|

|

市場調査レポート

商品コード

1654123

精密農業市場 - 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2024年~2034年)Precision Agriculture Market - A Global and Regional Analysis: Focus on Application, Product, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 精密農業市場 - 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年02月13日

発行: BIS Research

ページ情報: 英文 249 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の精密農業の市場規模は、2024年の98億6,000万米ドルから2034年には224億9,000万米ドルに達し、予測期間の2024年~2034年のCAGRは8.59%になると予測されています。

この成長の原動力は、モノのインターネット(IoT)、人工知能(AI)、データ分析などの先進技術の農作業への採用が増加していることです。これらの技術により、農家は資源利用の最適化、作物収量の向上、持続可能な農法の実践が可能になります。さらに、近代的な農業技術を推進する政府の取り組みや、世界の人口増加による食糧需要の増加は、精密農業市場の拡大に寄与する重要な要因です。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 98億6,000万米ドル |

| 2034年の予測 | 224億9,000万米ドル |

| CAGR | 8.59% |

精密農業は現代農業における変革的なアプローチであり、先進技術を活用して生産性を最適化し、資源の浪費を削減し、持続可能性を促進するものです。精密農業は、IoT、AI、センサー、ドローンなどのツールを統合して、リアルタイムのデータと実用的な洞察を提供し、農家が情報に基づいた意思決定を行えるようにします。これらの技術は、従来の農法への依存を減らし、投入コストを削減し、環境課題に取り組みながら作物の収量を向上させます。精密農業は、肥料や農薬の散布を最適化することで温室効果ガス排出量を削減し、世界の持続可能性目標や気候変動に配慮した取り組みに合致させるという重要な役割を担っています。データ分析と自動化の技術革新により、精密農業はスケーラブルで効率的なものとなり、世界の農家で採用率が高まっています。

精密農業市場は、IoT、AI、ロボット工学などの先進技術を活用して農法に革命をもたらす、農業分野における変革的イノベーションです。この市場は、リアルタイムのデータと分析を意思決定プロセスに統合することで、資源利用の最適化と作物の生産性向上に焦点を当てています。精密農業は、食糧安全保障、環境の持続可能性、気候の回復力といった世界の課題に対処するために不可欠であり、持続可能な開発を重視する傾向が強まっています。

この市場における先進的なツールやソリューションによって、農家は効率と収量を向上させながら、水、肥料、農薬の使用量を削減して環境への影響を最小限に抑えることができます。これらの技術は実用的な知見を提供し、利害関係者が厳しい規制基準や持続可能性の目標を達成できるようにします。気候変動に対する意識の高まりとデジタル農法の採用増加により、精密農業市場は急速な成長を遂げ、技術革新を促進し、弾力的で持続可能な世界の農業エコシステムを育成します。

当レポートでは、世界の精密農業市場について調査し、市場の概要とともに、用途別、製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 農業エコシステムに対する主要な実現技術の影響

- 市場力学:概要

- 農業用ドローン・ロボット市場

第2章 用途

- 用途の概要

- 精密農業市場(用途別)

- 精密農業市場(機能別)

- 精密農業市場(農産物別)

第3章 製品

- 製品セグメンテーション

- 製品概要

- 精密農業市場(技術別)

- 精密農業市場(製品別)

第4章 地域

- 地域別概要

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 精密農業ソフトウェアおよびサービスプロバイダー

- Accenture

- AGRIVI

- Bayer AG

- X (Alphabet Inc.)

- Amazon Web Services, Inc.

- IBM Corporation

- BASF

- Microsoft

- Farmers Edge Inc.

- The Toro Company

- 精密農業機器メーカー

- AGCO Corporation

- CNH Industrial N.V.

- Ag Leader Technology

- KUBOTA Corporation

- Deere & Company

- Hexagon AB

- Topcon Corporation

- CLAAS KGaA mbH

- YANMAR HOLDINGS Co., Ltd.

- TeeJet Technologies

第6章 調査手法

List of Figures

- Figure 1: Precision Agriculture Market (by Region), 2023, 2030, and 2034

- Figure 2: Precision Agriculture Market (by Application), 2023, 2030, and 2034

- Figure 3: Precision Agriculture Market (by Function), 2023, 2030, and 2034

- Figure 4: Precision Agriculture Market (by Farm Produce), 2023, 2030, and 2034

- Figure 5: Precision Agriculture Market (by Technology), 2023, 2030, and 2034

- Figure 6: Precision Agriculture Market (by Product), 2023, 2030, and 2034

- Figure 7: Precision Agriculture Market, Recent Developments

- Figure 8: Global Crop Yield (in Tons per Hectare),2020-2022

- Figure 9: Supply Chain and Risks within the Supply Chain

- Figure 10: Value Chain for Precision Agriculture Market

- Figure 11: Patent Analysis (by Country), January 2021-October 2024

- Figure 12: Patent Analysis (by Company), January 2021-October 2024

- Figure 13: Global Distribution of Irrigated vs. Rainfed Crop Production

- Figure 14: Global Pesticides Usage (in Tons), 2019-2022

- Figure 15: Growth Trajectory of the Agriculture Drones and Sensors Market (2023-2033)

- Figure 16: U.S. Precision Agriculture Market, $Million, 2023-2034

- Figure 17: Canada Precision Agriculture Market, $Million, 2023-2034

- Figure 18: Mexico Precision Agriculture Market, $Million, 2023-2034

- Figure 19: Germany Precision Agriculture Market, $Million, 2023-2034

- Figure 20: France Precision Agriculture Market $Million, 2023-2034

- Figure 21: Italy Precision Agriculture Market, $Million, 2023-2034

- Figure 22: Spain Precision Agriculture Market, $Million, 2023-2034

- Figure 23: U.K. Precision Agriculture Market, $Million, 2023-2034

- Figure 24: Netherlands Precision Agriculture Market, $Million, 2023-2034

- Figure 25: Denmark Precision Agriculture Market, $Million, 2023-2034

- Figure 26: Rest-of-Europe Precision Agriculture Market, $Million, 2023-2034

- Figure 27: China Precision Agriculture Market, $Million, 2023-2034

- Figure 28: Japan Precision Agriculture Market, $Million, 2023-2034

- Figure 29: India Precision Agriculture Market, $Million, 2023-2034

- Figure 30: Indonesia Precision Agriculture Market, $Million, 2023-2034

- Figure 31: Vietnam Precision Agriculture Market, $Million, 2023-2034

- Figure 32: Malaysia Precision Agriculture Market, $Million, 2023-2034

- Figure 33: Australia Precision Agriculture Market, $Million, 2023-2034

- Figure 34: Rest-of-Asia-Pacific Precision Agriculture Market, $Million, 2023-2034

- Figure 35: Israel Precision Agriculture Market, $Million, 2023-2034

- Figure 36: Turkey Precision Agriculture Market, $Million, 2023-2034

- Figure 37: South Africa Precision Agriculture Market, $Million, 2023-2034

- Figure 38: Rest-of-Middle East and Africa Precision Agriculture Market, $Million, 2023-2034

- Figure 39: South America Precision Agriculture Market, $Million, 2023-2034

- Figure 40: Brazil Precision Agriculture Market, $Million, 2023-2034

- Figure 41: Argentina Precision Agriculture Market, $Million, 2023-2034

- Figure 42: Chile Precision Agriculture Market, $Million, 2023-2034

- Figure 43: Peru Precision Agriculture Market, $Million, 2023-2034

- Figure 44: Rest-of-South America Precision Agriculture Market, $Million, 2023-2034

- Figure 45: Strategic Initiatives, 2021-2024

- Figure 46: Share of Strategic Initiatives, 2021-2024

- Figure 47: Data Triangulation

- Figure 48: Top-Down and Bottom-Up Approach

- Figure 49: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Precision Agriculture Market (by Hardware Systems), Price($/Unit), 2023-2034

- Table 4: Impact of Precision Agriculture Techniques on Farming

- Table 5: Impact Analysis of Market Navigating Factors, 2024-2034

- Table 6: List of Cybersecurity Attacks Seen in the Precision Agriculture Market

- Table 7: Precision Agriculture Market (by Region), $Million,2023-2034

- Table 8: North America Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 9: North America Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 10: North America Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 11: North America Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 12: North America Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 13: U.S. Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 14: U.S. Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 15: U.S. Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 16: U.S. Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 17: U.S. Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 18: Canada Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 19: Canada Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 20: Canada Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 21: Canada Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 22: Canada Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 23: Mexico Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 24: Mexico Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 25: Mexico Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 26: Mexico Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 27: Mexico Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 28: Europe Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 29: Europe Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 30: Europe Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 31: Europe Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 32: Europe Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 33: Germany Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 34: Germany Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 35: Germany Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 36: Germany Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 37: Germany Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 38: France Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 39: France Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 40: France Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 41: France Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 42: France Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 43: Italy Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 44: Italy Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 45: Italy Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 46: Italy Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 47: Italy Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 48: Spain Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 49: Spain Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 50: Spain Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 51: Spain Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 52: Spain Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 53: U.K. Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 54: U.K. Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 55: U.K. Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 56: U.K. Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 57: U.K. Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 58: Netherlands Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 59: Netherlands Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 60: Netherlands Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 61: Netherlands Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 62: Netherlands Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 63: Denmark Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 64: Denmark Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 65: Denmark Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 66: Denmark Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 67: Denmark Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 68: Rest-of-Europe Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 69: Rest-of-Europe Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 70: Rest-of-Europe Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 71: Rest-of-Europe Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 72: Rest-of-Europe Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 73: Asia-Pacific Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 74: Asia-Pacific Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 75: Asia-Pacific Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 76: Asia-Pacific Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 77: Asia-Pacific Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 78: China Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 79: China Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 80: China Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 81: China Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 82: China Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 83: Japan Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 84: Japan Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 85: Japan Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 86: Japan Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 87: Japan Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 88: India Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 89: India Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 90: India Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 91: India Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 92: India Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 93: Indonesia Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 94: Indonesia Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 95: Indonesia Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 96: Indonesia Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 97: Indonesia Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 98: Vietnam Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 99: Vietnam Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 100: Vietnam Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 101: Vietnam Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 102: Vietnam Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 103: Malaysia Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 104: Malaysia Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 105: Malaysia Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 106: Malaysia Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 107: Malaysia Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 108: Australia Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 109: Australia Precision Agriculture Market (by Function), $Million, 2023-2033

