|

|

市場調査レポート

商品コード

1780346

固体冷却の世界市場:冷却システム、冷蔵システム、熱電冷却、電気熱量冷却、磁気熱量冷却、チラー、クーラー、エアコン、冷蔵庫、冷凍庫 - 予測(~2030年)Solid State Cooling Market by Cooling System, Refrigeration System, Thermoelectric Cooling, Electrocaloric Cooling, Magnetocaloric Cooling, Chiller, Cooler, Air Conditioner, Refrigerator and Freezer - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 固体冷却の世界市場:冷却システム、冷蔵システム、熱電冷却、電気熱量冷却、磁気熱量冷却、チラー、クーラー、エアコン、冷蔵庫、冷凍庫 - 予測(~2030年) |

|

出版日: 2025年07月24日

発行: MarketsandMarkets

ページ情報: 英文 233 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

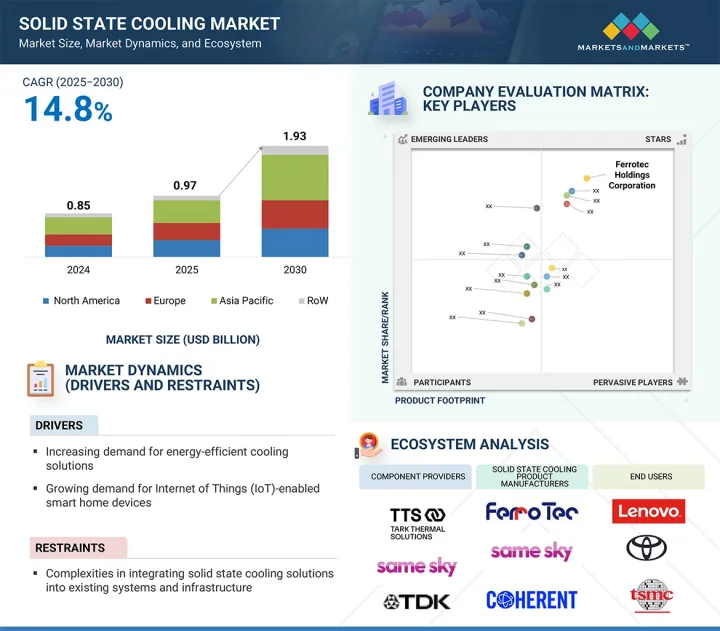

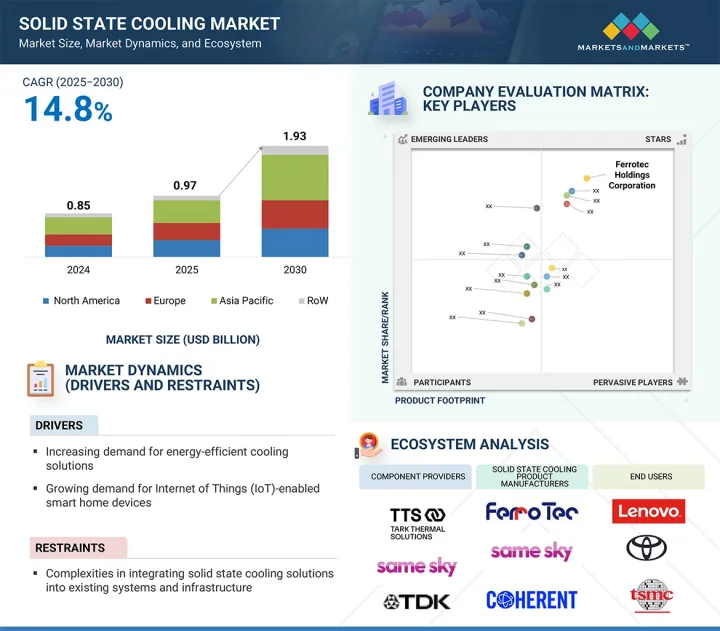

世界の固体冷却の市場規模は、2025年に9億7,000万米ドル、2030年までに19億3,000万米ドルに達すると予測され、2025年~2030年にCAGRで14.8%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 製品、技術、業界、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

繊細な医療機器や研究機器における静音・無振動の冷却に対する需要の高まりや、産業オートメーション、通信、半導体製造における低維持費のサーマルソリューションの採用の拡大が主な促進要因となっています。さらに、バッテリーや車内の温度制御を局所的に行う電気自動車で固体冷却の使用が増加していることも、固体冷却システムの需要を高めています。

