|

|

市場調査レポート

商品コード

1439030

アジア太平洋地域の次世代乳癌診断およびスクリーニング市場:分析・予測 (2023~2032年)Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market: Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋地域の次世代乳癌診断およびスクリーニング市場:分析・予測 (2023~2032年) |

|

出版日: 2024年02月29日

発行: BIS Research

ページ情報: 英文 82 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋地域の次世代乳癌診断およびスクリーニングの市場規模は、2023年の5億5,430万米ドルから、2032年には17億7,940万米ドルの規模に成長すると予測されています。

アジア太平洋地域の次世代乳癌診断およびスクリーニング市場:イントロダクション

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2032年 |

| 2023年評価 | 5億5,430万米ドル |

| 2032年予測 | 17億7,940万米ドル |

| CAGR | 13.84% |

アジア太平洋地域では、次世代乳癌診断およびスクリーニング市場の著しい成長が見込まれています。この成長を後押ししているのは、同地域における乳癌罹患率の増加などの要因です。早期発見とスクリーニングに焦点を当てた啓発キャンペーンの活発化も、この急増に寄与しています。さらに、より効果的なスクリーニング、予後予測、個別化治療戦略のために乳癌バイオマーカーの活用が重視されるようになっています。さらに、市場関係者間の協力的な取り組みやパートナーシップが、診断技術やスクリーニング手法の進歩をさらに後押ししています。アジア太平洋地域の次世代乳癌診断およびスクリーニング市場は、このようなダイナミクスを背景に、同地域全体の乳癌管理と転帰を改善するための有望な機会を提示しています。

当レポートでは、アジア太平洋地域の次世代乳癌診断およびスクリーニングの市場を調査し、市場概要、技術動向、法規制環境、市場影響因子の分析、市場規模の推移・予測、競合情勢、主要企業の分析などをまとめています。

市場の分類

セグメンテーション1:国別

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- シンガポール

- その他

目次

エグゼクティブサマリー

調査範囲

第1章 腫瘍分子診断市場

- 概要

- 癌の種類

- 技術

- 市場力学

- 規制承認製品

第2章 次世代乳癌診断およびスクリーニング市場

- 市場の見通し

- 製品の定義

- 定義:関連技術別

- 包含と除外

- 概要

第3章 業界の展望

- 主要な動向

- 乳癌診断のためのリキッドバイオプシー

- 次世代技術の完全自動化

- 規制の枠組み

- 米国の規制枠組み

- 欧州の規制枠組み

- アジア太平洋地域の規制枠組み

- 規制承認製品

- 臨床試験

- 乳癌罹患率増加率(国別)

- さまざまな手法の利点と制限

- 価格設定

第4章 地域

- アジア太平洋

- 主な調査結果

- 市場力学

- 市場規模・予測

第5章 市場:競合ベンチマーキング

- 次世代乳癌診断およびスクリーニングのアクティブ企業のエコシステム

- 企業プロファイル

- BGI Genomics Co., Ltd.

List of Figures

- Figure 1: Worldwide Breast Cancer Statistics (by Region), 2020

- Figure 2: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 3: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market (by Technology), $Million, 2022 and 2032

- Figure 4: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market (by Biomarker), $Million, 2022 and 2032

- Figure 5: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market (by Cancer Sub-Type), $Million, 2022 and 2032

- Figure 6: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market (by Offering), $Million, 2022 and 2032

- Figure 7: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market (by End User), $Million, 2022 and 2032

- Figure 8: Next-Generation Breast Cancer Diagnostic and Screening Market, Impact Analysis

- Figure 9: Next-Generation Breast Cancer Diagnostic and Screening Market, Key Development Analysis, January 2019-April 2023

- Figure 10: Next-Generation Breast Cancer Diagnostic and Screening Market: Research Methodology

- Figure 11: Primary Research Methodology

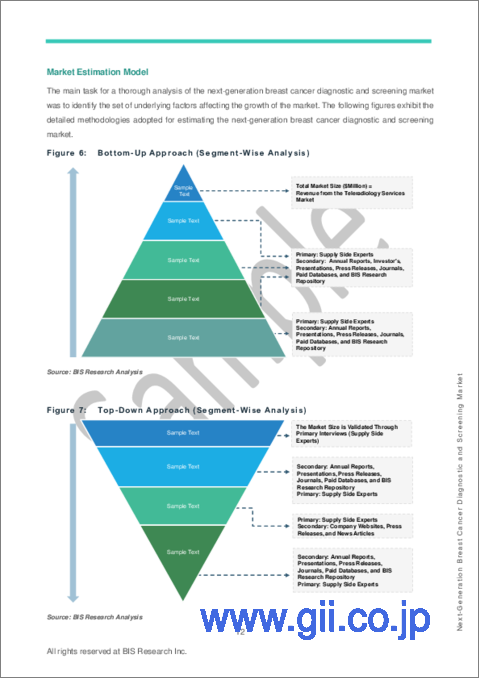

- Figure 12: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 13: Top-Down Approach (Segment-Wise Analysis)

