|

|

市場調査レポート

商品コード

1421556

産業用ギアボックスの世界市場:展望・予測(2023年~2028年)Industrial Gearbox Market - Global Outlook & Forecast 2023-2028 |

||||||

|

|||||||

| 産業用ギアボックスの世界市場:展望・予測(2023年~2028年) |

|

出版日: 2024年02月06日

発行: Arizton Advisory & Intelligence

ページ情報: 英文 288 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の産業用ギアボックスの市場規模は、2022年~2028年にCAGRで4.22%の成長が予測されます。

市場動向と機会

風力発電産業の台頭

世界の産業用ギアボックス市場は、従来のエネルギー源を再生可能な代替エネルギーに置き換えることが重視されるようになったため、特に風力発電部門で緩やかな成長を示しています。過去20年の間に、かつては高価な選択肢と考えられていた太陽光発電や風力発電は、石炭やガス発電所の新設と比較してコスト面で高い競争力を持つようになっています。新たな風力発電や太陽光発電プロジェクトの建設は、既存の石炭発電所やガス発電所の運転を継続するよりもコスト効率が高くなると予測されます。さらに、市場成長に寄与する主な要因として、Global Wind Energy Councilによる野心的な取り組みが挙げられます。彼らは2030年までに380GW、2050年までに2,000GWの洋上風力発電容量を目標に掲げています。このコミットメントにより、ギアボックスベンダーは風力タービンを展開する大きな機会をすぐに得ることができる可能性が高いです。

砂糖産業の増大

ITC Trade Map(国際ビジネス開発に向けた貿易統計)によると、2021年、インドネシアの粗糖の輸入額は約22億2,989万米ドルで、次いで中国が19億4,259万8,000米ドルでした。インドは13億4,079万3,000米ドルの輸出額で粗糖の第二の主要輸出国であり、6億3,006万5,000米ドルの輸出額でタイが続きます。さらに2021年11月、The Sugar Research Institute of Fijiは、2022年の商業栽培に向けて新しいサトウキビ品種を発表しました。この品種は糖度が高く、収量が向上し、生産者の収入が増え、糖の総生産が増加しました。したがって、産業用ギアボックス市場は、主に砂糖産業の成長によって需要が増加しています。砂糖産業は、多様な機械を幅広く利用する最大の産業の1つです。この産業領域では、ギアボックスが重要な役割を果たし、基本的な形式で広く採用されています。砂糖産業の経営にギヤボックスを組み込むことで、機械は効率的かつ結束して機能し、有益な成功につながります。ギアボックスの使用は、砂糖産業における機械の整然とした円滑な機能に寄与しています。

地域の分析

アジア太平洋が2022年の世界の産業用ギヤボックス市場を独占しました。この地域には、製造、サービス、自動車、電気駆動装置などの産業があり、その結果、複数の産業で用途がある電動工具、具体的には切削工具のニーズが高まっています。アジア太平洋は、その利用可能性と安い人件費のため、製造部門が強力です。日本と韓国が電化製品や自動車の主な製造・輸出国である一方、インドネシアと中国はテキスタイルと石油の輸出でリードしています。エネルギー需要の増加、急速な工業化と都市化、インフラ開発に向けた取り組みの高まりといった要因が、アジア太平洋の産業用ギアボックス市場の成長を後押ししています。

ベンダー情勢

世界の産業用ギアボックス市場を特徴づけているのは、大小さまざまな企業です。これらの企業は、革新的な製品を積極的に開発し、製品ラインナップを拡大するための研究開発活動に投資しています。国際企業がさまざまな地域でプレゼンスを増すにつれ、地元メーカーは競合する課題に直面する可能性があります。業界の競合は、主に製品の耐久性、寿命、性能、価格設定、カスタマイズオプションなどの要因を中心に展開されます。さらに、産業用ギヤボックス市場で活動する多くの企業が市場での地位を強化するために革新的な製品を開発しているため、製品の革新が市場で人気を集めています。

当レポートでは、世界の産業用ギアボックス市場について調査分析し、市場規模と予測、機会と動向、主要企業などの情報を提供しています。

目次

第1章 調査手法

第2章 調査目的

第3章 調査プロセス

第4章 調査対象・調査範囲

- 市場の定義

- 基準年

- 調査範囲

第5章 レポートの前提条件・注記

- 主な注意点

- 通貨換算

- 市場の導出

第6章 重要考察

- 概要

- 将来の機会

- 新興の風力発電産業

- 成長する砂糖産業

- セグメンテーション分析

- 製品

- 構成

- 地域の分析

- 主なスニペット

第7章 市場の概要

第8章 イントロダクション

- 概要

- 成長分析

- 市場シナリオ

- 近年の発展

- 効率的な産業用ギアボックスのニーズの高まり

- インダストリー4.0の拡大

- マテリアルハンドリング機器の自動化の進行

- ギアボックスのメンテナンスにおける課題

- 乾燥した場所の要件

- 温度

- 特定の問題

- 油圧システム vs. ギアボックス

- アジア太平洋における製造部門の増大

- 成長するロボット産業

第9章 市場の機会と動向

- 新興の風力発電産業

- 肥料生産の増加

- 技術の進歩

第10章 市場成長の実現要因

- 成長する砂糖産業

- 製紙、包装産業の台頭

- 大規模なセメント産業のプレゼンス

第11章 市場抑制要因

- 原材料価格の違反

- 技術の課題

第12章 市場情勢

- 市場規模と予測

- ファイブフォース分析

第13章 製品

- 市場のスナップショットと成長促進要因

- 市場の概要

- ヘリカル

- プラネタリ

- ベベル

- ウォーム減速

- その他

第14章 構成

- 市場のスナップショットと成長促進要因

- 市場の概要

- 平行軸

- 角度軸

- その他(構成)

