|

|

市場調査レポート

商品コード

1663328

細胞ベースアッセイ:各種技術と世界市場Cell-Based Assays: Technologies and Global Markets |

||||||

|

|||||||

| 細胞ベースアッセイ:各種技術と世界市場 |

|

出版日: 2025年02月11日

発行: BCC Research

ページ情報: 英文 139 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の細胞ベースアッセイの市場規模は、2024年の353億米ドルから、予測期間中はCAGR 9.8%で推移し、2029年には563億米ドルに達すると予測されています。

消耗品の部門は、2024年の199億米ドルから、予測期間中はCAGR 10.6%で推移し、2029年には329億米ドルに達すると予測されています。機器の部門は、2024年の87億米ドルから、CAGR 9.3%で推移し、2029年には135億米ドルに達すると予測されます。

当レポートでは、世界の細胞ベースアッセイの市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- 概要

- 創薬

- 細胞ベースアッセイの重要性

- 細胞シグナル伝達経路

- 薬物作用のメカニズム

- 遺伝子発現制御

- 細胞毒性と生存率

- 疾患モデル

- 細胞ベースアッセイの種類

- 細胞生存アッセイ

- 細胞増殖アッセイ

- 細胞毒性アッセイ

- 細胞ベースアッセイの応用

- 医薬品の発見と開発

- 毒性研究

- 癌研究

- 感染症研究

- 免疫学と炎症

- 分子経路解析

- 再生医療と組織工学

- バイオマーカーの発見と検証

- 精密医療と個別化医療

第3章 市場力学

- 概要

- 市場促進要因

- 慢性疾患の発症率の上昇

- 医薬品の発見と開発に対する需要の高まり

- 個別化医療への高い需要

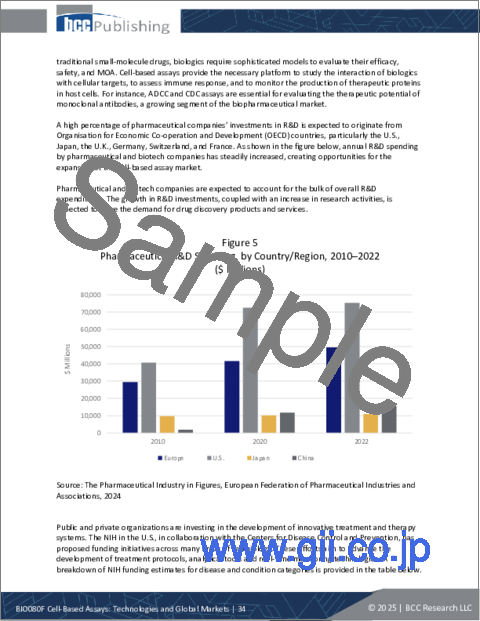

- 医薬品研究開発への投資増加

- 市場抑制要因

- アッセイの開発と維持にかかる高コスト

- 技術的な課題と複雑さ

- 試薬や消耗品の保存期間の短さ

- 市場機会

- 創薬における応用の拡大

- 診断とバイオマーカー発見の拡大

第4章 新興技術と開発

- 概要

- 新興技術

- CRISPR/Cas9技術

- ハイコンテンツスクリーニング (HCS) とイメージング

- データ分析におけるAIと機械学習 (ML)

- 特許分析

- 特許レビュー:主要管轄別

第5章 市場セグメンテーション分析

- 概要

- セグメンテーションの内訳

- 細胞ベースアッセイ:世界市場

- 市場分析:製品タイプ別

- 消耗品

- 機器

- ソフトウェア

- サービス

- 市場分析:用途別

- 創薬

- 吸収、分布、代謝、排泄 (ADME) /毒性

- 基礎研究

- 市場分析:エンドユーザー別

- バイオテクノロジーおよび製薬企業

- 学術研究機関

- CRO

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 競合情報

- 競合情勢

- 企業ランキング

第7章 細胞ベースアッセイ市場における持続可能性:ESGの観点

- 細胞ベースアッセイ市場における持続可能性

- 動物実験

- 小型化と自動化

- グリーンケミストリーと環境に優しい材料

- 3D細胞培養と組織モデル

- 廃棄物の削減と資源の最適化

- 創薬効率の向上

- ESGリスクと格付け:データの理解

- BCC Researchによる見解

第8章 付録

- 調査手法

- 出典

- 略語

- 企業プロファイル

- AGILENT TECHNOLOGIES INC.

- BD

- BIOIVT

- BIO-RAD LABORATORIES INC.

- CELL BIOLABS INC.

- CELL BIOLOGICS INC.

- CHARLES RIVER LABORATORIES

- DANAHER CORP.

- FUJIFILM HOLDINGS CORP.

- GE HEALTHCARE

- LONZA

- MERCK KGAA

- PROMEGA CORP.

- REVVITY

- THERMO FISHER SCIENTIFIC INC.

List of Tables

- Summary Table A : Global Market for Cell-based Assays, by Product Type, Through 2029

- Summary Table B : Global Market for Cell-based Assays, by Region, Through 2029

- Table 1 : Factors in Cell-based Assay Development

- Table 2 : Types of Cellular Assays

- Table 3 : New Cases and Deaths Due to Selected Cancers Globally, 2022

- Table 4 : U.S. NIH Funding for Selected Diseases, 2019-2023

- Table 5 : Existing Cell-based Assay Technologies

- Table 6 : Patents Issued for Cell-based Assays, by Jurisdiction, 2022-2024

- Table 7 : Global Market for Cell-based Assays, Through 2029

- Table 8 : Global Market for Cell-based Assays, by Product Type, Through 2029

- Table 9 : Global Market for Cell-based Assays, by Application, Through 2029

- Table 10 : Global Market for Cell-based Assays, by End User, Through 2029

- Table 11 : Global Market for Cell-based Assays, by Region, Through 2029

- Table 12 : North American Market for Cell-based Assays, by Country, Through 2029

- Table 13 : European Market for Cell-based Assays, by Country, Through 2029

- Table 14 : Asia-Pacific Market for Cell-based Assays, by Country, Through 2029

- Table 15 : RoW Market for Cell-based Assays, by Subregion, Through 2029

- Table 16 : Ranking of Companies in Cell-based Assay Market, 2023

- Table 17 : ESG Rankings for Major Cell-based Assay Companies, 2024*

- Table 18 : Information Sources in This Report

- Table 19 : Abbreviations Used in this Report

- Table 20 : Agilent Technologies Inc.: Company Snapshot

- Table 21 : Agilent Technologies Inc.: Financial Performance, FY 2022 and 2023

- Table 22 : Agilent Technologies Inc.: Product Portfolio

- Table 23 : Agilent Technologies Inc.: News/Key Developments, 2024

- Table 24 : BD: Company Snapshot

- Table 25 : BD: Financial Performance, FY 2023 and 2024

- Table 26 : BD: Product Portfolio

- Table 27 : BD: News/Key Developments, 2024

- Table 28 : BioIVT: Company Snapshot

- Table 29 : BioIVT: Product Portfolio

- Table 30 : BioIVT: News/Key Developments, 2023 and 2024

- Table 31 : Bio-Rad Laboratories Inc.: Company Snapshot

- Table 32 : Bio-Rad Laboratories Inc.: Financial Performance, FY 2022 and 2023

- Table 33 : Bio-Rad Laboratories Inc.: Product Portfolio

- Table 34 : Bio-Rad Laboratories Inc.: News/Key Developments, 2021-2024

- Table 35 : Cell Biolabs Inc.: Company Snapshot

- Table 36 : Cell Biolabs Inc.: Product Portfolio

- Table 37 : Cell Biologics Inc.: Company Snapshot

- Table 38 : Cell Biologics Inc.: Product Portfolio

- Table 39 : Charles River Laboratories: Company Snapshot

- Table 40 : Charles River Laboratories: Financial Performance, FY 2022 and 2023

- Table 41 : Charles River Laboratories: Product Portfolio

- Table 42 : Charles River Laboratories: News/Key Developments, 2023 and 2024

- Table 43 : Danaher Corp.: Company Snapshot

- Table 44 : Danaher Corp.: Financial Performance, FY 2022 and 2023

- Table 45 : Danaher Corp.: Product Portfolio

- Table 46 : Fujifilm Holdings Corp.: Company Snapshot

- Table 47 : Fujifilm Holdings Corp.: Financial Performance, FY 2022 and 2023

- Table 48 : Fujifilm Holdings Corp.: Product Portfolio

- Table 49 : GE Healthcare: Company Snapshot

- Table 50 : GE Healthcare: Financial Performance, FY 2022 and 2023

- Table 51 : GE Healthcare: Product Portfolio

- Table 52 : Lonza: Company Snapshot

- Table 53 : Lonza: Financial Performance, FY 2022 and 2023

- Table 54 : Lonza: Product Portfolio

- Table 55 : Lonza: News/Key Developments, 2021

- Table 56 : Merck KGaA: Company Snapshot

- Table 57 : Merck KGaA: Financial Performance, FY 2022 and 2023

- Table 58 : Merck KGaA: Product Portfolio

- Table 59 : Promega Corp.: Company Snapshot

- Table 60 : Promega Corp.: Product Portfolio

- Table 61 : Promega Corp.: News/Key Developments, 2023

- Table 62 : Revvity: Company Snapshot

- Table 63 : Revvity: Financial Performance, FY 2022 and 2023

- Table 64 : Revvity: Product Portfolio

- Table 65 : Revvity: News/Key Developments, 2023 and 2024

- Table 66 : Thermo Fisher Scientific Inc.: Company Snapshot

- Table 67 : Thermo Fisher Scientific Inc.: Financial Performance, FY 2022 and 2023

- Table 68 : Thermo Fisher Scientific Inc.: Product Portfolio

- Table 69 : Thermo Fisher Scientific Inc.: News/Key Developments, 2023 and 2024

List of Figures

- Summary Figure A : Global Market for Cell-based Assays, by Product Type, 2021-2029

- Summary Figure B : Global Market for Cell-based Assays, by Region, 2021-2029

- Figure 1 : Projected Global Aging Population (65 Years and Above), 1990-2050

- Figure 2 : Drug Discovery Process Steps

- Figure 3 : Market Dynamics of Cell-based Assays

- Figure 4 : FDA Approval of Personalized Medicines, 2015-2022

- Figure 5 : Pharmaceutical R&D Spending, by Country/Region, 2010-2022

- Figure 6 : Shares of Global Market for Cell-based Assays, by Product Type, 2023

- Figure 7 : Shares of Global Market for Cell-based Assays, by Application, 2023

- Figure 8 : Shares of Global Market for Cell-based Assays, by End User, 2023

- Figure 9 : R&D Spending of Biopharmaceutical Companies, 2010-2024

- Figure 10 : Shares of Global Market for Cell-based Assays, by Region, 2023

- Figure 11 : Shares of North American Market for Cell-based Assays, by Country, 2023

- Figure 12 : Shares of European Market for Cell-based Assays, by Country, 2023

- Figure 13 : Shares of Asia-Pacific Market for Cell-based Assays, by Country, 2023

- Figure 14 : Shares of RoW Market for Cell-based Assays, by Subregion, 2023

- Figure 15 : Agilent Technologies Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 16 : Agilent Technologies Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 17 : BD: Revenue Share, by Business Unit, FY 2024

- Figure 18 : BD: Revenue Share, by Country/Region, FY 2024

- Figure 19 : Bio-Rad Laboratories Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 20 : Bio-Rad Laboratories Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 21 : Charles River Laboratories: Revenue Share, by Business Unit, FY 2023

- Figure 22 : Charles River Laboratories: Revenue Share, by Country/Region, FY 2023

- Figure 23 : Danaher Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 24 : Danaher Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 25 : Fujifilm Holdings Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 26 : Fujifilm Holdings Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 27 : GE Healthcare: Revenue Share, by Business Unit, FY 2023

- Figure 28 : GE Healthcare: Revenue Share, by Country/Region, FY 2023

- Figure 29 : Lonza: Revenue Share, by Business Unit, FY 2023

- Figure 30 : Merck KGaA: Revenue Share, by Business Unit, FY 2023

- Figure 31 : Merck KGaA: Revenue Share, by Country/Region, FY 2023

- Figure 32 : Revvity: Revenue Share, by Business Unit, FY 2023

- Figure 33 : Revvity: Revenue Share, by Country/Region, FY 2023

- Figure 34 : Thermo Fisher Scientific Inc.: Revenue Share, by Business Unit, 2023

- Figure 35 : Thermo Fisher Scientific Inc.: Revenue Share, by Country/Region, 2023

The global market for cell-based assays is estimated to increase from $35.3 billion in 2024 to reach $56.3 billion by 2029, at a compound annual growth rate (CAGR) of 9.8% from 2024 through 2029.

The consumables market for cell-based assays is estimated to increase from $19.9 billion in 2024 to reach $32.9 billion by 2029, at a CAGR of 10.6% from 2024 through 2029.

The instruments market for cell-based assays is estimated to increase from $8.7 billion in 2024 to reach $13.5 billion by 2029, at a CAGR of 9.3% from 2024 through 2029.

Report Scope

The scope of this report on the global market for cell-based assay technologies encompasses an analysis of the current landscape, including market size, growth trends and segmentation by product type, application and end user. The report breaks down the cell-based assay market into four product categories: instruments, consumables, services, and software. It also segments the market by application, such as drug discovery; absorption, distribution, metabolism, and excretion (ADME)/toxicity testing; and basic research. The end users considered in the report include academic and research institutions, pharmaceutical and biotech companies, and clinical research organizations.

Geographically, the analysis covers North America, Europe, Asia-Pacific, and Rest of the World (RoW). The report also provides profiles of key market players and highlights industry trends, major products, mergers and acquisitions, and other partnerships expected to influence the future of the industry.

Report Includes

- 23 data tables and 48 additional tables

- Analyses of the trends in the global market for cell-based assays, with sales data for 2021-2023, estimates for 2024, and projections of compound annual growth rates (CAGRs) through 2029

- Evaluation of the market's current and future potential

- Estimates of the market for cell-based assays, revenue forecasts, and corresponding market share analysis by product, type/application, end user and geographic region

- Assessment of the current market, new developments, spending trends, and revenue prospects for cell-based assays in the pharmaceutical industry

- Coverage of major issues involved in the R&D of more effective cell-based approaches for drug discovery

- Information on increasing investments in R&D activities, key technology issues, industry-specific challenges, major types of end users, and COVID-19 implications

- Discussion of ESG challenges and practices of the industry

- Assessment of the competitive landscape, including the market shares of leading companies, their product portfolios and financial overviews

- Information on recent mergers and acquisitions, expansions, collaborations, investments, divestments and product launches

- Company profiles of major players within the industry, including Thermo Fisher Scientific Inc., Merck KGaA., Danaher Corp., Bio-Rad Laboratories Inc., and Charles River Laboratories.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Overview

- Drug Discovery

- Importance of Cell-based Assays

- Cell Signaling Pathways

- Mechanisms of Drug Action

- Gene Expression Regulation

- Cytotoxicity and Viability

- Disease Modeling

- Types of Cell-based Assays

- Cell Viability Assays

- Cell Proliferation Assays

- Cytotoxicity Assays

- Application of Cell-based Assays

- Drug Discovery and Development

- Toxicology Studies

- Cancer Research

- Infectious Disease Research

- Immunology and Inflammation

- Molecular Pathway Analysis

- Regenerative Medicine and Tissue Engineering

- Biomarker Discovery and Validation

- Precision and Personalized Medicine

Chapter 3 Market Dynamics

- Overview

- Market Drivers

- Rising Incidence of Chronic Diseases

- Rising Demand for Drug Discovery and Development

- High Demand for Personalized Medicine

- Increasing Investment in Drug R&D

- Market Restraints

- High Cost of Assay Development and Maintenance

- Technical Challenges and Complexity

- Short Shelf-life of Reagents and Consumables

- Market Opportunities

- Expanding Applications in Drug Discovery

- Expansion in Diagnostics and Biomarker Discovery

Chapter 4 Emerging Technologies and Developments

- Overview

- Emerging Technologies

- CRISPR/Cas9 Technology

- High-content Screening (HCS) and Imaging

- AI and Machine Learning (ML) in Data Analysis

- Patent Analysis

- Patent Review, by Leading Jurisdiction

Chapter 5 Market Segmentation Analysis

- Overview

- Segmentation Breakdown

- Cell-based Assays: Global Markets

- Market Analysis by Product Type

- Consumables

- Instruments

- Software

- Services

- Market Analysis by Application

- Drug Discovery

- Absorption, Distribution, Metabolism, and Excretion (ADME)/Toxicity

- Basic Research

- Market Analysis by End User

- Biotechnology and Pharmaceutical Companies

- Academic and Research Institutes

- Contract Research Organizations

- Geographic Breakdown

- Market Analysis by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 6 Competitive Intelligence

- Competitive Landscape

- Ranking of Companies in the Cell-based Assay Market

Chapter 7 Sustainability in Cell-based Assay Market: An ESG Perspective

- Sustainability in the Cell-based Assay Market

- Animal Testing

- Miniaturization and Automation

- Green Chemistry and Eco-friendly Materials

- 3D Cell Cultures and Tissue Models

- Waste Reduction and Optimization of Resources

- Improving Drug Discovery Efficiency

- ESG Risks and Ratings: Understanding the Data

- BCC Research Viewpoint

Chapter 8 Appendix

- Methodology

- Sources

- Abbreviations

- Company Profiles

- AGILENT TECHNOLOGIES INC.

- BD

- BIOIVT

- BIO-RAD LABORATORIES INC.

- CELL BIOLABS INC.

- CELL BIOLOGICS INC.

- CHARLES RIVER LABORATORIES

- DANAHER CORP.

- FUJIFILM HOLDINGS CORP.

- GE HEALTHCARE

- LONZA

- MERCK KGAA

- PROMEGA CORP.

- REVVITY

- THERMO FISHER SCIENTIFIC INC.