|

|

市場調査レポート

商品コード

1808961

6G通信:RIS (再構成可能インテリジェントサーフェス) 材料およびハードウェアの市場と技術 (2026~2046年)6G Communications: Reconfigurable Intelligent Surface RIS Materials and Hardware Markets, Technology 2026-2046 |

||||||

|

|||||||

| 6G通信:RIS (再構成可能インテリジェントサーフェス) 材料およびハードウェアの市場と技術 (2026~2046年) |

|

出版日: 2025年09月10日

発行: Zhar Research

ページ情報: 英文 591 Pages

納期: 即日から翌営業日

|

概要

サマリー

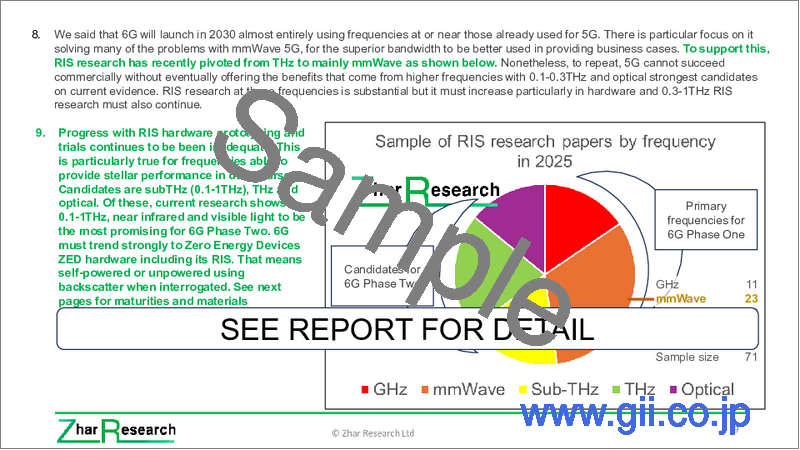

6G通信におけるRIS (再構成可能インテリジェントサーフェス) は、メタサーフェス市場の中で最大規模の市場となる可能性があります。これにより数十億ドル規模のビジネスが生まれるでしょう。しかし、付加価値のある材料やハードウェアを製造する企業にとって、RISの機会を理解する際にはジレンマが存在します。研究者たちは多くの場合、同じ意味を持つ複数の用語を使い分けながら難解な理論研究に没頭しており、RISシステムを開発する企業は当然ながら秘密主義的です。そのため、この分野のように急速に進化しているテーマでは、従来の市場調査は役に立ちません。

最新の実態を深く理解するために

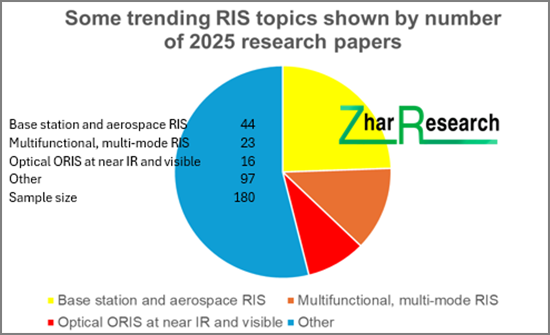

こうした状況を打破するのが本レポートです。本レポートは、主に2025年までに発表される膨大な新しい研究成果と直近の企業活動に焦点を当てており、全591ページであらゆる側面を網羅しています。商業的な観点を重視し、10件のSWOT分析、11章構成、2026~2046年にわたる25の予測ライン、30の主要結論、41の新しいインフォグラム、106社をカバーしています。さらに、6Gが2030年に開始されるにあたり、5G周波数帯またはその近傍でのRISの優先度や、非対角型、モーフィング、透明かつ全方位型RIS、アクティブRIS、航空宇宙向けRIS、大面積RISなど、新興分野における最新の画期的成果も多く取り上げています。

目次

第1章 エグゼクティブサマリー・総論・ロードマップ・予測

- 本書の目的

- 調査手法

- RISの背景

- 6Gに必要とされる多様なRISの種類

- 6G通信全般に関する10の主要な結論

- インフォグラム:主要な6Gシステムの目的

- 6G RISの材料およびコンポーネントの機会に関する7つの主要な結論

- 6G RISのコスト問題に関する7つの主要な結論

- 6G RISおよびリフレクトアレイ製造技術に関する6つの主要な結論

- SWOT評価

- 5Gおよび6G RISロードマップ (4ライン)

- 6G RISおよびリフレクトアレイ市場の予測

- 6G RIS市場規模

- 6G RIS販売面積

- 6G RIS平均価格 (工場出荷ベース、電子部品込み)

- 6G RIS市場価値:アクティブ型 vs 4タイプのセミパッシブ型、周波数別

- 6G RIS販売面積 vs 平均パネル面積、パネル販売数量、累計展開パネル数

- 6G RIS市場価値:基地局 vs 伝搬経路

- 世界のRISハードウェア市場価値における地域別シェア

- セミパッシブ型 vs アクティブ型RIS市場 (0.1~1THz vs 非6G THzエレクトロニクス)

- 6G 完全パッシブ型メタマテリアルリフレクトアレイ市場

- 補足情報

第2章 イントロダクション

- 概要

- RISの機能と有用性 ― 詳細な考察

- 6G RISに関連する標準化団体およびインフルエンサーの活動

- 6Gおよび6G RISの目的の拡大 vs 縮小、スマート無線環境

- 用語の乱立

- 産業および研究動向の変化

- 高周波数帯における到達距離改善:トラジェクトリーエンジニアリング

- その他18の研究進展に関する分析

- 6Gグローバルアーキテクチャの提案および補完システム

第3章 究極の6G RISハードウェアツールキット:不可視、広域、自律電源、自己学習、自己適応、自己修復、自己清掃、ユビキタス、自律型、長寿命、AI対応、動的スペクトラム共有、その他目

- 概要

- 不可視RIS ― 透明または視界に入らない形態

- 広域RISを含む、大規模インテリジェントサーフェス (LIS) と超大規模アンテナアレイ (ELAA)

- RISは自律電源化し、ゼロエネルギークライアントデバイスを可能にします

- 長寿命:設置後の保守を不要にする自己修復材料

- 最適化・自己学習・自己適応・自律化を実現するRISのためのAIと機械学習

- マルチモード/マルチ周波数、動的スペクトラム共有 (DSS) と6GおよびそのRIS

第4章 Beyond Diagonal (BD) RISアーキテクチャが6G RISの制約に対応:2025年までに進展が急増

- 定義、材料面での課題、適用可能性

- BD-RISの潜在的な利点

- BD-RISハードウェアの課題

- 実践と改善の必要性

第5章 STAR RIS、ISAC、SWIPTを含む多機能・マルチモードRIS

- 2025年の研究、産業動向、および可能性のレビューを含む概要

- 透過と反射を同時に行うSTAR RIS

- その他の多機能・マルチモードRIS

第6章 基地局、UM-MIMO、空の塔 (HAPS) およびその他のUAV RIS

- 概要

- UM-MIMOへの進展

- RIS対応・自律電源型の超大規模6G UM-MIMO基地局設計

- 大規模MIMO基地局向けRIS:清華大学、エマソン

- スモールセル基地局としてのRIS

- 2025年におけるRIS対応MIMOおよび基地局のその他重要な進展

- 衛星やUAVが6G RISを支援し、時にその恩恵を受ける方法:2025年までの進展

- 2024年の重要な進展

- 成層圏における大規模HAPS RIS

第7章 RISチューニング用ハードウェアの目標と2025年までの研究進展

- 概要

- RISチューニングに関する調査からの教訓:2025年以前

- 個別チューニングコンポーネントの進捗状況の詳細な分析

- 6G RISにおける0.1~1THzおよび近赤外 (NearIR) 向けのディスクリート部品を代替する調整材料の優先化

- 大規模RISおよび市場におけるその他のギャップ

第8章 6G向け光無線通信 (ORIS) :2025年までの主要な進展

- RISを含むその周波数帯でのOWCが、6Gにとって魅力的な追加要素となる理由

- 光RIS (ORIS) の可能性と課題 ― SWOT分析による評価

- ORISの実装手順

- 長距離・地下・水中・宇宙における光無線通信 (OWC) とRIS:2025年以前までの研究進展

- 短距離および屋内光無線通信 (OWC) とそのRIS:2025年以前までの研究進展

- 6Gに利用され得る光学材料

- 6G向けメタレンズ (2025年までの進展を含む)

- ミラーアレイORIS設計

第9章 6Gモーフィング型フレキシブルインテリジェントメタサーフェス (FIM)、6Gハイパーサーフェス、メタマテリアルの基礎

- 概要

- 2025年までの6G関連メタマテリアル研究における主要な進展の評価

- メタマテリアルの基礎

- メタサーフェスの基礎

- メタマテリアル全体の長期的な展望

- GHz、THz、赤外線、光メタマテリアルの新たな応用

- 熱メタマテリアル

- メタマテリアルとメタサーフェス全般のSWOT評価

- モーフィング型FIMの基礎と2025年までの研究進展

第10章 RISおよびリフレクトアレイの製造・検査・試験・コスト内訳

- 薄膜および透明エレクトロニクスの最先端技術

- ディスクリート基板、積層フィルムから完全なスマート材料統合へのトレンド

- フレキシブル、層状、2Dエネルギーハーベスティングおよびセンシングの重要性

- 6G RISにおける光学、低THz帯、高THz帯での製造技術の違い

- 6G RIS検査とテスト:2025年の新たな進歩

- RISコスト分析

第11章 6G RIS企業:製品、計画、特許、Zharによる評価 (2025~2026年)

- 概要と特許取得

- AGC Japan

- Alcan Systems Germany

- Alibaba China

- Alphacore USA

- China Telecom China Mobile, China Unicom, Huawei, ZTE, Lenovo, CICT China collaboration

- Ericsson Sweden

- Fractal Antenna Systems USA

- Greenerwave France

- Huawei China

- ITOCHU Japan

- Kymeta Corp. USA

- Kyocera Japan

- Metacept Systems USA

- Metawave USA

- NEC Japan

- Nokia Finland with LG Uplus South Korea

- NTT DoCoMo and NTTJapan

- Orange France

- Panasonic Japan

- Pivotal Commware USA

- Qualcomm USA

- Samsung Electronic South Korea

- Sekisui Japan

- SensorMetrix USA

- SK Telecom South Korea

- Sony Japan

- Teraview USA

- Vivo Mobile Communications China

- VTT Finland

- ZTE China