|

|

市場調査レポート

商品コード

1795398

医薬品とバイオテクノロジーにおける創薬段階の提携条件と契約(2020年~2025年)Discovery Stage Partnering Terms and Agreements in Pharma and Biotech 2020-2025 |

||||||

適宜更新あり

|

|||||||

| 医薬品とバイオテクノロジーにおける創薬段階の提携条件と契約(2020年~2025年) |

|

出版日: 2025年08月01日

発行: Current Partnering

ページ情報: 英文 1400+ Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

医薬品とバイオテクノロジーにおける創薬段階の提携条件と契約(2020年~2025年)

世界の医薬品・バイオテクノロジーにおける創薬段階の提携条件と契約(2020年~2025年)」レポートは、企業が創薬段階の提携取引に取り組む方法と理由、およびこれらの契約を支える財務的・戦略的条件について、包括的でデータ主導の分析を提供しています。この重要な業界リソースは、製薬およびバイオテクノロジー部門における初期段階のパートナーシップを定義する構造、交渉の力学、および財務上の考慮事項に関する深い洞察を提供します。

創薬段階において、ライセンシング契約は通常、ライセンシーにライセンサーの製品または技術をさらに開発する権利またはオプションを付与するものです。これらの契約は多くの場合、共同研究開発(R&D)から始まり、商業化契約につながる可能性もあるなど、複数の要素を含んでいます。

当レポートは、ヘルスケア分野における最新の創薬段階契約の詳細な内訳を提供し、企業が市場動向を把握し、競合の契約構造を評価し、自社の交渉戦略を最適化するのに役立ちます。

バイオテクノロジーおよび製薬企業のディールメーカー必携のリソース

世界の医薬品・バイオテクノロジーにおける創薬段階の提携条件と契約(2020年~2025年)」レポートは、バイオ医薬品の取引に携わる事業開発、法務、財務の専門家にとって不可欠なリソースです。

包括的な洞察、膨大な取引データベース、契約文書への直接アクセスにより、当レポートは以下のような究極のツールとして役立ちます。

- ディール構造と財務条件のベンチマーク

- 交渉戦略の最適化

- 潜在的パートナーの柔軟性とディールメーキング行動の評価

- 創薬段階のパートナーシップにおける動向とベストプラクティスの特定

- 当レポートは、複雑な創薬段階のパートナーシップをナビゲートするために、適切なパートナーと価値の高い契約を締結するために必要な明確なデータ、戦略的指針を提供します。

- 当レポートがディールメーカーに不可欠な理由

- 潜在的パートナーの柔軟性と交渉戦略に関する洞察を得ることは、創薬段階の取引を成功させる上で極めて重要です。主要な財務条件(契約一時金、マイルストーン、ロイヤルティなど)は大まかな概要を提供しますが、契約文書では、これらの支払いの実際のトリガーや条件についてより深く理解することができます。

- 当レポートでは、2020年以降に発表されたすべての創薬段階の提携案件を包括的にリストアップしており、入手可能な場合には財務条件も記載しています。また、米国証券取引委員会(SEC)に提出された公開契約文書など、詳細なオンライン契約記録へのリンクも2,473件以上掲載しています。

- これらの契約を分析することで、企業は潜在的リターンを最大化しつつ、業界ベンチマークに沿った取引を構築する上で競合優位性を得ることができます。

- 創薬段階の提携動向の包括的分析

当レポートの第1章では、創薬段階のディールメーキングと戦略的考察に関する詳細なオリエンテーションを提供しています。

第1章 -レポートの導入

第2章 企業が創薬段階の提携に取り組む理由

第3章 戦略的アプローチと取引構造(ケーススタディ付き)

第4章 - アップフロント、マイルストーン、ロイヤルティを含む支払い戦略

第5章 - 創薬ステージにおけるディールメーキング分析(2020年~2025年)(年別、治療領域別、技術タイプ別、主要ディールメーカー別)

第6章 - ヘッドラインバリュー、契約一時金、マイルストントリガー、ロイヤルティ率を含む財務条件の詳細分析

第7章 主要な創薬段階案件のヘッドライン金額別レビュー

第8章 最も活発な創薬段階のディールメーカー上位25社

第9章 創薬段階の提携契約のデータベース

第10章 2020年以降に発表された全ての創薬段階案件の包括的ディレクトリ

- 各ディールレコードは、ディールの全構造、財務条件、契約文書に簡単にアクセスできる独自のデータベースであるCurrent Agreementsにリンクされています。