第15章 エンドユーザー

- 市場のスナップショットと成長促進要因

- 市場の概要

- 発電

- セメント・骨材

- 食品・飲料

- 金属・鉱業

- 化学

- 建設

- マテリアルハンドリング

- その他

第16章 地域

- 市場のスナップショットと成長促進要因

- 地理的な概要

第17章 アジア太平洋

- PESTLE分析

- 市場規模と予測

- 製品

- 構成

- エンドユーザー

- 主要国

- 中国の市場規模と予測

- 日本の市場規模と予測

- インドの市場規模と予測

- オーストラリアの市場規模と予測

- 韓国の市場規模と予測

第18章 欧州

- PESTLE分析

- 市場規模と予測

- 製品

- 構成

- エンドユーザー

- 主要国

- ドイツの市場規模と予測

- フランスの市場規模と予測

- 英国の市場規模と予測

- イタリアの市場規模と予測

- スペインの市場規模と予測

第19章 北米

- PESTLE分析

- 市場規模と予測

- 製品

- 構成

- エンドユーザー

- 主要国

- 米国の市場規模と予測

- カナダの市場規模と予測

第20章 ラテンアメリカ

- PESTLE分析

- 市場規模と予測

- 製品

- 構成

- エンドユーザー

- 主要国

- ブラジルの市場規模と予測

- メキシコの市場規模と予測

- アルゼンチンの市場規模と予測

第21章 中東・アフリカ

- PESTLE分析

- 市場規模と予測

- 製品

- 構成

- エンドユーザー

- 主要国

- サウジアラビアの市場規模と予測

- 南アフリカの市場規模と予測

- アラブ首長国連邦の市場規模と予測

第22章 競合情勢

- 競合の概要

第23章 主要企業プロファイル

- NANGAOCHI GROUP

- BONFIGLIOLI

- ZF

第24章 その他の著名なベンダー

- HANGZHOU ADVANCE GEARBOX GROUP CO., LTD

- CHONGQING GEARBOX CO., LTD.

- NINGBO DONLY CO., LTD.

- NORD GROUP

- CHONGQING WANGJIANG INDUSTRY CO., LTD

- DALIAN HUARUI HEAVY INDUSTRY GROUP

- SUMITOMO HEAVY INDUSTRIES

- BAUER GEAR MOTOR

- EMERSON ELECTRIC

- ELECON ENGINEERING CO.LTD

- DANA BREVINI POWER TRANSMISSION

- JOHNSON ELECTRIC HOLDING LTD.

- J.S. GEARS

- FLENDER

- COMER INDUSTRIES

- CHINA HIGH-SPEED TRANSMISSION EQUIPMENT GROUP CO., LTD

- THE TIMKEN COMPANY

- RENK

- SEW-EURODRIVE

第25章 レポートのサマリー

- 重要事項

- 戦略的な推奨事項

第26章 量的サマリー

- 地域

- 製品

- 構成

- エンドユーザー

第27章 付録

List Of Exhibits

LIST OF EXHIBITS

- EXHIBIT 1 GLOBAL INDUSTRIAL GEARBOX MARKET: SEGMENTATION

- EXHIBIT 2 MARKET SIZE CALCULATION APPROACH 2022

- EXHIBIT 3 KEY DRIVING FACTORS OF THE INDUSTRIAL GEARBOX MARKET

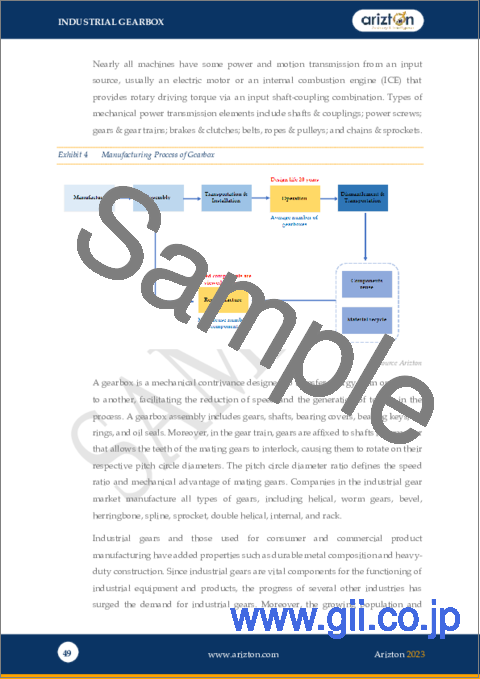

- EXHIBIT 4 MANUFACTURING PROCESS OF GEARBOX

- EXHIBIT 5 OVERVIEW: GROWTH ANALYSIS

- EXHIBIT 6 FEW ADVANTAGES OF INDUSTRIAL 4.0

- EXHIBIT 7 GLOBAL ROBOT SHIPMENT FOR PERSONAL & DOMESTIC SERVICES 2018-2023 (MILLION UNITS)

- EXHIBIT 8 IMPACT OF EMERGING WIND POWER INDUSTRY

- EXHIBIT 9 WIND ELECTRICITY CAPACITY ADDITIONS BY COUNTRIES 2022 VS. 2023 (IN GW)

- EXHIBIT 10 IMPACT OF INCREASING FERTILIZER PRODUCTION

- EXHIBIT 11 IMPACT OF ADVANCES IN TECHNOLOGY

- EXHIBIT 12 IMPACT OF GROWING SUGAR INDUSTRY

- EXHIBIT 13 IMPACT OF RISING PAPER AND PACKAGING INDUSTRY

- EXHIBIT 14 IMPACT OF PRESENCE OF LARGE CEMENT INDUSTRY

- EXHIBIT 15 IMPACT OF VIOLATION IN RAW MATERIAL PRICES

- EXHIBIT 16 RAW MATERIALS USED IN MANUFACTURING GEARBOX

- EXHIBIT 17 IMPACT OF TECHNICAL CHALLENGES

- EXHIBIT 18 FIVE MAJOR ISSUES GEARBOXES COMMONLY EXPERIENCES

- EXHIBIT 19 GLOBAL INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 20 KEY MARKET TRENDS OF GLOBAL INDUSTRIAL GEARBOX MARKET

- EXHIBIT 21 FIVE FORCES ANALYSIS 2022

- EXHIBIT 22 INCREMENTAL GROWTH BY PRODUCT 2022 & 2028

- EXHIBIT 23 GLOBAL INDUSTRIAL GEARBOX MARKET: OVERVIEW OF PRODUCT SEGMENT

- EXHIBIT 24 GLOBAL INDUSTRIAL GEARBOX BY PRODUCT: MARKET OVERVIEW

- EXHIBIT 25 GLOBAL HELICAL INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 26 OVERVIEW: HELICAL GEARBOX IN END-USER INDUSTRIES

- EXHIBIT 27 GLOBAL PLANETARY INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 28 USE OF PLANETARY GEARBOX IN THE AUTOMOTIVE INDUSTRY

- EXHIBIT 29 GLOBAL BEVEL INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 30 KEY FACTORS DRIVING BEVEL GEARBOX MARKET

- EXHIBIT 31 GLOBAL WORM REDUCTION INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 32 GLOBAL OTHER INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 33 INCREMENTAL GROWTH BY CONFIGURATION 2022 & 2028

- EXHIBIT 34 CLASSIFICATION OF CONFIGURATION SEGMENT OF GLOBAL INDUSTRIAL GEARBOX

- EXHIBIT 35 GLOBAL PARALLEL AXIS INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 36 GLOBAL ANGULAR AXIS INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 37 GLOBAL OTHERS INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 38 INCREMENTAL GROWTH BY END-USER 2022 & 2028

- EXHIBIT 39 CLASSIFICATION OF END-USER

- EXHIBIT 40 GLOBAL POWER GENERATION INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 41 TOTAL RENEWABLE ENERGY INSTALLED CAPACITY IN CHINA 2016-2021 (GW)

- EXHIBIT 42 GLOBAL CEMENT & AGGREGATES INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 43 PRIVATE HOME CONSTRUCTION IN US 2018-2022 (BILLION)

- EXHIBIT 44 GLOBAL FOOD & BEVERAGE INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 45 NUMBER OF MCDONALD'S RESTAURANTS IN EUROPE 2021

- EXHIBIT 46 GLOBAL METAL & MINING INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 47 GLOBAL CHANGES IN COAL PRODUCTION 2021-2022 (METRIC TONS)

- EXHIBIT 48 GLOBAL INDUSTRIAL GEARBOX MARKET BY CHEMICAL 2022-2028 ($ BILLION)

- EXHIBIT 49 GLOBAL CONSTRUCTION INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 50 ESTIMATED INVESTMENTS UNDER NATIONAL INFRASTRUCTURE PIPELINE BY SECTOR INDIA 2020-2025 (% SHARE)

- EXHIBIT 51 GLOBAL MATERIAL HANDLING INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 52 GLOBAL REVENUE OF LEADING E-COMMERCE RETAILERS 2022 ( $ BILLION)

- EXHIBIT 53 GLOBAL OTHERS INDUSTRIAL GEARBOX MARKET 2022-2028 ($ BILLION)

- EXHIBIT 54 INCREMENTAL GROWTH BY GEOGRAPHY 2022 & 2028

- EXHIBIT 55 GLOBAL INDUSTRIAL GEARBOX MARKET 2022 (% SHARE)

- EXHIBIT 56 GLOBAL INDUSTRIAL GEARBOX MARKET INCREMENTAL GROWTH 2022-2028 ($ BILLION)

- EXHIBIT 57 APAC PESTLE ANALYSIS

- EXHIBIT 58 INDUSTRIAL GEARBOX MARKET IN APAC 2022-2028 ($ BILLION)

- EXHIBIT 59 INCREMENTAL GROWTH IN APAC 2022 & 2028

- EXHIBIT 60 INDUSTRIAL GEARBOX MARKET IN CHINA 2022-2028 ($ BILLION)

- EXHIBIT 61 INDUSTRIAL GEARBOX MARKET IN JAPAN 2022-2028 ($ BILLION)

- EXHIBIT 62 INDUSTRIAL GEARBOX MARKET IN INDIA 2022-2028 ($ BILLION)

- EXHIBIT 63 INDUSTRIAL GEARBOX MARKET IN AUSTRALIA 2022-2028 ($ BILLION)

- EXHIBIT 64 INDUSTRIAL GEARBOX MARKET IN SOUTH KOREA 2022-2028 ($ BILLION)

- EXHIBIT 65 EUROPE PESTLE ANALYSIS

- EXHIBIT 66 INDUSTRIAL GEARBOX MARKET IN EUROPE 2022-2028 ($ BILLION)

- EXHIBIT 67 INCREMENTAL GROWTH IN EUROPE 2022 & 2028

- EXHIBIT 68 INDUSTRIAL GEARBOX MARKET IN GERMANY 2022-2028 ($ BILLION)

- EXHIBIT 69 INDUSTRIAL GEARBOX MARKET IN FRANCE 2022-2028 ($ BILLION)

- EXHIBIT 70 INDUSTRIAL GEARBOX MARKET IN THE UK 2022-2028 ($ BILLION)

- EXHIBIT 71 INDUSTRIAL GEARBOX MARKET IN ITALY 2022-2028 ($ BILLION)

- EXHIBIT 72 INDUSTRIAL GEARBOX MARKET IN SPAIN 2022-2028 ($ BILLION)

- EXHIBIT 73 NORTH AMERICA PESTLE ANALYSIS

- EXHIBIT 74 INDUSTRIAL GEARBOX MARKET IN NORTH AMERICA 2022-2028 ($ BILLION)

- EXHIBIT 75 INCREMENTAL GROWTH IN NORTH AMERICA 2022 & 2028

- EXHIBIT 76 INDUSTRIAL GEARBOX MARKET IN THE US 2022-2028 ($ BILLION)

- EXHIBIT 77 INDUSTRIAL GEARBOX MARKET IN CANADA 2022-2028 ($ BILLION)

- EXHIBIT 78 LATIN AMERICA PESTLE ANALYSIS

- EXHIBIT 79 INDUSTRIAL GEARBOX MARKET IN LATIN AMERICA 2022-2028 ($ BILLION)

- EXHIBIT 80 INCREMENTAL GROWTH IN LATIN AMERICA 2022 & 2028

- EXHIBIT 81 INDUSTRIAL GEARBOX MARKET IN BRAZIL 2022-2028 ($ BILLION)

- EXHIBIT 82 INDUSTRIAL GEARBOX MARKET IN MEXICO 2022-2028 ($ BILLION)

- EXHIBIT 83 INDUSTRIAL GEARBOX MARKET IN ARGENTINA 2022-2028 ($ BILLION)

- EXHIBIT 84 MIDDLE EAST & AFRICA PESTLE ANALYSIS

- EXHIBIT 85 INDUSTRIAL GEARBOX MARKET IN MEA 2022-2028 ($ BILLION)

- EXHIBIT 86 INCREMENTAL GROWTH IN MEA 2022 & 2028

- EXHIBIT 87 INDUSTRIAL GEARBOX MARKET IN SAUDI ARABIA 2022-2028 ($ BILLION)

- EXHIBIT 88 INDUSTRIAL GEARBOX MARKET IN SOUTH AFRICA 2022-2028 ($ BILLION)

- EXHIBIT 89 INDUSTRIAL GEARBOX MARKET IN UAE 2022-2028 ($ BILLION)

List Of Tables

LIST OF TABLES

- TABLE 1 KEY CAVEATS

- TABLE 2 CURRENCY CONVERSION 2016-2022

- TABLE 3 DIFFERENCE BETWEEN HYDRAULIC SYSTEMS AND GEARBOXES

- TABLE 4 GLOBAL HELICAL INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 5 GLOBAL PLANETARY INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 6 GLOBAL BEVEL INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 7 GLOBAL WORM REDUCTION INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 8 GLOBAL OTHER INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 9 GLOBAL PARALLEL AXIS INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 10 GLOBAL ANGULAR AXIS INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 11 GLOBAL OTHERS INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 12 GLOBAL POWER GENERATION INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 13 GLOBAL CEMENT & AGGREGATES INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 14 GLOBAL INDUSTRIAL GEARBOX MARKET BY FOOD & BEVERAGE BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 15 GLOBAL METAL & MINING INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 16 GLOBAL CHEMICAL INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 17 GLOBAL CONSTRUCTION INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 18 GLOBAL MATERIAL HANDLING INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 19 GLOBAL OTHERS INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 20 INDUSTRIAL GEARBOX MARKET IN APAC BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 21 INDUSTRIAL GEARBOX MARKET IN APAC BY CONFIGURATION 2022-2028 ($ BILLION)

- TABLE 22 INDUSTRIAL GEARBOX MARKET IN APAC BY END-USER 2022-2028 ($ BILLION)

- TABLE 23 INDUSTRIAL GEARBOX MARKET IN EUROPE BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 24 INDUSTRIAL GEARBOX MARKET IN EUROPE BY CONFIGURATION 2022-2028 ($ BILLION)

- TABLE 25 INDUSTRIAL GEARBOX MARKET IN EUROPE BY END-USER 2022-2028 ($ BILLION)

- TABLE 26 INDUSTRIAL GEARBOX MARKET IN NORTH AMERICA BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 27 INDUSTRIAL GEARBOX MARKET IN NORTH AMERICA BY CONFIGURATION 2022-2028 ($ BILLION)

- TABLE 28 INDUSTRIAL GEARBOX MARKET IN NORTH AMERICA BY END-USER 2022-2028 ($ BILLION)

- TABLE 29 INDUSTRIAL GEARBOX MARKET IN LATIN AMERICA BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 30 INDUSTRIAL GEARBOX MARKET IN LATIN AMERICA BY CONFIGURATION 2022-2028 ($ BILLION)

- TABLE 31 INDUSTRIAL GEARBOX MARKET IN LATIN AMERICA BY END-USER 2022-2028 ($ BILLION)

- TABLE 32 INDUSTRIAL GEARBOX MARKET IN MEA BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 33 INDUSTRIAL GEARBOX MARKET IN MEA BY CONFIGURATION 2022-2028 ($ BILLION)

- TABLE 34 INDUSTRIAL GEARBOX MARKET IN MEA BY END-USER 2022-2028 ($ BILLION)

- TABLE 35 NANGAOCHI GROUP: MAJOR PRODUCT OFFERINGS

- TABLE 36 BONFIGLIOLI: MAJOR PRODUCT OFFERINGS

- TABLE 37 ZF: MAJOR PRODUCT OFFERINGS

- TABLE 38 HANGZHOU ADVANCE GEARBOX GROUP CO., LTD.: MAJOR PRODUCT OFFERINGS

- TABLE 39 CHONGQING GEARBOX CO., LTD.: MAJOR PRODUCT OFFERINGS

- TABLE 40 NINGBO DONLY CO., LTD.: MAJOR PRODUCT OFFERINGS

- TABLE 41 NORD GROUP: MAJOR PRODUCT OFFERINGS

- TABLE 42 CHONGQING WANGJIANG INDUSTRY CO., LTD.: MAJOR PRODUCT OFFERINGS

- TABLE 43 DALIAN HUARUI HEAVY INDUSTRY GROUP CO., LTD: MAJOR PRODUCT OFFERINGS

- TABLE 44 SUMITOMO HEAVY INDUSTRIES: MAJOR PRODUCT OFFERINGS

- TABLE 45 BAUER GEAR MOTOR: MAJOR PRODUCT OFFERINGS

- TABLE 46 EMERSON ELECTRIC: MAJOR PRODUCT OFFERINGS

- TABLE 47 ELECON ENGINEERING CO. LTD: MAJOR PRODUCT OFFERINGS

- TABLE 48 DANA BERVINI POWER TRANSMISSION: MAJOR PRODUCT OFFERINGS

- TABLE 49 JOHNSON ELECTRIC HOLDING LTD: MAJOR PRODUCT OFFERINGS

- TABLE 50 J.S. GEARS: MAJOR PRODUCT OFFERINGS

- TABLE 51 FLENDER: MAJOR PRODUCT OFFERINGS

- TABLE 52 COMER INDUSTRIES: MAJOR PRODUCT OFFERINGS

- TABLE 53 CHINA HIGH-SPEED TRANSMISSION EQUIPMENT GROUP CO, LTD: MAJOR PRODUCT OFFERINGS

- TABLE 54 THE TIMKEN COMPANY: MAJOR PRODUCT OFFERINGS

- TABLE 55 RENK: PRODUCT OFFERINGS

- TABLE 56 SEW-EURODRIVE: MAJOR PRODUCT OFFERINGS

- TABLE 57 GLOBAL INDUSTRIAL GEARBOX MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 58 GLOBAL INDUSTRIAL GEARBOX MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 59 GLOBAL INDUSTRIAL GEARBOX MARKET BY CONFIGURATION 2022-2028 ($ BILLION)

- TABLE 60 GLOBAL INDUSTRIAL GEARBOX MARKET BY END-USER 2022-2028 ($ BILLION)

The industrial gearbox market is expected to grow at a CAGR of 4.22% from 2022-2028.

MARKET TRENDS & OPPORTUNITIES

Emerging Wind Power Industry

The global industrial gearbox market is experiencing gradual growth due to the increasing emphasis on replacing conventional energy sources with renewable alternatives, particularly in the wind power sector. Over the past two decades, solar and wind power generation, which were once considered costly options, have become highly competitive in terms of cost compared to the construction of new coal or gas plants. Building new wind and solar projects is expected to become more cost-efficient than continuing the operation of existing coal or gas plants. Moreover, an important factor contributing to the market's growth is the ambitious commitment made by the Global Wind Energy Council. They aim to achieve substantial offshore wind capacity, targeting 380 GW by 2030 and an impressive 2,000 GW by 2050 worldwide. This commitment will likely open significant opportunities for gearbox vendors to deploy wind turbines soon.

Increasing Sugar Industry

According to ITC Trade Map, Trade statistics for international business development, in 2021, The import value of Raw Cane Sugar in Indonesia was around USD 2,229,890 thousand, followed by China with an Import value of $ 1,942,598 thousand. India is the second major exporter of raw cane sugar, with an export value of $1,340,793 thousand, followed by Thailand with an export value of $630,065 thousand. Moreover, in November 2021, The Sugar Research Institute of Fiji released a new cane variety for commercial planting in 2022. The variety had a high sugar content, leading to better yield, more income for the growers, and increased total sugar production. Hence, the industrial gearbox market is witnessing increased demand, primarily driven by the growing sugar industry. The sugar sector is one of the largest industries that extensively utilize diverse machinery. In this industrial domain, gearboxes play a crucial role and are widely employed in their basic form. By integrating gearboxes into the operations of the sugar industry, the machines function efficiently and cohesively, leading to a positive and successful outcome. The use of gearboxes contributes to the well-organized and smooth functioning of the machines in the sugar industry.

SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT

The helical industrial gearbox segment dominated the global industrial gearbox market share in 2022. The parallel shafts and winding tooth lines are used in helical industrial gearboxes. They have stronger teeth that seamlessly blend, are quieter, and can transmit larger loads, making them ideal for elevated applications. The modular design and production of helical gearboxes offer various engineering and performance advantages, including a high degree of interchangeability of components and sub-assemblies, resulting in cost-effective construction while maintaining the highest standards of component integrity. Furthermore, the planetary industrial gearbox segment is the fastest-growing segment of the global industry during the forecast period. The planetary industrial gearbox is typically utilized as rotation multipliers. Automatic door openers, motorized wheels, and winches are among the most common applications of planetary industrial gearboxes.

Segmentation by Product

- Helical

- Planetary

- Bevel

- Worm Reduction

- Others

INSIGHTS BY CONFIGURATION

The global industrial gearbox market is configured by segments such as parallel axis, angular axis, and others. In 2022, the similar axis segment dominated the industry and accounted for a revenue share of over 41%. The parallel axis industrial gearbox has a simple mechanism for application in various industries. This type of industrial gearbox is highly efficient and runs at low and medium speeds. The angled axis segment is the fastest-growing segment of the industrial gearbox market. The angled axis industrial gearbox is produced at an angle of 90 degrees. The angled-axis industrial gearbox is widely used in the automotive and mechanical sectors.

Segmentation by Configuration

- Parallel Axis

- Angular Axis

- Others

INSIGHTS BY END-USER

The power generation end-user segment is dominating the global industrial gearbox market owing to the surge in demand for energy and power and the growing awareness regarding renewable energy, driving the market's growth. The industrial gearbox has many benefits, such as enhanced radial and axial load and reduced positioning time, causing the demand for industrial gearboxes. Moreover, the cement and aggregates market also significantly contributes to the market owing to cement consumption in the construction industry.

Segmentation by End-Users

- Power Generation

- Cement & Aggregates

- Food & Beverage

- Metals & Mining

- Chemical

- Construction

- Material Handling

- Others

GEOGRAPHICAL ANALYSIS

Asia-Pacific dominated the global industrial gearbox market in 2022. The region is home to several industries, including manufacturing, services, automobiles, and electrical drives, which consequently increase the need for power tools, explicitly cutting tools, which have applications in multiple industries. The APAC region has a strong manufacturing sector due to its easy availability and cheap labor cost. While Japan and South Korea are major manufacturers and exporters of electrical appliances and automobiles, Indonesia and China are leading in textile and oil exports. Factors such as growing demand for energy, rapid industrialization and urbanization, and rising initiatives for infrastructural development are boosting the growth of the industrial gearbox market in the Asia-Pacific region.

