|

|

市場調査レポート

商品コード

1735437

マイクロバイオームシーケンシングの世界市場Global Microbiome Sequencing Market |

||||||

|

|||||||

| マイクロバイオームシーケンシングの世界市場 |

|

出版日: 2025年05月21日

発行: BCC Research

ページ情報: 英文 124 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のマイクロバイオームシーケンシングの市場規模は、2024年の15億ドルから、2029年末には37億ドルに拡大すると見込まれており、2024年から2029年にかけてのCAGRは19.3%と予測されています。

北米市場の規模は、2024年の5億3,980万ドルから、2029年末には12億ドルに拡大すると見込まれており、同期間のCAGRは17.6%とされています。

欧州市場の規模は、2024年の4億4,450万ドルから、2029年末には11億ドルに拡大すると見込まれており、同期間のCAGRは20.0%と予測されています。

当レポートでは、世界のマイクロバイオームシーケンシングの市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

第2章 市場概要

- 概要

- 見通し

- マクロ経済分析

- 米中貿易戦争の影響

第3章 市場力学

- 市場促進要因

- ゲノムあたりのコストの削減

- 政府の取り組みと資金

- シーケンシング技術の進歩

- 市場抑制要因

- データの複雑さとバイオインフォマティクスの課題

- 標準化されたプロトコルと参照データベースの欠如

- 助成金の不足

- 市場機会

- 個別化医療と診断

- 医薬品の発見と開発

- 農業と食品産業

第4章 規制状況

- 概要

第5章 新興技術と特許分析

- 新興技術

- ナノポアシーケンシング

- SMRTシーケンシング

- マイクロフルイディクスを用いたFACS

- メタトランスクリプトームシーケンシング

- 特許分析

- 地域パターン

第6章 市場セグメント分析

- 市場動向

- セグメンテーションの内訳

- マイクロバイオームシーケンシング:世界市場

- 市場分析:シーケンシング技術別

- ハイスループットシーケンシング

- サンガーシーケンス

- 第三世代シーケンシング

- 市場分析:コンポーネント別

- 試薬・キット

- 機器

- 市場分析::研究室タイプ別

- ウェットラボ

- ドライラボ

- 市場分析:用途別

- 疾患診断研究

- 個別化医療

- 創薬

- 遺伝子検査

- その他

- 市場分析:エンドユーザー別

- 製薬・バイオテクノロジー

- 学術センター・研究機関

- その他

- 地理的内訳

- 市場内訳:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第7章 競合情勢

- 主要サプライヤーおよびメーカー

- マイクロバイオームシーケンシング業界の企業ランキング

- 戦略分析

第8章 環境・社会・ガバナンス (ESG) の観点

- マイクロバイオームシーケンシング市場における持続可能性

- ESGリスクと格付け:データの理解

- BCCによる総論

第9章 付録

- 調査手法

- 出典

- 略語

- 企業プロファイル

- BASECLEAR BV

- CD GENOMICS

- CHARLES RIVER LABORATORIES

- COSMOSID

- CROWN BIOSCIENCE

- DANAHER CORP.

- EUROFINS SCIENTIFIC

- ILLUMINA INC.

- MERIEUX NUTRISCIENCES

- MICROBIOME INSIGHTS

- NOVOGENE CO. LTD.

- OXFORD NANOPORE TECHNOLOGIES PLC

- PACBIO

- QIAGEN

- THERMO FISHER SCIENTIFIC INC.

- Emerging Startups

- Pendulum

- Microba

- Biomesense

List of Tables

- Summary Table : Global Market for Microbiome Sequencing, by Region, Through 2029

- Table 1 : Cost Per Genome, 2019-2022

- Table 2 : FDA-Approved Personalized Medicines, 2015-2022

- Table 3 : Regulatory Scenario for Microbiome Sequencing, by Country

- Table 4 : Global Market for Microbiome Sequencing, Through 2029

- Table 5 : Global Market for Microbiome Sequencing, by Sequencing Technology, Through 2029

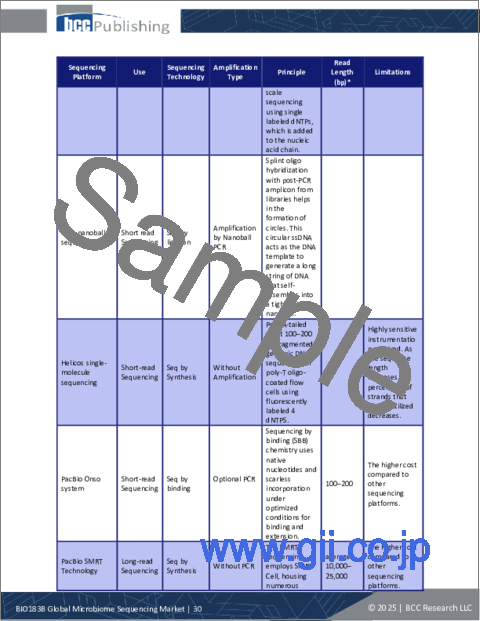

- Table 6 : NGS Technologies

- Table 7 : Experimental HTS Technology

- Table 8 : Illumina's Two-Channel SBS Instruments

- Table 9 : Comparison of Sanger Sequencing and Targeted NGS

- Table 10 : Global Market for Microbiome Sequencing, by Component, Through 2029

- Table 11 : Pricing of Microbiome Products, by Company

- Table 12 : Global Market for Microbiome Sequencing, by Laboratory Type, Through 2029

- Table 13 : Global Market for Microbiome Sequencing, by Application, Through 2029

- Table 14 : Global Market for Microbiome Sequencing Market, by End User, Through 2029

- Table 15 : Partnerships between Biotech and Pharma Companies for Microbiome Projects

- Table 16 : Academic Centers and Research Institutes Engaged in Microbiome Research

- Table 17 : Global Market for Microbiome Sequencing, by Region, Through 2029

- Table 18 : North American Market for Microbiome Sequencing, by Country, Through 2029

- Table 19 : North American Market for Microbiome Sequencing, by Sequencing Technology, Through 2029

- Table 20 : North American Market for Microbiome Sequencing, by Component, Through 2029

- Table 21 : North American Market for Microbiome Sequencing, by Laboratory Type, Through 2029

- Table 22 : North American Market for Microbiome Sequencing, by Application, Through 2029

- Table 23 : North American Market for Microbiome Sequencing, by End User, Through 2029

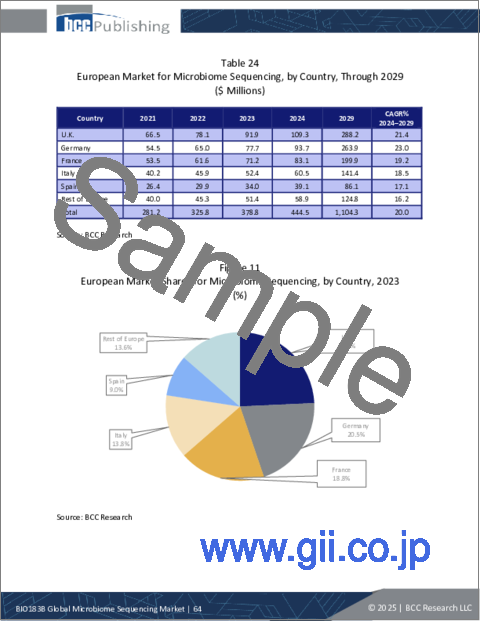

- Table 24 : European Market for Microbiome Sequencing, by Country, Through 2029

- Table 25 : European Market for Microbiome Sequencing, by Sequencing Technology, Through 2029

- Table 26 : European Market for Microbiome Sequencing, by Component, Through 2029

- Table 27 : European Market for Microbiome Sequencing, by Laboratory Type, Through 2029

- Table 28 : European Market for Microbiome Sequencing, by Application, Through 2029

- Table 29 : European Market for Microbiome Sequencing, by End User, Through 2029

- Table 30 : Asia-Pacific Market for Microbiome Sequencing, by Country, Through 2029

- Table 31 : Asia-Pacific Market for Microbiome Sequencing, by Sequencing Technology, Through 2029

- Table 32 : Asia-Pacific Market for Microbiome Sequencing, by Component, Through 2029

- Table 33 : Asia-Pacific Market for Microbiome Sequencing, by Laboratory Type, Through 2029

- Table 34 : Asia-Pacific Market for Microbiome Sequencing, by Application, Through 2029

- Table 35 : Asia-Pacific Market for Microbiome Sequencing, by End User, Through 2029

- Table 36 : MEA Market for Microbiome Sequencing, by Region, Through 2029

- Table 37 : MEA Market for Microbiome Sequencing, by Sequencing Technology, Through 2029

- Table 38 : MEA Market for Microbiome Sequencing, by Component, Through 2029

- Table 39 : MEA Market for Microbiome Sequencing, by Laboratory Type, Through 2029

- Table 40 : MEA Market for Microbiome Sequencing, by Application, Through 2029

- Table 41 : MEA Market for Microbiome Sequencing, by End User, Through 2029

- Table 42 : South American Market for Microbiome Sequencing, by Country, Through 2029

- Table 43 : South American Market for Microbiome Sequencing, by Sequencing Technology, Through 2029

- Table 44 : South American Market for Microbiome Sequencing, by Component, Through 2029

- Table 45 : South American Market for Microbiome Sequencing, by Laboratory Type, Through 2029

- Table 46 : South American Market for Microbiome Sequencing, by Application, Through 2029

- Table 47 : South American Market for Microbiome Sequencing, by End User, Through 2029

- Table 48 : Ranking of Leading Companies in the Microbiome Sequencing Industry, 2023

- Table 49 : Strategic Analysis in the Microbiome Sequencing Industry

- Table 50 : ESG Rankings for Major Microbiome Sequencing Companies*

- Table 51 : Information Sources for This Report

- Table 52 : Abbreviations Used in the Report

- Table 53 : BaseClear BV: Company Snapshot

- Table 54 : BaseClear BV: Product Portfolio

- Table 55 : CD Genomics: Company Snapshot

- Table 56 : CD Genomics: Product Portfolio

- Table 57 : Charles River Laboratories: Company Snapshot

- Table 58 : Charles River Laboratories: Financial Performance, FY 2023 and 2024

- Table 59 : Charles River Laboratories: Product Portfolio

- Table 60 : Charles River Laboratories: News/Key Developments, 2023

- Table 61 : CosmosID: Company Snapshot

- Table 62 : CosmosID: Product Portfolio

- Table 63 : CosmosID: News/Key Developments, 2022

- Table 64 : Crown Bioscience: Company Snapshot

- Table 65 : Crown Bioscience: Product Portfolio

- Table 66 : Danaher Corp.: Company Snapshot

- Table 67 : Danaher Corp.: Financial Performance, FY 2023 and 2024

- Table 68 : Danaher Corp.: Product Portfolio

- Table 69 : Danaher Corp.: News/Key Developments, 2024

- Table 70 : Eurofins Scientific: Company Snapshot

- Table 71 : Eurofins Scientific: Financial Performance, FY 2022 and 2023

- Table 72 : Eurofins Scientific: Product Portfolio

- Table 73 : Illumina Inc.: Company Snapshot

- Table 74 : Illumina Inc.: Financial Performance, FY 2023 and 2024

- Table 75 : Illumina Inc.: Product Portfolio

- Table 76 : Illumina Inc.: News/Key Developments, 2022-2025

- Table 77 : Merieux NutriSciences: Company Snapshot

- Table 78 : Merieux NutriSciences: Product Portfolio

- Table 79 : Microbiome Insights: Company Snapshot

- Table 80 : Microbiome Insights: Product Portfolio

- Table 81 : Microbiome Insights: News/Key Developments, 2024

- Table 82 : Novogene Co. Ltd.: Company Snapshot

- Table 83 : Novogene Co. Ltd.: Financial Performance, FY 2023 and 2024

- Table 84 : Novogene Co. Ltd.: Product Portfolio

- Table 85 : Oxford Nanopore Technologies plc: Company Snapshot

- Table 86 : Oxford Nanopore Technologies plc: Financial Performance, FY 2023 and 2024

- Table 87 : Oxford Nanopore Technologies plc: Product Portfolio

- Table 88 : Oxford Nanopore Technologies plc: News/Key Developments, 2024

- Table 89 : PacBio: Company Snapshot

- Table 90 : PacBio: Financial Performance, FY 2023 and 2024

- Table 91 : PacBio: Product Portfolio

- Table 92 : PacBio: News/Key Developments, 2023 and 2024

- Table 93 : QIAGEN: Company Snapshot

- Table 94 : QIAGEN: Financial Performance, FY 2022 and 2023

- Table 95 : QIAGEN: Product Portfolio

- Table 96 : QIAGEN: News/Key Developments, 2024

- Table 97 : Thermo Fisher Scientific Inc.: Company Snapshot

- Table 98 : Thermo Fisher Scientific Inc.: Financial Performance, FY 2023 and 2024

- Table 99 : Thermo Fisher Scientific Inc.: Product Portfolio

- Table 100 : Thermo Fisher Scientific Inc.: News/Key Developments, 2023

List of Figures

- Summary Figure : Global Market Shares of Microbiome Sequencing, by Region, 2023

- Figure 1 : Market Dynamics

- Figure 2 : Emerging Technologies in Microbiome Sequencing

- Figure 3 : Global Market Shares for Microbiome Sequencing, by Sequencing Technology, 2023

- Figure 4 : Global Market Shares for Microbiome Sequencing, by Sequencing Technology, 2023

- Figure 5 : Global Market Shares for Microbiome Sequencing, by Component, 2023

- Figure 6 : Global Market Shares for Microbiome Sequencing, by Laboratory Type, 2023

- Figure 7 : Global Market Shares for Microbiome Sequencing, by Application, 2023

- Figure 8 : Global Market Shares for Microbiome Sequencing, by End User, 2023

- Figure 9 : Global Market Shares for Microbiome Sequencing, by Region, 2023

- Figure 10 : North American Market Shares for Microbiome Sequencing, by Country, 2023

- Figure 11 : European Market Shares for Microbiome Sequencing, by Country, 2023

- Figure 12 : Asia-Pacific Market Shares for Microbiome Sequencing, by Country, 2023

- Figure 13 : MEA Market Shares for Microbiome Sequencing, by Region, 2023

- Figure 14 : South American Market Shares for Microbiome Sequencing, by Country, 2023

- Figure 15 : Charles River Laboratories: Revenue Shares, by Business Unit, FY 2024

- Figure 16 : Charles River Laboratories: Revenue Shares, by Country/Region, FY 2024

- Figure 17 : Danaher Corp.: Revenue Shares, by Business Unit, FY 2024

- Figure 18 : Danaher Corp.: Revenue Shares, by Country/Region, FY 2024

- Figure 19 : Eurofins Scientific: Revenue Shares, by Business Unit, FY 2023

- Figure 20 : Eurofins Scientific: Revenue Shares, by Country/Region, FY 2023

- Figure 21 : Illumina Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 22 : Illumina Inc.: Revenue Shares, by Country/Region, FY 2024

- Figure 23 : Oxford Nanopore Technologies plc: Revenue Shares, by Business Unit, FY 2024

- Figure 24 : Oxford Nanopore Technologies plc: Revenue Shares, by Country/Region, FY 2024

- Figure 25 : PacBio: Revenue Shares, by Business Unit, FY 2024

- Figure 26 : PacBio: Revenue Shares, by Country/Region, FY 2024

- Figure 27 : QIAGEN: Revenue Shares, by Business Unit, 2023

- Figure 28 : QIAGEN: Revenue Shares, by Country/Region, 2023

- Figure 29 : Thermo Fisher Scientific Inc.: Revenue Shares, by Business Unit, 2024

- Figure 30 : Thermo Fisher Scientific Inc.: Revenue Shares, by Country/Region, 2024

The global microbiome sequencing market is expected to grow from $1.5 billion in 2024 and is projected to reach $3.7 billion by the end of 2029, at a compound annual growth rate (CAGR) of 19.3% during the forecast period of 2024 to 2029.

The North American microbiome sequencing market is expected to grow from $539.8 million in 2024 and is projected to reach $1.2 billion by the end of 2029, at a CAGR of 17.6% during the forecast period of 2024 to 2029.

The European microbiome sequencing market is expected to grow from $444.5 million in 2024 and is projected to reach $1.1 billion by the end of 2029, at a CAGR of 20.0% during the forecast period of 2024 to 2029.

Report Scope

The report analyzes the microbiome sequencing market by component, sequencing technology, laboratory type, application and end user, offering insights into key trends and growth drivers. The study concludes with an analysis of leading companies and their offerings. The base year for the study is 2023, the estimated year is 2024 with projections through 2029, including compound annual growth rate (CAGR) for the forecast period.

This report analyzes the macroeconomic factors affecting the market. Market drivers, restraints and opportunities are identified. The report covers the regulatory landscape, recent technologies and patents in the market, as well as innovations in products and performance. The report also covers the competitive landscape, ESG factors and profiles of leading companies.

Regional analysis covers North America (U.S., Canada and Mexico), Europe (U.K., Germany, France, Italy, Spain and Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Australia and Rest of Asia-Pacific), Middle East and Africa (MEA) and South America (Brazil, Argentina and Rest of South America).

Report Includes

- 50 data tables and 51 additional tables

- Analyses of the global market trends for microbiome sequencing technologies, with revenue data from 2021-2024, and projected CAGRs through 2029

- Estimates of the size and revenue prospects for the global market, along with a market share analysis by sequencing technology, component, laboratory type, application, end user and region

- Facts and figures pertaining to the market dynamics, technological advances, regulations, and the impact of macroeconomic factors

- Insights derived from the Porter's Five Forces model, as well as global supply chain and PESTLE analyses

- A look at the emerging trends and opportunities in microbiome-based therapeutics, clinical trials

- Evaluation of recent patent activity and key granted and published patents

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, and the ESG scores and practices of leading companies

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Profiles of leading companies including Illumina Inc., Qiagen, Thermo Fisher Scientific Inc., Oxford Nanopore Technologies Plc., and PacBio.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Overview

- Outlook

- Macroeconomic Analysis

- Impact of U.S.-China Trade War

Chapter 3 Market Dynamics

- Market Drivers

- Decreasing Cost per Genome

- Government Initiatives and Funding

- Advances in Sequencing Technology

- Market Restraints

- Data Complexity and Bioinformatics Challenges

- Lack of Standardized Protocols and Reference Databases

- Lack of Grant Funding

- Market Opportunities

- Personalized Medicine and Diagnostics

- Drug Discovery and Development

- Agriculture and the Food Industry

Chapter 4 Regulatory Landscape

- Overview

Chapter 5 Emerging Technologies and Patent Analysis

- Emerging Technologies

- Nanopore Sequencing

- SMRT Sequencing

- FACS with Microfluidics

- Metatranscriptome Sequencing

- Patent Analysis

- Regional Patterns

Chapter 6 Market Segment Analysis

- Market Trends

- Segmentation Breakdown

- Microbiome Sequencing: Global Markets

- Market Analysis by Sequencing Technology

- High-throughput Sequencing

- Sanger Sequencing

- Third-Generation Sequencing

- Market Analysis by Component

- Reagents and Kits

- Instruments

- Market Analysis by Laboratory Type

- Wet Labs

- Dry Labs

- Market Analysis by Application

- Disease Diagnosis Research

- Personalized Medicine

- Drug Discovery

- Genetic Screening

- Other Applications

- Market Analysis by End User

- Pharmaceutical and Biotechnology

- Academic Centers and Research Institutes

- Other End Users

- Geographic Breakdown

- Market Breakdown by Region

- North America

- Europe

- Asia-Pacific

- MEA

- South America

Chapter 7 Competitive Landscape

- Key Suppliers and Manufacturers

- Ranking of Companies in the Microbiome Sequencing Industry

- Strategic Analysis

Chapter 8 Environmental, Social, and Governance (ESG) Perspective

- Sustainability in the Microbiome Sequencing Market

- ESG Risks and Ratings: Understanding the Data

- BCC Research Viewpoint

Chapter 9 Appendix

- Research Methodology

- Sources

- Abbreviations

- Company Profiles

- BASECLEAR BV

- CD GENOMICS

- CHARLES RIVER LABORATORIES

- COSMOSID

- CROWN BIOSCIENCE

- DANAHER CORP.

- EUROFINS SCIENTIFIC

- ILLUMINA INC.

- MERIEUX NUTRISCIENCES

- MICROBIOME INSIGHTS

- NOVOGENE CO. LTD.

- OXFORD NANOPORE TECHNOLOGIES PLC

- PACBIO

- QIAGEN

- THERMO FISHER SCIENTIFIC INC.

- Emerging Startups

- Pendulum

- Microba

- Biomesense