- 当レポートの主な利点

- 2020年以降の創薬段階のディール動向に関する包括的な洞察

- ヘッドラインバリュー、アップフロント、マイルストーン、ロイヤルティ構造など、主要な財務条件へのアクセス

- 実際のケーススタディを含むディール構造の内訳

- 実際の条項例を含む契約条件の分析

- 実際の契約に基づく取引条件のベンチマーク

- 潜在的パートナーに対する提案された取引条件の適合性を評価するためのデューデリジェンスに関する洞察

- 調査範囲

世界の医薬品・バイオテクノロジーにおける創薬段階の提携条件と契約(2020年~2025年)レポートは以下を提供します。

- 2020年以降のバイオ医薬品業界における創薬段階の取引動向の分析

- 契約一時金、マイルストーン、ロイヤルティなどの財務構造に関する洞察

- 実際の創薬段階の契約に関するケーススタディ

- 2,690件以上の創薬段階案件へのアクセス(入手可能な場合は契約記録付き)

- 2020年以降、最も活発な創薬段階のディールメーカーのプロファイル

- 最高額の創薬ステージ案件の詳細分析

各案件のインデックス

- 会社名(A-Z)

- ヘッドラインバリュー

- 契約時の開発段階

- ディールタイプ

- 特定の治療

- 簡単にアクセスできるように、すべての契約記録はオンライン版にリンクしており、利用可能な場合は契約文書全文にもリンクしています。

- 重要な質問に回答

当レポートは、入手可能な限り実際の契約書を分析することにより、以下のような重要な質問に対する明確な回答を提供します:

- 各契約では具体的にどのような権利が付与されているのか。

- どのような独占条件が適用されるのか。

- 契約は財務的にどのように構成されているか(アップフロント、マイルストーン、ロイヤルティ)

- 売上と支払いはどのように監査されるのか。

- 誰が開発、製造、商品化を管理するのか。

- 知的財産はどのように扱われるか。

- 守秘義務や出版権はどのように管理されるか。

- どのような条件で契約を解除できるか。

- どのような紛争解決メカニズムがあるのか。

- 所有者が変わった場合はどうなるのか。

目次

エグゼクティブサマリー

第1章 イントロダクション

第2章 -企業はなぜ創薬段階で提携するのか

- イントロダクション

- 創薬段階のパートナーシップの役割

- 創薬段階でのインライセンス

- 創薬段階でのライセンス供与

- 創薬段階、前臨床段階、臨床段階の取引の違い

- 創薬段階の提携契約を締結する理由

- ライセンサーが創薬段階の取引に参加する理由

- ライセンシーが創薬段階の取引に参加する理由

- 創薬ステージの提携契約の未来

第3章 創薬段階の取引戦略と構造

- イントロダクション

- 企業はどの段階で提携するのか

- 製薬/バイオテクノロジー分野の早期提携

- 製薬/バイオテクノロジー分野での提携

- 初期段階と後期段階の提携- リスクとコストの比較

- 企業は創薬、前臨床、臨床段階の提携にいくら費やしているのか

- 純粋型と複数コンポーネント型の提携契約

- 純粋なライセンシング契約構造

- 多要素創薬段階の提携契約

第4章 -創薬段階のパートナーシップ支払い戦略

- イントロダクション

- 創薬段階の支払い戦略

- 支払い方法

- ヘッドラインバリュー

- 前払い

- ローン

- 転換ローン

- 公平性

- 研究開発資金

- ライセンシング料

- マイルストーン支払い

- ロイヤルティの支払い

- クイッズ

- オプション支払い

第5章 創薬段階の取引成立の動向

- イントロダクション

- 長年にわたる創薬段階のパートナーシップ

- 創薬取引の属性

- 取引タイプ別の創薬段階の提携

- 疾患種別の創薬段階における提携

- 創薬段階の技術タイプ別の提携

- 2020年から2025年にかけて最も活発な企業別創薬段階の提携

第6章 -創薬段階の提携における支払い条件

- イントロダクション

- 創薬段階の支払い条件に関するガイドライン

- 創薬段階の支払い条件- 取引データ分析

- 支払条件分析

第7章 -創薬段階の主要取引

- イントロダクション

- 上位の創薬段階の取引、金額別

第8章 -最も活発な創薬段階のディールメーカー上位25件

- イントロダクション

- 最も活発な創薬段階のディールメーカー上位25件

第9章 -創薬段階のパートナー契約ディレクトリ

- イントロダクション

- 2020年から2025年までの契約に関する創薬段階の取引

第10章 開発段階別の創薬段階の取引成立

- イントロダクション

- 創薬段階別の取引

付録

Global Discovery Stage Partnering Terms and Agreements in Pharma and Biotech (2020-2025)

The Global Discovery Stage Partnering Terms and Agreements in Pharma and Biotech (2020-2025) report offers a comprehensive, data-driven analysis of how and why companies engage in discovery-stage partnering deals and the financial and strategic terms underpinning these agreements. This essential industry resource provides deep insights into the structure, negotiation dynamics, and financial considerations that define early-stage partnerships in the pharmaceutical and biotech sectors.

At the discovery stage, licensing agreements typically grant the licensee rights or options to further develop a licensor's product or technology. These agreements are often multi-component, beginning with collaborative research and development (R&D) and potentially leading to commercialization agreements.

This report provides a detailed breakdown of the latest discovery-stage agreements in the healthcare sector, helping companies identify market trends, evaluate competitive deal structures, and optimize their own negotiation strategies.

A Must-Have Resource for Biotech and Pharma Dealmakers

The Global Discovery Stage Partnering Terms and Agreements in Pharma and Biotech (2020-2025) report is an indispensable resource for business development, legal, and financial professionals involved in biopharma dealmaking.

With comprehensive insights, a vast deal database, and direct access to contract documents, this report serves as the ultimate tool for:

- Benchmarking deal structures and financial terms

- Optimizing negotiation strategies

- Assessing potential partners' flexibility and deal-making behavior

- Identifying trends and best practices in discovery-stage partnerships

- For those looking to navigate the complex landscape of discovery-stage partnering, this report offers the clarity, data, and strategic guidance needed to secure high-value agreements with the right partners.

- Why This Report is Essential for Dealmakers

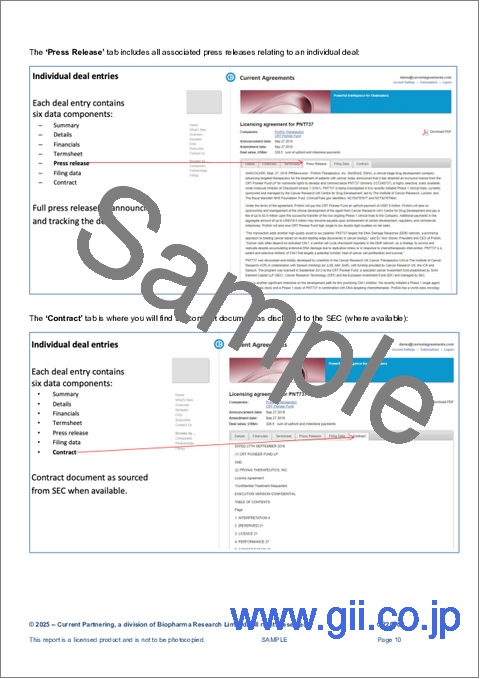

- Gaining insight into the flexibility and negotiation strategies of potential partners is crucial in structuring a successful discovery-stage deal. While headline financial terms (e.g., upfront payments, milestones, and royalties) provide a broad overview, contract documents offer a deeper understanding of the actual triggers and conditions for these payments-critical details that press releases and traditional databases often omit.

- This report contains a comprehensive listing of all discovery-stage partnering deals announced since 2020, including financial terms where available. It also features over 2,473 links to detailed online deal records, including publicly available contract documents filed with the SEC.

- By analyzing these agreements, companies gain a competitive edge in structuring deals that align with industry benchmarks while maximizing potential returns.

- Comprehensive Analysis of Discovery-Stage Partnering Trends

The first chapters of the report provide a detailed orientation to discovery-stage deal-making and strategic considerations:

Chapter 1 - Introduction to the report

Chapter 2 - Why companies engage in discovery-stage partnerships

Chapter 3 - Strategic approaches and deal structures, with case studies

Chapter 4 - Payment strategies, including upfronts, milestones, and royalties

Chapter 5 - Discovery-stage deal-making analysis (2020-2025), categorized by year, therapeutic area, technology type, and key dealmakers

Chapter 6 - Detailed analysis of financial terms, including headline values, upfront payments, milestone triggers, and royalty rates

Chapter 7 - A review of the leading discovery-stage deals by headline value

Chapter 8 - The top 25 most active discovery-stage dealmakers

Chapter 9 - A database of discovery-stage partnering agreements, including contract documents where available

Chapter 10 - A comprehensive directory of all discovery-stage deals announced since 2020

- Each deal record is linked to Current Agreements, a proprietary database that provides easy access to full deal structures, financial terms, and contract documents.

- Key Benefits of the Report

- Comprehensive insights into discovery-stage deal trends since 2020

- Access to key financial terms, including headline values, upfronts, milestones, and royalty structures

- Breakdown of deal structures, with real-world case studies

- Analysis of contractual terms, including real-world clause examples

- Benchmarking of deal terms based on actual agreements

- Due diligence insights to assess the suitability of proposed deal terms for potential partners

- Scope of the Report

The Global Discovery Stage Partnering Terms and Agreements in Pharma and Biotech (2020-2025) report provides:

- Analysis of discovery-stage dealmaking trends in the biopharma industry since 2020

- Insight into financial structures, including upfront, milestone, and royalty payments

- Case studies of real-life discovery-stage agreements

- Access to over 2,690 discovery-stage deals, with contract records where available

- Profiles of the most active discovery-stage dealmakers since 2020

- Detailed analysis of the highest-value discovery-stage deals

Each deal record is indexed by:

- Company (A-Z)

- Headline Value

- Stage of Development at Signing

- Deal Type

- Specific Therapy Focus

- For easy access, every deal record links to an online version, and where available, the full contract document.

- Critical Questions Answered

By analyzing actual contract agreements where available, this report provides definitive answers to critical questions such as:

- What specific rights are granted in each agreement?

- What exclusivity terms apply?

- How is the deal structured financially? (Upfronts, milestones, royalties)

- How are sales and payments audited?

- Who controls development, manufacturing, and commercialization?

- How is intellectual property handled?

- How are confidentiality and publication rights managed?

- Under what conditions can a deal be terminated?

- What dispute resolution mechanisms are in place?

- What happens in the event of a change in ownership?

- Gain the competitive edge-explore the report today.

Table of Contents

Executive Summary

Chapter 1 - Introduction

Chapter 2 - Why do companies partner at discovery stage?

- 2.1. Introduction

- 2.2. The role of discovery stage partnering

- 2.2.1. In-licensing at discovery stage

- 2.2.2. Out-licensing at discovery stage

- 2.3. Difference between discovery, preclinical and clinical stage deals

- 2.4. Reasons for entering into discovery stage partnering deals

- 2.4.1. Licensors reasons for entering discovery stage deals

- 2.4.2. Licensees reasons for entering discovery stage deals

- 2.5. The future of discovery stage partnering deals

Chapter 3 - Discovery stage deal strategies and structure

- 3.1. Introduction

- 3.2. At what stage do companies partner?

- 3.2.1. Partnering early in pharmaceutical/biotech

- 3.2.1.1. Discovery and preclinical stage partnering case studies

- 3.2.1.1.a. Case study 1

- 3.2.1.1.b. Case study 2

- 3.2.1.1.c. Case study 3

- 3.2.1.1.d. Case study 4

- 3.2.2. Partnering later in pharmaceutical/biotech

- 3.2.2.1. Clinical stage partnering case studies

- 3.2.2.1.a. Case study 5

- 3.2.2.1.b. Case study 6

- 3.2.2.1.c. Case study 7

- 3.2.2.1.d. Case study 8

- 3.3. Early and later stage partnering - a risk/cost comparison

- 3.4. What do companies spend on discovery, preclinical and clinical stage partnering?

- 3.5. Pure versus multi-component partnering deals

- 3.6. Pure licensing agreement structure

- 3.6.1. Example pure licensing agreements

- 3.6.1.a. Case study 9

- 3.6.1.b. Case study 10

- 3.7. Multicomponent discovery stage partnering agreements

- 3.7.1.a. Example multicomponent early stage clauses

- 3.7.1.a. Case study 11

- 3.7.1.b. Case study 12

Chapter 4 - Discovery stage partnering payment strategies

- 4.1. Introduction

- 4.2. Discovery stage payment strategies

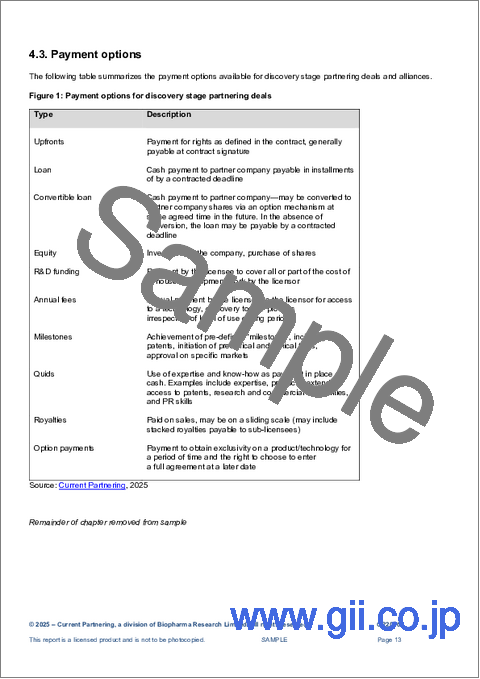

- 4.3. Payment options

- 4.3.1. Headline values

- 4.3.2. Upfront payments

- 4.3.2.1. Conditionality of upfront payments

- 4.3.3. Loans

- 4.3.4. Convertible loans

- 4.3.5. Equity

- 4.3.6. R&D funding

- 4.3.7. Licensing fees

- 4.3.8. Milestone payments

- 4.3.9. Royalty payments

- 4.3.9.1. Issues affecting royalty rates

- 4.3.9.2. Royalties on combination products

- 4.3.9.2.a. Case study 13

- 4.3.9.3. Guaranteed minimum/maximum annual payments

- 4.3.9.4. Royalty stacking

- 4.3.9.5. Royalties and supply/purchase contracts

- 4.3.10. Quids

- 4.3.11. Option payments

Chapter 5 - Trends in discovery stage deal making

- 5.1. Introduction

- 5.2. Discovery stage partnering over the years

- 5.2.1. Attributes of discovery deals

- 5.3. Discovery stage partnering by deal type

- 5.4. Discovery stage partnering by disease type

- 5.5. Partnering by discovery stage technology type

- 5.6. Discovery stage partnering by most active company, 2020 to 2025

Chapter 6 - Payment terms for discovery stage partnering

- 6.1. Introduction

- 6.2. Guidelines for discovery stage payment terms

- 6.2.1. Upfront payments

- 6.2.2. Milestone payments

- 6.2.3. Royalty payments

- 6.3. Discovery stage payment terms - deal data analysis

- 6.3.1. Public data

- 6.3.2. Survey data

- 6.4. Payment terms analysis

- 6.4.1. Discovery stage headline values

- 6.4.2. Discovery stage deal upfront payments

- 6.4.3. Discovery stage deal milestone payments

- 6.4.4. Discovery stage royalty rates

Chapter 7 - Leading discovery stage deals

- 7.1. Introduction

- 7.2. Top discovery stage deals by value

Chapter 8 - Top 25 most active discovery stage dealmakers

- 8.1. Introduction

- 8.2. Top 25 most active discovery stage dealmakers

Chapter 9 - Discovery stage partnering contracts directory

- 9.1. Introduction

- 9.2. Discovery stage deals with contracts 2020 to 2025

Chapter 10 - Discovery stage deal making by development stage

- 10.1. Introduction

- 10.2. Deals by discovery stage

Appendices

- Appendix 1 - Discovery stage dealmaking by companies A-Z

- Appendix 2 - Discovery stage dealmaking by industry sector

- Appendix 3 - Discovery stage dealmaking by stage of development

- Appendix 4 - Discovery stage dealmaking by therapy area

- Appendix 5 - Discovery stage dealmaking by technology type

- About Biopharma Research Ltd

- Current Partnering

- Current Agreements

- Recent report titles from Current Partnering

Table of figures

- Figure 1: Definition of discovery, preclinical and clinical phases in dealmaking

- Figure 3: Components of the pure licensing deal structure

- Figure 4: Payment options for discovery stage partnering deals

- Figure 5: Issues affecting royalty rates

- Figure 6: Discovery stage partnering frequency 2020 - 2025

- Figure 7: Discovery stage partnering by deal type since 2020

- Figure 8: Discovery stage partnering by disease type since 2020

- Figure 9: Discovery stage partnering by technology type since 2020

- Figure 10: Top 25 most active discovery stage dealmakers, 2020 to 2025

- Figure 11: Review of median upfront payments for discovery stage deals

- Figure 12: Review of median milestone payments for discovery stage deals

- Figure 13: Review of median royalty payments for discovery stage deals

- Figure 14: Discovery stage deals with a headline value

- Figure 15: Discovery stage deals with an upfront value

- Figure 16: Discovery stage deals with a milestone value

- Figure 17: Discovery stage deals with a royalty rate value

- Figure 18: Top discovery stage deals by deal value since 2020

- Figure 19: Most active discovery stage dealmakers 2020 to 2025