|

|

市場調査レポート

商品コード

1498719

欧州の自動運転農業機械市場:製品タイプ・用途・国別の分析・予測 (2023-2028年)Europe Autonomous Agriculture Equipment Market: Focus on Product Type, Application, and Country - Analysis and Forecast, 2023-2028 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の自動運転農業機械市場:製品タイプ・用途・国別の分析・予測 (2023-2028年) |

|

出版日: 2024年06月21日

発行: BIS Research

ページ情報: 英文 72 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

英国を除く欧州の自動運転農業機械の市場規模は、2023年の24億4,740万米ドルから、予測期間中はCAGR 15.54%で推移し、2028年には50億3,980万米ドルの規模に成長すると予測されています。

農業部門は、先進技術の導入、特に自動運転農業機械の出現により、変革期を迎えています。ロボット工学と農業の融合は、しばしば自律型農業、農業ロボット、ロボット農業と呼ばれ、農業慣行の新時代を切り開いています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2028年 |

| 2023年評価 | 24億4,740万米ドル |

| 2028年予測 | 50億3,980万米ドル |

| CAGR | 15.54% |

欧州の農業機械市場は、技術の進歩と効率的な農業ソリューションへの需要の高まりにより、著しい成長を遂げています。自動運転機械、精密農業ツール、スマート農業技術の革新が、この地域全体の生産性と持続可能性を高めています。主な動向には、GPSガイド付きトラクター、作物モニタリング用ドローン、ロボット収穫機の採用が含まれます。また、持続可能な農業の実践を推進する政府の取り組みや最新機器への補助金も市場拡大を後押ししています。大規模経営に注力する農業関連企業の台頭や、食糧安全保障の需要に応える必要性も、市場をさらに押し上げています。大手企業は最先端の機器を導入するためにR&Dに投資しており、欧州の農業機器市場を農業革新の最前線に位置付けています。

当レポートでは、欧州の自動運転農業機械の市場を調査し、業界の動向、エコシステム、進行中のプログラム、市場成長促進要因・抑制要因、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

市場の分類:

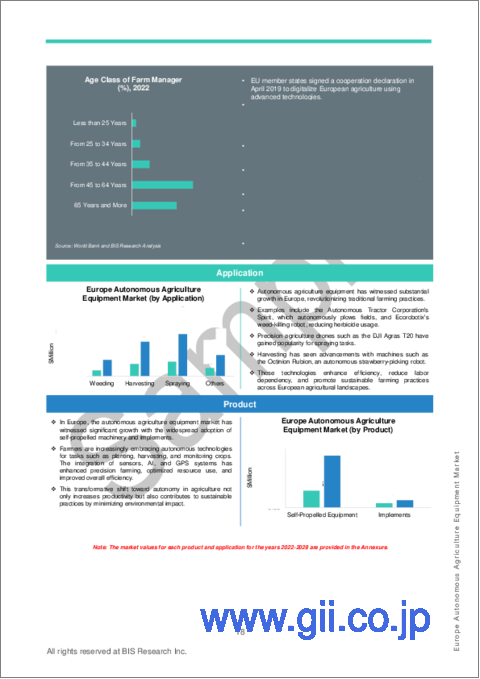

セグメント1:用途別

- 除草

- 収穫

- 散布

- その他

セグメント2:製品タイプ別

- 自走式機器

- トラクター

- 無人航空機 (UAV)

- ロボット

- 多機能機器

- 農具

セグメント3:国別

- ドイツ

- フランス

- トルコ

- ギリシャ

- オランダ

- ベルギー

- スイス

- ブルガリア

- ウクライナ

- その他

主要企業:

- Naio Technologies

- Koppert Machines & Zonen BV

- HORSCH

- Ecorobotix SA

目次

調査範囲

エグゼクティブサマリー

第1章 市場

- 業界の展望

- 進行中の動向

- エコシステム/進行中のプログラム

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業機会

- ケーススタディ

第2章 地域

- 欧州

- 欧州 (国別)

- 英国

第3章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 市場シェア分析

- 企業プロファイル

- 自走式装置

第4章 調査手法

List of Figures

- Figure 1: Benefits of Adopting Autonomous Agriculture Equipment

- Figure 2: Europe Autonomous Agriculture Equipment Market, $Billion, 2022-2028

- Figure 3: Europe Autonomous Agriculture Equipment Market, Units, 2022-2028

- Figure 4: Europe Autonomous Agriculture Equipment Market (by Application), $Million, 2022-2028

- Figure 5: Europe Autonomous Agriculture Equipment Market (by Application), Units, 2022-2028

- Figure 6: Europe Autonomous Agriculture Equipment Market (by Product Type), $Million, 2022-2028

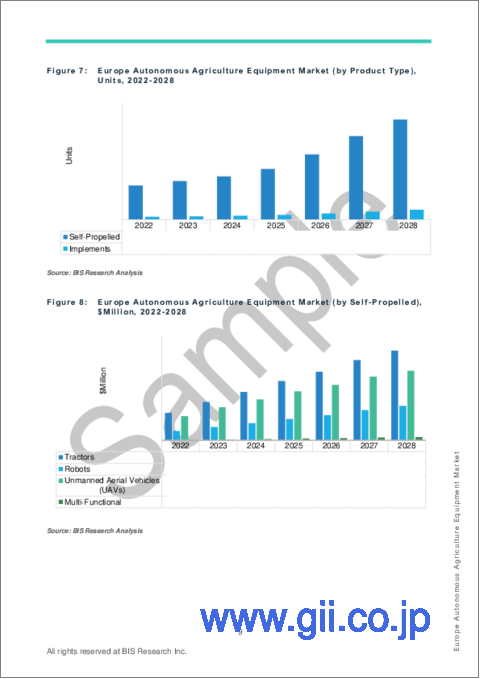

- Figure 7: Europe Autonomous Agriculture Equipment Market (by Product Type), Units, 2022-2028

- Figure 8: Europe Autonomous Agriculture Equipment Market (by Self-Propelled), $Million, 2022-2028

- Figure 9: Europe Autonomous Agriculture Equipment Market (by Self-Propelled), Units, 2022-2028

- Figure 10: Autonomous Agriculture Equipment Market (by Region), 2022

- Figure 11: Advantages of Integrating Digital Technologies in Agriculture Equipment

- Figure 12: Impact of Climate Change on Agricultural Production by 2030

- Figure 13: Naio Technologies Case Study for Weeding Application

- Figure 14: Garuda Aerospace Case Study for Spraying Application

- Figure 15: Koppert Machines & Zonen BV Case Study for Harvesting Application

- Figure 16: Krish Compusoft Services (KCS) Case Study for Irrigation Application

- Figure 17: Competitive Benchmarking Matrix

- Figure 18: Market Share Analysis of Autonomous Agriculture Equipment Market (by Company), 2022

- Figure 19: Naio Technologies: Product and Customer Portfolio Analysis

- Figure 20: Koppert Machines & Zonen BV: Product and Customer Portfolio Analysis

- Figure 21: HORSCH: Product and Customer Portfolio Analysis

- Figure 22: Ecoroboitx SA: Product and Customer Portfolio Analysis

- Figure 23: Data Triangulation

- Figure 24: Top-Down and Bottom-Up Approach

- Figure 25: Assumptions and Limitations

List of Tables

- Table 1: Key Consortiums and Associations in the Autonomous Agriculture Equipment Market

- Table 2: Key Regulatory Frameworks in the Autonomous Agriculture Equipment Market

- Table 3: Key Government Programs in the Autonomous Agriculture Equipment Market

Introduction to Europe Autonomous Agriculture Equipment Market

The Europe autonomous agriculture equipment market (excluding U.K.) is projected to reach $5,039.8 million by 2028 from $2,447.4 million in 2023, growing at a CAGR of 15.54% during the forecast period 2023-2028. The agricultural sector has undergone a transformative shift with the introduction of advanced technologies, notably the emergence of autonomous agricultural equipment. The fusion of robotics and farming, often referred to as autonomous agriculture, agricultural robots, and robotic farming, has ushered in a new era of agricultural practices.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2028 |

| 2023 Evaluation | $2,447.4 Million |

| 2028 Forecast | $5,039.8 Million |

| CAGR | 15.54% |

Market Introduction

The Europe agriculture equipment market is undergoing significant growth, driven by advancements in technology and increased demand for efficient farming solutions. Innovations in autonomous machinery, precision farming tools, and smart agriculture technologies are enhancing productivity and sustainability across the region. Key trends include the adoption of GPS-guided tractors, drones for crop monitoring, and robotic harvesters. Additionally, government initiatives promoting sustainable agricultural practices and subsidies for modern equipment are boosting market expansion. The rise of agribusinesses focusing on large-scale operations and the need to meet food security demands are further propelling the market. Leading companies are investing in research and development to introduce cutting-edge equipment, ensuring the Europe agriculture equipment market remains at the forefront of agricultural innovation.

Market Segmentation:

Segmentation 1: by Application

- Weeding

- Harvesting

- Spraying

- Others

Segmentation 2: by Product Type

- Self-Propelled Equipment

- Tractors

- Unmanned Aerial Vehicles (UAVs)

- Robots

- Multi-Functional

- Implements

Segmentation 3: by Country

- Germany

- France

- Turkey

- Greece

- Netherlands

- Belgium

- Switzerland

- Bulgaria

- Ukraine

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: In the realm of autonomous agriculture equipment, technological advancements are transforming agricultural landscapes. Autonomous agriculture equipment utilizes diverse technologies such as robots, drones, and data analytics. These tools offer precise insights into crop health, optimizing irrigation, pest management, and harvest times. Innovations such as satellite imaging and remote sensing provide a holistic view of fields, empowering farmers to make informed decisions. The market encompasses a range of solutions, from real-time monitoring platforms to AI-driven predictive analysis, enabling farmers to enhance productivity and reduce resource wastage significantly.

Growth/Marketing Strategy: The autonomous agriculture equipment market has witnessed remarkable growth strategies by key players. Business expansions, collaborations, and partnerships have been pivotal. Companies are venturing into multiple markets, forging alliances, and engaging in research collaborations to enhance their technological prowess. Collaborative efforts between tech companies and agricultural experts are driving the development of cutting-edge monitoring tools. Additionally, strategic joint ventures are fostering the integration of diverse expertise, amplifying the market presence of these solutions. This collaborative approach is instrumental in developing comprehensive, user-friendly, and efficient autonomous agriculture equipment.

Competitive Strategy: In the competitive landscape of autonomous agriculture, equipment manufacturers are diversifying their product portfolios to cover various crops and farming practices. Competitive benchmarking illuminates the strengths of market players, emphasizing their unique offerings and regional strengths. Partnerships with research institutions and agricultural organizations are driving innovation.

Key Market Players and Competition Synopsis

The featured companies have been meticulously chosen, drawing insights from primary experts and thorough evaluations of company coverage, product offerings, and market presence.

Some prominent names established in this market are:

- Naio Technologies

- Koppert Machines & Zonen BV

- HORSCH

- Ecorobotix SA

Table of Contents

Scope of the Study

Executive Summary

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Ongoing Trends

- 1.1.1.1 Intelligent Control Systems for Autonomous Agriculture Equipment

- 1.1.1.1.1 Model Predictive Control (MPC)-Based Approach for Vineyard Spraying

- 1.1.1.2 Design Innovations in Agriculture Equipment

- 1.1.1.3 Systematic and Integrated Monitoring Solutions

- 1.1.1.1 Intelligent Control Systems for Autonomous Agriculture Equipment

- 1.1.2 Ecosystem/Ongoing Programs

- 1.1.2.1 Consortiums and Associations

- 1.1.2.2 Regulatory Bodies

- 1.1.2.3 Government Programs

- 1.1.1 Ongoing Trends

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Need for Sustainable Agricultural Operations

- 1.2.1.2 Surge in Demand for Remote Solutions

- 1.2.2 Business Challenges

- 1.2.2.1 Lack of Interoperability and Standardization

- 1.2.2.2 Limited Accessibility and Adaptability

- 1.2.3 Business Opportunities

- 1.2.3.1 Advancements in Agricultural Innovations

- 1.2.3.1.1 Advanced Fertilizer and Spraying Machinery

- 1.2.3.1.2 Innovative Irrigation Systems

- 1.2.3.2 Increasing Use-Cases of Generative Artificial Intelligence in Agriculture

- 1.2.3.3 Adoption of Comprehensive Service-Oriented Solutions

- 1.2.3.1 Advancements in Agricultural Innovations

- 1.2.4 Case Study

- 1.2.4.1 Naio Technologies Case Study for Weeding Application

- 1.2.4.2 Garuda Aerospace Case Study for Spraying Application

- 1.2.4.3 Koppert Machines & Zonen BV Case Study for Harvesting Application

- 1.2.4.4 Krish Compusoft Services (KCS) Case Study for Irrigation Application

- 1.2.1 Business Drivers

2 Regions

- 2.1 Europe

- 2.1.1 Europe (by Country)

- 2.1.1.1 Germany

- 2.1.1.2 France

- 2.1.1.3 Netherlands

- 2.1.1.4 Switzerland

- 2.1.1.5 Belgium

- 2.1.1.6 Greece

- 2.1.1.7 Ukraine

- 2.1.1.8 Bulgaria

- 2.1.1.9 Turkey

- 2.1.1.10 Rest-of-Europe

- 2.1.1 Europe (by Country)

- 2.2 U.K.

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.2 Market Share Analysis

- 3.3 Company Profiles

- 3.3.1 Self-Propelled Equipment

- 3.3.1.1 Naio Technologies

- 3.3.1.1.1 Company Overview

- 3.3.1.1.2 Naio Technologies: Product and Customer Portfolio Analysis

- 3.3.1.2 Koppert Machines & Zonen BV

- 3.3.1.2.1 Company Overview

- 3.3.1.2.2 Koppert Machines & Zonen BV: Product and Customer Portfolio Analysis

- 3.3.1.3 HORSCH

- 3.3.1.3.1 Company Overview

- 3.3.1.3.2 HORSCH: Product and Customer Portfolio Analysis

- 3.3.1.4 Ecorobotix SA

- 3.3.1.4.1 Company Overview

- 3.3.1.4.2 Ecorobotix SA: Product and Customer Portfolio Analysis

- 3.3.1.1 Naio Technologies

- 3.3.1 Self-Propelled Equipment

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast