|

|

市場調査レポート

商品コード

1842717

6G通信の光とオプトロニクスの機会:市場・技術 (2026-2046年)6G Communications Optical and Optronic Opportunities: Markets, Technologies 2026-2046 |

||||||

|

|||||||

| 6G通信の光とオプトロニクスの機会:市場・技術 (2026-2046年) |

|

出版日: 2025年10月20日

発行: Zhar Research

ページ情報: 英文 452 Pages

納期: 即日から翌営業日

|

概要

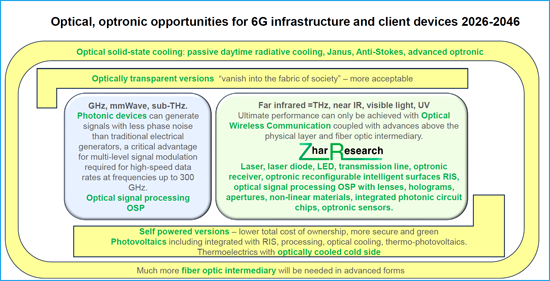

光学およびオプトロニクスは6G通信の成功に不可欠な要素であり、当レポートはその方向性を示します。本レポートでは、投資家から通信事業者、光学・オプトロニクス素材のサプライヤーや統合事業者まで、6Gバリューチェーンに関わるあらゆる関係者を対象としています。6Gは主に、既存の5Gハードウェアと周波数を改良して導入されますが、物理層を超えるレベルでの大幅な改善が期待されています。破壊的な新サービスと高い収益性を実現するためには、光学およびオプトロニクスの導入が急務となります。

不可欠な新しいハードウェア

6Gは、性能を桁違いに向上させることで、広く受け入れらるパフォーマンスを実現し、まったく新しいタイプのクライアントデバイスやビジネスモデルを生み出す可能性を約束しています。そのため、光無線通信 (OWC) 、 光信号処理 (OSP) 、自己発電用の太陽光発電技術、昼光放射冷却 (PDRC) による受動冷却技術、改良型光ファイバーおよび中間媒体などを加える必要があります。インフラの多くは光学的に透明化され、「社会に溶け込む通信網」として、より多くの場所で受け入れられるようになることが求められます。

卓越した性能を広範に実現するための必須ルート

これらの光学・オプトロニクス技術を導入してこそ、6Gは真に約束された性能水準に到達できます。単なるGHz帯の衛星通信や屋内Wi-Fiに留まらず、6Gはレーザーおよびレーザーダイオード、再構成可能なオプトロニクス知的表面 (RIS) 、フォトニックチップ、多接合型太陽電池フィルム、成層圏を飛行するソーラードローン基地局、オプトロニック伝送線、光ホログラフィー、スマートウィンドウなどに応用される多機能構造型オプトロニック素材などの新しい光技術の世界を包含します。

極めて包括的かつ実用的な452ページの商業レポート

452ページの本レポートは、博士レベルの専門知見をもとに2025年までの進展を徹底分析しています。内容は常にアップデートされているため、最新情報を入手でき、OWCだけでなく、すべての機会をカバーしています。

目次

第1章 エグゼクティブサマリーと結論

- 本レポートの目的と焦点

- 調査手法

- 6G通信システムおよびハードウェアに関する17の結論と10のインフォグラフ

- 11のSWOT評価

- 6Gシステム・材料・標準化ロードマップ

- 6G材料・ハードウェア市場の予測

第2章 イントロダクション

- 概要:6Gハードウェアの設計思想と教訓

- 6G成功のために不可欠な光学・オプトロニクス技術とは

- 6G材料における革新的進展の可能性

- 学術研究例と新たな市場調査の紹介

第3章 6G向け光無線通信 (OWC) インフラおよびクライアントデバイス

- OWCと2025年の研究動向

- OWCの範囲と2025年までの研究進展

- 衛星間および航空機・衛星間光通信ネットワーク

- 地上光通信局 (Airbusの事例)

- 6G通信におけるOWCの意義 (2025~2026年の研究)

- 光6G通信:2025年の調査を含む

- 概要

- インフォグラム:6Gにおける光学/オプトロニクス通信ハードウェアの重要性

- インフォグラム:遠赤外線 (THz) ・近赤外線・可視光を追加したTbps級光ファイバー併用OWCネットワーク

- 2025年の重要研究

- 6G非地上ネットワークへの応用:6G-NTNの活動

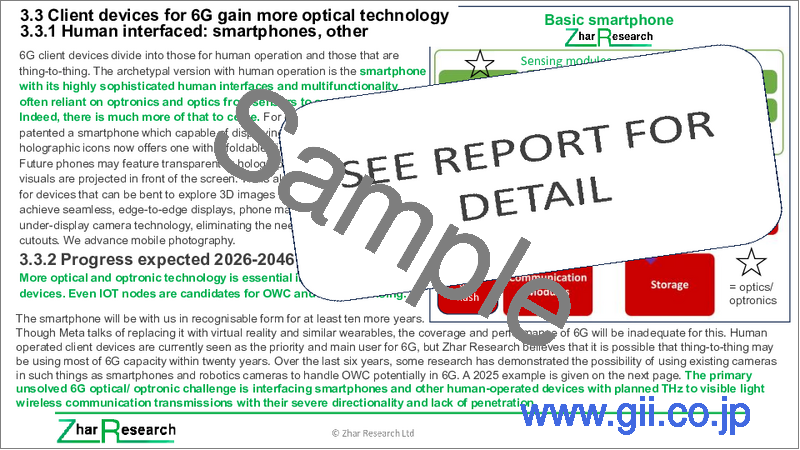

- 6G向けクライアントデバイス:より多くの光技術を活用

- ヒューマンインターフェース:スマートフォン、その他

- 2026年から2046年までの進捗予想

- スマートフォン向けVLC研究 (2025年)

- 次世代OWC用レーザー、レーザーダイオード、光検出器などのフォトニクス技術 (2025~2026年の研究)

- レーザー

- 将来の6G OWC LED、レーザーダイオード、光受信機、その他のデバイスと材料

第4章 6G向け光再構成型知的表面 (ORIS) および光チューニング技術 (2025年進展を含む)

- 概要

- 光通信RIS (ORIS) のSWOT分析および最新進展

- 概要

- ORISの利点と分散型RIS (DRIS) オプション

- ORISの課題

- 6G OWC向けRISのSWOT評価

- 可視光通信のSWOT評価

- ORIS実装プロセス

- 長距離、地下、水中、宇宙におけるRIS技術

- 概要

- 車両通信ネットワークおよびモバイル環境向けRIS強化OWC

- ハイブリッドRF-FSO RIS

- 水中光無線通信 (UOWC) システム

- 地下通信に必要なRIS

- RIS技術によるレーザー成層圏および宇宙通信

- 短距離および屋内OWCとそのRIS:2025年までの研究

- 屋内および空中の短距離

- RISを使用したLiFiなどの他の屋内および短距離屋外システムの活用

- 6G向けメタレンズ技術

- ミラーアレイ型ORISの設計と応用

第5章 6Gインフラおよびクライアントデバイス向けのその他の光学/オプトロニクス支援技術 (固体放射冷却、PDRC、透明ハードウェア、スマートウィンドウ)

- 概要

- 6Gの一般的な状況

- 6G RISにも対応可能な冷却ウィンドウの例

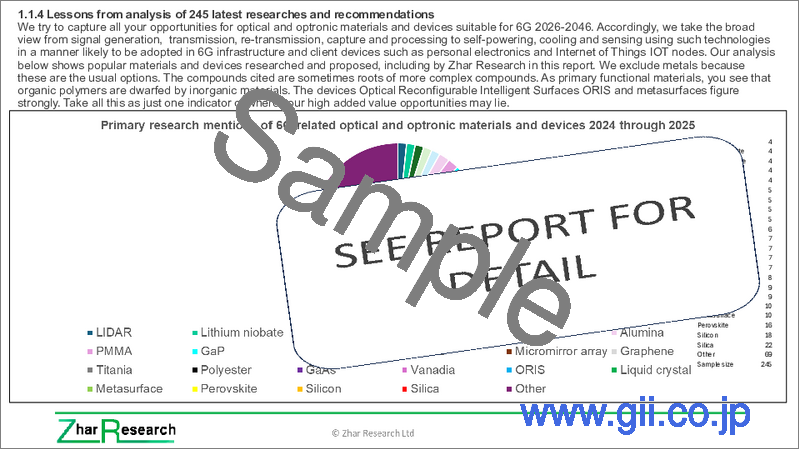

- 背景:6G向け熱的・誘電的・超広帯域ギャップ (UWBG) 材料 - 最新研究発表数に基づく優先度分析

- 6Gインフラに適した固体冷却および温度制御技術

- 6Gの要件には多様な光熱ソリューションが含まれる

- 主要候補材料および構造の比較

- 5~20℃の温度低下を実現する光学受動型固体冷却技術

- PDRC (昼間放射冷却) の基礎、10社の取り組み、2025年研究での優勢材料、SWOT分析

- 6Gに関連する2024~2025年の光学冷却研究の進展 (材料および詳細)

- ジャナス効果および反ストークス蛍光を含む6G向け先進放射冷却 (SWOT分析・2025年研究の分析付き)

- 反ストークス蛍光およびジャナス効果による自己冷却レーザーやその他6G機器の実現可能性

第6章 光信号処理 (OSP) 、多機能6Gインフラおよびクライアントデバイスを含む太陽光発電、遠赤外線およびテラヘルツ (THz) 波導およびケーブル、光ファイバー、オプトロニクスセンサー

- 概要

- 6G向け光信号処理OSP

- 6Gにおける光学・オプトロニクスのエネルギーハーベスティングへの応用

- 光学・オプトロニクスを含む13種類のエネルギーハーベスティング技術

- 6Gの個人デバイス、アクティブRIS、超多素子MIMO基地局の電力需要に対応したエネルギーハーベスティングオプション

- 周波数別の電磁エネルギーハーベスティングツールキットと太陽光発電の位置付け

- 質量のないエネルギー (massless energy) とのフォトニクス互換性を含むエネルギーハーベスティングシステム改良戦略とSWOT分析

- 6G通信インフラおよびクライアントデバイスにおけるゼロエネルギーデバイス (ZED) の重要性

- デバイスアーキテクチャ

- 太陽光発電およびその派生技術が6Gにおいて極めて重要である理由

- 最速のコスト削減を示す経験曲線 今後の大幅な発電量増加 オプトロニクス・光学などの手法を用いた単位体積・単位面積あたりの太陽光発電出力向上 2025年までの太陽光発電研究における最高効率の動向 多様なフォーマットの進化と6Gへの高い汎用性 pn接合型太陽光発電とその他方式の比較 ペロブスカイト太陽光発電への強い注目 ― 理由と2025年の研究進展 6Gインフラ向け熱放射型太陽光発電

- SWOT分析・6G導波管とケーブルの設計と材料

- 用途・オプション

- THzグラフェン、PTFE、PBVE、PP、PE/PP、LiNb、InAs、GaP、2つのSWOT分析、2025年までの研究進展

- 将来の6G用光ファイバー媒介材料 (シリカ、サファイア、PBTP、PE、PI、FRP) 、SWOT分析

- フォトニック定義型無線からケーブルまでの統合化、テラヘルツ6G向けフォトニック統合

- 6Gシステム設計における光ファイバーのSWOT分析

- オプトロニクスセンサー:フォトニックセンサー、赤外線センサー、LiDAR、光電子メムトランジスタ、光電センサー、太陽光発電センサー

第7章 6G関連材料およびハードウェアに関与する40社:製品・計画・特許・Zhar Researchによる評価

- 概要:想定される6Gハードウェアの構成と、メーカー事例および特許動向 (Apple、Intel、Ciscoなど)

- AGC Japan

- Airbus Europe

- Alcan Systems Germany

- Alibaba China

- Alphacore USA

- China Telecom China Mobile, China Unicom, Huawei, ZTE, Lenovo, CICT China collaboration

- Ericsson Sweden

- Fractal Antenna Systems USA

- Greenerwave France

- Huawei China

- ITOCHU Japan

- Kymeta Corp. USA

- Kyocera Japan

- Metacept Systems USA

- Metawave USA

- NEC Japan

- Nokia Finland with LG Uplus South Korea

- NTT DoCoMo and NTTJapan

- Orange France

- Panasonic Japan

- Pivotal Commware USA

- Qualcomm USA

- Samsung Electronic South Korea

- Sekisui Japan

- SensorMetrix USA

- SK Telecom South Korea

- Sony Japan

- Teraview USA

- Vivo Mobile Communications China

- VTT Finland

- ZTE China