|

|

市場調査レポート

商品コード

1812616

6G通信の有望材料・ハードウェア・システム:市場・技術機会 (2026-2046年)6G Communications Winning Materials, Hardware, Systems: Markets, Technology Opportunities 2026-2046 |

||||||

|

|||||||

| 6G通信の有望材料・ハードウェア・システム:市場・技術機会 (2026-2046年) |

|

出版日: 2025年09月16日

発行: Zhar Research

ページ情報: 英文 339 Pages

納期: 即日から翌営業日

|

概要

当レポートは、2030年のローンチ時およびそれ以降に出現する 6G材料およびハードウェアの機会について包括的な概要を提供します。システムや信号処理といった密接に関連するテーマも取り上げており、また、アイオノマー、メタマテリアル、エナジーハーベスター、透明材料、構造エレクトロニクスといった新興材料がどのように有用であるかを学ぶことができます。主要な6G材料およびハードウェアの機会は、以下の分野に重複して存在します:

- (a) 基地局:一部は「空のタワー (宇宙・航空) 」や建築構造物として進化

- (b) 伝搬経路を強化する装置:特に再構成可能インテリジェント表面 (RIS) 、より初歩的な製品であるリフレクトアレイ

- (c) CPE (顧客宅内機器)

- (d) クライアントデバイス

20年間の予測・ロードマップ:2026~2046年

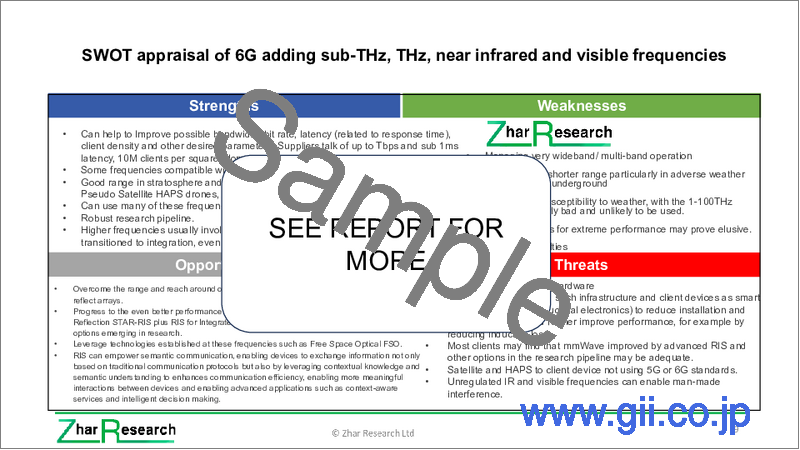

本レポートは、投資家から付加価値材料企業、製品・システムインテグレーター、モバイルネットワークオペレーター、学術関係者、規制当局など、バリューチェーンに関わるすべての関係者を支援します。潜在的なパートナーや買収先、勝利のアプローチ、ベストプラクティス、失敗から学ぶ教訓を見出すことができます。博士号レベルの新たな分析として、12件のSWOT評価、17の主要結論、多数の新しい比較チャート、インフォグラム、企業別評価、2046年までの6行ロードマップ、2046年までの48件の予測データライン、さらにZhar Research Commentと記された多数のセクションが提示されています。

目次

第1章 エグゼクティブサマリーと結論

- 本レポートの目的・背景・位置づけ

- 本分析の方法論と焦点

- 6G通信システムおよびハードウェアに関する16の結論 (22のインフォグラム、10のSWOT評価)

- 6Gシステム、材料、標準に関するロードマップ

- 6G材料およびハードウェア市場の予測

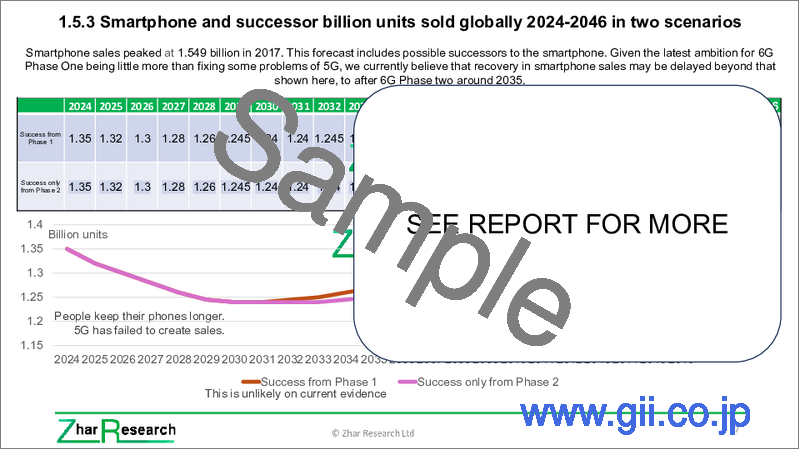

- 背景予測

第2章 イントロダクション

- 概要

- 6Gの2つのフェーズは不可避

- 上位レイヤーの進展と要件が物理レイヤーに与える影響

- 6Gフェーズにおける周波数帯:現在の一般的な周波数利用の文脈における位置づけ (SWOT分析)

- 主要な6Gインフラとクライアントデバイスの状況 (タイプ別)

- 6G材料全般における根本的な進歩

- 6Gとその他の破壊的ハードウェアの進歩の融合が本物のIoTを可能にする可能性

- 6G通信全般に関する10の主要な結論

- 追加資料:2025年までの学術研究事例と新しい市場調査

第3章 6Gに最適なコンポーネントと材料の分析

- 概要

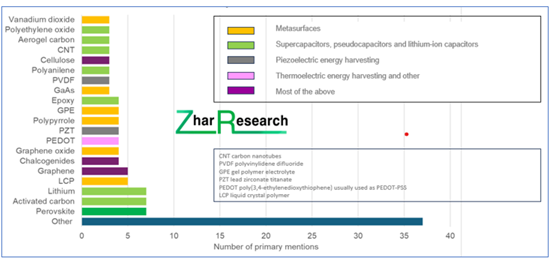

- 6G材料の全体分析

- 研究における最も成功した6G ZED化合物と炭素同素体のランキング

- 6G向けに優先される熱冷却・熱伝導材料およびハードウェア

- 6G用熱メタマテリアル

- 電気伝導性熱絶縁材を含む6G用アイオノゲル

- 6G向けの先進的な耐熱シールド・熱絶縁分析

- 6G向けに優先される無機・有機・複合熱絶縁材料

- 6G研究における低損失・熱材料の配合別動向

- 6G向けに優先される低損失誘電体

- 6G向けに優先される光学およびサブテラヘルツ材料 (0.1~1THz、近赤外線、可視光)

- 6G用メタマテリアルベースのRISの材料分析 (調整用材料・コンポーネントを含む)

第4章 基地局とNTN (非地上ネットワーク) 6G:UM-MIMO、HAPS、その他のUAV

- 関連分野の重なり:6G基地局とNTN

- UM-MIMOへの進展と消えゆく基地局

- 衛星やドローンが6Gを支援し、時にはその恩恵を受ける:2025年までの進展

- Internet of Drones

- 6Gの一部としての大型成層圏HAPS

第5章 伝搬経路と基地局を強化するRISおよびメタマテリアル反射アレイ

- 定義、6Gにおける複数の用途、高まる関心、乱立する用語

- 「6Gの至る所にRIS」という夢:インフォグラム

- 6Gに必要とされる多様なRISの種類

- 6G RISの機会に関する25の要点

- RISを活用した先進的クライアントデバイス:SWIPT、STIIPT、AmBC、CD-ZED

- 6G RISおよびその他における材料・コンポーネント機会の7つの側面

- 6G RISのコスト課題と削減の可能性

- 6G RISおよび反射アレイの製造技術

- 5件のSWOT評価

- 追加資料

第6章 ZED (ゼロエネルギーデバイス) と6Gインフラおよびクライアントデバイスにおけるバッテリーの排除

- 概要

- ZEDのコンテキスト

- 6Gのゼロエネルギー化:多くの場合バッテリー不要に

- バッテリー不要の6G ZEDを可能にする主要候補技術

- 特定の6G ZED設計アプローチの分析とSWOT評価

- AmBC (アンビエントバックキャッター通信)、群衆検出型CD-ZED、SWIPT

- 蓄電を排除する回路およびインフラのSWOT評価

- 2025年までのさらなる研究

第7章 6G材料およびハードウェア関連36社:製品、計画、特許、Zhar Researchによる評価

- 概要:6Gハードウェアの将来像 (メーカーの事例や特許動向を含む)

- AGC Japan

- Alcan Systems Germany

- Alibaba China

- Alphacore USA

- China Telecom China Mobile, China Unicom, Huawei, ZTE, Lenovo, CICT China collaboration

- Ericsson Sweden

- Fractal Antenna Systems USA

- Greenerwave France

- Huawei China

- ITOCHU Japan

- Kymeta Corp. USA

- Kyocera Japan

- Metacept Systems USA

- Metawave USA

- NEC Japan

- Nokia Finland with LG Uplus South Korea

- NTT DoCoMo and NTTJapan

- Orange France

- Panasonic Japan

- Pivotal Commware USA

- Qualcomm USA

- Samsung Electronic South Korea

- Sekisui Japan

- SensorMetrix USA

- SK Telecom South Korea

- Sony Japan

- Teraview USA

- Vivo Mobile Communications China

- VTT Finland

- ZTE China