|

|

市場調査レポート

商品コード

1794015

固体冷却材料およびシステムの市場および技術の動向 (2026~2046年):放射冷却・PDRC・カロリック冷却・熱電冷却・マルチモード・多目的・その他Solid State Cooling Materials and Systems Radiative, PDRC, Caloric, Thermoelectric, Multimode, Multipurpose, Other: Markets, Technology 2026-2046 |

||||||

|

|||||||

| 固体冷却材料およびシステムの市場および技術の動向 (2026~2046年):放射冷却・PDRC・カロリック冷却・熱電冷却・マルチモード・多目的・その他 |

|

出版日: 2025年08月19日

発行: Zhar Research

ページ情報: 英文 472 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

サマリー

地球温暖化、AIデータセンター、電気自動車、ゼロエミッション電力生産などの要因により、2026年から2046年にかけて冷却技術の需要が急増する見通しです。固体冷却は、多機能スマート材料の動向に合致し、より信頼性が高く、適用範囲が広く、長寿命であり、システムレベルで最も低コストを実現できる可能性を持つため、中心的な役割を果たすと考えられています。

当レポートは、固体冷却の材料およびシステムの市場および技術を調査したもので、付加価値をもたらす材料サプライヤー、製品インテグレーター、バリューチェーン全体に向けて、包括的かつ最新の分析を提供します。8章構成、11のSWOT評価、2026~2046年の33本の予測ライン、36のインフォグラム、全472ページで構成されており、この急速に進展する分野について、2025年までの進歩を完全に網羅し、2025年までに発表された最重要の調査書97本を取り上げています。

目次

第1章 本レポートの目的

- この分析の調査手法

- 冷却需要が高まる理由

- 固体冷却の性質と、なぜ今優先課題なのか

- 冷却ツールキットと現時点での有望分野

- 20の主要な結論

- 9種類の候補固体冷却技術の比較・評価

- 最新研究が対象とする主要用途

- 固体冷却における有望な材料と原理

- 2022~2025年の94本の調査書に見られるカロリック冷却の言及:タイプ別

- 2024~2025年の固体冷却に関する292件の調査における主要材料

- 蒸気圧縮冷却の代替の可能性

- 太陽光パネルの効率向上を目的とした冷却の可能性

- 6G通信インフラおよびクライアントデバイス冷却の可能性

- 自己冷却型レーザーの可能性

- 2000~2046年における各種固体冷却技術の温度低下幅

- パッシブ昼間放射冷却 (PDRC) および関連する放射冷却技術の評価

- 主要なカロリー冷却法の評価

- 熱電冷却のSWOT評価・材料分析

- 固体冷却ロードマップ:市場・技術別

- 市場予測:2026~2046年

- 冷却モジュールの世界市場:7技術別

- 商用製品における地上放射冷却性能

- 市場規模:エアコン

- HVAC、冷蔵庫、冷凍庫、その他冷却の世界市場

- 市場規模:冷蔵庫・冷凍庫

- 定置型バッテリー市場と冷却需要

- 6G通信インフラ・クライアント機器向け熱管理材料・構造の市場

- 6G向け誘電体・熱材料市場 (地域別)

- 5G vs 6G 熱インターフェース材料市場

- 6G vs 5G基地局市場

- 市場規模:6G基地局

- 市場規模:6G RIS

- 世界スマートフォン販売台数

- 熱メタデバイス市場:用途別

第2章 イントロダクション

- 概要

- 冷却需要の拡大とその性質の変化

- 2026年から2046年にかけての冷却要件の劇的な変化の例

- 2026年から2046年にかけて冷却技術がスマート材料へと向かう傾向

- 低電力で環境に優しく、より手頃な空調の再発明

- 広く使用・提案されている望ましくない材料:事業機会

- 固体冷却に対する競合技術の例

第3章 パッシブ昼間放射冷却 (PDRC)

- 概要

- PDRCの基礎

- 放射冷却材料の調査分析:構造・配合別

- 潜在的な利点と応用

- 2025年以前のその他の重要な進歩

- PDRCを商業化する企業

- 3M USA

- BASF Germany

- i2Cool USA

- LifeLabs USA

- Plasmonics USA

- Radicool Japan, Malaysia etc.

- SkyCool Systems USA

- SolCold Israel

- Spinoff from University of Massachusetts Amherst USA

- SRI USA

- PDRCのSWOT評価

第4章 放射冷却の広範な展望:自己適応型、スイッチ可能型、調整型、ヤヌス、アンチストークス、先端フォトニクス固体冷却を含む

- SWOT分析を伴う全体像の概要

- 2025年における放射冷却の22の広範な進展

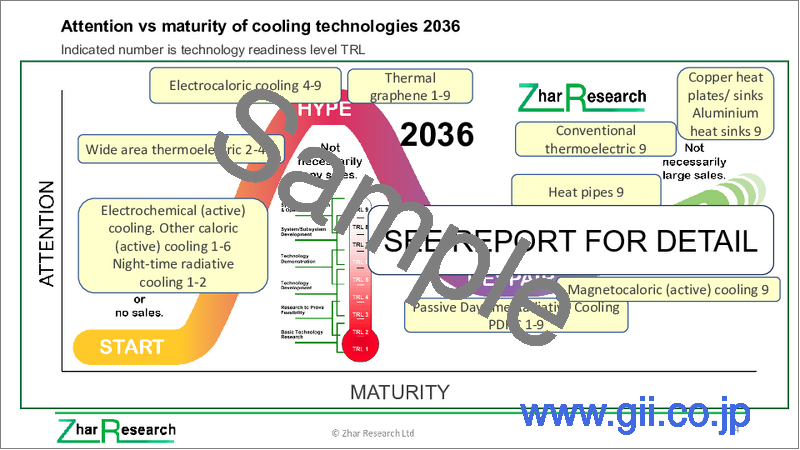

- 2026年における放射冷却技術の成熟度カーブ

- 自己適応型およびスイッチ可能放射冷却

- 双方向を利用した調整型放射冷却:ヤヌス放射体 (JET) の2024~2025年の進展・SWOT評価

- アンチストークス蛍光冷却の2024~2025年の進展とSWOT評価

- 先端フォトニクス冷却および加熱防止

第5章 強誘電相変化によるカロリック冷却

- 構造的および強誘電相変化を利用した冷却モードと材料

- 固体相変化冷却が特定の用途で他方式と競合し得る可能性

- カロリック冷却に関連する物理的原理

- カロリック冷却の動作原理

- 熱電冷却との比較および有望なカロリック技術の特定

- カロリック冷却の利用拡大に向けた研究提案

- 電気カロリック冷却

- 磁気熱量冷却・SWOT評価

- 機械カロリック冷却 (エラストカロリック、バロカロリック、ツイストカロリック冷却)

- 2025年におけるマルチカロリック冷却の進展

第6章 実現技術:メタマテリアル冷却材料とデバイス

- 概要

- メタアトム、パターニング、静的から動的への熱伝達

- 主要な結論:市場での位置づけ

- 主要な結論:代表的な配合、機能性、製造技術

- 最新の熱メタマテリアル研究132例における配合の人気動向

- 2025年および2024年におけるその他のメタマテリアル冷却および関連研究の進展

- 付加製造による設計、製造、特性、応用

第7章 将来の熱電冷却および熱電発電 (他の固体冷却の利用者かつ電力供給源として)

- 基本事項

- 熱電材料

- 広域およびフレキシブル熱電冷却は、市場に存在する未充足ニーズであり、対応すべき課題

- 建築物の放射冷却:熱電発電を組み合わせた多機能利用

- TECおよびTEGにおける放熱問題:進化する解決策

- 冷却を伴う熱電冷却・発電に関する20の進展

- 過去の進展

- ペルチェ冷却熱電モジュールおよび製品の製造企業82社

第8章 熱インターフェース材料 (TIM) およびその他の熱伝導材料・構造

- 概要:熱伝導接着剤から熱伝導コンクリートまで

- 熱伝導材料で冷却課題を解決する際の重要な考慮事項

- 熱インターフェース材料 (TIM)

- ポリマーの選択肢:シリコーンまたは炭素ベース

- 2025年およびそれ以前における熱伝導性ポリマーの進展

Summary

The period 2026-2046 will be marked by a surge in demand for cooling technology, reasons including global warming, AI datacenters, electric vehicles and zero-emission electricity production. Solid-state cooling will come center stage because it serves the trend to multifunctional smart materials and it tends to be more reliable, applicable and longer-lived, with potential for lowest cost at system level.

Unique report

The unique Zhar Research report, "Solid State Cooling Materials and Systems Radiative, PDRC, Caloric, Thermoelectric, Multimode, Multipurpose, Other: Markets, Technology 2026-2046" is the only comprehensive, up-to-date analysis of these opportunities for added value materials suppliers, product integrators and all in the value chain. It has 8 chapters, 11 SWOT appraisals, 33 forecast lines 2026-2046, 36 infograms and 472 pages. Essentially, for such a fast-moving subject, it has full coverage of the surge of advances through 2025, including the 97 most important research papers through 2025.

The self-sufficient Executive Summary and Conclusions (43 pages) pulls it all together with 20 primary conclusions, the forecasts, new tables, pie charts, SWOT appraisals and graphics. The Introduction (31 pages) explains why the need for cooling becomes much larger and often different in nature, from 1kW microchips to 6G Communications.

Reinventing cooling - PDRC and caloric progress

Learn the problems with the dominant vapor compression cooling in our refrigerators, freezers and air conditioning. Understand reinventing air conditioning to be lower power, greener, more affordable. See how replacing the undesirable materials widely used and proposed for cooling is an opportunity for you but recognise that there is competition for solid state cooling - examples being given.

Chapter 3. "Passive Daytime Radiative Cooling (PDRC)" has 100 pages because it discusses the surge in research through 2025 targeting apparel, windows, solar panels and much more. Understand 40 important advances in 2024-5 and activities of ten companies. Chapter 4. (41 pages) gives the wider picture of radiative cooling including self-adaptive, switchable, tuned, Janus, Anti-Stokes and advanced photonic solid-state cooling. Self-cooled high-power lasers are one Anti-Stokes prospect, possibly for emerging fusion power. Twenty-two wider advances in radiative cooling in 2025 are assessed here. There is a maturity curve of radiative cooling technologies in 2026.

Chapter 5. Caloric cooling by ferroic phase change takes 76 pages due to its importance. Although magnetocaloric forms have long had some commercialisation, the research and industrial interest through 2025 has turned to electrocaloric, and, to a lesser extent, elastocaloric options. This chapter also covers several other options with many comparisons. It concludes that the new focus is commercially appropriate. It explains why multi-mode and giant-caloric versions described here should also be tracked.

Metamaterial cooling now intensely researched

Chapter 6. "Enabling Technology: Metamaterial Cooling Materials and Devices" (54 pages) tracks the enormous recent progress in this aspect, which is largely a better way of serving cooling principles already described. Research is strong but commercialisation is, so far, modest. The basics are explained plus relevance to greenhouse, window, solar panel and personal cooling. Understand the manufacturing technologies, and popularity by formulation in 132 examples of latest thermal metamaterial research.

Thermoelectric cooling reinvented for different uses

Chapter 7 covers future thermoelectric cooling and thermoelectric harvesting as a user of and power provider for other solid-state cooling (53 pages). It explains how this old technology has now progressed to commercial neck coolers, with prospects of wide-area, flexible thermoelectrics and avoidance of toxigens and expensive materials and machining. It is a strong candidate for cooling the new 1kW chips and even researched for buildings. Secondarily, there is coverage of thermoelectric harvesting to power solid-state cooling. Indeed, thermoelectric cooling can be enhanced by other forms of solid-state cooling on its cold side. 20 recent advances in thermoelectric cooling and harvesting involving solid-state cooling are highlighted and 82 manufactures of Peltier cooling thermoelectric modules and products are listed.

Thermal conduction with new materials

The report then closes with Chapter 8 (57 pages) on the allied topics of thermal Interface Materials TIM and other thermal conducting materials and structures. Much of this concerns TIM materials, issues, advances and practicalities emerging plus thermally conducting solids in general with graphics, SWOT appraisals, comparison tables. Seven current TIM options are compared against nine parameters in one table and nine important TIM research advances in 2025 and 2024 are presented. See thermally conductive polymer advances in 2025, companies making thermally conductive additives and progress to more sophisticated thermal composites.

The Zhar Research report, "Solid State Cooling Materials and Systems Radiative, PDRC, Caloric, Thermoelectric, Multimode, Multipurpose, Other: Markets, Technology 2026-2046" is your essential guide to the multi-billion-dollar market that is emerging.

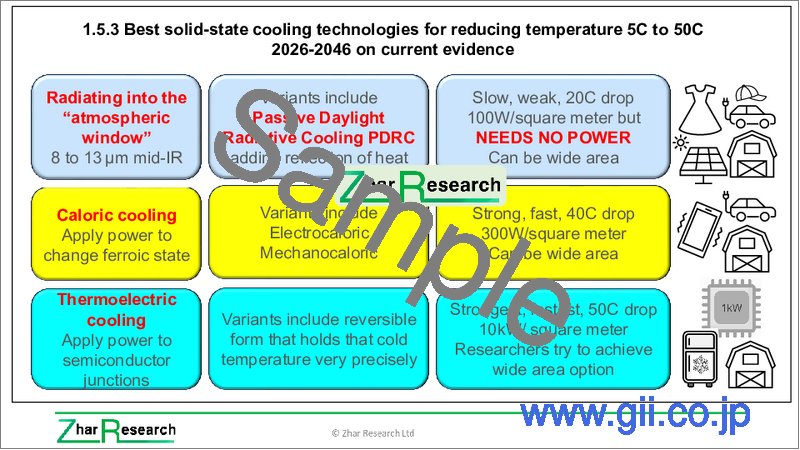

CAPTION: Best passive solid-state cooling technology for reducing temperature 5C to 20C 2026-2046 on current evidence. Source, Zhar Research report, "Solid State Cooling Materials and Systems Radiative, PDRC, Caloric, Thermoelectric, Multimode, Multipurpose, Other: Markets, Technology 2026-2046" .

Table of Contents

1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Reasons for the escalating need for cooling

- 1.4. The nature of solid-state cooling and why it is now a priority

- 1.5. Cooling toolkit and potential winners on current evidence

- 1.5.1. Cooling toolkit, trend to multimode with best solid-state cooling tools shown red

- 1.5.2. Best passive solid-state cooling technology for reducing temperature 5C to 40C 2026-2046 on current evidence

- 1.5.3. Best solid-state cooling technologies for reducing temperature 5C to 50C 2026-2046 on current evidence

- 1.6. Twenty primary conclusions

- 1.6.1. Nine candidate solid-state cooling technologies compared and appraised in columns

- 1.6.2. Primary applications targetted by latest research

- 1.6.3. Winning materials and principles for solid-state cooling generally

- 1.6.4. Primary mentions of caloric cooling by type in 94 research papers 2022 through 2025 as an indicator of relative progress

- 1.6.5. Leading materials in 292 research advances on solid state cooling 2024 through 2025

- 1.6.6. Potential for replacing vapor compression cooling

- 1.6.7. Potential for cooling solar panels to increase efficiency

- 1.6.8. Potential for cooling 6G Communications infrastructure and client devices

- 1.6.9. Potential for self-cooling lasers

- 1.7. Best reported and potential temperature drop by different solid-state technologies 2000-2046

- 1.8. Appraisal of Passive Daytime Radiative Cooling PDRC and allied radiative cooling technologies

- 1.8.1. SWOT appraisal of passive radiative cooling in general

- 1.8.2. SWOT appraisal of PDRC with materials analysis

- 1.8.3. SWOT appraisal of Janus effect for thermal management

- 1.8.4. SWOT appraisal of anti-Stokes fluorescence cooling

- 1.9. Appraisal of the leading types of caloric cooling

- 1.9.1. SWOT appraisal of electrocaloric cooling with materials analysis

- 1.9.2. SWOT appraisal of elastocaloric cooling

- 1.10. SWOT appraisal of thermoelectric cooling with materials analysis

- 1.11. Solid state cooling roadmap by market and by technology 2026-2046

- 1.12. Market forecasts as tables and graphs 2026-2046

- 1.12.1. Cooling module global market by seven technologies $ billion 2025-2046

- 1.12.2. Terrestrial radiative cooling performance in commercial products W/sq. m 2025-2046

- 1.12.3. Air conditioner value market $ billion 2024-2046

- 1.12.4. Global market for HVAC, refrigerators, freezers, other cooling $ billion 2025-2046

- 1.12.5. Refrigerator and freezer value market $ billion 2024-2046

- 1.12.6. Stationary battery market $ billion and cooling needs 2024-2046

- 1.12.7. Thermal management material and structure for 6G Communications infrastructure and client devices $ billion if 6G is successful 2026-2046

- 1.12.8. Dielectric and thermal materials for 6G value market % by location 2029-2046

- 1.12.9. 5G vs 6G thermal interface material market $ billion 2025-2046

- 1.12.10. Market for 6G vs 5G base stations units millions yearly 2025-2046

- 1.12.11. Market for 6G base stations market value $bn if successful 2029-2046

- 1.12.12. 6G RIS value market $ billion: active and three semi-passive categories 2029-2046

- 1.12.13. Smartphone billion units sold globally 2024-2046 if 6G is successful

- 1.12.14. Thermal meta-device market $ billion 2026-2046 by application segment

2. Introduction

- 2.1. Overview

- 2.2. Need for cooling becomes much larger and often different in nature

- 2.2.1. General situation

- 2.2.2. Infogram: Cooling needs increase for many reasons 2026-2046

- 2.3. Examples of radical changes in the requirements for cooling 2026-2046

- 2.3.1. Escalation of demand for air conditioning and forthcoming changes in requirement

- 2.3.2. Problems becoming severe with traditional cooling inadequate

- 2.3.3. Further reading on the problems of traditional vapor compression cooling

- 2.3.4. How 6G Communications from 2030 will bring new cooling requirements: infograms

- 2.3.5. Severe new microchip cooling requirements arriving

- 2.3.6. Other cooling problems and opportunities emerging in electronics and ICT

- 2.4. How cooling technology will trend to smart materials 2026-2046

- 2.5. Reinventing air conditioning to be lower power, greener, more affordable

- 2.6. Undesirable materials widely used and proposed: this is an opportunity for you

- 2.7. Examples of competition for solid state cooling

3. Passive daytime radiative cooling (PDRC)

- 3.1. Overview

- 3.2. PDRC basics

- 3.3. Radiative cooling materials by structure and formulation with research analysis

- 3.4. Potential benefits and applications

- 3.4.1. Overall opportunity and progress

- 3.4.2. Transparent PDRC for facades, solar panels and windows including 8 advances 2024 through 2025

- 3.4.3. Wearable PDRC, textile and fabric with 15 advances in 2024-5 and SWOT

- 3.4.4. PDRC cold side boosting power of thermoelectric generators

- 3.4.5. Color without compromise: advances in 2025 and earlier

- 3.4.6. Aerogel and porous material approaches

- 3.4.7. Environmental and inexpensive PDRC materials development

- 3.5. Other important advances in 2025 and earlier

- 3.5.1. 40 important advances in 2024-5

- 3.5.2. Other advances

- 3.6. Companies commercialising PDRC

- 3.6.1. 3M USA

- 3.6.2. BASF Germany

- 3.6.3. i2Cool USA

- 3.6.4. LifeLabs USA

- 3.6.5. Plasmonics USA

- 3.6.6. Radicool Japan, Malaysia etc.

- 3.6.7. SkyCool Systems USA

- 3.6.8. SolCold Israel

- 3.6.9. Spinoff from University of Massachusetts Amherst USA

- 3.6.10. SRI USA

- 3.7. SWOT appraisal of Passive Daytime Radiative Cooling PDRC

4. Wider picture of radiative cooling including self-adaptive, switchable, tuned, Janus, Anti-Stokes and advanced photonic solid-state cooling

- 4.1. Overview of the bigger picture with SWOT

- 4.2. Twenty-two wider advances in radiative cooling in 2025

- 4.3. Maturity curve of radiative cooling technologies in 2026

- 4.4. Self-adaptive and switchable radiative cooling

- 4.4.1. Vanadium phase change for self-adaptive versions in recent research

- 4.4.2. Alternative using liquid crystal

- 4.5. Tuned radiative cooling using both sides: Janus emitter JET advances in 2024 through 2025 with SWOT

- 4.6. Anti-Stokes fluorescence cooling advances in 2024 through 2025 with SWOT appraisal

- 4.7. Advanced photonic cooling and prevention of heating

5. Caloric cooling by ferroic phase change

- 5.1. Structural and ferroic phase change cooling modes and materials

- 5.2. Solid-state phase-change cooling potentially competing with other forms in named applications

- 5.3. The physical principles adjoining caloric cooling

- 5.4. Operating principles for caloric cooling

- 5.5. Caloric compared to thermoelectric cooling and winning caloric technologies identified

- 5.6. Some proposals for work to advance the use of caloric cooling

- 5.7. Electrocaloric cooling

- 5.7.1. Overview and SWOT appraisal

- 5.7.2. Operating principles, device construction, successful materials and form factors

- 5.7.3. Electrocaloric material popularity in latest research with explanation

- 5.7.4. Giant electrocaloric effect through 2025

- 5.7.5. Electrocaloric cooling: issues to address

- 5.7.6. 10 important advances in 2025

- 5.7.7. 58 earlier advances

- 5.8. Magnetocaloric cooling with SWOT appraisal

- 5.8.1. Overview with progress through 2035

- 5.8.2. Magnetocaloric cooling in detail with SWOT appraisal

- 5.9. Mechanocaloric cooling (elastocaloric, barocaloric, twistocaloric) cooling

- 5.9.1. Elastocaloric cooling overview: operating principle, system design, applications, SWOT

- 5.9.2. Elastocaloric advances in 2024-5

- 5.9.3. Barocaloric cooling

- 5.10. Multicaloric cooling advances in 2025

6. Enabling technology: Metamaterial cooling materials and devices

- 6.1. Overview

- 6.1.1. Capabilities

- 6.1.2. Types of metamaterial thermal management materials by function

- 6.1.3. Three families of metamaterials overlap

- 6.1.4. Expanding choice of applications and new market drivers

- 6.1.5. Examples of thermal metamaterials in recent advances

- 6.1.6. Greenhouse, window, solar panel and personal cooling with metamaterials

- 6.1.7. SWOT assessment for metamaterials and metasurfaces generally

- 6.1.8. SWOT appraisal of thermal metamaterials

- 6.2. The meta-atom, patterning and static to dynamic thermal transfer

- 6.3. Primary conclusions; market positioning

- 6.4. Primary conclusions: leading formulations, functionality and manufacturing technologies

- 6.5. Popularity by formulation in 132 examples of latest thermal metamaterial research

- 6.6. Other metamaterial cooling and allied research advances in 2025 and 2024

- 6.7. Additive manufacturing design, fabrication, property and application

7. Future thermoelectric cooling and thermoelectric harvesting as a user of and power provider for other solid-state cooling

- 7.1. Basics

- 7.1.1. Operation, examples

- 7.1.2. Thermoelectric cooling and temperature control applications 2025 and 2045

- 7.1.3. SWOT appraisal of thermoelectric cooling, temperature control and harvesting

- 7.2. Thermoelectric materials

- 7.2.1. Requirements

- 7.2.2. Useful and misleading metrics

- 7.2.3. Quest for better zT performance which is often the wrong approach

- 7.2.4. Some alternatives to bismuth telluride being considered

- 7.2.5. Non-toxic and less toxic thermoelectric materials, some lower cost

- 7.2.6. Ferron and spin driven thermoelectrics

- 7.3. Wide area and flexible thermoelectric cooling is a gap in the market for you to address

- 7.3.1. The need and general approaches

- 7.3.2. Advances in flexible and wide area thermoelectric cooling in 2025 and earlier

- 7.3.3. Wide area or flexible TEG research 40 examples that may lead to similar TEC

- 7.4. Radiation cooling of buildings: multifunctional with thermoelectric harvesting

- 7.5. The heat removal problem of TEC and TEG - evolving solutions

- 7.6. 20 advances in thermoelectric cooling and harvesting involving cooling

- 7.7. Earlier advances

- 7.8. 82 Manufactures of Peltier cooling thermoelectric modules and products

8. Thermal Interface Materials TIM and other thermal conducting materials and structures

- 8.1. Overview: thermal adhesives to thermally conductive concrete

- 8.1.1. TIM, heat spreaders from micro to heavy industrial: activity of 17 companies

- 8.1.2. 17 examples of research advances in 2025 and 2024 relevant to 6G transistors up to buildings

- 8.1.3. Annealed pyrolytic graphite: progress in 2025 and 2024 as microelectronic TIM

- 8.1.4. Thermally conductive concrete and allied work

- 8.2. Important considerations when solving thermal challenges with conductive materials

- 8.2.1. Bonding or non-bonding

- 8.2.2. Varying heat

- 8.2.3. Electrically conductive or not

- 8.2.4. Placement

- 8.2.5. Environmental attack

- 8.2.6. Choosing a thermal structure

- 8.2.7. Research on embedded cooling

- 8.3. Thermal Interface Material TIM

- 8.3.1. General

- 8.3.2. Seven current options compared against nine parameters

- 8.3.3. Nine important research advances in 2025 and 2024

- 8.3.4. Thermal pastes compared

- 8.3.5. TIM and other examples today: Henkel, Momentive, ShinEtsu, Sekisui, Fujitsu, Suzhou Dasen

- 8.3.6. 37 examples of TIM manufacturers

- 8.3.7. Thermal interface material trends as needs change: graphene, liquid metals etc.

- 8.4. Polymer choices: silicones or carbon-based

- 8.4.1. Comparison

- 8.4.2. Silicone parameters, ShinEtsu, patents

- 8.4.3. SWOT appraisal for silicone thermal conduction materials

- 8.5. Thermally conductive polymer advances in 2025 and earlier

- 8.5.1. Overview

- 8.5.2. Examples of companies making thermally conductive additives

- 8.5.3. Thermally conductive polymers: pie charts of host materials and particulates prioritised in research

- 8.5.4. Important progress in 2025 and earlier