- Table 110: Australia Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 111: Australia Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 112: Australia Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 113: Rest-of-Asia-Pacific Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 114: Rest-of-Asia-Pacific Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 115: Rest-of-Asia-Pacific Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 116: Rest-of-Asia-Pacific Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 117: Rest-of-Asia-Pacific Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 118: Middle East and Africa Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 119: Middle East and Africa Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 120: Middle East and Africa Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 121: Middle East and Africa Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 122: Middle East and Africa Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 123: Israel Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 124: Israel Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 125: Israel Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 126: Israel Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 127: Israel Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 128: Turkey Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 129: Turkey Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 130: Turkey Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 131: Turkey Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 132: Turkey Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 133: South Africa Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 134: South Africa Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 135: South Africa Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 136: South Africa Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 137: South Africa Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 138: Rest-of Middle East and Africa Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 139: Rest-of-Middle East and Africa Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 140: Rest-of-Middle East and Africa Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 141: Rest-of Middle East and Africa Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 142: Rest-of-Middle East and Africa Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 143: South America Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 144: South America Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 145: South America Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 146: South America Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 147: South America Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 148: Brazil Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 149: Brazil Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 150: Brazil Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 151: Brazil Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 152: Brazil Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 153: Argentina Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 154: Argentina Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 155: Argentina Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 156: Argentina Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 157: Argentina Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 158: Chile Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 159: Chile Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 160: Chile Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 161: Chile Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 162: Chile Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 163: Peru Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 164: Peru Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 165: Peru Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 166: Peru Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 167: Peru Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 168: Rest-of-South America Precision Agriculture Market (by Application), $Million, 2023-2034

- Table 169: Rest-of-South America Precision Agriculture Market (by Function), $Million, 2023-2034

- Table 170: Rest-of-South America Precision Agriculture Market (by Farm Produce), $Million, 2023-2034

- Table 171: Rest-of-South America Precision Agriculture Market (by Technology), $Million, 2023-2034

- Table 172: Rest-of-South America Precision Agriculture Market (by Product), $Million, 2023-2034

- Table 173: Market Share, 2023 for Precision Agriculture Software and Services Provider

- Table 174: Market Share, 2023 for Precision Agriculture Equipment Manufacturers

Precision Agriculture Market Overview

The global precision agriculture market is projected to reach $22.49 billion by 2034 from $9.86 billion in 2024, growing at a CAGR of 8.59% during the forecast period 2024-2034. This growth is driven by the increasing adoption of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and data analytics in farming practices. These technologies enable farmers to optimize resource utilization, enhance crop yields, and implement sustainable agricultural practices. Additionally, government initiatives promoting modern farming techniques and the rising demand for food due to a growing global population are significant factors contributing to the expansion of the precision agriculture market.

Introduction of Precision Agriculture

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $9.86 Billion |

| 2034 Forecast | $22.49 Billion |

| CAGR | 8.59% |

The study conducted by BIS Research highlights precision agriculture as a transformative approach in modern farming, leveraging advanced technologies to optimize productivity, reduce resource wastage, and promote sustainability. Precision agriculture integrates tools such as IoT, AI, sensors, and drones to provide real-time data and actionable insights, enabling farmers to make informed decisions. These technologies reduce dependency on conventional farming practices, lower input costs, and enhance crop yields while addressing environmental challenges. Precision agriculture plays a critical role in reducing greenhouse gas emissions by optimizing fertilizer and pesticide application, aligning with global sustainability goals and climate-smart initiatives. Data analytics and automation innovations make precision agriculture scalable and efficient, fostering higher adoption rates among farmers globally.

Market Introduction

The precision agriculture market is a transformative innovation in the agricultural sector, leveraging advanced technologies such as IoT, AI, and robotics to revolutionize farming practices. This market focuses on optimizing resource utilization and enhancing crop productivity by integrating real-time data and analytics into decision-making processes. Precision agriculture is critical for addressing global challenges such as food security, environmental sustainability, and climate resilience, aligning with the growing emphasis on sustainable development.