Segmentation by Geography

- APAC

- China

- Japan

- India

- Australia

- South Korea

- Europe

- France

- Germany

- Italy

- The U.K.

- Spain

- North America

- The U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

VENDOR LANDSCAPE

A diverse range of large and small players characterizes the global industrial gearbox market. These companies actively develop innovative products and invest in research and development initiatives to expand their product offerings. As international players grow their presence in various regions, local manufacturers may face competing challenges. The competition in the industry will primarily revolve around factors such as product durability, lifespan, performance, pricing, and customization options. Moreover, product innovation is gaining popularity in the market as many companies operating in the industrial gearbox market are developing innovative products to strengthen their position in the market.

Key Company Profiles

- Nangaochi Group

- Bonfiglioli

- ZF

Other Prominent Vendors

- Hangzhou ADVANCE Gearbox Group Co., Ltd.

- Chongqing Gearbox Co., Ltd.

- Ningbo Donly Co., Ltd.

- NORD Group

- Chongqing Wangjiang Industry Co., Ltd.

- Dalian Huarui Heavy Industry Group Co., Ltd

- Sumitomo Heavy Industries

- Bauer Gear GMBH

- Emerson Electric

- Elecon Engineering Co.Ltd

- Dana Bervini Power Transmission

- Jhonson Electric Holding Ltd

- J.S. Gears

- Flender GMBH

- Comer Industries S.p.A

- China High-Speed Transmission Equipment Group Co, Ltd

KEY QUESTIONS ANSWERED:

1. How big is the industrial gearbox market?

2. What is the growth rate of the global industrial gearbox market?

3. Which region dominates the global industrial gearbox market share?

4. Who are the key players in the global industrial gearbox market?

5. What are the significant trends in the industrial gearbox market?

TABLE OF CONTENTS

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

- 4.1 MARKET DEFINITION

- 4.1.1 INCLUSIONS

- 4.1.2 EXCLUSIONS

- 4.1.3 MARKET ESTIMATION CAVEATS

- 4.2 BASE YEAR

- 4.3 SCOPE OF THE STUDY

- 4.3.1 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

- 5.1 KEY CAVEATS

- 5.2 CURRENCY CONVERSION

- 5.3 MARKET DERIVATION

6 PREMIUM INSIGHTS

- 6.1 OVERVIEW

- 6.2 FUTURE OPPORTUNITIES

- 6.2.1 EMERGING WIND POWER INDUSTRY

- 6.2.2 GROWING SUGAR INDUSTRY

- 6.3 SEGMENTATION ANALYSIS

- 6.3.1 PRODUCT

- 6.3.2 CONFIGURATION

- 6.4 GEOGRAPHICAL ANALYSIS

- 6.5 KEY SNIPPETS

7 MARKET AT A GLANCE

8 INTRODUCTION

- 8.1 OVERVIEW

- 8.2 GROWTH ANALYSIS

- 8.3 MARKET SCENARIO

- 8.4 RECENT DEVELOPMENTS

- 8.5 RISE IN NEED FOR EFFICIENT INDUSTRIAL GEARBOX

- 8.6 EXPANSION OF INDUSTRY 4.0

- 8.7 RISING AUTOMATION IN MATERIAL-HANDLING EQUIPMENT

- 8.8 CHALLENGES IN MAINTAINING GEARBOXES

- 8.8.1 REQUIREMENT OF A DRY PLACE

- 8.8.2 TEMPERATURE

- 8.8.3 PARTICULATE ISSUES

- 8.9 HYDRAULIC SYSTEMS VS GEARBOXES

- 8.10 INCREASING MANUFACTURING SECTOR IN APAC

- 8.11 GROWING ROBOTIC INDUSTRY

9 MARKET OPPORTUNITIES & TRENDS

- 9.1 EMERGING WIND POWER INDUSTRY

- 9.2 INCREASING FERTILIZER PRODUCTION

- 9.3 ADVANCES IN TECHNOLOGY

10 MARKET GROWTH ENABLERS

- 10.1 GROWING SUGAR INDUSTRY

- 10.2 RISING PAPER AND PACKAGING INDUSTRY

- 10.3 PRESENCE OF LARGE CEMENT INDUSTRY

11 MARKET RESTRAINTS

- 11.1 VIOLATION IN RAW MATERIAL PRICES

- 11.2 TECHNICAL CHALLENGES

12 MARKET LANDSCAPE

- 12.1 MARKET SIZE & FORECAST

- 12.2 FIVE FORCES ANALYSIS

- 12.2.1 THREAT OF NEW ENTRANTS

- 12.2.2 BARGAINING POWER OF SUPPLIERS

- 12.2.3 BARGAINING POWER OF BUYERS

- 12.2.4 THREAT OF SUBSTITUTES

- 12.2.5 COMPETITIVE RIVALRY

13 PRODUCT

- 13.1 MARKET SNAPSHOT & GROWTH ENGINE

- 13.2 MARKET OVERVIEW

- 13.3 HELICAL

- 13.3.1 MARKET SIZE & FORECAST

- 13.3.2 MARKET BY GEOGRAPHY

- 13.4 PLANETARY

- 13.4.1 MARKET SIZE & FORECAST

- 13.4.2 MARKET BY GEOGRAPHY

- 13.5 BEVEL

- 13.5.1 MARKET SIZE & FORECAST

- 13.5.2 MARKET BY GEOGRAPHY

- 13.6 WORM REDUCTION

- 13.6.1 MARKET SIZE & FORECAST

- 13.6.2 MARKET BY GEOGRAPHY

- 13.7 OTHER

- 13.7.1 MARKET SIZE & FORECAST

- 13.7.2 MARKET BY GEOGRAPHY

14 CONFIGURATION

- 14.1 MARKET SNAPSHOT & GROWTH ENGINE

- 14.2 MARKET OVERVIEW

- 14.3 PARALLEL AXIS

- 14.3.1 MARKET SIZE & FORECAST

- 14.3.2 MARKET BY GEOGRAPHY

- 14.4 ANGULAR AXIS

- 14.4.1 MARKET SIZE & FORECAST

- 14.4.2 MARKET BY GEOGRAPHY

- 14.5 OTHERS (CONFIGURATIONS)

- 14.5.1 MARKET SIZE & FORECAST

- 14.5.2 MARKET BY GEOGRAPHY

15 END-USER

- 15.1 MARKET SNAPSHOT & GROWTH ENGINE

- 15.2 MARKET OVERVIEW

- 15.3 POWER GENERATION

- 15.3.1 MARKET SIZE & FORECAST

- 15.3.2 MARKET BY GEOGRAPHY

- 15.4 CEMENT & AGGREGATES

- 15.4.1 MARKET SIZE & FORECAST

- 15.4.2 MARKET BY GEOGRAPHY

- 15.5 FOOD & BEVERAGE

- 15.5.1 MARKET SIZE & FORECAST

- 15.5.2 MARKET BY GEOGRAPHY

- 15.6 METAL & MINING

- 15.6.1 MARKET SIZE & FORECAST

- 15.6.2 MARKET BY GEOGRAPHY

- 15.7 CHEMICAL

- 15.7.1 MARKET SIZE & FORECAST

- 15.7.2 MARKET BY GEOGRAPHY

- 15.8 CONSTRUCTION

- 15.8.1 MARKET SIZE & FORECAST

- 15.8.2 MARKET BY GEOGRAPHY

- 15.9 MATERIAL HANDLING

- 15.9.1 MARKET SIZE & FORECAST

- 15.9.2 MARKET BY GEOGRAPHY

- 15.10 OTHERS

- 15.10.1 MARKET SIZE & FORECAST

- 15.10.2 MARKET BY GEOGRAPHY

16 GEOGRAPHY

- 16.1 MARKET SNAPSHOT & GROWTH ENGINE

- 16.2 GEOGRAPHIC OVERVIEW

17 APAC

- 17.1 PESTLE ANALYSIS

- 17.1.1 POLITICAL

- 17.1.2 ECONOMIC

- 17.1.3 SOCIAL

- 17.1.4 TECHNOLOGICAL

- 17.1.5 LEGAL

- 17.1.6 ENVIRONMENTAL

- 17.2 MARKET SIZE & FORECAST

- 17.3 PRODUCT

- 17.3.1 MARKET SIZE & FORECAST

- 17.4 CONFIGURATION

- 17.4.1 MARKET SIZE & FORECAST

- 17.5 END-USER

- 17.5.1 MARKET SIZE & FORECAST

- 17.6 KEY COUNTRIES

- 17.7 CHINA: MARKET SIZE & FORECAST

- 17.8 JAPAN: MARKET SIZE & FORECAST

- 17.9 INDIA: MARKET SIZE & FORECAST

- 17.10 AUSTRALIA: MARKET SIZE & FORECAST

- 17.11 SOUTH KOREA: MARKET SIZE & FORECAST

18 EUROPE

- 18.1 PESTLE ANALYSIS

- 18.1.1 POLITICAL

- 18.1.2 ECONOMIC

- 18.1.3 SOCIAL

- 18.1.4 TECHNOLOGICAL

- 18.1.5 LEGAL

- 18.1.6 ENVIRONMENTAL

- 18.2 MARKET SIZE & FORECAST

- 18.3 PRODUCT

- 18.3.1 MARKET SIZE & FORECAST

- 18.4 CONFIGURATION

- 18.4.1 MARKET SIZE & FORECAST

- 18.5 END-USER

- 18.5.1 MARKET SIZE & FORECAST

- 18.6 KEY COUNTRIES

- 18.7 GERMANY: MARKET SIZE & FORECAST

- 18.8 FRANCE: MARKET SIZE & FORECAST

- 18.9 UK: MARKET SIZE & FORECAST

- 18.10 ITALY: MARKET SIZE & FORECAST

- 18.11 SPAIN: MARKET SIZE & FORECAST

19 NORTH AMERICA

- 19.1 PESTLE ANALYSIS

- 19.1.1 POLITICAL

- 19.1.2 ECONOMIC

- 19.1.3 SOCIAL

- 19.1.4 TECHNOLOGICAL

- 19.1.5 LEGAL

- 19.1.6 ENVIRONMENTAL

- 19.2 MARKET SIZE & FORECAST

- 19.3 PRODUCT

- 19.3.1 MARKET SIZE & FORECAST

- 19.4 CONFIGURATION

- 19.4.1 MARKET SIZE & FORECAST

- 19.5 END-USER

- 19.5.1 MARKET SIZE & FORECAST

- 19.6 KEY COUNTRIES

- 19.7 US: MARKET SIZE & FORECAST

- 19.8 CANADA: MARKET SIZE & FORECAST

20 LATIN AMERICA

- 20.1 PESTLE ANALYSIS

- 20.1.1 POLITICAL

- 20.1.2 ECONOMIC

- 20.1.3 SOCIAL

- 20.1.4 TECHNOLOGICAL

- 20.1.5 LEGAL

- 20.1.6 ENVIRONMENTAL

- 20.2 MARKET SIZE & FORECAST

- 20.3 PRODUCT

- 20.3.1 MARKET SIZE & FORECAST

- 20.4 CONFIGURATION

- 20.4.1 MARKET SIZE & FORECAST

- 20.5 END-USER

- 20.5.1 MARKET SIZE & FORECAST

- 20.6 KEY COUNTRIES

- 20.7 BRAZIL: MARKET SIZE & FORECAST

- 20.8 MEXICO: MARKET SIZE & FORECAST

- 20.9 ARGENTINA: MARKET SIZE & FORECAST

21 MIDDLE EAST & AFRICA

- 21.1 PESTLE ANALYSIS

- 21.1.1 POLITICAL

- 21.1.2 ECONOMIC

- 21.1.3 SOCIAL

- 21.1.4 TECHNOLOGICAL

- 21.1.5 LEGAL

- 21.1.6 ENVIRONMENTAL

- 21.2 MARKET SIZE & FORECAST

- 21.3 PRODUCT

- 21.3.1 MARKET SIZE & FORECAST

- 21.4 CONFIGURATION

- 21.4.1 MARKET SIZE & FORECAST

- 21.5 END-USER

- 21.5.1 MARKET SIZE & FORECAST

- 21.6 KEY COUNTRIES

- 21.7 SAUDI ARABIA MARKET SIZE & FORECAST

- 21.8 SOUTH AFRICA: MARKET SIZE & FORECAST

- 21.9 UAE: MARKET SIZE & FORECAST

22 COMPETITIVE LANDSCAPE

- 22.1 COMPETITION OVERVIEW

23 KEY COMPANY PROFILES

- 23.1 NANGAOCHI GROUP

- 23.1.1 BUSINESS OVERVIEW

- 23.1.2 PRODUCT OFFERINGS

- 23.1.3 KEY STRATEGIES

- 23.1.4 KEY STRENGTHS

- 23.1.5 KEY OPPORTUNITIES

- 23.2 BONFIGLIOLI

- 23.2.1 BUSINESS OVERVIEW

- 23.2.2 PRODUCT OFFERINGS

- 23.2.3 KEY STRATEGIES

- 23.2.4 KEY STRENGTHS

- 23.2.5 KEY OPPORTUNITIES

- 23.3 ZF

- 23.3.1 BUSINESS OVERVIEW

- 23.3.2 PRODUCT OFFERINGS

- 23.3.3 KEY STRATEGIES

- 23.3.4 KEY STRENGTHS

- 23.3.5 KEY OPPORTUNITIES

24 OTHER PROMINENT VENDORS

- 24.1 HANGZHOU ADVANCE GEARBOX GROUP CO., LTD

- 24.1.1 BUSINESS OVERVIEW

- 24.1.2 PRODUCT OFFERINGS

- 24.2 CHONGQING GEARBOX CO., LTD.

- 24.2.1 BUSINESS OVERVIEW

- 24.2.2 PRODUCT OFFERINGS

- 24.3 NINGBO DONLY CO., LTD.

- 24.3.1 BUSINESS OVERVIEW

- 24.3.2 PRODUCT OFFERINGS

- 24.4 NORD GROUP

- 24.4.1 BUSINESS OVERVIEW

- 24.4.2 PRODUCT OFFERINGS

- 24.5 CHONGQING WANGJIANG INDUSTRY CO., LTD

- 24.5.1 BUSINESS OVERVIEW

- 24.5.2 PRODUCT OFFERINGS

- 24.6 DALIAN HUARUI HEAVY INDUSTRY GROUP

- 24.6.1 BUSINESS OVERVIEW

- 24.6.2 PRODUCT OFFERINGS

- 24.7 SUMITOMO HEAVY INDUSTRIES

- 24.7.1 BUSINESS OVERVIEW

- 24.7.2 PRODUCT OFFERINGS

- 24.8 BAUER GEAR MOTOR

- 24.8.1 BUSINESS OVERVIEW

- 24.8.2 PRODUCT OFFERINGS

- 24.9 EMERSON ELECTRIC

- 24.9.1 BUSINESS OVERVIEW

- 24.9.2 PRODUCT OFFERINGS

- 24.10 ELECON ENGINEERING CO.LTD

- 24.10.1 BUSINESS OVERVIEW

- 24.10.2 PRODUCT OFFERINGS

- 24.11 DANA BREVINI POWER TRANSMISSION

- 24.11.1 BUSINESS OVERVIEW

- 24.11.2 PRODUCT OFFERINGS

- 24.12 JOHNSON ELECTRIC HOLDING LTD.

- 24.12.1 BUSINESS OVERVIEW

- 24.12.2 PRODUCT OFFERINGS

- 24.13 J.S. GEARS

- 24.13.1 BUSINESS OVERVIEW

- 24.13.2 PRODUCT OFFERINGS

- 24.14 FLENDER

- 24.14.1 BUSINESS OVERVIEW

- 24.14.2 PRODUCT OFFERINGS

- 24.15 COMER INDUSTRIES

- 24.15.1 BUSINESS OVERVIEW

- 24.15.2 PRODUCT OFFERINGS

- 24.16 CHINA HIGH-SPEED TRANSMISSION EQUIPMENT GROUP CO., LTD

- 24.16.1 BUSINESS OVERVIEW

- 24.16.2 PRODUCT OFFERINGS

- 24.17 THE TIMKEN COMPANY

- 24.17.1 BUSINESS OVERVIEW

- 24.17.2 PRODUCT OFFERINGS

- 24.18 RENK

- 24.18.1 BUSINESS OVERVIEW

- 24.18.2 PRODUCT OFFERINGS

- 24.19 SEW-EURODRIVE

- 24.19.1 BUSINESS OVERVIEW

- 24.19.2 PRODUCT OFFERINGS

25 REPORT SUMMARY

- 25.1 KEY TAKEAWAYS

- 25.2 STRATEGIC RECOMMENDATIONS

26 QUANTITATIVE SUMMARY

- 26.1 GEOGRAPHY

- 26.2 PRODUCT

- 26.3 CONFIGURATION

- 26.4 END-USER

27 APPENDIX

- 27.1 ABBREVIATIONS