|

|

市場調査レポート

商品コード

1641371

データセンターコロケーションの世界市場:見通し(2024年~2029年)Global Data Center Colocation Market Landscape 2024-2029 |

||||||

|

|||||||

| データセンターコロケーションの世界市場:見通し(2024年~2029年) |

|

出版日: 2025年01月21日

発行: Arizton Advisory & Intelligence

ページ情報: 英文 405 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のデータセンターコロケーションの市場規模は、2023年から2029年にかけてCAGR 10.97%で成長する見込みです。

電力調達、サプライチェーンの制約、労働力不足などの課題が依然として存在するにもかかわらず、事業者は市場に大容量を展開し続けています。人工知能による爆発的な需要により、2024年から2029年にかけて約48GWのデータセンター容量が追加されます。欧州のデータセンターコロケーション市場は成熟しており、英国、ドイツ、ノルウェーなどの国々がデータセンター新規開拓のホットスポットであり続ける一方、スペイン、イタリア、フィンランド、ポルトガル、ギリシャなどの二次市場からの寄与は前年比成長が見込まれています。

中東・アフリカ(MEA)では、UAE、サウジアラビア、南アフリカにおけるスマートシティプロジェクトやクラウドインフラへの政府投資が原動力となり、データセンターコロケーション市場が急速に拡大しています。アジア太平洋地域は、世界プロバイダーやローカルプロバイダーからの旺盛な投資により、引き続き活況を呈しています。中国、マレーシア、インド、日本、オーストラリア、韓国などの国々では、AIワークロードに対する需要の高まりと、クラウドサービスプロバイダーの複数の新市場への進出により、データセンター建設が増加しています。

当レポートでは、世界のデータセンターコロケーション市場について調査し、市場の概要とともに、国域別の動向、および市場の今後の予測などを提供しています。

目次

第1章 ARIZTONについて

第2章 データセンターの機能について

第3章 概要

第4章 対象セグメント

第5章 調査手法

第6章 市場の概要

第7章 重要考察

第8章 投資機会

- 投資:市場規模と予測

- 分野:市場規模と予測

- 電力容量:市場規模と予測

- コロケーション収益:市場規模と予測

第9章 市場力学

- 市場機会と動向

- 市場促進要因

- 市場抑制要因

- サイト選択基準

第10章 インフラストラクチャのセグメンテーション

- コロケーションタイプ

- 電気インフラ

- 機械インフラ

- 冷却システム

- 冷却技術

- 一般建設

第11章 地域セグメンテーション

第12章 北米

第13章 米国

第14章 カナダ

第15章 ラテンアメリカ

第16章 ブラジル

第17章 メキシコ

第18章 チリ

第19章 コロンビア

第20章 その他のラテンアメリカ

第21章 西欧

第22章 英国

第23章 ドイツ

第24章 フランス

第25章 オランダ

第26章 アイルランド

第27章 スイス

第28章 イタリア

第29章 スペイン

第30章 ベルギー

第31章 ポルトガル

第32章 その他の西欧諸国

第33章 北欧

第34章 デンマーク

第35章 スウェーデン

第36章 ノルウェー

第37章 フィンランドとアイスランド

第38章 中欧・東欧

第39章 ロシア

第40章 ポーランド

第41章 オーストリア

第42章 チェコ共和国

第43章 その他の中欧・東欧諸国

第44章 投資別市場

第45章 地域別市場

第46章 電力容量と再生可能エネルギーの導入

第47章 サポートインフラストラクチャ別のデータセンター市場

第48章 コロケーション収益別市場

第49章 中東

第50章 アラブ首長国連邦

第51章 サウジアラビア

第52章 イスラエル

第53章 オマーン

第54章 カタール

第55章 クウェート

第56章 ヨルダン

第57章 バーレーン

第58章 その他の中東諸国

第59章 アフリカ

第60章 南アフリカ

第61章 ケニア

第62章 ナイジェリア

第63章 エジプト

第64章 エチオピア

第65章 その他のアフリカ諸国

第66章 アジア太平洋

第67章 中国

第68章 香港

第69章 オーストラリア

第70章 ニュージーランド

第71章 インド

第72章 日本

第73章 台湾

第74章 韓国

第75章 その他のアジア太平洋諸国

第76章 東南アジア

第77章 シンガポール

第78章 マレーシア

第79章 タイ

第80章 インドネシア

第81章 フィリピン

第82章 ベトナム

第83章 その他の東南アジア諸国

第84章 競合情勢

第85章 市場参入企業

第86章 定量的要約

第87章 付録

The global data center colocation market by investment is expected to grow at a CAGR of 10.97% from 2023 to 2029.

KEY HIGHLIGHTS

- Even though challenges such as procuring power, supply chain constraints, and labor shortage still prevail, the operators are continuing to deploy high capacity into the markets.

- Explosive demand from Artificial Intelligence will lead to the addition of around 48 GW of data center capacity during 2024-2029.

- The European data center colocation market is mature, countries like the UK, Germany, and Norway remain hotspots for new data center development, while contributions from secondary markets such as Spain, Italy, Finland, Portugal, and Greece are expected to grow year-over-year.

- In the Middle East & Africa (MEA), the data center colocation market is rapidly expanding, driven by government investments in smart city projects and cloud infrastructure in the UAE, Saudi Arabia, and South Africa.

- The APAC region remains highly dynamic, with strong investments from global and local providers. Countries like China, Malaysia, India, Japan, Australia, and South Korea, are seeing increased data center construction due to growing demand for AI workloads and the expansion of cloud service providers into multiple new markets.

- Renewable energy is increasingly used to power data centers, and edge data centers are emerging to meet local connectivity demands.

The report includes the investment in the following areas:

Segmentation by Colocation Services

- Retail Colocation

- Wholesale Colocation

Segmentation by Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

Segmentation by Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgear

- PDUs

- Other Electrical Infrastructure

Segmentation by Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Segmentation by Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

Segmentation by Cooling Techniques

- Air-based Cooling

- Liquid-based Cooling

Segmentation by General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- DCIM/BMS Solutions

Segmentation by Tier Standards

- Tier I & II

- Tier III

- Tier IV

Segmentation by Geography

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Chile

- Colombia

- Rest of Latin America

- Western Europe

- UK

- Germany

- France

- Netherlands

- Ireland

- Switzerland

- Italy

- Spain

- Belgium

- Portugal

- Other Western European Countries

- Nordics

- Denmark

- Sweden

- Norway

- Finland & Iceland

- Central & Eastern European Countries

- Russia

- Poland

- Austria

- Czech Republic

- Other Central & Eastern European Countries

- Middle East

- UAE

- Saudi Arabia

- Israel

- Oman

- Qatar

- Kuwait

- Jordan

- Bahrain

- Other Middle Eastern Countries

- Africa

- South Africa

- Kenya

- Nigeria

- Egypt

- Ethiopia

- Other African Countries

- APAC

- China

- Hong Kong

- Australia

- New Zealand

- India

- Japan

- Taiwan

- South Korea

- Rest of APAC

- Southeast Asia

- Singapore

- Malaysia

- Thailand

- Indonesia

- Philippines

- Vietnam

- Other Southeast Asian Countries

KEY MARKETS TRENDS

Artificial Intelligence Growth Enabling Construction of Data Centers

- The rapid growth of new and disruptive technologies, particularly AI, has resulted in unprecedented power dynamics, digital transformation, and global economic effects. With the broad deployment of AI, particularly in general-purpose applications such as ChatGPT, a quick AI revolution is expected.

- The emergence of GenAI has sparked queries regarding its integration into products, benefit optimization, and ethical usage in the face of growing demand from vendors, consumers, and enterprises alike. Subsequently, the growth of AI is projected to support the data center colocation market growth. Also, following the U.S. and China, the EU has emerged as a major player in AI research and application. APAC countries are increasingly embracing AI, driven by the growing prevalence of automation and intelligent operations. Various governments in the region are introducing numerous AI strategies. For example, the Hong Kong government intends to leverage AI to monitor disasters and manage energy consumption.

Data Centers Prioritize Energy-Efficient, Sustainable Operations

- Data center operators are leveraging solar, wind, and other renewable energy technologies to reduce carbon footprint. The adoption of renewable energy aims to align data centers with sustainability objectives and minimize the environmental impact.

- Green data centers are revolutionizing operations, paving the way for a more sustainable and eco-friendly future. Minimizing energy costs will be pivotal for the future growth of data centers. As the region prioritizes environmental sustainability, green data centers will play an increasingly crucial role in organization's digital advances while mitigating their environmental footprint.

- Data center operators are securing green and sustainability-linked loans to support eco-friendly projects. Examples include STACK Infrastructure's USD 3 billion green financing in August 2024 and DataBank's USD 725 million loan in April 2024, both aimed at funding sustainable data center expansions.

INFRASTRUCTURE INSIGHTS

- The global data center colocation market is growing rapidly, with crucial infrastructure components that are vital for maintaining high reliability, energy efficiency, and scalability in data centers.

- UPS systems are shifting towards lithium-ion batteries instead of traditional lead-acid ones due to their smaller size, longer lifespan, and lower maintenance needs. Leading companies like Equinix, Digital Realty, and QTS Realty Trust are making significant investments in these advanced UPS systems to ensure uninterrupted operations.

- As the data center colocation market moves towards sustainable practices, providers such as ST Telemedia Global Data Centers, GDS Services, Compass Datacenters, STACK Infrastructure, Vantage Data Centers, and Digital Realty are starting to utilize alternative fuels like Hydrotreated Vegetable Oil (HVO) to cut down on carbon emissions from backup power sources. Digital Realty began using Hydrotreated Vegetable Oil (HVO) in its backup generators in California in April 2024, which significantly reduces carbon emissions compared to conventional diesel fuel. In July 2024, ST Telemedia Global Data Centres announced the replacement of its diesel generators in Singapore data centers with HVO generators.

- Racks, typically ranging from 36U to 55U, are evolving with standards like the Open Compute Project (OCP) and Open19, enabling customizable, scalable, and community-driven rack solutions that better meet the changing needs of colocation providers and their clients.

- Technologies such as row-based containment systems, passive/active rear door exchanges, liquid immersion, and liquid-to-chip cooling are becoming more popular for enhancing energy efficiency. Facilities like Equinix DB3 in Dublin are implementing chilled water systems with free cooling to optimize cooling while saving energy.

- In cooler climates, the adoption of free cooling is on the rise to decrease energy consumption. Facilities using free-cooling chillers to take advantage of low external temperatures, a trend that has been gaining grip for a long time in Western Europe, China, Japan, South Korea, Australia, the Nordics, the US, and Canada.

- In locations where water is scarce, providers in the data center colocation market are minimizing water usage by using air-cooled systems or recycled water. Digital Realty has rolled out water-efficient cooling solutions in its California facilities to ensure a balance between operational efficiency and sustainability.

- Facilities in the data center colocation market are increasingly adopting modular infrastructures namely, UPS systems and PDUs to gradually scale their power infrastructure. Flexential, for example, employs modular power solutions in its Atlanta data center to effectively address rising customer demand without incurring substantial upfront capital costs.

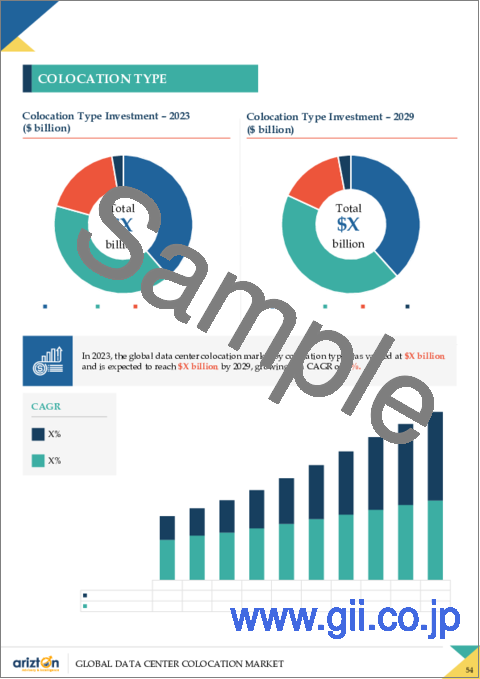

RETAIL VS WHOLESALE COLOCATION

- The global data center colocation market is expected to experience significant growth from 2024 to 2029, fueled by rising demand for wholesale/hyperscale colocation services. The market by revenue is projected to grow at a CAGR of 10.96% during this period, with substantial revenue anticipated due to increasing demand from AI and machine learning.

- From 2020 to 2023, the market demonstrated consistent year-over-year growth, with revenue increasing from USD 42.89 billion in 2020 to USD 60.41 billion in 2023, indicating a steady growth in colocation adoption.

- In terms of revenue generated from colocation services, the APAC region leads the global data center colocation market, accounting for nearly 40% of revenue in 2023, followed by the Americas at over 38%, among others.

- The data center colocation market has witnessed over 40+ new entrants in the last two years, which majorly include real estate asset management and subsidiaries of power producers.

- The expansion of data center capacity by leading cloud service providers is a key growth factor in the wholesale colocation segment, making it the preferred option for enterprises with high-capacity needs for cloud, big data, and AI applications.

VENDORS LANDSCAPE

PROMINENT COLOCATION OPERATORS

- AirTrunk

- Aligned Data Centers

- China Mobile

- China Telecom

- China Unicom

- ChinData Group

- CyrusOne

- Digital Realty

- Equinix

- NTT Global Data Centers

- QTS Realty Trust

- ST Telemedia Global Data Centre

- Stack Infrastructure

- Vantage Data Centers

OTHER PROMINENT COLOCATION OPERATORS

- Africa Data Centers

- Compass Datacenters

- American Tower

- Ark Data Centres

- Aruba S.p.A.

- Baosight Software

- Beijing Sinnet Technology

- CloudHQ

- Conapto

- Chayora

- Data4

- Elea Data Centers

- Dr.Peng Group

- Echelon Data Centres

- EdgeConneX

- Flexential

- OneAsia Network

- Goodman

- Green

- Gulf Data Hub

- Green Mountain AS

- HostDime

- K2 STRATEGIC

- Kao Data

- Khazna Data Centers

- Keppel Data Centres

- Merlin Properties

- Nabiax

- NEXTDC

- Ooredoo

- Open Access Data Centres

- Pure DC

- SUNeVision Holdings

- center3

- Scala Data Centers

- Serverfarm

- Switch

- Colt Data Centre Services

- Telehouse

- TierPoint

- Turk Telekom

- VNET

- YTL Data Center

- BDx Data Centers

- Turkcell

- CDC Data Centres

- ePLDT

- DCI Data Centers

- FPT Data Center

- Viettel IDC

- Telkom Indonesia

- Princeton Digital Group

- Singtel

- Chunghwa Telecom

- Cologix

- AT TOKYO

- LG Uplus

- LG CNS

- Digital Edge

- KT

- SK Broadband

- Global Technical Realty

- DataBank

- VIRTUS Data Centres

- Atman Data Center

NEW ENTRANTS

- Crane Data Centers

- ClusterPower

- EDGNEX Data Centres

- Edged U.S.

- Evolution Data Centres

- Rowan Digital Infrastructure

- Tract

- Quantum Loophole

- Nation Data Center

- Form8tion

- Kasi Cloud

- AQ Compute

- Gaw Capital

- Corscale

- 5C Data Centers

- Epoch Digital

- Mainova Webhouse

- Ada Infrastructure

- Polar DC

- DC01UK

- CleanArc Data Centers

- Ezditek

- DataVolt

- GreenScale

- YCO Cloud

- FLOW Digital Infrastructure

- Digital Halo

- Cloudoon

- Anan

- NED

- Latos

- Prometheus Hyperscale

- Qareeb Data Centres

- Oppidan Investment Company

- DataOne

- Layer 9 Data Centers

- Start Campus

- BW Digital

- EDGNEX Data Centres by DAMAC

- Empyrion Digital

- SC Zeus

- Open DC

KEY QUESTIONS ANSWERED:

1. How big is the global data center colocation market?

2. What is the growth rate of the global data center colocation market?

3. What is the estimated market size in terms of area in the global data center colocation market by 2029?

4. Which region holds the most significant global data center colocation market share?

5. How many MW of power capacity is expected to reach the global data center colocation market by 2029?

TABLE OF CONTENTS

1. ABOUT ARIZTON

2. ABOUT OUR DATA CENTER CAPABILITIES

3. WHAT'S INCLUDED

4. SEGMENTS INCLUDED

5. RESEARCH METHODOLOGY

6. MARKET AT GLANCE

7. PREMIUM INSIGHTS

8. INVESTMENT OPPORTUNITIES

- 8.1. INVESTMENT: MARKET SIZE & FORECAST

- 8.2. AREA: MARKET SIZE & FORECAST

- 8.3. POWER CAPACITY: MARKET SIZE & FORECAST

- 8.4. COLOCATION REVENUE: MARKET SIZE & FORECAST

9. MARKET DYNAMICS

- 9.1. MARKET OPPORTUNITIES & TRENDS

- 9.2. MARKET GROWTH ENABLERS

- 9.3. MARKET RESTRAINTS

- 9.4. SITE SELECTION CRITERIA

10. INFRASTRUCTURE SEGMENTATION

- 10.1. COLOCATION TYPE

- 10.2. ELECTRICAL INFRASTRUCTURE

- 10.3. MECHANICAL INFRASTRUCTURE

- 10.4. COOLING SYSTEMS

- 10.5. COOLING TECHNIQUES

- 10.6. GENERAL CONSTRUCTION

11. GEOGRAPHY SEGMENTATION

12. NORTH AMERICA

- 12.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 12.2. DATA CENTER MARKET BY INVESTMENT

- 12.3. DATA CENTER MARKET BY AREA

- 12.4. DATA CENTER MARKET BY POWER CAPACITY

- 12.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 12.6. DATA CENTER MARKET BY COLOCATION REVENUE

13. US

- 13.1. MARKET BY INVESTMENT

- 13.2. MARKET BY AREA

- 13.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 13.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 13.5. MARKET BY COLOCATION REVENUE

14. CANADA

- 14.1. MARKET BY INVESTMENT

- 14.2. MARKET BY AREA

- 14.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 14.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 14.5. MARKET BY COLOCATION REVENUE

15. LATIN AMERICA

- 15.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 15.2. DATA CENTER MARKET BY INVESTMENT

- 15.3. DATA CENTER MARKET BY AREA

- 15.4. DATA CENTER MARKET BY POWER CAPACITY

- 15.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 15.6. DATA CENTER MARKET BY COLOCATION REVENUE

16. BRAZIL

- 16.1. MARKET BY INVESTMENT

- 16.2. MARKET BY AREA

- 16.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 16.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 16.5. MARKET BY COLOCATION REVENUE

17. MEXICO

- 17.1. MARKET BY INVESTMENT

- 17.2. MARKET BY AREA

- 17.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 17.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 17.5. MARKET BY COLOCATION REVENUE

18. CHILE

- 18.1. MARKET BY INVESTMENT

- 18.2. MARKET BY AREA

- 18.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 18.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 18.5. MARKET BY COLOCATION REVENUE

19. COLOMBIA

- 19.1. MARKET BY INVESTMENT

- 19.2. MARKET BY AREA

- 19.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 19.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 19.5. MARKET BY COLOCATION REVENUE

20. REST OF LATIN AMERICA

- 20.1. MARKET BY INVESTMENT

- 20.2. MARKET BY AREA

- 20.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 20.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 20.5. MARKET BY COLOCATION REVENUE

21. WESTERN EUROPE

- 21.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 21.2. DATA CENTER MARKET BY INVESTMENT

- 21.3. DATA CENTER MARKET BY AREA

- 21.4. DATA CENTER MARKET BY POWER CAPACITY

- 21.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 21.6. DATA CENTER MARKET BY COLOCATION REVENUE

22. UK

- 22.1. MARKET BY INVESTMENT

- 22.2. MARKET BY AREA

- 22.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 22.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 22.5. MARKET BY COLOCATION REVENUE

23. GERMANY

- 23.1. MARKET BY INVESTMENT

- 23.2. MARKET BY AREA

- 23.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 23.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 23.5. MARKET BY COLOCATION REVENUE

24. FRANCE

- 24.1. MARKET BY INVESTMENT

- 24.2. MARKET BY AREA

- 24.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 24.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 24.5. MARKET BY COLOCATION REVENUE

25. NETHERLANDS

- 25.1. MARKET BY INVESTMENT

- 25.2. MARKET BY AREA

- 25.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 25.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 25.5. MARKET BY COLOCATION REVENUE

26. IRELAND

- 26.1. MARKET BY INVESTMENT

- 26.2. MARKET BY AREA

- 26.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 26.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 26.5. MARKET BY COLOCATION REVENUE

27. SWITZERLAND

- 27.1. MARKET BY INVESTMENT

- 27.2. MARKET BY AREA

- 27.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 27.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 27.5. MARKET BY COLOCATION REVENUE

28. ITALY

- 28.1. MARKET BY INVESTMENT

- 28.2. MARKET BY AREA

- 28.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 28.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 28.5. MARKET BY COLOCATION REVENUE

29. SPAIN

- 29.1. MARKET BY INVESTMENT

- 29.2. MARKET BY AREA

- 29.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 29.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 29.5. MARKET BY COLOCATION REVENUE

30. BELGIUM

- 30.1. MARKET BY INVESTMENT

- 30.2. MARKET BY AREA

- 30.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 30.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 30.5. MARKET BY COLOCATION REVENUE

31. PORTUGAL

- 31.1. MARKET BY INVESTMENT

- 31.2. MARKET BY AREA

- 31.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 31.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 31.5. MARKET BY COLOCATION REVENUE

32. OTHER WESTERN EUROPEAN COUNTRIES

- 32.1. MARKET BY INVESTMENT

- 32.2. MARKET BY AREA

- 32.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 32.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 32.5. MARKET BY COLOCATION REVENUE

33. NORDICS

- 33.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 33.2. DATA CENTER MARKET BY INVESTMENT

- 33.3. DATA CENTER MARKET BY AREA

- 33.4. DATA CENTER MARKET BY POWER CAPACITY

- 33.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 33.6. DATA CENTER MARKET BY COLOCATION REVENUE

34. DENMARK

- 34.1. MARKET BY INVESTMENT

- 34.2. MARKET BY AREA

- 34.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 34.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 34.5. MARKET BY COLOCATION REVENUE

35. SWEDEN

- 35.1. MARKET BY INVESTMENT

- 35.2. MARKET BY AREA

- 35.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 35.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 35.5. MARKET BY COLOCATION REVENUE

36. NORWAY

- 36.1. MARKET BY INVESTMENT

- 36.2. MARKET BY AREA

- 36.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 36.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 36.5. MARKET BY COLOCATION REVENUE

37. FINLAND & ICELAND

- 37.1. MARKET BY INVESTMENT

- 37.2. MARKET BY AREA

- 37.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 37.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 37.5. MARKET BY COLOCATION REVENUE

38. CENTRAL & EASTERN EUROPE

- 38.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 38.2. DATA CENTER MARKET BY INVESTMENT

- 38.3. DATA CENTER MARKET BY AREA

- 38.4. DATA CENTER MARKET BY POWER CAPACITY

- 38.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 38.6. DATA CENTER MARKET BY COLOCATION REVENUE

39. RUSSIA

- 39.1. MARKET BY INVESTMENT

- 39.2. MARKET BY AREA

- 39.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 39.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 39.5. MARKET BY COLOCATION REVENUE

40. POLAND

- 40.1. MARKET BY INVESTMENT

- 40.2. MARKET BY AREA

- 40.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 40.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 40.5. MARKET BY COLOCATION REVENUE

41. AUSTRIA

- 41.1. MARKET BY INVESTMENT

- 41.2. MARKET BY AREA

- 41.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 41.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 41.5. MARKET BY COLOCATION REVENUE

42. CZECH REPUBLIC

- 42.1. MARKET BY INVESTMENT

- 42.2. MARKET BY AREA

- 42.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 42.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 42.5. MARKET BY COLOCATION REVENUE

43. OTHER CENTRAL & EASTERN EUROPEAN COUNTRIES

44. MARKET BY INVESTMENT

45. MARKET BY AREA

46. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

47. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

48. MARKET BY COLOCATION REVENUE

49. MIDDLE EAST

- 49.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 49.2. DATA CENTER MARKET BY INVESTMENT

- 49.3. DATA CENTER MARKET BY AREA

- 49.4. DATA CENTER MARKET BY POWER CAPACITY

- 49.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 49.6. DATA CENTER MARKET BY COLOCATION REVENUE

50. UAE

- 50.1. MARKET BY INVESTMENT

- 50.2. MARKET BY AREA

- 50.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 50.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 50.5. MARKET BY COLOCATION REVENUE

51. SAUDI ARABIA

- 51.1. MARKET BY INVESTMENT

- 51.2. MARKET BY AREA

- 51.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 51.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 51.5. MARKET BY COLOCATION REVENUE

52. ISRAEL

- 52.1. MARKET BY INVESTMENT

- 52.2. MARKET BY AREA

- 52.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 52.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 52.5. MARKET BY COLOCATION REVENUE

53. OMAN

- 53.1. MARKET BY INVESTMENT

- 53.2. MARKET BY AREA

- 53.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 53.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 53.5. MARKET BY COLOCATION REVENUE

54. QATAR

- 54.1. MARKET BY INVESTMENT

- 54.2. MARKET BY AREA

- 54.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 54.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 54.5. MARKET BY COLOCATION REVENUE

55. KUWAIT

- 55.1. MARKET BY INVESTMENT

- 55.2. MARKET BY AREA

- 55.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 55.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 55.5. MARKET BY COLOCATION REVENUE

56. JORDAN

- 56.1. MARKET BY INVESTMENT

- 56.2. MARKET BY AREA

- 56.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 56.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 56.5. MARKET BY COLOCATION REVENUE

57. BAHRAIN

- 57.1. MARKET BY INVESTMENT

- 57.2. MARKET BY AREA

- 57.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 57.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 57.5. MARKET BY COLOCATION REVENUE

58. OTHER MIDDLE EASTERN COUNTRIES

- 58.1. MARKET BY INVESTMENT

- 58.2. MARKET BY AREA

- 58.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 58.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 58.5. MARKET BY COLOCATION REVENUE

59. AFRICA

- 59.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 59.2. DATA CENTER MARKET BY INVESTMENT

- 59.3. DATA CENTER MARKET BY AREA

- 59.4. DATA CENTER MARKET BY POWER CAPACITY

- 59.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 59.6. DATA CENTER MARKET BY COLOCATION REVENUE

60. SOUTH AFRICA

- 60.1. MARKET BY INVESTMENT

- 60.2. MARKET BY AREA

- 60.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 60.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 60.5. MARKET BY COLOCATION REVENUE

61. KENYA

- 61.1. MARKET BY INVESTMENT

- 61.2. MARKET BY AREA

- 61.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 61.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 61.5. MARKET BY COLOCATION REVENUE

62. NIGERIA

- 62.1. MARKET BY INVESTMENT

- 62.2. MARKET BY AREA

- 62.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 62.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 62.5. MARKET BY COLOCATION REVENUE

63. EGYPT

- 63.1. MARKET BY INVESTMENT

- 63.2. MARKET BY AREA

- 63.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 63.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 63.5. MARKET BY COLOCATION REVENUE

64. ETHIOPIA

- 64.1. MARKET BY INVESTMENT

- 64.2. MARKET BY AREA

- 64.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 64.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 64.5. MARKET BY COLOCATION REVENUE

65. OTHER AFRICAN COUNTRIES

- 65.1. MARKET BY INVESTMENT

- 65.2. MARKET BY AREA

- 65.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 65.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 65.5. MARKET BY COLOCATION REVENUE

66. APAC

- 66.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 66.2. DATA CENTER MARKET BY INVESTMENT

- 66.3. DATA CENTER MARKET BY AREA

- 66.4. DATA CENTER MARKET BY POWER CAPACITY

- 66.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 66.6. DATA CENTER MARKET BY COLOCATION REVENUE

67. CHINA

- 67.1. MARKET BY INVESTMENT

- 67.2. MARKET BY AREA

- 67.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 67.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 67.5. MARKET BY COLOCATION REVENUE

68. HONG KONG

- 68.1. MARKET BY INVESTMENT

- 68.2. MARKET BY AREA

- 68.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 68.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 68.5. MARKET BY COLOCATION REVENUE

69. AUSTRALIA

- 69.1. MARKET BY INVESTMENT

- 69.2. MARKET BY AREA

- 69.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 69.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 69.5. MARKET BY COLOCATION REVENUE

70. NEW ZEALAND

- 70.1. MARKET BY INVESTMENT

- 70.2. MARKET BY AREA

- 70.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 70.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 70.5. MARKET BY COLOCATION REVENUE

71. INDIA

- 71.1. MARKET BY INVESTMENT

- 71.2. MARKET BY AREA

- 71.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 71.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 71.5. MARKET BY COLOCATION REVENUE

72. JAPAN

- 72.1. MARKET BY INVESTMENT

- 72.2. MARKET BY AREA

- 72.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 72.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 72.5. MARKET BY COLOCATION REVENUE

73. TAIWAN

- 73.1. MARKET BY INVESTMENT

- 73.2. MARKET BY AREA

- 73.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 73.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 73.5. MARKET BY COLOCATION REVENUE

74. SOUTH KOREA

- 74.1. MARKET BY INVESTMENT

- 74.2. MARKET BY AREA

- 74.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 74.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 74.5. MARKET BY COLOCATION REVENUE

75. REST OF APAC

- 75.1. MARKET BY INVESTMENT

- 75.2. MARKET BY AREA

- 75.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 75.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 75.5. MARKET BY COLOCATION REVENUE

76. SOUTHEAST ASIA

- 76.1. MARKET SNAPSHOT & KEY HIGHLIGHTS

- 76.2. DATA CENTER MARKET BY INVESTMENT

- 76.3. DATA CENTER MARKET BY AREA

- 76.4. DATA CENTER MARKET BY POWER CAPACITY

- 76.5. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 76.6. DATA CENTER MARKET BY COLOCATION REVENUE

77. SINGAPORE

- 77.1. MARKET BY INVESTMENT

- 77.2. MARKET BY AREA

- 77.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 77.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 77.5. MARKET BY COLOCATION REVENUE

78. MALAYSIA

- 78.1. MARKET BY INVESTMENT

- 78.2. MARKET BY AREA

- 78.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 78.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 78.5. MARKET BY COLOCATION REVENUE

79. THAILAND

- 79.1. MARKET BY INVESTMENT

- 79.2. MARKET BY AREA

- 79.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 79.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 79.5. MARKET BY COLOCATION REVENUE

80. INDONESIA

- 80.1. MARKET BY INVESTMENT

- 80.2. MARKET BY AREA

- 80.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 80.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 80.5. MARKET BY COLOCATION REVENUE

81. PHILIPPINES

- 81.1. MARKET BY INVESTMENT

- 81.2. MARKET BY AREA

- 81.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 81.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 81.5. MARKET BY COLOCATION REVENUE

82. VIETNAM

- 82.1. MARKET BY INVESTMENT

- 82.2. MARKET BY AREA

- 82.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 82.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 82.5. MARKET BY COLOCATION REVENUE

83. REST OF SOUTHEAST ASIA

- 83.1. MARKET BY INVESTMENT

- 83.2. MARKET BY AREA

- 83.3. POWER CAPACITY & RENEWABLE ENERGY ADOPTION

- 83.4. DATA CENTER MARKET BY SUPPORT INFRASTRUCTURE

- 83.5. MARKET BY COLOCATION REVENUE

84. COMPETITIVE LANDSCAPE

85. MARKET PARTICIPANTS

86. QUANTITATIVE SUMMARY

87. APPENDIX

- 87.1. ABBREVIATIONS

- 87.2. DEFINITIONS