|

|

市場調査レポート

商品コード

1352085

防衛向け没入型リアリティ市場- 世界および地域別分析:タイプ別、コンポーネント別、デバイス別、用途別、地域別 - 分析と予測(2023年~2033年)Immersive Reality for Defense Market - A Global and Regional Analysis: Focus on Type, Component, Devices, Application, and Region - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 防衛向け没入型リアリティ市場- 世界および地域別分析:タイプ別、コンポーネント別、デバイス別、用途別、地域別 - 分析と予測(2023年~2033年) |

|

出版日: 2023年09月22日

発行: BIS Research

ページ情報: 英文 211 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の防衛向け没入型リアリティの市場規模は、2023年に26億4,000万米ドルとなりました。

同市場は、2023年~2033年にかけて18.78%のCAGRで拡大し、2033年までに147億5,000万米ドルに達すると予測されています。

防衛用途の没入型リアリティの分野は、訓練、シミュレーション、作戦の有効性を高めるための高度な技術ソリューションに対するニーズの高まりに後押しされ、防衛・軍事産業における極めて重要な領域として急速に浮上しています。没入型リアリティとは、ユーザーや訓練生を人工的な環境に包み込み、これまでにない忠実さと没入感で実世界のシナリオを再現できる多感覚体験を提供する一連の技術を指します。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023 - 2033 |

| 2023 の評価 | 26億4,000万米ドル |

| 2033 の予測 | 147億5,000万米ドル |

| CAGR | 18.78% |

この分野では、さまざまな分野が中心的な役割を果たし、それぞれが没入型リアリティ技術の革新的な利用を通じて防衛能力の変革に貢献しています。訓練とシミュレーションは、兵士、パイロット、その他の防衛要員のための現実的な訓練環境を作り出す上で、没入型リアリティが極めて重要な役割を果たす重要な分野です。このような没入型シミュレーションにより、隊員は複雑でストレスの高い状況下でスキルを練習し、洗練させることができ、最終的には実世界のシナリオにおける即応性とパフォーマンスを高めることができます。

没入型リアリティはまた、軍事戦略家がさまざまな戦術シナリオを視覚化してシミュレートすることで、より良い意思決定と戦略立案を可能にする、任務計画と分析の分野でも大きな進歩を遂げています。この分野には、貴重な状況認識やデータ可視化ツールを提供する仮想現実(VR)や拡張現実(AR)などの技術が含まれます。

さらに、没入型リアリティの統合は、軍事装備や車両の設計とテストの方法に革命をもたらしています。VRとARを通じて、エンジニアと設計者は仮想環境で試作品を作成し評価することができ、性能と機能を最適化しながら時間と資源を節約することができます。

防衛作戦や状況認識の領域では、兵士や指揮官に強化されたデータ可視化、ナビゲーション補助、リアルタイム情報オーバーレイを提供することで、没入型リアリティソリューションの恩恵を受けています。これらの技術は、現場でのコミュニケーション、調整、意思決定を改善します。

防衛のための没入型リアリティの分野は、軍事技術の変革の原動力として立ちはだかり、従来の防衛パラダイムに課題する幅広い技術とアプリケーションを提供します。防衛機関や軍隊が進化する脅威や作戦上の課題に直面し続ける中、没入型リアリティの統合は、訓練、シミュレーション、任務計画、重要な防衛作戦の遂行において達成できることの限界を再定義する態勢を整えています。

当レポートでは、世界の防衛向け没入型リアリティ市場について調査し、市場の概要とともに、タイプ別、コンポーネント別、デバイス別、用途別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場

- 業界の展望

- ビジネスダイナミクス

第2章 用途

- 世界の防衛向け没入型リアリティ市場(用途別)

- 市場概要

- 3Dモデリング

- シミュレーションとトレーニング

- メンテナンスと監視

- 状況認識

第3章 製品

- 世界の防衛向け没入型リアリティ市場(タイプ別)

- 市場概要

- 拡張現実(AR)

- 仮想現実(VR)

- 複合現実(MR)

- 世界の防衛向け没入型リアリティ市場(コンポーネント別)

- 市場概要

- センサー

- カメラ

- プロセッサー

- モジュール

- メモリ

- 画面

- その他

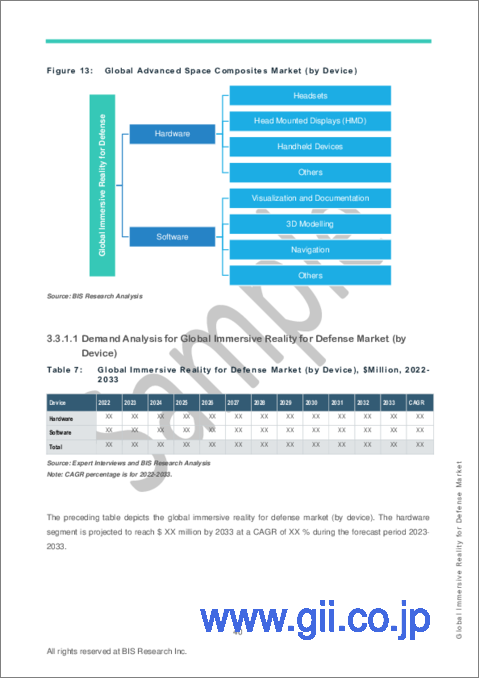

- 世界の防衛向け没入型リアリティ市場(デバイス別)

- 市場概要

- ハードウェア

- ソフトウェア

第4章 地域

- 世界の防衛向け没入型リアリティ市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- Bohemia Interactive Simulations

- CAE, Inc

- HTX Labs

- Indra Sistemas, S.A

- Lockheed Martin

- Red Six Aerospace, Inc

- SimX

- Thales Group

- VRgineers, Inc

- Varjo

- その他の主要参入企業プロファイル

第6章 成長の機会と推奨事項

- 成長の機会

- 没入型リアリティソリューションメーカー

- データの予測とモデリングの要素

List of Figures

- Figure 1: Global Immersive Reality for Defense Market, $Billion, 2022-2033

- Figure 2: Global Immersive Reality for Defense (by Application), $Million, 2022 and 2033

- Figure 3: Global Immersive Reality for Defense Market (by Type), $Million, 2022 and 2033

- Figure 4: Global Immersive Reality for Defense Market (by Component), $Million, 2022 and 2033

- Figure 5: Global Immersive Reality for Defense Market (by Device), $Million, 2022 and 2033

- Figure 6: Global Immersive Reality for Defense Market (by Region), $Billion, 2033

- Figure 7: Global Immersive Reality for Defense Market Coverage

- Figure 8: Supply Chain Analysis

- Figure 9: Immersive Reality for Defense Market, Business Dynamics

- Figure 10: Share of Key Market Developments, January 2021-September 2023

- Figure 11: Global Immersive Reality for Defense Market (by Application)

- Figure 12: Global Immersive Reality for Defense Market (by Type)

- Figure 13: Global Immersive Reality for Defense Market (by Component)

- Figure 14: Global Immersive Reality for Defense Market (by Device)

- Figure 15: Competitive Benchmarking of Key Players

- Figure 16: Research Methodology

- Figure 17: Top-Down and Bottom-Up Approach

- Figure 18: Assumptions and Limitations

List of Tables

- Table 1: Startups and Investments, 2021-2023

- Table 2: Patents, January 2021-September 2023

- Table 3: Mergers and Acquisitions, January 2021-September 2023

- Table 4: Partnerships, Collaborations, Agreements, and Contracts, January 2021-September 2023

- Table 5: Global Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 6: Global Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 7: Global Immersive Reality for Defense Market (by Component), $Million, 2022-2033

- Table 8: Global Immersive Reality for Defense Market (by Device), $Million, 2022-2033

- Table 9: Global Immersive Reality for Defense Market (by Hardware), $Million, 2022-2033

- Table 10: Global Immersive Reality for Defense Market (by Software), $Million, 2022-2033

- Table 11: Key Software Solutions Utilized for Immersive Defense Applications

- Table 12: Global Immersive Reality for Defense Market (by Region), $Million, 2022-2033

- Table 13: North America Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 14: North America Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 15: U.S. Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 16: U.S. Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 17: Canada Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 18: Canada Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 19: Europe Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 20: Europe Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 21: U.K. Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 22: U.K. Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 23: Germany Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 24: Germany Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 25: France Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 26: France Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 27: Russia Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 28: Russia Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 29: Rest-of-Europe Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 30: Rest-of-Europe Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 31: Asia-Pacific Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 32: Asia-Pacific Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 33: China Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 34: China Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 35: Japan Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 36: Japan Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 37: India Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 38: India Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 39: Rest-of-Asia-Pacific Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 40: Rest-of-Asia-Pacific Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 41: Middle East Immersive Reality for Defense Market (by Application), $Million, 2022-2033

- Table 42: Middle East Immersive Reality for Defense Market (by Type), $Million, 2022-2033

- Table 43: Benchmarking and Weightage Parameters

- Table 44: Bohemia Interactive Simulations: Product Portfolio

- Table 45: Bohemia Interactive Simulations: Mergers and Acquisitions

- Table 46: Bohemia Interactive Simulations: Partnerships, Collaborations, Agreements, and Contracts

- Table 47: CAE, Inc.: Product Portfolio

- Table 48: CAE, Inc.: Mergers and Acquisitions

- Table 49: CAE, Inc.: Partnerships, Collaborations, Agreements, and Contracts

- Table 50: HTX Labs: Product Portfolio

- Table 51: HTX Labs: Partnerships, Collaborations, Agreements, and Contracts

- Table 52: Indra Sistemas, S.A.: Product Portfolio

- Table 53: Indra Sistemas, S.A.: Mergers and Acquisitions

- Table 54: Indra Sistemas, S.A.: Partnerships, Collaborations, Agreements, and Contracts

- Table 55: Lockheed Martin: Product Portfolio

- Table 56: Lockheed Martin: Partnerships, Collaborations, Agreements, and Contracts

- Table 57: Red Six Aerospace, Inc.: Product Portfolio

- Table 58: Red Six Aerospace, Inc.: Partnerships, Collaborations, Agreements, and Contracts

- Table 59: SimX: Product Portfolio

- Table 60: SimX: Partnerships, Collaborations, Agreements, and Contracts

- Table 61: Thales Group: Product Portfolio

- Table 62: Thales Group: Mergers and Acquisitions

- Table 63: VRgineers, Inc.: Product Portfolio

- Table 64: VRgineers, Inc.: Partnerships, Collaborations, Agreements, and Contracts

- Table 65: Varjo: Product Portfolio

- Table 66: Varjo: Partnerships, Collaborations, Agreements, and Contracts

- Table 67: Other Key Players Profile in the Immersive Reality for Defense Market

“Global Immersive Reality for Defense Market to Reach $14.75 Billion by 2033.”

Introduction to Immersive Reality for Defense Applications

The field of immersive reality for defense applications is rapidly emerging as a pivotal domain within the defense and military industry, driven by the increasing need for advanced technological solutions to enhance training, simulation, and operational effectiveness. Immersive reality refers to a spectrum of technologies that envelop users/trainees in synthetic environments, providing a multisensory experience that can replicate real-world scenarios with unprecedented fidelity and immersion.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $2.64 Billion |

| 2033 Forecast | $14.75 Billion |

| CAGR | 18.78% |

Within this field, various segments are taking center stage, each contributing to the transformation of defense capabilities through the innovative use of immersive reality technologies. Training and simulation represent a critical sector where immersive reality plays a pivotal role in creating realistic training environments for soldiers, pilots, and other defense personnel. These immersive simulations enable personnel to practice and refine their skills in complex and high-stress situations, ultimately enhancing readiness and performance in real-world scenarios.

Immersive reality is also making significant strides in mission planning and analysis, where it allows military strategists to visualize and simulate various tactical scenarios, enabling better decision-making and strategic planning. This segment encompasses technologies such as virtual reality (VR) and augmented reality (AR) that provide valuable situational awareness and data visualization tools.

Additionally, the integration of immersive reality is revolutionizing the way military equipment and vehicles are designed and tested. Through VR and AR, engineers and designers can create and assess prototypes in virtual environments, saving time and resources while optimizing performance and functionality.

The realm of defense operations and situational awareness benefits from immersive reality solutions by providing soldiers and commanders with enhanced data visualization, navigation aids, and real-time information overlays. These technologies improve communication, coordination, and decision-making in the field.

The immersive reality for defense applications field stands as a driving force behind the transformation of military technologies, offering a wide array of technologies and applications that challenge traditional defense paradigms. As defense agencies and armed forces continue to face evolving threats and operational challenges, the integration of immersive reality is poised to redefine the limits of what can be achieved in training, simulation, mission planning, and the execution of critical defense operations.

Market Introduction

Immersive reality technologies are rapidly reshaping the landscape of defense applications, offering a host of benefits such as enhanced training, simulation, and operational efficiency. These cutting-edge solutions provide cost-effectiveness, realism, and multifaceted functionalities, making them indispensable in modern defense operations. One of the primary applications of immersive reality in the defense sector is advanced training and simulation. Virtual reality (VR) and augmented reality (AR) systems enable soldiers to engage in realistic combat scenarios, hone their skills, and develop tactical expertise in a safe and controlled environment. This not only reduces training costs but also enhances the effectiveness of military personnel.

In addition to training, immersive reality is also instrumental in mission planning and execution. Heads-up displays (HUDs) and augmented reality systems are used to provide real-time information to soldiers, pilots, and commanders, improving situational awareness and decision-making on the battlefield. Furthermore, immersive reality plays a pivotal role in remote operations and drone piloting. Operators can immerse themselves in the battlefield through VR headsets, controlling unmanned vehicles and drones with precision and accuracy.

The present state of the immersive reality for the defense market is marked by substantial growth driven by multiple factors. Foremost among them is the pressing need to enhance soldier readiness and preparedness for complex and diverse threats. Immersive reality solutions offer highly realistic and adaptable training scenarios that replicate real-world conditions, enabling soldiers to hone their skills in a safe and controlled environment. Additionally, the integration of immersive technologies into defense operations optimizes mission planning, enhances communication, and supports real-time decision-making on the battlefield.

The expanding landscape of asymmetric warfare, urban combat scenarios, and the growing use of unmanned systems have further underscored the significance of immersive reality technologies in defense applications. The ability to visualize, analyze, and respond to dynamic situations in real-time through immersive interfaces is becoming a critical asset for military personnel and commanders alike.

Market Segmentation:

Segmentation 1: by Application

- 3D Modeling

- Simulation and Training

- Maintenance and Monitoring

- Situational Awareness

Simulation and Training Segment to Dominate the Global Immersive Reality for Defense Market (by Application)

The global immersive reality for defense market (by application) is expected to generate huge revenues from the simulation and training segment, followed by the situational awareness segment. The simulation and training segment reported a revenue generation of $994.7 million in 2022 and is expected to grow at a CAGR of 18.79% during the forecast period 2023-2033.

Segmentation 2: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

North America accounted for the highest market share in 2022 in the global immersive reality for defense market and registered a CAGR of 18.47%, owing to a significant number of companies based in the region. North America's growth is driven by various activities in the U.S. defense industry. In North America, the U.S. has the largest share of growth in the immersive reality for defense market and is anticipated to grow at a CAGR of 18.33%

Segmentation 3: by Type

- Augmented Reality (AR)

- Virtual Reality (VR)

- Mixed Reality (MR)

Augmented Reality Segment to Lead the Global Immersive Reality for Defense Market (by Type)

The global immersive reality for defense market (by type) is expected to generate huge revenues from the augmented reality (AR) segment, followed by the virtual reality (VR) segment. The AR segment reported a revenue generation of $1,047.0 million in 2022 and is expected to grow at a CAGR of 18.75% during the forecast period 2023-2033.

Segmentation 4: by Component

- Sensors

- Camera

- Processor

- Modules

- Memory

- Display

- Others

Camera Segment to Lead the Global Immersive Reality for Defense Market (by Component)

The global immersive reality for defense market (by component) is expected to be led by the camera segment. The camera segment reported a revenue generation of $333.0 million in 2022 and is expected to grow at a CAGR of 18.83% during the forecast period 2023-2033.

Segmentation 5: by Device

- Hardware

- Software

Hardware Segment to Lead the Global Immersive Reality for Defense Market (by Device)

The global immersive reality for defense market (by device) is expected to be led by the hardware segment. The hardware segment reported a revenue generation of $1,329.2 million in 2022 and is expected to grow at a CAGR of 18.76% during the forecast period 2023-2033.

Recent Developments in the Global Immersive Reality for Defense Market

- In August 2023, HTX Labs and Vinci VR announced a strategic partnership to develop and deliver immersive training solutions using the EMPACT platform. The EMPACT platform is a comprehensive solution for secure, centralized content management, self-authoring courseware creation, and deployment of this content and courseware across a spectrum of hardware and devices.

- In June 2023, Red Six Aerospace, Inc. announced a partnership with the U.K.'s Royal Air Force (RAF) and the National Security Strategic Investment Fund (NSSIF) for augmentation of the U.K. military's flying training system, known as UKMFTS, through the integration of Advanced Tactical Augmented Reality System (ATARS).

- In May 2023, HTX Labs won a small business innovation research (SBIR) Phase III contract with the U.S. Air Force to facilitate the Tech Training Transformation Cloud (T3Cloud) solution, a significant advancement that would amplify the utilization and influence of immersive learning throughout the Air Force Academy.

- In April 2023, Applied Virtual Simulation (AVS) won a $11.8 million contract from the Australian Defence Force (ADF) for provisioning a suite of common simulation software (CSS) solutions to support the ADF's Land Simulation Core 2.0 Tranche 1 program.

- In March 2023, Leonardo and Varjo announced a partnership to collaboratively develop the capabilities of Leonardo's aircraft training solutions using Varjo's MR systems. This development would utilize Varjo's XR-3 headset to enhance the pilot training experience across multiple operations.

Demand - Drivers, Challenges, and Opportunities

Market Demand Drivers: Increasing Need for Training with Enhanced Situational and Spatial Awareness toward Increased Soldier Lethality

The increasing demand for training solutions that augment situational and spatial awareness within the immersive reality (IR) for defense market is rooted in the imperative to enhance soldier lethality by means of comprehensive and advanced preparatory measures. This pivotal business driver factor underscores the critical role of immersive reality technologies in fundamentally redefining traditional defense training paradigms. Conventional training methodologies often falter in replicating the intricacies of complex operational environments and fail to impart soldiers with real-time, high-fidelity situational awareness. Immersive reality solutions decisively address this challenge by seamlessly fusing physical and digital realms, thereby empowering soldiers to engage in hyper-realistic training scenarios that closely emulate genuine combat conditions. Through the seamless integration of spatially accurate visualizations, auditory cues, and tangible haptic feedback, trainees can holistically internalize the terrain, threats, and tactical prospects, resulting in vastly improved decision-making capabilities and significantly expedited response times.

Market Challenges: Tackling Cybersickness and Information Overload

Cybersickness, a phenomenon akin to motion sickness induced by perceptual incongruence in immersive environments, poses a challenge to the widespread adoption of immersive reality solutions. The nature of these environments, designed to replicate real-world situations, can lead to sensory conflicts between visual and vestibular inputs, potentially resulting in discomfort, disorientation, and reduced operational effectiveness for defense personnel. Mitigating cybersickness requires a comprehensive approach encompassing hardware refinement, software optimization, and user adaptation strategies. Simultaneously, the surge of information overload in immersive reality scenarios presents another formidable challenge. The integration of diverse data streams, such as real-time sensor data, communication feeds, and augmented information overlays, can overwhelm users, impeding their ability to process, comprehend, and act upon critical information.

Market Opportunities: Development of Glass Box Systems

The XR-enabled see-through glass box systems for tanks are a cutting-edge advancement poised to revolutionize armored vehicle operations. XR integration into tanks through see-through glass box systems holds tremendous potential for enhancing agile operations by enabling the occupants to have a 360-degree scope of situational awareness. This innovation involves incorporating display panels onto the interior of tanks, which are seamlessly integrated with high-resolution cameras placed on the tank's exterior. These cameras capture the external environment in real time, and the processed video feed is projected onto the interior display panels. This allows tank crews to see through the tank's metal shell and effectively eliminate blind spots.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader to understand the different types of immersive solutions available for defense deployment and their potential globally. Moreover, the study provides the reader with a detailed understanding of the immersive reality for defense market by technology, inclusive of the key developments in the respective segments globally.

Growth/Marketing Strategy: The immersive reality for defense market has seen some major development by key players operating in the market, such as partnership, collaboration, and joint venture. The favored strategy for the collaboration between defense agencies and private players is primordially contracting the development and delivery of advanced materials and specialized composite components for space system applications. For instance, in April 2021, Microsoft Corporation won a fixed price purchase agreement valued at $21.88 billion from the U.S. Army for supplying 120,000 customized HoloLens MR headsets over a period of 10 years for the Integrated Visual Augmentation System (IVAS) program, planned to enhance the training and situational awareness capabilities of the U.S. Army's Close Combat Force (CCF). The IVAS integrates a variety of technologies within a single framework, enabling soldiers to engage in combat, rehearsals, and training seamlessly. This collection of functionalities harnesses existing high-resolution night vision, thermal imaging, and soldier-borne sensors, all unified into a cohesive heads-up display (HUD). The outcome is an enhanced level of situational awareness, the ability for precise target engagement, and more informed decision-making.

Competitive Strategy: Key players in the immersive reality for defense market have been analyzed and profiled in the study, inclusive of major segmentations and service offerings companies provide in the technology segments, respectively. Moreover, a detailed competitive benchmarking of the players operating in the immersive reality for defense market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the revenue pockets in the market.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, are employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Primary Research

The primary sources involve industry experts from the immersive reality for defense industry, including headset manufacturers, simulator manufacturers, immersive simulation solutions developers, and extended reality (XR) startups. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as The Defense Post, Virtual Reality Society, TechViz, VR/AR Association, Modern Battlespace, and XR Today, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as www.auganix.org and www.defense.gov.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights that are gathered from primary experts.

In the global immersive reality for defense market, established players account for 55% of the market, and small-scale players and startups account for 45% of the market. The primordial established commercial players and legacy companies are BAE Systems, CAE, Inc., Indra Sistemas, S.A., Thales Group, and Lockheed Martin, among others. The primordial startups and small-scale players include SimX, HTX Labs, VRgineers, Inc., AjnaLens, Red Six Aerospace Inc., and among others.

Key Companies Profiled:

|

|

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Global Immersive Reality for Defense Market: Overview

- 1.1.2 Ongoing and Upcoming Programs

- 1.1.2.1 U.S. Army's Squad Immersive Virtual Trainer (SiVT)

- 1.1.2.2 Remote Augmented Reality Maintenance Assistance (RARM-A)

- 1.1.2.3 Mixed and Immersive Reality Assessment Generation Engine (MIRAGE)

- 1.1.2.4 Virtual Battlespace Simulation (VBS) Training and Military Operations in Urbanized Terrain (MOUT) Training

- 1.1.3 Futuristic Trends in Immersive Reality

- 1.1.3.1 Neuromorphic Computing

- 1.1.3.2 Brain-Computer Interface (BCI) in Immersive Reality Solutions

- 1.1.3.3 Immersive Synthetic Training Environment (STE)

- 1.1.3.4 Tactical Augmented Reality (TAR)

- 1.1.3.5 Virtual Squad Training System (VSTS)

- 1.1.3.6 Artificial Intelligence (AI) Integration in AR-Based Military Simulations

- 1.1.4 Startups and Investment Landscape

- 1.1.5 Supply Chain Analysis

- 1.1.6 Patent Analysis

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Increasing Need for Training with Enhanced Situational and Spatial Awareness toward Increased Soldier Lethality

- 1.2.1.2 Development toward Multi-Domain Operations (MDO) Army by 2035

- 1.2.2 Business Challenges

- 1.2.2.1 Tackling Cybersickness and Information Overload

- 1.2.2.2 Security Concerns in Immersive Solutions

- 1.2.3 Business Strategies

- 1.2.3.1 Mergers and Acquisitions

- 1.2.4 Corporate Strategies

- 1.2.4.1 Partnerships, Collaborations, Agreements, and Contracts

- 1.2.5 Business Opportunities

- 1.2.5.1 Advancements toward Next-Generation Command and Control (C2) System Platforms

- 1.2.5.2 Development of Glass Box Systems

- 1.2.1 Business Drivers

2 Application

- 2.1 Global Immersive Reality for Defense Market (by Application)

- 2.1.1 Market Overview

- 2.1.1.1 Demand Analysis for Global Immersive Reality for Defense Market (by Application)

- 2.1.2 3D Modeling

- 2.1.3 Simulation and Training

- 2.1.4 Maintenance and Monitoring

- 2.1.5 Situational Awareness

- 2.1.1 Market Overview

3 Product

- 3.1 Global Immersive Reality for Defense Market (by Type)

- 3.1.1 Market Overview

- 3.1.1.1 Demand Analysis for Global Immersive Reality for Defense Market (by Type)

- 3.1.2 Augmented Reality (AR)

- 3.1.3 Virtual Reality (VR)

- 3.1.4 Mixed Reality (MR)

- 3.1.1 Market Overview

- 3.2 Global Immersive Reality for Market (by Component)

- 3.2.1 Market Overview

- 3.2.1.1 Demand Analysis for Global Immersive Reality for Defense Market (by Component)

- 3.2.2 Sensors

- 3.2.3 Camera

- 3.2.4 Processor

- 3.2.5 Modules

- 3.2.6 Memory

- 3.2.7 Display

- 3.2.8 Others

- 3.2.1 Market Overview

- 3.3 Global Immersive Reality for Defense Market (by Device)

- 3.3.1 Market Overview

- 3.3.1.1 Demand Analysis for Global Immersive Reality for Defense Market (by Device)

- 3.3.2 Hardware

- 3.3.2.1 Headsets

- 3.3.2.2 Head Mounted Displays (HMD)

- 3.3.2.3 Handheld Devices

- 3.3.2.4 Others

- 3.3.3 Software

- 3.3.3.1 Visualization and Documentation

- 3.3.3.2 3D Modeling

- 3.3.3.3 Navigation

- 3.3.3.4 Others

- 3.3.1 Market Overview

4 Region

- 4.1 Global Immersive Reality for Defense Market (by Region)

- 4.2 North America

- 4.2.1 Market

- 4.2.1.1 Key Players in North America

- 4.2.1.2 Business Drivers

- 4.2.1.3 Business Challenges

- 4.2.2 Application

- 4.2.2.1 North America Immersive Reality for Defense Market (by Application)

- 4.2.3 Product

- 4.2.3.1 North America Immersive Reality for Defense Market (by Type)

- 4.2.4 North America (by Country)

- 4.2.4.1 U.S.

- 4.2.4.1.1 Market

- 4.2.4.1.1.1 Key Players in the U.S.

- 4.2.4.1.2 Application

- 4.2.4.1.2.1 U.S. Immersive Reality for Defense Market (by Application)

- 4.2.4.1.3 Product

- 4.2.4.1.3.1 U.S. Immersive Reality for Defense Market (by Type)

- 4.2.4.1.1 Market

- 4.2.4.2 Canada

- 4.2.4.2.1 Market

- 4.2.4.2.1.1 Key Players in Canada

- 4.2.4.2.2 Application

- 4.2.4.2.2.1 Canada Immersive Reality for Defense Market (by Application)

- 4.2.4.2.3 Product

- 4.2.4.2.3.1 Canada Immersive Reality for Defense Market (by Type)

- 4.2.4.2.1 Market

- 4.2.4.1 U.S.

- 4.2.1 Market

- 4.3 Europe

- 4.3.1 Market

- 4.3.1.1 Key Players in Europe

- 4.3.1.2 Business Drivers

- 4.3.1.3 Business Challenges

- 4.3.2 Application

- 4.3.2.1 Europe Immersive Reality for Defense Market (by Application)

- 4.3.3 Product

- 4.3.3.1 Europe Immersive Reality for Defense Market (by Type)

- 4.3.4 Europe (by Country)

- 4.3.4.1 U.K.

- 4.3.4.1.1 Market

- 4.3.4.1.1.1 Key Players in the U.K.

- 4.3.4.1.2 Application

- 4.3.4.1.2.1 U.K. Immersive Reality for Defense Market (by Application)

- 4.3.4.1.3 Product

- 4.3.4.1.3.1 U.K. Immersive Reality for Defense Market (by Type)

- 4.3.4.1.1 Market

- 4.3.4.2 Germany

- 4.3.4.2.1 Market

- 4.3.4.2.1.1 Key Players in Germany

- 4.3.4.2.2 Application

- 4.3.4.2.2.1 Germany Immersive Reality for Defense Market (by Application)

- 4.3.4.2.3 Product

- 4.3.4.2.3.1 Germany Immersive Reality for Defense Market (by Type)

- 4.3.4.2.1 Market

- 4.3.4.3 France

- 4.3.4.3.1 Market

- 4.3.4.3.1.1 Key Players in France

- 4.3.4.3.2 Application

- 4.3.4.3.2.1 France Immersive Reality for Defense Market (by Application)

- 4.3.4.3.3 Product

- 4.3.4.3.3.1 France Immersive Reality for Defense Market (by Type)

- 4.3.4.3.1 Market

- 4.3.4.4 Russia

- 4.3.4.4.1 Market

- 4.3.4.4.1.1 Key Players in Russia

- 4.3.4.4.2 Application

- 4.3.4.4.2.1 Russia Immersive Reality for Defense Market (by Application)

- 4.3.4.4.3 Product

- 4.3.4.4.3.1 Russia Immersive Reality for Defense Market (by Type)

- 4.3.4.4.1 Market

- 4.3.4.5 Rest-of-Europe

- 4.3.4.5.1 Application

- 4.3.4.5.1.1 Rest-of-Europe Immersive Reality for Defense Market (by Application)

- 4.3.4.5.2 Product

- 4.3.4.5.2.1 Rest-of-Europe Immersive Reality for Defense Market (by Type)

- 4.3.4.5.1 Application

- 4.3.4.1 U.K.

- 4.3.1 Market

- 4.4 Asia-Pacific

- 4.4.1 Market

- 4.4.1.1 Key Players in Asia-Pacific

- 4.4.1.2 Business Drivers

- 4.4.1.3 Business Challenges

- 4.4.2 Application

- 4.4.2.1 Asia-Pacific Immersive Reality for Defense Market (by Application)

- 4.4.3 Product

- 4.4.3.1 Asia-Pacific Immersive Reality for Defense Market (by Type)

- 4.4.4 Asia-Pacific (by Country)

- 4.4.4.1 China

- 4.4.4.1.1 Market

- 4.4.4.1.1.1 Key Players in China

- 4.4.4.1.2 Application

- 4.4.4.1.2.1 China Immersive Reality for Defense Market (by Application)

- 4.4.4.1.3 Product

- 4.4.4.1.3.1 China Immersive Reality for Defense Market (by Type)

- 4.4.4.1.1 Market

- 4.4.4.2 Japan

- 4.4.4.2.1 Market

- 4.4.4.2.1.1 Key Players in Japan

- 4.4.4.2.2 Application

- 4.4.4.2.2.1 Japan Immersive Reality for Defense Market (by Application)

- 4.4.4.2.3 Product

- 4.4.4.2.3.1 Japan Immersive Reality for Defense Market (by Type)

- 4.4.4.2.1 Market

- 4.4.4.3 India

- 4.4.4.3.1 Market

- 4.4.4.3.1.1 Key Players in India

- 4.4.4.3.2 Application

- 4.4.4.3.2.1 India Immersive Reality for Defense Market (by Application)

- 4.4.4.3.3 Product

- 4.4.4.3.3.1 India Immersive Reality for Defense Market (by Type)

- 4.4.4.3.1 Market

- 4.4.4.4 Rest-of-Asia-Pacific

- 4.4.4.4.1 Application

- 4.4.4.4.1.1 Rest-of-Asia-Pacific Immersive Reality for Defense Market (by Application)

- 4.4.4.4.2 Product

- 4.4.4.4.2.1 Rest-of-Asia-Pacific Immersive Reality for Defense Market (by Type)

- 4.4.4.4.1 Application

- 4.4.4.1 China

- 4.4.1 Market

- 4.5 Rest-of-the-World

- 4.5.1 Market

- 4.5.1.1 Key Players in Rest-of-the World

- 4.5.1.2 Business Drivers

- 4.5.1.3 Business Challenges

- 4.5.2 Rest-of-the-World (by Region)

- 4.5.2.1 Middle East

- 4.5.2.1.1 Market

- 4.5.2.1.1.1 Key Players in the Middle East

- 4.5.2.1.2 Application

- 4.5.2.1.2.1 Middle East Immersive Reality for Defense Market (by Application)

- 4.5.2.1.3 Product

- 4.5.2.1.3.1 Middle East Immersive Reality for Defense Market (by Type)

- 4.5.2.1.1 Market

- 4.5.2.1 Middle East

- 4.5.1 Market

5 Competitive Benchmarking and Company Profiles

- 5.1 Competitive Benchmarking

- 5.2 Bohemia Interactive Simulations

- 5.2.1 Company Overview

- 5.2.1.1 Role of Bohemia Interactive Simulations in the Immersive Reality for Defense Market

- 5.2.1.2 Customers

- 5.2.1.3 Product Portfolio

- 5.2.2 Business Strategies

- 5.2.2.1 Mergers and Acquisitions

- 5.2.3 Corporate Strategies

- 5.2.3.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.2.4 Analyst View

- 5.2.1 Company Overview

- 5.3 CAE, Inc.

- 5.3.1 Company Overview

- 5.3.1.1 Role of CAE, Inc. in the Immersive Reality for Defense Market

- 5.3.1.2 Customers

- 5.3.1.3 Product Portfolio

- 5.3.2 Business Strategies

- 5.3.2.1 Mergers and Acquisitions

- 5.3.3 Corporate Strategies

- 5.3.3.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 5.3.4 Analyst View

- 5.3.1 Company Overview

- 5.4 HTX Labs

- 5.4.1 Company Overview

- 5.4.1.1 Role of HTX Labs in the Immersive Reality for Defense Market

- 5.4.1.2 Customers

- 5.4.1.3 Product Portfolio

- 5.4.2 Corporate Strategies

- 5.4.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 5.4.3 Analyst View

- 5.4.1 Company Overview

- 5.5 Indra Sistemas, S.A.

- 5.5.1 Company Overview

- 5.5.1.1 Role of Indra Sistemas, S.A. in the Immersive Reality for Defense Market

- 5.5.1.2 Customers

- 5.5.1.3 Product Portfolio

- 5.5.2 Business Strategies

- 5.5.2.1 Mergers and Acquisitions

- 5.5.3 Corporate Strategies

- 5.5.3.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 5.5.4 Analyst View

- 5.5.1 Company Overview

- 5.6 Lockheed Martin

- 5.6.1 Company Overview

- 5.6.1.1 Role of Lockheed Martin in the Immersive Reality for Defense Market

- 5.6.1.2 Customers

- 5.6.1.3 Product Portfolio

- 5.6.2 Corporate Strategies

- 5.6.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 5.6.3 Analyst View

- 5.6.1 Company Overview

- 5.7 Red Six Aerospace, Inc.

- 5.7.1 Company Overview

- 5.7.1.1 Role of Red Six Aerospace, Inc. in the Immersive Reality for Defense Market

- 5.7.1.2 Customers

- 5.7.1.3 Product Portfolio

- 5.7.2 Corporate Strategies

- 5.7.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 5.7.3 Analyst View

- 5.7.1 Company Overview

- 5.8 SimX

- 5.8.1 Company Overview

- 5.8.1.1 Role of SimX in the Immersive Reality for Defense Market

- 5.8.1.2 Customers

- 5.8.1.3 Product Portfolio

- 5.8.2 Corporate Strategies

- 5.8.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.8.3 Analyst View

- 5.8.1 Company Overview

- 5.9 Thales Group

- 5.9.1 Company Overview

- 5.9.1.1 Role of Thales Group in the Immersive Reality for Defense Market

- 5.9.1.2 Customers

- 5.9.1.3 Product Portfolio

- 5.9.2 Business Strategies

- 5.9.2.1 Mergers and Acquisitions

- 5.9.3 Analyst View

- 5.9.1 Company Overview

- 5.1 VRgineers, Inc.

- 5.10.1 Company Overview

- 5.10.1.1 Role of VRgineers, Inc. in the Immersive Reality for Defense Market

- 5.10.1.2 Customers

- 5.10.1.3 Product Portfolio

- 5.10.2 Corporate Strategies

- 5.10.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

- 5.10.3 Analyst View

- 5.10.1 Company Overview

- 5.11 Varjo

- 5.11.1 Company Overview

- 5.11.1.1 Role of Varjo in the Immersive Reality for Defense Market

- 5.11.1.2 Customers

- 5.11.1.3 Product Portfolio

- 5.11.2 Corporate Strategies

- 5.11.2.1 Partnerships, Collaborations, Agreements, and Contracts

- 5.11.3 Analyst View

- 5.11.1 Company Overview

- 5.12 Other Key Player Profiles

6 Growth Opportunities and Recommendations

- 6.1 Growth Opportunities

- 6.1.1 Growth Opportunity: Digital Twins in Immersive Defense Systems

- 6.1.1.1 Recommendations

- 6.1.1 Growth Opportunity: Digital Twins in Immersive Defense Systems

- 6.2 Immersive Reality Solutions Manufacturers

- 6.2.1 Growth Opportunity: Meta Lens based XR Devices

- 6.2.1.1 Recommendations

- 6.2.1 Growth Opportunity: Meta Lens based XR Devices

- 6.3 Factors for Data Prediction and Modeling