|

|

市場調査レポート

商品コード

1517513

定期健康診断市場Routine Health Screening Market |

||||||

|

|||||||

| 定期健康診断市場 |

|

出版日: 2024年06月19日

発行: BCC Research

ページ情報: 英文 136 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の定期健康診断の市場規模は、2024年の597億米ドルから、予測期間中はCAGR 6.8%で推移し、2029年末には829億米ドルに達すると予測されています。

糖尿病検査の部門は、2024年の116億米ドルから、CAGR 7.5%で推移し、2029年末には166億米ドルに達すると予測されています。また、コレステロール検査の部門は、2024年の97億米ドルから、CAGR 6.7%で推移し、2029年末には134億米ドルに達すると予測されています。

当レポートでは、世界の定期健康診断の市場を調査し、市場概要、市場影響因子および市場機会の分析、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- 概要

- コレステロール検査

- 糖尿病検査

- 血圧検査

- 癌検査

- 出生前検査

- 視力・聴力検査

- 骨密度検査

- 甲状腺プロファイル検査

- 必須栄養素チェック

- その他

第3章 市場力学

- 定期健康診断市場に影響を与える要因

- 市場促進要因

- 市場抑制要因

- 市場課題

- 市場機会

第4章 市場セグメンテーション分析

- セグメンテーションの内訳

- 定期健康診断市場:検査タイプ別

- コレステロール検査

- 糖尿病検査

- 血圧検査

- 癌検診

- 出生前検査

- 視力・聴力検査

- 骨密度検査

- 甲状腺プロファイル検査

- 必須栄養素検査

- その他

- 定期健康診断市場:サンプルタイプ別

- 概要

- 血液サンプル

- 尿サンプル

- 画像サンプル

- その他

- 定期健康診断市場:技術別

- 概要

- QPCR (定量的ポリメラーゼ連鎖反応)

- Q-FISH (定量的蛍光in situハイブリダイゼーション) 技術

- 免疫学的検査

- 医療画像処理

- STELA (単一テロメア長解析)

- その他

- 地理的内訳

- 定期健康診断市場:地域別

- 北米

- アジア太平洋

- 欧州

- その他の地域

第5章 市場における新興技術と今後の技術

- 新興技術と今後の技術

- ディープフェノタイピング技術

- デジタルヘルス介入

- デジタル精密医療

- ウェアラブルデバイスとリモートモニタリング

- 多発癌性検出 (MCD) アッセイ

- 日常的な健康診断におけるAI

- 5G対応デバイス

- 遺伝子検査

- 定期健康診断市場における技術的懸念

- 有効性データ

- データプライバシー

- 規制状況

- サプライチェーンの課題

- 最近の動向

第6章 ESGの展開

- 定期健康診断業界の持続可能性

- WHO Global Action Plan

- BCCの見解

第7章 競合情勢

- M&A・提携

- 製造業者とサービスプロバイダーの市場シェア分析

- 戦略的提携

第8章 付録

- 調査手法

- 出典

- 略語

- 企業プロファイル

- ARUP LABORATORIES

- CERBA HEALTHCARE

- EUROFINS SCIENTIFIC

- EXACT SCIENCE CORP.

- OPKO HEALTH INC.

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- NATERA INC.

- QUEST DIAGNOSTICS INC.

- SONIC HEALTHCARE LTD.

- SYNLAB AG

List of Tables

- Summary Table : Global Routine Health Screening Market, by Test Type, Through 2029

- Table 1 : Projected Number of Adults 50 Years and Older with More than One Chronic Condition in the United States, 2020-2050

- Table 2 : Estimated False Positive Probability of One Screening Occasion

- Table 3 : Preventive Health Screenings, by Age

- Table 4 : Global Routine Health Screening Market, by Test Type, Through 2029

- Table 5 : Global Cholesterol Screening Market in Routine Health Screening, by Region, Through 2029

- Table 6 : Global Diabetes Screening Market in Routine Health Screening, by Region, Through 2029

- Table 7 : Global Blood Pressure Screening Market in Routine Health Screening, by Region, Through 2029

- Table 8 : Global Cancer Screening Market in Routine Health Screening, by Region, Through 2029

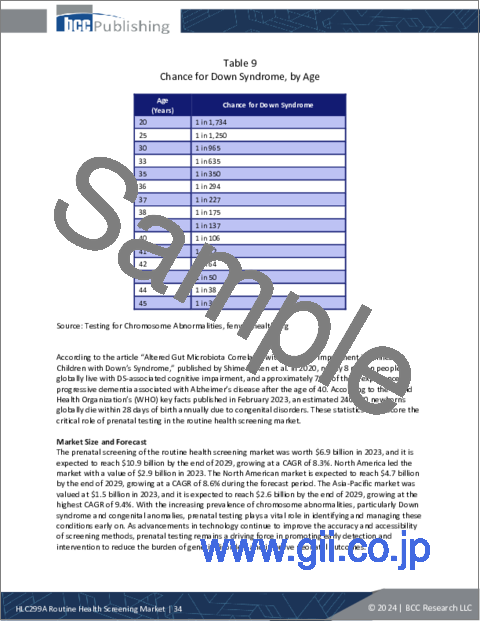

- Table 9 : Chance for Down Syndrome, by Age

- Table 10 : Global Prenatal Screening Market in Routine Health Screening, by Region, Through 2029

- Table 11 : Global Vision and Hearing Screening Market in Routine Health Screening, by Region, Through 2029

- Table 12 : Global Bone Density Test Market in Routine Health Screening, by Region, Through 2029

- Table 13 : Global Thyroid Profile Test Market in Routine Health Screening, by Region, Through 2029

- Table 14 : Global Essential Nutrients Test Market in Routine Health Screening, by Region, Through 2029

- Table 15 : Global Other Screening Tests Market in Routine Health Screening, by Region, Through 2029

- Table 16 : Global Routine Health Screening Market, by Sample, Through 2029

- Table 17 : Global Routine Health Screening Market Based on Blood Sample, by Region, Through 2029

- Table 18 : Global Routine Health Screening Market Based on Urine Sample, by Region, Through 2029

- Table 19 : Global Routine Health Screening Market Based on Imaging Sample, by Region, Through 2029

- Table 20 : Global Routine Health Screening Market based on Other Types of Sample, by Region, Through 2029

- Table 21 : Global Routine Health Screening Market, by Technology, Through 2029

- Table 22 : Global Routine Health Screening Market based on Quantitative Polymerase Chain Reaction (QPCR) Technology, by Region, Through 2029

- Table 23 : Global Routine Health Screening Market based on Q-FISH (Quantitative Fluorescence in Situ Hybridization) Technology, by Region, Through 2029

- Table 24 : Global Routine Health Screening Market Based on Immunoassays Technology, by Region, Through 2029

- Table 25 : Global Routine Health Screening Market based on Medical Imaging Technology, by Region, Through 2029

- Table 26 : Global Routine Health Screening Market based on STELA (Single Telomere Length Analysis), Technology, by Region, Through 2029

- Table 27 : Global Routine Health Screening Market based on Other Technologies, by Region, Through 2029

- Table 28 : Global Routine Health Screening Market, by Region, Through 2029

- Table 29 : North American Routine Health Screening Market, by Country, Through 2029

- Table 30 : APAC Routine Health Screening Market, by Country, Through 2029

- Table 31 : European Routine Health Screening Market, by Country, Through 2029

- Table 32 : ESG Highlights by Major Players, 2023

- Table 33 : ESG Rankings for Major Routine Health Screening Companies, 2023

- Table 34 : Mergers and Acquisitions: Routine Health Screening Tests Manufacturers and Service Providers, 2021-2024

- Table 35 : Major Strategic Alliances in the Routine Health Screening Industry, 2021-2024

- Table 36 : Information Sources in this Report

- Table 37 : Major Abbreviations Used in This Report

- Table 38 : ARUP Laboratories: Company Snapshot

- Table 39 : ARUP Laboratories: Product Portfolio

- Table 40 : ARUP Laboratories: News/Key Developments, 2021-2024

- Table 41 : Cerba Healthcare: Company Snapshot

- Table 42 : Cerba Healthcare: Product Portfolio

- Table 43 : Cereba Healthcare: News/Key Developments, 2021-2023

- Table 44 : Eurofins Scientific: Company Snapshot

- Table 45 : Eurofins Scientific: Financial Performance, FY 2022 and 2023

- Table 46 : Eurofins Scientific: Product Portfolio

- Table 47 : Eurofins Scientific: News/Key Developments, 2022

- Table 48 : Exact Science Corp.: Company Snapshot

- Table 49 : Exact Science Corp.: Financial Performance, FY 2022 and 2023

- Table 50 : Exact Science Corp.: Product Portfolio

- Table 51 : Exact Science Corp.: News/Key Developments, 2021-2024

- Table 52 : OPKO Health Inc.: Company Snapshot

- Table 53 : OPKO Health Inc.: Financial Performance, FY 2022 and 2023

- Table 54 : OPKO Health Inc.: Product Portfolio

- Table 55 : OPKO Health Inc.: News/Key Developments, 2021-2023

- Table 56 : Laboratory Corporation of America Holdings: Company Snapshot

- Table 57 : Laboratory Corporation of America Holdings: Financial Performance, FY 2022 and 2023

- Table 58 : Laboratory Corporation of America Holdings: Product Portfolio

- Table 59 : Laboratory Corporation of America Holdings: News/Key Developments, 2022-2024

- Table 60 : Natera Inc.: Company Snapshot

- Table 61 : Natera Inc: Financial Performance, FY 2022 and 2023

- Table 62 : Natera Inc.: Product Portfolio

- Table 63 : Natera Inc.: News/Key Developments, 2024

- Table 64 : Quest Diagnostic Inc.: Company Snapshot

- Table 65 : Quest Diagnostic Inc.: Financial Performance, FY 2022 and 2023

- Table 66 : Quest Diagnostic Inc.: Product Portfolio

- Table 67 : Quest Diagnostic Inc.: News/Key Developments, 2021-2024

- Table 68 : Sonic Healthcare Ltd.: Company Snapshot

- Table 69 : Sonic Healthcare Ltd.: Financial Performance FY 2022 and 2023

- Table 70 : Sonic Healthcare Ltd.: Product Portfolio

- Table 71 : Sonic Healthcare Ltd.: News/Key Developments, 2022

- Table 72 : SYNLAB AG: Company Snapshot

- Table 73 : SYNLAB AG: Company Financials, FY 2022 and 2023

- Table 74 : SYNLAB AG: Product Portfolio

- Table 75 : SYNLAB AG: News/Key Developments, 2022

List of Figures

- Summary Figure : Global Routine Health Screening Market, by Test Type, 2021-2029

- Figure 1 : Differentiating Cancer Screening from Early Diagnosis Based on Symptom Onset

- Figure 2 : Role of AI-Based Approaches in Various Themes of Healthcare Research

- Figure 3 : Detection and Intervention through Cancer Screening

- Figure 4 : Global Routine Health Screening Market Dynamics

- Figure 5 : 10 Common Chronic Conditions in Adults 65+, U.S., 2024

- Figure 6 : Percentage of Visits to Health Centers by Primary Reason for the Visit: United States, 2020

- Figure 7 : Per Capita Healthcare Expenditure for Few Top Countries, 2021

- Figure 8 : Global Routine Health Screening Market Shares, by Test Type, 2023

- Figure 9 : Global Cholesterol Screening Market in Routine Health Screening, by Region, 2021-2029

- Figure 10 : Global Diabetes Screening Market in Routine Health Screening, by Region, 2021-2029

- Figure 11 : Global Diabetes Screening Market in Routine Health Screening, by Region, 2021-2029

- Figure 12 : Global Cancer Screening Market in Routine Health Screening, by Region, 2021-2029

- Figure 13 : Global Prenatal Screening Market in Routine Health Screening, by Region, 2021-2029

- Figure 14 : Global Vision and Hearing Screening Market in Routine Health Screening, by Region, 2021-2029

- Figure 15 : Global Bone Density Test Market in Routine Health Screening, by Region, 2021-2029

- Figure 16 : Global Thyroid Profile Test Market in Routine Health Screening, by Region, 2021-2029

- Figure 17 : Global Essential Nutrients Test Market in Routine Health Screening, by Region, 2021-2029

- Figure 18 : Global Other Screening Tests Market in Routine Health Screening, by Region, 202-2029

- Figure 19 : Global Routine Health Screening Market, by Sample, 2021-2029

- Figure 20 : Global Routine Health Screening Market Shares, by Sample, 2023

- Figure 21 : Diagnostic Significance of Urinary Markers and Metabolites for Disease

- Figure 22 : Global Routine Health Screening Market, by Technology, 2021-2029

- Figure 23 : Global Routine Health Screening Market, by Region, 2021-2029

- Figure 24 : Global Routine Health Screening Market Shares, by Region, 2023

- Figure 25 : North American Routine Health Screening Market Shares, by Country, 2023

- Figure 26 : APAC Routine Health Screening Market Shares, by Country, 2023

- Figure 27 : European Routine Health Screening Market Shares, by Country, 2023

- Figure 28 : Global Routine Health Screening Market Shares, by Key Manufacturers and Service Providers, 2023

- Figure 29 : Eurofins Scientific: Revenue Shares, by Business Unit, FY 2023

- Figure 30 : Eurofins Scientific: Revenue Shares, by Country/Region, FY 2023

- Figure 31 : Exact Science Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 32 : Exact Science Corp.: Revenue Shares, by Country/Region, FY 2023

- Figure 33 : OPKO Health Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 34 : OPKO Health Inc.: Revenue Shares, by Country/Region, FY 2023

- Figure 35 : Laboratory Corporation of America Holdings: Revenue Shares, by Business Unit, FY 2023

- Figure 36 : Laboratory Corporation of America Holdings: Revenue Shares, by Country/Region, FY 2022

- Figure 37 : Natera Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 38 : Natera Inc.: Revenue Shares, by Country/Region, FY 2023

- Figure 39 : Quest Diagnostic Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 40 : Sonic Healthcare Ltd.: Revenue Shares, by Business Unit, FY 2023

- Figure 41 : Sonic Healthcare Ltd.: Revenue Shares, by Country/Region, FY 2023

- Figure 42 : SYNLAB AG: Revenue Shares, by Business Unit, FY 2023

- Figure 43 : SYNLAB AG.: Revenue Shares, by Country/Region, FY 2023

The global market for routine health screening is expected to grow from $59.7 billion in 2024 and is projected to reach $82.9 billion by the end of 2029, at a compound annual growth rate (CAGR) of 6.8% during the forecast period of 2024 to 2029.

The global market for routine health screening for diabetes screening is expected to grow from $11.6 billion in 2024 and is projected to reach $16.6 billion by the end of 2029, at a compound annual growth rate (CAGR) of 7.5% during the forecast period of 2024 to 2029.

The global market for routine health screening for cholesterol screening is expected to grow from $9.7 billion in 2024 and is projected to reach $13.4 billion by the end of 2029, at a compound annual growth rate (CAGR) of 6.7% during the forecast period of 2024 to 2029.

Report Scope

The routine health screening market presents a vast and promising opportunity as it responds to evolving healthcare trends and societal needs. With an increasing emphasis on preventive healthcare, routine health screenings have become instrumental in detecting potential health issues at early stages. The market's expansion is propelled by the rising incidence of non-communicable diseases, such as diabetes and cardiovascular disorders, coupled with the aging global population, necessitating proactive health management strategies. Technological advancements, including innovations in diagnostic tools and the integration of artificial intelligence, enhance the accuracy and accessibility of screenings, catering to a broader demographic. The aftermath of the COVID-19 pandemic has further underscored the importance of regular health check-ups, reinforcing the significance of routine health screenings.

Additionally, incorporating these screenings into corporate wellness programs and the trend toward personalized medicine further amplifies the market's potential. The routine health screening market is poised for substantial expansion, playing a pivotal role in the proactive and personalized management of individual health globally. This report presents insights into this market's current and future potential, drivers, challenges, opportunities, industry status, developments, market trends, geographical challenges, and strategies (e.g., mergers, acquisitions, collaborations). The report informs all market players, potential entrants, government agencies, and other interested parties. The report covers geographic regions in detail, so companies interested in expanding their geographic reach will also find this study helpful.

Report Includes

- 37 data tables and 39 additional tables

- An overview of the global market for routine health screening

- Analysis of global market trends, featuring revenue data for 2021-2023, estimates for 2024, forecasts for 2029 and projected CAGRs through 2029

- Evaluation of the current market's size and revenue growth prospects, along with a market share analysis by test type, sample type, technology, and region

- A look at recent innovations, technological advances, and product launches in the market

- Analysis of the industry's regulatory framework and policies

- A discussion of ESG challenges and practices in the routine health screening industry

- An analysis of the key companies' market shares, proprietary technologies, alliances, and other strategies

- A discussion of key patents

- Profiles of the leading players, including Quest Diagnostics, Laboratory Corporation of America Holdings, Sonic Healthcare Ltd., Eurofins Scientific, and SYNLAB AG

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Overview

- Cholesterol Test

- Diabetes Test

- Blood Pressure Test

- Cancer Screening Test

- Prenatal Testing

- Vision and Hearing Screening

- Bone Density Test

- Thyroid Profile Test

- Essential Nutrients Check

- Others

Chapter 3 Market Dynamics

- Factors Affecting the Routine Health Screening Market

- Market Drivers

- Advancements in Screening Technologies

- Growing Prevalence of Chronic Diseases

- Growing Health Consciousness

- Increasing Healthcare Spending

- Market Restraints

- High Costs Associated with Routine Health Screening

- Psychological Barriers

- Lack of Awareness and Acceptability in Low and Middle Income Countries

- Market Challenges

- False Positive and False Negative Screening Test Results

- Declining Reimbursement

- Market Opportunities

- Adoption of AI in Routine Health Screening

- Expansive Opportunities in Emerging Economies

Chapter 4 Market Segmentation Analysis

- Segmentation Breakdown

- Routine Health Screening Market, by Test Type

- Cholesterol Screening

- Diabetes Screening

- Blood Pressure Test

- Cancer Screening

- Prenatal Screening

- Vision and Hearing Screening

- Bone Density Test

- Thyroid Profile Test

- Essential Nutrients Tests

- Others

- Routine Health Screening Market, by Sample Type

- Overview

- Blood-Based Sample

- Urine-Based Sample

- Imaging Sample

- Other Samples

- Routine Health Screening Market, by Technology

- Overview

- QPCR (Quantitative Polymerase Chain Reaction)

- Q-FISH (Quantitative Fluorescence In Situ Hybridization) Technology

- Immunoassays

- Medical Imaging

- STELA (Single Telomere Length Analysis)

- Other Technologies

- Geographic Breakdown

- Routine Health Screening Market, by Region

- North America

- Asia-Pacific

- Europe

- Rest of the World

Chapter 5 Emerging and Upcoming Technologies in the Market

- Introduction

- Emerging and Upcoming Technologies

- Deep Phenotyping Technologies

- Digital Health Interventions

- Digital Precision Medicine

- Wearable Devices and Remote Monitoring

- Multicancer Detection (MCDs) Assays

- Artificial Intelligence in Routine Health Screening

- 5G-Enabled Devices

- Genetics Testing

- Technological Concerns in the Routine Health Screening Market

- Efficacy Data

- Data Privacy

- Regulatory Landscape

- Supply Chain Challenges

- Recent Developments

Chapter 6 ESG Development

- Introduction

- Sustainability in Routine Health Screening Industry

- WHO Global Action Plan

- BCC Research Viewpoint

Chapter 7 Competitive Landscape

- Mergers, Acquisitions and Collaborations

- Manufacturer and Service Provider Market Share Analysis

- Strategic Alliances

Chapter 8 Appendix

- Methodology

- Sources

- Abbreviations

- Company Profiles

- ARUP LABORATORIES

- CERBA HEALTHCARE

- EUROFINS SCIENTIFIC

- EXACT SCIENCE CORP.

- OPKO HEALTH INC.

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- NATERA INC.

- QUEST DIAGNOSTICS INC.

- SONIC HEALTHCARE LTD.

- SYNLAB AG