|

|

市場調査レポート

商品コード

1426139

自動車用ADASセンサーの世界市場:見通しと予測(2024年~2029年)Automotive ADAS Sensor Market - Global Outlook & Forecast 2024-2029 |

||||||

|

|||||||

| 自動車用ADASセンサーの世界市場:見通しと予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Arizton Advisory & Intelligence

ページ情報: 英文 356 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動車用ADASセンサーの市場規模は、2023年に175億米ドルとなりました。同市場は、2023年から2029年にかけて14.06%のCAGRで成長すると予測されています。

自動車業界は、ADAS(先進運転支援システム)センサーの安全機能に対するかつてない需要など、変革的な拡大を遂げています。交通安全の重要性が注目され続ける中、 ドライバーと乗客の安全性を高める先進技術を自動車に装備することが重視されるようになっています。この動向の特徴は、レーダー、ライダー、カメラ、超音波センサーなどのADASセンサーを最新の車両に統合し、リアルタイムのデータ収集と安全関連機能の実行を促進することが急増していることです。安全に対する意識が高まるこの時代において、ADASセンサーはイノベーションの最前線にあり、事故の削減と交通安全の向上を目指しています。この動向は自動車業界を再構築し、センサーメーカーに安全機能に対する急増する需要に応える大きな機会を提供しています。自動車セクターにおける開発と投資の要となっています。

ADAS(先進運転支援システム)センサーの統合は、自動車の安全性と運転体験の未来を形作る上で極めて重要な役割を果たしており、自動車業界は変革期を迎えています。この進化に拍車をかけている重要な原動力のひとつは、最先端のADAS技術を搭載した高級車に対する需要の高まりです。この世界の需要は、多様な消費者の嗜好、規制状況、経済状況を反映し、各国で独自に顕在化しています。高級車は、そのプレミアムな機能、性能、ブランドの威信を特徴とし、先進的な安全性と利便性技術のショーケースとなりつつあります。レーダー、LiDAR、カメラ、超音波センサーを含むADASセンサーの搭載は、この変革の最前線にあります。高級車の購入者は最先端の技術を求めることが多く、自動車メーカーは先進的なセンサーベースのシステムを組み込むことでプレミアムモデルの差別化を図り、自動車用ADASセンサー市場の成長を支えています。

当レポートでは、世界の自動車用ADASセンサー市場について調査し、市場の概要とともに、製品別、用途別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 調査対象・調査範囲

第2章 重要考察

第3章 市場の概要

第4章 イントロダクション

- 概要

- アーキテクチャ

- データ融合

- 自動車技術者協会(SAE)

- 世界の自動車産業

- 世界経済シナリオ

第5章 市場機会と動向

- 自動運転車の開発の高まり

- 安全機能に対する高い需要

- マルチセンサーフュージョンの採用の増加

- ソフトウェア定義のADASセンサーの台頭

第6章 市場成長の促進要因

- 交通と車両の安全に対する意識の高まり

- 新興国における先進車両の普及率の高さ

- 高級車の需要の高まり

第7章 市場抑制要因

- 熟練労働者の不足

- センサーのコストが高い

第8章 市場情勢

- 市場概要

- ベンダー分析

- 需要に関する洞察

- 市場規模と予測

- 製品

- 用途

- 車両タイプ

- ファイブフォース分析

第9章 製品

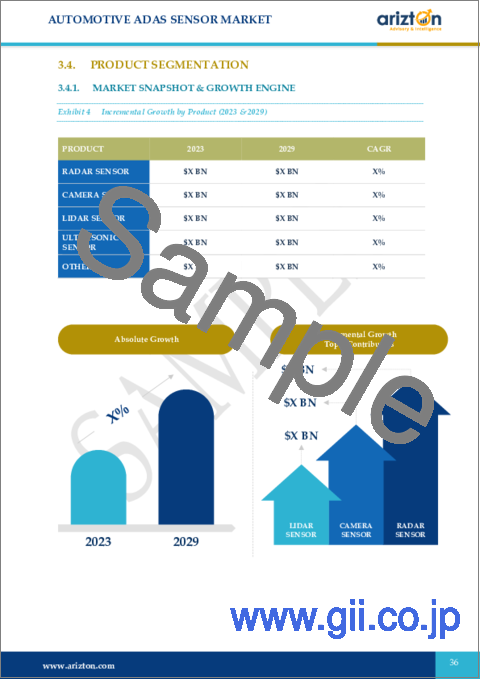

- 市場のスナップショットと成長促進要因

- 市場概要

- レーダーセンサー

- カメラセンサー

- LiDARセンサー

- 超音波センサー

- その他

第10章 用途

- 市場のスナップショットと成長促進要因

- 市場概要

- アダプティブクルーズコントロール

- 自動/インテリジェント緊急ブレーキ

- 車線逸脱警報システム

- 死角検出システム

- その他

第11章 車両タイプ

- 市場のスナップショットと成長促進要因

- 市場概要

- 乗用車

- 小型商用車

- 大型商用車

第12章 地域

第13章 アジア太平洋

第14章 北米

第15章 欧州

第16章 中東・アフリカ

第17章 ラテンアメリカ

第18章 競合情勢

- 競合の概要

第19章 主要企業プロファイル

- CONTINENTAL

- DENSO CORPORATION

- INFINEON TECHNOLOGIES

- NXP SEMICONDUCTORS

- RENESAS ELECTRONICS CORPORATION

- ROBERT BOSCH

第20章 その他の著名なベンダー

- ALLEGRO MICROSYSTEMS

- AMPHENOL

- ANALOG DEVICES

- APTIV

- AUTOLIV

- CTS

- ELMOS SEMICONDUCTOR

- INTEL CORPORATION

- MAGNA INTERNATIONAL

- MELEXIS

- MICRON TECHNOLOGY

- ON SEMICONDUCTOR CORPORATION

- QUANERGY SOLUTIONS

- ROHM

- SAMSUNG ELECTRONICS

- SENSATA TECHNOLOGIES

- SK HYNIX

- STMICROELECTRONICS

- TE CONNECTIVITY

- TEXAS INSTRUMENTS

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- VALEO

- ZF FRIEDRICHSHAFEN

第21章 レポートの概要

第22章 定量的な概要

第23章 付録

List Of Exhibits

LIST OF EXHIBITS

- EXHIBIT 1 MARKET SIZE CALCULATION APPROACH (2023)

- EXHIBIT 2 SAE LEVELS OF DRIVING AUTOMATION

- EXHIBIT 3 KEY TRENDS IN AUTOMOTIVE INDUSTRY

- EXHIBIT 4 PRODUCTION OF CARS IN (2022)

- EXHIBIT 5 GLOBAL GDP GROWTH 2019-2024 (%)

- EXHIBIT 6 IMPACT OF RISING DEVELOPMENT OF AUTONOMOUS VEHICLES

- EXHIBIT 7 SEMICONDUCTORS USED IN AUTONOMOUS VEHICLES

- EXHIBIT 8 IMPACT OF HIGH DEMAND FOR SAFETY FEATURES

- EXHIBIT 9 IMPACT OF INCREASING ADOPTION OF MULTI-SENSOR FUSION

- EXHIBIT 10 IMPACT OF RISE OF SOFTWARE-DEFINED ADAS SENSOR

- EXHIBIT 11 IMPACT OF RISING AWARENESS OF ROAD & VEHICULAR SAFETY

- EXHIBIT 12 KEY INSTANCES DRIVING DEMAND FOR ADAS SENSORS

- EXHIBIT 13 IMPACT OF HIGH ADOPTION OF ADVANCED VEHICLES IN EMERGING ECONOMIES

- EXHIBIT 14 KEY ADOPTION INITIATIVES OF ADAS SENSORS IN EMERGING ECONOMIES

- EXHIBIT 15 IMPACT OF RISING DEMAND FOR LUXURY VEHICLES

- EXHIBIT 16 IMPACT OF LACK OF SKILLED LABOR

- EXHIBIT 17 IMPACT OF HIGH COST OF SENSORS

- EXHIBIT 18 FACTORS INFLUENCING DEMAND FOR AUTOMOTIVE ADAS SENSOR

- EXHIBIT 19 FACTORS DRIVING VENDORS' SUCCESS

- EXHIBIT 20 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 21 FIVE FORCES ANALYSIS (2023)

- EXHIBIT 22 INCREMENTAL GROWTH BY PRODUCT (2023 & 2029)

- EXHIBIT 23 GLOBAL AUTOMOTIVE RADAR SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 24 GLOBAL AUTOMOTIVE CAMERA SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 25 GLOBAL AUTOMOTIVE LIDAR SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 26 GLOBAL AUTOMOTIVE ULTRASONIC SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 27 GLOBAL AUTOMOTIVE OTHER ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 28 INCREMENTAL GROWTH BY APPLICATION (2023 & 2029)

- EXHIBIT 29 GLOBAL ADAPTIVE CRUISE CONTROL MARKET 2023-2029 ($ BILLION)

- EXHIBIT 30 GLOBAL AUTOMATIC EMERGENCY BRAKING MARKET 2023-2029 ($ BILLION)

- EXHIBIT 31 GLOBAL LANE DEPARTURE WARNING SYSTEM MARKET 2023-2029 ($ BILLION)

- EXHIBIT 32 GLOBAL BLIND SPOT DETECTION SYSTEM MARKET 2023-2029 ($ BILLION)

- EXHIBIT 33 GLOBAL OTHER AUTOMOTIVE ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 34 INCREMENTAL GROWTH BY VEHICLE TYPE (2023 & 2029)

- EXHIBIT 35 KEY INSIGHTS

- EXHIBIT 36 GLOBAL PASSENGER VEHICLE AUTOMOTIVE ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 37 GLOBAL LIGHT VEHICLE SALES FORECAST 2020-2040 (MILLION)

- EXHIBIT 38 GLOBAL LIGHT COMMERCIAL VEHICLE AUTOMOTIVE ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 39 GLOBAL HEAVY COMMERCIAL VEHICLE AUTOMOTIVE ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 40 INCREMENTAL GROWTH BY GEOGRAPHY (2023 & 2029)

- EXHIBIT 41 TOTAL MOTOR VEHICLE PRODUCTION, 2019-2022 (UNITS)

- EXHIBIT 42 EMERGING ELECTRIC VEHICLE MARKET IN APAC

- EXHIBIT 43 AUTOMOTIVE ADAS SENSOR MARKET IN APAC 2023-2029 ($ BILLION)

- EXHIBIT 44 INCREMENTAL GROWTH IN APAC (2023 & 2029)

- EXHIBIT 45 OVERALL CHINA AUTOMOTIVE INDUSTRY BY SALES SEGMENT 2013-2021 (MILLION UNITS)

- EXHIBIT 46 AUTOMOTIVE ADAS SENSOR MARKET IN CHINA 2023-2029 ($ BILLION)

- EXHIBIT 47 TOTAL MOTOR VEHICLE PRODUCTION 2019-2022 (UNITS)

- EXHIBIT 48 AUTOMOTIVE ADAS SENSOR MARKET IN JAPAN 2023-2029 ($ BILLION)

- EXHIBIT 49 APPLICATION OF ADAS FEATURES IN CARS: INDIA

- EXHIBIT 50 AUTOMOTIVE ADAS SENSOR MARKET IN INDIA 2023-2029 ($ BILLION)

- EXHIBIT 51 AUTOMOTIVE ADAS SENSOR MARKET IN SOUTH KOREA 2023-2029 ($ BILLION)

- EXHIBIT 52 AUTOMOTIVE ADAS SENSOR MARKET IN AUSTRALIA 2023-2029 ($ BILLION)

- EXHIBIT 53 AUTOMOTIVE ADAS SENSOR MARKET IN SINGAPORE 2023-2029 ($ BILLION)

- EXHIBIT 54 AUTOMOTIVE ADAS SENSOR MARKET IN INDONESIA 2023-2029 ($ BILLION)

- EXHIBIT 55 OVERALL AUTOMOTIVE INDUSTRY IN THAILAND

- EXHIBIT 56 AUTOMOTIVE ADAS SENSOR MARKET IN THAILAND 2023-2029 ($ BILLION)

- EXHIBIT 57 MARKET DYNAMICS IN NORTH AMERICA

- EXHIBIT 58 AUTOMOTIVE ADAS SENSOR MARKET IN NORTH AMERICA 2023-2029 ($ BILLION)

- EXHIBIT 59 INCREMENTAL GROWTH IN NORTH AMERICA (2023 & 2029)

- EXHIBIT 60 US AUTOMOTIVE ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 61 CANADIAN AUTOMOTIVE INDUSTRY, 2014-2021 ($ BILLION)

- EXHIBIT 62 AUTOMOTIVE ADAS SENSOR MARKET IN CANADA 2023-2029 ($ BILLION)

- EXHIBIT 63 NEW PASSENGER CAR REGISTRATION IN EUROPE, JANUARY-SEPTEMBER (2019-22) IN MILLION

- EXHIBIT 64 AUTOMOTIVE ADAS SENSOR MARKET IN EUROPE 2023-2029 ($ BILLION)

- EXHIBIT 65 INCREMENTAL GROWTH IN EUROPE (2023 & 2029)

- EXHIBIT 66 KEY INSIGHTS: AUTOMOTIVE INDUSTRY

- EXHIBIT 67 AUTOMOTIVE ADAS SENSOR MARKET IN GERMANY 2023-2029 ($ BILLION)

- EXHIBIT 68 KEY INSIGHTS: AUTOMOTIVE INDUSTRY (2023)

- EXHIBIT 69 UK AUTOMOTIVE ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 70 PASSENGER AUTO REGISTRATIONS, DECEMBER (2022)

- EXHIBIT 71 AUTOMOTIVE ADAS SENSOR MARKET IN FRANCE 2023-2029 ($ BILLION)

- EXHIBIT 72 PASSENGER CAR IN ITALY, JANUARY TO SEPTEMBER (2019-2022)

- EXHIBIT 73 AUTOMOTIVE ADAS SENSOR MARKET IN ITALY 2023-2029 ($ BILLION)

- EXHIBIT 74 PASSENGER CAR IN SPAIN, JANUARY TO SEPTEMBER (2019-2022)

- EXHIBIT 75 AUTOMOTIVE ADAS SENSOR MARKET IN SPAIN 2023-2029 ($ BILLION)

- EXHIBIT 76 AUTOMOTIVE ADAS SENSOR MARKET IN RUSSIA 2023-2029 ($ BILLION)

- EXHIBIT 77 OVERALL AUTOMOTIVE INDUSTRY IN POLAND (2022)

- EXHIBIT 78 AUTOMOTIVE ADAS SENSOR MARKET IN POLAND 2023-2029 ($ BILLION)

- EXHIBIT 79 KEY FACTS & FIGURES

- EXHIBIT 80 AUTOMOTIVE ADAS SENSOR MARKET IN MIDDLE EAST & AFRICA 2023-2029 ($ BILLION)

- EXHIBIT 81 INCREMENTAL GROWTH IN MIDDLE EAST & AFRICA (2023 & 2029)

- EXHIBIT 82 AUTOMOTIVE ADAS SENSOR MARKET IN SAUDI ARABIA 2023-2029 ($ BILLION)

- EXHIBIT 83 UAE AUTOMOTIVE ADAS SENSOR MARKET 2023-2029 ($ BILLION)

- EXHIBIT 84 AUTOMOTIVE ADAS SENSOR MARKET IN SOUTH AFRICA 2023-2029 ($ BILLION)

- EXHIBIT 85 AUTOMOTIVE ADAS SENSOR MARKET IN TURKEY 2023-2029 ($ BILLION)

- EXHIBIT 86 AUTOMOTIVE ADAS SENSOR MARKET IN LATIN AMERICA 2023-2029 ($ BILLION)

- EXHIBIT 87 INCREMENTAL GROWTH IN LATIN AMERICA (2023 & 2029)

- EXHIBIT 88 AUTOMOTIVE ADAS SENSOR MARKET IN BRAZIL 2023-2029 ($ BILLION)

- EXHIBIT 89 AUTOMOTIVE ADAS SENSOR MARKET IN MEXICO 2023-2029 ($ BILLION)

- EXHIBIT 90 MAJOR FACTORS DRIVING DEMAND FOR AUTOMOTIVE ADAS SENSORS IN ARGENTINA

- EXHIBIT 91 KEY INSIGHTS

- EXHIBIT 92 AUTOMOTIVE ADAS SENSOR MARKET IN ARGENTINA 2023-2029 ($ BILLION)

- EXHIBIT 93 AUTOMOTIVE ADAS SENSOR MARKET IN REST OF LATIN AMERICA 2023-2029 ($ BILLION)

- EXHIBIT 94 KEY CAVEATS

List Of Tables

LIST OF TABLES

- TABLE 1 MAJOR SENSOR CAPABILITIES

- TABLE 2 AVERAGE COST OF SENSORS ($)

- TABLE 3 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 4 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 5 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 6 GLOBAL AUTOMOTIVE RADAR SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 7 GLOBAL AUTOMOTIVE CAMERA SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 8 GLOBAL AUTOMOTIVE LIDAR SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 9 GLOBAL AUTOMOTIVE ULTRASONIC SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 10 GLOBAL AUTOMOTIVE OTHER ADAS SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 11 GLOBAL ADAPTIVE CRUISE CONTROL MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 12 GLOBAL AUTOMATIC EMERGENCY BRAKING MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 13 GLOBAL LANE DEPARTURE WARNING SYSTEM MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 14 GLOBAL BLIND SPOT DETECTION SYSTEM MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 15 GLOBAL OTHER AUTOMOTIVE ADAS SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 16 GLOBAL PASSENGER VEHICLE AUTOMOTIVE ADAS SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 17 GLOBAL LIGHT COMMERCIAL VEHICLE AUTOMOTIVE ADAS SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 18 GLOBAL HEAVY COMMERCIAL VEHICLE AUTOMOTIVE ADAS SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 19 APAC AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 20 APAC AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 21 APAC AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 22 NORTH AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 23 NORTH AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 24 NORTH AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 25 EUROPE AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 26 EUROPE AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 27 APAC AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 28 MIDDLE EAST & AFRICA AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 29 MIDDLE EAST & AFRICA AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 30 MIDDLE EAST & AFRICA AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 31 LATIN AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 32 LATIN AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 33 LATIN AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 34 REGIONAL EMPLOYEES AND LOCATIONS

- TABLE 35 CONTINENTAL: MAJOR PRODUCT OFFERINGS

- TABLE 36 BUSINESS SEGMENTS: ACTIVITIES

- TABLE 37 DENSO CORPORATION: MAJOR PRODUCT OFFERINGS

- TABLE 38 CORE COMPETENCIES IN SEGMENTS

- TABLE 39 INFINEON TECHNOLOGIES: MAJOR PRODUCT OFFERINGS

- TABLE 40 CORE COMPETENCIES IN SEGMENTS

- TABLE 41 NXP SEMICONDUCTORS: MAJOR PRODUCT OFFERINGS

- TABLE 42 BUSINESS OVERVIEW

- TABLE 43 RENESAS ELECTRONICS CORPORATION: MAJOR PRODUCT OFFERINGS

- TABLE 44 REGIONAL EMPLOYEES AND LOCATIONS

- TABLE 45 ROBERT BOSCH: MAJOR PRODUCT OFFERINGS

- TABLE 46 ALLEGRO MICROSYSTEMS: MAJOR PRODUCT OFFERINGS

- TABLE 47 AMPHENOL: MAJOR PRODUCT OFFERINGS

- TABLE 48 ANALOG DEVICES: MAJOR PRODUCT OFFERINGS

- TABLE 49 APTIV: MAJOR PRODUCT OFFERINGS

- TABLE 50 AUTOLIV: MAJOR PRODUCT OFFERINGS

- TABLE 51 CTS: MAJOR PRODUCT OFFERINGS

- TABLE 52 ELMOS SEMICONDUCTOR: MAJOR PRODUCT OFFERINGS

- TABLE 53 INTEL CORPORATION: MAJOR PRODUCT OFFERINGS

- TABLE 54 MAGNA INTERNATIONAL: MAJOR PRODUCT OFFERINGS

- TABLE 55 MELEXIS: MAJOR PRODUCT OFFERINGS

- TABLE 56 MICRON TECHNOLOGIES: MAJOR PRODUCT OFFERINGS

- TABLE 57 ON SEMICONDUCTOR CORPORATION: MAJOR PRODUCT OFFERINGS

- TABLE 58 QUANERGY SOLUTIONS: MAJOR PRODUCT OFFERINGS

- TABLE 59 ROHM: MAJOR PRODUCT OFFERINGS

- TABLE 60 SAMSUNG ELECTRONICS: MAJOR PRODUCT OFFERINGS

- TABLE 61 SENATA TECHNOLOGIES: MAJOR PRODUCT OFFERINGS

- TABLE 62 SK HYNIX: MAJOR PRODUCT OFFERINGS

- TABLE 63 STMICROELECTRONICS: MAJOR PRODUCT OFFERINGS

- TABLE 64 TE CONNECTIVITY: MAJOR PRODUCT OFFERINGS

- TABLE 65 TEXAS INSTRUMENTS: MAJOR PRODUCT OFFERINGS

- TABLE 66 TOSHIBA ELECTRONIC DEVICES & STORAGE: MAJOR PRODUCT OFFERINGS

- TABLE 67 VALEO: MAJOR PRODUCT OFFERINGS

- TABLE 68 ZF FRIEDRICHSHAFEN: MAJOR PRODUCT OFFERINGS

- TABLE 69 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET BY GEOGRAPHY 2023-2029 ($ BILLION)

- TABLE 70 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET BY GEOGRAPHY 2023-2029 (%)

- TABLE 71 APAC AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 72 APAC AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 73 APAC AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 74 NORTH AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 75 NORTH AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 76 NORTH AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 77 EUROPE AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 78 EUROPE AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 79 EUROPE AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 80 MIDDLE EAST & AFRICA AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 81 MIDDLE EAST & AFRICA AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 82 MIDDLE EAST & AFRICA AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 83 LATIN AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 84 LATIN AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 85 LATIN AMERICA AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 86 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET BY PRODUCT 2023-2029 ($ BILLION)

- TABLE 87 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET BY APPLICATION 2023-2029 ($ BILLION)

- TABLE 88 GLOBAL AUTOMOTIVE ADAS SENSOR MARKET BY VEHICLE TYPE 2023-2029 ($ BILLION)

- TABLE 89 CURRENCY CONVERSION (2016-2023)

The global automotive ADAS sensors market was valued at USD 17.50 billion in 2023 and is expected to grow at a CAGR of 14.06% from 2023-2029.

MARKET TRENDS & OPPORTUNITIES

High Demand for Safety Features

The automotive industry is witnessing a transformative trend marked by an unprecedented demand for safety features within Advanced Driver Assistance Systems (ADAS) sensors. As the importance of road safety continues to gain prominence, a growing emphasis is being placed on equipping vehicles with advanced technologies that enhance driver and passenger safety. This trend is characterized by a surge in integrating ADAS sensors, such as radar, lidar, cameras, and ultrasonic sensors, into modern vehicles to facilitate real-time data collection and the execution of safety-related functions. In this era of heightened awareness regarding safety, ADAS sensors are at the forefront of innovation, aiming to reduce accidents and improve road safety. This trend is reshaping the automotive landscape and offering significant opportunities for sensor manufacturers to meet the burgeoning demand for safety features. It is a cornerstone of development and investment within the automotive sector.

Rising Demand for Luxury Vehicles

The automotive industry is undergoing a transformative shift, with the integration of Advanced Driver Assistance Systems (ADAS) sensors playing a pivotal role in shaping the future of vehicle safety and driving experience. One significant driver fueling this evolution is the escalating demand for luxury vehicles with cutting-edge ADAS technologies. This global demand manifests uniquely in various countries, reflecting diverse consumer preferences, regulatory landscapes, and economic conditions. Luxury vehicles, characterized by their premium features, performance, and brand prestige, are increasingly becoming showcases for advanced safety and convenience technologies. The incorporation of ADAS sensors, including radar, LiDAR, cameras, and ultrasonic sensors, is at the forefront of this transformation. Luxury car buyers often seek cutting-edge technologies, and automakers strive to differentiate their premium models by incorporating advanced sensor-based systems and supporting the growth of the automotive ADAS sensors market.

INDUSTRY RESTRAINTS

High Cost of Sensors

The high cost of sensors in the global automotive ADAS sensors market can be a significant restraint. ADAS relies heavily on radar, lidar, cameras, ultrasonic sensors, and others to gather data about the vehicle's surroundings and make informed decisions to enhance safety and driving experience. ADAS sensors often incorporate advanced technologies to provide accurate and real-time data. For example, lidar sensors use laser beams to measure distances, and advanced cameras may have high-resolution imaging capabilities. The complexity of these technologies can drive up production costs. Developing and improving sensor technologies require significant investment in research and development. Designing, testing, and refining these sensors contribute to their overall expense.

SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT

The global automotive ADAS sensors market by product is segmented into radar, camera, lidar, ultrasonic, and others. The radar sensor market holds the most prominent segmental share in 2023. Radar sensors use radio waves to detect objects around the vehicle, helping to monitor the environment and provide valuable information for various safety features. Further, several factors contribute to the growing demand for radar sensors in the market. These factors highlight the importance of radar technology in enhancing vehicle safety and enabling various advanced features. Increasing focus on worldwide vehicle safety regulations and standards is a significant driver for adopting ADAS technologies, including radar sensors. Governments and safety organizations are pushing for integrating advanced safety features in vehicles to reduce accidents and improve road safety.

Segmentation by Product

- Radar Sensor

- Camera Sensor

- LiDAR Sensor

- Ultrasonic Sensor

- Others

INSIGHT BY APPLICATION

The Adaptive Cruise Control (ACC) application segment will dominate the global automotive ADAS sensors market in 2023. ACC is a feature in ADAS that enhances traditional cruise control by automatically adjusting a vehicle's speed to maintain a safe following distance from the vehicle ahead. Several factors contribute to the growing demand for ACC in the global automotive ADAS sensors market, including a high focus on road safety. ACC helps maintain a safe following distance, reducing the risk of rear-end collisions. As safety becomes a more significant concern for both consumers and regulatory bodies, the adoption of ACC as a safety feature is on the rise. ACC can enhance the driving experience in heavily congested traffic by automatically adjusting the vehicle's speed according to traffic flow; this reduces driver stress and contributes to more efficient traffic flow.

Segmentation by Application

- Adaptive Cruise Control

- Automatic/Intelligent Emergency Braking

- Lane Departure Warning System

- Blind Spot Detection System

- Others

INSIGHT BY VEHICLE TYPE

The global automotive ADAS sensors market by vehicle type is segmented into passenger, light, and heavy commercial vehicles. In 2023, the market has been dominated by the passenger vehicle segment. This is significantly due to new and advanced features in modern vehicles and the growing electric vehicle industry across the automotive ADAS sensor market. Moreover, with rising demand for infotainment & telematics services, passenger vehicles are becoming more connected, with features like in-car infotainment systems, navigation, vehicle-to-vehicle (V2V) communication, and smartphone integration, all of which rely on semiconductor components. Furthermore, heavy commercial vehicles include trucks, buses, and other large vehicles for transporting goods and passengers long distances. Improved economic development and industrialization mainly drive the demand for goods transportation, leading to increased demand for heavy commercial vehicles and related sensor technologies.

Segmentation by Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicle

- Heavy Commercial Vehicle

GEOGRAPHICAL ANALYSIS

APAC holds the largest global automotive ADAS sensors market share, accounting for over 38% in 2023. As one of the fastest-growing automotive markets in the world, APAC is characterized by its diverse range of countries, from established automotive powerhouses like Japan and South Korea to emerging economies such as China and India. Furthermore, with key automotive giants like Japan, South Korea, and China, the region produces a significant portion of the world's vehicles. The integration of automotive ADAS sensors has been pivotal in enhancing these vehicles' performance, safety, and features. Connected vehicles and advanced infotainment systems are sought after by consumers in the APAC region. Moreover, the improving economic conditions of Asian countries (including China, India, and South Korea) position the region as the most attractive global automotive ADAS sensors market.

Segmentation by Geography

- APAC

- China

- Japan

- South Korea

- Australia

- Singapore

- Indonesia

- Thailand

- India

- North America

- The U.S.

- Canada

- Europe

- Germany

- The U.K.

- France

- Italy

- Spain

- Russia

- Poland

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

COMPETITIVE LANDSCAPE

The global automotive ADAS sensors market is characterized by a high degree of fragmentation, featuring numerous local and international players. This fragmentation results from the presence of both local and global market participants. Key players in the global automotive ADAS sensors market include Robert Bosch, Continental, Infineon Technologies, NXP Semiconductors, DENSO Corporation, Renesas Electronic Corporation, and others. Competition among these entities is fierce, driven by the rapidly evolving technological landscape that demands vendors to innovate and upgrade continually within the automotive industry. Given this dynamic environment, vendors are compelled to refine their unique value propositions to establish a robust presence in the market. Furthermore, vendors compete based on features, offerings, variety, and pricing. Vendors use new business models and focus on developing the portfolio of their establishments to drive growth. The focus has shifted toward using high-quality raw materials and efficient semiconductor sources.

Key Company Profiles

- Continental

- DENSO CORPORATION

- Infineon Technologies

- NXP Semiconductors

- Renesas Electronics Corporation

- Robert Bosch

Other Prominent Vendors

- Allegro MicroSystems

- Amphenol

- Analog Devices

- Aptiv

- Autoliv

- CTS

- Elmos Semiconductor

- Intel Corporation

- Magna International

- Melexis

- Micron Technology

- ON Semiconductor Corporation

- Quanergy Solutions

- ROHM

- Samsung Electronics

- Sensata Technologies

- SK Hynix

- STMicroelectronics

- TE Connectivity

- Texas Instruments

- Toshiba Electronic Devices & Storage

- Valeo

- ZF Friedrichshafen

KEY QUESTIONS ANSWERED:

1. How big is the automotive ADAS sensors market?

2. What is the growth rate of the global automotive ADAS sensors market?

3. Which region dominates the global automotive ADAS sensors market share?

4. What are the significant trends in the automotive ADAS sensors market?

5. Who are the key players in the global automotive ADAS sensors market?

TABLE OF CONTENTS

1 SCOPE & COVERAGE

- 1.1. MARKET DEFINITION

- 1.1.1. INCLUSIONS

- 1.1.2. EXCLUSIONS

- 1.1.3. MARKET ESTIMATION CAVEATS

- 1.2. MARKET DEFINITIONS

- 1.2.1. MARKET BY PRODUCT

- 1.2.2. MARKET BY APPLICATION

- 1.2.3. MARKET BY VEHICLE TYPE

- 1.2.4. REGIONS & COUNTRIES COVERED:

- 1.2.5. BASE YEAR

- 1.3. MARKET DERIVATION

2 PREMIUM INSIGHTS

- 2.1 OPPORTUNITY POCKETS

- 2.1.1 MARKET DEFINITION

- 2.1.2 REPORT OVERVIEW

- 2.1.3 OPPORTUNITY & CHALLENGE ANALYSIS

- 2.1.4 SEGMENT ANALYSIS

- 2.1.5 REGIONAL ANALYSIS

- 2.1.6 COMPETITIVE LANDSCAPE

3 MARKET AT A GLANCE

4 INTRODUCTION

- 4.1 OVERVIEW

- 4.1.1 ARCHITECTURE

- 4.1.2 DATA FUSION

- 4.2 SOCIETY OF AUTOMOTIVE ENGINEERS (SAE)

- 4.3 GLOBAL AUTOMOTIVE INDUSTRY

- 4.4 GLOBAL ECONOMIC SCENARIO

5 MARKET OPPORTUNITIES & TRENDS

- 5.1 RISING DEVELOPMENT OF AUTONOMOUS VEHICLES

- 5.2 HIGH DEMAND FOR SAFETY FEATURES

- 5.3 INCREASING ADOPTION OF MULTI-SENSOR FUSION

- 5.4 RISE OF SOFTWARE-DEFINED ADAS SENSOR

6 MARKET GROWTH ENABLERS

- 6.1 RISING AWARENESS OF ROAD AND VEHICULAR SAFETY

- 6.2 HIGH ADOPTION OF ADVANCED VEHICLES IN EMERGING ECONOMIES

- 6.3 RISING DEMAND FOR LUXURY VEHICLES

7 MARKET RESTRAINTS

- 7.1 LACK OF SKILLED LABOR

- 7.2 HIGH COST OF SENSORS

8 MARKET LANDSCAPE

- 8.1 MARKET OVERVIEW

- 8.2 VENDOR ANALYSIS

- 8.3 DEMAND INSIGHTS

- 8.4 MARKET SIZE & FORECAST

- 8.5 PRODUCT

- 8.5.1 MARKET SIZE & FORECAST

- 8.6 APPLICATION

- 8.6.1 MARKET SIZE & FORECAST

- 8.7 VEHICLE TYPE

- 8.7.1 MARKET SIZE & FORECAST

- 8.8 FIVE FORCES ANALYSIS

- 8.8.1 THREAT OF NEW ENTRANTS

- 8.8.2 BARGAINING POWER OF SUPPLIERS

- 8.8.3 BARGAINING POWER OF BUYERS

- 8.8.4 THREAT OF SUBSTITUTES

- 8.8.5 COMPETITIVE RIVALRY

9 PRODUCT

- 9.1 MARKET SNAPSHOT & GROWTH ENGINE

- 9.2 MARKET OVERVIEW

- 9.3 RADAR SENSOR

- 9.3.1 MARKET OVERVIEW

- 9.3.2 MARKET SIZE & FORECAST

- 9.3.3 MARKET BY GEOGRAPHY

- 9.4 CAMERA SENSOR

- 9.4.1 MARKET OVERVIEW

- 9.4.2 MARKET SIZE & FORECAST

- 9.4.3 MARKET BY GEOGRAPHY

- 9.5 LIDAR SENSOR

- 9.5.1 MARKET OVERVIEW

- 9.5.2 MARKET SIZE & FORECAST

- 9.5.3 MARKET BY GEOGRAPHY

- 9.6 ULTRASONIC SENSOR

- 9.6.1 MARKET OVERVIEW

- 9.6.2 MARKET SIZE & FORECAST

- 9.6.3 MARKET BY GEOGRAPHY

- 9.7 OTHERS

- 9.7.1 MARKET OVERVIEW

- 9.7.2 MARKET SIZE & FORECAST

- 9.7.3 MARKET BY GEOGRAPHY

10 APPLICATION

- 10.1 MARKET SNAPSHOT & GROWTH ENGINE

- 10.2 MARKET OVERVIEW

- 10.3 ADAPTIVE CRUISE CONTROL

- 10.3.1 MARKET OVERVIEW

- 10.3.2 MARKET SIZE & FORECAST

- 10.3.3 MARKET BY GEOGRAPHY

- 10.4 AUTOMATIC/INTELLIGENT EMERGENCY BRAKING

- 10.4.1 MARKET OVERVIEW

- 10.4.2 MARKET SIZE & FORECAST

- 10.4.3 MARKET BY GEOGRAPHY

- 10.5 LANE DEPARTURE WARNING SYSTEM

- 10.5.1 MARKET OVERVIEW

- 10.5.2 MARKET SIZE & FORECAST

- 10.5.3 MARKET BY GEOGRAPHY

- 10.6 BLIND SPOT DETECTION SYSTEM

- 10.6.1 MARKET OVERVIEW

- 10.6.2 MARKET SIZE & FORECAST

- 10.6.3 MARKET BY GEOGRAPHY

- 10.7 OTHERS

- 10.7.1 MARKET OVERVIEW

- 10.7.2 MARKET SIZE & FORECAST

- 10.7.3 MARKET BY GEOGRAPHY

11 VEHICLE TYPE

- 11.1 MARKET SNAPSHOT & GROWTH ENGINE

- 11.2 MARKET OVERVIEW

- 11.3 PASSENGER VEHICLES

- 11.3.1 MARKET OVERVIEW

- 11.3.2 MARKET SIZE & FORECAST

- 11.3.3 MARKET BY GEOGRAPHY

- 11.4 LIGHT COMMERCIAL VEHICLE

- 11.4.1 MARKET OVERVIEW

- 11.4.2 MARKET SIZE & FORECAST

- 11.4.3 MARKET BY GEOGRAPHY

- 11.5 HEAVY COMMERCIAL VEHICLE

- 11.5.1 MARKET OVERVIEW

- 11.5.2 MARKET SIZE & FORECAST

- 11.5.3 MARKET BY GEOGRAPHY

12 GEOGRAPHY

- 12.1 MARKET SNAPSHOT & GROWTH ENGINE

- 12.2 GEOGRAPHIC OVERVIEW

13 APAC

- 13.1 MARKET OVERVIEW

- 13.2 MARKET SIZE & FORECAST

- 13.3 PRODUCT

- 13.3.1 MARKET SIZE & FORECAST

- 13.4 APPLICATION

- 13.4.1 MARKET SIZE & FORECAST

- 13.5 VEHICLE TYPE

- 13.5.1 MARKET SIZE & FORECAST

- 13.6 KEY COUNTRIES

- 13.7 CHINA: MARKET SIZE & FORECAST

- 13.8 JAPAN: MARKET SIZE & FORECAST

- 13.9 INDIA: MARKET SIZE & FORECAST

- 13.10 SOUTH KOREA: MARKET SIZE & FORECAST

- 13.11 AUSTRALIA: MARKET SIZE & FORECAST

- 13.12 SINGAPORE: MARKET SIZE & FORECAST

- 13.13 INDONESIA: MARKET SIZE & FORECAST

- 13.14 THAILAND: MARKET SIZE & FORECAST

14 NORTH AMERICA

- 14.1 MARKET OVERVIEW

- 14.2 MARKET SIZE & FORECAST

- 14.3 PRODUCT

- 14.3.1 MARKET SIZE & FORECAST

- 14.4 APPLICATION

- 14.4.1 MARKET SIZE & FORECAST

- 14.5 VEHICLE TYPE

- 14.5.1 MARKET SIZE & FORECAST

- 14.6 KEY COUNTRIES

- 14.7 US: MARKET SIZE & FORECAST

- 14.8 CANADA: MARKET SIZE & FORECAST

15 EUROPE

- 15.1 MARKET OVERVIEW

- 15.2 MARKET SIZE & FORECAST

- 15.3 PRODUCT

- 15.3.1 MARKET SIZE & FORECAST

- 15.4 APPLICATION

- 15.4.1 MARKET SIZE & FORECAST

- 15.5 VEHICLE TYPE

- 15.5.1 MARKET SIZE & FORECAST

- 15.6 KEY COUNTRIES

- 15.7 GERMANY: MARKET SIZE & FORECAST

- 15.8 UK: MARKET SIZE & FORECAST

- 15.9 FRANCE: MARKET SIZE & FORECAST

- 15.10 ITALY: MARKET SIZE & FORECAST

- 15.11 SPAIN: MARKET SIZE & FORECAST

- 15.12 RUSSIA: MARKET SIZE & FORECAST

- 15.13 POLAND: MARKET SIZE & FORECAST

16 MIDDLE EAST & AFRICA

- 16.1 MARKET OVERVIEW

- 16.2 MARKET SIZE & FORECAST

- 16.3 PRODUCT

- 16.3.1 MARKET SIZE & FORECAST

- 16.4 APPLICATION

- 16.4.1 MARKET SIZE & FORECAST

- 16.5 VEHICLE TYPE

- 16.5.1 MARKET SIZE & FORECAST

- 16.6 KEY COUNTRIES

- 16.7 SAUDI ARABIA: MARKET SIZE & FORECAST

- 16.8 UAE: MARKET SIZE & FORECAST

- 16.9 SOUTH AFRICA: MARKET SIZE & FORECAST

- 16.10 TURKEY: MARKET SIZE & FORECAST

17 LATIN AMERICA

- 17.1 MARKET OVERVIEW

- 17.2 MARKET SIZE & FORECAST

- 17.3 PRODUCT

- 17.3.1 MARKET SIZE & FORECAST

- 17.4 APPLICATION

- 17.4.1 MARKET SIZE & FORECAST

- 17.5 VEHICLE TYPE

- 17.5.1 MARKET SIZE & FORECAST

- 17.6 KEY COUNTRIES

- 17.7 BRAZIL: MARKET SIZE & FORECAST

- 17.8 MEXICO: MARKET SIZE & FORECAST

- 17.9 ARGENTINA: MARKET SIZE & FORECAST

- 17.10 REST OF LATIN AMERICA: MARKET SIZE & FORECAST

18 COMPETITIVE LANDSCAPE

- 18.1 COMPETITION OVERVIEW

19 KEY COMPANY PROFILES

- 19.1 CONTINENTAL

- 19.1.1 BUSINESS OVERVIEW

- 19.1.2 PRODUCT OFFERINGS

- 19.1.3 KEY STRATEGIES

- 19.1.4 KEY STRENGTHS

- 19.1.5 KEY OPPORTUNITIES

- 19.2 DENSO CORPORATION

- 19.2.1 BUSINESS OVERVIEW

- 19.2.2 PRODUCT OFFERINGS

- 19.2.3 KEY STRATEGIES

- 19.2.4 KEY STRENGTHS

- 19.2.5 KEY OPPORTUNITIES

- 19.3 INFINEON TECHNOLOGIES

- 19.3.1 BUSINESS OVERVIEW

- 19.3.2 PRODUCT OFFERINGS

- 19.3.3 KEY STRATEGIES

- 19.3.4 KEY STRENGTHS

- 19.3.5 KEY OPPORTUNITIES

- 19.4 NXP SEMICONDUCTORS

- 19.4.1 BUSINESS OVERVIEW

- 19.4.2 PRODUCT OFFERINGS

- 19.4.3 KEY STRATEGIES

- 19.4.4 KEY STRENGTHS

- 19.4.5 KEY OPPORTUNITIES

- 19.5 RENESAS ELECTRONICS CORPORATION

- 19.5.1 BUSINESS OVERVIEW

- 19.5.2 PRODUCT OFFERINGS

- 19.5.3 KEY STRATEGIES

- 19.5.4 KEY STRENGTHS

- 19.5.5 KEY OPPORTUNITIES

- 19.6 ROBERT BOSCH

- 19.6.1 BUSINESS OVERVIEW

- 19.6.2 PRODUCT OFFERINGS

- 19.6.3 KEY STRATEGIES

- 19.6.4 KEY STRENGTHS

- 19.6.5 KEY OPPORTUNITIES

20 OTHER PROMINENT VENDORS

- 20.1 ALLEGRO MICROSYSTEMS

- 20.1.1 BUSINESS OVERVIEW

- 20.1.2 PRODUCT OFFERINGS

- 20.2 AMPHENOL

- 20.2.1 BUSINESS OVERVIEW

- 20.2.2 PRODUCT OFFERINGS

- 20.3 ANALOG DEVICES

- 20.3.1 BUSINESS OVERVIEW

- 20.3.2 PRODUCT OFFERINGS

- 20.4 APTIV

- 20.4.1 BUSINESS OVERVIEW

- 20.4.2 PRODUCT OFFERINGS

- 20.5 AUTOLIV

- 20.5.1 BUSINESS OVERVIEW

- 20.5.2 PRODUCT OFFERINGS

- 20.6 CTS

- 20.6.1 BUSINESS OVERVIEW

- 20.6.2 PRODUCT OFFERINGS

- 20.7 ELMOS SEMICONDUCTOR

- 20.7.1 BUSINESS OVERVIEW

- 20.7.2 PRODUCT OFFERINGS

- 20.8 INTEL CORPORATION

- 20.8.1 BUSINESS OVERVIEW

- 20.8.2 PRODUCT OFFERINGS

- 20.9 MAGNA INTERNATIONAL

- 20.9.1 BUSINESS OVERVIEW

- 20.9.2 PRODUCT OFFERINGS

- 20.10 MELEXIS

- 20.10.1 BUSINESS OVERVIEW

- 20.10.2 PRODUCT OFFERINGS

- 20.11 MICRON TECHNOLOGY

- 20.11.1 BUSINESS OVERVIEW

- 20.11.2 PRODUCT OFFERINGS

- 20.12 ON SEMICONDUCTOR CORPORATION

- 20.12.1 BUSINESS OVERVIEW

- 20.12.2 PRODUCT OFFERINGS

- 20.13 QUANERGY SOLUTIONS

- 20.13.1 BUSINESS OVERVIEW

- 20.13.2 PRODUCT OFFERINGS

- 20.14 ROHM

- 20.14.1 BUSINESS OVERVIEW

- 20.14.2 PRODUCT OFFERINGS

- 20.15 SAMSUNG ELECTRONICS

- 20.15.1 BUSINESS OVERVIEW

- 20.15.2 PRODUCT OFFERINGS

- 20.16 SENSATA TECHNOLOGIES

- 20.16.1 BUSINESS OVERVIEW

- 20.16.2 PRODUCT OFFERINGS

- 20.17 SK HYNIX

- 20.17.1 BUSINESS OVERVIEW

- 20.17.2 PRODUCT OFFERINGS

- 20.18 STMICROELECTRONICS

- 20.18.1 BUSINESS OVERVIEW

- 20.18.2 PRODUCT OFFERINGS

- 20.19 TE CONNECTIVITY

- 20.19.1 BUSINESS OVERVIEW

- 20.19.2 PRODUCT OFFERINGS

- 20.20 TEXAS INSTRUMENTS

- 20.20.1 BUSINESS OVERVIEW

- 20.20.2 PRODUCT OFFERINGS

- 20.21 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- 20.21.1 BUSINESS OVERVIEW

- 20.21.2 PRODUCT OFFERINGS

- 20.22 VALEO

- 20.22.1 BUSINESS OVERVIEW

- 20.22.2 PRODUCT OFFERINGS

- 20.23 ZF FRIEDRICHSHAFEN

- 20.23.1 BUSINESS OVERVIEW

- 20.23.2 PRODUCT OFFERINGS

21 REPORT SUMMARY

- 21.1 KEY TAKEAWAYS

- 21.2 STRATEGIC RECOMMENDATIONS

22 QUANTITATIVE SUMMARY

- 22.1 MARKET BY GEOGRAPHY

- 22.2 APAC

- 22.2.1 PRODUCT: MARKET SIZE & FORECAST

- 22.2.2 APPLICATION: MARKET SIZE & FORECAST

- 22.2.3 VEHICLE TYPE: MARKET SIZE & FORECAST

- 22.3 NORTH AMERICA

- 22.3.1 NORTH AMERICA: MARKET SIZE & FORECAST

- 22.3.2 APPLICATION: MARKET SIZE & FORECAST

- 22.3.3 VEHICLE TYPE: MARKET SIZE & FORECAST

- 22.4 EUROPE

- 22.4.1 PRODUCT: MARKET SIZE & FORECAST

- 22.4.2 APPLICATION: MARKET SIZE & FORECAST

- 22.4.3 VEHICLE TYPE: MARKET SIZE & FORECAST

- 22.5 MIDDLE EAST & AFRICA

- 22.5.1 PRODUCT: MARKET SIZE & FORECAST

- 22.5.2 APPLICATION: MARKET SIZE & FORECAST

- 22.5.3 VEHICLE TYPE: MARKET SIZE & FORECAST

- 22.6 LATIN AMERICA

- 22.6.1 PRODUCT: MARKET SIZE & FORECAST

- 22.6.2 APPLICATION: MARKET SIZE & FORECAST

- 22.6.3 VEHICLE TYPE: MARKET SIZE & FORECAST

- 22.7 PRODUCT

- 22.7.1 MARKET SIZE & FORECAST

- 22.8 APPLICATION

- 22.8.1 MARKET SIZE & FORECAST

- 22.9 VEHICLE TYPE

- 22.9.1 MARKET SIZE & FORECAST

23 APPENDIX

- 23.1 RESEARCH METHODOLOGY

- 23.2 RESEARCH PROCESS

- 23.3 REPORT ASSUMPTIONS & CAVEATS

- 23.3.1 KEY CAVEATS

- 23.3.2 CURRENCY CONVERSION

- 23.4 ABBREVIATIONS