|

|

市場調査レポート

商品コード

1458546

高圧加工機器の世界市場:世界および地域の分析 ( 2023-2033年)High-Pressure Processing Equipment Market: A Global and Regional Analysis, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 高圧加工機器の世界市場:世界および地域の分析 ( 2023-2033年) |

|

出版日: 2024年04月03日

発行: BIS Research

ページ情報: 英文

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の高圧加工機器の市場規模は、2023年の6億6,240万米ドルから、予測期間中は8.09%のCAGRで推移し、2033年には14億4,210万米ドルの規模に成長すると予測されています。

世界の高圧加工機器の市場は著しい成長を遂げており、北米が高圧加工技術の導入と進歩でリードしています。持続可能性への世界的シフトが同市場の主要な促進要因であり、高圧加工機器ソリューションの革新と投資を促進しています。高圧加工機器市場は、化学保存料を使用せず、賞味期限が長く、加工を最小限に抑えた食品に対する消費者需要の高まりにより、著しい成長を遂げている。また、厳格な食品安全規制により、食品メーカーの間で高圧加工技術の採用が進んでいます。高圧加工技術は主に食肉、鶏肉、魚介類、果物、野菜、ジュース、乳製品、調理済み食品の加工に利用されます。鮮度と栄養価を維持しながら、これらの製品の賞味期限を延ばすのに役立っています。食品サプライチェーンがグローバル化するにつれ、輸送や流通を通じて食品の品質と安全性を維持することが重視されるようになっています。高圧加工は生鮮品の賞味期限延長に役立つため、食品廃棄物を減らし、輸送中の製品の完全性を確保することができます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2033年 |

| 2023年評価 | 6億6,240万米ドル |

| 2033年予測 | 14億4,210万米ドル |

| CAGR | 8.09% |

用途別では、食肉製品の部門が世界の高圧加工機器市場を独占:

食肉製品における高圧加工 (HPP) は、保存期間を延長し、安全性を向上させ、食肉製品の品質を維持する能力により、食品業界で大きな支持を得ています。食肉製品における高圧加工(HPP)の主な利点のひとつは、サルモネラ菌、大腸菌、リステリア菌などの病原菌を効果的に減少させる能力です。高圧はこれらの微生物の細胞構造を破壊し、食肉の官能特性に影響を与えることなく不活性化します。高圧加工は、腐敗の原因となる微生物や酵素を抑制することで、食肉製品の保存期間を延ばすのに役立ちます。これにより、製造業者は保存料や添加物を追加することなく、冷蔵保存期間の長い食肉製品を製造することができます。高圧加工は、牛肉、豚肉、鶏肉などの生肉、ソーセージ、惣菜などの加工肉、調理済みハムやローストビーフなどの調理済み製品など、幅広い食肉製品に利用されています。

北米の高圧加工機器市場は、食品の安全性と品質に関する消費者の意識の高まり、技術の進歩、高圧加工技術に対する規制当局の支援によって、継続的な成長が見込まれています。クリーンラベル食品と最小限の加工食品に対する消費者の需要の増加と、食中毒や食品の安全性に対する懸念の高まりが、北米の食品加工業者の間で高圧加工技術の採用を促進しています。さらに、腐敗しやすい製品の賞味期限を延長し、その官能的特性を維持する高圧加工の能力が、さまざまな分野のメーカーを引き付けています。北米の食品加工市場は、人口増加、都市化、食生活の嗜好の変化、技術の進歩といった要因によって牽引されている世界最大級の市場です。効率性、持続可能性、技術革新に重点を置きながら、市場は安定成長を続けています。米国のFDAやカナダの保健省などの規制機関は、高圧加工機器の規制状況を形成する上で重要な役割を果たしています。食品安全に関する規制やガイドラインの遵守は、高圧加工システムのメーカーやオペレーターにとって極めて重要です。

当レポートでは、世界の高圧加工機器の市場を調査し、市場概要、主要動向、技術・特許の分析、法規制環境、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

市場の分類:

