|

|

市場調査レポート

商品コード

1439023

アジア太平洋の次世代IVD市場:分析と予測(2023年~2033年)Asia-Pacific Next-Generation IVD Market: Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の次世代IVD市場:分析と予測(2023年~2033年) |

|

出版日: 2024年02月29日

発行: BIS Research

ページ情報: 英文 99 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価額 | 214億3,000万米ドル |

| 2033年予測 | 423億5,000万米ドル |

| CAGR | 7.05% |

アジア太平洋の次世代IVD(体外診断薬)市場は、2023年に214億3,000万米ドルとなりました。

同市場は、2033年には423億5,000万米ドルに達し、2023年~2033年のCAGRは7.05%になると予測されています。診断学における革新的技術の出現は、次世代IVD(体外診断薬)市場の成長を活性化させる可能性を秘めています。分子診断学、ゲノミクス、次世代シーケンシング(NGS)は、この成長を促進する上で極めて重要な役割を果たすと予想され、疾患検出を強化し、最終的に患者の転帰を変える新たな機会を提供します。

アジア太平洋は、次世代IVD(体外診断薬)市場において著しく進展、成長しています。この拡大にはいくつかの重要な要因があります。第一に、慢性疾患や感染症の増加により、より正確で効率的な診断ソリューションが必要とされています。第二に、中国、インド、日本などの国々における急速な都市化と医療費の増加が、高度な診断技術の採用を促進しています。第三に、個別化医療や疾病の早期発見の利点に関するヘルスケアプロバイダーや患者の意識の高まりが、革新的なIVDソリューションの需要に拍車をかけています。さらに、ヘルスケアインフラの改善や研究開発活動の促進を目的とした政府の支援策も、アジア太平洋の市場成長に貢献しています。

当レポートでは、アジア太平洋の次世代IVD市場について調査し、市場の概要とともに、タイプ別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 製品の定義

- 市場範囲

- 調査手法

第2章 市場概要

- イントロダクション

- COVID-19による次世代IVD市場への影響

第3章 業界分析

- 法的要件

- アジア太平洋における法的要件と枠組み

第4章 次世代IVD市場、地域別、100万米ドル、2022年~2033年

- 概要

- アジア太平洋

- 市場力学

- 市場規模と予測

第5章 企業プロファイル

- 次世代IVD市場エコシステムにおける活躍企業

- Sysmex Corporation

List of Figures

- Figure 1: Facts about Next-Generation IVD Market

- Figure 2: Equipment's used for Next-Generation In-Vitro Diagnostics

- Figure 3: Asia-Pacific Next-Generation IVD Market, $Billion, 2022 and 2033

- Figure 4: Trend Analysis of Next-Generation In-vitro Diagnostics Ecosystem

- Figure 5: Common Chronic Conditions for Population Above 65 years

- Figure 6: Key Challenges in the Asia-Pacific Next-Generation IVD Market based on Primary Respondents

- Figure 7: New In-Vitro Diagnostics Regulations (IVDR) and Medical Device Regulation (MDR)

- Figure 8: Major Highlights Witnessed in the Next-Generation IVD Market During COVID-19 Impact

- Figure 9: Role of POC Diagnostics in Next-Generation IVD Market During Pandemic

- Figure 10: Leading and Emerging Companies in the Next-Generation IVD Ecosystem

- Figure 11: Leading Companies in the Next-Generation IVD Ecosystem and Their Market Share (%)

- Figure 12: Key Developments Undertaken by Companies in the Next-Generation IVD Market, July 2019-June 2023

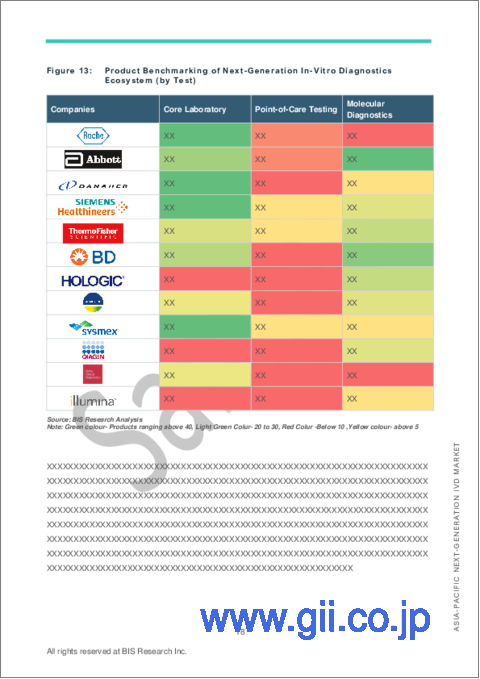

- Figure 13: Product Benchmarking of Next-Generation In-Vitro Diagnostics Ecosystem (by Test)

- Figure 14: Asia-Pacific Next-Generation IVD Market (by Type), Share (%), 2022 and 2033

- Figure 15: Asia-Pacific Next-Generation IVD Market (by End User), Share (%), 2022 and 2033

- Figure 16: Next-Generation IVD Market: Research Methodology

- Figure 17: Primary Research Methodology

- Figure 18: Bottom-Up Approach (Segment-Wise Analysis)

- Figure 19: Top-Down Approach (Segment-Wise Analysis)

- Figure 20: Asia-Pacific Next-Generation IVD Market, $Billion, 2022-2033

- Figure 21: Product Benchmarking of Next-Generation In-vitro Diagnostics Market (by Type)

- Figure 22: In-Vitro Diagnostic Trends during the COVID-19 Pandemic

- Figure 23: Timeline of IVDR 2017/746

- Figure 24: Next-Generation IVD Market (by Region), Share (%), 2022

- Figure 25: Next-Generation IVD Market (by Region), $Billion, 2022-2033

- Figure 26: Asia-Pacific Next-Generation IVD Market, $Billion, 2022-2033

- Figure 27: Asia-Pacific Next-Generation IVD Market (by End User), $Billion, 2022-2033

- Figure 28: Asia-Pacific Next-Generation IVD Market (by Type), $Billion, 2022-2033

- Figure 29: Asia-Pacific Next-Generation Core Laboratory IVD Market (by Type), $Billion, 2022-2033

- Figure 30: Asia-Pacific Next-Generation IVD Market (by Country), $Billion, 2022-2033

- Figure 31: China Next-Generation IVD Market, $Billion, 2022-2033

- Figure 32: China Next-Generation IVD Market (by End User), $Billion, 2022-2033

- Figure 33: China Next-Generation IVD Market (by Type), $Billion, 2022-2033

- Figure 34: China Next-Generation Core Laboratory IVD Market (by Type), $Billion, 2022-2033

- Figure 35: Japan Next-Generation IVD Market, $Billion, 2022-2033

- Figure 36: Japan Next-Generation IVD Market (by End User), $Billion, 2022-2033

- Figure 37: Japan Next-Generation IVD Market (by Type), $Billion, 2022-2033

- Figure 38: Japan Next-Generation Core Laboratory IVD Market (by Type), $Billion, 2022-2033

- Figure 39: India Next-Generation IVD Market, $Billion, 2022-2033

- Figure 40: India Next-Generation IVD Market (by End User), $Billion, 2022-2033

- Figure 41: India Next-Generation IVD Market (by Type), $Billion, 2022-2033

- Figure 42: India Next-Generation Core Laboratory IVD Market (by Type), $Billion, 2022-2033

- Figure 43: Australia Next-Generation IVD Market, $Billion, 2022-2033

- Figure 44: Australia Next-Generation IVD Market (by End User), $Billion, 2022-2033

- Figure 45: Australia Next-Generation IVD Market (by Type), $Billion, 2022-2033

- Figure 46 Australia Next-Generation Core Laboratory IVD Market (by Type), $Billion, 2022-2033

- Figure 47: South Korea Next-Generation IVD Market, $Billion, 2022-2033

- Figure 48: South Korea Next-Generation IVD Market (by End User), $Billion, 2022-2033

- Figure 49: South Korea Next-Generation IVD Market (by Type), $Billion, 2022-2033

- Figure 50: South Korea Next-Generation Core Laboratory IVD Market (by Type), $Billion, 2022-2033

- Figure 51: Rest-of-Asia-Pacific Next-Generation IVD Market, $Billion, 2022-2033

- Figure 52: Rest-of-Asia-Pacific Next-Generation IVD Market (by End User), $Billion, 2022-2033

- Figure 53: Rest-of-Asia-Pacific Next-Generation IVD Market (by Type), $Billion, 2022-2033

- Figure 54: Rest-of-Asia-Pacific Next-Generation Core Laboratory IVD Market (by Type), $Billion, 2022-2033

- Figure 55: Total Number of Companies Profiled

- Figure 56: Sysmex Corporation: Product Portfolio

- Figure 57: Sysmex Corporation: Overall Financials, $Million, 2020-2022

- Figure 58: Sysmex Corporation: Revenue (by Segment), $Million, 2020-2022

- Figure 59: Sysmex Corporation: Revenue (by Region), $Million, 2020-2022

- Figure 60: Sysmex Corporation: R&D Expenditure, $Million, 2020-2022

List of Tables

- Table 1: Impact Analysis of Market Drivers, and Restraints on the Asia-Pacific Next-Generation IVD Market

- Table 2: Impact of COVID-19 on Different Countries

- Table 3: Asia-Pacific: Market Dynamics

- Table 4: Next-Generation IVD Market, Active Players

The Asia-Pacific Next-Generation IVD Market Expected to Reach $42.35 Billion by 2033

Introduction to Asia-Pacific Next-Generation IVD (In vitro diagnostics) Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $21.43 Billion |

| 2033 Forecast | $42.35 Billion |

| CAGR | 7.05% |

The Asia-Pacific next-generation IVD market was valued at $21.43 billion in 2023 and is expected to reach $42.35 billion by 2033, growing at a CAGR of 7.05% between 2023 and 2033. The emergence of innovative technologies in diagnostics holds promise for revitalizing the growth of the next-generation In Vitro Diagnostics (IVD) market. Molecular diagnostics, genomics, and Next-Generation Sequencing (NGS) are anticipated to play pivotal roles in driving this growth, offering fresh opportunities for enhanced disease detection and ultimately transforming patient outcomes.

Market Introduction

The Asia-Pacific (APAC) region is witnessing significant advancements and growth in the Next-Generation In Vitro Diagnostics (IVD) market. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases and infectious ailments necessitates more accurate and efficient diagnostic solutions. Secondly, rapid urbanization and rising healthcare expenditures in countries like China, India, and Japan are driving the adoption of advanced diagnostic technologies. Thirdly, growing awareness among healthcare providers and patients regarding the benefits of personalized medicine and early disease detection is spurring demand for innovative IVD solutions. Additionally, supportive government initiatives aimed at improving healthcare infrastructure and promoting research and development activities further contribute to market growth in the APAC region.

Market Segmentation:

Segmentation 1: by Type

- Core Laboratory Diagnostics

- POC Testing

- Molecular Diagnostics

Segmentation 2: by End User

- Hospitals and Clinics

- Diagnostic Laboratories

- Academic and Research Institutions

- Other End Users

Segmentation 3: by Country

- Japan

- India

- China

- South Korea

- Australia

- Rest-of-Asia-Pacific

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The next-generation IVD market has been extensively segmented on the basis of various categories, such as type, end user, and country. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: The next-generation IVD market has numerous startups paving their way into manufacturing kits, panels, assays, and instruments and entering the market. Key players in the next-generation IVD market analyzed and profiled in the study involve established players that offer various kinds of disease-specific panels and multiplex instruments.

Table of Contents

Executive Summary

1 Markets

- 1.1 Product Definition

- 1.1.1 Inclusion and Exclusion Criteria

- 1.2 Market Scope

- 1.2.1 Key Questions Answered in the Report

- 1.3 Research Methodology

- 1.3.1 Next-Generation IVD Market: Research Methodology

- 1.3.2 Data Sources

- 1.3.2.1 Primary Data Sources

- 1.3.2.2 Secondary Data Sources

- 1.3.3 Market Estimation Model

- 1.3.4 Criteria for Company Profiling

2 Market Overview

- 2.1 Introduction

- 2.1.1 Next-Generation IVD Market Outlook

- 2.1.1.1 POC-IVD

- 2.1.1.2 Diagnostic Expenditures

- 2.1.1.3 Pricing Patterns of Next-Generation IVD

- 2.1.2 Market Size and Growth Potential

- 2.1.2.1 Short-Term Impact (2020-2025)

- 2.1.2.2 Long-Term Impact (2026-2033)

- 2.1.3 Product Benchmarking by Next- Generation In-vitro Diagnostics Market, (by Type)

- 2.1.1 Next-Generation IVD Market Outlook

- 2.2 COVID-19 Impact on the Next-Generation IVD Market

- 2.2.1 Impact on Operations

- 2.2.2 COVID-19 Impact: Current Scenario of the Market

- 2.2.3 Pre-COVID Assessment

- 2.2.4 Post-COVID-19 Market Assessment

3 Industry Analysis

- 3.1 Legal Requirements

- 3.1.1 Legal Requirements and Framework in Asia-Pacific

4 Next-Generation IVD Market, by Region, $Million, 2022-2033

- 4.1 Overview

- 4.2 Asia-Pacific

- 4.2.1 Market Dynamics

- 4.2.2 Market Size and Forecast

- 4.2.2.1 Asia-Pacific Next-Generation IVD Market (by End User)

- 4.2.2.2 Asia-Pacific Next-Generation IVD Market (by Type)

- 4.2.2.2.1 Asia-Pacific Next-Generation Core Laboratory IVD Market, (by Type)

- 4.2.2.3 Asia-Pacific Next-Generation IVD Market (by Country)

- 4.2.2.3.1 China

- 4.2.2.3.1.1 Market Size and Forecast

- 4.2.2.3.1.1.1 China Next-Generation IVD Market (by End User)

- 4.2.2.3.1.1.2 China Next-Generation IVD Market (by Type)

- 4.2.2.3.2 Japan

- 4.2.2.3.2.1 Market Size and Forecast

- 4.2.2.3.2.1.1 Japan Next-Generation IVD Market (by End User)

- 4.2.2.3.2.1.2 Japan Next-Generation IVD Market (by Type)

- 4.2.2.3.3 India

- 4.2.2.3.3.1 Market Size and Forecast

- 4.2.2.3.3.1.1 India Next-Generation IVD Market (by End User)

- 4.2.2.3.3.1.2 India Next-Generation IVD Market (by Type)

- 4.2.2.3.4 Australia

- 4.2.2.3.4.1 Market Size and Forecast

- 4.2.2.3.4.1.1 Australia Next-Generation IVD Market (by End User)

- 4.2.2.3.4.1.2 Australia Next-Generation IVD Market (by Type)

- 4.2.2.3.5 South Korea

- 4.2.2.3.5.1 Market Size and Forecast

- 4.2.2.3.5.1.1 South Korea Next-Generation IVD Market (by End User)

- 4.2.2.3.5.1.2 South Korea Next-Generation IVD Market (by Type)

- 4.2.2.3.6 Rest-of-Asia-Pacific

- 4.2.2.3.6.1 Market Size and Forecast

- 4.2.2.3.6.1.1 Rest-of-Asia-Pacific Next-Generation IVD Market (by End User)

- 4.2.2.3.6.1.2 Rest-of-Asia-Pacific Next-Generation IVD Market (by Type)

- 4.2.2.3.1 China

5 Company Profiles

- 5.1 Overview

- 5.2 Next-Generation IVD Market Ecosystem Active Players

- 5.3 Sysmex Corporation

- 5.3.1 Company Overview

- 5.3.2 Role of Sysmex Corporation in the Next-Generation IVD Market

- 5.3.3 Financials

- 5.3.4 Recent Developments

- 5.3.4.1 Business Strategies

- 5.3.5 Analyst Perspective