- Figure 14: Oncology Molecular Diagnostic Market, Solid Tumor, $Million, 2022 and 2032

- Figure 15: Oncology Molecular Diagnostic Market, Hematological Malignancy, $Million, 2022 and 2032

- Figure 16: Oncology Molecular Diagnostic Market, Market Dynamics

- Figure 17: Next-Generation Breast Cancer Diagnostic and Screening Market, Size and Growth Potential, $Million, 2022-2032

- Figure 18: Market Size and Growth Potential (by Region), $Million, 2022-2032

- Figure 19: FDA Guidelines for CDx Approval

- Figure 20: Criteria for CMS Coverage/Reimbursement

- Figure 21: Europe In-Vitro Diagnostic Devices Regulation Regulatory Process

- Figure 22: Breast Cancer Incidence Growth Rates (by Country), 2020 and 2040

- Figure 23: Advantages and Limitations of Different Techniques in the Next-Generation Breast Cancer Diagnostic and Screening Market

- Figure 24: Next-Generation Breast Cancer Diagnostic and Screening Market Share (by Region), 2022-2032

- Figure 25: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market, Incremental Opportunity (by Country), $Million, 2023-2032

- Figure 26: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 27: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market (by Country), Share (%), 2022 and 2032

- Figure 28: China Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 29: Japan Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 30: India Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 31: Australia Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 32: South Korea Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 33: Singapore Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 34: Rest-of-Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market, $Million, 2022-2032

- Figure 35: BGI Genomics Co., Ltd. Product Portfolio

- Figure 36: BGI Genomics Co., Ltd.: Overall Financials, $Million, 2020-2022

List of Tables

- Table 1: Key Questions Answered in the Report

- Table 2: Some of the Regulatory-Approved Oncology Molecular Diagnostic Products/Services for Different Types of Solid Tumors

- Table 3: Some of the Regulatory-Approved Next-Generation Breast Cancer Diagnostic and Screening Products/Tests

- Table 4: Next-Generation Breast Cancer Diagnostic and Screening, Clinical Trials

- Table 5: Pricing of Some Products/Services for Next-Generation Breast Cancer Diagnostic and Screening

- Table 6: Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market, Impact Analysis

- Table 7: Next-Generation Breast Cancer Diagnostic and Screening Active Players Ecosystem

- Table 8: BGI Genomics Co. Ltd.: Key Products and Features

The Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market Expected to Reach $1,779.4 Million by 2032

Introduction to Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $554.3 Million |

| 2032 Forecast | $1,779.4 Million |

| CAGR | 13.84% |

The Asia-Pacific next-generation breast cancer diagnostic and screening market was valued at $554.3 million in 2023 and is anticipated to reach $1,779.4 million by 2032. The anticipated growth in the next-generation breast cancer diagnostic and screening market is projected to be fueled by several factors. These include the uptick in the occurrence of breast cancer cases, heightened awareness concerning early detection of breast cancer, a growing emphasis on breast cancer biomarkers for improved screening, prognosis, and tailored treatment, as well as the escalation in partnerships and collaborations among industry participants.

Market Introduction

The Asia-Pacific (APAC) region anticipates significant growth in the next-generation breast cancer diagnostic and screening market. This growth is propelled by various factors, including the increasing incidence of breast cancer cases in the region. Heightened awareness campaigns focusing on early detection and screening contribute to this surge. Additionally, there's a growing emphasis on utilizing breast cancer biomarkers for more effective screening, prognosis, and personalized treatment strategies. Moreover, the collaborative efforts and partnerships among market players further drive advancements in diagnostic technologies and screening methodologies. With these dynamics in play, the APAC next-generation breast cancer diagnostic and screening market presents promising opportunities for improved breast cancer management and outcomes across the region.

Market Segmentation

Segmentation 1: by Country

- Japan

- China

- India

- Australia

- South Korea

- Singapore

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Growth/Marketing Strategy: The APAC next-generation breast cancer diagnostic and screening market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, product launches, and funding activities. Partnerships, alliances, and business expansions accounted for the maximum number of key developments in the APAC next-generation breast cancer diagnostic and screening market, followed by regulatory and legal activities and mergers and acquisitions.

Competitive Strategy: Key players in the APAC next-generation breast cancer diagnostic and screening market analyzed and profiled in the study involve players that offer next-generation breast cancer diagnostic and screening products and services. Moreover, comprehensive competitive strategies such as partnerships, agreements, collaborations, product launches and approvals, and funding scenarios will aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

Executive Summary

Scope of the Study

Research Methodology

1 Oncology Molecular Diagnostic Market

- 1.1 Overview

- 1.2 Cancer Type

- 1.3 Technology

- 1.4 Market Dynamics

- 1.5 Regulatory-Approved Products

2 Next-Generation Breast Cancer Diagnostic and Screening Market

- 2.1 Market Outlook

- 2.1.1 Product Definition

- 2.1.2 Definition by Technologies Involved

- 2.1.2.1 Real-Time Polymerase Chain Reaction (RT-PCR)

- 2.1.2.2 Fluorescence In-Situ Hybridization (FISH)

- 2.1.2.3 Next-Generation Sequencing

- 2.1.2.4 Immunohistochemistry (IHC)

- 2.1.3 Inclusion and Exclusion

- 2.1.4 Overview

- 2.1.4.1 Market Size and Growth Potential, $Million, 2022-2032

3 Industry Outlook

- 3.1 Key Trends

- 3.1.1 Liquid Biopsy for Breast Cancer Diagnosis

- 3.1.2 Complete Automation of Next-Generation Techniques

- 3.2 Regulatory Framework

- 3.2.1 Regulatory Framework in the U.S.

- 3.2.1.1 FDA Regulation

- 3.2.1.2 CMS Regulations (Reimbursement Scenario)

- 3.2.2 Regulatory Framework in Europe

- 3.2.3 Regulatory Framework in Asia-Pacific

- 3.2.3.1 China

- 3.2.3.2 Japan

- 3.2.1 Regulatory Framework in the U.S.

- 3.3 Regulatory-Approved Products

- 3.4 Clinical Trials

- 3.5 Breast Cancer Incidence Growth Rates (by Country)

- 3.6 Advantages and Limitations of Different Techniques

- 3.7 Pricing

4 Regions

- 4.1 Asia-Pacific

- 4.1.1 Key Findings

- 4.1.2 Market Dynamics

- 4.1.2.1 Impact Analysis

- 4.1.3 Market Sizing and Forecast

- 4.1.3.1 Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market (by Country)

- 4.1.3.1.1 China

- 4.1.3.1.1.1 Market Dynamics

- 4.1.3.1.1.2 Market Sizing and Forecast

- 4.1.3.1.2 Japan

- 4.1.3.1.2.1 Market Dynamics

- 4.1.3.1.2.2 Market Sizing and Forecast

- 4.1.3.1.3 India

- 4.1.3.1.3.1 Market Dynamics

- 4.1.3.1.3.2 Market Sizing and Forecast

- 4.1.3.1.4 Australia

- 4.1.3.1.4.1 Market Dynamics

- 4.1.3.1.4.2 Market Sizing and Forecast

- 4.1.3.1.5 South Korea

- 4.1.3.1.5.1 Market Dynamics

- 4.1.3.1.5.2 Market Sizing and Forecast

- 4.1.3.1.6 Singapore

- 4.1.3.1.6.1 Market Dynamics

- 4.1.3.1.6.2 Market Sizing and Forecast

- 4.1.3.1.7 Rest-of-Asia-Pacific

- 4.1.3.1.7.1 Market Dynamics

- 4.1.3.1.7.2 Market Sizing and Forecast

- 4.1.3.1.1 China

- 4.1.3.1 Asia-Pacific Next-Generation Breast Cancer Diagnostic and Screening Market (by Country)

5 Markets - Competitive Benchmarking

- 5.1 Next-Generation Breast Cancer Diagnostic and Screening Active Players Ecosystem

- 5.2 Company Profiles

- 5.2.1 BGI Genomics Co., Ltd.

- 5.2.1.1 Company Overview

- 5.2.1.2 Role of BGI Genomics Co., Ltd. in the Next-Generation Breast Cancer Diagnostic and Screening Market

- 5.2.1.3 Financials

- 5.2.1.4 Recent Developments

- 5.2.1.5 Analyst Perception

- 5.2.1 BGI Genomics Co., Ltd.