セグメンテーション1:用途別

- 果物・野菜製品

- ジュース・その他の飲料

- 乳製品

- 肉製品

- シーフード

- その他

セグメンテーション2:容量別

- 100L未満

- 100-300 L

- 300L超

セグメンテーション3:向き別

- 横型

- 縦型

セグメンテーション4:地域別

- 北米:米国、カナダ、メキシコ

- 欧州:ドイツ、フランス、スペイン、イタリア、その他

- アジア太平洋:日本、中国、オーストラリア・ニュージーランド、韓国、その他

- その他の地域

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- 動向:概要

- 持続可能な実践を重視

- クリーンラベル食品の需要増加

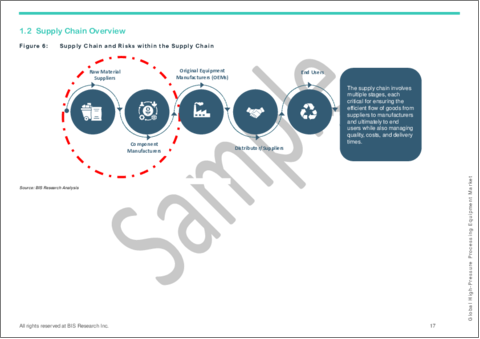

- サプライチェーンの概要

- バリューチェーン分析

- マーケットマップ

- R&Dレビュー

- 特許出願動向(国別・年別)

- 規制状況

- 市場力学の概要

- 市場促進要因

- 市場の課題

- 市場機会

第2章 用途

- 用途の分類

- 用途の概要

- 世界の高圧加工機器市場:用途別

- 用途

第3章 製品

- 製品の分類

- 製品概要

- 世界の高圧加工機器市場:容量別

- 容量

- 世界の高圧加工機器市場:向き別

- 向き

第4章 地域

- 地域概要

- 促進要因・抑制要因

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場:競合ベンチマーキング・企業プロファイル

- 次なるフロンティア

- 地理的評価

- HIPERBARIC

- thyssenkrupp AG

- JBT

- Quintus Technologies AB

- EXDIN Solutions

- Stansted Fluid Power Products Ltd

- KOBE STEEL, LTD.

- Caterpillar

- Universal Pure

- Hydrolock Continuous Sterilizers

- Idus HPP Systems S.L.U.

- Bao Tou KeFA High Pressure Technology Co., Ltd

- GEA Group Aktiengesellschaft

- American Pasteurization Company

- Bajaj Processpack Ltd.

第6章 調査手法

List of Figures

- Figure 1: Region with Largest Share of Market, 2022, 2026, and 2033

- Figure 2: Global High-Pressure Processing Equipment Market (by Application), 2022, 2026, and 2033

- Figure 3: Global High-Pressure Processing Equipment Market (by Vessel Volume Type), 2022, 2026, and 2033

- Figure 4: Global High-Pressure Processing Equipment Market (by Orientation Type), 2022, 2026, and 2033

- Figure 5: High-Pressure Processing Equipment Market, Recent Developments

- Figure 6: Supply Chain and Risks within the Supply Chain

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2020-December 2023

- Figure 9: Patent Analysis (by Year), January 2020-December 2023

- Figure 10: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 11: U.S. High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 12: Canada High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 13: Mexico High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 14: France High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 15: Germany High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 16: Spain High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 17: Italy High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 18: Rest-of-Europe Hydrogen Fuel Cell Market, $Million, 2022-2033

- Figure 19: China High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 20: Australia and New Zealand High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 21: Japan High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 22: South Korea High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 23: Rest-of-Asia-Pacific High-Pressure Processing Equipment Market, $Million, 2022-2033

- Figure 24: Strategic Initiatives, 2020-2023

- Figure 25: Share of Strategic Initiatives

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

- Figure 28: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: High-Pressure Processing Equipment Market, Opportunities across Regions

- Table 3: Global High-Pressure Processing Equipment Market (by Region), Units, 2022-2033

- Table 4: Global High-Pressure Processing Equipment Market (by Region), $Million, 2022-2033

- Table 5: North America High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 6: North America High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 7: North America High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 8: North America High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 9: North America High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 10: North America High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 11: U.S. High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 12: U.S. High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 13: U.S. High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 14: U.S. High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 15: U.S. High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 16: U.S. High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 17: Canada High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 18: Canada High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 19: Canada High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 20: Canada High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 21: Canada High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 22: Canada High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 23: Mexico High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 24: Mexico High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 25: Mexico High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 26: Mexico High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 27: Mexico High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 28: Mexico High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 29: Europe High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 30: Europe High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 31: Europe High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 32: Europe High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 33: Europe High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 34: Europe High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 35: France High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 36: France High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 37: France High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 38: France High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 39: France High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 40: France High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 41: Germany High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 42: Germany High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 43: Germany High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 44: Germany High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 45: Germany High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 46: Germany High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 47: Spain High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 48: Spain High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 49: Spain High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 50: Spain High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 51: Spain High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 52: Spain High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 53: Italy High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 54: Italy High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 55: Italy High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 56: Italy High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 57: Italy High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 58: Italy High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 59: Rest-of-Europe High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 60: Rest-of-Europe High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 61: Rest-of-Europe High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 62: Rest-of-Europe High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 63: Rest-of-Europe High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 64: Rest-of-Europe High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 65: Asia-Pacific High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 66: Asia-Pacific High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 67: Asia-Pacific High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 68: Asia-Pacific High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 69: Asia-Pacific High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 70: Asia-Pacific High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 71: China High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 72: China High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 73: China High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 74: China High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 75: China High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 76: China High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 77: Australia and New Zealand High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 78: Australia and New Zealand High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 79: Australia and New Zealand High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 80: Australia and New Zealand High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 81: Australia and New Zealand High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 82: Australia and New Zealand High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 83: Japan High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 84: Japan High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 85: Japan High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 86: Japan High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 87: Japan High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 88: Japan High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 89: South Korea High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 90: South Korea High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 91: South Korea High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 92: South Korea High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 93: South Korea High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 94: South Korea High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 95: Rest-of-Asia-Pacific High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 96: Rest-of-Asia-Pacific High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 97: Rest-of-Asia-Pacific High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 98: Rest-of-Asia-Pacific High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 99: Rest-of-Asia-Pacific High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 100: Rest-of-Asia-Pacific High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

- Table 101: Rest-of-the-World High-Pressure Processing Equipment Market (by Application), Units, 2022-2033

- Table 102: Rest-of-the-World High-Pressure Processing Equipment Market (by Application), $Million, 2022-2033

- Table 103: Rest-of-the-World High-Pressure Processing Equipment Market (by Vessel Volume Type), Units, 2022-2033

- Table 104: Rest-of-the-World High-Pressure Processing Equipment Market (by Vessel Volume Type), $Million, 2022-2033

- Table 105: Rest-of-the-World High-Pressure Processing Equipment Market (by Orientation Type), Units, 2022-2033

- Table 106: Rest-of-the-World High-Pressure Processing Equipment Market (by Orientation Type), $Million, 2022-2033

Introduction to the Global High-Pressure Processing Equipment Market

The global high-pressure processing equipment market has experienced remarkable growth, with North America taking the lead in adopting and advancing the high-pressure processing equipment technology. The global shift toward sustainability is a key driver in the global high-pressure processing equipment market, driving both innovation and investment in high-pressure processing equipment solutions. The market for high-pressure processing equipment has been witnessing significant growth due to rising consumer demand for minimally processed foods with extended shelf life without the use of chemical preservatives. Additionally, stringent food safety regulations are driving the adoption of high-pressure processing technology among food manufacturers. High-pressure processing technology is primarily utilized in the processing of meat, poultry, seafood, fruits, vegetables, juices, dairy products, and ready-to-eat meals. It helps in extending the shelf life of these products while maintaining freshness and nutritional value. As food supply chains become more globalized, there's a greater emphasis on maintaining food quality and safety throughout transportation and distribution. High-pressure processing helps in extending the shelf life of perishable products, thereby reducing food waste and ensuring product integrity during transit.

The global high-pressure processing equipment market is estimated to reach $1,442.1 million by 2033 from $662.4 million in 2023, growing at a CAGR of 8.09% during the forecast period 2023-2033.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $662.4 Million |

| 2033 Forecast | $1,442.1 Million |

| CAGR | 8.09% |

Industrial Impact

HIPERBARIC, thyssenkrupp AG, and JBT are some of the leading players globally in the high-pressure processing equipment Market. EXDIN Solutions and American Pasteurization are some of the emerging private companies that have remained in the limelight for the last few years in the high-pressure processing equipment market.

Some of the strategies adopted by high-pressure processing equipment manufacturers are new product launches, business expansions, mergers and acquisitions, partnerships, and collaborations. Mergers and acquisitions, partnerships, and collaborations have been the most preferred strategies in the market.

Market Segmentation:

Segmentation 1: by Application

- Fruit and Vegetable Products

- Juices and Other Beverages

- Dairy Products

- Meat Products

- Seafood

- Others

Meat Products to Dominate the Global High-Pressure Processing Equipment Market (by Application)

High-pressure processing (HPP) in meat products has gained significant traction in the food industry due to its ability to extend shelf life, improve safety, and maintain the quality of meat products. One of the primary benefits of high-pressure processing (HPP) in meat products is its ability to effectively reduce pathogenic bacteria such as Salmonella, Escherichia coli (E. coli), and Listeria monocytogenes. High pressure disrupts the cellular structure of these microorganisms, rendering them inactive without affecting the sensory attributes of the meat. High-pressure processing helps in extending the shelf life of meat products by inhibiting spoilage microorganisms and enzymes responsible for deterioration. This enables manufacturers to produce meat products with longer refrigerated shelf life without the need for additional preservatives or additives. High-pressure processing is utilized across a wide range of meat products, including raw meats such as beef, pork, and poultry, processed meats such as sausages, deli meats, and ready-to-eat products including cooked ham and roast beef.

Segmentation 2: by Vessel Volume Type

- Less than 100 L

- 100-300 L

- Above 300 L

- 100-300 L to Dominate the Global High-Pressure Processing Equipment Market (by Vessel Volume Type)

High-pressure processing equipment systems with vessel volumes ranging from 100 to 300 liters are often considered medium-scale high-pressure processing equipment. These equipment are suitable for mid-sized food manufacturers and processors, allowing for the processing of moderate batch sizes. They are versatile and can handle a variety of food products, including juices, meats, and prepared meals. High-pressure processing (HPP) equipment with vessel volumes ranging from 100 to 300 liters is typically utilized by medium to large-scale food processing facilities to treat a considerable quantity of food products in each processing batch. The initial investment in high-pressure processing equipment may be significant. Many food processors consider it a worthwhile investment in midsize high-pressure processing equipment due to the increasing demand for food products with extended shelf life, improved food safety, and preserved product quality.

Segmentation 3: by Orientation Type

- Horizontal

- Vertical

Horizontal to Dominate the Global High-Pressure Processing Equipment Market (by Orientation Type)

In horizontal high-pressure processing systems, the pressure vessel is positioned horizontally. Food products are typically loaded onto trays or shelves and stacked horizontally within the vessel. Products are loaded horizontally onto trays or shelves, which are then pushed into the pressure vessel. Loading and unloading are typically done manually or with the assistance of automated systems. Horizontal systems typically have a higher processing capacity compared to vertical systems. They can accommodate a larger volume of products per batch due to the horizontal stacking of trays or shelves. Horizontal systems are more suitable for products that are sensitive to compression or require careful handling during processing. The horizontal orientation allows for the gentle treatment of delicate items. Horizontal systems may be easier to maintain and clean due to their accessible design. Trays or shelves can be removed for thorough cleaning, and maintenance tasks are relatively straightforward.

Segmentation 4: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Spain, Italy, and Rest-of-Europe

- Asia-Pacific - Japan, China, Australia and New Zealand, South Korea, and Rest-of-Asia-Pacific

- Rest-of-the-World

The high-pressure processing equipment market in North America is poised for continued growth, driven by increasing consumer awareness regarding food safety and quality, technological advancements, and regulatory support for high-pressure processing technology. The increasing consumer demand for clean-label and minimally processed foods, coupled with growing concerns about foodborne illnesses and food safety, is driving the adoption of high-pressure processing technology among food processors in North America. Additionally, the ability of high-pressure processing to extend the shelf life of perishable products and maintain their sensory attributes is attracting manufacturers across various segments. The North American food processing market is one of the largest in the world, driven by factors such as population growth, urbanization, changing dietary preferences, and technological advancements. The market continues to grow steadily, with a focus on efficiency, sustainability, and innovation. Regulatory bodies such as the Food and Drug Administration (FDA) in the United States and Health Canada play a significant role in shaping the regulatory landscape for high-pressure processing equipment. Compliance with food safety regulations and guidelines is crucial for manufacturers and operators of high-pressure processing systems.

Recent Developments in the Global High-Pressure Processing Equipment Market

- In March 2023, the Canadian Food Inspection Agency (CFIA) developed and published a document as guidance to assist food businesses in achieving compliance with the Safe Food for Canadians Regulations. Health Canada determined that high-pressure processing (HPP) treatment up to a maximum pressure of 87,000 pounds per square inch (600 megapascals) for a duration of less than 27 minutes does not adversely affect the nutritional quality or chemical safety of a food product compared to its untreated counterpart.

- In September 2023, HIPERBARIC, one of the global leaders in high-pressure processing technologies, in collaboration with the Commonwealth Scientific and Industrial Research Organisation (CSIRO), Australia's national science agency, introduced an innovative solution such as high-pressure thermal processing (HPTP). This groundbreaking system combines the microbial lethality of heat with the rapid speed of high pressure, revolutionizing food processing and preservation. CSIRO has developed a patented canister that is integrated into existing HIPERBARIC high-pressure processing machines as the core of HPTP.

- In March 2021, thyssenkrupp AG inaugurated Germany's largest high-pressure processing (HPP) center in Quakenbruck, which is capable of processing up to 26 tons of foodstuffs daily. Situated within the Business and Innovation Park Quakenbruck (BIQ), the 630 m2 facility strategically collaborates with the DIL German Institute for Food Technology for research and development endeavors. This initiative marks a significant step forward in the field of food processing, emphasizing thyssenkrupp AG's commitment to innovation and advancing technology in the food industry.

Demand - Drivers, Challenges, and Opportunities

Market Demand Drivers: Increasing Demand for Processed Food Products with Preserved Nutritional Value

The increasing demand for processed foods that prioritize nutritional preservation is a powerful force driving the high-pressure processing (HPP) equipment market. Consumers today seek the convenience of processed foods but insist on healthier, more natural options. HPP uniquely delivers on this by inactivating harmful microbes while maintaining a food product's fresh taste, nutritional content, and sensory qualities, something traditional heat-based pasteurization often compromises.

This surge in demand for minimally processed, nutritionally dense foods is bolstering the HPP market. Growing focus on clean-label foods and a heightened aversion to artificial preservatives are further fueling HPP adoption. Its usage expands across beverages, meat, seafood, plant-based products, and more, offering a way to deliver convenience without compromising quality.

Market Challenges: High Initial Cost of the HPP Equipment

Demand for foods preserved through high-pressure processing (HPP) is poised to grow at a significant growth rate, yet the steep upfront costs for the requisite equipment present a formidable challenge. HPP technology demands a significant capital investment from food manufacturers, attributed to the specialized technology and sturdy construction needed to endure extreme pressures, which elevates the cost. This high barrier to entry significantly slows the broader and quicker adoption of HPP across the food industry. Smaller entities and newcomers to HPP often find it challenging to justify the hefty initial investment, leading them to continue with more conventional, cost-effective preservation methods despite potential misalignments with clean-label trends.

Furthermore, the elevated expenses create obstacles for businesses aiming to enhance their HPP capabilities or explore new product innovations. The perceived financial risk may contribute to a potential slowdown in the expansion pace of the HPP equipment market.

Market Opportunities: Expansion of Product Portfolio Specific to Application

The diversification of product lines to meet the varying demands of different applications presents a crucial opportunity to drive growth in the high-pressure processing (HPP) equipment market. With HPP's advantages spanning numerous food categories, there's a recognized demand for equipment tailored to the distinct requirements of various sectors. For instance, the equipment needed for processing meat and seafood under HPP differs from those for handling plant-based items or ready-to-eat meals.

By crafting HPP systems specialized for specific uses, manufacturers can boost processing efficiency, elevate product quality, and enhance consumer attraction. This specialized approach underscores dedication to innovation and establishes manufacturers as frontrunners in particular market niches. The emergence of application-specific HPP equipment is poised to draw new entrants to the market, intensifying competition and spurring additional innovation.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of the high-pressure processing equipment products available in the market, which is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of sustainable high-pressure processing equipment solutions. Therefore, the high-pressure processing equipment business is a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The global high-pressure processing equipment market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships and collaborations.

Competitive Strategy: The key players in the high-pressure processing equipment market analyzed and profiled in the study include high-pressure processing equipment manufacturers. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Research Methodology

Factors for Data Prediction and Modeling

- The scope of this report has been focused on high-pressure processing equipment only.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2021 to December 2023 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was unavailable, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global high-pressure processing equipment market.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the high-pressure processing equipment market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as GFI and Delft University of Technology.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and high-pressure processing (HPP) equipment market penetration.

Some of the prominent names in the global high-pressure processing equipment market are:

- HIPERBARIC

- JBT

- thyssenkrupp AG

- EXDIN Solutions

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Overview

- 1.1.2 Emphasis on Sustainable Practices

- 1.1.3 Increasing Demand for Clean-Labeled Foods

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Market Map

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country and Year)

- 1.4 Regulatory Landscape

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Increasing Demand for Processed Food Products with Preserved Nutritional Value

- 1.5.1.2 Surging Demand for Packaged Foods

- 1.5.1.3 Government Regulations with No Additives and Preservatives

- 1.5.2 Market Challenges

- 1.5.2.1 High Initial Cost of the HPP Equipment

- 1.5.2.2 High-Energy Consumption of High-Pressure Processing (HPP) Equipment

- 1.5.3 Market Opportunities

- 1.5.3.1 Expansion of Product Portfolio Specific to Application

- 1.5.3.2 Government Support for Advancement in Food Technology Sector

- 1.5.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Global High-Pressure Processing Equipment Market (by Application)

- 2.3.1 Application

- 2.3.1.1 Fruit and Vegetable Products

- 2.3.1.2 Juices and Other Beverages

- 2.3.1.3 Dairy Products

- 2.3.1.4 Meat Products

- 2.3.1.5 Seafood

- 2.3.1.6 Others

- 2.3.1 Application

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Global High-Pressure Processing Equipment Market (by Vessel Volume Type)

- 3.3.1 Vessel Volume Type

- 3.3.1.1 Less than 100 L

- 3.3.1.2 100-300 L

- 3.3.1.3 Above 300 L

- 3.3.1 Vessel Volume Type

- 3.4 Global High-Pressure Processing Equipment Market (by Orientation Type)

- 3.4.1 Orientation Type

- 3.4.1.1 Horizontal

- 3.4.1.2 Vertical

- 3.4.1 Orientation Type

4 Regions

- 4.1 Regional Summary

- 4.2 Drivers and Restraints

- 4.3 North America

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 North America (by Country)

- 4.3.6.1 U.S.

- 4.3.6.2 Canada

- 4.3.6.3 Mexico

- 4.4 Europe

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Europe (by Country)

- 4.4.6.1 France

- 4.4.6.2 Germany

- 4.4.6.3 Spain

- 4.4.6.4 Italy

- 4.4.6.5 Rest-of-Europe

- 4.5 Asia-Pacific

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Asia-Pacific (by Country)

- 4.5.6.1 China

- 4.5.6.2 Australia and New Zealand

- 4.5.6.3 Japan

- 4.5.6.4 South Korea

- 4.5.6.5 Rest-of-Asia-Pacific

- 4.6 Rest-of-the-World

- 4.6.1 Regional Overview

- 4.6.2 Driving Factors for Market Growth

- 4.6.3 Factors Challenging the Market

- 4.6.4 Application

- 4.6.5 Product

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 HIPERBARIC

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share, 2022

- 5.2.2 thyssenkrupp AG

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share, 2022

- 5.2.3 JBT

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share, 2022

- 5.2.4 Quintus Technologies AB

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share, 2022

- 5.2.5 EXDIN Solutions

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share, 2022

- 5.2.6 Stansted Fluid Power Products Ltd

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share, 2022

- 5.2.7 KOBE STEEL, LTD.

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share, 2022

- 5.2.8 Caterpillar

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share, 2022

- 5.2.9 Universal Pure

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share, 2022

- 5.2.10 Hydrolock Continuous Sterilizers

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share, 2022

- 5.2.11 Idus HPP Systems S.L.U.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share, 2022

- 5.2.12 Bao Tou KeFA High Pressure Technology Co., Ltd

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share, 2022

- 5.2.13 GEA Group Aktiengesellschaft

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share, 2022

- 5.2.14 American Pasteurization Company

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share, 2022

- 5.2.15 Bajaj Processpack Ltd.

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share, 2022

- 5.2.1 HIPERBARIC

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast