|

|

市場調査レポート

商品コード

1416207

アジア太平洋のADASおよび自律センサーメンテナンス機器市場: - 分析と予測(2022年~2032年)Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market: Analysis and Forecast, 2022-2032 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋のADASおよび自律センサーメンテナンス機器市場: - 分析と予測(2022年~2032年) |

|

出版日: 2024年01月26日

発行: BIS Research

ページ情報: 英文 105 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

| 主要市場統計 | |

|---|---|

| 予測期間 | 2022年~2032年 |

| 2022年評価 | 38万1,500米ドル |

| 2032年予測 | 2,777万4,600米ドル |

| CAGR | 53.54% |

アジア太平洋のADASおよび自律センサーメンテナンス機器の市場規模(中国を除く)は、2022年に38万1,500米ドルとなりました。

同市場は、2032年には2,777万4,600米ドルに達すると予測され、予測期間の2022年~2032年年のCAGRは53.54%になるとみられています。ADASおよび自律センサーメンテナンス機器市場の成長は、自律走行への欲求の高まりと、特に半自律走行車と完全自律走行車に関する車両の安全性の重視の高まりからもたらされると予測されます。

アジア太平洋地域では、ADASおよび自律センサーメンテナンス機器市場が大幅な成長を遂げています。この成長の特徴は、ADASと自律センサ保守のためのソリューションを提供する企業数の急増です。自律走行技術の急速な進展と車両内のセンサーの普及が、アジア太平洋地域全体でADASとセンサー保守ソリューションの採用を促進しています。安全性の向上、エネルギー効率の改善、交通渋滞の緩和、アクセシビリティの向上といったメリットを背景とした自律走行車に対する需要の高まりが、この動向に寄与しています。レベル1およびレベル2の自律走行車は、ほとんどの自動車市場ですでに道路上に存在しています。予測期間においてADASおよび自律センサ保守ソリューションの需要が伸び続ける中、アジア太平洋のADASおよび自律センサーメンテナンス機器業界では、既存および新興機器プロバイダー間の競合が激化すると予想されます。

当レポートでは、アジア太平洋のADASおよび自律センサーメンテナンス機器市場について調査し、市場の概要とともに、車両タイプ別、推進タイプ別、自律度別、製品タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界の展望

- ビジネスダイナミクス

- COVID-19の業界への影響

第2章 地域

- 中国

- アジア太平洋と日本

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競合マトリックス

- 市場シェアの範囲

- 企業プロファイル

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market Overview, $Thousand, 2021-2032

- Figure 2: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market Overview, Thousand Units, 2021-2032

- Figure 3: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), $Million, 2021-2032

- Figure 4: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Thousand Units, 2021-2032

- Figure 5: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), $Thousand, 2021-2032

- Figure 6: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Thousand Units, 2021-2032

- Figure 7: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), $Million, 2021-2032

- Figure 8: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Thousand Units, 2021-2032

- Figure 9: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), $Million, 2021-2032

- Figure 10: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Thousand Units, 2021-2032

- Figure 11: ADAS and Autonomous Sensor Maintenance Equipment Market (by Region), $Thousand, 2021

- Figure 12: ADAS and Autonomous Sensor Maintenance Equipment Market (by Region), Thousand Units, 2021

- Figure 13: ADAS and Autonomous Sensor Maintenance Equipment Market Supply Chain

- Figure 14: ADAS and Autonomous Sensor Maintenance Equipment Market: Business Dynamics

- Figure 15: Impact of Business Drivers

- Figure 16: Impact of Business Restraints

- Figure 17: Key Corporate Strategies (by Company), 2019-2023

- Figure 18: Partnerships, Joint Ventures, Collaborations, and Alliances (by Company), 2019-2023

- Figure 19: Impact of Business Opportunities

- Figure 20: Competitive Benchmarking for ADAS and Autonomous Sensor Maintenance Equipment Manufacturers in China

- Figure 21: China ADAS and Autonomous Sensor Maintenance Equipment Market, $Thousand and Thousand Units, 2021-2032

- Figure 22: Competitive Benchmarking for ADAS and Autonomous Sensor Maintenance Equipment Manufacturers in Asia-Pacific and Japan

- Figure 23: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market, $Thousand and Thousand Units, 2021-2032

- Figure 24: Competitive Benchmarking for the ADAS and Autonomous Sensor Maintenance Equipment Market, 2021

- Figure 25: Research Methodology

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

- Figure 28: Assumptions and Limitations

List of Tables

- Table 1: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market Overview, Value

- Table 2: Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market Overview, Volume

- Table 3: Key Companies Profiled

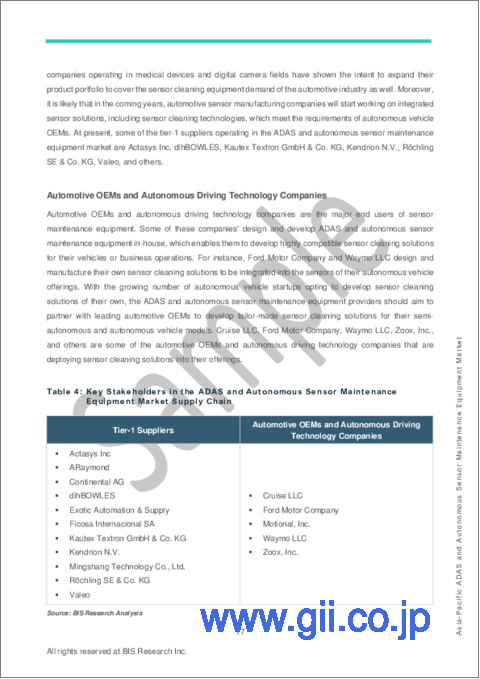

- Table 4: Key Stakeholders in the ADAS and Autonomous Sensor Maintenance Equipment Market Supply Chain

- Table 5: Consortiums, Associations, and Regulatory Bodies in the Automotive Ecosystem

- Table 6: ADAS and Autonomous Sensor Maintenance Equipment Market (by Region), $Thousand, 2021-2032

- Table 7: ADAS and Autonomous Sensor Maintenance Equipment Market (by Region), Thousand Units, 2021-2032

- Table 8: China ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), $Thousand, 2021-2032

- Table 9: China ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Thousand Units, 2021-2032

- Table 10: China ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), $Thousand, 2021-2032

- Table 11: China ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Thousand Units, 2021-2032

- Table 12: China ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), $Thousand, 2021-2032

- Table 13: China ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Thousand Units, 2021-2032

- Table 14: China ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), $Thousand, 2021-2032

- Table 15: China ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Thousand Units, 2021-2032

- Table 16: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), $Thousand, 2021-2032

- Table 17: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Thousand Units, 2021-2032

- Table 18: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), $Thousand, 2021-2032

- Table 19: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Thousand Units, 2021-2032

- Table 20: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), $Thousand, 2021-2032

- Table 21: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Thousand Units, 2021-2032

- Table 22: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), $Thousand, 2021-2032

- Table 23: Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Thousand Units, 2021-2032

- Table 24: Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), $Thousand, 2021-2032

- Table 25: Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Thousand Units, 2021-2032

- Table 26: Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), $Thousand, 2021-2032

- Table 27: Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Thousand Units, 2021-2032

- Table 28: Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), $Thousand, 2021-2032

- Table 29: Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Thousand Units, 2021-2032

- Table 30: Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), $Thousand, 2021-2032

- Table 31: Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Thousand Units, 2021-2032

- Table 32: South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), $Thousand, 2021-2032

- Table 33: South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Thousand Units, 2021-2032

- Table 34: South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), $Thousand, 2021-2032

- Table 35: South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Thousand Units, 2021-2032

- Table 36: South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), $Thousand, 2021-2032

- Table 37: South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Thousand Units, 2021-2032

- Table 38: South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), $Thousand, 2021-2032

- Table 39: South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Thousand Units, 2021-2032

- Table 40: India ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), $Thousand, 2021-2032

- Table 41: India ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Thousand Units, 2021-2032

- Table 42: India ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), $Thousand, 2021-2032

- Table 43: India ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Thousand Units, 2021-2032

- Table 44: India ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), $Thousand, 2021-2032

- Table 45: India ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Thousand Units, 2021-2032

- Table 46: India ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), $Thousand, 2021-2032

- Table 47: India ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Thousand Units, 2021-2032

- Table 48: Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), $Thousand, 2021-2032

- Table 49: Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Thousand Units, 2021-2032

- Table 50: Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), $Thousand, 2021-2032

- Table 51: Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Thousand Units, 2021-2032

- Table 52: Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), $Thousand, 2021-2032

- Table 53: Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Thousand Units, 2021-2032

- Table 54: Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), $Thousand, 2021-2032

- Table 55: Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Thousand Units, 2021-2032

- Table 56: Market Share Range of the Key Companies for the ADAS and Autonomous Sensor Maintenance Equipment Market, 2021

- Table 57: Mingshang Technology Co., Ltd.: Product and Service Portfolio

- Table 58: U.S. Automotive Production, Thousand Units, 2021-2032

- Table 59: U.S. ADAS Integrated Automotive Production, Thousand Units, 2021-2032

- Table 60: U.S. ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Thousand Units, 2021-2032

“The Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market (excluding China) Expected to Reach $27,774.6 Thousand by 2032.”

Introduction to Asia-Pacific ADAS and Autonomous Sensor Maintenance Equipment Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2022 - 2032 |

| 2022 Evaluation | $381.5 Thousand |

| 2032 Forecast | $27,774.6 Thousand |

| CAGR | 53.54% |

The Asia-Pacific ADAS and autonomous sensor maintenance equipment market (excluding China) was valued at $381.5 thousand in 2022 and is expected to reach $27,774.6 thousand by 2032, growing at a CAGR of 53.54% during the forecast period 2022-2032. The growth of the ADAS and autonomous sensor maintenance equipment market is projected to result from the rising desire for autonomous driving and a heightened emphasis on vehicle safety, particularly concerning semi-autonomous and fully autonomous vehicles.

Market Introduction

The APAC region is witnessing substantial growth in the ADAS and autonomous sensor maintenance equipment market. This growth is characterized by a surge in the number of companies offering solutions for ADAS and autonomous sensor maintenance. The rapid advancements in autonomous driving technologies and the proliferation of sensors in vehicles are driving the adoption of ADAS and sensor maintenance solutions across the APAC region. The increasing demand for autonomous vehicles, driven by benefits like enhanced safety, improved energy efficiency, reduced traffic congestion, and enhanced accessibility, is contributing to this trend. Level 1 and level 2 autonomous vehicles are already present on roads in most automotive markets. As the demand for ADAS and autonomous sensor maintenance solutions continues to grow in the forecast period, competition among established and emerging equipment providers is expected to intensify in the APAC ADAS and autonomous sensor maintenance equipment industry.

Market Segmentation:

Segmentation 1: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Robotaxis

Segmentation 2: by Propulsion Type

- Electric Vehicle (EV)

- Internal Combustion Engine (ICE) Vehicle

Segmentation 3: by Level of Autonomy

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

Segmentation 4: by Product Type

- Fluids

- Fluids and Wiper Blade

- Fluids and Air Jet

- Others

Segmentation 5: by Country

- Japan

- South Korea

- India

- Rest-of-Asia-Pacific and Japan

How can this report add value to an organization?

Product/Innovation Strategy: The leading automotive OEMs are continuously working to manufacture and sell vehicles with higher autonomous driving capabilities, i.e., level 3 and above. The growing need for affordable and high-performing ADAS and autonomous sensor maintenance equipment is one of the major factors for the growth of the APACADAS and autonomous sensor maintenance equipment market. The market is more on the consolidated side at present, where ADAS and autonomous maintenance equipment providers have been successful to a certain extent in strengthening their market position in the market, with a few automotive OEMs and autonomous vehicle businesses working on such solutions in-house. However, with the rise of autonomous driving, the existing established players are expected to face stiff competition from emerging players. Moreover, partnerships and collaborations are expected to play a crucial role in strengthening market position over the coming years, with the companies focusing on bolstering their technological capabilities and gaining a dominant market share in the ADAS and autonomous sensor maintenance equipment industry.

Growth/Marketing Strategy: The APAC ADAS and autonomous sensor maintenance equipment market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships, agreements, and collaborations.

Competitive Strategy: The key players in the APAC ADAS and autonomous sensor maintenance equipment market analyzed and profiled in the study include ADAS and autonomous sensor maintenance equipment providers that develop, maintain, and market ADAS and autonomous sensor maintenance equipment. Moreover, a detailed competitive benchmarking of the players operating in the APAC ADAS and autonomous sensor maintenance equipment market has been done to help the reader understand the ways in which players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

Executive Summary

Scope of the Study

1. Markets

- 1.1. Industry Outlook

- 1.1.1. Supply Chain Analysis

- 1.1.2. Industry Trends

- 1.1.2.1. Ultrasonic Cleaning for Autonomous Vehicle Sensors

- 1.1.2.2. Passive Aerodynamics

- 1.1.3. Consortiums, Associations, and Regulatory Bodies

- 1.2. Business Dynamics

- 1.2.1. Business Drivers

- 1.2.1.1. Growing Demand for Autonomous Driving

- 1.2.1.2. Increasing Focus on Vehicle Safety for Semi-Autonomous and Autonomous Vehicles

- 1.2.2. Business Restraints

- 1.2.2.1. Optimization of Cleaning Fluid Usage

- 1.2.2.2. System Design Related Challenges

- 1.2.3. Business Strategies

- 1.2.4. Corporate Strategies

- 1.2.4.1. Partnerships, Joint Ventures, Collaborations, and Alliances

- 1.2.5. Business Opportunities

- 1.2.5.1. Increasing Focus on Technological Advancements in Sensor Maintenance Equipment

- 1.2.5.2. Sensor Cleaning Solutions for Highly and Fully Automated Vehicles

- 1.2.1. Business Drivers

- 1.3. Impact of COVID-19 on the Industry

2. Regions

- 2.1. China

- 2.1.1. Market

- 2.1.1.1. Buyer Attributes

- 2.1.1.2. Key Solution Providers in China

- 2.1.1.3. Competitive Benchmarking

- 2.1.1.4. Business Challenges

- 2.1.1.5. Business Drivers

- 2.1.2. Applications

- 2.1.2.1. China ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Value and Volume Data, 2021-2032

- 2.1.2.2. China ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Value and Volume Data, 2021-2032

- 2.1.2.3. China ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Value and Volume Data, 2021-2032

- 2.1.3. Products

- 2.1.3.1. China ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Value and Volume Data, 2021-2032

- 2.1.1. Market

- 2.2. Asia-Pacific and Japan

- 2.2.1. Market

- 2.2.1.1. Buyer Attributes

- 2.2.1.2. Key Solution Providers in Asia-Pacific and Japan

- 2.2.1.3. Competitive Benchmarking

- 2.2.1.4. Business Challenges

- 2.2.1.5. Business Drivers

- 2.2.2. Applications

- 2.2.2.1. Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Value and Volume Data, 2021-2032

- 2.2.2.2. Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Value and Volume Data, 2021-2032

- 2.2.2.3. Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Value and Volume Data, 2021-2032

- 2.2.3. Products

- 2.2.3.1. Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Value and Volume Data, 2021-2032

- 2.2.4. Asia-Pacific and Japan (by Country)

- 2.2.4.1. Japan

- 2.2.4.1.1. Market

- 2.2.4.1.1.1. Buyers Attributes

- 2.2.4.1.1.2. Key Solution Providers in Japan

- 2.2.4.1.1.3. Business Challenges

- 2.2.4.1.1.4. Business Drivers

- 2.2.4.1.2. Applications

- 2.2.4.1.2.1. Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Value and Volume Data, 2021-2032

- 2.2.4.1.2.2. Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Value and Volume Data, 2021-2032

- 2.2.4.1.2.3. Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Value and Volume Data, 2021-2032

- 2.2.4.1.3. Products

- 2.2.4.1.3.1. Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Value and Volume Data, 2021-2032

- 2.2.4.1.1. Market

- 2.2.4.2. South Korea

- 2.2.4.2.1. Market

- 2.2.4.2.1.1. Buyers Attributes

- 2.2.4.2.1.2. Key Solution Providers in South Korea

- 2.2.4.2.1.3. Business Challenges

- 2.2.4.2.1.4. Business Drivers

- 2.2.4.2.2. Applications

- 2.2.4.2.2.1. South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Value and Volume Data, 2021-2032

- 2.2.4.2.2.2. South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Value and Volume Data, 2021-2032

- 2.2.4.2.2.3. South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Value and Volume Data, 2021-2032

- 2.2.4.2.3. Products

- 2.2.4.2.3.1. South Korea ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Value and Volume Data, 2021-2032

- 2.2.4.2.1. Market

- 2.2.4.3. India

- 2.2.4.3.1. Market

- 2.2.4.3.1.1. Buyer Attributes

- 2.2.4.3.1.2. Key Solution Providers in India

- 2.2.4.3.1.3. Business Challenges

- 2.2.4.3.1.4. Business Drivers

- 2.2.4.3.2. Applications

- 2.2.4.3.2.1. India ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Value and Volume Data, 2021-2032

- 2.2.4.3.2.2. India ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Value and Volume Data, 2021-2032

- 2.2.4.3.2.3. India ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Value and Volume Data, 2021-2032

- 2.2.4.3.3. Products

- 2.2.4.3.3.1. India ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Value and Volume Data, 2021-2032

- 2.2.4.3.1. Market

- 2.2.4.4. Rest-of-Asia-Pacific and Japan

- 2.2.4.4.1. Market

- 2.2.4.4.1.1. Buyers Attributes

- 2.2.4.4.1.2. Key Solution Providers in Rest-of-Asia-Pacific and Japan

- 2.2.4.4.1.3. Business Challenges

- 2.2.4.4.1.4. Business Drivers

- 2.2.4.4.2. Applications

- 2.2.4.4.2.1. Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Vehicle Type), Value and Volume Data, 2021-2032

- 2.2.4.4.2.2. Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Propulsion Type), Value and Volume Data, 2021-2032

- 2.2.4.4.2.3. Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Level of Autonomy), Value and Volume Data, 2021-2032

- 2.2.4.4.3. Products

- 2.2.4.4.3.1. Rest-of-Asia-Pacific and Japan ADAS and Autonomous Sensor Maintenance Equipment Market (by Product Type), Value and Volume Data, 2021-2032

- 2.2.4.4.1. Market

- 2.2.4.1. Japan

- 2.2.1. Market

3. Markets - Competitive Benchmarking & Company Profiles

- 3.1. Competitive Benchmarking

- 3.1.1. Competitive Position Matrix

- 3.1.1.1. Key Steps for Competitive Position Matrix

- 3.1.1.2. Analysis of Key Companies

- 3.1.2. Market Share Range

- 3.1.1. Competitive Position Matrix

- 3.2. Company Profiles

- 3.2.1. Private Companies

- 3.2.1.1. Mingshang Technology Co., Ltd.

- 3.2.1.1.1. Company Overview

- 3.2.1.1.2. Role of Mingshang Technology Co., Ltd. in the ADAS and Autonomous Sensor Maintenance Equipment Market

- 3.2.1.1.3. Product Portfolio

- 3.2.1.1.4. Analyst View

- 3.2.1.1. Mingshang Technology Co., Ltd.

- 3.2.1. Private Companies

4. Research Methodology

- 4.1. Data Sources

- 4.1.1. Primary Data Sources

- 4.1.2. Secondary Data Sources

- 4.2. Data Triangulation

- 4.3. Market Estimation and Forecast

- 4.3.1. Bottom-Up Approach

- 4.3.2. U.S. ADAS and Autonomous Sensor Maintenance Equipment Market Estimation Process:

- 4.3.3. Factors for Data Prediction and Modeling