Advanced tools and solutions in this market enable farmers to minimize environmental impact by reducing water, fertilizer, and pesticide usage while improving efficiency and yields. These technologies provide actionable insights, empowering stakeholders to meet stringent regulatory standards and sustainability goals. With rising awareness of climate change and increasing adoption of digital farming practices, the precision agriculture market is set for rapid growth, driving innovation and fostering a resilient and sustainable global agricultural ecosystem.

Industrial Impact

The industrial impact of the precision agriculture market spans sustainable farming practices, resource optimization, and regulatory compliance. Advancements in IoT, AI, and robotics drive innovation, enabling real-time monitoring, data-driven decision-making, and efficient use of water, fertilizers, and pesticides. These developments foster collaborations among technology providers, agribusinesses, and government bodies, raising industry standards and accelerating research and development in agriculture.

Additionally, the emphasis on sustainable farming practices aligns with global climate goals, influencing industrial practices and ensuring adherence to stricter environmental regulations. As a result, the precision agriculture market plays a pivotal role in enhancing productivity, reducing environmental footprints, and promoting the adoption of smart farming technologies, supporting a resilient and sustainable global agricultural ecosystem.

Market Segmentation:

Segmentation 1: by Application

- Field Monitoring

- Crop Forecasting

- Precision Planting

- Precision Spraying

- Precision Fertilization

- Precision Irrigation

- Farm Management

- Others

Precision Irrigation Segment to Dominate the Precision Agriculture Market (by Application)

In the precision agriculture market, the precision irrigation segment is expected to dominate by application, driven by the growing need for efficient water management and sustainable farming practices. Precision irrigation technologies offer tailored solutions to optimize water usage, ensuring crops receive the exact amount needed to enhance yield and reduce waste. Farmers are adopting these systems to improve resource efficiency and productivity with increasing water scarcity and rising global food demand. Advancements in IoT-enabled sensors, real-time data analytics, and automated irrigation systems are enhancing the scalability and effectiveness of precision irrigation.

Segmentation 2: by Function

- Farm Management

- Field Management

- Fleet Management

Field Management to Dominate the Precision Agriculture Market (by Function)

Field management is expected to dominate the precision agriculture market by function, driven by its critical role in optimizing farming practices and improving crop yields. Field management enables precise monitoring of soil health, crop conditions, and environmental factors by leveraging advanced technologies such as IoT sensors, drones, and data analytics. This real-time data empowers farmers to make informed decisions, enhancing productivity while reducing resource wastage. The adoption of field management practices is further fueled by advancements in automation and predictive analytics, which streamline operations and minimize environmental impact.

Segmentation 3: by Farm Produce

- Field Crops

- Permanent Crops

- Other Farm Produce

Field Crops to Dominate the Precision Agriculture Market (by Farm Produce)

Field crops are anticipated to dominate the precision agriculture market by farm produce, driven by their extensive cultivation and critical role in global food security. Precision agriculture technologies such as GPS-guided equipment, sensors, and drones are increasingly being adopted to enhance the productivity of crops such as wheat, rice, corn, and soybeans. These tools enable precise monitoring of crop health, soil conditions, and resource utilization, resulting in higher yields and reduced input costs. The dominance of field crops is further supported by advancements in data analytics and automation, which optimize large-scale farming operations. As global agricultural practices shift toward sustainability and efficiency to address rising food demands and environmental concerns, the adoption of precision agriculture for field crops is set to grow significantly, solidifying its position as the leading segment in the market.

Segmentation 4: by Technology

- Guidance Technology

- Sensing Technology

- Variable Rate Application Technology

- Data Analytics and Intelligence

- Others

Guidance Technology to Dominate the Precision Agriculture Market (by Technology)

Guidance technology is expected to dominate the precision agriculture market by technology, driven by its essential role in enhancing farm efficiency and productivity. This technology utilizes GPS-based systems, automated steering, and real-time tracking to enable precise navigation and field operations, minimizing overlaps and reducing input wastage. The growing adoption of autonomous tractors and other smart farming machinery further accelerates the integration of guidance technology in agricultural practices. Advancements in GPS accuracy, sensor integration, and machine learning have enhanced the efficiency and reliability of guidance systems.

Segmentation 5: by Product

- Hardware

- Automation and Control Systems

- Sensing and Navigation Systems

- Indoor Farming Equipment

- Software

- Farm Operations Management

- Hardware Control Applications

- Data And Predictive Analytics

- Support Services

Hardware Systems to Dominate the Precision Agriculture Market (by Product)

Hardware systems are projected to dominate the precision agriculture market by product, owing to their critical role in enabling smart farming practices. Devices such as sensors, drones, GPS systems, and automated machinery form the backbone of precision agriculture, providing real-time data and facilitating efficient farm management. These systems help monitor soil health, weather conditions, and crop performance, ensuring optimized resource utilization and higher yields. The growing adoption of advanced farming equipment and IoT-enabled devices has been driving the demand for hardware systems. Continuous innovation in hardware technology, such as improved sensor accuracy and durable agricultural drones, enhances their usability and efficiency.

Segmentation 6: by Region

- North America: U.S., Canada, and Mexico

- Europe: Germany, France, U.K., Spain, Italy, Netherlands, Denmark, and Rest-of-Europe

- Asia-Pacific: China, Japan, India, Indonesia, Vietnam, Malaysia, Australia, and Rest-of-Asia-Pacific

- Middle East and Africa: Israel, Turkey, South Africa, and Rest-of-Middle East and Africa

- South America: Brazil, Argentina, Chile, Peru, and Rest-of-South America

North America to Dominate the Precision Agriculture Market (by Region)

North America is set to dominate the precision agriculture market due to advanced technological adoption, large-scale farming operations, and supportive policies such as the U.S. Farm Bill. Key players such as John Deere and Trimble drive innovation, leveraging GPS, IoT, and AI to optimize inputs and enhance yields. The region's robust data infrastructure and access to venture capital further enable scalability. Meanwhile, Mexico is expected to witness the fastest growth, with a high CAGR of 14.47%, driven by the increasing adoption of precision tools to meet rising agricultural demands.

Recent Developments in the Precision Agriculture Market

- In February 2022, Ag Leader Technology expanded its DirectCommand application product portfolio with the introduction of RightSpot, further strengthening its comprehensive farm solution offerings. RightSpot features advanced nozzle-by-nozzle sprayer control, delivering consistent coverage, enhanced flexibility, improved productivity, and precise accuracy. By maintaining the desired rate and pressure across varying speeds and terrains, RightSpot optimizes input efficiency with accurate droplet size and coverage, effectively reducing waste and operational time.

- In May 2024, AGCO Corporation announced the official opening of The Fendt Lodge in Jackson, Minnesota, on May 1, 2024. This state-of-the-art facility will serve as the brand's North American headquarters, providing a venue for product launches, customer and dealer engagements, and a dedicated visitors center.

- In March 2024, CNH Industrial N.V. announced its commitment to enhancing rural connectivity in Latin America. The company aims to streamline farming operations and boost productivity by utilizing its extensive suite of precision technology solutions. These advanced technologies, designed to save time, reduce costs, and optimize resources, depend on robust internet connectivity. With a network of over 190 provider partners across 144 countries, CNH Industrial N.V. ensures seamless product connectivity and comprehensive coverage to support its equipment worldwide.

- In January 2024, Bayer AG unveiled its Climate FieldView digital farming platform enhancements for the 2024 crop season. The updates include advanced functionalities in FieldView Plus, newly tailored features within the FieldView Premium subscription tier, and significant improvements to the platform's in-cab experience.

Demand - Drivers, Limitations, and Opportunities

Market Demand Drivers: Rising Adoption of Precision Irrigation Technologies

The rising adoption of precision irrigation technologies is a significant market driver in the global precision agriculture sector. As farmers increasingly confront challenges such as climate change and resource scarcity, the benefits of precision irrigation become more pronounced. Key behavioral factors, including perceived economic benefits, environmental consciousness, and perceived compatibility with existing practices, influence farmers' decisions to embrace these technologies.

For instance, in January 2024, Netafim, in partnership with Regrow Ag, introduced drip irrigation systems for rice cultivation, reducing water consumption by 70% and nearly eliminating methane emissions. These advancements align with global sustainability goals, encouraging farmers to transition to climate-smart practices. The ability to secure carbon credits through these technologies further accelerates their adoption, fostering resilience in agricultural systems and positioning precision irrigation as a critical component in modern, sustainable farming.

Market Challenges: Growing Concerns Over Data Security

Data security concerns significantly restrain the precision agriculture market, as farmers and agricultural enterprises remain cautious about potential data breaches. Precision agriculture systems collect extensive data on farm operations, including crop performance and resource usage, raising fears of unauthorized access or data theft. This apprehension can hinder the adoption of digital technologies as stakeholders prioritize safeguarding their proprietary agricultural information.

In 2020, a ransomware attack on a major U.S. agricultural cooperative disrupted operations, exposing the vulnerabilities of digital systems in precision agriculture. This incident underscored the significant risks of data breaches and cyberattacks, prompting heightened caution among farmers and agribusinesses. Consequently, skepticism toward adopting precision agriculture technologies that collect and store sensitive farm data has grown as stakeholders focus on protecting their information from potential threats.

Market Opportunities: Partnerships with Agri-Tech Startups

Collaborations with agri-tech startups present a significant growth opportunity for the precision agriculture market. These partnerships enable established companies to harness innovative solutions developed by startups, including advanced technologies such as AI-driven analytics, IoT-enabled devices, and precision farming tools. By integrating these innovations into their offerings, larger firms can enhance their product portfolios and maintain a competitive edge in the market.

Such partnerships also enable faster market entry, tailored solutions for specific agricultural challenges, and the scalability of new technologies to a wider audience. For instance, in 2021, Deere & Company acquired Blue River Technology to integrate its cutting-edge machine learning and computer vision capabilities into Deere's agricultural machinery. This strategic move significantly bolstered Deere's precision agriculture offerings, enhancing crop monitoring accuracy and resource efficiency. As a result, this collaboration became instrumental in driving the adoption of advanced precision agriculture technologies, solidifying Deere & Company's position as a leader in agricultural innovation.

How can this report add value to an organization?

This report adds value to an organization by providing in-depth insights into the precision agriculture market, enabling informed decision-making and strategic planning. It highlights emerging technologies, market trends, and competitive dynamics, helping organizations identify growth opportunities and align their offerings with industry needs. The report's detailed segmentation and regional analysis support targeted market entry strategies, while its regulatory and sustainability insights ensure compliance and alignment with global goals. By leveraging this report, organizations can drive innovation, enhance operational efficiency, and gain a competitive edge in the evolving precision agriculture landscape.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the market analysis is U.S.$. Currencies other than the U.S.$ have been converted to the U.S.$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate was taken from the historical exchange rate on the Oanda website.

- Nearly all the recent developments from January 2021 to November 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the precision agriculture market.

The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the precision agriculture market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources Include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as the Census Bureau, OICA, and ACEA.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include segmentations and percentage shares

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled in the precision agriculture market have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Accenture

- AGRIVI

- Bayer AG

- X (Alphabet Inc.)

- Amazon Web Services (AWS), Inc

- IBM Corporation

- BASF

- Microsoft

- Farmers Edge Inc.

- The Toro Company

- AGCO Corporation

- CNH Industrial N.V.

- Ag Leader Technology

- KUBOTA Corporation

- Deere & Company

- Hexagon AB

- Topcon Corporation

- YANMAR HOLDINGS Co., Ltd.

- TeeJet Technologies

Companies not part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

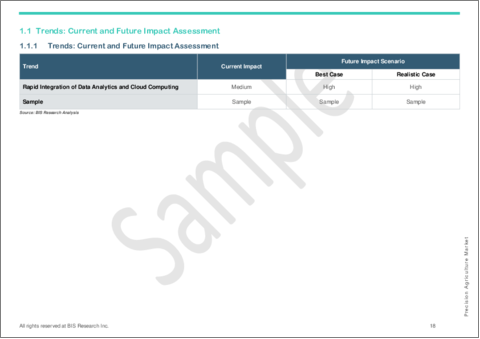

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Current and Future Impact Assessment

- 1.1.1.1 Rapid Integration of Data Analytics and Cloud Computing

- 1.1.1.2 Increasing Requirement for Crop Yield

- 1.1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country and Company)

- 1.4 Regulatory Landscape

- 1.4.1 Regulations for the Precision Agriculture Market

- 1.5 Impact of Key Enabling Technologies on the Farming Ecosystem

- 1.6 Market Dynamics: Overview

- 1.6.1 Market Drivers

- 1.6.1.1 Rising Adoption of Precision Irrigation Technologies

- 1.6.1.2 Increasing Number of Pest Variant Drives Demand for Smart Monitoring Technologies

- 1.6.2 Market Restraints

- 1.6.2.1 Growing Concerns Over Data Security

- 1.6.2.2 Limited Network Connectivity

- 1.6.3 Market Opportunities

- 1.6.3.1 Partnerships with Agri-Tech Startups

- 1.6.3.2 Customization for Specialty Crops

- 1.6.1 Market Drivers

- 1.7 Agriculture Drone and Robot Market

2 Application

- 2.1 Application Summary

- 2.2 Precision Agriculture Market (by Application)

- 2.2.1 Field Monitoring

- 2.2.2 Crop Forecasting

- 2.2.3 Precision Planting

- 2.2.4 Precision Spraying

- 2.2.5 Precision Fertilization

- 2.2.6 Precision Irrigation

- 2.2.7 Farm Management

- 2.2.8 Others

- 2.3 Precision Agriculture Market (by Function)

- 2.3.1 Farm Management

- 2.3.2 Field Management

- 2.3.3 Fleet Management

- 2.4 Precision Agriculture Market (by Farm Produce)

- 2.4.1 Field Crops

- 2.4.1.1 Cereals

- 2.4.1.2 Oil Crops

- 2.4.1.3 Roots, Tubers, and Plantains

- 2.4.1.4 Industrial Crops

- 2.4.1.5 Others

- 2.4.2 Permanent Crops

- 2.4.2.1 Fruits

- 2.4.2.2 Vegetables

- 2.4.2.3 Nuts

- 2.4.2.4 Others

- 2.4.3 Other Farm Produce

- 2.4.1 Field Crops

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Precision Agriculture Market (by Technology)

- 3.3.1 Guidance Technology

- 3.3.2 Sensing Technology

- 3.3.3 Variable Rate Application Technology

- 3.3.4 Data Analytics and Intelligence

- 3.3.5 Others

- 3.4 Precision Agriculture Market (by Product)

- 3.4.1 Hardware Systems

- 3.4.1.1 Automation and Control Systems

- 3.4.1.1.1 Displays or Yield Monitors

- 3.4.1.1.2 Flow and Application Rate Control Valves

- 3.4.1.1.3 Handheld Computers/Mobile Devices

- 3.4.1.2 Sensing and Navigation Systems

- 3.4.1.2.1 Sensing Systems

- 3.4.1.2.2 Global Positioning System (GPS)/Global Navigation Satellite System (GNSS)

- 3.4.1.2.3 Guidance and Steering Systems

- 3.4.1.3 Indoor Farming Equipment

- 3.4.1.3.1 Climate Control Systems

- 3.4.1.3.2 LED Grow Lights

- 3.4.1.3.3 Others

- 3.4.1.1 Automation and Control Systems

- 3.4.2 Software

- 3.4.2.1 Farm Operation Management Software

- 3.4.2.2 Hardware Control Application Software

- 3.4.2.3 Data and Predictive Analytics Software

- 3.4.3 Support Services

- 3.4.3.1 Integration and Deployment

- 3.4.3.2 Maintenance and Repair

- 3.4.3.3 Other Services

- 3.4.1 Hardware Systems

4 Region

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Application

- 4.2.6.2 Product

- 4.2.7 Canada

- 4.2.7.1 Application

- 4.2.7.2 Product

- 4.2.8 Mexico

- 4.2.8.1 Application

- 4.2.8.2 Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Application

- 4.3.6.2 Product

- 4.3.7 France

- 4.3.7.1 Application

- 4.3.7.2 Product

- 4.3.8 Italy

- 4.3.8.1 Application

- 4.3.8.2 Product

- 4.3.9 Spain

- 4.3.9.1 Application

- 4.3.9.2 Product

- 4.3.10 U.K.

- 4.3.10.1 Application

- 4.3.10.2 Product

- 4.3.11 Netherlands

- 4.3.11.1 Application

- 4.3.11.2 Product

- 4.3.12 Denmark

- 4.3.12.1 Application

- 4.3.12.2 Product

- 4.3.13 Rest-of-Europe

- 4.3.13.1 Application

- 4.3.13.2 Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Application

- 4.4.6.2 Product

- 4.4.7 Japan

- 4.4.7.1 Application

- 4.4.7.2 Product

- 4.4.8 India

- 4.4.8.1 Application

- 4.4.8.2 Product

- 4.4.9 Indonesia

- 4.4.9.1 Application

- 4.4.9.2 Product

- 4.4.10 Vietnam

- 4.4.10.1 Application

- 4.4.10.2 Product

- 4.4.11 Malaysia

- 4.4.11.1 Application

- 4.4.11.2 Product

- 4.4.12 Australia

- 4.4.12.1 Application

- 4.4.12.2 Product

- 4.4.13 Rest-of-Asia-Pacific

- 4.4.13.1 Application

- 4.4.13.2 Product

- 4.5 Middle East and Africa (MEA)

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Israel

- 4.5.6.1 Application

- 4.5.6.2 Product

- 4.5.7 Turkey

- 4.5.7.1 Application

- 4.5.7.2 Product

- 4.5.8 South Africa

- 4.5.8.1 Application

- 4.5.8.2 Product

- 4.5.9 Rest-of-Middle East and Africa

- 4.5.9.1 Application

- 4.5.9.2 Product

- 4.6 South America

- 4.6.1 Application

- 4.6.2 Product

- 4.6.3 Brazil

- 4.6.3.1 Application

- 4.6.3.2 Product

- 4.6.4 Argentina

- 4.6.4.1 Application

- 4.6.4.2 Product

- 4.6.5 Chile

- 4.6.5.1 Application

- 4.6.5.2 Product

- 4.6.6 Peru

- 4.6.6.1 Application

- 4.6.6.2 Product

- 4.6.7 Rest-of-South America

- 4.6.7.1 Application

- 4.6.7.2 Product

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Precision Agriculture Software and Services Provider

- 5.3.1 Accenture

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share, 2023

- 5.3.2 AGRIVI

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share, 2023

- 5.3.3 Bayer AG

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share, 2023

- 5.3.4 X (Alphabet Inc.)

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share, 2023

- 5.3.5 Amazon Web Services, Inc.

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share, 2023

- 5.3.6 IBM Corporation

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers/End Users

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share, 2023

- 5.3.7 BASF

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share, 2023

- 5.3.8 Microsoft

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share, 2023

- 5.3.9 Farmers Edge Inc.

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share, 2023

- 5.3.10 The Toro Company

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share, 2023

- 5.3.1 Accenture

- 5.4 Precision Agriculture Equipment Manufacturers

- 5.4.1 AGCO Corporation

- 5.4.1.1 Overview

- 5.4.1.2 Top Products/Product Portfolio

- 5.4.1.3 Top Competitors

- 5.4.1.4 Target Customers

- 5.4.1.5 Key Personnel

- 5.4.1.6 Analyst View

- 5.4.1.7 Market Share, 2023

- 5.4.2 CNH Industrial N.V.

- 5.4.2.1 Overview

- 5.4.2.2 Top Products/Product Portfolio

- 5.4.2.3 Top Competitors

- 5.4.2.4 Target Customers

- 5.4.2.5 Key Personnel

- 5.4.2.6 Analyst View

- 5.4.2.7 Market Share, 2023

- 5.4.3 Ag Leader Technology

- 5.4.3.1 Overview

- 5.4.3.2 Top Products/Product Portfolio

- 5.4.3.3 Top Competitors

- 5.4.3.4 Target Customers

- 5.4.3.5 Key Personnel

- 5.4.3.6 Analyst View

- 5.4.3.7 Market Share, 2023

- 5.4.4 KUBOTA Corporation

- 5.4.4.1 Overview

- 5.4.4.2 Top Products/Product Portfolio

- 5.4.4.3 Top Competitors

- 5.4.4.4 Target Customers/End Users

- 5.4.4.5 Key Personnel

- 5.4.4.6 Analyst View

- 5.4.4.7 Market Share, 2023

- 5.4.5 Deere & Company

- 5.4.5.1 Overview

- 5.4.5.2 Top Products/Product Portfolio

- 5.4.5.3 Top Competitors

- 5.4.5.4 Target Customers

- 5.4.5.5 Key Personnel

- 5.4.5.6 Analyst View

- 5.4.5.7 Market Share, 2023

- 5.4.6 Hexagon AB

- 5.4.6.1 Overview

- 5.4.6.2 Top Products/Product Portfolio

- 5.4.6.3 Top Competitors

- 5.4.6.4 Target Customers

- 5.4.6.5 Key Personnel

- 5.4.6.6 Analyst View

- 5.4.6.7 Market Share, 2023

- 5.4.7 Topcon Corporation

- 5.4.7.1 Overview

- 5.4.7.2 Top Products/Product Portfolio

- 5.4.7.3 Top Competitors

- 5.4.7.4 Target Customers

- 5.4.7.5 Key Personnel

- 5.4.7.6 Analyst View

- 5.4.7.7 Market Share, 2023

- 5.4.8 CLAAS KGaA mbH

- 5.4.8.1 Overview

- 5.4.8.2 Top Products/Product Portfolio

- 5.4.8.3 Top Competitors

- 5.4.8.4 Target Customers/End Users

- 5.4.8.5 Key Personnel

- 5.4.8.6 Analyst View

- 5.4.8.7 Market Share, 2023

- 5.4.9 YANMAR HOLDINGS Co., Ltd.

- 5.4.9.1 Overview

- 5.4.9.2 Top Products/Product Portfolio

- 5.4.9.3 Top Competitors

- 5.4.9.4 Target Customers

- 5.4.9.5 Key Personnel

- 5.4.9.6 Analyst View

- 5.4.9.7 Market Share, 2023

- 5.4.10 TeeJet Technologies

- 5.4.10.1 Overview

- 5.4.10.2 Top Products/Product Portfolio

- 5.4.10.3 Top Competitors

- 5.4.10.4 Target Customers

- 5.4.10.5 Key Personnel

- 5.4.10.6 Analyst View

- 5.4.10.7 Market Share, 2023

- 5.4.1 AGCO Corporation

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast