|

市場調査レポート

商品コード

1872362

ハンドヘルドバーコードスキャナー市場:2025年2025 Handheld Barcode Scanner Market Report |

||||||

|

|||||||

| ハンドヘルドバーコードスキャナー市場:2025年 |

|

出版日: 2025年11月17日

発行: VDC Research Group, Inc.

ページ情報: 英文 42 Pages/85 Exhibits

納期: 即日から翌営業日

|

概要

本レポートの内容

本レポートは、2Dイメージャ、リニアイメージャ (CCDスキャナ) 、レーザースキャナを含むハンドヘルド型バーコードスキャナの主要な戦略的課題、動向、促進要因に関するVDCの分析を継続するものです。本調査では、地域、イメージング/スキャン技術、産業、チャネルなどの区分別に2024年から2029年までの複数の市場分析を提示し、詳細な5カ年予測を掲載しています。VDCのアナリストによる調査と解説では、世界および地域市場の動向、技術動向、成長機会、主要ベンダーに関する詳細な情報をまとめています。

本レポートで扱う主な質問

- 激動の数年間を経たスキャナー市場は今後どのような展開が予想され、その理由は何か?

- 主要ベンダーの製品ポートフォリオと戦略はどのようなものか? ハンドヘルドスキャナーベンダーは、視線 (ラインオブサイト) を必要とする従来型バーコードスキャンを超えたデータキャプチャ要件にどう対応し、また、AI や画像処理の進化を活用してどのように製品差別化を図るか?

- 既存大手ベンダーは、低価格/エントリークラス製品からの競争にどう対応するか?

- 従来の主要産業市場や地域市場は、ハンドヘルドバーコード製品において、短期的・長期的にどのような動向を示すか?

掲載組織:

|

|

|

エグゼクティブサマリー

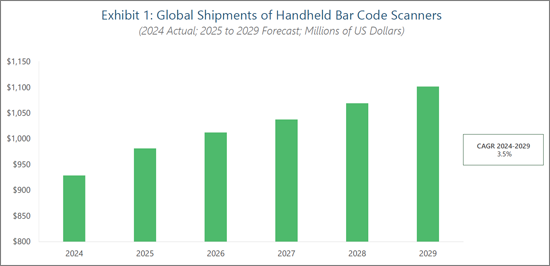

2024年の世界のハンドヘルドバーコードスキャナーの売上は、過去13年間で最も低い水準となりました。今回の市場縮小は主に、販売経路が過剰在庫を処理し、過剰供給能力を調整する中で起きたコロナ後の市場調整を反映しています。POSスキャン、物流のピッキング/梱包、医療現場での投薬管理など、ハンドヘルドスキャナーの従来用途自体は依然として必要とされているものの、市場は根本的に変化しています。スキャン作業の多いワークフローにおける新しいウェアラブルフォームファクターとの競争、新興市場ベンダーによる低価格・エントリークラス製品の台頭、ソフトウェアベースのコンピュータビジョンツールの実用性向上、代替データキャプチャ手法などが、従来の水準に挑戦しています。

成長回復に影響を与える主な市場要因には、レーザーやリニアイメージャーから2Dスキャナーへの継続的な移行、老朽化した既設機器のアップグレード需要、新しいデータキャプチャワークフローへの対応が含まれます。2Dイメージャーへの投資は、ベンダーが1Dオプションに代わってカメラベースのソリューションポートフォリオを積極的に拡大していることにより加速しています。エンドユーザーが複数のバーコード表記/タイプを読み取れる能力、全方向データキャプチャ、損傷コードの読み取り性能、コンプライアンスラベリング、シリアライゼーション、トレーサビリティなどの高度アプリケーションのサポートといった利点をますます享受しているためです。

インフォグラフィック

製品開発において、主要競合企業は機能と形状・設計に注力し、それぞれのターゲットとなる産業市場やユースケース特有のワークフロー要件に合わせた設計を行っています。主要ベンダーは、損傷コードの照準・照明・読み取り性能を向上させるためにAI を高度化しており、さらに、カラーイメージャ搭載機、RAIN RFID 読み取り対応デバイスなど、多様なアイテム識別ニーズに対応する高度なデバイス設計を進めています。また、Zebra、Honeywell、Datalogic、Newland AIDC、Code Corporation の上位5社は、2024年において合計の市場シェアを拡大しており、2023年と比べても成長が見られました。

目次

図表リスト

本レポートの内容

取り上げられている質問

本レポートを読むべき人

本レポートに掲載されている組織

エグゼクティブサマリー

- 主な調査結果

世界市場:概要

- 地域市場の分析

- 南北アメリカ

- 欧州・中東・アフリカ

- アジア太平洋

製品・技術の動向

- RFID

- 2D vs リニアイメージャーとレーザー技術

- ソフトウェアプラットフォーム

産業市場

- 小売

- 製造

- ヘルスケア

- 輸送・物流

競合情勢・ベンダープロファイル

- CipherLab

- Code Corporation

- Cognex

- Datalogic

- Honeywell

- Newland AIDC

- Socket Mobile

- Unitech

- Zebra