「冷蔵庫セグメントが2025年に冷蔵システム市場で最大のシェアを占める見込みです。」

冷蔵庫セグメントは、住宅、商業、医療用途で広く使用されているため、2025年の冷蔵システム向け固体冷却市場で最大のシェアを占めると予測されています。熱電冷却を利用する固体冷却冷蔵庫は、静音運転、コンパクトなサイズ、冷媒の不使用、低維持費など、従来のシステムに比べて複数の利点があります。これらの特長により、ミニ冷蔵庫、ポータブル医療用ストレージユニット、高家電の特殊冷蔵など、小規模な冷却ニーズに特に適しています。さらに、エネルギー効率に優れた環境にやさしい冷蔵オプションに対する需要の高まりや、医療や個人使用におけるポータブルでコンパクトな冷蔵システムの採用の増加も、引き続きこの製品の優位性を後押ししています。材料効率の向上と製造コストの低下に伴い、固体冷却冷蔵庫は先進国市場や新興国市場にとって、より実行可能で魅力的なソリューションになりつつあります。

「エアコンセグメントが2025年~2030年に冷却システムセグメントの市場でもっとも高いCAGRを記録すると予測されます。」

エアコンセグメントは、従来のHVACシステムに代わる、コンパクトでエネルギー効率に優れた冷媒を使用しないものへの需要の高まりにより、予測期間に冷却システム市場で最高のCAGRを記録する見込みです。固体冷却空調システム、特にサーモエレクトリック技術とエレクトロカロリック技術に基づくものは、静音運転、正確な温度制御、局所的または個人的な気候ゾーンへの統合の可能性を提供します。従来のエアコンから排出される温室効果ガスの削減を目標とする持続可能性と環境規制への注目が高まる中、産業界と消費者は、住宅、自動車、商業用途向けの固体冷却ソリューションを模索しています。継続的な研究開発と材料の進歩により、システムの性能と拡張性が向上し、固体冷却空調は、スペースに制約のある環境やオフグリッド環境における次世代空調ソリューションとしてますます魅力的になっています。

「中国が2025年~2030年に世界の固体冷却市場で最高のCAGRを示すと予測されます。」

中国は、電子機器製造基盤の急速な拡大、電気自動車採用の強力な推進、医療、工業、消費者部門にわたるエネルギー効率の高い熱ソリューションへの需要の高まりにより、予測期間に世界の固体冷却市場で最高のCAGRを示す可能性が高いです。従来の冷媒を使用したシステムへの依存を減らすことへの注目は、有利な政府政策や研究開発資金に支えられて、固体冷却技術の採用を後押ししています。さらに、主要コンポーネントメーカーのプレゼンス、国内消費の増加、サーモエレクトリック材料の継続的な進歩により、中国は世界市場の重要な成長エンジンとなっています。

当レポートでは、世界の固体冷却市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 固体冷却市場の企業にとって魅力的な機会

- 固体冷却市場:製品別

- 固体冷却市場:業界別

- 固体冷却市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- チラーの平均販売価格:主要企業別(2024年)

- チラーの平均販売価格の動向:地域別(2020年~2024年)

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入データ

- 輸出データ

- 主な会議とイベント(2025年~2026年)

- ケーススタディ分析

- 基準と規制情勢

- 規制機関、政府機関、その他の組織

- 固体冷却市場に関連する規格と規制

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 固体冷却市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 業界に対する影響

第6章 固体冷却システムのコンポーネント

- イントロダクション

- 冷蔵システムコンポーネント

- TECモジュール(冷蔵グレード)

- コンパクトコントロールユニット

- サーマルインターフェースマテリアル

- 冷蔵システムのその他のコンポーネント

- 冷却システムコンポーネント

- 大容量TECモジュール/カスケードTEC

- スマートコントロールボード

- ヒートスプレッダー・ヒートシンク

- サーマルインターフェースマテリアル

- 冷却システムのその他のコンポーネント

第7章 固体冷却市場:製品別

- イントロダクション

- 冷蔵システム

- 冷蔵庫

- 冷凍庫

- 冷却システム

- エアコン

- クーラー

- チラー

第8章 固体冷却市場:技術別

- イントロダクション

- 熱電冷却

- 電気熱量冷却

- 磁気熱量冷却

- その他の技術

第9章 固体冷却市場:業界別

- イントロダクション

- 自動車

- コンシューマーエレクトロニクス・半導体

- 医療

- その他の業界

第10章 固体冷却市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- 南米

- アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年1月~2025年4月

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- COHERENT CORP.

- DELTA ELECTRONICS, INC.

- FERROTEC HOLDINGS CORPORATION

- TARK THERMAL SOLUTIONS

- KOMATSU LTD.

- CRYSTAL LTD.

- SAME SKY

- SOLID STATE COOLING SYSTEMS, INC.

- TE TECHNOLOGY, INC.

- TEC MICROSYSTEMS GMBH

- その他の企業

- ALIGN SOURCING LLC.

- AMS TECHNOLOGIES AG

- EVERREDTRONICS

- XIAMEN HICOOL ELECTRONICS CO., LTD.

- INHECO INDUSTRIAL HEATING & COOLING GMBH

- KRYOTHERM

- MERIT TECHNOLOGY GROUP

- PHONONIC

- SHEETAK INC.

- THERMONAMIC ELECTRONICS (JIANGXI) CORP., LTD.

- WELLEN TECHNOLOGY CO., LTD.

- EUROPEAN THERMODYNAMICS LTD.

- THERMOELECTRIC COOLING AMERICA CORPORATION

- MEERSTETTER ENGINEERING

- CUSTOM THERMOELECTRIC, LLC

第13章 付録

List of Tables

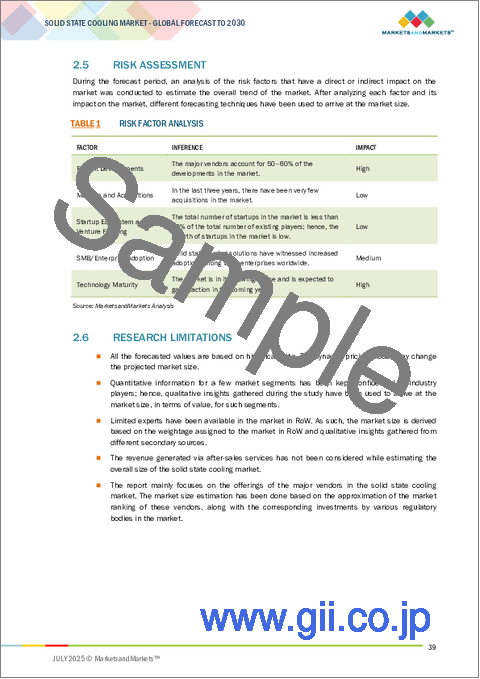

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE OF CHILLERS, BY KEY PLAYER, 2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF CHILLERS, BY REGION (USD)

- TABLE 4 ROLE OF PARTICIPANTS IN SOLID STATE COOLING ECOSYSTEM

- TABLE 5 LIST OF KEY PATENTS IN SOLID STATE COOLING MARKET, 2020-2024

- TABLE 6 IMPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

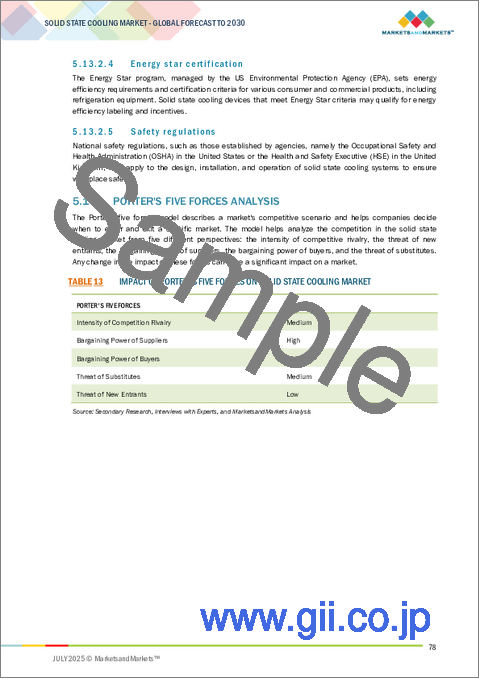

- TABLE 13 IMPACT OF PORTER'S FIVE FORCES ON SOLID STATE COOLING MARKET

- TABLE 14 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 18 SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 19 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 20 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 21 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 22 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 24 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 25 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 26 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 27 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 28 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 29 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 32 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 34 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 35 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SOLID STATE COOLING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 46 SOLID STATE COOLING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 47 COMPARATIVE STUDY OF DIFFERENT SOLID STATE COOLING TECHNOLOGIES AND THEIR POTENTIAL

- TABLE 48 SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 49 SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 50 AUTOMOTIVE: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 AUTOMOTIVE: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS & SEMICONDUCTOR: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS & SEMICONDUCTOR: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 HEALTHCARE: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 HEALTHCARE: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 OTHER VERTICALS: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 OTHER VERTICALS: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: SOLID STATE COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: SOLID STATE COOLING MARKET, BY COUNTRY, 2025-2030(USD MILLION)

- TABLE 62 NORTH AMERICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 66 US: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 67 US: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 68 US: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 69 US: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 70 CANADA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 71 CANADA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 72 CANADA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 73 CANADA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 74 MEXICO: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 75 MEXICO: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 76 MEXICO: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 77 MEXICO: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 78 EUROPE: SOLID STATE COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 EUROPE: SOLID STATE COOLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 81 EUROPE: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 82 EUROPE: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 84 UK: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 85 UK: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 86 UK: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 87 UK: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 88 GERMANY: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 89 GERMANY: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 90 GERMANY: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 91 GERMANY: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 92 FRANCE: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 93 FRANCE: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 94 FRANCE: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 95 FRANCE: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 96 ITALY: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 97 ITALY: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 98 ITALY: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 99 ITALY: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 100 REST OF EUROPE: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 101 REST OF EUROPE: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 102 REST OF EUROPE: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 103 REST OF EUROPE: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 104 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY COUNTRY, 2025-2030(USD MILLION)

- TABLE 106 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 110 CHINA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 111 CHINA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 112 CHINA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 113 CHINA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 114 JAPAN: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 115 JAPAN: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 116 JAPAN: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 117 JAPAN: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 118 SOUTH KOREA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 119 SOUTH KOREA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 120 SOUTH KOREA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 121 SOUTH KOREA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 126 ROW: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 ROW: SOLID STATE COOLING MARKET, BY REGION, 2025-2030(USD MILLION)

- TABLE 128 ROW: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 129 ROW: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 130 ROW: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 131 ROW: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 132 MIDDLE EAST: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 133 MIDDLE EAST: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 135 MIDDLE EAST: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 136 SOUTH AMERICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 137 SOUTH AMERICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH AMERICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH AMERICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 140 AFRICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 141 AFRICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 142 AFRICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 143 AFRICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 144 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN SOLID STATE COOLING MARKET

- TABLE 145 DEGREE OF COMPETITION

- TABLE 146 SOLID STATE COOLING MARKET: PRODUCT FOOTPRINT

- TABLE 147 SOLID STATE COOLING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 148 SOLID STATE COOLING MARKET: VERTICAL FOOTPRINT

- TABLE 149 SOLID STATE COOLING MARKET: REGION FOOTPRINT

- TABLE 150 SOLID STATE COOLING MARKET: LIST OF STARTUPS/SMES

- TABLE 151 SOLID STATE COOLING MARKET: PRODUCT FOOTPRINT

- TABLE 152 SOLID STATE COOLING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 153 SOLID STATE COOLING MARKET: VERTICAL FOOTPRINT

- TABLE 154 SOLID STATE COOLING MARKET: REGION FOOTPRINT

- TABLE 155 SOLID STATE COOLING MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020-APRIL 2025

- TABLE 156 SOLID STATE COOLING MARKET: DEALS, JANUARY 2020-APRIL 2025

- TABLE 157 SOLID STATE COOLING: EXPANSIONS, JANUARY 2020-APRIL 2025

- TABLE 158 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 159 COHERENT CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 COHERENT CORP.: PRODUCT/SERVICE LAUNCHES

- TABLE 161 COHERENT CORP.: DEALS

- TABLE 162 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 163 DELTA ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 DELTA ELECTRONICS, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 165 FERROTEC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 166 FERROTEC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 FERROTEC HOLDINGS CORPORATION: DEALS

- TABLE 168 FERROTEC HOLDINGS CORPORATION: EXPANSIONS

- TABLE 169 TARK THERMAL SOLUTIONS: COMPANY OVERVIEW

- TABLE 170 TARK THERMAL SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 TARK THERMAL SOLUTIONS: PRODUCT/SERVICE LAUNCHES

- TABLE 172 TARK THERMAL SOLUTIONS: DEALS

- TABLE 173 KOMATSU: COMPANY OVERVIEW

- TABLE 174 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 CRYSTAL LTD.: COMPANY OVERVIEW

- TABLE 176 CRYSTAL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 SAME SKY: COMPANY OVERVIEW

- TABLE 178 SAME SKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 SAME SKY: PRODUCT/SERVICE LAUNCHES

- TABLE 180 SAME SKY: DEALS

- TABLE 181 SOLID STATE COOLING SYSTEMS: COMPANY OVERVIEW

- TABLE 182 SOLID STATE COOLING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 SOLID STATE COOLING SYSTEMS: PRODUCT/SERVICE LAUNCHES

- TABLE 184 TE TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 185 TE TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TEC MICROSYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 187 TEC MICROSYSTEMS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 TEC MICROSYSTEMS GMBH: PRODUCT/SERVICE LAUNCHES

List of Figures

- FIGURE 1 SOLID STATE COOLING MARKET AND REGIONAL SCOPE

- FIGURE 2 SOLID STATE COOLING MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF SOLID STATE COOLING PRODUCTS AND SOLUTIONS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SOLID STATE COOLING MARKET, 2021-2030

- FIGURE 9 COOLING SYSTEMS SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2030

- FIGURE 10 THERMOELECTRIC COOLING TECHNOLOGY TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 11 CONSUMER ELECTRONICS & SEMICONDUCTOR VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 12 ASIA PACIFIC DOMINATED SOLID STATE COOLING MARKET IN 2024

- FIGURE 13 SURGING DEMAND FOR RELIABLE AND ENERGY-EFFICIENT SOLUTIONS TO DRIVE MARKET

- FIGURE 14 COOLING SYSTEMS TO DOMINATE MARKET IN 2030

- FIGURE 15 CONSUMER ELECTRONICS & SEMICONDUCTOR SEGMENT TO LEAD MARKET IN 2030

- FIGURE 16 ASIA PACIFIC TO DOMINATE MARKET IN 2030

- FIGURE 17 SOLID STATE COOLING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 SOLID STATE COOLING MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 GLOBAL EV CAR SALES, 2024

- FIGURE 20 SOLID STATE COOLING MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 SOLID STATE COOLING MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 SOLID STATE COOLING MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE OF CHILLERS, BY KEY PLAYER, 2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF CHILLERS, BY REGION, 2020-2024

- FIGURE 26 SOLID STATE COOLING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 KEY PLAYERS IN SOLID STATE COOLING ECOSYSTEM

- FIGURE 28 FUNDING AND RELATED DEALS IN SOLID STATE TECHNOLOGY, 2021-2024

- FIGURE 29 NUMBER OF PATENTS GRANTED IN SOLID STATE COOLING MARKET, 2015-2024

- FIGURE 30 IMPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 PORTER'S FIVE FORCES: SOLID STATE COOLING MARKET

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 35 COOLING SYSTEMS TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 36 THERMOELECTRIC TECHNOLOGY TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 37 AUTOMOTIVE SEGMENT TO BE FASTEST-GROWING VERTICAL DURING FORECAST PERIOD

- FIGURE 38 SOLID STATE COOLING MARKET FOR ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: SOLID STATE COOLING MARKET SNAPSHOT

- FIGURE 40 EUROPE: SOLID STATE COOLING MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: SOLID STATE COOLING MARKET

- FIGURE 42 ROW: SOLID STATE COOLING MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 45 COMPANY VALUATION, 2024

- FIGURE 46 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 47 BRAND/PRODUCT COMPARISON

- FIGURE 48 SOLID STATE COOLING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 SOLID STATE COOLING MARKET: COMPANY FOOTPRINT

- FIGURE 50 SOLID STATE COOLING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 SOLID STATE COOLING MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 52 COHERENT CORP.: COMPANY SNAPSHOT

- FIGURE 53 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 54 FERROTEC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 KOMATSU: COMPANY SNAPSHOT

The global solid state cooling market is expected to reach USD 0.97 billion in 2025 and USD 1.93 billion by 2030, registering at a CAGR of 14.8% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Technology, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising demand for silent, vibration-free cooling in sensitive medical and laboratory devices and the growing adoption of low-maintenance thermal solutions in industrial automation, telecom, and semiconductor manufacturing are key drivers. Furthermore, the increasing use of solid state cooling in electric vehicles for localized battery and cabin temperature control augments the demand for solid state cooling systems.

"Refrigerators segment is expected to hold the largest share of the market for refrigeration systems in 2025."

The refrigerators segment is expected to hold the largest share of the solid state cooling market for refrigeration systems in 2025 due to their widespread use across residential, commercial, and medical applications. Solid state cooling refrigerators, which utilize thermoelectric cooling, offer several advantages over traditional systems, including silent operation, compact size, no use of refrigerants, and low maintenance. These features make them particularly suitable for small-scale cooling needs such as mini-fridges, portable medical storage units, and specialty refrigeration in premium consumer appliances. Additionally, the increasing demand for energy-efficient and environmentally friendly refrigeration options and the rising adoption of portable and compact refrigeration systems in healthcare and personal use continue to drive its dominance. As material efficiency improves and manufacturing costs decline, solid state cooling refrigerators are becoming a more viable and attractive solution for developed and emerging markets.

"Air conditioners segment is projected to witness the highest CAGR in market for cooling systems segment between 2025 and 2030."

The air conditioners segment is expected to register the highest CAGR in the market for cooling systems during the forecast period due to the growing demand for compact, energy-efficient, and refrigerant-free alternatives to traditional HVAC systems. Solid state cooling air conditioning systems, particularly those based on thermoelectric and electrocaloric technologies, offer silent operation, precise temperature control, and the potential for integration into localized or personal climate zones. With increasing focus on sustainability and environmental regulations targeting the reduction of greenhouse gas emissions from conventional air conditioners, industries and consumers are exploring solid state cooling solutions for residential, automotive, and commercial applications. Ongoing R&D and material advancements improve system performance and scalability, making solid state cooling air conditioning increasingly attractive for next-generation climate control solutions in space-constrained or off-grid environments.

"China is expected to exhibit the highest CAGR in the global solid state cooling market from 2025 to 2030."

China is likely to exhibit the highest CAGR in the global solid state cooling market during the forecast period due to its rapidly expanding electronics manufacturing base, strong push for electric vehicle adoption, and growing demand for energy-efficient thermal solutions across medical, industrial, and consumer sectors. The focus on reducing reliance on conventional refrigerant-based systems, supported by favorable government policies and R&D funding, boosts the adoption of solid state cooling technologies. Additionally, the presence of major component manufacturers, rising domestic consumption, and ongoing advancements in thermoelectric materials position China as a key growth engine in the global market.

Extensive primary interviews were conducted with key industry experts in the solid state cooling market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 10%, Tier 2 - 55%, and Tier 3 - 35%

- By Designation: C-level Executives - 45%, Managers - 25%, and Others - 30%

- By Region: North America - 15%, Europe - 20%, Asia Pacific - 55%, and RoW - 10%

Ferrotec Holdings Corporation (Japan), Coherent Corp. (US), Delta Electronics, Inc. (Taiwan), Komatsu Ltd. (Japan), and Tark Thermal Solutions (US) are some of the key players in the solid state cooling market.

Research Coverage:

This research report categorizes the solid state cooling market based on product (cooling systems and refrigeration systems), technology (thermoelectric cooling, electrocaloric cooling, magnetocaloric cooling, and other technologies), vertical (automotive, consumer electronics & semiconductors, healthcare, and other verticals), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the solid state cooling market and forecasts the same till 2030. Apart from this, the report also consists of leadership mapping and analysis of all the companies included in the solid state cooling ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall solid state cooling market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (surging demand for energy-efficient cooling solutions; rising implementation of IoT-enabled smart home devices; growing adoption of electric and hybrid electric vehicles; booming data center industry), restraints (high initial investment and manufacturing costs associated with solid state cooling technology; complexities in integrating solid state cooling solutions into existing systems and infrastructure; regulatory barriers and standards compliance requirements in healthcare and automotive industries), opportunities (emerging applications of solid state cooling technology in aerospace, defense, and consumer sectors; growing industrialization and urbanization), and challenges (complexities in designing and engineering solid state cooling systems for diverse applications and operating conditions; shortage of qualified experts with technical know-how regarding thermoelectric cooling and thermal management) influencing the growth of the solid state cooling market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the solid state cooling market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the solid state cooling market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the solid state cooling market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Ferrotec Holdings Corporation (Japan), Coherent Corp. (US), Delta Electronics, Inc. (Taiwan), Komatsu Ltd. (Japan), and Tark Thermal Solutions (US) in the solid state cooling market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SOLID STATE COOLING MARKET

- 4.2 SOLID STATE COOLING MARKET, BY PRODUCT

- 4.3 SOLID STATE COOLING MARKET, BY VERTICAL

- 4.4 SOLID STATE COOLING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for energy-efficient cooling solutions

- 5.2.1.2 Rising implementation of IoT-enabled smart home devices

- 5.2.1.3 Growing adoption of electric and hybrid electric vehicles

- 5.2.1.4 Thriving data center industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment and manufacturing costs associated with solid state cooling technology

- 5.2.2.2 Complexities associated with integrating solid state cooling solutions into existing systems and infrastructure

- 5.2.2.3 Regulatory barriers and standards compliance requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing deployment in aerospace, defense, and consumer sectors

- 5.2.3.2 Expanding industrialization and urbanization

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with designing and engineering solid state cooling systems

- 5.2.4.2 Shortage of qualified experts with technical knowledge

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF CHILLERS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF CHILLERS, BY REGION, 2020-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Thermoelectric cooling

- 5.8.1.2 Magnetic cooling

- 5.8.1.3 Electrocaloric cooling

- 5.8.1.4 Thermoelastic cooling

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Heat exchangers

- 5.8.2.2 Thermal interface materials (TIMs)

- 5.8.2.3 Temperature sensors and control systems

- 5.8.2.4 Power electronics and drivers

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Thermal management solutions

- 5.8.3.2 Energy harvesting systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 INTEL INTEGRATED PHONONIC'S SOLID STATE COOLING TECHNOLOGY INTO ITS DATA CENTERS TO REDUCE ENERGY CONSUMPTION AND ENVIRONMENTAL IMPACT

- 5.12.2 THERMO FISHER SCIENTIFIC INCORPORATED TE TECHNOLOGY'S SOLID-STATE COOLING MODULES INTO ITS ULTRA-LOW TEMPERATURE FREEZERS TO ENSURE PRECISE TEMPERATURE CONTROL AND STABILITY

- 5.12.3 BMW GROUP IMPLEMENTED II-VI MARLOW'S THERMOELECTRIC COOLING MODULES IN ELECTRIC VEHICLES TO ENSURE EFFICIENT OPERATION AND PREVENT OVERHEATING

- 5.12.4 PHILIPS HEALTHCARE INTEGRATED LAIRD'S SOLID-STATE COOLING MODULES INTO ITS MEDICAL IMAGING EQUIPMENT TO MAINTAIN OPTIMAL OPERATING TEMPERATURE

- 5.12.5 NASA PARTNERED WITH ATG TO DEVELOP SOLID STATE COOLING SYSTEMS FOR SPACE MISSIONS

- 5.13 STANDARDS AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS AND REGULATIONS RELATED TO SOLID STATE COOLING MARKET

- 5.13.2.1 International Electrotechnical Commission (IEC) standards

- 5.13.2.2 Underwriters Laboratories (UL) Standards

- 5.13.2.3 ISO standards

- 5.13.2.4 Energy star certification

- 5.13.2.5 Safety regulations

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITION RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF 2025 US TARIFF ON SOLID STATE COOLING MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON VERTICALS

6 COMPONENTS OF SOLID STATE COOLING SYSTEMS

- 6.1 INTRODUCTION

- 6.2 REFRIGERATION SYSTEM COMPONENTS

- 6.2.1 TEC MODULES (REFRIGERATION-GRADE)

- 6.2.2 COMPACT CONTROL UNITS

- 6.2.3 THERMAL INTERFACE MATERIALS

- 6.2.4 OTHER COMPONENTS IN REFRIGERATION SYSTEMS

- 6.3 COOLING SYSTEM COMPONENTS

- 6.3.1 HIGH-CAPACITY TEC MODULES/CASCADE TECS

- 6.3.2 SMART CONTROL BOARDS

- 6.3.3 HEAT SPREADERS & HEAT SINKS

- 6.3.4 THERMAL INTERFACE MATERIALS

- 6.3.5 OTHER COMPONENTS IN COOLING SYSTEMS

7 SOLID STATE COOLING MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 REFRIGERATION SYSTEMS

- 7.2.1 REFRIGERATORS

- 7.2.1.1 Advancements in materials science, semiconductor technology, and thermal management to boost segmental growth

- 7.2.2 FREEZERS

- 7.2.2.1 Increasing demand for energy-efficient and environmentally friendly cooling solutions to drive market

- 7.2.1 REFRIGERATORS

- 7.3 COOLING SYSTEMS

- 7.3.1 AIR CONDITIONERS

- 7.3.1.1 Growing demand for cooling solutions with precise control and minimal maintenance to boost demand

- 7.3.2 COOLERS

- 7.3.2.1 Surging demand for compact and high-power electronics to offer lucrative growth opportunities

- 7.3.3 CHILLERS

- 7.3.3.1 Increasing demand for precise temperature control in medical equipment to support market growth

- 7.3.1 AIR CONDITIONERS

8 SOLID STATE COOLING MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 THERMOELECTRIC COOLING

- 8.2.1 GROWING APPLICATIONS IN CONSUMER ELECTRONICS, AUTOMOTIVE, AND MEDICAL DEVICES TO FOSTER MARKET GROWTH

- 8.2.2 TYPES OF THERMOELECTRIC COOLING

- 8.2.2.1 Single-stage

- 8.2.2.2 Multi-stage

- 8.2.2.3 Thermocycler

- 8.3 ELECTROCALORIC COOLING

- 8.3.1 CLIMATE-FRIENDLY COOLING AND RAPID RESPONSE TIME TO DRIVE MARKET

- 8.4 MAGNETOCALORIC COOLING

- 8.4.1 LOW ENERGY CONSUMPTION AND REDUCED NOISE LEVELS TO FOSTER MARKET GROWTH

- 8.5 OTHER TECHNOLOGIES

9 SOLID STATE COOLING MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE

- 9.2.1 ACCELERATED EV ADOPTION TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 9.2.2 CASE STUDY: BMW COLLABORATED WITH GENTHERM TO INTEGRATE SOLID STATE COOLING SYSTEMS IN ITS VEHICLES FOR PERSONALIZED CLIMATE CONTROL

- 9.2.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON AUTOMOTIVE VERTICAL

- 9.3 CONSUMER ELECTRONICS & SEMICONDUCTOR

- 9.3.1 RISE OF EDGE COMPUTING AND ALWAYS-ON FEATURES IN MOBILE AND IOT DEVICES TO BOOST DEMAND

- 9.3.2 CASE STUDY: INTEL COLLABORATED WITH TARK THERMAL SOLUTIONS TO INTEGRATE SOLID STATE COOLING TECHNOLOGY INTO CPUS FOR EFFICIENT HEAT DISSIPATION AND THERMAL MANAGEMENT

- 9.3.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON CONSUMER ELECTRONICS & SEMICONDUCTOR VERTICAL

- 9.4 HEALTHCARE

- 9.4.1 EMPHASIS ON ADDRESSING TEMPERATURE MANAGEMENT CHALLENGES AND IMPROVING PATIENT CARE TO FUEL MARKET GROWTH

- 9.4.2 CASE STUDY: PFIZER COLLABORATED WITH PHONONIC TO DEPLOY SOLID STATE COOLING TECHNOLOGY IN VACCINE STORAGE UNITS TO ENSURE PRECISE TEMPERATURE CONTROL

- 9.4.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON HEALTHCARE VERTICAL

- 9.5 OTHER VERTICALS

- 9.5.1 CASE STUDY: BOEING COLLABORATED WITH LAIRD THERMAL SYSTEMS TO IMPLEMENT SOLID STATE COOLING TECHNOLOGY IN AIRCRAFT AVIONICS SYSTEMS TO ENHANCE COMPONENT RELIABILITY AND LONGEVITY

- 9.5.2 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON OTHER VERTICALS

10 SOLID STATE COOLING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Increasing number of construction projects to boost demand

- 10.2.3 CANADA

- 10.2.3.1 Growing investment in data centers to fuel market growth

- 10.2.4 MEXICO

- 10.2.4.1 Rapid urbanization and infrastructure development to boost demand

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.2.1 Emphasis on developing electric vehicle infrastructure to accelerate market growth

- 10.3.3 GERMANY

- 10.3.3.1 Adoption of Industry 4.0 and smart manufacturing techniques to foster market growth

- 10.3.4 FRANCE

- 10.3.4.1 Rising focus on reducing greenhouse gases to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Rising focus on developing energy-efficient buildings to offer lucrative growth opportunities

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Emphasis on energy conservation and carbon emissions reduction to fuel market growth

- 10.4.3 JAPAN

- 10.4.3.1 Increasing need for advanced cooling solutions in healthcare sector to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Thriving electronics & semiconductor industries to fuel market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 ROW: MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Rapid economic development and infrastructure expansion to foster market growth

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Rising investment in green technologies to drive market

- 10.5.4 AFRICA

- 10.5.4.1 Increasing awareness of environmental impact of traditional cooling methods to boost demand

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020-APRIL 2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 KEY PLAYERS IN SOLID STATE COOLING MARKET, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 11.7.5.1 Company footprint

- 11.7.5.2 Product footprint

- 11.7.5.3 Technology footprint

- 11.7.5.4 Vertical footprint

- 11.7.5.5 Region footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2024

- 11.8.5.1 List of startups/SMEs

- 11.8.6 COMPANY FOOTPRINT: STARTUPS/SMES

- 11.8.6.1 Company footprint

- 11.8.6.2 Product footprint

- 11.8.6.3 Technology footprint

- 11.8.6.4 Vertical footprint

- 11.8.6.5 Region footprint

- 11.9 COMPETITIVE SCENARIOS

- 11.9.1 PRODUCT/SERVICE LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 COHERENT CORP.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product/Service launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 DELTA ELECTRONICS, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product/Service launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 FERROTEC HOLDINGS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 TARK THERMAL SOLUTIONS

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product/Service launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 KOMATSU LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths/Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses/Competitive threats

- 12.1.6 CRYSTAL LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 SAME SKY

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product/Service launches

- 12.1.7.3.2 Deals

- 12.1.8 SOLID STATE COOLING SYSTEMS, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product/Service launches

- 12.1.9 TE TECHNOLOGY, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 TEC MICROSYSTEMS GMBH

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product/Service launches

- 12.1.1 COHERENT CORP.

- 12.2 OTHER PLAYERS

- 12.2.1 ALIGN SOURCING LLC.

- 12.2.2 AMS TECHNOLOGIES AG

- 12.2.3 EVERREDTRONICS

- 12.2.4 XIAMEN HICOOL ELECTRONICS CO., LTD.

- 12.2.5 INHECO INDUSTRIAL HEATING & COOLING GMBH

- 12.2.6 KRYOTHERM

- 12.2.7 MERIT TECHNOLOGY GROUP

- 12.2.8 PHONONIC

- 12.2.9 SHEETAK INC.

- 12.2.10 THERMONAMIC ELECTRONICS (JIANGXI) CORP., LTD.

- 12.2.11 WELLEN TECHNOLOGY CO., LTD.

- 12.2.12 EUROPEAN THERMODYNAMICS LTD.

- 12.2.13 THERMOELECTRIC COOLING AMERICA CORPORATION

- 12.2.14 MEERSTETTER ENGINEERING

- 12.2.15 CUSTOM THERMOELECTRIC, LLC

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS