|

|

市場調査レポート

商品コード

1378379

非破壊検査 (NDT) 機器およびービスの世界市場:超音波・放射線・渦電流・その他Nondestructive Testing Equipment and Services: Ultrasonic, Radiographic, Eddy Current and Others |

||||||

|

|||||||

| 非破壊検査 (NDT) 機器およびービスの世界市場:超音波・放射線・渦電流・その他 |

|

出版日: 2023年11月09日

発行: BCC Research

ページ情報: 英文 321 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の非破壊検査 (NDT) 機器およびービスの市場規模は、2023年の313億米ドルから、予測期間中は10.1%のCAGRで推移し、2028年末には507億米ドルの規模に成長すると予測されています。

地域別で見ると、北米市場は、2023年の101億米ドルから、同期間中10.4%のCAGRで推移し、2028年末には165億米ドルの規模に成長すると予測されています。また、アジア太平洋地域市場は、2023年の78億米ドルから、12.8%のCAGRで推移し、2028年には142億米ドルの規模に成長すると予測されています。

当レポートでは、世界の非破壊検査 (NDT) 機器およびービスの市場を調査し、市場および技術の概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術および特許の動向、ESGの展開、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

- 市場の見通し

- 市場概要

第3章 市場概要

- 非破壊検査の定義

- 業界の概念

- 業界の重要性

- NDTの手法

- ライフサイクル評価

- ライフサイクルコスト

- 技術ライフサイクル

- 非破壊検査 (NDT) の歴史

- 非破壊技術の歴史

- 現在の市場概要

- トレーニングとNDT認定

- NDT認証レベル

- 再認定

- 認定要件

- 認定試験

- ドキュメンテーション

- 認定レベル

- 認定要件

- トレーニングと認定機関

- バリューチェーン分析

- 市場規制/基準

- ポーターのファイブフォース分析

- COVID-19:NDT機器およびサービス市場への影響

- 総論

第4章 市場力学

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

第5章 市場内訳:セグメント別

- 非破壊検査装置

- 超音波検査 (UT)

- 放射線検査 (RT)

- 外観検査 (VI)

- 渦電流検査 (ECT)

- 磁粉検査 (MPI)

- 音響放射試験 (AET)

- 液体浸透検査 (LPI)

- IRサーモグラフィーテスト (IRT)

- その他のNDT試験方法

- NDTサービス

- NDT検査サービス

- NDTトレーニングサービス

- NDT機器レンタルサービス

- NDT機器の校正サービス

- その他のNDTサービス

第6章 市場内訳:用途別

- 石油・ガス

- 石油・ガスのNDT用途のタイプ

- 発電

- 原子力発電所におけるNDT

- 火力発電所におけるNDT

- 航空宇宙・防衛

- 自動車・輸送

- 交通安全

- 輸送:海運・鉄道

- インフラ

- 橋のNDT

- 建物のNDT

- 製造

- 金属製造業におけるNDT

- 化学産業におけるNDT

- その他の用途

- 複合材料

第7章 市場内訳:地域別

- 世界市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋地域

- 南米

- その他の地域

第8章 NDT機器およびサービス業界の持続可能性:ESGの展望

- NDT機器およびサービス業界におけるESGの重要性

- NDT機器およびサービス業界における主要なESG問題

- NDT機器およびサービス業界のESGパフォーマンス分析

- ESGの浸透

- 環境面のパフォーマンス

- 社会面のパフォーマンス

- ガバナンス面のパフォーマンス

- NDT機器およびサービス市場におけるESGに対する消費者の意識

- NDT機器およびサービス業界におけるESGの実践

- NDT機器およびサービス業界におけるESG関連のリスク

- NDT機器およびサービス業界におけるESG関連の機会

- ケーススタディ

- BCCによる総論

第9章 特許分析

第10章 M&Aと資金調達の見通し

第11章 競合情勢

- 主要企業

- 戦略的分析

- 製品の発売と開発

- M&A

- 拡張・投資

- 提携・協力

第12章 企業プロファイル

- 3DX-RAY LTD.

- ADVANCED INSPECTION TECHNOLOGIES INC.

- ADVANCED NDT LTD.

- BRUKER AXS GMBH

- CARESTREAM HEALTH INC.

- COMET AG

- EDDYFI TECHNOLOGIES

- GENERAL ELECTRIC CO.

- HOTTINGER BRUEL & KJAER GMBH

- NIKON CORP.

- OLYMPUS CORP.

- RAPISCAN SYSTEMS

- SHIMADZU CORP.

- SMITHS GROUP PLC

- SPELLMAN HIGH VOLTAGE ELECTRONICS CORP.

- THERMO FISHER SCIENTIFIC INC.

- TELEDYNE TECHNOLOGIES INC.

List of Tables

- Summary Table : Global Market for NDT Equipment and Services, by Region, Through 2028

- Table 1 : Market Regulations/Standards

- Table 2 : Porter's Five Forces Analysis: Overview

- Table 3 : Global Market for NDT Equipment and Services, by Type, Through 2028

- Table 4 : Global Market for NDT Equipment, by Type, Through 2028

- Table 5 : Global Market for NDT Equipment, by Technique, Through 2028

- Table 6 : Global Market for NDT Equipment, by Region, Through 2028

- Table 7 : Global Market for Ultrasonic Testing Equipment, by Technique, Through 2028

- Table 8 : Global Market for Ultrasonic Testing Equipment, by Type of Equipment, Through 2028

- Table 9 : Global Market for Ultrasonic Testing Equipment, by Region, Through 2028

- Table 10 : Global Market for Ultrasonic Testing Equipment, by Application, Through 2028

- Table 11 : Global Market for Radiographic Testing Equipment, by Technique, Through 2028

- Table 12 : Global Market for Radiographic Testing Equipment, by Type of Equipment, Through 2028

- Table 13 : Global Market for Radiographic Testing Equipment, by Region, Through 2028

- Table 14 : Global Market for Radiographic Testing Equipment, by Application, Through 2028

- Table 15 : Global Market for Visual Inspection Equipment, by Technique, Through 2028

- Table 16 : Global Market for Visual Inspection Equipment, by Type of Equipment, Through 2028

- Table 17 : Global Market for Visual Inspection Equipment, by Region, Through 2028

- Table 18 : Global Market for Visual Inspection Equipment, by Application, Through 2028

- Table 19 : Global Market for Eddy-Current Testing Equipment, by Technique, Through 2028

- Table 20 : Global Market for Eddy-Current Testing Equipment, by Type of Equipment, Through 2028

- Table 21 : Global Market for Eddy-Current Testing Equipment, by Region, Through 2028

- Table 22 : Global Market for Eddy-Current Testing Equipment, by Application, Through 2028

- Table 23 : Global Market for Magnetic Particle Inspection Equipment, by Technique, Through 2028

- Table 24 : Global Market for Magnetic Particle Inspection Equipment, by Type of Equipment, Through 2028

- Table 25 : Global Market for Magnetic Particle Inspection Equipment, by Region, Through 2028

- Table 26 : Global Market for Magnetic Particle Inspection Equipment, by Application, Through 2028

- Table 27 : Global Market for Acoustic Emission Testing Equipment, by Technique, Through 2028

- Table 28 : Global Market for Acoustic Emission Testing Equipment, by Type of Equipment, Through 2028

- Table 29 : Global Market for Acoustic Emission Testing Equipment, by Region, Through 2028

- Table 30 : Global Market for Acoustic Emission Testing Equipment, by Application, Through 2028

- Table 31 : Advantages and Disadvantages of Liquid Penetrant Inspection

- Table 32 : Global Market for Liquid Penetrant Inspection Equipment, by Technique, Through 2028

- Table 33 : Global Market for Liquid Penetrant Inspection Equipment, by Type of Equipment, Through 2028

- Table 34 : Global Market for Liquid Penetrant Inspection Equipment, by Region, Through 2028

- Table 35 : Global Market for Liquid Penetrant Inspection Equipment, by Application, Through 2028

- Table 36 : Global Market for IR Thermography Testing Equipment, by Technique, Through 2028

- Table 37 : Global Market for IR Thermography Testing Equipment, by Type of Equipment, Through 2028

- Table 38 : Global Market for IR Thermography Testing Equipment, by Region, Through 2028

- Table 39 : Global Market for IR Thermography Testing Equipment, by Application, Through 2028

- Table 40 : Global Market for Other Testing Equipment, by Technique, Through 2028

- Table 41 : Global Market for Other Testing Equipment, by Region, Through 2028

- Table 42 : Global Market for Other Testing Equipment, by Application, Through 2028

- Table 43 : Global Market for NDT Services, by Type, Through 2028

- Table 44 : Global Market for NDT Services, by Region, Through 2028

- Table 45 : Global Market for NDT Inspection Services, by Region, Through 2028

- Table 46 : Global Market for NDT Training Services, by Region, Through 2028

- Table 47 : Global Market for NDT Equipment Rental Services, by Region, Through 2028

- Table 48 : Global Market for NDT Equipment Calibration Services, by Region, Through 2028

- Table 49 : Global Market for Other NDT Services, by Region, Through 2028

- Table 50 : Global Market for NDT Equipment, by Application, Through 2028

- Table 51 : Global Market for NDT Equipment in Oil and Gas Applications, by Type of Equipment, Through 2028

- Table 52 : Global Market for NDT Equipment in Oil and Gas Applications, by Region, Through 2028

- Table 53 : Global Market for NDT Equipment in Power Generation Applications, by Type of Equipment, Through 2028

- Table 54 : Global Market for NDT Equipment in Power Generation Applications, by Region, Through 2028

- Table 55 : Global Market for NDT Equipment in Aerospace and Defense Applications, by Type of Equipment, Through 2028

- Table 56 : Global Market for NDT Equipment in Aerospace and Defense Applications, by Region, Through 2028

- Table 57 : Global Market for NDT Equipment in Automotive and Transportation Applications, by Type of Equipment, Through 2028

- Table 58 : Global Market for NDT Equipment in Automotive and Transportation Applications, by Region, Through 2028

- Table 59 : Global Market for NDT Equipment in Infrastructure Applications, by Type of Equipment, Through 2028

- Table 60 : Global Market for NDT Equipment in Infrastructure Applications, by Region, Through 2028

- Table 61 : Global Market for NDT Equipment in Maufacturing Applications, by Type of Equipment, Through 2028

- Table 62 : Global Market for NDT Equipment in Maufacturing Applications, by Region, Through 2028

- Table 63 : Global Market for NDT Equipment in Other Applications, by Type of Equipment, Through 2028

- Table 64 : Global Market for NDT Equipment in Other Applications, by Region, Through 2028

- Table 65 : Global Market for NDT Equipment and Services, by Region, Through 2028

- Table 66 : North American Market for NDT Equipment and Services, by Type of Equipment, Through 2028

- Table 67 : North American Market for NDT Equipment and Services, by Type of Service, Through 2028

- Table 68 : North American Market for NDT Equipment, by Application, Through 2028

- Table 69 : North American Market for NDT Equipment and Services, by Country, Through 2028

- Table 70 : European Market for NDT Equipment and Services, by Type of Equipment, Through 2028

- Table 71 : European Market for NDT Equipment and Services, by Type of Service, Through 2028

- Table 72 : European Market for NDT Equipment, by Application, Through 2028

- Table 73 : European Market for NDT Equipment and Services, by Country, Through 2028

- Table 74 : Asia-Pacific Market for NDT Equipment and Services, by Type of Equipment, Through 2028

- Table 75 : Asia-Pacific Market for NDT Equipment and Services, by Type of Service, Through 2028

- Table 76 : Asia-Pacific Market for NDT Equipment, by Application, Through 2028

- Table 77 : Asia-Pacific Market for NDT Equipment and Services, by Country, Through 2028

- Table 78 : South American Market for NDT Equipment and Services, by Type of Equipment, Through 2028

- Table 79 : South American Market for NDT Equipment and Services, by Type of Service, Through 2028

- Table 80 : South American Market for NDT Equipment, by Application, Through 2028

- Table 81 : South American Market for NDT Equipment and Services, by Country, Through 2028

- Table 82 : RoW Market for NDT Equipment and Services, by Type of Equipment, Through 2028

- Table 83 : RoW Market for NDT Equipment and Services, by Type of Service, Through 2028

- Table 84 : RoW Market for NDT Equipment, by Application, Through 2028

- Table 85 : RoW Market for NDT Equipment and Services, by Country, Through 2028

- Table 86 : Global NDT Equipment and Services Market: Environmental ESG Metrics, 2022

- Table 87 : Global NDT Equipment and Services Market: Social ESG Metrics, 2022

- Table 88 : Global NDT Equipment and Services Market: Governance ESG Metrics, 2022

- Table 89 : Company Patents Shares of NDT Equipment and Services, 2022

- Table 90 : M&A, January 2021-August 2023

- Table 91 : Start-up Funding in the NDT Equipment and Services Industry, January 2021-August 2023

- Table 92 : Product Launches and Developments, by Major Players, 2020-2023*

- Table 93 : Mergers and Acquisitions, by Major Players, 2020-2023*

- Table 94 : Expansions and Investments, by Major Players, 2020-2023*

- Table 95 : Collaborations and Partnerships, by Major Players, 2020-2023*

- Table 96 : 3DX-Ray Ltd.: NDT Equipment and Services Product Portfolio

- Table 97 : Advanced Inspection Technologies Inc.: NDT Equipment and Services Product Portfolio

- Table 98 : Advanced NDT Ltd.: NDT Equipment and Services Product Portfolio

- Table 99 : Bruker AXS GmbH: Annual Revenue, 2022

- Table 100 : Bruker AXS GmbH: News, 2019

- Table 101 : Bruker AXS GmbH: NDT Equipment and Services Product Portfolio

- Table 102 : Carestream Health Inc.: NDT Equipment and Services Product Portfolio

- Table 103 : Comet AG: Annual Revenue, 2022

- Table 104 : Comet AG: News, 2022

- Table 105 : Comet AG: NDT Equipment and Services Product Portfolio

- Table 106 : Eddyfi Technologies: News, 2022

- Table 107 : Eddyfi Technologies: NDT Equipment and Services Product Portfolio

- Table 108 : General Electric Company: Annual Revenue, 2022

- Table 109 : General Electric Company: NDT Equipment and Services Product Portfolio

- Table 110 : Hottinger Bruel & Kjaer GmbH: NDT Equipment and Services Product Portfolio

- Table 111 : Nikon Corp.: Annual Revenue, 2022

- Table 112 : Nikon Corp.: News, 2023

- Table 113 : Nikon Corp.: NDT Equipment and Services Product Portfolio

- Table 114 : Olympus Corp.: Annual Revenue, 2022

- Table 115 : Olympus Corp.: News, 2020

- Table 116 : Olympus Corp.: NDT Equipment and Services Product Portfolio

- Table 117 : Rapiscan Systems: News, 2023

- Table 118 : Rapiscan Systems: NDT Equipment and Services Product Portfolio

- Table 119 : Shimadzu Corp.: Annual Revenue, 2022

- Table 120 : Shimadzu Corp.: NDT Equipment and Services Product Portfolio

- Table 121 : Smiths Group plc: Annual Revenue, 2022

- Table 122 : Smiths Group plc: News, 2023

- Table 123 : Smiths Group plc: NDT Equipment and Services Product Portfolio

- Table 124 : Spellman High Voltage Electronics Corp.: News, 2022

- Table 125 : Spellman High Voltage Electronics Corp.: NDT Equipment and Services Product Portfolio

- Table 126 : Thermo Fisher Scientific Inc.: Annual Revenue, 2022

- Table 127 : Thermo Fisher Scientific Inc.: NDT Equipment and Services Product Portfolio

- Table 128 : Teledyne Technologies Inc.: Annual Revenue, 2022

- Table 129 : Teledyne Technologies Inc.: News, 2023

- Table 130 : Teledyne Technologies Inc.: NDT Equipment and Services Product Portfolio

List of Figures

- Summary Figure : Global Market Shares of NDT Equipment and Services, by Region, 2022

- Figure 1 : Market Value Chain Analysis

- Figure 2 : Porter's Five Forces Analysis

- Figure 3 : Bargaining Power of Buyers

- Figure 4 : Bargaining Power of Suppliers

- Figure 5 : Threat of New Entrants

- Figure 6 : Threat of Substitutes

- Figure 7 : Degree of Competition

- Figure 8 : Key Factors Impacting the NDT Equipment and Services Market

- Figure 9 : Global Market Shares of NDT Equipment and Services, by Type, 2022

- Figure 10 : Global Market Shares of NDT Equipment and Services, by Type, 2028

- Figure 11 : Global Market Shares of NDT Equipment, by Type, 2022

- Figure 12 : Global Market Shares of NDT Equipment, by Type, 2028

- Figure 13 : Global Market Shares of NDT Equipment, by Technique, 2022

- Figure 14 : Global Market Shares of NDT Equipment, by Technique, 2028

- Figure 15 : Global Market Shares of NDT Equipment, by Region, 2022

- Figure 16 : Global Market Shares of NDT Equipment, by Region, 2028

- Figure 17 : Global Market Shares of Ultrasonic Testing Equipment, by Technique, 2022

- Figure 18 : Global Market Shares of Ultrasonic Testing Equipment, by Technique, 2028

- Figure 19 : Global Market Shares of Ultrasonic Testing Equipment, by Type of Equipment, 2022

- Figure 20 : Global Market Shares of Ultrasonic Testing Equipment, by Type of Equipment, 2028

- Figure 21 : Global Market Shares of Ultrasonic Testing Equipment, by Region, 2022

- Figure 22 : Global Market Shares of Ultrasonic Testing Equipment, by Region, 2028

- Figure 23 : Global Market Shares of Ultrasonic Testing Equipment, by Application, 2022

- Figure 24 : Global Market Shares of Ultrasonic Testing Equipment, by Application, 2028

- Figure 25 : Global Market Shares of Radiographic Testing Equipment, by Technique, 2022

- Figure 26 : Global Market Shares of Radiographic Testing Equipment, by Technique, 2028

- Figure 27 : Global Market Shares of Radiographic Testing Equipment, by Type of Equipment, 2022

- Figure 28 : Global Market Shares of Radiographic Testing Equipment, by Type of Equipment, 2028

- Figure 29 : Global Market Shares of Radiographic Testing Equipment, by Region, 2022

- Figure 30 : Global Market Shares of Radiographic Testing Equipment, by Region, 2028

- Figure 31 : Global Market Shares of Radiographic Testing Equipment, by Application, 2022

- Figure 32 : Global Market Shares of Radiographic Testing Equipment, by Application, 2028

- Figure 33 : Global Market Shares of Visual Inspection Equipment, by Technique, 2022

- Figure 34 : Global Market Shares of Visual Inspection Equipment, by Technique, 2028

- Figure 35 : Global Market Shares of Visual Inspection Equipment, by Type of Equipment, 2022

- Figure 36 : Global Market Shares of Visual Inspection Equipment, by Type of Equipment, 2028

- Figure 37 : Global Market Shares of Visual Inspection Equipment, by Region, 2022

- Figure 38 : Global Market Shares of Visual Inspection Equipment, by Region, 2028

- Figure 39 : Global Market Shares of Visual Inspection Equipment, by Application, 2022

- Figure 40 : Global Market Shares of Visual Inspection Equipment, by Application, 2028

- Figure 41 : Global Market Shares of Eddy-Current Testing Equipment, by Technique, 2022

- Figure 42 : Global Market Shares of Eddy-Current Testing Equipment, by Technique, 2028

- Figure 43 : Global Market Shares of Eddy-Current Testing Equipment, by Type of Equipment, 2022

- Figure 44 : Global Market Shares of Eddy-Current Testing Equipment, by Type of Equipment, 2028

- Figure 45 : Global Market Shares of Eddy-Current Testing Equipment, by Region, 2022

- Figure 46 : Global Market Shares of Eddy-Current Testing Equipment, by Region, 2028

- Figure 47 : Global Market Shares of Eddy-Current Testing Equipment, by Application, 2022

- Figure 48 : Global Market Shares of Eddy-Current Testing Equipment, by Application, 2028

- Figure 49 : Global Market Shares of Magnetic Particle Inspection Equipment, by Technique, 2022

- Figure 50 : Global Market Shares of Magnetic Particle Inspection Equipment, by Technique, 2028

- Figure 51 : Global Market Shares of Magnetic Particle Inspection Equipment, by Type of Equipment, 2022

- Figure 52 : Global Market Shares of Magnetic Particle Inspection Equipment, by Type of Equipment, 2028

- Figure 53 : Global Market Shares of Magnetic Particle Inspection Equipment, by Region, 2022

- Figure 54 : Global Market Shares of Magnetic Particle Inspection Equipment, by Region, 2028

- Figure 55 : Global Market Shares of Magnetic Particle Inspection Equipment, by Application, 2022

- Figure 56 : Global Market Shares of Magnetic Particle Inspection Equipment, by Application, 2028

- Figure 57 : Global Market Shares of Acoustic Emission Testing Equipment, by Technique, 2022

- Figure 58 : Global Market Shares of Acoustic Emission Testing Equipment, by Technique, 2028

- Figure 59 : Global Market Shares of Acoustic Emission Testing Equipment, by Type of Equipment, 2022

- Figure 60 : Global Market Shares of Acoustic Emission Testing Equipment, by Type of Equipment, 2028

- Figure 61 : Global Market Shares of Acoustic Emission Testing Equipment, by Region, 2022

- Figure 62 : Global Market Shares of Acoustic Emission Testing Equipment, by Region, 2028

- Figure 63 : Global Market Shares of Acoustic Emission Testing Equipment, by Application, 2022

- Figure 64 : Global Market Shares of Acoustic Emission Testing Equipment, by Application, 2028

- Figure 65 : Global Market Shares of Liquid Penetrant Inspection Equipment, by Technique, 2022

- Figure 66 : Global Market Shares of Liquid Penetrant Inspection Equipment, by Technique, 2028

- Figure 67 : Global Market Shares of Liquid Penetrant Inspection Equipment, by Type of Equipment, 2022

- Figure 68 : Global Market Shares of Liquid Penetrant Inspection Equipment, by Type of Equipment, 2028

- Figure 69 : Global Market Shares of Liquid Penetrant Inspection Equipment, by Region, 2022

- Figure 70 : Global Market Shares of Liquid Penetrant Inspection Equipment, by Region, 2028

- Figure 71 : Global Market Shares of Liquid Penetrant Inspection Equipment, by Application, 2022

- Figure 72 : Global Market Shares of Liquid Penetrant Inspection Equipment, by Application, 2028

- Figure 73 : Global Market Shares of IR Thermography Testing Equipment, by Technique, 2022

- Figure 74 : Global Market Shares of IR Thermography Testing Equipment, by Technique, 2028

- Figure 75 : Global Market Shares of IR Thermography Testing Equipment, by Type of Equipment, 2022

- Figure 76 : Global Market Shares of IR Thermography Testing Equipment, by Type of Equipment, 2028

- Figure 77 : Global Market Shares of IR Thermography Testing Equipment, by Region, 2022

- Figure 78 : Global Market Shares of IR Thermography Testing Equipment, by Region, 2028

- Figure 79 : Global Market Shares of IR Thermography Testing Equipment, by Application, 2022

- Figure 80 : Global Market Shares of IR Thermography Testing Equipment, by Application, 2028

- Figure 81 : Global Market Shares of Other Testing Equipment, by Technique, 2022

- Figure 82 : Global Market Shares of Other Testing Equipment, by Technique, 2028

- Figure 83 : Global Market Shares of Other Testing Equipment, by Region, 2022

- Figure 84 : Global Market Shares of Other Testing Equipment, by Region, 2028

- Figure 85 : Global Market Shares of Other Testing Equipment, by Application, 2022

- Figure 86 : Global Market Shares of Other Testing Equipment, by Application, 2028

- Figure 87 : Global Market Shares of NDT Services, by Type, 2022

- Figure 88 : Global Market Shares of NDT Services, by Type, 2028

- Figure 89 : Global Market Shares of NDT Services, by Region, 2022

- Figure 90 : Global Market Shares of NDT Services, by Region, 2028

- Figure 91 : Global Market Shares of NDT Inspection Services, by Region, 2022

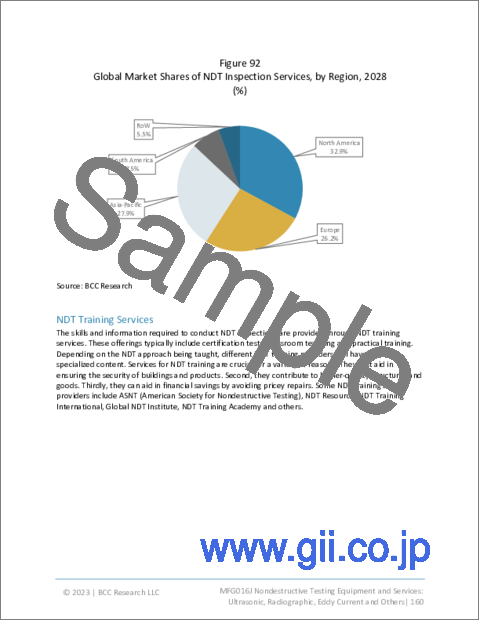

- Figure 92 : Global Market Shares of NDT Inspection Services, by Region, 2028

- Figure 93 : Global Market Shares of NDT Training Services, by Region, 2022

- Figure 94 : Global Market Shares of NDT Training Services, by Region, 2028

- Figure 95 : Global Market Shares of NDT Equipment Rental Services, by Region, 2022

- Figure 96 : Global Market Shares of NDT Equipment Rental Services, by Region, 2028

- Figure 97 : Global Market Shares of NDT Equipment Calibration Services, by Region, 2022

- Figure 98 : Global Market Shares of NDT Equipment Calibration Services, by Region, 2028

- Figure 99 : Global Market Shares of Other NDT Services, by Region, 2022

- Figure 100 : Global Market Shares of Other NDT Services, by Region, 2028

- Figure 101 : Global Market Shares of NDT Equipment, by Application, 2022

- Figure 102 : Global Market Shares of NDT Equipment, by Application, 2028

- Figure 103 : Global Market Shares of NDT Equipment in Oil and Gas Applications, by Type of Equipment, 2022

- Figure 104 : Global Market Shares of NDT Equipment in Oil and Gas Applications, by Type of Equipment, 2028

- Figure 105 : Global Market Shares of NDT Equipment in Oil and Gas Applications, by Region, 2022

- Figure 106 : Global Market Shares of NDT Equipment in Oil and Gas Applications, by Region, 2028

- Figure 107 : Global Market Shares of NDT Equipment in Power Generation Applications, by Type of Equipment, 2022

- Figure 108 : Global Market Shares of NDT Equipment in Power Generation Applications, by Type of Equipment, 2028

- Figure 109 : Global Market Shares of NDT Equipment in Power Generation Applications, by Region, 2022

- Figure 110 : Global Market Shares of NDT Equipment in Power Generation Applications, by Region, 2028

- Figure 111 : Global Market Shares of NDT Equipment in Aerospace and Defense Applications, by Type of Equipment, 2022

- Figure 112 : Global Market Shares of NDT Equipment in Aerospace and Defense Applications, by Type of Equipment, 2028

- Figure 113 : Global Market Shares of NDT Equipment in Aerospace and Defense Applications, by Region, 2022

- Figure 114 : Global Market Shares of NDT Equipment in Aerospace and Defense Applications, by Region, 2028

- Figure 115 : Global Market Shares of NDT Equipment in Automotive and Transportation Applications, by Type of Equipment, 2022

- Figure 116 : Global Market Shares of NDT Equipment in Automotive and Transportation Applications, by Type of Equipment, 2028

- Figure 117 : Global Market Shares of NDT Equipment in Automotive and Transportation Applications, by Region, 2022

- Figure 118 : Global Market Shares of NDT Equipment in Automotive and Transportation Applications, by Region, 2028

- Figure 119 : Global Market Shares of NDT Equipment in Infrastructure Applications, by Type of Equipment, 2022

- Figure 120 : Global Market Shares of NDT Equipment in Infrastructure Applications, by Type of Equipment, 2028

- Figure 121 : Global Market Shares of NDT Equipment in Infrastructure Applications, by Region, 2022

- Figure 122 : Global Market Shares of NDT Equipment in Infrastructure Applications, by Region, 2028

- Figure 123 : Global Market Shares of NDT Equipment in Maufacturing Applications, by Type of Equipment, 2022

- Figure 124 : Global Market Shares of NDT Equipment in Maufacturing Applications, by Type of Equipment, 2028

- Figure 125 : Global Market Shares of NDT Equipment in Maufacturing Applications, by Region, 2022

- Figure 126 : Global Market Shares of NDT Equipment in Maufacturing Applications, by Region, 2028

- Figure 127 : Global Market Shares of NDT Equipment in Other Applications, by Type of Equipment, 2022

- Figure 128 : Global Market Shares of NDT Equipment in Other Applications, by Type of Equipment, 2028

- Figure 129 : Global Market Shares of NDT Equipment in Other Applications, by Region, 2022

- Figure 130 : Global Market Shares of NDT Equipment in Other Applications, by Region, 2028

- Figure 131 : Global Market for NDT Equipment and Services, by Region

- Figure 132 : Global Market Shares of NDT Equipment and Services, by Region, 2022

- Figure 133 : Global Market Shares of NDT Equipment and Services, by Region, 2028

- Figure 134 : U.S. Market for NDT Equipment and Services, 2022-2028

- Figure 135 : Canadian Market for NDT Equipment and Services, 2022-2028

- Figure 136 : Mexican Market for NDT Equipment and Services, 2022-2028

- Figure 137 : German Market for NDT Equipment and Services, 2022-2028

- Figure 138 : French Market for NDT Equipment and Services, 2022-2028

- Figure 139 : Italian Market for NDT Equipment and Services, 2022-2028

- Figure 140 : U.K. Market for NDT Equipment and Services, 2022-2028

- Figure 141 : Rest of European Market for NDT Equipment and Services, 2022-2028

- Figure 142 : Chinese Market for NDT Equipment and Services, 2022-2028

- Figure 143 : Japanese Market for NDT Equipment and Services, 2022-2028

- Figure 144 : Indian Market for NDT Equipment and Services, 2022-2028

- Figure 145 : Rest of Asia-Pacific Market for NDT Equipment and Services, 2022-2028

- Figure 146 : ESG Compliant Companies in the Global Market for NDT Equipment and Services, 2022

- Figure 147 : Number of Patents, by Year, 2018 to 2023*

- Figure 148 : Patents Shares of NDT Equipment and Services, by Region, 2022

- Figure 149 : Distribution Share of M&A in the NDT Equipment and Services Industry, by Region, 2021-2023*

- Figure 150 : Distribution Share of Start-up Funding Amounts in the NDT Equipment and Services Industry, by Deal Type, 2021-2023*

- Figure 151 : Market Shares of NDT Equipment and Services, by Leading Player, 2022

- Figure 152 : Shares of the Most Followed Strategies in the Global Market for NDT Equipment and Services, 2020-2023*

- Figure 153 : Bruker AXS GmbH: Annual Revenue, 2021 and 2022

- Figure 154 : Bruker AXS GmbH: Revenue Shares, by Business Unit, 2022

- Figure 155 : Bruker AXS GmbH: Revenue Shares, by Country/Region, 2022

- Figure 156 : Comet AG: Annual Revenue, 2021 and 2022

- Figure 157 : Comet AG: Revenue Shares, by Business Unit, 2022

- Figure 158 : Comet AG: Revenue Shares, by Country/Region, 2022

- Figure 159 : General Electric Co.: Annual Revenue, 2021 and 2022

- Figure 160 : General Electric Company: Revenue Shares, by Business Unit, 2022

- Figure 161 : General Electric Co.: Revenue Shares, by Country/Region, 2022

- Figure 162 : Nikon Corp.: Annual Revenue, 2021 and 2022

- Figure 163 : Nikon Corp.: Revenue Shares, by Business Unit, 2022

- Figure 164 : Nikon Corp.: Revenue Shares, by Country/Region, 2022

- Figure 165 : Olympus Corp.: Annual Revenue, 2021 and 2022

- Figure 166 : Olympus Corp.: Revenue Shares, by Business Unit, 2022

- Figure 167 : Olympus Corp.: Revenue Shares, by Country/Region, 2022

- Figure 168 : Shimadzu Corp.: Annual Revenue, 2021 and 2022

- Figure 169 : Shimadzu Corp.: Revenue Shares, by Business Unit, 2022

- Figure 170 : Shimadzu Corp.: Revenue Shares, by Country/Region, 2022

- Figure 171 : Smiths Group plc: Annual Revenue, 2021 and 2022

- Figure 172 : Smiths Group plc: Revenue Shares, by Business Unit, 2022

- Figure 173 : Smiths Group plc: Revenue Shares, by Country/Region, 2022

- Figure 174 : Thermo Fisher Scientific Inc.: Annual Revenue, 2021 and 2022

- Figure 175 : Thermo Fisher Scientific Inc.: Revenue Shares, by Business Unit, 2022

- Figure 176 : Thermo Fisher Scientific Inc.: Revenue Shares, by Country/Region, 2022

- Figure 177 : Teledyne Technologies Inc.: Annual Revenue, 2021 and 2022

- Figure 178 : Teledyne Technologies Inc.: Revenue Shares, by Business Unit, 2022

- Figure 179 : Teledyne Technologies Inc.: Revenue Shares, by Country/Region, 2022

Highlights:

The global market for NDT equipment and services is estimated to increase from $31.3 billion in 2023 to reach $50.7 billion by 2028, at a compound annual growth rate (CAGR) of 10.1% from 2023 through 2028.

North American market for NDT equipment and services is estimated to increase from $10.1 billion in 2023 to reach $16.5 billion by 2028, at a compound annual growth rate (CAGR) of 10.4% from 2023 through 2028.

Asia-Pacific market for NDT equipment and services is estimated to increase from $7.8 billion in 2023 to reach $14.2 billion by 2028, at a compound annual growth rate (CAGR) of 12.8% from 2023 through 2028.

Report Scope:

In this report, the market has been segmented based on types (equipment type and service type), application and geography. The report provides an overview of the global NDT equipment and services market and analyzes market trends. Using 2022 as the base year, the report provides estimated market data for 2023-2028. Revenue forecasts for this period are segmented based on types (equipment type and service type), application and geography. Market values have been estimated based on the triangulation method using parameters such as the total revenue of NDT equipment and services providers, primary interview results and secondary white paper information.

The report covers the market for NDT equipment and services with regard to the application base across different regions. It also highlights major trends and challenges that affect the market and the vendor landscape. The report estimates the global market for NDT equipment and services in 2022 and provides projections for the expected market size through 2028.

Report Includes:

- 92 data tables and 39 additional tables

- An overview of the global market landscape related to the nondestructive testing equipment and services: ultrasonic, radiographic, eddy current and others

- In-depth analysis of global market trends, featuring historical revenue data for 2022, estimated figures for 2023, as well as forecasts for 2025, and 2028. This analysis includes projections of Compound Annual Growth Rates (CAGRs) spanning through 2028

- Evaluation of the current market size and revenue growth prospects specific to non destructive testing equipment and services, accompanied by a comprehensive market share analysis categorized by equipment type, service type, technique, application, and geographical region

- An overview of the challenges that the industry is facing and a discussion on how to overcome them

- Discussion on concepts, importance and life cycle assessment of the industry and information on training and NDT certification requirements and coverage of market regulations and standards

- An analysis of pipeline products and ESG trends

- Market share analysis of the key companies and coverage of their proprietary technologies, strategic alliances, and patent activity

- Company profiles of the leading players including Thermo Fisher Scientific Inc., Smiths Group plc., Olympus Corp., General Electric Company., and Nikon Corp.

Table of Contents

Chapter 1 Introduction

- Introduction

- Study Goals and Objectives

- Reasons for Doing the Study

- Scope of Report

- What's New in This Update?

- Methodology

- Information Sources

- Geographic Breakdown

- Segmentation Breakdown

Chapter 2 Summary and Highlights

- Market Outlook

Chapter 3 Market Overview

- Definition of Nondestructive Testing

- Concepts in the Industry

- Importance of the Industry

- NDT Methods

- Life Cycle Assessment

- Life Cycle Cost

- Technology Life Cycle

- History of Nondestructive Testing (NDT)

- History of Nondestructive Technologies

- Current Market Overview

- Training and NDT Certification

- NDT Certification Levels

- Recertification

- Certification Requirements

- Certification Examinations

- Documentation

- Levels of Certification

- Certification Requirements

- Accredited Bodies for Training and Certification

- Value Chain Analysis

- Market Regulations/Standards

- Porter's Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of New Entrants

- Threat of Substitutes

- Degree of Competition

- Impact of COVID-19 on the Market for NDT Equipment and Services

- Conclusion

Chapter 4 Market Dynamics

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

Chapter 5 Market Breakdown by Segment

- Introduction

- NDT Equipment

- Ultrasonic Testing (UT)

- Radiographic Testing (RT)

- Visual Inspection (VI)

- Eddy-Current Testing (ECT)

- Magnetic Particle Inspection (MPI)

- Acoustic Emission Testing (AET)

- Liquid Penetrant Inspection (LPI)

- IR Thermography Testing (IRT)

- Other NDT Testing Methods

- NDT Services

- NDT Inspection Services

- NDT Training Services

- NDT Equipment Rental Services

- NDT Equipment Calibration Services

- Other NDT Services

Chapter 6 Market Breakdown by Application

- Introduction

- Oil and Gas

- Types of Oil and Gas NDT Applications

- Power Generation

- NDT in Nuclear Power Plants

- NDT in Thermal Power Plants

- Aerospace and Defense

- Automotive and Transportation

- Transportation Security

- Transportation-Shipping and Railroads

- Infrastructure

- NDT on Bridges

- NDT on Buildings

- Manufacturing

- NDT in Metals Production Industries

- NDT in Chemical Industries

- Other Applications

- Composites

Chapter 7 Market Breakdown by Region

- Total Global Value by Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- U.K.

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- South America

- Rest of the World (RoW)

Chapter 8 Sustainability in the NDT Equipment and Services Industry: An ESG Perspective

- Importance of ESG in the NDT Equipment and Services Industry

- Key ESG Issues in the NDT Equipment and Services Industry

- NDT Equipment and Services Industry ESG Performance Analysis

- ESG Penetration

- Environmental Performance

- Social Performance

- Governance Performance

- Consumer Attitudes toward ESG in the Market for NDT Equipment and Services

- ESG Practices in the NDT Equipment and Services Industry

- ESG-Related Risks in the NDT Equipment and Services Industry

- ESG-Related Opportunities in the NDT Equipment and Services Industry

- Case Study

- Concluding Remarks from BCC

Chapter 9 Patent Analysis

- Patent Analysis

- Recently Granted Key Patents

Chapter 10 M&A and Funding Outlook

- M&A Analysis

- Start-up Funding in the Equipment and Services Industry

Chapter 11 Competitive Landscape

- Top Companies

- Strategic Analysis

- Product Launches and Developments

- Acquisitions and Mergers

- Expansions and Investments

- Collaborations and Partnerships

Chapter 12 Company Profiles

- 3DX-RAY LTD.

- ADVANCED INSPECTION TECHNOLOGIES INC.

- ADVANCED NDT LTD.

- BRUKER AXS GMBH

- CARESTREAM HEALTH INC.

- COMET AG

- EDDYFI TECHNOLOGIES

- GENERAL ELECTRIC CO.

- HOTTINGER BRUEL & KJAER GMBH

- NIKON CORP.

- OLYMPUS CORP.

- RAPISCAN SYSTEMS

- SHIMADZU CORP.

- SMITHS GROUP PLC

- SPELLMAN HIGH VOLTAGE ELECTRONICS CORP.

- THERMO FISHER SCIENTIFIC INC.

- TELEDYNE TECHNOLOGIES INC.