- 6.2.2 Role of ALCEN in the Clinical Biomarkers Market

- 6.2.3 Analyst's Perspective

- 6.3 bioMerieux S.A.

- 6.3.1 Company Overview

- 6.3.2 Role of bioMerieux S.A. in the Clinical Biomarkers Market

- 6.3.3 Corporate Strategies

- 6.3.3.1 Funding and Expansion

- 6.3.3.2 Product Launches

- 6.3.4 Financials

- 6.3.5 Analyst's Perspective

- 6.4 CENTOGENE N.V.

- 6.4.1 Company Overview

- 6.4.2 Role of CENTOGENE N.V. in the Clinical Biomarkers Market

- 6.4.3 Business Strategies

- 6.4.3.1 Funding

- 6.4.4 Corporate Strategies

- 6.4.4.1 Synergistic Activities

- 6.4.5 Financials

- 6.4.6 Analyst's Perspective

- 6.5 Eurofins Scientific

- 6.5.1 Company Overview

- 6.5.2 Role of Eurofins Scientific in the Clinical Biomarkers Market

- 6.5.1 Corporate Strategies

- 6.5.1.1 Product Launches

- 6.5.2 Financials

- 6.5.3 Analyst's Perspective

- 6.6 F. Hoffmann-La Roche Ltd

- 6.6.1 Company Overview

- 6.6.2 Role of F. Hoffmann-La Roche Ltd in the Clinical Biomarkers Market

- 6.6.3 Business Strategies

- 6.6.3.1 Product Launches

- 6.6.4 Corporate Strategies

- 6.6.4.1 Synergistic Activities

- 6.6.5 Financials

- 6.6.6 Analyst's Perspective

- 6.7 QIAGEN N.V.

- 6.7.1 Company Overview

- 6.7.2 Role of QIAGEN N.V. in the Clinical Biomarkers Market

- 6.7.3 Corporate Strategies

- 6.7.3.1 Product Launches

- 6.7.4 Business Strategies

- 6.7.4.1 Synergistic Activities

- 6.7.5 Financials

- 6.7.6 Analyst's Perspective